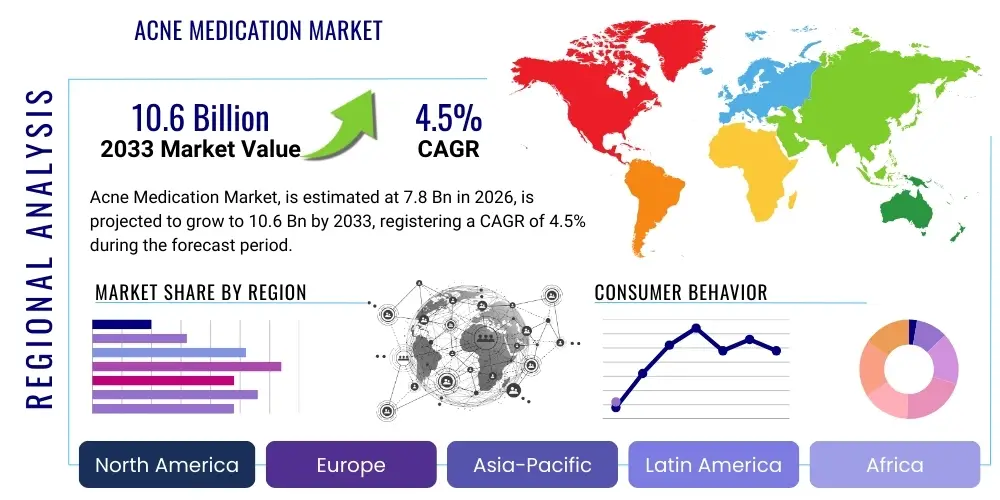

Acne Medication Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442650 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Acne Medication Market Size

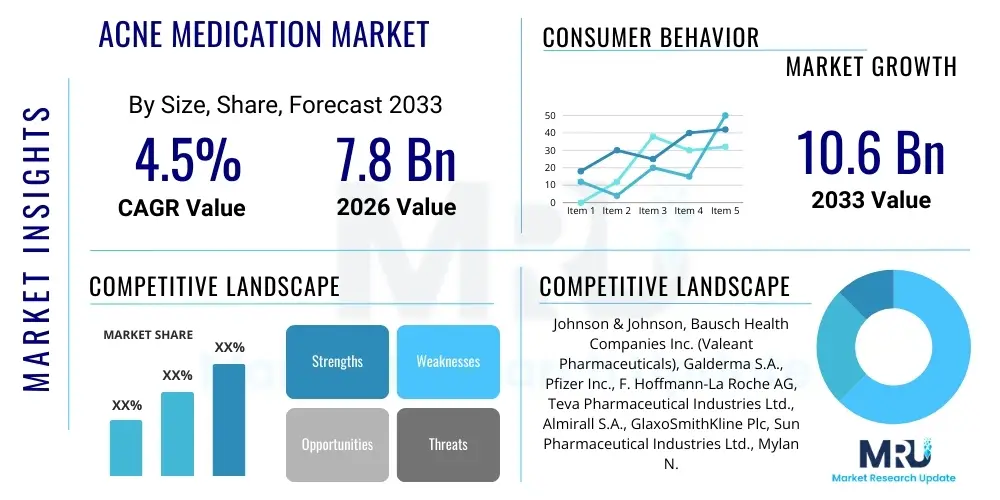

The Acne Medication Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 7.8 Billion in 2026 and is projected to reach USD 10.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global prevalence of acne vulgaris across adolescent and adult populations, coupled with continuous advancements in topical and systemic treatment modalities. The market expansion is further accelerated by rising consumer awareness regarding dermatological health and the increasing adoption of combination therapies that offer enhanced efficacy and reduced side effects compared to traditional monotherapies. Furthermore, strategic initiatives by major pharmaceutical firms focused on developing novel drug delivery systems, such as microencapsulation techniques and specialized gels, are expected to provide significant impetus to market valuation.

The transition toward prescription-based, highly effective combination products, particularly those integrating retinoids with antimicrobials, is a dominant trend shaping the revenue generation landscape. While the Over-The-Counter (OTC) segment maintains a substantial volume share, the prescription segment commands a higher value share due to premium pricing and complex regulatory approval processes required for novel systemic treatments. Geographical expansion into emerging economies, characterized by improving healthcare infrastructure and growing disposable incomes, represents a crucial factor driving the long-term compounding growth rate observed over the defined forecast window. Stakeholders are heavily investing in clinical trials targeting resistant acne forms, promising therapeutic breakthroughs that will redefine standard care protocols and elevate market size.

Key financial projections indicate that patent expiration of certain blockbuster drugs may introduce competitive pressure from generic alternatives, yet this is mitigated by a robust pipeline of innovative biologics and device-assisted treatments entering the clinical phase. The shift in consumer preference toward less invasive, aesthetically superior treatment options, including chemical peels and light therapy devices used adjunctively with pharmaceutical agents, also contributes marginally to the expanded scope of the acne medication domain, reinforcing the overall upward revision of market size forecasts toward the USD 10.6 Billion target by 2033. Investment in digital platforms for patient education and telehealth consultations further streamlines access to professional dermatological care, ensuring consistent demand for high-value medication products.

Acne Medication Market introduction

The Acne Medication Market encompasses a diverse range of pharmacological and cosmetic treatments designed to manage and mitigate acne vulgaris, a chronic inflammatory skin condition affecting the pilosebaceous unit. This market includes prescription drugs such as topical retinoids, systemic antibiotics, hormonal agents, and isotretinoin, alongside a broad spectrum of over-the-counter products primarily containing benzoyl peroxide, salicylic acid, and sulfur. The primary objective of these medications is to address the core pathophysiological factors contributing to acne development: excessive sebum production, follicular hyperkeratinization, colonization by Cutibacterium acnes (formerly P. acnes), and subsequent inflammation. The complexity of acne pathogenesis necessitates varied product offerings, catering to mild, moderate, and severe cases, spanning gels, creams, lotions, oral tablets, and specialized dermatological solutions designed for targeted efficacy and minimized systemic absorption.

Major applications of acne medications span clinical dermatology settings, retail pharmacy distribution, and direct-to-consumer digital channels. Clinically, medications are used in monotherapy or, more commonly, in combination therapies to maximize therapeutic synergy, such as pairing topical retinoids for comedolytic effects with antibiotics or benzoyl peroxide for antimicrobial action. Beyond treating active lesions, a critical benefit of effective acne medication is the prevention of permanent scarring and post-inflammatory hyperpigmentation, significantly improving the patient's psychological well-being and quality of life. The market is intensely competitive, driven by continuous innovation in drug formulations to improve patient adherence, bioavailability, and tolerability, particularly concerning irritation and dryness commonly associated with highly potent agents like tretinoin and isotretinoin. Manufacturers are focused on developing fixed-dose combination products that simplify treatment regimens and enhance therapeutic outcomes across diverse patient demographics.

Driving factors for sustained market growth include the globally rising incidence of adult-onset acne, particularly among women, often linked to hormonal fluctuations, stress, and lifestyle factors. Furthermore, increasing awareness through social media and direct-to-consumer marketing campaigns has led to higher rates of self-diagnosis and professional consultation, subsequently boosting medication uptake. Technological advancements in transdermal delivery systems, such as nanoparticles and liposomal carriers, are enhancing drug stability and penetration, thereby increasing the therapeutic index of existing molecules. Additionally, strong governmental support in developed economies for dermatological research and improved insurance coverage for specialty treatments are instrumental in maintaining high demand. The continuous development of non-antibiotic alternatives, addressing the pervasive global issue of antimicrobial resistance (AMR) associated with prolonged topical antibiotic use, represents a significant positive catalyst for future market evolution and innovation.

Acne Medication Market Executive Summary

The Acne Medication Market is poised for steady expansion through the forecast period, underpinned by robust business trends focusing on advanced pharmaceutical development and targeted consumer engagement. Key business trends include the strategic divestment by large pharmaceutical companies of non-core dermatology assets, allowing specialized firms to consolidate expertise and focus R&D resources on niche therapeutics, such as acne treatments resistant to standard care. There is an observable shift towards personalized medicine approaches, where genetic profiling and advanced diagnostic tools guide the selection of appropriate systemic or topical treatments, maximizing efficacy and minimizing adverse effects. Furthermore, investment in biosimilars for emerging biologic acne treatments is beginning to shape the competitive landscape, promising cost-effective alternatives and broadening patient access, while digital health integration, particularly teledermatology, accelerates diagnosis and prescription fulfillment globally.

Regionally, the market exhibits divergent growth profiles. North America retains its position as the largest market, driven by high healthcare expenditure, sophisticated diagnostic capabilities, and rapid adoption of novel premium prescription medications. The region benefits from strong presence of major market players and a high awareness level regarding cosmetic dermatology. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by expanding middle-class populations, improving access to healthcare, rising skin health consciousness, and a significant youth demographic highly susceptible to acne. Conversely, European growth remains stable, characterized by strict regulatory frameworks and a preference for established, proven treatments, though adoption of advanced laser and light therapies alongside medication is gaining traction in Western European nations. The regulatory convergence across certain regional blocs is streamlining market entry for internationally approved pharmaceutical products.

Segmentation trends highlight the dominance of the topical segment by volume, particularly due to the accessibility and effectiveness of retinoids and benzoyl peroxide products in treating mild to moderate acne. However, the systemic treatment segment, led by oral antibiotics and isotretinoin derivatives, commands a substantial value share, driven by their necessity in severe, nodulocystic acne cases. Within the distribution channel segment, retail pharmacies maintain primary importance, but e-commerce and direct-to-consumer platforms are exhibiting exponential growth, especially for OTC and cosmeceutical acne solutions. The drug class segmentation demonstrates a shift away from traditional antibiotic monotherapy towards combination products and non-antibiotic anti-inflammatory agents, reflecting global efforts to combat antimicrobial resistance (AMR) and improve long-term treatment outcomes. This strategic pivoting toward non-antibiotic mechanisms of action is a defining trend influencing R&D priorities across the industry spectrum.

AI Impact Analysis on Acne Medication Market

Common user and industry questions regarding the impact of Artificial Intelligence (AI) on the Acne Medication Market center predominantly on its ability to revolutionize diagnosis, personalize treatment protocols, and accelerate drug discovery. Users frequently inquire: "How can AI improve the accuracy of acne severity assessment?" "Will AI-powered tools replace dermatologists?" and "What role does machine learning play in identifying new therapeutic targets for acne?" The underlying key themes identified through this analysis reveal a high expectation for AI to enhance diagnostic efficiency, particularly through image recognition and deep learning models that can analyze dermatoscopic images with high precision, providing objective metrics for severity scoring and tracking treatment response. Concerns revolve around data privacy, regulatory challenges, and the potential displacement of human expertise, although expectations for optimized personalized medication regimens, guided by AI analysis of individual patient data (genetics, microbiome, lifestyle), are exceedingly high, driving investment in this specialized area of computational dermatology.

AI’s influence is transformative, specifically within the drug development lifecycle for novel acne medications. Machine learning algorithms are being deployed to analyze vast datasets of chemical compounds, biological pathways, and clinical trial results to predict the efficacy and toxicity profiles of potential drug candidates more rapidly than traditional methods. This capability significantly reduces the time and cost associated with preclinical research, allowing pharmaceutical companies to prioritize molecules with the highest likelihood of success, thus accelerating the introduction of next-generation treatments, especially those targeting inflammatory pathways or specific microbial strains resistant to existing antibiotics. Furthermore, AI assists in optimizing clinical trial design by identifying the most suitable patient populations and predicting optimal dosing schedules based on predictive modeling, thereby enhancing overall research efficiency and market readiness.

In the commercial and patient care spheres, AI algorithms are instrumental in optimizing market strategies and enhancing patient adherence. AI-driven telemedicine platforms utilize deep learning to analyze patient-submitted photographs, offering initial severity assessments and guiding users to appropriate OTC or prescription products, often via automated prescription generation integrated with pharmaceutical supply chains. For pharmaceutical companies, AI models analyze real-world data and sales trends to forecast demand accurately, optimize inventory management, and identify untapped regional markets based on demographic and environmental factors influencing acne prevalence. This comprehensive application of AI, spanning R&D, diagnosis, personalization, and logistical optimization, solidifies its role as a fundamental disruptive force reshaping the operational dynamics and value proposition of the global acne medication sector.

- Enhanced Diagnostic Accuracy: AI algorithms utilize image recognition for objective, rapid scoring of acne severity, leading to standardized clinical assessments.

- Personalized Treatment Regimens: Machine learning analyzes patient genomics, microbiome data, and lifestyle factors to recommend highly tailored medication combinations and dosages.

- Accelerated Drug Discovery: AI predicts therapeutic targets, analyzes compound efficacy, and optimizes preclinical screening, significantly shortening the development timeline for novel agents.

- Clinical Trial Optimization: Predictive modeling identifies ideal patient cohorts and optimizes trial protocols, reducing costs and increasing the statistical power of studies.

- Improved Patient Adherence: AI-powered applications provide personalized reminders, symptom tracking, and virtual consultations, boosting compliance with multi-step medication routines.

- Supply Chain and Demand Forecasting: Automated analysis of regional disease prevalence and sales data enhances inventory management and reduces stock-outs for critical medications.

- Teledermatology Expansion: Integration of AI into virtual care platforms facilitates remote diagnosis and prescription issuance, particularly benefiting underserved geographic areas.

- Identification of Non-Responders: AI models predict patients who may not respond to standard care (e.g., specific antibiotics), guiding early adoption of alternative, specialized treatments.

DRO & Impact Forces Of Acne Medication Market

The Acne Medication Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively defining the Impact Forces that dictate market direction and growth velocity. The principal Drivers include the high global prevalence of acne vulgaris across age groups, coupled with increasing awareness of effective treatment options and the rising aesthetic consciousness among consumers who seek immediate and lasting relief from skin blemishes. This demand is further amplified by technological advancements in drug delivery systems, particularly micro-encapsulation and fixed-dose combinations, which improve treatment efficacy and patient adherence. Conversely, significant Restraints are posed by the side effects associated with high-potency drugs like isotretinoin (including teratogenicity and psychological impacts), leading to regulatory scrutiny and patient hesitancy. The escalating issue of antimicrobial resistance (AMR) associated with prolonged topical antibiotic use also mandates a shift away from these agents, pressuring manufacturers to innovate and find non-antibiotic alternatives, thereby slowing the adoption of established, lower-cost treatments.

The primary Opportunities reside in the development of novel anti-inflammatory and sebum-regulating agents that bypass the need for antibiotics, offering long-term management without contributing to AMR. Significant commercial potential exists in targeted markets, such as adult-onset acne therapeutics and products specifically formulated for sensitive skin types, where existing treatments often cause excessive irritation. Furthermore, the integration of digital health technologies, including AI-driven diagnostics and remote monitoring platforms, presents an opportunity to streamline the patient journey from diagnosis to sustained treatment, expanding market reach and improving therapeutic outcomes in geographically dispersed populations. Strategic collaborations between pharmaceutical companies and cosmeceutical brands to develop synergistic treatment-and-maintenance regimens also represent a viable avenue for market penetration and value creation, leveraging the high consumer trust in recognized dermatology-focused brands.

The overarching Impact Forces—namely, technological innovation, regulatory environment shifts, and public health concerns (like AMR)—exert profound pressure on market dynamics. The mandatory implementation of stringent safety measures and Risk Evaluation and Mitigation Strategies (REMS) for powerful systemic drugs, such as those derived from vitamin A, influences prescribing patterns and market accessibility. Simultaneously, fierce competition in the generic segment necessitates continuous R&D investment in proprietary, patent-protected formulations to maintain profit margins and market exclusivity. The social impact of acne, driving demand for treatments that restore self-esteem, acts as a perpetual demand force, compelling pharmaceutical companies to consistently prioritize efficacy and user experience in their product development pipelines, ensuring that the market responds dynamically to both clinical imperatives and consumer preferences for superior aesthetic outcomes.

Segmentation Analysis

The Acne Medication Market is comprehensively segmented based on Drug Type, Therapeutic Agent, Formulation, Route of Administration, and Distribution Channel, reflecting the diverse clinical needs and commercial pathways within the industry. Understanding these segmentations is critical for stakeholders to identify high-growth areas and tailor market entry strategies. The complexity of acne treatments, ranging from simple OTC products to highly regulated systemic drugs, necessitates a granular classification to accurately assess market share and future growth potential across different therapeutic modalities. The Drug Type segmentation, distinguishing between prescription medications and over-the-counter (OTC) products, is paramount, with prescription drugs commanding higher revenue due to specialized efficacy, while OTC products dominate unit volume driven by accessibility and immediate consumer appeal for mild cases.

The Therapeutic Agent category provides insight into the chemical compounds driving the market, highlighting the continuous dominance of retinoids (both topical and oral) due to their efficacy in targeting follicular hyperkeratinization, a primary cause of acne. However, the rapidly growing non-antibiotic antimicrobial and anti-inflammatory agent segment underscores the industry’s response to antimicrobial resistance concerns, indicating a future shift in standard practice. Formulation analysis, comparing gels, creams, and solutions, dictates patient preference and adherence, with gels often preferred for oily skin and creams for dry or sensitive types. This differentiation allows manufacturers to target specific patient subsets effectively, optimizing product usage and treatment outcomes based on skin type and lesion morphology.

Further granularity is provided by the Route of Administration (Topical vs. Systemic) and Distribution Channel (Retail Pharmacies, Hospital Pharmacies, E-commerce). Topical administration remains the first-line treatment for most acne presentations, representing the largest segment by units sold. Systemic administration, while necessary for severe inflammatory acne, contributes substantially to overall market value due to the higher cost associated with oral medications. The accelerating digitization of healthcare is fundamentally reshaping the Distribution Channel segment, with e-commerce platforms experiencing rapid growth, driven by consumer preference for convenience and discreet purchasing of both OTC and increasingly, prescription items via teledermatology portals, challenging the traditional dominance of physical retail pharmacies.

- By Drug Type:

- Prescription Medications

- Systemic Medications (e.g., Isotretinoin, Oral Antibiotics, Hormonal Agents)

- Topical Prescription Medications (e.g., Topical Retinoids, Fixed-dose combinations)

- Over-The-Counter (OTC) Products

- Benzoyl Peroxide Formulations

- Salicylic Acid Products

- Natural and Herbal Acne Treatments

- Prescription Medications

- By Therapeutic Agent:

- Retinoids (e.g., Tretinoin, Adapalene, Tazarotene)

- Antibiotics (e.g., Clindamycin, Erythromycin, Minocycline)

- Anti-inflammatory Agents (Non-Antibiotic)

- Hormonal Agents (e.g., Oral Contraceptives, Spironolactone)

- Azelaic Acid

- Other Agents (e.g., Dapsone, Nicotinamide)

- By Formulation:

- Creams and Lotions

- Gels and Solutions

- Cleansers and Face Washes (Medicated)

- Oral Tablets and Capsules

- Pads and Masks

- By Route of Administration:

- Topical Administration (Largest volume segment)

- Systemic Administration (Highest value segment)

- By Distribution Channel:

- Retail Pharmacies (Traditional channel)

- Hospital Pharmacies

- E-commerce & Online Pharmacies (Fastest growing channel)

- Dermatology Clinics and Specialty Stores

Value Chain Analysis For Acne Medication Market

The Value Chain for the Acne Medication Market is an intricate sequence spanning drug discovery, raw material sourcing, manufacturing, distribution, and final delivery to the end-user, with significant value addition occurring at the research and development (R&D) and specialized manufacturing stages. Upstream Analysis focuses primarily on the sourcing and synthesis of Active Pharmaceutical Ingredients (APIs), such as specialized retinoid molecules, antibiotic compounds, and complex excipients required for formulation stability and enhanced drug delivery. Critical upstream processes involve rigorous quality control, ensuring compliance with Good Manufacturing Practices (GMP) and sustainable sourcing practices, particularly for natural or botanical ingredients incorporated into cosmeceutical acne products. Innovation at this stage, particularly in developing enantiomerically pure APIs or optimizing crystallization processes, directly impacts the final product cost and patentability, establishing the foundational value proposition of the medication.

The core of the value chain is the formulation and manufacturing process, where raw APIs are transformed into patient-ready forms (gels, creams, tablets). This step demands advanced pharmaceutical technology, especially for fixed-dose combination products requiring complex stabilization techniques to prevent degradation or interaction between active ingredients. Downstream Analysis centers on market access and distribution efficiency. The distribution channel is bifurcated into direct channels, where manufacturers supply large hospital networks or major pharmacy chains directly, and indirect channels, utilizing wholesalers and distributors to penetrate smaller retail outlets and international markets. Effective cold chain management is vital for certain temperature-sensitive biologic treatments, ensuring product integrity until it reaches the consumer. Pricing strategies, managed care contracts, and insurance reimbursement policies play a crucial role downstream in determining product accessibility and uptake.

The entire chain is heavily regulated, requiring stringent adherence to pharmacological guidelines from discovery through commercialization. Direct channels, characterized by stronger manufacturer control over pricing and branding, typically involve sophisticated direct-to-consumer marketing campaigns and professional detailing to dermatologists. Indirect channels, while offering broader geographical reach, involve multiple intermediaries, potentially increasing logistical costs and complexity. The escalating importance of e-commerce has introduced a new dynamic in the distribution landscape, shortening the distance between the manufacturer and the patient for OTC products and, increasingly, for prescription drugs via specialized online pharmacies, demanding robust digital supply chain integration and security measures to maintain product authenticity and patient confidentiality.

Acne Medication Market Potential Customers

The primary potential customers and end-users of acne medication span a wide demographic spectrum, encompassing adolescents, adults with persistent or late-onset acne, and individuals seeking aesthetic or preventative dermatological care. The largest volumetric consumer group consists of adolescents and young adults (ages 12-25), who experience acne due to the hormonal changes of puberty. This group primarily drives demand for accessible OTC products (like salicylic acid washes and benzoyl peroxide gels) and first-line prescription topicals (such as retinoids and topical antibiotics). Their purchasing decisions are often influenced by digital marketing, social media trends, and peer recommendations, requiring manufacturers to maintain a strong presence in digital communication channels and focus on aesthetically pleasing, easy-to-use formulations that integrate seamlessly into daily routines.

A rapidly growing segment of high-value customers includes adults (ages 25+), particularly adult women experiencing hormonal acne, who represent a significant market for specialized, premium products. This group typically requires more potent, systemic treatments (like hormonal agents or oral antibiotics) and is more likely to consult dermatologists directly, leading to higher rates of prescription medication utilization. These customers prioritize efficacy, reduced side effects, and long-term maintenance solutions to prevent recurrence and scarring. Pharmaceutical companies target this demographic with advanced, higher-priced combination therapies and specialized delivery systems, often marketed through professional medical channels and targeted awareness campaigns emphasizing anti-aging benefits alongside acne clearance.

Further segmentation includes patients suffering from severe and refractory acne (nodulocystic acne), who are the core market for high-potency systemic treatments like isotretinoin. This group, although smaller in number, drives substantial revenue due to the complexity and duration of their treatment regimens, which often require intensive monitoring and prescription fulfillment through specialized programs (like REMS). Lastly, the market also serves customers interested in preventative care and cosmeceuticals, who utilize lower-concentration medicinal components adjunctively with their skincare routines. Manufacturers must address the needs of all these diverse end-users by offering a comprehensive portfolio, ranging from affordable, high-volume OTC goods to expensive, specialized prescription pharmaceuticals managed via specialist practitioners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 10.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Bausch Health Companies Inc. (Valeant Pharmaceuticals), Galderma S.A., Pfizer Inc., F. Hoffmann-La Roche AG, Teva Pharmaceutical Industries Ltd., Almirall S.A., GlaxoSmithKline Plc, Sun Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Bayer AG, Dr. Reddy’s Laboratories Ltd., Novartis International AG, Foamix Pharmaceuticals (Menlo Therapeutics), Dermira Inc. (Eli Lilly). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acne Medication Market Key Technology Landscape

The technology landscape within the Acne Medication Market is dynamically shifting, driven by pharmaceutical innovation focused on enhancing efficacy, improving safety profiles, and optimizing patient adherence. A primary technological focus involves advanced Drug Delivery Systems (DDS), crucial for topical formulations. These include micro-encapsulation and nanoparticle technologies, which protect the active pharmaceutical ingredient (API) from degradation, ensure targeted release into the pilosebaceous unit, and significantly reduce systemic absorption, thereby minimizing local side effects such as irritation, erythema, and dryness. Specialized vehicles, such as liposomal gels and micro-sponge carriers, are increasingly being utilized to sustain the delivery of potent agents like retinoids over extended periods, maximizing their comedolytic and anti-inflammatory effects while improving the overall aesthetic feel of the product, which is vital for patient compliance.

Another pivotal technological area is the development of Fixed-Dose Combination (FDC) products featuring enhanced stability technology. FDCs, such as those combining a retinoid (e.g., adapalene) and an antimicrobial (e.g., benzoyl peroxide), require sophisticated formulation science to prevent chemical interaction and degradation between the components. Novel stabilization techniques, including specialized pH buffers and anhydrous bases, are essential to ensure the shelf life and therapeutic potency of these complex combination treatments, which are becoming the standard of care for moderate acne. Furthermore, the rising threat of antimicrobial resistance is propelling research into non-antibiotic technologies, including synthetic anti-inflammatory peptides and compounds that target specific microbial virulence factors rather than broad bactericidal action, representing a critical technological shift toward sustainable acne management.

Beyond traditional pharmaceuticals, the market is increasingly integrating Digital Health Technologies and diagnostic innovations. Telemedicine platforms incorporating AI-driven image analysis are streamlining remote diagnosis and prescription renewals. On the clinical research front, high-throughput screening and genomics are identifying novel biological targets, moving beyond traditional agents. For example, research into targeting the mechanisms of androgen receptor activity or specific inflammatory cytokines offers pathways for entirely new classes of systemic and topical treatments. These technological breakthroughs, from improved topical vehicles to advanced computational drug discovery, collectively promise more efficacious, tolerable, and patient-centric acne management solutions, solidifying technology as a key determinant of competitive advantage and future market segmentation.

Regional Highlights

North America dominates the global Acne Medication Market, primarily due to exceptionally high healthcare spending, widespread awareness of advanced dermatological treatments, and high diagnosis rates supported by robust insurance coverage. The United States, in particular, drives significant revenue, characterized by a rapid adoption curve for novel, premium-priced prescription treatments and systemic therapies, including branded retinoids and specialty oral antibiotics. The region benefits from the strong presence of major multinational pharmaceutical companies that heavily invest in R&D and targeted direct-to-consumer marketing campaigns, maintaining a mature yet high-value market. Furthermore, sophisticated regulatory pathways facilitate the timely introduction of innovative drug delivery technologies, reinforcing North America's status as the leading market segment both in terms of market value and therapeutic advancement.

Europe represents a mature market characterized by stringent regulatory environments, particularly within the European Medicines Agency (EMA), which emphasizes safety and cost-effectiveness. Western European countries, including Germany, France, and the UK, are the primary contributors to regional revenue, driven by established dermatological practices and a high uptake of fixed-dose combination products. While public healthcare systems often influence pricing and limit the adoption speed of certain premium treatments compared to the US, the increasing consumer demand for cosmeceutical and natural ingredient-based acne solutions provides a strong growth auxiliary to traditional pharmaceutical sales. Efforts to streamline drug approval processes across the European Union promise to harmonize market penetration strategies for pharmaceutical companies, promoting steady, moderate growth throughout the forecast period.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting significant opportunities driven by massive population density, rising disposable incomes, and dramatically improving healthcare infrastructure across developing economies like China and India. The cultural emphasis on appearance and increasing urbanization contribute to heightened aesthetic consciousness, driving demand for both effective OTC and prescription acne treatments. Local market growth is further propelled by the expansion of multinational pharmaceutical firms into these countries through strategic partnerships and localized manufacturing, improving product accessibility and affordability. This region’s high volume of young people entering adolescence guarantees sustained long-term demand, necessitating investment in scalable production and culturally appropriate marketing efforts to capture emerging market shares effectively.

Latin America (LATAM) exhibits strong potential, although market growth is often volatile due to macroeconomic instabilities and varying healthcare access levels across countries like Brazil and Mexico. The market is primarily driven by the demand for affordable generics and imported OTC medications. Improving access to specialists and increasing standardization of regulatory processes are slowly unlocking higher-value prescription segments. Pharmaceutical companies often focus on tier-two cities and expanding rural distribution networks to overcome logistical challenges, leveraging the inherent demographic demand for skin health solutions, which remains consistently high despite economic fluctuations. The emphasis in LATAM is currently on volume growth through accessible pricing strategies and robust local partnerships.

The Middle East and Africa (MEA) region is fragmented, with significant market value concentrated in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) due to high per-capita incomes and state-of-the-art private healthcare facilities. These countries demonstrate a high willingness to adopt premium-priced, advanced prescription medications and cosmetic dermatology procedures. Conversely, much of Africa remains constrained by limited healthcare expenditure and poor market penetration, relying heavily on donated or low-cost essential medicines. Market expansion in MEA is highly dependent on foreign direct investment in healthcare infrastructure and increased consumer education efforts regarding the treatability of chronic skin conditions, suggesting that regional growth will be highly uneven, prioritizing high-net-worth urban centers for specialty product launches.

- North America (Dominant Market): High consumer awareness, robust R&D, and rapid adoption of premium prescription therapies and fixed-dose combinations.

- Europe (Mature Market): Steady growth driven by established healthcare systems; strong demand for both traditional pharmaceuticals and cosmeceutical adjunctive treatments.

- Asia Pacific (Fastest Growing): Fueled by large youth populations, rising disposable income, rapid urbanization, and improving access to specialized dermatological care in nations like China and India.

- Latin America: Demand centered on cost-effective generics and essential OTC products; growth potential linked to improved specialist access and economic stabilization in key economies.

- Middle East & Africa (MEA): Growth concentrated in affluent GCC countries with high adoption of high-value imported drugs; slower penetration across broader African markets due to infrastructural limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acne Medication Market. These companies are pivotal in driving innovation, defining competitive strategy, and influencing global distribution, primarily through extensive R&D pipelines focused on next-generation retinoids, non-antibiotic therapeutics, and advanced drug delivery systems. Strategic activities often involve mergers, acquisitions, and licensing agreements aimed at consolidating market share and achieving geographical expansion across high-growth regions like APAC.- Johnson & Johnson

- Bausch Health Companies Inc. (Valeant Pharmaceuticals)

- Galderma S.A.

- Pfizer Inc.

- F. Hoffmann-La Roche AG

- Teva Pharmaceutical Industries Ltd.

- Almirall S.A.

- GlaxoSmithKline Plc

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris)

- Bayer AG

- Dr. Reddy’s Laboratories Ltd.

- Novartis International AG

- Foamix Pharmaceuticals (Menlo Therapeutics)

- Dermira Inc. (Eli Lilly)

- Aclaris Therapeutics, Inc.

- Cipher Pharmaceuticals Inc.

- Nestlé Skin Health

- L'Oréal S.A. (Active Cosmetics Division)

Frequently Asked Questions

Analyze common user questions about the Acne Medication market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the acne medication market?

The primary factor driving market growth is the high global prevalence of acne vulgaris across adolescent and adult populations, coupled with increasing consumer awareness and aesthetic consciousness, leading to higher demand for effective pharmaceutical and cosmeceutical solutions. Additionally, advancements in drug delivery systems enhancing efficacy and patient adherence are key drivers.

How is antimicrobial resistance (AMR) impacting the formulation of acne medications?

AMR is significantly restraining the use of traditional topical and oral antibiotics in monotherapy. This concern compels pharmaceutical R&D to focus on non-antibiotic treatments, such as novel anti-inflammatory agents, sebum inhibitors, and fixed-dose combination products that integrate benzoyl peroxide or retinoids, reducing reliance on broad-spectrum antimicrobial agents.

Which geographic region currently holds the largest market share for acne medications?

North America holds the largest market share, driven by high healthcare expenditure, established insurance coverage for specialty drugs, and the rapid adoption of innovative, premium prescription formulations. The region maintains a leading position due to strong R&D investment and effective commercialization strategies by major global players.

What role does technology play in the future diagnosis and treatment of acne?

Technology, specifically Artificial Intelligence (AI) and teledermatology, is crucial for future acne management. AI-powered image analysis enables rapid, objective diagnosis and severity assessment, while personalized medicine platforms leverage AI to tailor medication regimens based on individual patient data, significantly improving therapeutic outcomes and access to care.

What is the difference in market value between topical and systemic acne treatments?

Topical treatments dominate the market in terms of unit volume sold, serving as the first line of defense for mild to moderate acne. However, systemic treatments, which include potent oral drugs necessary for severe cases, command a higher value share of the market due to their higher complexity, regulatory requirements, and premium pricing structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager