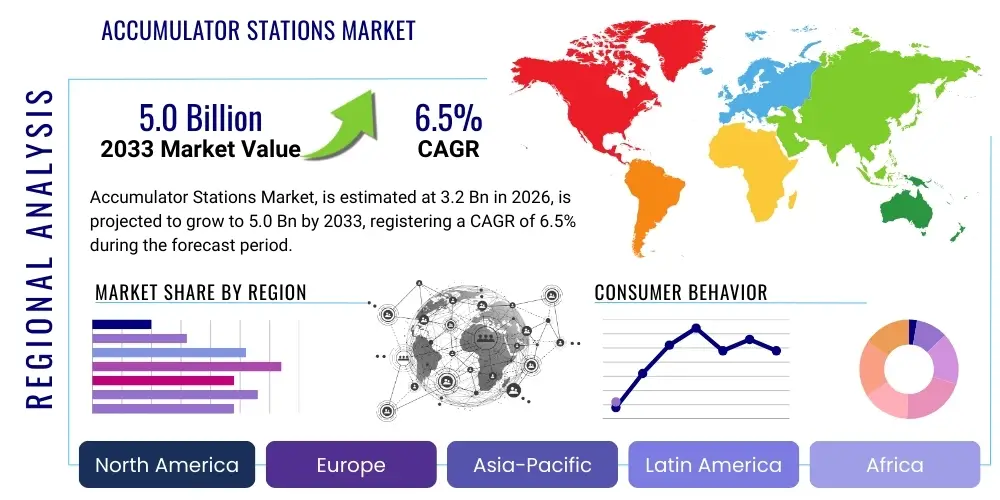

Accumulator Stations Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442142 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Accumulator Stations Market Size

The Accumulator Stations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing automation across heavy industries, the critical need for reliable energy storage solutions, and stringent safety regulations mandating efficient hydraulic buffering systems, particularly in manufacturing, construction, and oil and gas sectors.

The valuation reflects sustained investment in infrastructure projects globally, where hydraulic power systems are indispensable. Market growth is further bolstered by the technological transition towards smarter, more integrated accumulator systems featuring advanced monitoring capabilities and predictive maintenance functions. As end-users prioritize efficiency and minimizing downtime, the demand for high-performance, tailored accumulator stations designed for specific operational environments continues to escalate, contributing significantly to the overall market size progression.

Accumulator Stations Market introduction

Accumulator Stations are integral components within hydraulic systems, designed to store energy, dampen pressure pulsations, compensate for leaks, and provide emergency power during pump failure. These stations typically consist of one or more hydraulic accumulators—such as bladder, piston, or diaphragm types—integrated with safety blocks, charging valves, pressure relief systems, and monitoring devices, forming a complete, ready-to-use subsystem. The primary function is to optimize system efficiency and stability, allowing smaller pumps to be used for peak load demands by drawing upon stored hydraulic energy, thereby reducing overall operational costs and energy consumption across various industrial applications.

Major applications of accumulator stations span a wide range of industries including heavy machinery manufacturing, where they ensure continuous operation of stamping presses and forging equipment; renewable energy generation, particularly in pitch control systems for wind turbines; and offshore drilling, where they provide essential fail-safe mechanisms for blowout preventers (BOPs). Furthermore, the marine sector utilizes them extensively for steering gear and crane operations, demonstrating their versatility and crucial role in safety-critical high-power hydraulic circuits. The product description emphasizes reliability, customized capacity planning, and adherence to international pressure vessel standards (e.g., ASME, PED).

The market is currently being driven by the global push towards industrial automation, requiring highly responsive and precise hydraulic control systems. Benefits include substantial energy savings by optimizing pump cycling, enhanced system performance through pulsation dampening, increased equipment lifespan due to reduced shock loads, and improved operational safety. These stations are essential for maintaining constant pressure in demanding applications, mitigating fluid compression issues, and providing hydraulic reserves critical for emergency shutdowns, making them a fundamental element in modern, complex machinery across almost every high-power industrial domain.

Accumulator Stations Market Executive Summary

The global Accumulator Stations Market is experiencing sustained growth, characterized by strong business trends centered on digitalization and customized system design. Key business trends involve the integration of IoT sensors and real-time data analytics into accumulator stations, enabling advanced condition monitoring and predictive maintenance strategies. This shift from reactive repair to proactive maintenance is a significant commercial differentiator. Furthermore, consolidation among key manufacturers is driving innovation in material science for improved accumulator bladder longevity and enhanced operational pressure ratings, catering specifically to ultra-heavy-duty industrial requirements and extreme environment applications, such as deep-sea and aerospace hydraulic testing.

Regionally, the market dynamics are polarized, with Asia Pacific (APAC) demonstrating the highest growth rates, driven by rapid industrialization, particularly in China and India, focusing on infrastructure development and large-scale manufacturing expansion. North America and Europe, while mature markets, emphasize technological upgrades and the adoption of high-efficiency, energy-saving accumulator systems to comply with stringent environmental regulations and reduce their overall carbon footprint. The Middle East and Africa (MEA) exhibit steady growth, largely dependent on oil and gas exploration activities requiring high-pressure, reliable hydraulic control systems for safety equipment and drilling operations, stimulating demand for robust, high-specification accumulator stations.

Segment trends indicate a strong preference for Piston Accumulator Stations in high-pressure, large-volume applications due to their superior performance stability and longevity under extreme conditions. However, the Bladder Accumulator Stations segment maintains dominance in terms of volume due to its cost-effectiveness and versatility across standard industrial hydraulics. The end-use segments show pronounced growth in the machinery manufacturing sector and the renewable energy segment, specifically wind energy, where hydraulic accumulator stations are vital for pitch and yaw control mechanisms. This segmentation shift reflects a move towards precision engineering and specialized application requirements across the industrial landscape.

AI Impact Analysis on Accumulator Stations Market

User queries regarding AI's impact on the Accumulator Stations Market frequently center on predictive failure prevention, efficiency optimization, and autonomous system management. Users are highly interested in how machine learning algorithms can analyze pressure fluctuation data, temperature profiles, and usage cycles collected from smart sensors integrated into modern accumulator stations to accurately predict component wear, particularly bladder or seal failure, before catastrophic downtime occurs. Key concerns revolve around the cybersecurity risks associated with networked hydraulic systems and the cost-benefit analysis of retrofitting existing conventional stations with AI-enabled monitoring technology. Expectations are high regarding significant reductions in maintenance expenditures and substantial improvements in system reliability through algorithmic decision-making.

The deployment of Artificial Intelligence is transforming accumulator station management from a manual, time-based maintenance schedule to an adaptive, condition-based strategy. AI systems process continuous data streams from hydraulic sensors (pressure, flow, temperature, vibration) to establish baseline operational norms. Deviations from these norms are flagged, allowing maintenance teams to address incipient failures, such as slow pressure decay or unusual thermal patterns, well in advance. This proactive intervention minimizes unplanned stoppages, which are extremely costly in heavy industries like steel production or deep-sea drilling, fundamentally altering the service and support landscape for hydraulic equipment providers.

Furthermore, AI optimization extends beyond maintenance into operational efficiency. Machine learning models can dynamically adjust accumulator pre-charge pressures based on real-time load requirements and environmental factors, ensuring the hydraulic system operates at peak efficiency. For example, in automated manufacturing lines, AI can coordinate the charging and discharging cycles of multiple accumulator stations to minimize instantaneous power draw from the central pump unit, contributing directly to energy conservation and reducing the overall wear on pumping machinery. This level of dynamic control, unattainable through conventional programmable logic controllers (PLCs), significantly enhances the overall utility and value proposition of high-end accumulator systems in Industry 4.0 environments.

- AI enables highly accurate predictive maintenance of accumulator bladder and seal integrity.

- Machine Learning algorithms optimize pre-charge pressure settings based on dynamic load conditions, maximizing energy efficiency.

- Integrated AI platforms automate data analysis of pressure curves and temperature trends for early fault detection.

- Smart accumulator stations utilize AI for autonomous diagnostics and remote operational adjustments.

- Optimization models derived from AI reduce peak power consumption requirements for the hydraulic power unit.

- AI integration facilitates sophisticated asset performance management (APM) across large fleets of hydraulic machinery.

DRO & Impact Forces Of Accumulator Stations Market

The Accumulator Stations Market growth is powerfully propelled by increasing global demand for sophisticated automation in manufacturing and construction, stringent safety regulations requiring fail-safe hydraulic backups, and the inherent energy efficiency benefits provided by hydraulic energy storage. Conversely, high initial investment costs associated with specialized, high-pressure equipment and volatility in raw material prices (steel, specialized polymers for bladders) pose significant restraints. Opportunities lie squarely in the emerging markets of Asia and Latin America, the rapid adoption of renewable energy technologies (wind and solar farms), and the development of lightweight, composite-material accumulators suitable for mobile machinery. These forces collectively shape a competitive landscape where innovation in material science and digital integration are key determinants of market success and competitive advantage for leading manufacturers.

Driving factors include the necessity for effective shock absorption and pulsation dampening in large fluid power systems, protecting expensive components and extending machinery lifespan. The increasing complexity and scale of industrial machinery, such as large injection molding machines and metal forming presses, necessitate robust accumulator stations capable of handling intermittent, high-flow demands. Furthermore, regulatory frameworks in developed economies, particularly regarding safety standards in mining and oil & gas operations, mandate the installation of certified accumulator stations to ensure immediate control response during power failures or emergencies, thereby institutionalizing demand across critical infrastructure sectors.

Restraints are primarily focused on the technical challenges of maintaining accumulators, including the periodic need to monitor and recharge gas pre-charge, and the inherent risk of fluid contamination. The market also faces substitution threats from electro-mechanical actuator systems in lower-power applications, although hydraulic systems retain a critical advantage in power density. Opportunities are abundant in customization, where manufacturers can tailor station design, material selection, and certification to unique industry needs, such as non-magnetic specifications for scientific research or specific corrosion resistance levels for marine environments. The ongoing development of digitally enabled accumulator stations, which self-monitor and report pre-charge status, significantly mitigates maintenance restraints, offering a substantial avenue for future market expansion.

Segmentation Analysis

The Accumulator Stations Market is strategically segmented across several critical dimensions, including Accumulator Type, Application, End-Use Industry, and Operating Pressure Range, providing a granular view of market dynamics and specialized demand areas. Analyzing these segments helps stakeholders understand where technological investment and market penetration efforts yield the highest returns. For example, the segmentation by Accumulator Type—Bladder, Piston, and Diaphragm—reveals distinct purchasing patterns based on required pressure fidelity and flow volume. Piston accumulators dominate large-scale, high-pressure systems, while bladder accumulators offer a balance of cost and performance suitable for the majority of industrial applications, demonstrating the necessity of tailored product portfolios for comprehensive market coverage.

Further breakdown by End-Use Industry illustrates the varied requirements and growth drivers. Segments such as Construction, Mining, and Oil & Gas prioritize ruggedness, high volume storage capacity, and certified safety features for explosive environments. Conversely, sectors like Aerospace and Precision Machinery emphasize lightweight design, highly responsive performance, and exceptional seal integrity to maintain operational precision under challenging conditions. This variance dictates the necessary R&D focus, driving manufacturers toward niche specialization and targeted marketing strategies that address the specific regulatory compliance and operational challenges unique to each industry vertical globally.

Understanding these segmentations is crucial for forecasting future growth trajectories. The fastest-growing segments are those tied to the renewable energy sector and automated machinery, reflecting global shifts toward sustainable practices and increased factory efficiency. The market is increasingly differentiating itself based on smart functionalities, such as integrated sensor packages and network connectivity (IoT-enabled stations), which form a nascent yet rapidly expanding sub-segment within the broader technology classification. Manufacturers able to offer certified, robust, and digitally integrated solutions across these segments are best positioned for long-term sustainable market leadership and enhanced stakeholder value creation.

- By Accumulator Type:

- Bladder Accumulator Stations

- Piston Accumulator Stations

- Diaphragm Accumulator Stations

- By Operating Pressure:

- Low Pressure (<100 bar)

- Medium Pressure (100–350 bar)

- High Pressure (>350 bar)

- By Application:

- Energy Storage

- Shock and Pulsation Dampening

- Volume Compensation and Leakage Makeup

- Emergency Power/Auxiliary Systems

- By End-Use Industry:

- Construction and Mining Equipment

- Oil and Gas (Offshore and Onshore)

- Manufacturing and Metal Processing

- Aerospace and Defense

- Renewable Energy (Wind Turbine Pitch Control)

- Marine and Offshore Applications

Value Chain Analysis For Accumulator Stations Market

The value chain for the Accumulator Stations Market begins with raw material suppliers, focusing primarily on high-grade steel alloys for pressure vessels, specialized polymers and elastomers for bladders and seals, and specific gas (Nitrogen) suppliers for pre-charge. Upstream analysis highlights the critical dependence on global commodity markets for steel and rubber components, where price volatility directly impacts manufacturing costs and profit margins. Component manufacturing, which involves forging, precision machining, and specialized welding of high-pressure shells, requires significant capital investment and adherence to stringent international pressure vessel codes (e.g., PED 2014/68/EU, ASME Boiler and Pressure Vessel Code). Suppliers capable of guaranteeing material traceability and certification hold significant leverage in this initial phase.

Midstream activities encompass the core manufacturing of the accumulator station itself, integrating the pressure vessel, gas and fluid ports, safety blocks, pressure transducers, and mounting hardware. Major players typically manage this integration in-house, ensuring system compliance and quality control. The distribution channel is bifurcated: direct sales channels handle large, custom-engineered projects for major OEMs in heavy industries (downstream), where technical consultation and post-sales support are paramount. Indirect channels rely on regional distributors and specialized hydraulic system integrators who serve smaller end-users, handling inventory and localized technical services. The efficiency and technical competency of this distribution network are crucial for market reach, especially in emerging industrial hubs.

Downstream analysis focuses on installation, commissioning, maintenance, and replacement cycles. End-users require highly specialized technical expertise for correct installation and safe pre-charge setting, which is often provided by the original equipment manufacturer or certified service partners. The long operational lifespan of accumulator stations means that the aftermarket service—including periodic recharging, seal replacement, and certification renewal—forms a substantial and profitable segment of the value chain. This aftermarket continuity fosters long-term customer relationships and creates significant barriers to entry for new competitors who lack extensive service infrastructure and certified field engineers, thus reinforcing the market position of established global suppliers.

Accumulator Stations Market Potential Customers

The primary customers for Accumulator Stations are diverse, encompassing major industrial manufacturers, infrastructure developers, energy companies, and heavy equipment operators globally. End-users typically prioritize system reliability, adherence to strict safety standards, performance consistency under demanding operational cycles, and minimal total cost of ownership. Key buyers include Original Equipment Manufacturers (OEMs) specializing in injection molding machinery, forging presses, cranes, and marine equipment, who integrate these stations directly into their finished products to provide necessary hydraulic buffering and system efficiency. These customers value long-term contracts and highly standardized, globally certifiable products that can withstand continuous duty operation.

Another significant customer segment is the energy sector, particularly oil and gas drilling companies (both offshore and onshore), and utility providers managing wind turbine farms. In oil and gas, accumulator stations are mission-critical for Blowout Preventers (BOPs), where they must deliver instantaneous, high-pressure hydraulic power to close safety valves in emergencies, emphasizing certified reliability and corrosion resistance. For renewable energy, they stabilize hydraulic pitch control systems in large wind turbines, requiring compact, highly durable solutions with low maintenance requirements, reflecting a shift towards distributed energy infrastructure requiring reliable remote monitoring capabilities.

Furthermore, infrastructure and construction sectors, utilizing heavy mobile equipment such as excavators, loaders, and tunnel boring machines, represent core end-users. These customers rely on accumulator stations for shock absorption to protect hydraulic cylinders and hoses from external impact loads, and for power assistance during peak demands, improving fuel efficiency and operational throughput. Government defense departments and aerospace manufacturers also constitute high-value customers, demanding customized, often proprietary solutions that meet stringent military specifications for fluid cleanliness, temperature extremes, and vibration resistance, driving demand for specialized, high-performance diaphragm and piston accumulator variants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Hydac International, Olaer (Parker), Fawcett Christie, Roth Hydraulics, Fox S.r.l., Accumulators Inc., Jiangsu Huade Hydraulic, HAWE Hydraulik, Moog Inc., Argo-Hytos, Continental AG, Freudenberg Sealing Technologies, Tobul Accumulator, Tuff Seal, NOK Corporation, Wuxi Hongtai, Shenzhen Huaxinda. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accumulator Stations Market Key Technology Landscape

The technology landscape within the Accumulator Stations Market is centered around three core areas: advanced material science, smart monitoring integration, and system modularity. In material science, continuous innovation focuses on developing lightweight, high-strength composite materials to replace traditional steel pressure vessels, particularly for mobile and aerospace applications where weight reduction is paramount. Simultaneously, research into proprietary elastomers and seal materials aims to enhance the chemical compatibility and thermal resilience of bladders and piston seals, allowing accumulator stations to operate reliably under more extreme temperature ranges and with specialized hydraulic fluids, thereby expanding their applicability in harsh industrial settings like high-heat processing or chemical manufacturing environments.

A critical shift is the rapid integration of Industry 4.0 technologies, transforming conventional accumulator stations into intelligent components. The use of wireless IoT sensors for real-time monitoring of key parameters—specifically hydraulic pressure, pre-charge gas pressure, fluid temperature, and localized vibration—is now standard for premium offerings. These sensors transmit data to cloud-based platforms utilizing edge computing capabilities, enabling operators to track performance remotely and implement condition-based monitoring strategies. This digitalization drastically improves uptime, facilitates predictive maintenance schedules, and ensures regulatory compliance by maintaining accurate operational logs and minimizing the risk of catastrophic failure due to inadequate gas pre-charge.

Furthermore, technology development is heavily concentrated on optimizing energy storage and management efficiency. Modern accumulator stations feature enhanced modular designs, allowing for easier customization, expansion, and servicing in the field. This modularity reduces installation complexity and maintenance downtime. Innovations also include energy regeneration systems, where accumulator stations are integrated into hydraulic braking or load-handling systems to recapture kinetic energy, convert it into hydraulic potential energy, and store it for later use. This closed-loop energy management is highly relevant in industrial presses and hybrid vehicles, pushing the accumulator station beyond simple buffering into an active energy management device, thereby enhancing the overall energy efficiency of the macro system.

Regional Highlights

The global Accumulator Stations Market exhibits diverse regional growth trajectories influenced by industrial maturity, regulatory environment, and investment in infrastructure. Asia Pacific (APAC) stands out as the highest-growth region, primarily due to the rapid urbanization and industrial expansion in countries such as China, India, and Southeast Asian nations. Substantial government investment in manufacturing infrastructure, coupled with the flourishing automotive and electronics sectors, necessitates high volumes of hydraulic equipment, driving demand for both standard and high-performance accumulator stations. Localized manufacturing capabilities are also increasing, though many high-specification products are still imported from established European and North American suppliers. This region focuses heavily on cost-effective, robust solutions.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on technological sophistication and compliance with strict safety and environmental standards. In these regions, the demand is shifting towards smart, IoT-enabled accumulator stations that facilitate predictive maintenance and comply with energy efficiency mandates. The aerospace, defense, and advanced manufacturing sectors in these regions require customized, highly reliable, and certified systems, driving premium pricing and innovation in materials and monitoring technology. The European market, particularly Germany and Italy, is a major hub for hydraulic component manufacturing, influencing global product standards and technological evolution within the hydraulic power sector.

Latin America and the Middle East & Africa (MEA) offer considerable opportunities driven by specific industry needs. Latin America's market growth is tied to mining, agriculture, and construction activities, requiring rugged accumulator stations that can withstand harsh operating conditions and remote service locations. The MEA region’s demand is heavily concentrated in the Oil and Gas sector, specifically for exploration, extraction, and processing facilities. Accumulator stations are essential components in hydraulic control units for drilling rigs and safety systems (BOPs). The growth in this region is volatile but highly significant for high-pressure piston and bladder accumulators that meet stringent offshore safety certifications and corrosion resistance requirements.

- North America: Focus on IoT integration, aerospace applications, and high-efficiency systems compliant with sophisticated safety standards. High demand driven by revitalization of manufacturing sectors.

- Europe: Center for hydraulic technology innovation, driven by stringent PED and Machinery Directive compliance. Strong adoption in automotive, renewable energy (wind farms), and precision machinery.

- Asia Pacific (APAC): Leading market in volume growth due to massive industrialization, infrastructure development, and growing investment in local manufacturing hubs (China, India). Emphasis on construction and heavy machinery sectors.

- Latin America: Demand driven by large-scale mining operations and agricultural machinery, favoring durable, high-capacity accumulator stations capable of withstanding remote, challenging environments.

- Middle East and Africa (MEA): Market concentration in the Oil and Gas sector, requiring highly reliable, certified high-pressure accumulators for critical safety functions like Blowout Preventers (BOPs).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accumulator Stations Market.- Bosch Rexroth

- Parker Hannifin

- Eaton Corporation

- Hydac International

- Olaer (A division of Parker Hannifin)

- Fawcett Christie (A subsidiary of Parker Hannifin)

- Roth Hydraulics (formerly Roquet Hydraulic Systems)

- Fox S.r.l.

- Accumulators Inc.

- Jiangsu Huade Hydraulic

- HAWE Hydraulik

- Moog Inc.

- Argo-Hytos

- Continental AG

- Freudenberg Sealing Technologies

- Tobul Accumulator

- Tuff Seal

- NOK Corporation

- Wuxi Hongtai

- Shenzhen Huaxinda

Frequently Asked Questions

Analyze common user questions about the Accumulator Stations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an accumulator station in a hydraulic system?

The primary function is hydraulic energy storage, allowing the system to handle peak flow demands without requiring oversized pumps. It also dampens pressure pulsations, compensates for fluid leakage, and provides immediate emergency power for safety functions during system failure or power loss, ensuring operational stability and component protection across industrial machinery.

Which accumulator type dominates the market, and why is it preferred?

Bladder Accumulator Stations currently dominate the market volume due to their cost-effectiveness, high flow rates, and excellent sealing integrity between the gas and fluid chambers. They are versatile for various industrial applications and are widely adopted for shock absorption and pulsation dampening in standard hydraulic circuits.

How is Industry 4.0 technology influencing the design of modern accumulator stations?

Industry 4.0 is driving the integration of IoT sensors into accumulator stations, enabling real-time condition monitoring, remote diagnostics, and predictive maintenance capabilities. This digitalization allows operators to continuously monitor pre-charge pressure and temperature, drastically reducing unplanned downtime and optimizing system efficiency through algorithmic control.

What are the key drivers for market growth in the Asia Pacific region?

Market growth in the Asia Pacific region is primarily driven by extensive infrastructure development, rapid industrialization, and significant expansion in the manufacturing sector (automotive, electronics, heavy machinery). These factors create high demand for reliable, high-volume hydraulic systems and associated energy storage components.

What is the typical lifespan and required maintenance for a hydraulic accumulator?

The lifespan of a high-quality hydraulic accumulator station can exceed 20 years, although the internal components, particularly the bladder or seals, require periodic monitoring and replacement (typically every 3 to 7 years, depending on usage). Required maintenance mainly involves checking and recharging the nitrogen pre-charge pressure to ensure optimal system performance and safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager