AC Arc Welding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442640 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

AC Arc Welding Machine Market Size

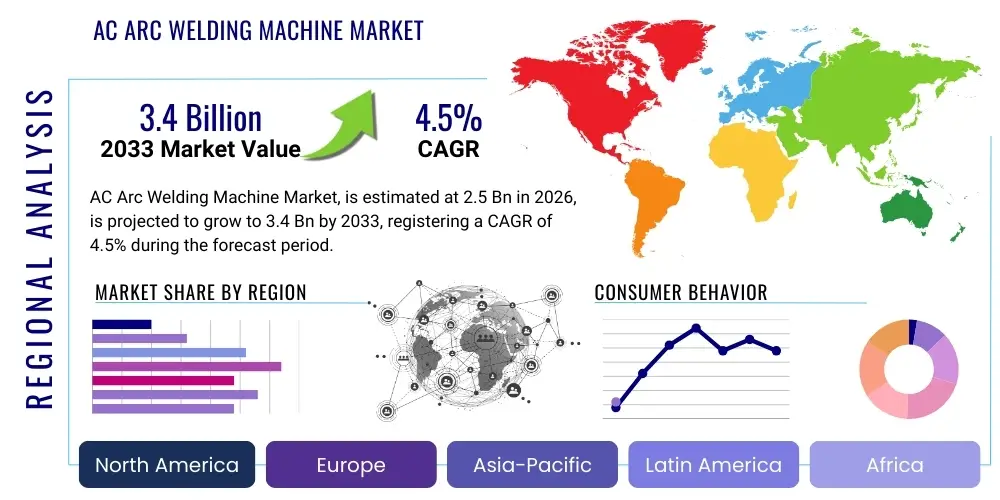

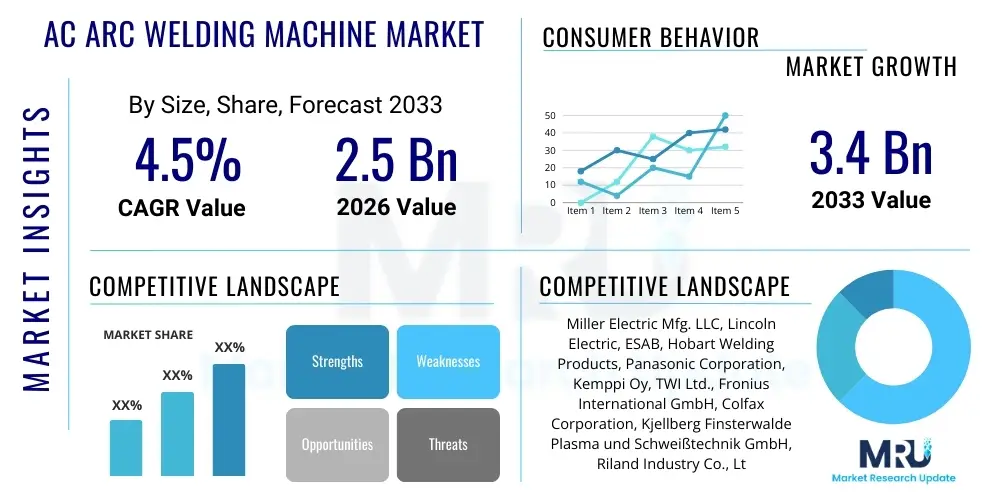

The AC Arc Welding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

AC Arc Welding Machine Market introduction

The AC Arc Welding Machine Market encompasses equipment designed to deliver alternating current (AC) for various electric arc welding processes, predominantly Shielded Metal Arc Welding (SMAW), also known as stick welding. AC welders are characterized by their robust design, ease of use, and suitability for welding thicker materials, making them a foundational tool in fabrication and repair industries worldwide. While modern DC and inverter-based welders offer specific advantages in portability and arc control, AC machines maintain significant market share due to their lower initial cost, high duty cycles, and reliable performance in demanding industrial environments, particularly where specialized aluminum or magnetic arc blow mitigation is required. Their fundamental simplicity also translates into reduced maintenance needs, contributing significantly to their enduring presence in workshops and field operations globally. The core of these machines involves a highly durable transformer designed for rigorous industrial duty.

The primary product description involves transformer-based power sources that convert high-voltage, low-amperage input power into low-voltage, high-amperage output required for creating a stable arc capable of melting electrodes and base metals. Major applications span structural steel construction, general repair and maintenance, agricultural equipment fabrication, and certain segments within the automotive aftermarket, especially body repairs and heavy vehicle maintenance. The core benefits include superior effectiveness on materials that are heavily coated, rusty, or moderately dirty, inherent stability against magnetic arc blow in large ferromagnetic components, and widespread accessibility due to lower capital investment compared to sophisticated inverter technologies. These machines are essential workhorses in developing economies and cost-sensitive industrial environments where predictable performance and ruggedness outweigh the need for highly advanced digital control systems.

Driving factors for sustained growth include the global uptick in infrastructure development projects, especially prevalent across the Asia Pacific region, necessitating robust and reliable welding solutions for critical elements such as bridges, extensive pipeline systems, and large commercial and industrial structures. Furthermore, the burgeoning maintenance, repair, and overhaul (MRO) sector continues to rely heavily on the ruggedness and forgiving operational nature of AC arc welding processes, which are often the default choice for immediate, on-site repairs under challenging conditions. The continuous need for basic, entry-level welding solutions in vocational training centers and small to medium-sized enterprises (SMEs) further cements the market’s inherent stability, ensuring a predictable demand curve even as rapid technological advancements push the higher end of the welding industry toward more digitalized and automated solutions. Economic resilience, minimal complexity, and predictable performance underpin the enduring market relevance of AC arc welding machines across diverse and demanding industrial landscapes.

AC Arc Welding Machine Market Executive Summary

The global AC Arc Welding Machine Market is experiencing moderate, yet fundamentally stable, growth primarily driven by persistent global industrialization and necessary heavy maintenance requirements across foundational infrastructure and various manufacturing sectors. Current business trends indicate a steady demand for traditional transformer-based AC units, particularly among price-sensitive industrial consumers, small fabrication shops, and large construction companies that prioritize ultimate durability, ease of repair, and high duty cycles over advanced, potentially more fragile, electronic features. However, the competitive landscape is simultaneously evolving with a noticeable market shift toward hybrid AC/DC machines. These hybrids offer improved operational flexibility and better arc characteristics, partially mitigating the intense competitive pressure exerted by high-performance inverter technology. Consequently, key manufacturers are strategically focusing on enhancing energy efficiency, integrating basic digital controls, and reducing the physical footprint of these inherently robust machines to maintain competitiveness and appeal to the space and power specifications of modern industrial workshops.

Regional trends decisively highlight the Asia Pacific (APAC) as the unquestionable epicenter of global AC arc welding machine demand, fueled by unprecedented, massive government and private sector investment in infrastructure across densely populated, rapidly industrializing countries such as China, India, and various Southeast Asian nations. This region’s high volume of structural fabrication, new construction, and heavy machinery repair work provides a significant and continuous volume driver for reliable, foundational AC welding equipment. Conversely, North America and Europe, representing mature and highly regulated markets, maintain steady, high-value demand, predominantly through the specialized Maintenance, Repair, and Overhaul (MRO) sector. In these developed regions, AC machines fill specialized application niches where alternating current is technically superior, such as critical aluminum alloy welding using TIG or specifically mitigating severe magnetic arc blow issues frequently encountered when welding very large steel components. Furthermore, proactive governmental policies promoting skilled trade vocational training and supporting domestic manufacturing initiatives contribute positively to regional equipment consumption patterns, ensuring a necessary and continuous replacement cycle for industrial capital equipment.

Segment trends analysis underscores the sustained dominance of the Low Power Range segment (typically units below 300 Amps) due to its vast and broad applicability across small workshops, independent repair garages, educational institutions, and entry-level industrial use. In terms of end-use application, the Construction and Infrastructure sector remains the single largest consumer of AC arc welding machines, given the indispensable nature of stick welding for on-site structural fabrication, immediate field repairs, and fundamental structural integrity assessments. Technologically, while purely AC transformer machines remain essential, there is a gradual but notable upward trend in demand for highly specialized constant current (CC) AC units, which provide the consistent, precise output control required for the highest quality Shielded Metal Arc Welding processes. The gradual integration of essential digital interfaces for accurate parameter setting, even in conventional AC transformer models, is emerging as a critical product differentiator, significantly enhancing the overall ease of use, repeatability, and compliance across diverse industrial tasks and operator skill levels.

AI Impact Analysis on AC Arc Welding Machine Market

Common user questions regarding the potential impact of Artificial Intelligence (AI) on the AC Arc Welding Machine Market frequently center on whether automation will ultimately render traditional manual AC welding processes obsolete, precisely how AI can be practically implemented to improve the often-basic performance characteristics of conventional transformer units, and the potential for applying sophisticated predictive maintenance protocols to rugged, electromechanical equipment. Users consistently express concerns about the prohibitive integration costs and complexity of AI versus the tangible operational benefits for what is essentially low-cost, mature machinery. The consensus derived from market analysis suggests that while AI is highly unlikely to revolutionize or fundamentally change the core electromagnetic transformer technology itself, it will exert a profound influence on peripheral processes, operator training methodologies, quality assurance, and preventive maintenance protocols. Key themes emerging from user expectations include using AI to dramatically enhance welder safety through sophisticated monitoring systems, optimizing welding parameter settings for novice or inconsistent users, and crucially, utilizing machine learning algorithms to accurately predict component failure, thereby significantly extending the serviceable lifespan and maximizing the operational efficiency of these vital capital assets.

The practical application of Artificial Intelligence within the specific domain of AC Arc Welding Machines is strategically directed towards three primary areas: optimizing operational efficiency, ensuring superior weld quality consistency in manual operations, and proactively streamlining complex maintenance schedules. Although AC welders are structurally and electronically simpler than their advanced inverter counterparts, AI algorithms possess the capability to process large volumes of operational data—including input power fluctuations, real-time duty cycle utilization, electrode consumption rates, and thermal profiling—to provide invaluable, real-time feedback to both the machine operators and centralized management systems. This data-driven, intelligent approach strategically moves the market toward ‘smart’ manual welding, where basic, durable equipment is supported by non-intrusive, intelligent monitoring systems that actively work to reduce common human errors and minimize costly, unplanned downtime. This directly addresses prevalent user demands for significantly enhanced reliability and predictable performance in mission-critical applications.

Furthermore, AI is expected to play an increasingly crucial and supportive role in global workforce development and rigorous quality assurance processes intrinsically linked to AC welding. Advanced Virtual Reality (VR) and Augmented Reality (AR) training platforms, powered by sophisticated machine learning models, can realistically simulate the unique arc characteristics and operational nuances of AC welding scenarios, allowing trainees to rapidly and effectively develop crucial expertise and muscle memory without incurring the environmental and financial costs of excessive material waste. In post-weld quality control, AI-driven visual inspection systems can analyze the physical attributes of weld beads created using AC equipment far faster, more objectively, and more consistently than traditional human inspectors. These systems can immediately flag subtle defects associated with incorrect amperage, unstable travel speed, or insufficient penetration. This smart integration of intelligence, even overlaid onto basic, foundational machinery, ensures that traditional AC welding remains a viable, high-quality, and compliant fabrication method in the face of increasingly stringent global industrial standards and complexity.

- Enhanced Predictive Maintenance: AI algorithms analyze continuous operational data (e.g., internal temperature, input voltage stability, current output history) to accurately forecast potential transformer winding or cooling system failures, thereby minimizing catastrophic unexpected downtime.

- Optimized Parameter Settings: Machine learning models utilize historical performance data and electrode specifications to suggest ideal amperage and electrode manipulation settings, significantly improving the consistency and first-time weld quality, particularly benefiting less experienced operators.

- Intelligent Training Simulators: AI-powered VR/AR tools realistically replicate the specific arc sound, feel, and puddle dynamics of AC welders, dramatically accelerating the specialized skill acquisition timeline for new entrants into the welding profession.

- Automated Quality Inspection: AI vision systems quickly and consistently assess the surface integrity, uniformity, and overall compliance of AC welds against predefined fabrication standards, ensuring rapid throughput in quality control processes.

- Energy Consumption Management: Monitoring and control systems use AI to dynamically optimize usage patterns, regulate fan operation, and manage effective duty cycles, contributing substantially to operational cost savings in large industrial fabrication facilities.

DRO & Impact Forces Of AC Arc Welding Machine Market

The AC Arc Welding Machine Market is influenced by a highly dynamic interplay of interconnected factors, encapsulated by drivers, restraints, and opportunities (DRO). Key drivers include significant and accelerating global growth in heavy construction and specialized fabrication sectors, particularly concentrated in emerging economies where the inherent robustness, simplicity, and superior affordability of AC units make them the undisputed preferred choice for fundamental, foundational welding tasks. Furthermore, the established, scientifically proven benefits of AC welding, such as its fundamental resistance to debilitating magnetic arc blow—a critical and often unavoidable issue when welding massive, highly magnetic steel structures—ensure their non-negotiable continued necessity in specific, high-demand industrial applications, such as shipbuilding and large diameter pipe welding. Conversely, the primary restraints center on the relentless, rapid technological shift towards advanced, multi-functional inverter-based welders, which offer superior arc stability, significantly enhanced portability, and advanced multifunctional capabilities (e.g., high-frequency TIG, MIG compatibility). These highly competitive, feature-rich alternatives pose a formidable challenge, particularly targeting precision, high-specification manufacturing environments where fine arc control is prioritized over sheer ruggedness. Nevertheless, substantial market opportunities are readily available in the accelerated development and commercialization of hybrid AC/DC machines. These innovative systems intelligently leverage the proven, low-cost reliability of the conventional AC power source combined with the performance enhancements provided by modern rectification and advanced digital control circuits, offering a commercially viable and technologically balanced solution for discerning industrial buyers.

Impact forces within the AC Arc Welding Machine Market are heavily dominated by the high threat of substitute products and intense competitive rivalry, analyzed through the lens of Porter's Five Forces framework. The high threat of substitution originates directly from the continuous, aggressive innovation cycles in DC inverter technology, which is rapidly becoming both increasingly affordable and significantly more powerful, thereby directly eroding the traditional, foundational market share historically held by the bulky, older generation AC transformer units. Simultaneously, the competitive rivalry among existing established AC manufacturers is considered moderate but highly strategic, focusing intensively on margin-thinning pricing strategies and marginal, iterative improvements in core areas like energy efficiency, as the foundational transformer technology itself is mature and largely commoditized. Analyzing the supply chain, supplier power is currently relatively low due to the standardized and globally sourced nature of key components, which include copper and aluminum windings and specialized steel cores, leading to inherent commoditization across the basic range of AC welding equipment. Conversely, buyer power is categorized as high, especially concerning large-scale construction, infrastructure, and shipyard clients, as these entities typically purchase equipment in bulk volumes. They possess significant leverage and can easily switch between competing technologies or manufacturers based fundamentally on pricing, long-term operational costs, and the quality of post-sales service contracts, collectively placing persistent, downward pressure on manufacturer profit margins.

The expansive opportunity landscape for AC arc welders is further amplified by the increasing global necessity for extensive repair and essential maintenance work on aging global infrastructure, a sprawling sector where rugged, durable, and easily transportable field-ready AC welders are often deemed absolutely indispensable. Furthermore, regulatory forces, specifically evolving international standards related to energy efficiency (such as the strict European Ecodesign directives or equivalent ANSI standards), function as both a powerful restraint (compelling manufacturers to fundamentally update decades-old designs) and a significant opportunity (aggressively driving internal innovation toward the adoption of more efficient transformer materials, reduced winding losses, and smarter, fan-on-demand cooling systems). Successfully navigating these complex environmental and performance regulations while simultaneously maintaining the core strength of cost-effectiveness is a critical strategic imperative for market stakeholders aiming for sustainable long-term growth and robust competitiveness against technologically superior, albeit frequently more costly, alternative welding solutions across all major global industrial markets.

Segmentation Analysis

The AC Arc Welding Machine Market is meticulously and strategically segmented based on several critical criteria, including output power characteristics, specific technological design, final end-use application, and broad geographical region. This systematic, structured analysis provides an essential granular view of the specific demand drivers across vastly different end-user industries, spanning from small home hobbyists and independent contractors to massive industrial fabrication complexes and global shipyards. The primary segmentation by type fundamentally distinguishes between Constant Current (CC) machines, which are absolutely crucial for producing high-quality, deep-penetration stick welding, and Constant Voltage (CV) machines, which, while less common for pure stick welding, are sometimes adapted for specialized wire feeding systems or high-speed applications; however, CC configuration remains overwhelmingly dominant within the conventional AC stick welding domain due to process requirements. Segmentation based on end-use application allows manufacturers to precisely tailor product attributes, such as durability, required duty cycle, and maximum power output, to the unique needs of distinct sectors like heavy civil construction, demanding automotive repair and aftermarket services, extensive pipe fabrication, and general metalworking, thereby ensuring optimal product-market fit and maximizing operational performance reliability for the ultimate end-user.

Further strategic segmentation by power range systematically delineates the market into three primary categories: low power (typically defined as output under 300 Amps), medium power (ranging between 300 and 500 Amps), and high power (exceeding 500 Amps). The low-to-medium power segments collectively command the overwhelming largest share of the total market, effectively catering to the extensive Maintenance, Repair, and Overhaul (MRO) market, countless smaller fabrication shops, and vocational training centers where critical purchasing criteria include portability, ease of use, and a lower initial capital cost. In stark contrast, the high-power segment is absolutely critical for the success of large-scale, heavy industrial projects, notably large-scale shipbuilding, heavy structural steel infrastructure, and specialized mining equipment repair, where continuous high deposition rates, unwavering reliability, and an extremely high duty cycle are stringent, non-negotiable operational requirements. Understanding these distinct segmented needs across the power spectrum enables manufacturers to significantly optimize their multi-channel distribution strategies—utilizing high-volume retail and vocational suppliers for the lower-power units, while relying on highly specialized direct industrial sales teams and engineers for the marketing and service of high-power, customized industrial equipment.

Consequently, the overall market structure is highly heterogeneous and complex, requiring sophisticated, differentiated marketing strategies, highly focused product development pipelines, and tailored after-sales support frameworks. The enduring technological relevance and core reliability of AC arc welding technology mean that while the overall volume growth rate may be statistically slower compared to the explosive growth witnessed in emerging digital welding technologies, this segment represents a critical and highly stable source of foundational industrial revenue. Strategic focus for market leaders involves continuous, iterative improvement—specifically enhancing the user interface for greater precision, integrating mandatory global safety features (such as the Voltage Reduction Device, or VRD), and offering robust, highly competitive warranty and maintenance service packages. These core strategies are essential levers employed by major market stakeholders to successfully defend their established positions within these distinct application and power segments against the increasingly aggressive competitive encroachment from technologically superior, yet structurally less rugged, welding solutions currently entering the global market.

- By Type:

- Constant Current (CC) Machines: Dominant for traditional SMAW, offering stable output essential for electrode melting.

- Constant Voltage (CV) Machines (Less common for pure AC arc): Used primarily in conjunction with mechanized wire feeding systems, requiring specific configurations.

- By Power Range (Amperage):

- Low Power (Below 300 Amps): High volume, MRO, small workshops, and educational use.

- Medium Power (300 - 500 Amps): Standard industrial fabrication, mid-size construction projects, and heavy maintenance.

- High Power (Above 500 Amps): Heavy industry, shipbuilding, structural infrastructure, and applications demanding continuous high output.

- By Application:

- Construction and Infrastructure: Largest segment, relying on robustness and site suitability for structural steel.

- Automotive and Transportation (Repair/Aftermarket): General vehicle chassis and heavy equipment repair.

- Shipbuilding and Marine Fabrication: Critical applications where arc blow mitigation is essential.

- Oil and Gas (Pipeline and Field Repair): High demand for rugged, portable, and reliable field repair units.

- General Fabrication and Metalworking: Diverse consumption across SMEs and custom fabrication shops.

Value Chain Analysis For AC Arc Welding Machine Market

The value chain for the AC Arc Welding Machine Market strategically commences with upstream activities centered on meticulous raw material procurement, focusing primarily on high-conductivity materials such as specialized copper and high-grade aluminum windings, critical magnetic core components like specialized silicon steel laminations, and, for certain heavy-duty models, robust transformer oil used for essential cooling. Manufacturers strategically leverage highly efficient global supply chains to source these standardized yet critical components cost-effectively, though it is important to note that geopolitical risks and acute commodity price volatility directly and significantly impact upstream production costs. The subsequent manufacturing phase encompasses core assembly, precise winding of the primary and secondary coils, protective casing fabrication, and the final integration of necessary control circuits and safety devices. Companies in this mature market constantly emphasize lean manufacturing techniques and strict process efficiency to maintain highly competitive pricing, a necessity given the relatively standardized and commoditized nature of the final transformer product. Rigorous quality control protocols at this foundational stage are absolutely crucial to ensure the achievement of high rated duty cycles and full compliance with international electrical and safety standards, establishing the expected foundational robustness and longevity of traditional AC welding equipment.

Midstream activities involve complex and highly organized logistics and distribution channel management. Direct distribution channels are typically employed for high-power, premium industrial units that are sold directly to large institutional end-users (e.g., major shipyards, primary steel mills, large EPC firms), allowing manufacturers to maintain indispensable close customer relationships and efficiently offer highly specific bundled service and maintenance agreements. However, the overwhelming majority of low and medium-power AC machines are moved efficiently through indirect channels, relying extensively on a vast and decentralized network of regional welding equipment distributors, high-volume hardware and industrial supply stores, specialized vocational training centers, and increasingly, sophisticated, dedicated e-commerce platforms. These essential distributors provide critical localized services, including maintaining essential local inventory, offering immediate technical support, providing financing options to smaller businesses, and managing spare parts inventory, thereby making the final product readily accessible to an extremely diverse user base, ranging from individual contractors to sophisticated Small and Medium Enterprises (SMEs).

Downstream analysis critically focuses on efficient installation, long-term maintenance, and proactive after-sales service provision. Given that AC welders are frequently utilized in extremely harsh, challenging industrial and outdoor environments, immediate reliability and quick, cost-effective maintenance turnaround times are absolutely paramount operational metrics. Dedicated service networks, encompassing both manufacturer-authorized centers and qualified independent service providers, play a pivotal role in offering robust preventative maintenance packages and essential repair services, consequently extending the productive and usable lifespan of the capital equipment—a significant and appealing value proposition for highly cost-conscious industrial buyers. Furthermore, the continuous and reliable supply of standardized welding consumables, particularly electrodes suitable for AC operation (e.g., E6011, E7018), forms a crucial, high-frequency component of the downstream value proposition, ensuring operational continuity and minimizing work stoppages for end-users located across disparate construction sites and permanent fabrication facilities globally.

AC Arc Welding Machine Market Potential Customers

Potential customers for AC Arc Welding Machines span an exceptionally broad and diverse spectrum of industries, primarily encompassing those engaged in heavy fabrication, structural erection, extensive field maintenance, and essential vocational training. The single largest and most critical buying segment includes major engineering, procurement, and construction (EPC) firms deeply involved in large-scale civil infrastructure projects, such as the construction of bridges, complex high-rise commercial and residential buildings, and expansive industrial facilities. These large entities place a premium value on the unparalleled robust nature, inherent operational simplicity, and superior performance characteristics of AC welders when utilized on heavy structural steel and highly thick metal sections. Another major and consistently reliable customer base is the Maintenance, Repair, and Overhaul (MRO) sector, which includes general automotive and equipment repair garages, intensive agricultural machinery maintenance services, and mobile field service crews who explicitly require durable, easily transportable, and forgiving welding equipment for diverse, immediate on-site material repairs under uncontrolled conditions.

Furthermore, several specialized industrial sectors constitute highly significant, consistent customer segments. The global shipbuilding and complex marine fabrication industries frequently utilize AC machines due to their unique efficacy in completely mitigating magnetic arc blow, a pervasive issue when welding large, complex ferromagnetic hull components, which often severely affects standard DC welders. This technical advantage ensures their indispensable role in major shipyard operations. Educational and vocational training institutes also represent a consistent, high-volume customer segment, as AC stick welding is globally taught as the fundamental, foundational welding process due leveraging the simplicity and durability of the equipment and the fundamental hands-on skills it effectively imparts. These essential institutions ensure a continuous and predictable demand stream for basic, reliable AC units, which are universally viewed as essential, entry-level apparatus for the development and training of new skilled welders worldwide.

In terms of observable buyer behavior, large corporate, institutional buyers typically prioritize extremely high duty cycles, guaranteed compliance with specific, non-negotiable industry standards (e.g., AWS D1.1, ISO 3834), and comprehensive, long-term service agreements and robust technical support. Small and medium enterprises (SMEs) and independent professional contractors, in contrast, are highly sensitive to the initial capital purchase price, actively seeking the lowest feasible total cost of ownership coupled with maximum guaranteed durability and minimal necessary maintenance requirements throughout the equipment's lifespan. This inherent duality in core customer demands necessitates that market manufacturers maintain a carefully tiered and highly flexible product portfolio, offering both highly durable, premium industrial-grade units (often with integrated advanced features) and more cost-optimized, basic transformer models specifically targeted at the smaller professional user and the high-volume DIY market, thereby effectively addressing the diverse and often conflicting purchasing drivers present within the complex global market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miller Electric Mfg. LLC, Lincoln Electric, ESAB, Hobart Welding Products, Panasonic Corporation, Kemppi Oy, TWI Ltd., Fronius International GmbH, Colfax Corporation, Kjellberg Finsterwalde Plasma und Schweißtechnik GmbH, Riland Industry Co., Ltd., Jasic Technology, AOTAI Electric, Hugong, Wuxi Victor Power, Telwin S.p.A., CEA Group, Time Group Inc., Arc Machines, Inc., Weld-Tek. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AC Arc Welding Machine Market Key Technology Landscape

The core technological foundation underpinning the AC Arc Welding Machine Market remains the highly durable and reliable transformer design, which operates on fundamental electromagnetic induction principles to efficiently step down utility voltage and dramatically increase the necessary welding current. Traditional AC welders are fundamentally defined by their reliance on massive copper or aluminum windings precisely placed around a laminated steel core, forming a fixed and robust magnetic circuit necessary for alternating current flow. While this foundational technology is definitively mature, recent and ongoing developmental efforts are intensely focused on advanced material science and iterative component optimization. Specifically, manufacturers are increasingly adopting higher grade, lower-loss silicon steel laminations to significantly improve the electrical efficiency of the core and reduce parasitic heat generation, which directly translates into an enhanced operational duty cycle—a paramount performance metric for heavy industrial usage. Furthermore, sophisticated thermal management systems are being continuously improved, frequently incorporating modern fan-on-demand technology to minimize unnecessary noise and drastically reduce energy consumption when the machine is not operating under heavy, sustained load conditions.

A significant, market-shaping technological shift, although not strictly confined to the scope of pure AC transformation, involves the substantial and increasing integration of solid-state electronic components for superior arc control and essential safety feature implementation. Many advanced modern AC welders now strategically incorporate sophisticated rectification and digital control circuits that enable advanced performance features such as optimized hot start capability, dynamic arc force control, and automatic anti-stick functions, capabilities traditionally and exclusively associated with high-end DC or inverter machines. This strategic hybrid approach leverages the unparalleled reliability and low operational cost of the fundamental AC transformer as the primary power source while strategically integrating advanced semiconductor technology to significantly enhance the overall welding arc characteristics. This integration makes the AC welding process far more forgiving, dramatically versatile for a wider range of electrode types, and provides a level of control previously unattainable. Crucially, mandatory safety technologies, specifically the globally regulated Voltage Reduction Device (VRD), are rapidly becoming standard across all new models, automatically and safely dropping the open circuit voltage to a non-hazardous level when the machine is not actively creating an arc, effectively addressing critical safety concerns in challenging construction environments and areas with high ambient humidity.

The contemporary market also reflects a measurable, gradual adoption of basic, user-friendly digital interfaces designed for precise and consistent parameter setting, strategically moving away from purely mechanical analog dials and gauges. This measured digitization, while maintaining the simplicity of the underlying transformer, allows for accurate and repeatable replication of welding settings, which is absolutely vital for stringent quality compliance, traceability, and ensuring consistent quality output in modern, regulated fabrication shops. Moreover, continuous technological advancements in specialized cooling methods, including optimized oil-cooling systems for critical high-duty cycle industrial units, continue to strongly differentiate premium, heavy-industrial AC models from standard, entry-level offerings. Ultimately, the current technology landscape for AC arc welding is defined by foundational resilience and uncompromising durability, strategically augmented by iterative improvements rigorously focused on electrical efficiency gains, mandatory safety compliance integration, and enhanced operator arc control, collectively ensuring the enduring relevance and sustained market share of the AC machine in the most demanding, heavy-duty industrial applications worldwide.

Regional Highlights

Geographically, the AC Arc Welding Machine Market exhibits distinctly diverse growth trajectories and consumption patterns that are heavily influenced by regional economic development, the pace of industrialization, and specific industrial maturity levels. The Asia Pacific (APAC) region fundamentally holds the dominant global market share and is decisively projected to exhibit the fastest Compound Annual Growth Rate throughout the entire forecast period. This robust and accelerated expansion is fundamentally linked to unprecedented governmental and private sector spending on massive infrastructure developments, including new railways, extensive bridges, strategic power plants, and rapid urbanization projects, particularly concentrated in rapidly industrializing and densely populated nations such as India, Vietnam, and Indonesia. The massive construction sector's inherent reliance on cost-effective, extremely durable, and functionally reliable welding solutions makes the AC arc welder a primary, high-volume choice across countless new fabrication sites and maintenance depots throughout the region. Furthermore, the immense and burgeoning small and medium enterprise (SME) sector across APAC, which focuses intensely on general fabrication, component manufacturing, and localized maintenance, significantly drives the overall volume demand for reliable low-to-medium power AC units, ensuring the region’s market dominance.

North America and Europe collectively represent highly mature markets characterized by sustained, stable demand, which is primarily originating from the vital Maintenance, Repair, and Overhaul (MRO) sector and highly specialized heavy fabrication niches, such as within the regulated aerospace and defense supply chains (where specific material certifications and process control may still favor conventional methods). Although the overall adoption rate of advanced inverter technology is markedly higher in these developed regions, AC welders successfully retain a critical, non-replaceable niche due to their unique performance characteristics, particularly their superior ability to completely mitigate the effects of magnetic arc blow when operators are working with large, complex magnetic steel assemblies—a technical necessity. The regulatory environments in Europe, which strictly focus on energy efficiency (dictated by AEO optimization principles) and mandatory operator safety standards (like VRD), compel manufacturers to continuously and expensively upgrade their core AC product lines, often resulting in slightly higher-priced, premium models that boast superior integrated safety features and higher certified efficiency ratings, catering to a sophisticated industrial clientele.

Latin America (LATAM) and the Middle East and Africa (MEA) are recognized as high-potential emerging markets currently exhibiting promising, accelerated growth trends. In the LATAM region, significant infrastructure upgrades, sustained mining operations expansion, and large-scale oil and gas sector investments actively drive market demand, focusing intensely on rugged, field-serviceable, and easily repairable equipment—characteristics intrinsically inherent to traditional AC welders. In the MEA region, specifically the Gulf Cooperation Council (GCC) states, enormous public spending on large-scale construction projects, coupled with the continuous, expansive development of oil and gas processing and export facilities, necessitates vast quantities of consistently reliable welding equipment for both new construction phases and complex ongoing facility maintenance. While short-term economic volatility and geopolitical risks can occasionally impact immediate capital investment cycles, the overarching long-term trend strongly supports sustained and increasing demand for durable, low-maintenance AC arc welding solutions across these rapidly developing industrial hubs, ensuring critical regional diversity in the overall global market landscape and providing strong future revenue streams for key market players.

- Asia Pacific (APAC): Dominant global market share and projected highest growth rate, fueled by colossal infrastructure spending, rapid expansion of the shipbuilding industry, and the exponential growth of the SME manufacturing base across key nations including China, India, and Southeast Asia.

- North America: Characterized by a stable, mature market primarily sustained by intensive MRO activities, specialized, highly regulated heavy fabrication, and robust replacement cycles necessary within the aging industrial infrastructure. Market preference is driven by quality, advanced safety compliance, and professional-grade durability.

- Europe: A mature and highly regulated market defined by stringent environmental and safety regulations (e.g., Ecodesign directives), which drives demand exclusively for highly efficient, premium AC and specialized hybrid AC/DC models utilized mainly in specialized precision engineering and critical repair applications.

- Latin America (LATAM): A rapidly growing market strongly fueled by extensive investments in core mining, complex oil and gas infrastructure, and necessary public works projects. There is a strong regional preference for robust, low-maintenance equipment capable of withstanding challenging field and environmental conditions.

- Middle East and Africa (MEA): High growth potential stemming from large-scale energy sector projects and persistent construction booms, particularly evident in the Gulf region, emphasizing the necessity for high-duty cycle machines capable of continuous and reliable operation in extremely harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AC Arc Welding Machine Market.- Miller Electric Mfg. LLC

- Lincoln Electric

- ESAB

- Hobart Welding Products

- Panasonic Corporation

- Kemppi Oy

- TWI Ltd.

- Fronius International GmbH

- Colfax Corporation (through ESAB)

- Kjellberg Finsterwalde Plasma und Schweißtechnik GmbH

- Riland Industry Co., Ltd.

- Jasic Technology

- AOTAI Electric

- Hugong

- Wuxi Victor Power

- Telwin S.p.A.

- CEA Group

- Time Group Inc.

- Arc Machines, Inc.

- Weld-Tek

Frequently Asked Questions

Analyze common user questions about the AC Arc Welding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using an AC Arc Welding Machine over a DC machine?

The main technological advantage of AC arc welding is its exceptional ability to effectively mitigate magnetic arc blow, which is a debilitating issue frequently encountered when welding thick, long, or complex steel structures using direct current (DC). AC provides a inherently stable, cleaner arc initiation, making it essential for critical heavy fabrication and repair jobs.

How is the AC Arc Welding Machine Market adapting to modern inverter technology competition?

The market is successfully adapting by integrating basic digital controls for precise settings, mandated enhanced safety features like the Voltage Reduction Device (VRD), and strongly focusing on developing robust hybrid AC/DC transformer units. Manufacturers strategically leverage the AC machine’s lower initial capital cost and inherent structural durability as critical competitive differentiators, particularly appealing to high-volume construction sectors.

Which geographical region is currently driving the largest volume demand for AC welders?

The Asia Pacific (APAC) region currently drives the largest volume demand for AC welders globally. This significant demand is attributed to massive, ongoing infrastructure development, high rates of industrialization, and the essential necessity for cost-effective, extremely robust welding equipment across rapidly expanding construction and heavy fabrication industries in major countries like China and India.

Are AC Arc Welding Machines considered energy efficient under new global regulations?

Traditional AC transformer welders are inherently less energy efficient compared to modern inverter technologies due to core losses. However, manufacturers are now legally mandated to adhere to new regulations (e.g., Ecodesign) by upgrading internal components, utilizing superior lower-loss core materials, and integrating optimized electronic cooling systems to substantially improve their overall electrical efficiency and compliance ratings.

What specific applications are best suited for high-amperage AC Arc Welding Machines (500+ Amps)?

High-amperage AC Arc Welding Machines are optimally suited for large-scale, heavy industrial applications that demand continuous, high deposition rates and extremely high operational duty cycles. Primary examples include critical heavy structural steel erection, extensive, large diameter pipeline welding, complex shipbuilding, and industrial plant maintenance where material thickness and continuous operation without overheating are non-negotiable requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager