Activated Aluminum Oxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442464 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Activated Aluminum Oxide Market Size

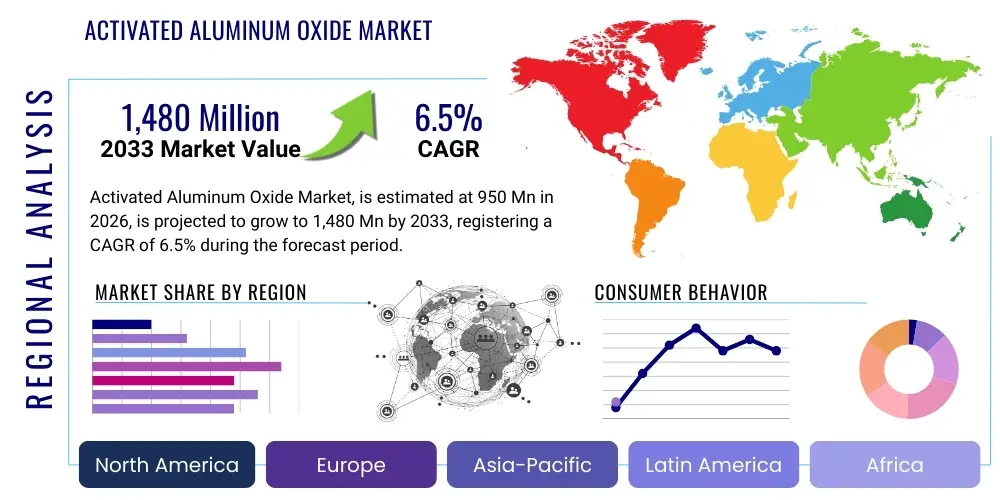

The Activated Aluminum Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 950 Million in 2026 and is projected to reach USD 1,480 Million by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global demand for high-purity industrial gases and the stringent environmental regulations mandating efficient water and wastewater treatment processes globally. Activated aluminum oxide, recognized for its superior adsorption properties and thermal stability, remains a critical material across diverse industrial purification applications.

Market expansion is particularly notable in emerging economies across Asia Pacific, where rapid industrialization and escalating infrastructure projects require advanced desiccant and catalyst support materials. Furthermore, the persistent need for fluoride removal in potable water sources, especially in regions affected by endemic fluorosis, solidifies the importance of activated aluminum oxide granules as an effective, low-cost solution. Technological advancements focusing on optimizing pore structure and surface area further enhance the material’s performance, contributing to its sustained market growth trajectory through 2033.

Activated Aluminum Oxide Market introduction

Activated Aluminum Oxide, chemically Aluminum Oxide (Al₂O₃) in a highly porous and high-surface-area form, is a critical material primarily utilized as an adsorbent, desiccant, and catalyst support across numerous heavy and specialized industries. Its manufacturing process involves controlled thermal treatment of aluminum hydroxide, resulting in a robust, sphere-shaped material characterized by high porosity, chemical inertness, and exceptional thermal stability. This unique structure allows it to selectively adsorb moisture, gases, and specific pollutants from liquids and streams, making it indispensable in purification technologies.

Major applications of Activated Aluminum Oxide span gas drying (including compressed air and natural gas), industrial fluid purification, catalyst preparation (especially in the petrochemical sector for the production of polyethylene and in the Claus process for sulfur recovery), and crucial water treatment processes such as defluoridation and arsenic removal. The inherent benefits include high adsorption capacity, regenerability, longevity under harsh operating conditions, and mechanical resilience, which collectively contribute to reduced operational costs and enhanced process efficiency for end-users. The market is fundamentally driven by the escalating requirements for stringent air and water quality standards globally, the expansion of natural gas processing infrastructure, and continuous innovations in catalytic converters and industrial desiccants.

Activated Aluminum Oxide Market Executive Summary

The Activated Aluminum Oxide Market exhibits robust growth, underpinned by favorable business trends in environmental remediation and sustained infrastructure development within the oil and gas sector. Segment trends indicate that the catalyst support application segment, fueled by the rising demand for high-performance chemical catalysts in polymerization and cracking processes, holds a significant market share and is expected to witness the fastest growth rate. Conversely, the desiccant application maintains high volume demand due to the ubiquitous need for industrial air and gas drying to prevent corrosion and maintain operational integrity across manufacturing facilities, electronics production, and pipeline transport.

Regionally, Asia Pacific dominates the global landscape, largely attributable to rapid industrial expansion, massive investments in refinery and petrochemical projects in countries like China and India, and critical governmental initiatives addressing water contamination issues, specifically fluoride removal. North America and Europe, characterized by established industrial bases, focus intensely on stringent regulatory compliance, driving demand for high-efficiency activated aluminum oxide grades for mercury removal and advanced air drying applications. Overall, strategic expansions by key manufacturers to increase production capacity and enhance material purity are defining competitive dynamics, positioning the market for sustained high-single-digit growth through the forecast period.

AI Impact Analysis on Activated Aluminum Oxide Market

User queries regarding the impact of Artificial Intelligence (AI) on the Activated Aluminum Oxide market frequently center on how AI-driven optimization techniques can enhance manufacturing efficiency, predict material performance under varying conditions, and revolutionize supply chain logistics. Key thematic concerns include the ability of AI to model complex adsorption kinetics, potentially leading to the development of next-generation activated materials with tailored pore size distributions. Users also expect AI to facilitate real-time monitoring and predictive maintenance of industrial adsorption columns, thereby maximizing the lifespan and regeneration cycles of activated aluminum oxide media, directly impacting operational expenditure for large-scale users in petrochemical and gas processing plants.

The core expectation is that AI algorithms, particularly machine learning (ML) models, will analyze vast datasets related to raw material quality, calcination parameters, and end-use performance metrics (such as breakthrough curves and adsorption capacities). This analysis will empower manufacturers to achieve 'smart manufacturing' capabilities, reducing energy consumption during production and ensuring consistent product quality tailored precisely to specific contaminant removal challenges, such as highly selective mercury or arsenic sequestration. Furthermore, AI is anticipated to optimize inventory management and forecasting for high-volume end-users, ensuring optimal stock levels of this essential purification agent.

In the research and development sphere, AI algorithms are being deployed to screen potential dopants and modifications to the alumina surface structure, accelerating the discovery of novel activated materials with superior selectivity and stability. This computational approach significantly cuts down the time and cost associated with traditional experimental methods, potentially introducing highly specialized activated aluminum oxide derivatives faster than conventional R&D cycles allow. The integration of AI into quality control, ensuring every batch meets rigorous industrial specifications for surface area, crush strength, and particle size distribution, represents a major step toward enhancing the material’s market value and reliability across sensitive applications.

- AI optimizes calcination and activation processes, leading to superior material properties and energy savings during manufacturing.

- Machine Learning models predict optimal material regeneration cycles, minimizing downtime and extending the service life of activated alumina columns in industrial operations.

- Predictive analytics enhance supply chain efficiency, accurately forecasting demand from petrochemical and water treatment sectors.

- AI aids in computational materials science, accelerating the design and synthesis of highly selective, modified activated aluminum oxide adsorbents for niche pollutants.

- Smart sensors integrated with AI monitor adsorption column performance in real-time, preventing breakthrough failures and ensuring consistent effluent quality.

DRO & Impact Forces Of Activated Aluminum Oxide Market

The Activated Aluminum Oxide Market dynamics are shaped by a confluence of driving factors, inherent restraints, and emerging opportunities, collectively defining the impact forces influencing its trajectory. Primary drivers include the global intensification of environmental regulations concerning air emissions and water quality, necessitating efficient purification solutions like activated alumina for contaminant removal, particularly fluoride, arsenic, and sulfur compounds. Additionally, the flourishing oil and gas industry, especially in natural gas processing, relies heavily on activated alumina for moisture and CO₂ removal, providing sustained demand growth. However, market growth is restrained by the volatile pricing of precursor raw materials, namely aluminum hydroxide and bauxite, and intense competition from alternative desiccants and adsorbents such as molecular sieves and specialized activated carbon, which may offer better performance in specific high-pressure or high-temperature environments.

Opportunities for market penetration and value capture lie predominantly in the development of highly specialized and doped activated aluminum oxide grades tailored for emerging applications, such as high-efficiency lithium extraction from brine solutions and advanced gas chromatography separations. Furthermore, expansion into developing nations, where water purification infrastructure is rapidly being upgraded to meet basic hygiene standards, presents significant potential, specifically utilizing activated alumina’s proven efficacy in defluoridation campaigns. The cumulative impact forces exert moderate-to-high pressure on manufacturers to innovate continuously, focusing on sustainability through improved regeneration methods and lower energy consumption during production to maintain cost competitiveness and regulatory advantage.

Segmentation Analysis

The Activated Aluminum Oxide market is comprehensively segmented based on its primary application, end-use industry, and distinct product form, reflecting the diverse industrial requirements it satisfies globally. Segmentation by application delineates the major revenue streams derived from its use as an adsorbent/desiccant, a catalyst support, and a dedicated material for water treatment, each segment driven by unique industrial cycles and regulatory frameworks. Further granularity is achieved by analyzing the end-use sectors, including petrochemical, oil and gas, chemical manufacturing, pharmaceuticals, and environmental remediation, which dictate the necessary material specifications, such as crush strength, surface area, and chemical purity. Product form segmentation typically distinguishes between spheres, granules, and powder, catering to different reactor designs and processing needs across various industrial setups.

- By Application:

- Adsorbent/Desiccant

- Catalyst Support

- Water Treatment Media (Defluoridation, Arsenic Removal)

- Regenerative Air and Gas Drying

- By End-Use Industry:

- Oil & Gas

- Petrochemical

- Chemical

- Environmental (Water and Air Purification)

- Pharmaceutical

- Food & Beverage

- By Product Form:

- Spheres/Beads

- Granules

- Powder

Value Chain Analysis For Activated Aluminum Oxide Market

The value chain for Activated Aluminum Oxide commences with upstream analysis focusing on the secure sourcing and processing of raw materials, predominantly bauxite and aluminum hydroxide. The quality and purity of these precursors are crucial, as they dictate the final properties of the activated product, including surface area and pore size distribution. Key upstream activities involve bauxite mining, subsequent Bayer process refinement to produce high-purity aluminum hydroxide, and the specialized calcination techniques employed by manufacturers to induce activation. Relationships with suppliers are critical, emphasizing long-term contracts to mitigate the risk associated with raw material price volatility and ensure a consistent supply of input necessary for continuous production cycles.

Midstream activities encompass the core manufacturing processes, including controlled thermal treatments (activation), shaping (spherical formation, granulation), quality control testing (measuring crush strength and adsorption capacity), and often, chemical doping or functionalization to tailor the material for specific catalytic or removal tasks. Downstream analysis focuses on the efficient distribution and end-user engagement. The distribution channel involves both direct sales to large, integrated petrochemical or industrial gas companies and indirect sales through specialized chemical distributors and regional agents who provide technical support and smaller volume batches to diverse end-users like municipal water treatment plants and smaller manufacturing facilities. Effective technical consulting and post-sales support are integral parts of the downstream value proposition, ensuring optimal performance and regeneration cycles for the deployed material.

Activated Aluminum Oxide Market Potential Customers

Potential customers for Activated Aluminum Oxide span a wide spectrum of heavy industrial and specialized sectors, primarily being entities requiring stringent fluid separation, purification, or catalysis. Major end-users include large integrated oil and gas companies that utilize activated alumina extensively for drying natural gas streams and removing trace contaminants before liquefaction or pipeline transport. Additionally, petrochemical manufacturers rely on it as a crucial catalyst support for polymerization reactors (e.g., polyethylene production) and in processes like hydrodesulfurization and the Claus process for sulfur recovery, making them high-volume consumers demanding exceptional thermal stability and mechanical strength.

Beyond the hydrocarbon sectors, municipal and private water treatment agencies constitute a significant and growing customer segment, specifically purchasing activated alumina beads for defluoridation in areas with high natural fluoride concentrations, as well as for arsenic removal to meet public health standards. Other key buyers include manufacturers of compressed air systems, who use activated alumina desiccants to protect sensitive pneumatic equipment from moisture damage, and specialized chemical companies requiring high-purity media for chromatographic separations and unique adsorption challenges in pharmaceutical synthesis and fine chemical production. The procurement process for these customers is highly technical, often involving rigorous performance testing and strict compliance with global quality and safety specifications before adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,480 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Honeywell International Inc., Axens SA, Porocel Corporation, Sumitomo Chemical Co., Ltd., J.M. Huber Corporation, Chemours Company, Sorbead India, Hindustan Unilever Limited (HUL), AGC Chemicals, Shandong Aluminum Industry, Jiangsu Jingui Alumina, Pingxiang Activated Alumina, Wuxi South Star Materials, CHALCO, Scientific Adsorbents Inc., Zhengzhou Huaer Aluminum, Hengye Activated Alumina, Alfa Aesar, Luoyang Jianlong Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Activated Aluminum Oxide Market Key Technology Landscape

The core technology surrounding the Activated Aluminum Oxide market involves sophisticated control over the activation process, primarily focused on modifying the material’s texture, including pore volume, surface area, and particle morphology, to optimize performance for specific applications. Current technological advancements center on developing doped and impregnated alumina grades. For instance, impregnation with potassium permanganate (KMnO4) or other metal oxides enhances the material’s capacity for selective removal of pollutants like sulfur, mercury, and volatile organic compounds (VOCs) in gas streams, extending its utility beyond simple moisture adsorption. Advanced manufacturing techniques, such as spray drying and precision pelletizing, are employed to ensure high mechanical integrity and uniform particle size distribution, which is critical for minimizing pressure drop in large industrial reactors and fixed-bed systems.

A significant technological focus is placed on enhancing the regenerability of the adsorbent media. Research is progressing on low-temperature regeneration techniques and solvent-based recovery methods that minimize energy expenditure and reduce thermal stress on the alumina matrix, thereby prolonging its useful lifespan. Furthermore, the shift towards sustainable manufacturing is driving the adoption of cleaner energy sources during the high-temperature calcination phase. Nanotechnology is beginning to influence the sector, exploring the use of nano-scale activated alumina particles to achieve higher surface areas per unit mass, potentially revolutionizing catalyst support design and improving the kinetics of adsorption reactions, especially in highly specialized and fast-flow systems where reaction speed is paramount.

Another emerging technological area is the integration of digital twin technology in reactor design and operation. This allows end-users to simulate the performance of activated alumina beds under various real-time operating conditions (temperature, pressure, flow rate), optimizing packing density, predicting breakthrough times, and scheduling regeneration proactively. This digital transformation is enhancing the efficiency of traditional adsorption systems, moving them from static processes to dynamically managed operations. The use of innovative binding agents and shaping technologies also enables the creation of highly durable spherical products that resist attrition and dusting, ensuring operational stability and cleanliness in sensitive chemical processing environments.

Regional Highlights

Regional analysis underscores the heterogeneous market dynamics driven by differing levels of industrialization, regulatory regimes, and availability of natural resources.

- Asia Pacific (APAC): Dominates the global market in terms of volume and growth rate, primarily driven by massive infrastructure investments, expansion of the petrochemical and refining capacity in China and India, and urgent necessity for large-scale water treatment projects to address industrial discharge and potable water contamination (specifically defluoridation).

- North America: Characterized by high-value, specialized demand. The market here is mature, focusing heavily on high-specification catalyst supports for advanced chemical manufacturing and high-efficiency desiccant applications in the compressed air and natural gas processing sectors, driven by stringent EPA and OSHA regulations.

- Europe: Exhibits steady growth, largely spurred by the focus on circular economy initiatives and advanced environmental remediation technologies. Demand is strong for activated alumina used in air purification (removal of specialized contaminants) and in niche chemical synthesis applications demanding high purity.

- Middle East & Africa (MEA): Growth is tied directly to the expansion of oil, gas, and petrochemical infrastructure. Activated aluminum oxide is critical here for natural gas drying and sulfur recovery processes (Claus catalyst), supported by major national energy development plans and massive capital expenditure in the energy sector.

- Latin America: Expected to show moderate growth, fueled by increasing investment in refining capabilities and the growing need for municipal water purification solutions to combat widespread issues like arsenic and fluoride contamination in drinking water sources across several key economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Activated Aluminum Oxide Market.- BASF SE

- Honeywell International Inc.

- Axens SA

- Porocel Corporation

- Sumitomo Chemical Co., Ltd.

- J.M. Huber Corporation

- Chemours Company

- Sorbead India

- Hindustan Unilever Limited (HUL)

- AGC Chemicals

- Shandong Aluminum Industry

- Jiangsu Jingui Alumina

- Pingxiang Activated Alumina

- Wuxi South Star Materials

- CHALCO (Aluminum Corporation of China Limited)

- Scientific Adsorbents Inc.

- Zhengzhou Huaer Aluminum

- Hengye Activated Alumina

- Alfa Aesar (Thermo Fisher Scientific)

- Luoyang Jianlong Chemical

Frequently Asked Questions

Analyze common user questions about the Activated Aluminum Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is activated aluminum oxide and what are its primary uses?

Activated Aluminum Oxide is a highly porous form of aluminum oxide (Al₂O₃) known for its high surface area and exceptional adsorption properties. Its primary uses include acting as a desiccant for drying gases (like air and natural gas), a catalyst support in petrochemical reactions (e.g., Claus process), and an effective adsorbent for removing contaminants like fluoride and arsenic from water sources.

How is activated aluminum oxide regenerated for reuse in industrial applications?

Regeneration of activated aluminum oxide is typically achieved through thermal swing adsorption (TSA). The material is heated to temperatures between 150°C and 300°C using dry, hot gas (often heated air or nitrogen). This process desorbs the captured moisture or contaminants, restoring the material's adsorption capacity for subsequent use, minimizing operational waste.

Which factors primarily drive the growth of the Activated Aluminum Oxide Market?

Market growth is predominantly driven by increasing global mandates for environmental protection and clean water supply, the rapid expansion of the natural gas processing industry requiring efficient gas drying, and the continuous demand for high-performance catalyst supports in the growing chemical and petrochemical manufacturing sectors worldwide.

What is the key difference between activated alumina used as a catalyst support versus an adsorbent?

While the base material is the same, activated alumina used as a catalyst support is often chemically doped or surface-modified to enhance interaction with specific catalytic elements (like transition metals) and requires higher thermal stability. As an adsorbent, the focus is primarily on maximizing surface area and controlling pore size for optimum physical adsorption of target molecules like water vapor or specific ions.

What regions are expected to experience the fastest growth in activated alumina consumption?

Asia Pacific (APAC) is projected to experience the fastest market growth. This is due to accelerated industrialization, large-scale investments in new refineries and chemical plants, and governmental pressure to upgrade municipal water treatment facilities, particularly in rapidly developing economies like China, India, and Southeast Asian nations.

The global Activated Aluminum Oxide Market continues to evolve, driven by environmental responsibility and technological refinement in material science. The versatility of activated alumina across critical industrial processes ensures its sustained relevance and high investment potential through the end of the forecast period. Manufacturers who focus on tailored products, supply chain optimization, and leveraging advanced digital technologies will be best positioned to capture market share and navigate the evolving regulatory landscape, securing long-term profitability within this foundational materials sector. Strategic geographical expansions into key emerging markets remain a crucial element of corporate strategy for maximizing revenue growth in the coming decade. The shift towards sustainable production methods and enhanced product longevity represents the next major technological leap for the industry.

Further analysis into the competitive landscape reveals a moderate level of market concentration, with several large international chemical conglomerates holding dominant positions, especially in the high-purity catalyst support segment. However, regional manufacturers, particularly those based in Asia, are increasingly challenging established players by offering cost-effective solutions for commodity adsorbent applications. Pricing strategies are highly complex, varying significantly based on material grade, particle size, purity standards, and the volume of procurement, requiring meticulous contract negotiation and supply chain management by end-users. Future market stability will depend heavily on the continuous availability of competitively priced raw materials and the effective management of industrial byproduct streams associated with the alumina production process.

The critical role of Activated Aluminum Oxide in climate change mitigation efforts, particularly its application in capturing or separating certain greenhouse gases, is an area receiving heightened research focus. While traditional applications in drying and purification remain the revenue backbone, innovation related to carbon capture and specialized pollutant removal represents high-growth niches. Investment in R&D aimed at developing activated alumina capable of operating efficiently in extremely aggressive chemical environments or under ultra-high pressures will define the premium segment of the market. Regulatory bodies globally are expected to further tighten standards on permissible contaminant levels in air and water, solidifying the fundamental necessity of high-quality activated alumina media across all industrial sectors.

Technological barriers to entry for new market players remain relatively high, primarily due to the capital-intensive nature of the specialized calcination equipment required to produce high-purity, structurally robust material, and the extensive certifications needed for critical applications like catalyst support in major petrochemical facilities. Existing players benefit from intellectual property related to proprietary surface modification techniques and established supply chain relationships for bauxite and aluminum hydroxide. Nevertheless, collaborative partnerships between material scientists and engineering firms are accelerating the development of novel applications, such as using activated alumina in thermal energy storage systems or in advanced battery components, hinting at potential market diversification outside its traditional purification roles.

The market also faces inherent challenges related to the disposal or recycling of spent activated alumina media, especially when it has been used to adsorb hazardous substances like heavy metals or radioactive materials. Sustainable disposal practices and the development of cost-effective, environmentally sound recycling processes are becoming increasingly important competitive factors. Companies that successfully implement circular economy models for their activated alumina products will gain a significant advantage in markets with strict environmental, social, and governance (ESG) investing criteria. This emphasis on lifecycle management moves the industry toward a more sustainable and responsible operational paradigm.

In terms of end-use evolution, the demand for activated alumina in the food and beverage industry, particularly for filtering and clarifying liquids, is showing steady, albeit specialized, growth. In these applications, exceptionally high purity and compliance with strict food safety standards (e.g., FDA regulations) are mandatory. The market addresses this requirement by offering specialized, low-dust, and chemically inert grades. Furthermore, the pharmaceutical sector relies on activated alumina for chromatographic separation and purification steps in drug manufacturing, demanding traceable, consistent quality and batch-to-batch repeatability, reinforcing the need for stringent quality control across the value chain, from raw material sourcing to final product packaging and sterilization.

The global push toward hydrogen economy development offers a long-term opportunity for Activated Aluminum Oxide manufacturers. Hydrogen purification and storage processes, particularly those involving adsorption and separation, will require high-performance desiccant and catalyst support materials. Activated alumina, given its stability and capacity for selective adsorption, is well-positioned to serve this emerging market, requiring only minor technical adaptations to meet the specific demands of high-pressure, low-temperature hydrogen processing environments. Early investments in R&D targeting hydrogen-related applications will be pivotal for securing a foothold in this anticipated future market segment.

Moreover, the integration of advanced sensors and IoT (Internet of Things) devices within adsorption columns is transforming the operational efficiency of activated alumina usage. Real-time data on moisture saturation, contaminant loading, and temperature profiles enables predictive modeling, minimizing the safety margin traditionally built into regeneration schedules. This technological integration not only saves energy and extends material life but also enhances the overall reliability of industrial processes, driving end-users towards suppliers who can offer integrated material and digital monitoring solutions. The convergence of physical materials science and digital technology is rapidly becoming a standard expectation in high-value industrial applications.

Pricing dynamics within the activated alumina market are often influenced by regional energy costs, particularly electricity and natural gas rates, as the activation process is highly energy-intensive. Manufacturers located in regions with access to stable, low-cost energy sources maintain a significant cost advantage. Global trade tariffs and logistics costs also contribute to final product pricing, leading to localized manufacturing strategies aimed at serving major consuming regions directly. Analyzing these regional cost structures is crucial for stakeholders developing sourcing and market entry strategies within the activated aluminum oxide value chain.

Finally, competition from substitutes, such as specialized polymeric adsorbents and high-performance molecular sieves (zeolites), presents a constant challenge. While activated alumina typically offers a strong balance of cost-effectiveness, regeneration capability, and broad applicability, molecular sieves often outperform it in highly selective or extreme temperature/pressure gas drying applications. Manufacturers are countering this by enhancing the intrinsic selectivity of activated alumina through surface modifications and optimizing production to provide superior mechanical and thermal resistance, ensuring its competitive edge in core applications like water defluoridation and compressed air drying where cost sensitivity is higher.

The market for Activated Aluminum Oxide in air pollution control systems, especially for industrial off-gases, is growing due to increasingly strict air quality regulations, particularly in urbanized industrial areas. Activated alumina, often combined with other catalytic materials, is essential for reducing emissions of acid gases and volatile organic compounds (VOCs). This environmental remediation application segment, though specialized, commands premium pricing due to the necessity of high efficiency and compliance with regulatory mandates, offering a lucrative opportunity for manufacturers specializing in high-performance environmental media. This segment is characterized by complex regulatory requirements and long procurement cycles.

Another area of specialized growth is the medical and pharmaceutical sector, where activated alumina is utilized for chromatographic separations and as an excipient in some formulations. In these applications, the material must meet exceptionally high purity standards, often exceeding 99.99% Al₂O₃, and must adhere to Good Manufacturing Practice (GMP) guidelines. The volume demand from this sector is lower than petrochemicals, but the revenue per kilogram is significantly higher, positioning this as a strategic growth avenue focusing on advanced material certification and quality assurance protocols. Suppliers must demonstrate robust quality systems and full traceability.

The market trajectory is also influenced by macroeconomic factors, including global manufacturing output and overall industrial capital expenditure. Downturns in the construction or automotive sectors can temporarily suppress demand for related chemicals and refined products, indirectly affecting the need for activated alumina catalysts and purification agents. Conversely, large-scale public investment in municipal water systems acts as a stabilizing force, providing consistent demand regardless of short-term industrial fluctuations. Monitoring these macroeconomic indicators is vital for accurate market forecasting and strategic planning.

The increasing complexity of industrial fluid streams, often containing a mixture of contaminants, requires increasingly sophisticated adsorption solutions. This demand drives the need for multi-functional activated alumina media, sometimes layered or combined with other adsorbents within the same column to achieve sequential or simultaneous removal of diverse pollutants (e.g., moisture, arsenic, and VOCs). Research efforts are focused on improving the synergistic performance of these hybrid systems, ensuring that activated alumina maintains its role as a versatile backbone material in complex purification train designs. This complexity demands higher technical support from the suppliers' side.

Digitalization also plays a pivotal role in market access and customer retention. Manufacturers are utilizing advanced digital marketing strategies, leveraging AEO and GEO principles to provide authoritative content, technical specifications, and application guides online. This ensures that when engineers and procurement specialists search for 'high surface area alumina desiccant' or 'fluoride removal media,' the leading suppliers' information is instantly accessible and contextually optimized for search and generative AI tools. High-quality technical documentation and simulation tools are now competitive differentiators.

Furthermore, the development of lightweight activated alumina components for aerospace and automotive applications, particularly in advanced thermal management systems, represents a niche opportunity. These applications require materials with high thermal conductivity combined with low density. While volume is currently low, the technological barrier is high, promising premium margins for innovators. This requires a deep understanding of materials engineering beyond traditional adsorption science, bridging the gap between chemical production and high-performance engineering sectors.

In summary, the Activated Aluminum Oxide market is fundamentally sound, anchored by non-negotiable industrial requirements for purification and catalysis. Its growth is secured by global environmental compliance trends and sustained demand from the hydrocarbon processing sector. Future success hinges on continuous material innovation, particularly in specialization and sustainability, coupled with the strategic integration of digital technologies to optimize both manufacturing and end-user performance, ensuring the material remains competitive against substitutes in the rapidly evolving industrial landscape.

To conclude the detailed analysis, the activated aluminum oxide market demonstrates resilience and adaptability. Key stakeholders must prioritize research into sustainable sourcing of aluminum hydroxide, invest in energy-efficient activation technologies, and forge strong partnerships with end-users to co-develop custom-engineered solutions. The ability to quickly respond to new regulatory requirements, particularly those concerning trace contaminant removal in water and air, will be the defining factor for market leaders moving towards 2033. The long-term outlook remains positive, driven by global efforts to enhance industrial efficiency and safeguard environmental quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager