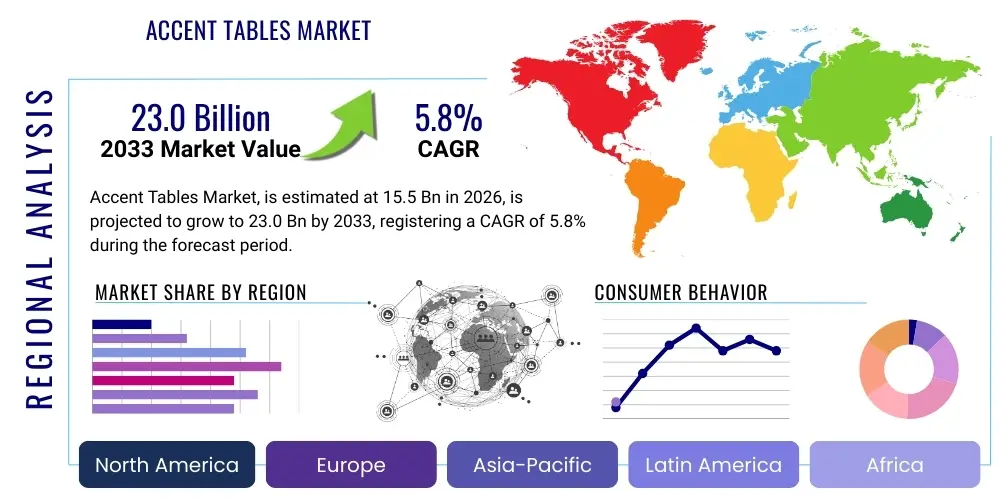

Accent Tables Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441307 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Accent Tables Market Size

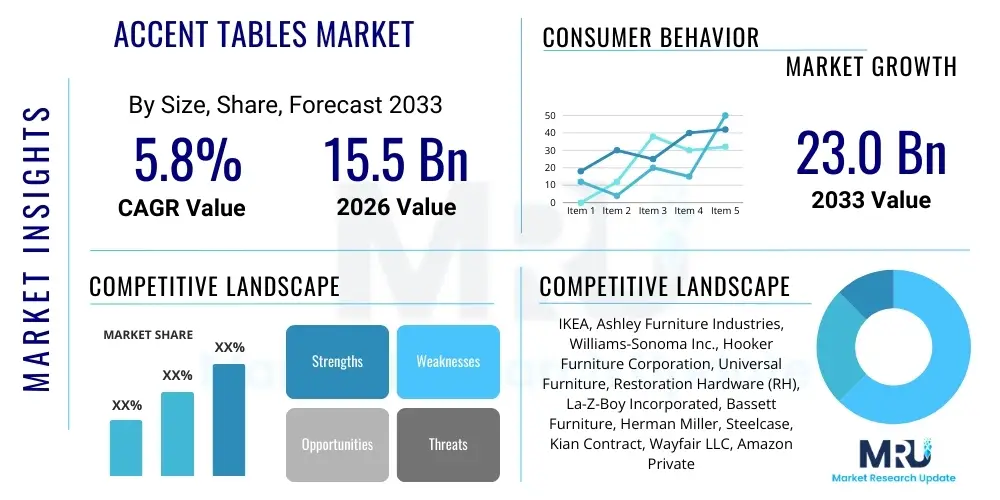

The Accent Tables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Accent Tables Market introduction

The Accent Tables Market encompasses a diverse range of functional and decorative furniture pieces designed to enhance the aesthetic appeal and utility of interior spaces, including living rooms, bedrooms, and hallways. These tables, which include end tables, console tables, coffee tables, and specialized nesting tables, serve dual purposes: providing surfaces for practical items like lamps, beverages, or books, and acting as crucial decorative elements that complement the overarching design theme of a room. The market growth is inherently tied to global trends in residential real estate development, increasing consumer expenditure on home renovation and interior design, and the rising demand for multi-functional furniture solutions in smaller urban dwellings. Furthermore, the product’s appeal lies in its flexibility, allowing consumers to frequently update their décor with minimal investment compared to major furniture pieces.

Major applications of accent tables span both the residential and commercial sectors. In residential settings, they are indispensable for creating defined zones and adding layers of texture and material contrast to modern or traditional interiors. Commercially, they are utilized extensively in hospitality (hotels, resorts), corporate lobbies, and upscale retail environments to establish sophisticated waiting areas and display points. The primary benefits driving market expansion include the ease of integration into existing décor, the wide availability of designs catering to various aesthetic preferences (from minimalist contemporary to ornate classic), and the perceived value addition to the overall room ambiance. As disposable incomes rise globally, particularly in emerging economies, consumers increasingly view accent tables not merely as utility items but as essential lifestyle and decor statements.

Driving factors for the Accent Tables Market include a resurgence in the do-it-yourself (DIY) home improvement culture, the significant influence of social media platforms (like Instagram and Pinterest) driving quick home décor turnover, and advancements in manufacturing techniques that enable the use of sustainable and innovative materials such as reclaimed wood, recycled metals, and composite materials with marble finishes. The e-commerce explosion has also democratized access to specialty and custom-made accent tables, offering unparalleled choice to consumers worldwide. This accessibility, coupled with sustained urbanization and a focus on aesthetically pleasing, personalized interior spaces, forms the foundational support for the market's robust projected growth through the forecast period.

Accent Tables Market Executive Summary

The Accent Tables Market is characterized by dynamic business trends centered on rapid product innovation, driven primarily by material science and consumer preference for customization. Key business trends involve the merging of technology and furniture, such as tables with integrated charging ports and smart lighting features, and a significant shift towards omni-channel distribution models, ensuring seamless integration between physical showrooms and sophisticated online configurators. Manufacturers are strategically focusing on supply chain resilience and ethical sourcing, responding directly to heightened consumer demand for sustainability and transparency in material origins, particularly regarding wood and metal components. The competitive landscape remains fragmented, pushing established players to leverage direct-to-consumer (D2C) channels and aggressive digital marketing campaigns to maintain market share against agile, digitally native brands.

Regionally, North America and Europe maintain dominance, characterized by high consumer spending power and mature interior design markets, driving demand for premium, high-end materials like genuine marble and artisanal metalwork. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid urbanization, substantial growth in the middle-class population in countries like China and India, and large-scale residential and commercial infrastructure projects. This region is witnessing a rising preference for compact, multi-functional accent tables tailored for smaller apartment living. Economic stability and robust residential housing markets continue to underpin demand across all major geographies, with localized trends influencing design specifics, such as a preference for Japanese minimalist aesthetics in parts of East Asia and rustic farmhouse styles in certain Western markets.

Segment trends highlight a strong consumer pivot towards multifunctional and convertible accent tables, specifically C-tables and nesting table sets, which maximize space efficiency without sacrificing design appeal. In terms of materials, the demand for mixed materials—combining industrial metal frames with organic wooden tops or luxurious marble accents—is experiencing significant momentum, reflecting a contemporary design preference. The distribution channel segment is seeing a remarkable transformation, with online retail channels now representing the fastest-growing segment, surpassing traditional brick-and-mortar furniture stores in growth rate due to better visualization tools, lower overheads, and efficient direct-to-home delivery capabilities. Furthermore, within the end-user segment, the commercial sector, particularly hospitality remodeling and new luxury apartment furnishings, is driving steady demand for durable, contract-grade accent tables.

AI Impact Analysis on Accent Tables Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Accent Tables Market primarily revolve around three core themes: personalized design recommendations, optimized manufacturing and supply chain efficiency, and the integration of smart features into the furniture itself. Users frequently ask how AI can generate bespoke table designs based on their existing room aesthetics, dimensions, and preferred style history, effectively acting as an automated interior designer. There is also keen interest in how AI-powered demand forecasting and inventory management can reduce lead times and minimize waste in the production of varied materials like customized metal frames or unique wood finishes. Finally, users seek clarification on the practical smart home integrations—such as tables that automatically adjust lighting or monitor air quality—and whether these features will become standard across the mid-to-high price range accent tables.

The application of AI in the design and retail phases is revolutionizing the customer experience and accelerating product turnover. AI algorithms analyze vast datasets of consumer preferences, social media trends, and regional sales patterns to predict popular styles, colors, and material combinations, enabling manufacturers to launch hyper-targeted product lines months ahead of traditional design cycles. This predictive capability significantly reduces the risk of overstocking unpopular designs, a perennial challenge in the cyclical furniture industry. Furthermore, AI-driven visualization tools and Augmented Reality (AR) apps allow consumers to virtually place a desired accent table in their home before purchase, dramatically lowering return rates associated with sizing and color discrepancies, thereby boosting overall retail efficiency and customer satisfaction.

In the operational sphere, AI is being deployed for advanced supply chain optimization, particularly crucial for the complex logistics associated with global furniture components (e.g., sourcing wood from sustainable forests, metal components from specialized fabricators). Machine learning models analyze transportation routes, inventory fluctuations, and material availability to establish the most cost-effective and environmentally friendly pathways for production and delivery. On the factory floor, AI-powered robotics are enhancing precision in cutting and assembly, especially for intricate metal or stone inlay work often found in premium accent tables, ensuring consistency and high quality while mitigating labor costs. While direct AI integration within the physical table remains niche (limited to smart charging and basic sensors), the transformative impact is predominantly visible in the back-end processes of design, logistics, and customer interface.

- AI-Powered Personalized Design: Generates bespoke table recommendations based on user uploaded room images and style history, enhancing conversion rates.

- Optimized Inventory Management: Machine learning models predict seasonal and regional demand shifts, minimizing excess inventory and maximizing material utilization.

- Enhanced AR Visualization: AI-driven augmented reality tools allow precise virtual placement of tables in customer homes, drastically reducing product returns.

- Supply Chain Efficiency: Algorithms optimize material sourcing, manufacturing schedules, and global logistics, ensuring faster delivery of diverse components.

- Smart Manufacturing: Robotics guided by AI systems improve precision cutting of materials like glass, metal, and engineered wood, ensuring high-quality finishes.

DRO & Impact Forces Of Accent Tables Market

The Accent Tables Market is significantly influenced by powerful dual forces: the accelerating consumer preference for customized and stylish home furnishings (Drivers) versus the persistent challenges associated with fluctuating raw material costs and complex global logistics (Restraints). The primary opportunities lie in capitalizing on technological integration—both in manufacturing efficiency and offering smart furniture features—and penetrating rapidly expanding emerging markets, particularly within the APAC region where urbanization is driving massive housing construction. These factors collectively establish a highly competitive environment where innovation in design and efficiency in the supply chain determine market leaders. The overarching Impact Forces dictate that companies investing heavily in sustainable sourcing and D2C digital platforms are best positioned to capture long-term value, while those reliant solely on traditional retail channels face growing competitive pressure from online specialists.

Driving factors are led by rising disposable incomes across developing nations, facilitating increased discretionary spending on non-essential home décor items, and the pervasive global trend of aestheticization of living spaces fueled by interior design media. Furthermore, the functional flexibility of accent tables, which often serve as space-saving solutions in smaller urban apartments, ensures sustained demand. However, the market faces significant restraints, chiefly volatility in the price of key raw materials like timber, steel, and imported exotic stones, which directly impacts manufacturing costs and profit margins. Additionally, the furniture market’s susceptibility to cyclical economic downturns means consumer spending on non-essential items like accent tables can be quickly curtailed during periods of recession or high inflation, posing a notable commercial risk to manufacturers and retailers.

Opportunities for growth are abundant, particularly through strategic product differentiation via sustainable materials and ethical manufacturing certifications, appealing to the environmentally conscious millennial and Gen Z consumer base. The expansion of e-commerce platforms provides a crucial channel for market penetration, allowing specialty designers and smaller manufacturers to bypass traditional distribution hurdles and reach a global audience. The Impact Forces framework emphasizes competitive intensity driven by product differentiation. Key impact forces include rapid design plagiarism—where successful styles are quickly copied by low-cost manufacturers—and the intense pricing pressure exerted by mega-retailers who can leverage massive scale. Successful market players must focus on intellectual property protection for unique designs, establish robust, localized supply chains, and build strong brand narratives centered on quality, origin, and sustainability to withstand external economic shocks and internal competitive erosion.

Segmentation Analysis

The Accent Tables Market is meticulously segmented based on product type, material composition, distribution channel, and end-user application to provide a granular view of consumer preferences and operational dynamics. This segmentation reveals distinct growth trajectories for specialized products like console tables, which are highly popular in residential hallways and entryways, compared to ubiquitous end tables used extensively near seating arrangements. The dominance of wood and engineered wood materials remains strong due to cost-effectiveness and versatility, but there is an increasing market share captured by mixed materials blending industrial aesthetics (metal) with luxurious finishes (marble or glass). The evolution of distribution channels, favoring online retail for ease of comparison and logistical efficiency, is a critical structural change underpinning market dynamics and driving investment decisions among leading industry participants.

Analyzing these segments provides strategic insights. For instance, manufacturers targeting the commercial segment (hotels and corporate offices) must focus on durability, fire-retardant coatings, and standardized design options suitable for bulk procurement, differentiating themselves from those serving the residential sector which prioritizes bespoke design and varied material combinations. The distribution analysis confirms that e-commerce is not merely a supplementary channel but the primary growth engine, necessitating continuous investment in digital infrastructure, visual merchandising, and rapid fulfillment networks. These segmentation insights are essential for market participants seeking to optimize their product portfolios, align their manufacturing capabilities with high-growth material trends, and strategically target consumer groups through the most effective sales channels.

- By Type:

- Coffee Tables

- End Tables/Side Tables

- Console Tables

- Nesting Tables

- C-Tables and Snack Tables

- By Material:

- Wood and Engineered Wood

- Metal (Steel, Aluminum, Iron)

- Glass

- Marble/Stone

- Mixed Materials (e.g., Metal frame with Marble top)

- By Distribution Channel:

- Offline Retail (Specialty Furniture Stores, Departmental Stores, Home Decor Boutiques)

- Online Retail (E-commerce Platforms, Company Websites, Third-party Marketplaces)

- By End-User:

- Residential

- Commercial (Hospitality, Corporate Offices, Retail Spaces)

Value Chain Analysis For Accent Tables Market

The value chain for the Accent Tables Market begins with upstream activities focused on raw material procurement, encompassing the sourcing of timber, metals, stone, and composite panels. A critical aspect of upstream analysis involves ensuring responsible sourcing, particularly adherence to sustainable forestry standards (like FSC certification) for wood products, which influences both the cost structure and the brand perception. Key upstream suppliers include lumber mills, specialized metal fabricators, and glass manufacturers. Managing the volatility and quality consistency of these global commodities is crucial; poor quality inputs directly impact the finished product's structural integrity and aesthetic appeal, necessitating strong, long-term relationships with certified suppliers to mitigate supply risks and ensure ethical standards are maintained throughout the supply base.

The core manufacturing and midstream processes involve design, cutting, assembly, finishing (e.g., painting, powder coating, polishing), and quality control. Midstream efficiency, often enhanced through automation and precision machinery, determines the final unit cost and production throughput. Downstream activities focus on inventory management, warehousing, and distribution. The distribution channel analysis is pivotal, distinguishing between direct channels (manufacturer selling directly to consumers via proprietary websites or showrooms) and indirect channels (selling through major retailers, specialty chains, or third-party e-commerce platforms like Amazon and Wayfair). Indirect channels provide broad market access but involve margin reduction due to retailer commissions, while direct channels offer higher margins and greater control over the customer experience, demanding significant investment in logistics and customer service infrastructure.

The shift towards e-commerce has intensely modified the downstream segment. Effective inventory positioning and rapid fulfillment capabilities are now non-negotiable competitive requirements. Companies are increasingly investing in sophisticated Enterprise Resource Planning (ERP) systems to link upstream material acquisition with downstream distribution needs, minimizing warehousing costs and mitigating the risk of obsolescence, especially for fast-fashion furniture trends. Direct distribution channels are seeing substantial growth as manufacturers seek to gather valuable customer data and build brand loyalty, bypassing traditional retail gatekeepers. This strategy requires robust last-mile logistics solutions adapted to handling bulky, often delicate furniture items, thus increasing the complexity and cost associated with final delivery and potentially requiring specialized installation services.

Accent Tables Market Potential Customers

The primary potential customers for the Accent Tables Market are broadly categorized into Residential Consumers and Commercial Buyers, each possessing distinct purchase criteria and volume requirements. Residential consumers, particularly those aged 25-55 with middle-to-high disposable incomes, represent the largest volume segment. These customers are highly influenced by aesthetic trends, interior design media, and the desire for personalization and functional utility. They often purchase tables as accent pieces to refresh existing décor or complete newly furnished rooms. Key motivators for this demographic include design uniqueness, material quality (especially sustainable or artisanal finishes), and ease of integration into their living spaces. E-commerce platforms are the preferred purchase channel due to convenience and extensive variety, emphasizing the need for robust online customer service and clear product visualization.

Commercial customers constitute a significant high-value segment, characterized by bulk purchasing and stringent requirements concerning durability, fire safety standards (contract-grade furniture), and consistency across multiple units. This category includes hospitality enterprises (hotels, serviced apartments, resorts), corporate entities (office lobbies, executive waiting areas), and institutional buyers (universities, healthcare facilities). These buyers prioritize long-term performance, ease of maintenance, and the manufacturer’s ability to handle large, complex orders with predictable timelines. Purchase decisions are often made through B2B tenders or specialized design firms, necessitating manufacturers to maintain strong relationships with interior architects, procurement managers, and contract dealers specializing in commercial furnishings.

A crucial emerging segment comprises first-time homeowners and apartment dwellers in rapidly urbanizing areas, particularly Millennials and Gen Z individuals who prioritize affordability and multi-functionality due to limited living space. These consumers are prime targets for nesting tables, C-tables, and modular designs, often leaning toward value-oriented materials like engineered wood and metal. They are highly responsive to sustainable brand narratives and digital marketing. Manufacturers must therefore tailor their offerings to address the dual demands of contemporary design and practical space-saving solutions, utilizing channels such as mass-market retailers and budget-friendly online marketplaces to capture this large, growing demographic, ensuring that the accent tables appeal as essential, transitional pieces of furniture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture Industries, Williams-Sonoma Inc., Hooker Furniture Corporation, Universal Furniture, Restoration Hardware (RH), La-Z-Boy Incorporated, Bassett Furniture, Herman Miller, Steelcase, Kian Contract, Wayfair LLC, Amazon Private Label, CB2, Arhaus |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accent Tables Market Key Technology Landscape

The technology landscape in the Accent Tables Market is primarily defined by advancements in materials science, manufacturing automation, and digital interaction tools rather than proprietary embedded electronics. Core manufacturing technologies focus on achieving precision and flexibility in handling diverse material inputs. Computer Numerical Control (CNC) machinery is standard for intricate wood cutting, metal fabrication, and precise stone carving, allowing for highly complex geometrical designs with minimal error and waste. Laser cutting and advanced welding techniques are crucial for producing sleek, durable metal frames required for modern industrial or minimalist accent tables. Furthermore, surface finishing technologies, such as advanced powder coatings for metal and high-pressure lamination (HPL) for engineered wood, ensure longevity, scratch resistance, and aesthetic consistency, which are vital for meeting commercial contract specifications.

In terms of consumer engagement, digital technologies are paramount. Augmented Reality (AR) applications are increasingly utilized by major retailers and furniture manufacturers, allowing potential buyers to use their smartphone cameras to visualize an accent table in their actual living space. This technology addresses the common hesitation regarding size and fit, significantly improving the online purchasing confidence and reducing logistical complexities associated with returns. Product configurators, often built using 3D rendering software, enable customers to select specific materials, finishes, and dimensions for semi-customizable tables before placing an order, merging mass production efficiency with personalized design requests. This digital ecosystem minimizes the need for extensive physical showrooms and streamlines the path from design concept to consumer order fulfillment.

While the internal technological complexity of the tables themselves remains relatively low compared to consumer electronics, a growing trend involves integrating discrete technologies to enhance utility. This includes wireless charging pads seamlessly embedded into the tabletop surface, USB-A and USB-C power ports discreetly mounted beneath the rim, and subtle LED lighting features that provide ambient illumination. These integrations appeal to the modern consumer who seeks convenience and a clutter-free environment. Furthermore, sustainable manufacturing technologies, such as closed-loop water treatment systems and the utilization of recycled content processing machinery, are becoming key technological differentiators, signaling a commitment to environmental stewardship and meeting the escalating demand for eco-friendly home furnishings.

Regional Highlights

Regional dynamics within the Accent Tables Market demonstrate varied maturity levels and growth rates, heavily influenced by urbanization trends, consumer disposable income, and housing market stability. North America, encompassing the United States and Canada, represents a cornerstone market characterized by high consumer appetite for frequent décor changes and a strong preference for large-scale, high-quality furniture, especially end tables and substantial coffee tables. The robust e-commerce penetration and the presence of major global furniture retailers drive sustained high sales volume. Consumers in this region often prioritize branded products and specialty materials like authentic reclaimed wood or high-end natural stone. Market growth, though steady, is largely dependent on the velocity of new housing starts and existing home renovation activities.

Europe constitutes another major market, defined by strong regional distinctions. Western European countries (Germany, UK, France) emphasize sophisticated, minimalist design and high standards for material sustainability and environmental compliance, driving demand for locally sourced, certified wood and enduring designs. Conversely, emerging Eastern European economies are experiencing faster growth rates driven by rising middle-class wealth and the rapid modernization of residential properties. The European market highly values artisanal craftsmanship, often resulting in strong demand for uniquely designed console tables and bespoke pieces, supported by a dense network of small, specialized furniture designers and manufacturers.

The Asia Pacific (APAC) region is projected to register the fastest growth during the forecast period. This rapid expansion is primarily attributed to unprecedented urbanization in countries like China, India, and Southeast Asian nations, leading to massive residential construction and significant growth in commercial sectors, particularly luxury hospitality. The high population density necessitates a strong market demand for space-saving and multifunctional furniture, making nesting tables and C-tables exceptionally popular. Furthermore, the rising adoption of Western interior design aesthetics, coupled with increasing disposable incomes, drives consumers towards both domestic and international premium accent table brands, making APAC a key strategic investment area for global manufacturers.

- North America: Market leader driven by high consumer expenditure, focus on large coffee and end tables, robust e-commerce infrastructure, and strong preference for luxury materials.

- Europe: Characterized by demand for sustainable, high-quality, and design-forward furniture; strong regulatory focus on material origin; growth concentrated in Western Europe (premium segment) and Eastern Europe (mass market expansion).

- Asia Pacific (APAC): Highest growth potential fueled by massive urbanization, strong demand for space-efficient and multifunctional designs, and rising adoption of modern interior décor in middle-class households.

- Latin America (LATAM): Emerging market demonstrating moderate growth tied to economic stability; demand often centered around domestically produced, functional, and value-oriented wood and metal tables.

- Middle East and Africa (MEA): Growth driven by luxury residential projects and high-end hospitality development, particularly in the GCC countries, favoring ornate, high-status materials like polished metal and marble.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accent Tables Market.- IKEA

- Ashley Furniture Industries

- Williams-Sonoma Inc.

- Hooker Furniture Corporation

- Universal Furniture

- Restoration Hardware (RH)

- La-Z-Boy Incorporated

- Bassett Furniture

- Herman Miller

- Steelcase (Commercial focus)

- Kian Contract

- Wayfair LLC

- Amazon Private Label (e.g., Rivet, Stone & Beam)

- CB2

- Arhaus

- Bernhardt Furniture Company

- Global Furniture Group

- Natuzzi S.p.A.

- Roche Bobois

- Flexsteel Industries

Frequently Asked Questions

Analyze common user questions about the Accent Tables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Accent Tables Market?

Market growth is predominantly driven by increasing global residential construction and renovation activities, rising consumer disposable incomes, a strong emphasis on personalized home aesthetics influenced by social media, and the critical need for multifunctional, space-saving furniture solutions in densely populated urban centers worldwide.

Which material segment holds the largest share in the Accent Tables Market?

The Wood and Engineered Wood segment currently holds the largest market share due to its versatility, affordability, and wide range of finishing options. However, the Mixed Materials segment, which combines elements like metal frames with marble or glass tops, is witnessing the fastest growth due to contemporary design trends.

How is the rise of e-commerce impacting the distribution of accent tables?

E-commerce platforms are transforming the distribution landscape by providing unparalleled product variety, enabling easier price comparison, and utilizing advanced tools like Augmented Reality (AR) for virtual placement. Online retail is the fastest-growing distribution channel, demanding manufacturers invest heavily in logistics and digital marketing capabilities.

What is the significance of sustainability in purchasing accent tables?

Sustainability is becoming a critical purchasing criterion, particularly among younger consumers. Demand is rising for tables made from ethically sourced or reclaimed wood, recycled metals, and those produced by manufacturers with certified eco-friendly processes. Sustainable certifications enhance brand reputation and justify premium pricing.

What are C-tables and why are they becoming increasingly popular?

C-tables are accent tables featuring a C-shaped base designed to slide directly over the edge of a sofa or chair, maximizing utility in compact spaces. Their popularity stems from their multifunctional use as laptop stands or temporary snack tables, offering practical convenience and flexibility crucial for modern, smaller living environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager