Account Aggregators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442068 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Account Aggregators Market Size

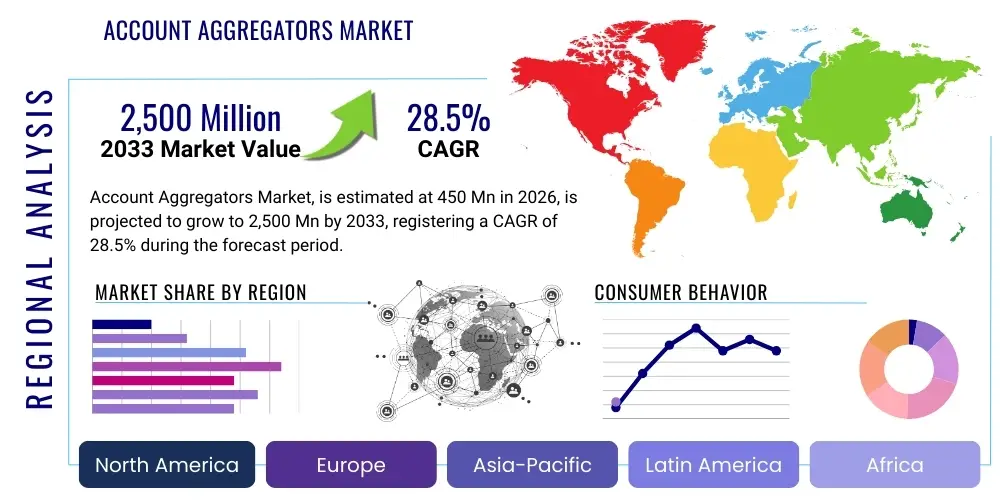

The Account Aggregators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 2,500 Million by the end of the forecast period in 2033. This remarkable expansion is primarily driven by the global regulatory push toward Open Banking and the increasing demand for seamless, personalized financial services delivered through digital channels. The shift from manual data retrieval to secure, consent-based data sharing infrastructure is fundamentally reshaping how financial institutions interact with customer information, positioning Account Aggregators as critical middleware in the modern financial ecosystem.

Account Aggregators Market introduction

The Account Aggregators (AA) Market encompasses sophisticated platforms and technological frameworks designed to securely and digitally retrieve, consolidate, and share a user’s financial data from various financial information providers (FIPs) with financial information users (FIUs), strictly based on the explicit consent of the consumer. These systems act as essential conduits, facilitating data portability across the banking, insurance, and wealth management sectors. Unlike traditional screen scraping or API models, AA frameworks, particularly those implemented under regulatory mandates like India’s AA framework or Europe’s PSD2 (Payment Services Directive 2), prioritize robust security, standardized API protocols, and auditable consent mechanisms, thereby fostering trust and compliance in the digital data economy.

The core value proposition of Account Aggregators lies in their ability to unlock and utilize previously siloed customer data, driving innovation in product offerings and enhancing risk assessment capabilities for financial institutions. Major applications span across streamlined loan origination, comprehensive financial planning, personalized wealth management advice, and improved credit scoring models that rely on real-time transaction history rather than static reports. This technology empowers both consumers, who gain control over their data, and businesses, who can offer hyper-personalized services, leading to greater financial inclusion and efficiency within the ecosystem.

Key driving factors accelerating the adoption of Account Aggregators include stringent regulatory initiatives compelling data sharing, significant advancements in API technology ensuring rapid and secure integration, and the rising consumer expectation for unified digital experiences. The benefits derived from AA implementation are manifold: reduced operational costs for data collection, enhanced data accuracy and freshness, improved customer onboarding experiences, and the creation of entirely new business models focused on consent-based financial product cross-selling. As jurisdictions worldwide continue to solidify Open Finance regulations, the market for AA solutions is poised for exponential expansion, particularly in emerging economies where financial services penetration is rapidly increasing.

Account Aggregators Market Executive Summary

The Account Aggregators Market is currently defined by dynamic regulatory landscapes and accelerated technological integration, establishing itself as a pivotal infrastructure layer for the global Open Finance movement. Business trends indicate a strong move toward interoperable platforms and specialized AA providers focusing on specific verticals, such as lending analytics or insurance data aggregation, rather than generalized data access. Major financial institutions are increasingly engaging in strategic partnerships or acquiring existing AA firms to internalize data sharing capabilities, recognizing that consumer data consent is a primary asset. Furthermore, the market exhibits a clear trend toward standardization of APIs to ensure seamless data flow across different FIPs and FIUs, reducing integration complexity and fostering quicker market adoption for new financial products.

Regionally, the market presents a bifurcated growth pattern. European markets (driven by PSD2) and emerging markets like India (driven by the unique AA regulatory framework) are experiencing rapid adoption cycles fueled by government mandate and robust underlying digital public infrastructure. North America, while less centrally regulated, is seeing growth driven by major fintech players and infrastructure providers utilizing commercially standardized aggregation APIs, focusing on credit and wealth management applications. Asia Pacific (excluding India) is gearing up for significant expansion as countries like Australia (with CDR) and Singapore develop their own tailored Open Finance frameworks, anticipating immense growth opportunities in cross-border financial data sharing and localized digital payments.

Segmentation trends highlight the increasing dominance of cloud-based deployment models, which offer the scalability and flexibility necessary for handling massive volumes of real-time transactional data. Large enterprises, particularly tier-one banks and major insurance companies, remain the largest consumers of AA services due to their extensive legacy systems and immediate need for compliance and modernization. However, the Small and Medium-sized Enterprise (SME) segment is projected to exhibit the highest CAGR, driven by the need for simplified access to commercial credit and streamlined financial management tools facilitated by aggregated account data. Applications related to credit scoring and loan origination currently account for the largest market share, though financial planning and personalized wealth advisory services are rapidly gaining momentum.

AI Impact Analysis on Account Aggregators Market

User inquiries regarding AI's impact on Account Aggregators frequently center on how machine learning enhances data security, enables predictive analysis of consumer behavior, and automates compliance checks within consent frameworks. Common questions explore whether AI can identify fraudulent consent usage, how it handles the normalization of disparate data formats received from various FIPs, and the extent to which AI-driven analytics create competitive advantages for FIUs. Users are keenly interested in AI's role in deriving actionable intelligence from large, newly accessible datasets—moving beyond mere aggregation to meaningful interpretation—and the ethical implications of using AI to process highly sensitive financial information, especially concerning bias and data privacy protection.

AI and Machine Learning (ML) are not just complementary technologies but foundational components poised to revolutionize the operational efficiency and analytical depth of Account Aggregators. AI algorithms are crucial for post-aggregation processes, specifically in cleaning, normalizing, and standardizing diverse data formats received from potentially hundreds of different FIP systems. This process ensures data consistency, which is vital for FIUs using the data for underwriting or advisory services. Furthermore, sophisticated ML models are being deployed for fraud detection, anomaly identification, and monitoring the usage patterns of delegated consent, thereby significantly enhancing the security and integrity of the entire AA ecosystem.

The integration of AI also transforms the utility of the aggregated data itself. By applying deep learning techniques, Account Aggregators can offer value-added services such as predictive cash flow forecasting, personalized financial health scores, and automated budget categorization far superior to basic rule-based systems. This shift transforms the AA platform from a simple data pipe into an intelligent insights engine, providing FIUs with a competitive edge in personalized product recommendations and risk mitigation. This evolution ensures that Account Aggregators remain central to the Open Finance infrastructure, driving deeper financial inclusion and tailored customer experiences.

- AI optimizes data normalization and standardization across diverse FIP formats.

- Machine Learning enhances real-time fraud detection and anomaly monitoring within data streams.

- Predictive analytics enables sophisticated credit scoring and risk assessment models for FIUs.

- Natural Language Processing (NLP) aids in structuring unstructured transaction descriptions for better categorization.

- AI automates auditing of consumer consent logs, ensuring strict regulatory compliance (AEO).

- Enhanced security features via behavioral biometrics and pattern recognition safeguard sensitive data transfers.

- Creation of specialized AI-driven financial health metrics and personalized advisory dashboards.

DRO & Impact Forces Of Account Aggregators Market

The Account Aggregators Market is propelled by powerful drivers centered on regulatory alignment and technological advancement, while simultaneously navigating significant hurdles related to data security and interoperability. The primary driver is the global mandate towards Open Banking and Open Finance, which necessitates secure, consent-based data sharing infrastructure. Complementing this is the opportunity for disruptive innovation, allowing fintech companies to build specialized financial services using previously inaccessible customer data, thereby expanding financial inclusion. However, this growth trajectory is tempered by substantial restraints, chiefly the need to maintain absolute data privacy and security in the face of escalating cyber threats, coupled with the inherent challenge of achieving seamless technical interoperability across thousands of diverse FIP legacy systems. These forces interact to define the pace and direction of market development.

Drivers: Mandatory regulatory frameworks such as PSD2 in Europe and the Account Aggregator framework in India force institutions to adopt these solutions, providing immediate scalability. The increasing digitization of financial services globally demands faster, more secure customer verification processes, which AAs efficiently provide. Furthermore, consumer demand for personalized financial products and the willingness to share data for better offers pushes financial institutions to integrate aggregation capabilities. The availability of robust, standardized APIs further reduces the time-to-market for new AA solutions, accelerating adoption across various enterprise sizes.

Restraints: The fundamental challenge remains ensuring consumer trust; any data breach involving an AA platform could severely undermine market adoption and lead to regulatory penalties. High initial integration costs, especially for legacy FIP systems that require significant overhauls to support new API standards, present a barrier to entry for smaller banks. Regulatory uncertainty in jurisdictions without fully defined Open Finance rules can stifle investment. Moreover, the technical complexity involved in aggregating data from diverse systems (ranging from core banking mainframes to modern cloud platforms) creates ongoing maintenance and standardization challenges.

Opportunities: Opportunities abound in expanding the scope beyond traditional banking accounts (credit, deposits) to include non-traditional financial data, such as insurance policies, pension funds, government tax records, and utility bills (Open Data movement). This scope expansion allows for truly holistic financial profiles. Geographically, emerging economies represent immense untapped potential due as they leapfrog older financial infrastructure directly to digital AA systems. The development of specialized value-added services, like advanced AI analytics and cross-border aggregation, presents lucrative monetization avenues for AA providers.

Impact Forces: The overarching impact force is the shift in data ownership philosophy, moving control from the institution back to the consumer. This mandates transparency and accountability from all participants. Regulatory bodies continually refine security and consent standards, forcing AAs to adapt rapidly. Competitive pressure from large technology companies (Big Tech) entering financial services also compels banks and fintechs to utilize AA data for superior customer experience, driving continuous innovation in the underlying technology infrastructure.

Segmentation Analysis

The Account Aggregators Market segmentation provides a crucial framework for understanding the diverse applications and end-user uptake across the financial ecosystem. The market is primarily segmented based on deployment model, enterprise size, application type, and end-user industry, reflecting the varied needs of stakeholders from cutting-edge fintech startups to massive tier-one global banks. Analysis reveals that the choice of deployment (cloud vs. on-premise) is heavily correlated with enterprise size and regulatory requirements, while application focus drives the primary revenue streams for AA providers.

Cloud-based solutions dominate the market due to their inherent scalability, lower operational overhead, and speed of deployment, which are essential characteristics for handling real-time data flows and rapid user onboarding. Conversely, larger financial institutions with strict regulatory mandates concerning data residency sometimes opt for hybrid or specific on-premise solutions, particularly in early adoption phases. Application segmentation clearly shows that immediate needs like credit assessment and loan origination, which offer quantifiable ROI, currently hold the largest market share, but growth is strongest in areas like personalized financial planning, reflecting the maturation of the Open Finance landscape.

In terms of end-users, the Banking and Financial Services (BFSI) sector remains the bedrock of the AA market, driven by mandated compliance and modernization efforts. However, the fastest growth is observed in the Fintech sector, where agility and a data-first approach allow startups to leverage aggregated data immediately to create disruptive products, often targeting underserved consumer segments. The market dynamics are highly influenced by the ability of AA platforms to integrate seamlessly into diverse core systems and provide compliant, high-quality data feeds that meet the stringent requirements of various financial services.

- By Deployment Model:

- Cloud-based

- On-premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application:

- Financial Planning and Advisory

- Wealth Management and Investment Services

- Credit Scoring and Risk Assessment

- Loan Origination and Underwriting

- Personal Finance Management (PFM) Tools

- Regulatory Compliance and Reporting

- By End-User:

- Banks and Financial Institutions (BFSI)

- Fintech Companies and Startups

- Insurance Sector (Insurtech)

- Government and Regulatory Bodies

- Other Financial Service Providers (e.g., Pension Funds)

Value Chain Analysis For Account Aggregators Market

The value chain of the Account Aggregators Market is complex, involving multiple distinct layers, starting from data generation and ending with the delivery of value-added insights to the end consumer. The upstream segment is dominated by Financial Information Providers (FIPs), which are primarily banks, mutual funds, insurance companies, and telecom providers, responsible for hosting and securing the raw financial data. These FIPs must invest heavily in modernizing their core systems and developing robust, standardized APIs (often mandated by regulation) to enable secure data retrieval by the AAs. The efficiency and quality of the FIPs' API infrastructure directly influence the reliability of the entire aggregation ecosystem.

The central and most critical component of the value chain is the Account Aggregator (AA) platform itself. AAs serve as the middleware, focusing on obtaining verifiable consumer consent, securely linking accounts, retrieving data from FIPs, normalizing the data, and securely transmitting it to Financial Information Users (FIUs). Their core functions involve stringent security protocols, consent management frameworks (including revocation and auditing), and ensuring compliance with jurisdictional data privacy laws. A robust AA must maintain high uptime and handle massive throughput of real-time data requests, leveraging advanced encryption and tokenization techniques to protect data during transit.

The downstream segment consists of the Financial Information Users (FIUs), such as lending firms, wealth managers, PFM tool providers, and specialized fintechs, who utilize the aggregated data to create personalized products and services. Distribution channels are predominantly direct, involving API integration between the AA platform and the FIU's internal systems or product interfaces. However, indirect channels also exist through specialized data marketplaces or partner ecosystems where AAs collaborate with analytics providers to offer pre-processed, high-value data insights, effectively transforming raw data into actionable intelligence for FIUs to consume directly within their workflow. The optimization of this downstream integration is crucial for maximizing the commercial value derived from account aggregation.

Account Aggregators Market Potential Customers

The primary end-users and buyers of Account Aggregator services are diverse, spanning the entire spectrum of financial services and related commercial entities that rely on comprehensive customer financial profiles for operational efficiency and risk management. Traditional banks and large non-banking financial companies (NBFCs) constitute a significant customer base, driven by regulatory compliance needs and the imperative to offer digital, competitive lending and wealth products. These institutions utilize AAs to streamline KYC (Know Your Customer) processes, accelerate loan decisions, and enhance their anti-money laundering (AML) capabilities by accessing reliable, consent-based transaction history.

A second major customer category includes the burgeoning ecosystem of Fintech startups and specialized digital lenders. For these agile entities, AA data is fundamental to their business model, allowing them to rapidly assess creditworthiness for niche markets, offer hyper-personalized budgeting tools, or facilitate peer-to-peer lending platforms. As they typically lack the extensive, long-term relationship data held by incumbent banks, AAs provide them with immediate access to rich, granular financial information necessary to compete effectively on speed and product relevance. The lower capital expenditure required for API integration compared to establishing legacy data links makes AA services particularly attractive to this segment.

Furthermore, the insurance sector (Insurtech) and wealth management firms are rapidly increasing their adoption of AA services. Insurers use aggregated data to dynamically assess risk profiles, personalize premium structures, and automate claims processing based on verifiable income and expenditure patterns. Wealth managers leverage AA data to construct comprehensive views of a client's total financial assets, liabilities, and spending habits across multiple institutions, enabling highly customized investment advice and retirement planning. Regulatory bodies and tax authorities also represent a potential future customer segment, utilizing standardized AA frameworks for streamlined compliance reporting and tax verification processes, thereby broadening the market's reach beyond pure commercial finance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 2,500 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Finicity (Mastercard), Yodlee (Envestnet), Plaid, Salt Edge, Basiq, Credit Kudos (Apple), Tink (Visa), Akoya, Konsentus, Flinks, Codat, OneSchema, Privo, NDGIT, AccountScore, TrueLayer, PISP, Klarna, Open Banking Ltd., CDR Australia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Account Aggregators Market Key Technology Landscape

The technological infrastructure underlying the Account Aggregators Market is defined by a reliance on robust, modern API architecture, advanced cryptographic techniques, and highly scalable cloud computing platforms. The foundation of AA functionality rests on standardized RESTful APIs, which facilitate secure, high-volume data exchange between FIPs and the AA platform. These APIs must strictly adhere to regulatory mandates regarding authentication (often using OAuth 2.0 or similar secure protocols) and data format standards (such as ISO 20022 or custom JSON schemas) to ensure interoperability and consistency across the ecosystem. The ability to handle synchronous and asynchronous requests efficiently is critical for providing real-time financial insights.

Security technologies are paramount within the AA landscape. Encryption is implemented at multiple stages: encryption-in-transit (using TLS/SSL) and encryption-at-rest. More specialized technologies include tokenization, where sensitive account numbers are replaced with non-sensitive substitutes (tokens) for transaction processing, minimizing the exposure of raw PII (Personally Identifiable Information). Digital consent management systems, often built on secure ledger technologies or advanced relational databases, are essential for maintaining an immutable, auditable record of consumer permissions, which is the legal basis for data sharing. These systems must provide consumers with granular control over what data is shared, with whom, and for how long.

Furthermore, the infrastructure increasingly incorporates advanced data processing technologies. Data normalization engines use AI and complex mapping algorithms to harmonize data formats from disparate FIP sources into a unified structure, making the data immediately usable by FIUs for analytics. Cloud infrastructure providers (AWS, Azure, GCP) play a crucial role, offering the necessary elastic scaling and geographical redundancy required for high-availability financial services. The deployment of microservices architecture is common, allowing AA providers to rapidly update specific functional components (e.g., a new FIP API integration or an updated consent module) without disrupting the entire service, thereby accelerating market responsiveness and resilience.

Regional Highlights

The Account Aggregators Market exhibits distinct development trajectories across major global regions, heavily influenced by local regulatory maturity and consumer digital adoption rates. North America, while lacking a unified federal Open Banking mandate comparable to Europe, is driven by commercial agreements and influential technology providers like Plaid and Finicity. Growth here is concentrated in areas where data aggregation offers clear, measurable commercial benefits, such as mortgage lending and credit monitoring, utilizing existing commercial API partnerships. Investment is significant, focusing on highly secure, proprietary aggregation tools that serve the dominant players in banking and fintech. The complexity arises from navigating the patchwork of state-level privacy laws and maintaining proprietary integration models.

Europe stands out due to the mandatory implementation of PSD2, which legally required banks to open up payment account data via standardized APIs (AEO). This mandate created a foundation for rapid AA growth, primarily centered on Payment Initiation Service Providers (PISPs) and Account Information Service Providers (AISPs). The market is highly competitive, focusing on cross-border aggregation services within the EU and the UK, with ongoing initiatives to expand PSD2's scope into Open Finance (beyond payment accounts). Regulatory clarity and mandated standardization have lowered the barrier to entry for smaller fintechs, driving high rates of innovation in payment and personal finance applications.

Asia Pacific (APAC) represents the region with the highest future growth potential, driven primarily by India's groundbreaking, consent-layer AA framework and Australia's Consumer Data Right (CDR) regime. India's AA ecosystem, leveraging the country's Digital Public Infrastructure (DPI), provides a blueprint for scalable, high-volume data sharing across vast populations, significantly accelerating financial inclusion. Other APAC nations, including Singapore, Hong Kong, and Japan, are formulating or implementing their own Open Finance policies, promising substantial market creation in the mid-term. The region benefits from a large, digitally native population willing to adopt new financial technologies rapidly, provided data security and trust mechanisms are robust.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for Account Aggregators, characterized by rapid urbanization and high mobile penetration rates, which support digital finance adoption. Brazil, with its PIX instant payment system and mandatory Open Finance framework (driven by the Central Bank), is leading the charge in LATAM, creating vast opportunities for AA providers specializing in data localization and adherence to unique regional compliance needs. In MEA, regulatory sandboxes and strategic initiatives in financial hubs like Dubai and Saudi Arabia are facilitating the initial adoption of AA technology to enhance lending efficiency and reduce dependency on traditional credit bureau data. Growth in these regions is heavily reliant on governmental endorsement and investment in core digital infrastructure.

- North America: Market growth is primarily driven by private-sector initiatives, robust commercial APIs, and focus on credit and wealth management applications, managing complex state-level regulations.

- Europe (EU & UK): Growth mandated by PSD2/Open Banking regulations; high competition in PISP/AISP services; strong emphasis on cross-border data portability and expanding to Open Finance.

- Asia Pacific (APAC): Exponential growth potential led by India's AA framework and Australia's CDR; focus on financial inclusion, high-volume transactions, and utilizing DPI for scalability.

- Latin America (LATAM): Brazil is the regional leader with mandated Open Finance; high growth potential driven by digital transformation and need for enhanced credit assessment models.

- Middle East and Africa (MEA): Adoption driven by specific government initiatives in financial hubs; focus on modernizing banking systems and addressing underbanked populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Account Aggregators Market.- Finicity (Mastercard)

- Yodlee (Envestnet)

- Plaid

- Salt Edge

- Basiq

- Credit Kudos (Apple)

- Tink (Visa)

- Akoya

- Konsentus

- Flinks

- Codat

- OneSchema

- Privo

- NDGIT

- AccountScore

- TrueLayer

- PISP

- Klarna

- Open Banking Ltd.

- CDR Australia

Frequently Asked Questions

Analyze common user questions about the Account Aggregators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Account Aggregator and how is it different from traditional screen scraping?

An Account Aggregator (AA) is a secure, consent-based digital framework that retrieves and consolidates a customer’s financial data from various financial institutions. Unlike traditional screen scraping, which often relies on storing customer credentials and lacks regulatory standardization, AAs use secure, standardized APIs (often mandated by Open Banking regulations) and require explicit, granular, and revokable digital consent, ensuring higher security and data ownership for the consumer.

Is data sharing through Account Aggregators secure and compliant with global privacy laws?

Yes, data sharing via compliant Account Aggregators is highly secure. AAs typically adhere to strict global standards like GDPR and local Open Finance regulations, utilizing end-to-end encryption, digital tokenization, and strict identity verification protocols. The AA framework ensures that data is shared only with the specific consent of the user, making the process auditable and compliant with stringent data privacy legislation worldwide.

Which industries benefit most from integrating Account Aggregator services?

The primary beneficiaries are the Banking and Financial Services Industry (BFSI), Fintech companies, and the Insurance sector. Fintechs use AAs for rapid credit assessment and personalized finance apps, while banks leverage them for streamlined loan origination, KYC verification, and offering customized wealth advisory services based on holistic customer data.

What is the primary role of APIs in the Account Aggregator ecosystem?

APIs (Application Programming Interfaces) are the foundational technology enabling the AA ecosystem. They provide the standardized, secure digital channels through which Financial Information Providers (FIPs) expose customer data to Account Aggregators (AAs) upon receiving valid consent. High-quality, standardized APIs ensure efficient, real-time, and reliable data flow, driving interoperability across the financial landscape.

How does the implementation of AI enhance the value proposition of Account Aggregators?

AI significantly enhances AA value by transforming raw aggregated data into actionable financial intelligence. AI algorithms are used for data normalization, cleaning transaction data, automating fraud detection, and creating predictive analytics models for superior credit scoring and personalized financial planning, moving the AA platform beyond simple data retrieval to sophisticated insight generation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager