AC and DC Backup Stationary Battery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441559 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

AC and DC Backup Stationary Battery Market Size

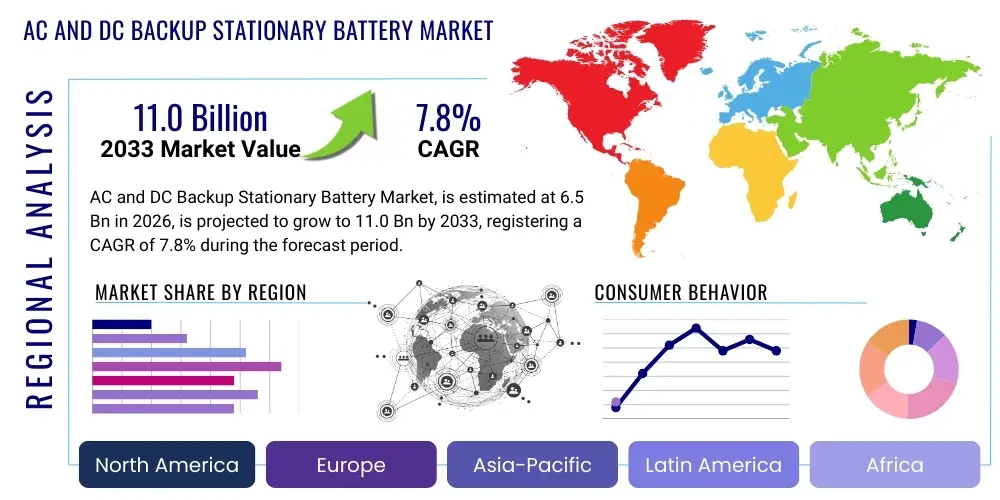

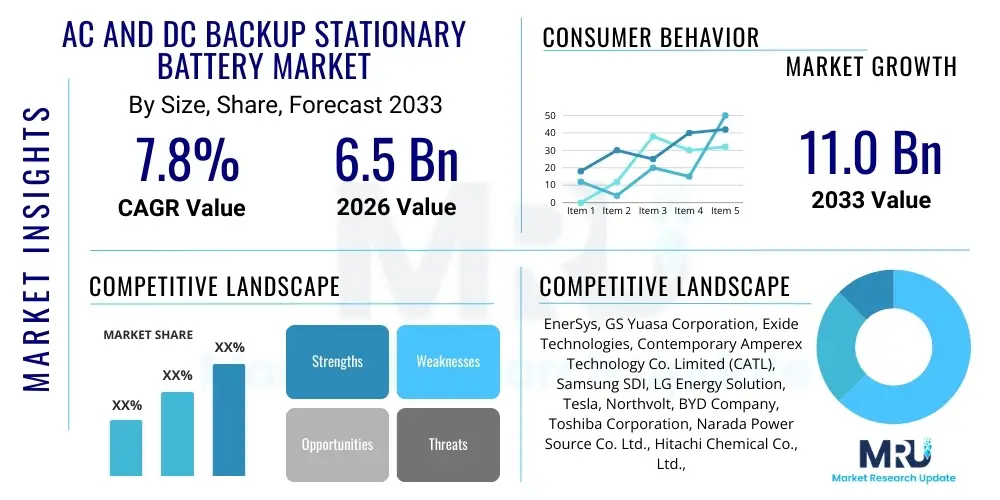

The AC and DC Backup Stationary Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for uninterrupted power supply across critical infrastructure sectors globally, including telecommunications, data centers, and utility grids. The transition toward renewable energy sources, which necessitates reliable energy storage solutions to stabilize fluctuating power output, further solidifies the market's robust trajectory. Investment in resilient power infrastructure, particularly in emerging economies undergoing rapid digitalization and industrial expansion, plays a crucial role in inflating the overall market valuation. Furthermore, regulatory mandates concerning power quality and reliability in essential services are compelling businesses and governments alike to prioritize high-performance backup battery systems, spanning both traditional lead-acid and advanced lithium-ion chemistries.

Market growth is also intimately tied to technological advancements focused on improving energy density, cycle life, and safety features of stationary batteries. The shift from centralized power generation to distributed energy resources (DERs) amplifies the necessity for sophisticated backup systems capable of integrating seamlessly with smart grids and managing complex load profiles. AC backup systems typically utilize batteries paired with inverters, serving large-scale commercial and industrial applications where reliable alternating current is paramount. Conversely, DC backup systems are essential for telecommunication towers, switchgear, and dedicated data center equipment bays, capitalizing on the inherent reliability and lower complexity of direct current storage. The convergence of these needs—reliable long-duration storage coupled with high-power short-duration support—is creating diversified opportunities for manufacturers specializing in hybrid solutions and advanced battery management systems (BMS).

Geographically, high-growth regions, particularly in the Asia Pacific, are witnessing massive deployment of 5G infrastructure and hyperscale data centers, directly translating into heightened demand for robust stationary backup power. The ongoing modernization of aging electrical grids in North America and Europe, often involving substantial capital expenditure on modern battery storage infrastructure, also contributes significantly to market size acceleration. Policy incentives promoting battery manufacturing and deployment, alongside a heightened awareness of climate change impacts necessitating power failure mitigation strategies, ensure that the market for AC and DC stationary backup batteries remains fundamentally strong and positioned for continued substantial financial growth throughout the forecast period, achieving the projected multi-billion dollar valuation by 2033.

AC and DC Backup Stationary Battery Market introduction

The AC and DC Backup Stationary Battery Market encompasses all electrochemical storage systems designed explicitly to provide emergency or standby power to critical loads in the event of primary power failure, serving durations ranging from minutes (UPS systems) to several hours (utility storage). These batteries are designated as "stationary" because they are permanently installed in fixed locations, contrasting with mobile or automotive applications. The primary function is to ensure operational continuity and data integrity across crucial sectors. Products range from Valve Regulated Lead Acid (VRLA) and Flooded Lead Acid batteries, traditionally dominant in telecommunications and utilities, to modern Lithium-ion (Li-ion) systems, which are increasingly favored in high-density applications like data centers due to their superior energy density and reduced footprint. Backup systems are crucial for maintaining safety, security, and essential services, defining their indispensable nature in modern industrial and digital economies.

Major applications for these stationary battery systems include Uninterruptible Power Supplies (UPS) in corporate infrastructure and server farms, standby power for telecommunication central offices and cellular tower sites (especially DC systems), emergency lighting and signaling systems, and grid-scale frequency regulation and black-start capability for utilities. The benefit proposition is centered on enhanced operational resilience, minimized downtime costs, and compliance with stringent industry regulations regarding safety and continuity of service. In data centers, for instance, a reliable backup system can prevent catastrophic data loss and financial penalties associated with service interruptions. Furthermore, the longevity and low maintenance profile of advanced battery systems contribute positively to the total cost of ownership (TCO) over their operational life. The market is increasingly segmented by both chemistry (lead-acid, Li-ion, flow batteries) and configuration (high-power short-duration AC support versus long-duration DC retention).

Driving factors propelling this market include the relentless global expansion of digital infrastructure, fueled by cloud computing, edge computing, and 5G network rollouts, all requiring robust power backups. Furthermore, the inherent volatility introduced by renewable energy sources (solar and wind) demands stable stationary storage solutions to balance supply and demand on the electrical grid, extending the application scope beyond traditional emergency use. Regulatory frameworks mandating higher standards of power reliability in healthcare facilities and financial institutions also serve as significant market drivers. The continual reduction in the cost of Lithium-ion batteries, making them more competitive against conventional lead-acid solutions, accelerates their adoption, particularly in new installations prioritizing energy efficiency and space utilization, thereby sustaining strong market momentum.

AC and DC Backup Stationary Battery Market Executive Summary

The AC and DC Backup Stationary Battery Market demonstrates strong growth momentum, underpinned by key business trends emphasizing resilient infrastructure and energy transition. Business trends highlight a pronounced shift toward higher-density, lower-maintenance battery chemistries, with Li-ion adoption accelerating in new installations, particularly for modular and scalable data center UPS systems. Manufacturers are focusing on vertical integration and developing sophisticated Battery Management Systems (BMS) that enhance predictive maintenance and optimize discharge cycles, reducing failure rates and extending asset life. Strategic partnerships between battery suppliers and large infrastructure developers (e.g., telecom providers and utilities) are crucial for securing large volume contracts and facilitating specialized product deployment. The competitive landscape is characterized by innovation in both material science (e.g., solid-state potential) and system integration, addressing safety concerns, notably thermal runaway in Li-ion, through advanced cooling and fire suppression technologies. Furthermore, increasing geopolitical focus on supply chain security is driving diversification of raw material sourcing and localized manufacturing capabilities, especially in North America and Europe.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, attributed to unprecedented investment in 5G telecommunications networks and the establishment of numerous hyperscale data center facilities across countries like China, India, and Southeast Asia. Regulatory policies supporting rural electrification and utility modernization in this region create substantial long-duration storage demand. North America and Europe, while mature markets, exhibit steady demand driven by stringent grid reliability standards, replacement cycles for aging VRLA batteries, and significant governmental focus on integrating renewable energy into existing power grids, mandating large-scale stationary energy storage. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by expanding mobile penetration and investment in essential oil and gas infrastructure where remote, reliable backup power is essential. Regional market performance is highly correlated with local infrastructure spending and energy policy adherence.

Segment trends reveal that the Lithium-ion battery segment is poised for the fastest CAGR, largely replacing traditional chemistries in high-power applications, though Lead-Acid batteries retain dominance in cost-sensitive and legacy applications due to their proven reliability and low initial capital expenditure. In terms of end-use, the Data Center and Telecom sectors remain the largest consumers, demanding both high-rate (AC UPS) and long-duration (DC telecom) backups, respectively. The utility sector is rapidly increasing its market share, driven by large-scale energy storage projects aimed at improving grid resiliency and managing peak demand. The growing proliferation of hybrid AC/DC solutions, which optimize power delivery for complex infrastructure sites, indicates a trend toward more customized and integrated energy storage solutions across all primary market segments, ensuring tailored reliability for distinct operational needs.

AI Impact Analysis on AC and DC Backup Stationary Battery Market

User queries regarding AI's influence on the stationary battery market often focus on predictive maintenance, optimization of charge/discharge cycles, and smart grid integration. Users are concerned about how AI can extend battery life, prevent unexpected failures (a critical factor in backup systems), and manage complex, multi-source power environments. Key themes revolve around the transition from reactive maintenance to proactive, AI-driven asset management, especially given the high capital expenditure and criticality of these battery systems. Expectations center on AI algorithms analyzing vast streams of operational data—including temperature fluctuations, voltage readings, and usage patterns—to forecast degradation rates accurately. Furthermore, the integration of stationary batteries into smart grids necessitates AI for optimal participation in demand response programs and real-time energy arbitrage, maximizing the financial returns and operational efficacy of these large-scale investments. Users seek confirmation that AI will deliver tangible improvements in reliability and cost-efficiency, mitigating the risks associated with critical power infrastructure failures.

AI's role is transformative, moving beyond simple monitoring to comprehensive system optimization. By leveraging machine learning models, battery management systems (BMS) can now dynamically adjust charging parameters based on predicted load requirements and historical aging data, thereby significantly enhancing battery cycle life and reducing the Total Cost of Ownership (TCO). This precision management is particularly vital for Li-ion batteries, where temperature and charging protocols heavily influence longevity. Furthermore, AI facilitates highly accurate fault detection and diagnosis. Early identification of anomalies, such as localized cell imbalance or thermal instability precursors, allows operators to intervene before a major failure compromises backup capability, ensuring the high availability required by data centers and telecom networks. This predictive capability translates directly into improved service reliability and reduced operational expenditures related to unplanned downtime and emergency replacements. The deployment of edge computing devices integrated with battery racks further enables localized AI processing, providing instantaneous decision-making capabilities crucial for managing momentary grid fluctuations.

In the context of utility-scale storage, AI algorithms optimize energy trading and grid support services. By predicting solar and wind generation output and anticipating peak demand hours, AI ensures that the stationary battery assets are fully charged and ready to deploy power when most needed, maximizing the economic value of the battery while maintaining grid stability. For large installations using various chemistries (e.g., hybrid lead-acid and Li-ion systems), AI orchestrates the optimal use of each storage type based on the specific power event (e.g., utilizing high-power Li-ion for rapid response and long-duration lead-acid for sustained outages). This intelligent integration minimizes unnecessary wear and tear on the more expensive high-performance units. As the complexity of power systems increases with distributed generation and bidirectional power flow, AI becomes an indispensable tool for maintaining system reliability and operational efficiency across the AC and DC backup stationary battery market.

- AI enables predictive maintenance, forecasting battery degradation and failure risks based on real-time operational data.

- Optimization of charge and discharge cycles through machine learning enhances battery longevity and energy efficiency.

- AI facilitates smart grid integration, optimizing battery deployment for frequency regulation and demand response services.

- Improved thermal management and fault detection using AI algorithms mitigate safety risks associated with thermal runaway in Li-ion systems.

- Enhanced system control allows for dynamic adjustment of power output based on instantaneous load changes, maximizing reliability during power transitions.

DRO & Impact Forces Of AC and DC Backup Stationary Battery Market

The AC and DC Backup Stationary Battery Market is fundamentally shaped by powerful drivers, significant restraints, and emerging opportunities (DRO), all filtered through pervasive impact forces, influencing strategic decision-making and market direction. A primary driver is the accelerating digitalization of the global economy, necessitating unfailing power for data centers, 5G networks, and critical national infrastructure. Coupled with this is the global energy transition toward renewable sources, which inherently demands massive stationary storage capacity to manage intermittency and ensure grid stability, thereby moving batteries from purely backup roles to active grid assets. Conversely, major restraints include the high initial capital expenditure (CAPEX) associated with high-density battery systems, particularly Lithium-ion, and ongoing concerns regarding the long-term supply chain security and price volatility of critical raw materials such such as lithium, cobalt, and nickel. Regulatory complexity across different regions concerning battery safety standards, recycling, and disposal also poses a notable hurdle for manufacturers and operators, delaying widespread adoption in some segments. Opportunities abound in the development of next-generation battery chemistries (e.g., solid-state, sodium-ion, flow batteries) offering superior safety and cost profiles, alongside immense potential in the burgeoning market for Edge Data Centers, which require highly localized and reliable power backup solutions.

Impact forces acting on this market are multifaceted, encompassing macroeconomic shifts, regulatory pressures, and environmental concerns. The increasing frequency of extreme weather events due to climate change acts as a powerful external force, compelling organizations and municipalities to invest aggressively in robust, long-duration backup power systems to ensure continuity during natural disasters. Regulatory impact forces, particularly those relating to mandated power quality and environmental protection (e-waste directives), steer the market toward certified, sustainable battery solutions with clear end-of-life recycling pathways. Economically, global inflationary pressures and interest rate hikes can temporarily dampen infrastructure investment, yet the strategic necessity of power resilience often overrides short-term economic headwinds, ensuring sustained foundational demand. Furthermore, the competitive intensity among battery manufacturers, particularly between Asian suppliers offering highly cost-effective Li-ion products and established Western players focusing on premium, long-life systems, creates a downward pressure on pricing while simultaneously accelerating innovation in energy density and safety features. The convergence of these drivers and forces dictates the pace and direction of technological innovation and commercial deployment.

The synergy between increasing infrastructure dependence and the pursuit of energy sustainability forms the core market propellant. The rapid deployment of 5G networks requires DC power integrity across millions of small cells, driving specialized DC battery market growth. Simultaneously, the large-scale integration of utility-grade storage projects (often AC coupled) is reshaping the utility landscape. To mitigate restraints, manufacturers are heavily investing in circular economy initiatives, focusing on battery second life applications and advanced recycling technologies to address raw material scarcity and environmental concerns proactively. This strategic alignment with sustainability mandates, combined with governmental incentives for energy storage deployment (such as tax credits and subsidies in key regions like the US and Europe), substantially magnifies the opportunities for market penetration. Consequently, the persistent demand for reliable power, driven by modernization and resilience requirements, ensures that the market successfully navigates its inherent restraints and capitalizes on high-value opportunities throughout the forecast period.

Detailed analysis of DRO and impact forces:

- Drivers:

- Rapid global deployment of 5G and Edge Computing infrastructure, necessitating highly reliable DC and AC backup power.

- Increasing frequency and severity of grid outages due to climate change and aging electrical infrastructure, driving demand for enhanced resiliency.

- Mandatory regulatory compliance for power reliability in critical sectors such as healthcare, finance, and telecommunications.

- Falling costs and improving energy density of Lithium-ion batteries, accelerating their adoption over traditional lead-acid systems.

- Global transition towards decentralized renewable energy sources requiring stationary storage for stabilization and grid support.

- Restraints:

- High upfront capital investment required for large-scale stationary battery installations.

- Supply chain volatility and price fluctuations of essential raw materials (Lithium, Nickel, Cobalt).

- Safety concerns related to thermal runaway and fire risks, particularly with high-density Li-ion chemistries.

- Challenges and costs associated with battery recycling, disposal, and managing end-of-life battery assets.

- Long lead times and complex permitting processes for utility-scale energy storage projects.

- Opportunities:

- Development and commercialization of next-generation chemistries like Solid-State and Sodium-ion batteries offering enhanced safety and cost structure.

- Expansion into niche applications such as microgrids, hydrogen fuel cell backups, and integrated Vehicle-to-Grid (V2G) enabling infrastructure.

- Market penetration in emerging economies undergoing rapid infrastructure development and electrification.

- Implementation of AI and sophisticated Battery Management Systems (BMS) for enhanced performance optimization and predictive maintenance.

- Growth of the battery second life market for less demanding applications like residential backup and non-critical industrial use.

- Impact Forces:

- Geopolitical tensions affecting critical mineral sourcing and manufacturing localization strategies.

- Environmental, Social, and Governance (ESG) mandates driving preference for sustainable and ethical battery production.

- Technological disruption from competing energy storage solutions (e.g., Flywheels, Compressed Air Storage).

- Governmental incentives (tax credits, subsidies) accelerating deployment, particularly for renewable integration projects.

- Inflationary pressure impacting manufacturing costs and end-user pricing strategies.

Segmentation Analysis

The AC and DC Backup Stationary Battery Market is comprehensively segmented based on several critical dimensions, allowing for detailed analysis of market dynamics, competitive positioning, and growth avenues. Key segmentation revolves around the battery chemistry employed, the power configuration (AC vs. DC), the power rating or capacity (measured in kWh or MWh), and the diverse end-user applications that rely on these systems. Chemistry segmentation, differentiating between established lead-acid and rapidly growing lithium-ion categories, fundamentally drives technology adoption trends and pricing strategies. Configuration distinguishes between AC UPS systems, necessitating integrated inverters for alternating current output, and inherent DC systems, often used directly for telecom and industrial control applications. The convergence of these technical segments reflects the specialized needs of modern critical infrastructure, moving toward hybrid and modular battery architectures to achieve optimal reliability and efficiency.

Further granularity in segmentation involves distinguishing between power ratings, where small systems (<100 kWh) serve typical commercial buildings and localized telecom sites, and utility-scale systems (>1 MWh) are deployed for grid regulation and large-scale renewable integration projects. This distinction highlights the variance in system design requirements, safety protocols, and operational lifespan expectations across different application scales. End-user categorization is vital, separating the high-reliability demands of Data Centers and Telecommunication from the regulated environments of Healthcare and the substantial scale of the Utility sector. Each segment exhibits unique procurement cycles, regulatory requirements, and technical specifications for acceptable backup duration and discharge rate, compelling manufacturers to tailor product offerings precisely to these domain-specific needs.

This detailed segmentation not only provides a framework for sizing the market but also illuminates key competitive battlegrounds. For instance, the transition segment—where traditional VRLA batteries are being replaced by Li-ion in existing telecom infrastructure—represents a high-value opportunity, especially in mature markets. Understanding the interplay between AC versus DC requirements is crucial, as DC systems maintain a strong foothold in core telecommunication infrastructure due to historical standardization and efficiency, while AC systems dominate general commercial UPS and most utility applications. The segmentation analysis thus serves as an indispensable tool for strategic planning, resource allocation, and identifying underserved pockets of demand across the global backup power ecosystem.

- By Battery Type (Chemistry):

- Lead-Acid Batteries (Flooded Lead-Acid, Valve Regulated Lead Acid (VRLA))

- Lithium-Ion Batteries (Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP))

- Flow Batteries (Vanadium Redox Flow Batteries)

- Other Chemistries (Nickel-Cadmium (Ni-Cd), Sodium-Ion)

- By Configuration (System Type):

- AC Backup Systems (requiring inverters for output)

- DC Backup Systems (direct current output)

- Hybrid Systems

- By Power Rating/Capacity:

- Small Scale (Below 100 kWh)

- Medium Scale (100 kWh to 1 MWh)

- Large Scale/Utility Scale (Above 1 MWh)

- By End-Use Application:

- Data Centers and IT Infrastructure

- Telecommunications (5G, Central Offices, Cell Towers)

- Utility and Grid Services (Substations, Generation, Renewables Integration)

- Commercial and Industrial (Manufacturing Plants, Financial Services, Oil & Gas)

- Residential and Off-Grid Systems

- Healthcare Facilities and Emergency Services

Value Chain Analysis For AC and DC Backup Stationary Battery Market

The value chain for the AC and DC Backup Stationary Battery Market is highly complex, spanning from the extraction and processing of raw materials to final system integration and post-sales maintenance and recycling. The upstream segment involves the mining and refinement of critical minerals, specifically lithium, cobalt, nickel, manganese, and lead. This stage is characterized by high capital investment, geopolitical risk, and stringent environmental regulations, particularly for Li-ion components. Suppliers specializing in high-purity chemical precursors and electrode materials form the next crucial link, transforming raw elements into usable battery components like cathodes, anodes, and electrolytes. Manufacturers often seek long-term supply agreements or backward integration to mitigate material price volatility and ensure consistent quality, which is paramount for the safety and performance of stationary batteries. The performance and cost efficiency established at this upstream stage heavily dictate the final product's competitiveness.

The midstream involves the core manufacturing process, where cells are produced, assembled into modules, and then integrated into complete battery racks or systems, coupled with necessary electronics such as Battery Management Systems (BMS), power conversion systems (PCS), and cooling infrastructure. System integrators play a vital role here, ensuring compatibility between the battery storage unit and the specific AC or DC power infrastructure of the end-user facility (e.g., pairing the battery system with the UPS or rectifier). Distribution channels are highly varied, involving direct sales to large utility and hyperscale data center operators, indirect sales through value-added resellers (VARs) specializing in industrial power solutions, and distribution through electrical wholesale networks for smaller commercial systems. Direct distribution is common for customized, large-scale projects, allowing manufacturers to maintain tight control over installation and commissioning, whereas indirect channels facilitate broader market reach and localized service provision.

The downstream segment is focused on installation, operation, maintenance, and the crucial end-of-life management, including recycling and second-life utilization. Post-sales services, which include predictive maintenance contracts—increasingly AI-enhanced—are significant revenue generators and critical differentiators in this market, given the mission-critical nature of the applications. Proper recycling and disposal processes are becoming non-negotiable, driven by regulatory demands and corporate sustainability goals (ESG), establishing a circular economy component that closes the value chain loop. Successful market participants optimize their value chain by securing stable upstream supply, excelling in midstream system integration (especially in BMS sophistication), and offering comprehensive, long-term maintenance and circular economy services downstream, ensuring overall product reliability and customer retention. This integration of production and service capability is essential for capturing market share.

AC and DC Backup Stationary Battery Market Potential Customers

The primary customers for AC and DC Backup Stationary Batteries are organizations whose operational continuity is dependent on an unwavering power supply and where downtime results in significant financial loss, regulatory penalties, or public safety hazards. Foremost among these are Data Centers, ranging from corporate enterprise facilities to massive hyperscale cloud computing providers. These entities require high-rate AC backup systems (UPS) to bridge the gap between grid failure and generator start-up, demanding superior power density and reliability, predominantly utilizing Lithium-ion technology for space efficiency and rapid response. Simultaneously, the Telecommunication sector, including mobile network operators (MNOs) and fixed-line providers, represents a massive buyer base, relying heavily on DC backup systems for central offices, remote base stations (cell towers), and 5G small cell deployments. The telecom sector prioritizes long-duration reliability in remote or off-grid locations, making it a critical market for both VRLA and specialized Li-ion DC systems.

The Utility and Power Generation sector constitutes another major customer segment, procuring large-scale systems (often measured in MWh) for grid stabilization, frequency regulation, transmission and distribution (T&D) switchgear backup, and integrating intermittent renewable energy sources (wind and solar farms). These systems require robust, often high-voltage, AC-coupled solutions capable of long cycle life and adherence to strict grid codes, making them key consumers of both advanced Lithium-ion and emerging Flow Battery technologies. Beyond core infrastructure, the Commercial and Industrial (C&I) segment includes financial institutions, petrochemical plants, manufacturing facilities, and transportation systems, all requiring UPS systems to safeguard critical processes, control systems, and data against power perturbations. These users prioritize durability and localized support, often relying on both traditional lead-acid systems for legacy infrastructure and Li-ion for new investments requiring lower maintenance.

Emerging and specialized customer segments include Healthcare Facilities (hospitals and emergency centers), which have stringent regulations demanding uninterruptible power for life support and critical medical equipment, and government/defense establishments requiring highly secure and resilient power infrastructure. Furthermore, the burgeoning Microgrid and Distributed Energy Resources (DER) market represents substantial future demand, as remote communities, industrial parks, and university campuses seek energy independence and optimized power management through integrated stationary storage solutions. In essence, any organization where the cost of power interruption significantly outweighs the investment in backup power qualifies as a prime potential customer, driving diversified demand across all product configurations and battery chemistries in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EnerSys, GS Yuasa Corporation, Exide Technologies, Contemporary Amperex Technology Co. Limited (CATL), Samsung SDI, LG Energy Solution, Tesla, Northvolt, BYD Company, Toshiba Corporation, Narada Power Source Co. Ltd., Hitachi Chemical Co., Ltd., Leclanché SA, Vertiv Group Corp., ABB Ltd., Siemens AG, Rolls Battery Engineering, C&D Technologies, Inc., Saft (TotalEnergies), Fiamm Energy Technology S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AC and DC Backup Stationary Battery Market Key Technology Landscape

The technological landscape of the AC and DC Backup Stationary Battery Market is defined by intense competition and rapid evolution across three core areas: battery chemistry, power conversion systems, and system intelligence (BMS and software). Traditional Lead-Acid technology, particularly VRLA, remains crucial due to its low initial cost, established recycling infrastructure, and long-standing reliability in telecom DC plants and utility switchgear. However, the dominant technology driver is Lithium-ion (Li-ion), with Lithium Iron Phosphate (LFP) chemistry gaining significant traction over Nickel Manganese Cobalt (NMC) in stationary applications due to LFP's superior safety profile, longer calendar life, and lack of cobalt, which mitigates certain supply chain risks. Manufacturers are investing heavily in modular Li-ion systems, allowing for easy scalability and integration into standard rack designs, simplifying deployment for data centers and commercial UPS applications.

Beyond lead-acid and Li-ion, emerging technologies such as Flow Batteries (e.g., Vanadium Redox Flow) are carving out a niche in long-duration energy storage (LDES), particularly for utility and microgrid applications where duration requirements often exceed four to eight hours. Flow batteries offer inherently scalable capacity, non-flammability, and minimal degradation over tens of thousands of cycles, though their lower energy density and higher complexity compared to Li-ion currently limit their use in space-constrained environments like data centers. Parallel innovation is focused on advanced power electronics, including highly efficient bi-directional inverters and rectifiers, which are essential for seamless transitions between grid power, battery power, and distributed generation sources. The efficiency of these Power Conversion Systems (PCS) directly impacts the overall system performance, reducing energy losses and maximizing the effective capacity delivered during a backup event.

Crucially, the integration of sophisticated Battery Management Systems (BMS) and intelligent software platforms is transforming stationary batteries from passive backups to active, grid-interactive assets. Modern BMS features include cell-level voltage and temperature monitoring, advanced state-of-charge (SOC) and state-of-health (SOH) algorithms, and active or passive cell balancing to extend lifespan. These systems, often enhanced by AI and machine learning capabilities, allow operators to predict maintenance needs, participate in demand response programs, and optimize energy arbitrage opportunities. The convergence of hardware improvements—safer chemistries, higher densities—with software intelligence ensures that current stationary battery systems are not only reliable backup sources but also integral components of the modern, flexible, and resilient power infrastructure, ready to manage complex AC and DC loads efficiently across diverse operational settings.

Regional Highlights

The global AC and DC Backup Stationary Battery Market exhibits significant regional variation in terms of market maturity, technological adoption, and regulatory frameworks, fundamentally influencing localized growth dynamics. Asia Pacific (APAC) dominates the market both in volume and growth rate, primarily fueled by massive infrastructure spending in China, India, and Southeast Asia. The region is the epicenter for hyperscale data center construction, requiring continuous, high-rate AC power protection. Furthermore, APAC nations are rapidly expanding their 5G telecommunication networks, driving immense demand for DC stationary batteries for millions of base stations and edge infrastructure sites. Government initiatives supporting renewable energy integration, such as large solar and wind projects in Australia and India, also necessitates substantial utility-scale storage, ensuring the region remains the primary global market driver throughout the forecast period. Localized manufacturing capabilities, particularly in China and South Korea, provide a cost advantage and ensure readily available supply of Li-ion battery components, further solidifying APAC's market position.

North America is characterized by high technological maturity, stringent reliability standards, and a strong focus on grid modernization. The US market, in particular, is driven by significant investment in data center expansion and regulatory mandates promoting Energy Storage Systems (ESS) integration, often supported by federal tax incentives like the Investment Tax Credit (ITC). Demand is bifurcated, with critical infrastructure heavily adopting high-performance Li-ion for UPS applications, while legacy utility and telecom sites continue ongoing replacement and maintenance cycles for VRLA systems. The emphasis on mitigating natural disaster impacts also compels businesses and utilities to invest in more resilient, longer-duration storage solutions. Canada follows similar trends, prioritizing infrastructure resilience and renewable energy integration, particularly for remote or northern communities utilizing microgrid applications. The region is witnessing a strategic shift towards domestically sourced battery components to enhance supply chain security and reduce reliance on overseas manufacturing.

Europe represents a highly mature, but rapidly transforming market, strongly guided by the European Green Deal and stringent decarbonization targets. This translates into massive demand for stationary storage to support renewable generation (wind and solar) and enhance grid stability. Germany, the UK, and France are leading the adoption of utility-scale storage, often utilizing advanced Li-ion and exploring emerging flow battery chemistries. The market is also heavily influenced by regulatory frameworks focusing on battery safety, standardization, and end-of-life recycling (e.g., the EU Battery Regulation), which imposes strict compliance requirements on manufacturers and importers. The telecom sector in Europe maintains high reliability standards, driving steady demand for high-quality DC backup systems for communication infrastructure modernization. Finally, Latin America and the Middle East & Africa (MEA) are emerging as significant growth territories. Latin America's market growth is tied to telecommunications infrastructure expansion and managing volatile power grids, while MEA growth is driven by oil and gas operations requiring robust backup power in remote locations, alongside significant investments in renewable energy projects in the Gulf Cooperation Council (GCC) countries requiring dedicated AC stationary storage to manage output fluctuations.

- Asia Pacific (APAC): Highest growth due to hyperscale data centers, 5G deployment, and dominant localized Li-ion manufacturing capacity; key markets include China, India, and Japan.

- North America: Mature market focusing on grid resilience, regulatory incentives (ITC), and rapid Li-ion adoption in high-tier data centers; key markets are the United States and Canada.

- Europe: Driven by aggressive decarbonization goals and the European Green Deal, leading to significant utility-scale ESS deployment and strict adherence to Battery Regulation standards; key markets include Germany, UK, and France.

- Latin America: Emerging market characterized by telecom expansion and need for grid stabilization; focus on reliable DC systems.

- Middle East & Africa (MEA): Growth driven by investment in oil & gas critical infrastructure backup and utility-scale renewable energy projects, particularly in the GCC region and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AC and DC Backup Stationary Battery Market.- EnerSys

- GS Yuasa Corporation

- Exide Technologies

- Contemporary Amperex Technology Co. Limited (CATL)

- Samsung SDI

- LG Energy Solution

- Tesla

- Northvolt

- BYD Company

- Toshiba Corporation

- Narada Power Source Co. Ltd.

- Hitachi Chemical Co., Ltd.

- Leclanché SA

- Vertiv Group Corp. (as a system integrator and provider)

- ABB Ltd. (as a system integrator and solution provider)

- Siemens AG (as a solution provider)

- Rolls Battery Engineering

- C&D Technologies, Inc.

- Saft (TotalEnergies)

- Fiamm Energy Technology S.p.A.

Frequently Asked Questions

Analyze common user questions about the AC and DC Backup Stationary Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between AC and DC stationary backup batteries?

AC stationary backup systems typically integrate the battery with an inverter to deliver alternating current (AC) power, primarily used for general commercial UPS and large facility loads. DC stationary systems deliver direct current (DC) power directly, commonly used in telecommunication infrastructure, switchgear, and some data center components, capitalizing on the inherent reliability of DC technology.

Which battery chemistry is dominating the stationary backup market?

While Valve Regulated Lead Acid (VRLA) batteries maintain a large installed base, Lithium-ion (Li-ion), particularly Lithium Iron Phosphate (LFP), is rapidly dominating new installations in high-power applications like data centers and grid storage due to superior energy density, longer cycle life, and improved safety features compared to older chemistries.

How is 5G deployment impacting the demand for stationary backup batteries?

5G deployment necessitates a massive increase in reliable DC backup power for millions of new small cells and edge computing nodes. This expansion drives significant market growth for compact, high-performance DC stationary battery solutions optimized for reliable, remote operation across the global telecommunication infrastructure.

What role does AI play in optimizing the performance of backup battery systems?

AI is integrated into Battery Management Systems (BMS) to provide predictive maintenance, accurately forecasting battery degradation and potential failures. This optimization enhances operational lifespan, adjusts charge/discharge cycles based on real-time data, and improves integration into complex smart grid environments for optimal energy management.

What are the main growth drivers for utility-scale stationary battery adoption?

The main drivers are the need for grid modernization, managing the intermittency of renewable energy sources (solar and wind), and ensuring frequency regulation. Utility-scale batteries provide critical stability services and black-start capabilities, driving substantial investment in large-capacity (>1 MWh) stationary energy storage systems worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager