Accounts Payable and Accounts Receivable Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441273 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Accounts Payable and Accounts Receivable Software Market Size

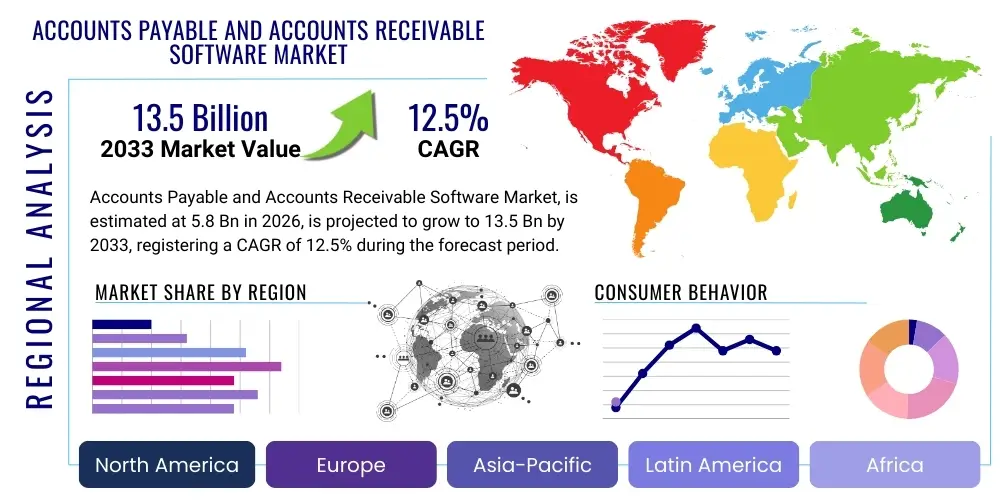

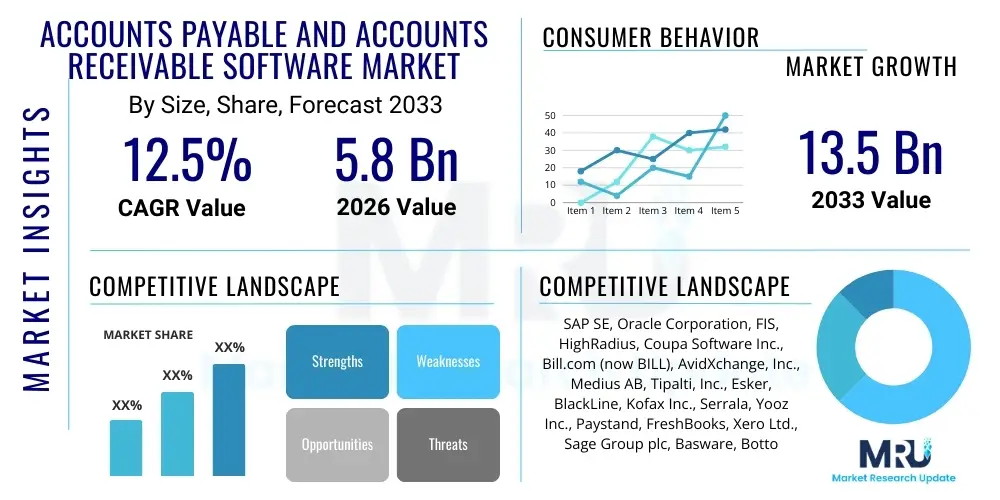

The Accounts Payable and Accounts Receivable Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Accounts Payable and Accounts Receivable Software Market introduction

The Accounts Payable (AP) and Accounts Receivable (AR) Software Market encompasses specialized financial management solutions designed to automate and optimize the flow of money in and out of an organization. AP software streamlines processes such as invoice capture, three-way matching, approval workflows, and vendor payments, significantly reducing manual intervention and minimizing errors. Conversely, AR software focuses on improving cash flow by automating invoicing, collections management, payment processing, and reconciliation. The primary goal of these integrated platforms is to enhance operational efficiency, ensure regulatory compliance, reduce processing costs, and accelerate the financial closing cycle for businesses across various scales and industries.

The market is defined by the rapid shift towards digital transformation within finance departments globally. Products range from standalone, highly specialized tools focusing solely on specific functions (like dynamic discounting or advanced collections prediction) to comprehensive, integrated Enterprise Resource Planning (ERP) modules that offer end-to-end financial transaction management. Major applications span across corporate finance, shared service centers, and small and medium-sized enterprises (SMEs) seeking to transition from legacy paper-based systems or inefficient spreadsheet management. The inherent benefits, such as enhanced fraud detection capabilities, improved vendor relations, and maximized working capital utilization, are key drivers spurring market adoption.

Key driving factors fueling the expansion of this market include the increasing global adoption of Software as a Service (SaaS) models, which offer flexible deployment and scalability; the stringent need for compliance with international e-invoicing and tax regulations; and the necessity for accurate, real-time financial reporting crucial for strategic decision-making. Furthermore, the continuous integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) is transforming traditional processing workflows into intelligent, touchless operations, making these software solutions indispensable tools for modern financial operations management.

Accounts Payable and Accounts Receivable Software Market Executive Summary

The Accounts Payable and Accounts Receivable Software Market is undergoing significant evolution driven by technological convergence and shifting business models. Business trends emphasize the consolidation of AP and AR functions onto unified platforms to gain holistic visibility into cash conversion cycles and optimize working capital management. The shift towards cloud-native solutions offering enhanced security, continuous updates, and lower total cost of ownership (TCO) is a dominant commercial trajectory, favoring specialized SaaS providers over traditional on-premise vendors. Geopolitical and macroeconomic factors, including global supply chain volatility, are further accelerating the demand for real-time visibility into supplier payments and customer outstanding balances, necessitating robust automation tools capable of handling complex cross-border transactions and multi-currency operations.

Regionally, North America maintains the largest market share, characterized by high technological maturity, substantial enterprise spending on digital transformation initiatives, and stringent internal audit requirements driving the need for automated controls. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid SME digitalization, burgeoning e-commerce sectors, and governmental pushes for standardized digital invoicing mandates in countries like India, Singapore, and Australia. Europe is driven primarily by mandatory regulatory compliance, particularly concerning VAT enforcement and EU-wide public procurement e-invoicing standards, which necessitate immediate software upgrades and implementation.

Segmentation trends indicate strong growth in the medium enterprise segment, where the complexity of transactions often outstrips manual capacity, yet the resources for full-scale custom ERP implementation are limited, making modular SaaS solutions highly attractive. By deployment, the cloud segment is overwhelmingly dominant, reflecting the global preference for elastic infrastructure and subscription-based pricing models. Application-wise, cash management and expense management are seeing accelerated integration with core AP/AR functions, positioning the software suite as a critical component of treasury management and overall financial risk mitigation strategies.

AI Impact Analysis on Accounts Payable and Accounts Receivable Software Market

User inquiries regarding AI's impact on AP/AR software primarily revolve around three core themes: operational efficiency gains, accuracy enhancements, and job displacement concerns. Users are keen to understand how AI-driven capabilities—such as Intelligent Document Processing (IDP), predictive analytics for cash forecasting, and autonomous workflow routing—can translate into measurable cost reductions and faster processing times (touchless processing). There is high expectation for AI to solve persistent challenges related to manual data entry errors, complex compliance validation, and ineffective collections strategies by leveraging machine learning to identify patterns and anomalies. Conversely, a significant underlying concern involves the security implications of automated financial decision-making and the necessary reskilling of existing finance staff to manage and govern these increasingly autonomous systems, rather than performing traditional data processing tasks.

The integration of AI, particularly Machine Learning (ML) and Robotic Process Automation (RPA), is fundamentally redefining the competitive landscape of the AP and AR software market. In Accounts Payable, AI utilizes Optical Character Recognition (OCR) combined with Natural Language Processing (NLP) to achieve high levels of straight-through processing (STP) for invoices, regardless of format. This capability drastically reduces the need for human intervention in data capture and validation. In Accounts Receivable, AI algorithms are employed for credit risk scoring and dynamic segmentation of customers, allowing for highly personalized and automated collections outreach, thereby optimizing the probability of timely payment and minimizing bad debt reserves.

Vendors are increasingly prioritizing the development of predictive models. For AP, this includes predicting optimal payment timing to maximize early payment discounts or avoid late fees. For AR, predictive models forecast customer propensity to pay, enabling proactive intervention. This shift moves the software beyond mere transactional processing into strategic financial planning support. This transformative influence positions AI as the primary technology enabling the transition from reactive financial reporting to proactive, intelligent working capital management, driving market innovation and forcing legacy system providers to rapidly modernize their offerings.

- Enhanced Straight-Through Processing (STP) through Intelligent Document Processing (IDP).

- Predictive analytics for optimizing payment schedules and maximizing early payment discounts (AP).

- Automated classification and coding of complex invoices using machine learning models.

- Dynamic collections prioritization and strategy optimization based on predictive customer behavior (AR).

- Improved fraud detection through continuous transactional monitoring and anomaly identification.

- Autonomous workflow routing and exception handling, reducing manual oversight.

- Advanced cash flow forecasting precision by integrating ML-derived payment/collection probabilities.

DRO & Impact Forces Of Accounts Payable and Accounts Receivable Software Market

The Accounts Payable and Accounts Receivable Software Market is propelled by compelling drivers centered on digital imperative and financial efficiency, while simultaneously constrained by implementation complexities and data security concerns. The overarching force is the global pressure on finance departments to optimize working capital and achieve faster financial closings, making automation a necessity rather than a luxury. Opportunities lie significantly in offering vertical-specific solutions and leveraging the SaaS model to penetrate the underserved mid-market. These elements create a powerful set of impact forces that favor agile, cloud-based solutions capable of rapid deployment and integration with existing core enterprise systems.

Key drivers include the mandate for regulatory compliance, especially the global proliferation of e-invoicing laws (e.g., Peppol in Europe, GST mandates in Asia), which necessitate digital data structures and automated validation. Furthermore, the rising volume and complexity of B2B transactions, coupled with distributed remote work models, accelerate the need for cloud-based, accessible, and secure processing platforms. Restraints primarily involve the high initial investment required for comprehensive system implementation and integration, particularly for large enterprises with fragmented legacy systems. Data security and the fear of financial fraud within automated systems also present a significant hurdle, requiring vendors to continuously invest in robust security protocols and access control mechanisms.

The opportunity landscape is vast, especially in emerging economies undergoing rapid digitalization and among SMEs seeking affordable, scalable entry-level solutions. The move towards specialized niche functionality, such as expense reporting integration, compliance-as-a-service offerings, and advanced treasury links, provides vendors with avenues for differentiation. The overall impact forces are high, creating a market environment where competitive advantage is dictated by superior integration capabilities, advanced AI functionality, and demonstrable ROI derived from speed and accuracy gains, compelling traditional vendors to rapidly adopt next-generation architectures.

Segmentation Analysis

The Accounts Payable and Accounts Receivable Software Market is comprehensively segmented across several key dimensions, providing a multi-faceted view of adoption trends and user preferences. The primary segmentation categories include deployment model (Cloud/SaaS vs. On-Premise), enterprise size (SMEs vs. Large Enterprises), and application type (AP vs. AR). This structured breakdown is essential for vendors to tailor their product offerings, pricing structures, and go-to-market strategies effectively, recognizing the diverse needs of businesses operating under different technological capabilities and financial scales.

The deployment model segmentation highlights the ongoing industry pivot, with Cloud/SaaS solutions dominating new subscriptions due to their agility, lower capital expenditure requirements, and scalability. This model appeals strongly to SMEs and organizations requiring quick deployment and integration with disparate systems. Conversely, On-Premise deployments, while declining, remain relevant for highly regulated industries like banking or government agencies that possess stringent internal data security mandates and already have significant infrastructure investment tied to legacy ERP environments.

The market bifurcation based on enterprise size reveals that Large Enterprises are the primary consumers of high-end, customized integrated suites, often bundled within major ERP platforms, focusing on complex multi-national transactions and sophisticated compliance tools. The SME segment, however, is the fastest-growing cohort, favoring modular, user-friendly, and cost-effective software that provides essential automation without the overhead of enterprise-level complexity. Application segmentation shows steady demand across both AP and AR functions, although AP solutions frequently garner more immediate attention due to the pressing need to control vendor relationships, manage liabilities, and prevent payment fraud.

- By Deployment Model:

- Cloud/SaaS

- On-Premise

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Accounts Payable (AP)

- Accounts Receivable (AR)

- Integrated Suites

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Manufacturing

- Healthcare

- IT and Telecommunication

- Others (Government, Education)

Value Chain Analysis For Accounts Payable and Accounts Receivable Software Market

The value chain of the Accounts Payable and Accounts Receivable Software Market commences with upstream activities focusing on technology development, specifically the continuous enhancement of core functionalities such as Intelligent Document Processing (IDP), AI/ML integration for predictive analytics, and secure cloud infrastructure management. Key upstream suppliers include data providers, cloud infrastructure services (AWS, Azure, GCP), and specialized AI/RPA engine developers. Strategic collaborations at this stage, particularly around API integration and microservices architecture, determine the speed and scalability of the resulting software solution.

Midstream activities involve the core software development, customization, testing, and deployment phases. This stage is dominated by the software vendors who convert raw technology into scalable, user-friendly financial applications. Significant value is created through seamless integration capabilities with existing ERP systems (e.g., SAP, Oracle), accounting software (e.g., QuickBooks, Xero), and financial institutions via API banking. The efficiency of the software is directly tied to the robustness of its data security framework, workflow configuration engine, and adherence to global financial compliance standards.

Downstream activities center on distribution, implementation, and ongoing customer support. Distribution channels are bifurcated into direct sales models, often preferred for large enterprise clients requiring custom implementation and complex contractual negotiations, and indirect channels relying on strategic partnerships with system integrators (SIs), value-added resellers (VARs), and technology alliances. The long-term value capture is highly dependent on effective post-sales services, including continuous technical support, regular software updates reflecting new regulatory mandates, and client training, ensuring high customer retention rates and subscription longevity.

Accounts Payable and Accounts Receivable Software Market Potential Customers

The potential customer base for Accounts Payable and Accounts Receivable software is extensive, spanning virtually every sector that handles financial transactions, from small startups to multinational corporations and governmental entities. The universal necessity of efficient cash flow management positions finance departments and controllers within organizations as the primary end-users and decision-makers. However, the specific requirements differ significantly based on transactional volume and regulatory complexity, creating distinct buyer segments. Businesses characterized by high transaction volumes, fragmented invoicing processes, or complex international supply chains are the most motivated buyers due to the measurable ROI from automation.

Key buying centers include Chief Financial Officers (CFOs) focused on strategic financial oversight and working capital optimization, Finance Controllers prioritizing accuracy and regulatory compliance, and IT Directors managing system integration and security infrastructure. E-commerce companies and retail chains that manage thousands of daily transactions and need real-time reconciliation represent a high-growth customer segment. Simultaneously, manufacturing and logistics firms with complex procurement processes and large supplier bases are continuously seeking AP automation solutions to streamline matching and reduce vendor disputes, viewing the software as an operational necessity.

Moreover, the adoption is rapidly increasing among public sector entities and non-profit organizations that are mandated to uphold high transparency standards and often face severe resource constraints. These organizations require software solutions that offer strong audit trails, easy integration with public finance systems, and strict adherence to government accounting standards. The universal need for timely, accurate, and compliant financial processing cements the global business landscape as the core buyer ecosystem for these automated financial management tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, FIS, HighRadius, Coupa Software Inc., Bill.com (now BILL), AvidXchange, Inc., Medius AB, Tipalti, Inc., Esker, BlackLine, Kofax Inc., Serrala, Yooz Inc., Paystand, FreshBooks, Xero Ltd., Sage Group plc, Basware, Bottomline Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accounts Payable and Accounts Receivable Software Market Key Technology Landscape

The technological landscape of the AP/AR software market is highly sophisticated, driven by the convergence of cloud computing, intelligent automation, and advanced data analytics. Cloud infrastructure, primarily delivered through multi-tenant Software as a Service (SaaS) architecture, forms the foundational backbone, offering scalability, accessibility, and robust disaster recovery mechanisms essential for critical financial operations. This shift away from traditional licensed software allows for continuous deployment of updates and regulatory compliance patches, drastically improving time-to-value for end-users. Secure API integration is paramount, enabling seamless data exchange between AP/AR platforms and core ERP systems, banking interfaces, and third-party validation services.

Intelligent automation technologies are the primary differentiator in modern AP/AR solutions. This includes Robotic Process Automation (RPA) for handling repetitive, rule-based tasks (e.g., data input verification, status checks) and Artificial Intelligence (AI) components. AI is utilized heavily in Intelligent Document Processing (IDP), which combines advanced Optical Character Recognition (OCR) with Natural Language Processing (NLP) to extract, validate, and categorize financial data from diverse document formats (invoices, receipts, contracts) with minimal error rates. Machine Learning (ML) algorithms further refine these processes by learning from historical exceptions and payment patterns, improving predictive accuracy for cash forecasting and fraud detection over time.

Furthermore, blockchain technology, although nascent, is gaining traction in specialized areas, particularly for securing cross-border B2B payments and establishing immutable audit trails, enhancing trust between trading partners. Advanced data visualization and dashboarding tools are also critical, translating complex transactional data into actionable insights for financial managers, facilitating quicker decisions regarding cash positioning, supplier spend analysis, and collections performance metrics. The competitive edge is increasingly determined by the speed and depth of AI integration, moving systems toward a "touchless finance" environment.

Regional Highlights

North America holds the dominant share in the AP/AR software market, primarily driven by early and aggressive adoption of cloud technologies, significant enterprise investment in digital transformation, and a culture prioritizing operational efficiency. The United States, in particular, showcases a high concentration of large multinational corporations and technology vendors, leading to rapid iteration and market penetration of advanced AI-powered solutions. Regulatory complexity and the need for stringent internal controls (like SOX compliance) also mandate the use of automated, audit-ready financial systems, ensuring sustained high demand across the region. Canada mirrors this trend, albeit on a smaller scale, with strong emphasis on SaaS adoption among mid-market firms.

Europe represents a highly fragmented yet rapidly modernizing market, largely propelled by government mandates regarding standardized e-invoicing (e.g., Directive 2014/55/EU) and VAT compliance across member states. Countries such as Germany, the UK, and France are critical markets due to their large manufacturing and financial services sectors, demanding sophisticated solutions for complex, multi-jurisdictional transactions. The necessity of managing diverse languages, currencies, and local regulatory requirements drives demand for highly flexible, modular, and localized software solutions, often favoring vendors with strong pan-European coverage capabilities.

The Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rapid urbanization, massive growth in e-commerce, and increasing government support for digitalization. Countries like India (driven by GST digitalization), China, and Southeast Asian nations are quickly adopting cloud-based solutions to leapfrog legacy infrastructure. The large presence of Small and Medium Enterprises (SMEs) in this region creates an immense opportunity for vendors offering affordable, mobile-first, and easily integrable AP/AR solutions. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth concentrated in sectors such as energy, natural resources, and telecommunications, driven by the need to streamline cross-border trade finance and ensure financial transparency.

- North America: Market leader due to high tech penetration, large corporate spending, and stringent regulatory requirements necessitating robust audit trails.

- Europe: Growth primarily driven by widespread governmental mandates for e-invoicing (Peppol network adoption) and complex VAT compliance rules.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive SME digitalization, e-commerce expansion, and strong governmental backing for digital finance initiatives.

- Latin America: Emerging market focusing on managing cross-border transactions and improving transparency within highly regulated environments.

- Middle East & Africa (MEA): Growth centered around oil and gas, finance sectors, seeking automation to enhance security and operational efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accounts Payable and Accounts Receivable Software Market.- SAP SE

- Oracle Corporation

- FIS

- HighRadius

- Coupa Software Inc.

- Bill.com (now BILL)

- AvidXchange, Inc.

- Medius AB

- Tipalti, Inc.

- Esker

- BlackLine

- Kofax Inc.

- Serrala

- Yooz Inc.

- Paystand

- FreshBooks

- Xero Ltd.

- Sage Group plc

- Basware

- Bottomline Technologies

Frequently Asked Questions

Analyze common user questions about the Accounts Payable and Accounts Receivable Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating to cloud-based AP/AR software?

The primary benefit is improved operational scalability and reduced Total Cost of Ownership (TCO), achieved through lower capital expenditure, flexible subscription models, continuous security updates, and enhanced accessibility for geographically dispersed finance teams. Cloud solutions also facilitate quicker integration with modern banking and ERP systems via APIs.

How is AI specifically transforming the Accounts Payable workflow?

AI is transforming Accounts Payable by enabling touchless processing. Intelligent Document Processing (IDP) automates invoice capture, categorization, and validation. Machine Learning algorithms then perform three-way matching and flag exceptions automatically, drastically reducing manual data entry errors and accelerating invoice approval cycles.

What is the current market trend regarding integrated AP and AR suites?

The dominant trend is the move toward unified, integrated AP/AR suites. Businesses seek single-platform solutions to gain end-to-end visibility into the cash conversion cycle, optimize working capital, minimize reconciliation gaps, and ensure consistent data governance across both payables and receivables functions.

Which regulatory factors are most significantly driving market adoption globally?

Global e-invoicing mandates, such as those implemented across the European Union (Peppol) and mandated digital tax reporting frameworks in large economies (like India’s GST or Brazil’s Nota Fiscal), are the most significant drivers. These regulations necessitate software capable of structured data exchange and automated compliance verification.

How important are predictive analytics in Accounts Receivable software?

Predictive analytics are critically important in AR software as they leverage historical payment data and external factors to accurately forecast customer payment propensity. This allows finance teams to proactively prioritize collections efforts, adjust credit terms dynamically, and significantly reduce Days Sales Outstanding (DSO) and bad debt exposure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager