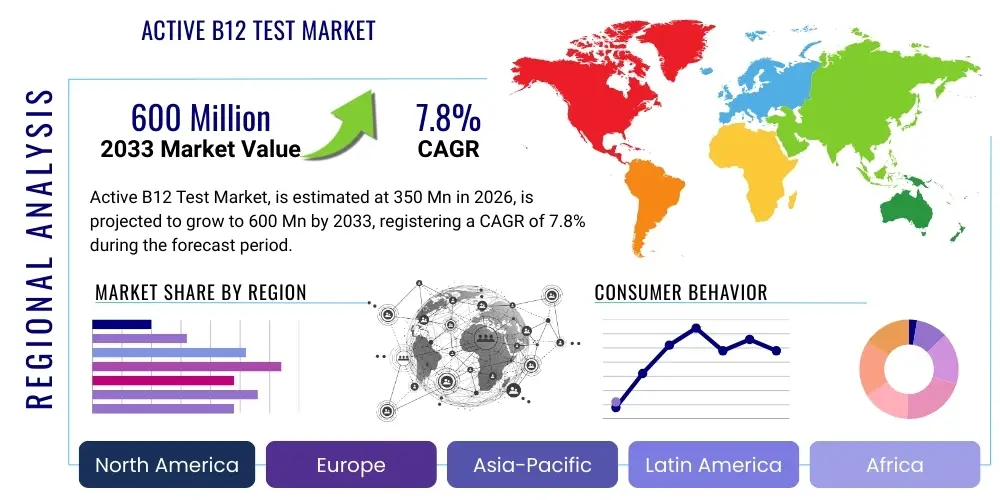

Active B12 Test Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441356 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Active B12 Test Market Size

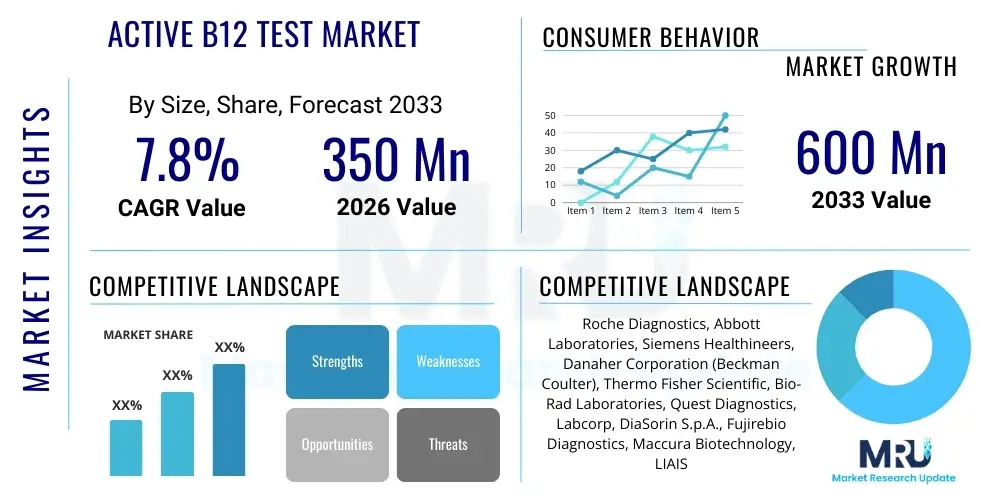

The Active B12 Test Market, driven by increasing awareness regarding vitamin deficiencies and the limitations of traditional total B12 assays, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This growth trajectory is significantly influenced by the clinical recognition of holotranscobalamin (HoloTC) as a superior, early biomarker for functional Vitamin B12 status, prompting broader adoption across diagnostic and clinical settings globally. The inherent superiority of the active B12 test in reflecting biologically available B12, rather than inactive forms bound to haptocorrin, enhances its utility in managing populations at risk, particularly the elderly and individuals following restrictive diets, thereby sustaining robust market expansion throughout the forecast period.

The market is estimated at $350 Million in 2026, reflecting established usage in specialized laboratories and early integration into routine screening protocols in developed healthcare systems. By the end of the forecast period in 2033, the market is projected to reach $600 Million. This substantial financial growth is underpinned by advancements in assay technologies, particularly the development of high-throughput automated chemiluminescence and immunometric platforms, which lower the cost per test and improve laboratory efficiency. Furthermore, geographic expansion into emerging markets, coupled with rising chronic disease prevalence where B12 deficiency is a significant co-morbidity (such as diabetes and gastrointestinal disorders), will solidify the market’s valuation, driving investments in diagnostic infrastructure and point-of-care solutions focused on accurate and timely detection.

Active B12 Test Market introduction

The Active B12 Test Market encompasses diagnostic tools and assays specifically designed to measure holotranscobalamin (HoloTC), the biologically active fraction of Vitamin B12, crucial for cellular function and DNA synthesis. This specialized testing represents a significant advancement over traditional total B12 measurements, which often fail to distinguish between functional and non-functional B12, leading to ambiguous results and potential misdiagnosis of deficiency. The product portfolio includes various test formats, such as enzyme-linked immunosorbent assays (ELISA), chemiluminescence immunoassays (CLIA), and sophisticated mass spectrometry methods, all aimed at providing a more accurate assessment of a patient's vitamin status, particularly in early stages of deficiency where neurological damage is preventable. Major applications span clinical diagnostics in hospitals, primary care settings, specialized endocrinology and hematology clinics, and large reference laboratories that process high volumes of samples for diverse patient demographics, including pregnant women, vegetarians, and individuals with malabsorption disorders.

The primary benefits of utilizing Active B12 testing include improved diagnostic sensitivity and specificity, allowing clinicians to initiate timely treatment and prevent irreversible health consequences associated with prolonged B12 deficiency, such as peripheral neuropathy, cognitive decline, and megaloblastic anemia. The increased reliability of HoloTC results reduces the need for secondary confirmatory tests like methylmalonic acid (MMA) or homocysteine, streamlining the diagnostic pathway and reducing overall healthcare costs. Driving factors for market growth include the rising prevalence of autoimmune conditions like pernicious anemia, the increasing global geriatric population susceptible to malabsorption issues, and growing public health campaigns emphasizing nutritional health and early detection of deficiencies, particularly within value-based care models that prioritize accurate initial diagnostics.

Furthermore, the pharmaceutical sector's push for personalized medicine and precision nutrition heavily influences the demand for highly accurate nutritional biomarkers like Active B12. As drug therapies and dietary interventions become more tailored, the need for robust diagnostic markers to monitor efficacy and adherence grows. Technological innovation, particularly in miniaturization and automation of testing platforms, is making Active B12 testing more accessible outside traditional centralized laboratories, potentially enabling integration into routine health panels and wellness programs. This combination of clinical necessity, technological maturity, and proactive healthcare policy underscores the dynamic expansion of the Active B12 Test Market, positioning it as a fundamental component of preventive and diagnostic medicine.

Active B12 Test Market Executive Summary

The Active B12 Test Market is currently experiencing a robust expansion driven by pronounced business trends favoring specialized, high-accuracy diagnostic tools over conventional screening methods. Key business trends include significant investments by major in-vitro diagnostics (IVD) manufacturers in developing fully automated, random-access platforms for HoloTC measurement, aiming for higher throughput and reduced turnaround times in clinical settings. Strategic mergers and acquisitions among large diagnostic companies are consolidating market share and integrating advanced assay technologies, while partnerships with laboratory information systems (LIS) providers enhance data management and clinical decision support integration. The push towards standardization of HoloTC reference ranges globally is another critical business trend, facilitating broader acceptance and reliable cross-border clinical comparison, which ultimately enhances payer reimbursement rates and physician trust in the diagnostic value proposition.

Regionally, North America and Europe maintain dominance, primarily due to established healthcare infrastructures, high public awareness of nutritional deficiencies, and favorable reimbursement policies for advanced diagnostics. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapidly expanding healthcare expenditure, increasing incidence of lifestyle-related nutritional disorders, and the expansion of private diagnostic laboratory chains adopting state-of-the-art testing technology. In emerging economies, the rising middle class's demand for better healthcare quality and the introduction of national health programs focused on maternal and child health—where B12 deficiency is a significant concern—are acting as powerful catalysts for regional market penetration. Latin America and the Middle East and Africa (MEA) are also showing promising growth, albeit starting from a lower base, with opportunities concentrated in urban centers and specialized tertiary care hospitals.

Segment trends highlight the dominance of the Chemiluminescence Immunoassay (CLIA) segment, attributable to its high sensitivity, automation capabilities, and cost-effectiveness in high-volume laboratory environments. Simultaneously, the Mass Spectrometry segment, though generally more expensive, is gaining traction in research institutions and specialized reference laboratories requiring the absolute highest level of accuracy and multiplexing capabilities for simultaneous analysis of related biomarkers. Application trends show hospitals and reference laboratories remaining the primary end-users, but the fastest-growing segment is Point-of-Care Testing (POCT) as manufacturers develop reliable, rapid testing devices suitable for physician offices and outpatient clinics. This shift indicates a market move towards decentralized testing, aiming to provide immediate clinical actionable results, thus optimizing patient management pathways.

AI Impact Analysis on Active B12 Test Market

User queries regarding AI's influence on the Active B12 Test Market frequently revolve around automation accuracy, the integration of results into electronic health records (EHRs), and AI’s capability to predict deficiency risk factors based on patient histories. Users are particularly interested in how AI can optimize laboratory workflows, handle the high volume of incoming samples efficiently, and reduce human error associated with manual processes like sample preparation and result interpretation checks. A significant theme is the expectation that AI-powered clinical decision support systems (CDSS) will move beyond mere result reporting to offer personalized diagnostic insights, correlating HoloTC levels with clinical symptoms, medication history (e.g., proton pump inhibitors, metformin), and genetic predispositions, thus enhancing the overall utility of the test for physicians managing complex patient cases.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and diagnostic precision within the Active B12 testing ecosystem. In laboratory settings, AI algorithms are being deployed for predictive maintenance of automated analyzers, optimizing reagent usage, and ensuring rigorous quality control by flagging subtle anomalies in assay performance that might be missed by traditional statistical methods. Furthermore, in data processing, AI tools are essential for standardizing data inputs across disparate laboratory systems, minimizing variability, and creating robust data lakes that fuel sophisticated research into B12 metabolism and deficiency correlation with other markers.

The future impact of AI extends significantly into the clinical application domain, where ML models can analyze vast datasets of patient demographic, dietary, and genetic information to identify individuals at high risk of developing B12 deficiency even before symptoms manifest or Active B12 levels fall critically low. This predictive capability shifts the clinical paradigm from reactive diagnosis to proactive screening, maximizing the preventive potential of HoloTC testing. Moreover, AI-driven CDSS can provide real-time recommendations to primary care providers regarding appropriate follow-up testing, optimal supplementation dosages, and necessary lifestyle changes, effectively translating complex laboratory results into actionable clinical strategies, thereby enhancing patient outcomes and decreasing the burden of chronic deficiency management.

- AI optimizes automated analyzer performance through predictive maintenance and real-time quality control adjustments.

- Machine Learning models analyze patient data (e.g., genomics, drug use) to forecast B12 deficiency risk, enabling proactive screening.

- AI-powered Clinical Decision Support Systems (CDSS) integrate HoloTC results with EHRs to provide personalized diagnostic and therapeutic recommendations.

- Natural Language Processing (NLP) streamlines the integration and standardization of test results across multi-site laboratory networks.

- Automation facilitated by AI reduces manual intervention in sample handling and preparation, minimizing laboratory throughput time and error rates.

DRO & Impact Forces Of Active B12 Test Market

The Active B12 Test Market is propelled by significant drivers, yet faces critical restraints, while simultaneously benefiting from substantial opportunities, all converging to shape its overall impact forces. A primary driver is the global increase in chronic diseases and conditions known to impair B12 absorption, such as celiac disease, Crohn’s disease, and widespread use of common medications like metformin for diabetes and proton pump inhibitors (PPIs) for GERD. This clinical link mandates more precise B12 status monitoring, favoring the HoloTC assay. However, the market growth is moderately restrained by the relatively higher cost of Active B12 tests compared to conventional total B12 assays, particularly in developing economies with limited healthcare budgets and reluctance by some regional payers to fully reimburse the more expensive, specialized testing, leading to slower adoption among general practitioners.

Opportunities for exponential market growth lie predominantly in the development and commercialization of robust Point-of-Care (POC) testing devices for Active B12, allowing immediate results in decentralized healthcare settings like pharmacies and remote clinics, greatly improving patient compliance and accessibility. Furthermore, expanding the regulatory acceptance and clinical guideline inclusion of HoloTC as a primary screening tool across major health organizations globally represents a major opportunity to cement its market position. The interplay of these factors creates powerful impact forces: the increasing clinical consensus on HoloTC’s superiority acts as a positive force, pushing diagnostic laboratories to phase out older assays, while simultaneously, the challenge of achieving global standardization of assay calibration and reference materials imposes a friction force, requiring sustained collaborative effort among IVD manufacturers, regulatory bodies, and metrology institutes to ensure clinical equivalence across different proprietary platforms.

The most compelling impact force remains the demographic shift towards an aging global population, which naturally increases the cohort susceptible to B12 deficiency due to age-related decline in intrinsic factor production and hydrochloric acid secretion necessary for B12 absorption. This demographic imperative ensures sustained, non-cyclical demand for reliable diagnostic markers like Active B12. Concurrently, competitive pressure among key market players to innovate on assay throughput, multiplexing capabilities (e.g., simultaneous measurement of HoloTC and MMA), and lowering the production cost per test exerts a continuous force towards technological efficiency. Successfully navigating the restraints related to cost and standardization while capitalizing on POCT innovation will determine the overall market acceleration and penetration rate across diverse global healthcare systems throughout the forecast period.

Segmentation Analysis

The Active B12 Test Market is systematically segmented based on Product Type, Application, and Technology, reflecting the diverse needs and operational scales of clinical and research facilities worldwide. This segmentation is crucial for stakeholders to identify high-growth niches and tailor product development and marketing strategies accordingly. The Product Type segmentation distinguishes between Reagents & Consumables, which dominate the volume and recurring revenue streams due to continuous usage in high-throughput environments, and Instruments/Analyzers, which represent high-value capital expenditure investments necessary for initial laboratory setup. The continuous evolution of reagents, including enhanced stability and improved shelf life, remains a key focus area for IVD companies seeking a competitive edge in recurring sales.

Application-wise, the market is segmented across Diagnostic Laboratories, Hospitals & Clinics, and Academic & Research Institutions. Diagnostic Laboratories, including large central reference labs, hold the largest market share due to their capacity for processing massive test volumes efficiently, often serving multiple smaller healthcare providers. However, Hospitals and Clinics represent a critical segment due to the immediate clinical needs associated with inpatient care and specialized outpatient management, demanding rapid, reliable results. Technology segmentation, the foundation of analytical performance, highlights the competitive landscape between established methods like ELISA and high-end techniques such as Mass Spectrometry (MS), driven by requirements for either cost-efficiency and high automation or unparalleled analytical specificity, respectively. Each segment demonstrates unique growth drivers, with consumables and diagnostic labs being volume leaders, while MS and POCT represent high-growth, technology-driven sub-markets.

- By Product Type:

- Reagents and Kits

- Instruments/Analyzers

- Consumables and Accessories

- By Technology:

- Chemiluminescence Immunoassay (CLIA)

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Mass Spectrometry (LC-MS/MS)

- Radioimmunoassay (RIA)

- By Application/End-User:

- Diagnostic Laboratories

- Hospitals and Clinics

- Academic and Research Institutions

- Biopharmaceutical Companies

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Active B12 Test Market

The value chain for the Active B12 Test Market begins with upstream activities focused on the specialized research, development, and sourcing of critical raw materials, primarily high-purity antibodies specific to holotranscobalamin and necessary labeling enzymes or magnetic beads used in advanced immunoassays. Key upstream players include specialized biotech companies and chemical manufacturers providing purified calibrators, control materials, and proprietary reagents. Successful management of the upstream segment requires stringent quality control protocols to ensure assay reproducibility and minimizing batch-to-batch variation, which is paramount for maintaining the clinical reliability demanded by regulatory bodies like the FDA and EMA. Innovation in antibody engineering to improve specificity and stability directly impacts the quality of the final diagnostic product.

The core segment of the value chain involves the manufacturing and assembly of diagnostic kits and automated instruments by major IVD companies. This stage encompasses complex processes such as bulk reagent production, kit packaging, instrument integration, software development, and obtaining necessary regulatory clearances. Following manufacturing, the distribution channel plays a pivotal role. Distribution is primarily managed through a blend of direct sales forces for large institutional clients (major hospitals and reference laboratories) and an extensive network of indirect distributors for reaching smaller clinics, regional labs, and international markets. The efficiency of the cold chain logistics is crucial for maintaining the integrity of temperature-sensitive reagents and kits, especially when targeting geographically diverse regions with challenging infrastructure.

Downstream analysis focuses on the final consumption and utilization by end-users—the diagnostic laboratories and clinical settings. Here, value is added through high-volume testing services, rapid result turnaround, and expert interpretation. Post-sales service, technical support, and the provision of continuous training for laboratory technicians are vital elements of the downstream segment, enhancing customer retention and product adoption. Successful players in this market must optimize both the direct channel, ensuring personalized technical consultation and service contracts, and the indirect channel, leveraging established local partners who possess profound knowledge of regional regulatory environments and procurement processes, ensuring wide market penetration and sustained customer trust in the diagnostic solutions provided.

Active B12 Test Market Potential Customers

The primary potential customers and end-users of Active B12 testing solutions are heterogeneous but generally fall into two broad categories: institutions focused on high-volume diagnostic throughput and clinical entities dedicated to patient management and specialized care. High-volume buyers include large centralized Reference Laboratories (e.g., Quest Diagnostics, Labcorp equivalents globally) and national health service pathology centers. These entities require robust, high-throughput automated analyzers, bulk purchasing of reagents and consumables, and seamless integration with existing laboratory information management systems (LIMS) to efficiently process large screening panels for nutritional status across vast patient populations, often serving as the benchmark for standardization and quality assurance within a region.

The second major customer group comprises hospitals (both public and private tertiary care centers) and specialized clinical units, particularly those focusing on geriatric care, hematology, gastroenterology, and neurology. These customers utilize Active B12 tests for targeted diagnosis of symptomatic patients, monitoring treatment efficacy (especially in cases of pernicious anemia or post-bariatric surgery malabsorption), and performing crucial pre-operative or pre-treatment assessments. For these clients, the key purchasing criteria often center on the clinical reliability of the assay, the ability to deliver rapid results, and the availability of specialized support for complex cases, favoring sophisticated instrumentation and high-quality calibration standards over the lowest cost per test.

Emerging segments of potential customers include wellness clinics, specialized nutrition consultants, and direct-to-consumer testing providers. Although currently a smaller market share, these customers are increasingly focusing on preventive health and personalized nutrition, driving demand for accurate, accessible testing like Active B12, often preferring decentralized or point-of-care solutions. Furthermore, pharmaceutical and nutraceutical companies represent significant potential customers, utilizing the assays in clinical trials to monitor the bioavailability and efficacy of new B12 formulations or related therapeutic compounds. Addressing the specific needs of these varied customer profiles—from the price sensitivity of bulk labs to the clinical urgency of hospital settings—is central to a successful market penetration strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million |

| Market Forecast in 2033 | $600 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher Corporation (Beckman Coulter), Thermo Fisher Scientific, Bio-Rad Laboratories, Quest Diagnostics, Labcorp, DiaSorin S.p.A., Fujirebio Diagnostics, Maccura Biotechnology, LIAISON, Tosoh Bioscience, Ortho Clinical Diagnostics, Randox Laboratories, Eiken Chemical, ALPCO, Biorbyt, Creative Diagnostics, Wako Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active B12 Test Market Key Technology Landscape

The Active B12 Test Market is characterized by a dynamic technology landscape primarily dominated by immunoassay techniques optimized for high throughput and automation. Chemiluminescence Immunoassay (CLIA) platforms represent the current commercial standard, favored for their high analytical sensitivity, wide measuring range, and seamless integration into fully automated clinical analyzers (such as those offered by Abbott, Roche, and Siemens). CLIA technology minimizes manual handling, reduces inter-operator variability, and is cost-effective for large reference laboratories. Ongoing technological development in CLIA focuses on refining antibody specificity to HoloTC, enhancing signal-to-noise ratios, and achieving shorter incubation times to accelerate turnaround time (TAT), ensuring rapid clinical decision-making. The high penetration of CLIA contributes significantly to the market’s volume base.

A second crucial technological segment is Liquid Chromatography-Mass Spectrometry (LC-MS/MS). While generally confined to specialized research laboratories and high-end reference centers, LC-MS/MS offers unparalleled analytical specificity, overcoming potential interferences common in antibody-based assays. This technique is particularly valuable for complex samples or when confirming results from less specific assays. The trend in MS technology development is focused on miniaturizing instruments, simplifying sample preparation protocols, and reducing the total run time, aiming to make it a more accessible and routine diagnostic tool rather than strictly a reference method. The ability of LC-MS/MS to potentially measure multiple B-vitamins and related metabolites simultaneously (multiplexing) represents a future avenue for technological convergence in nutritional diagnostics.

Furthermore, the technology landscape includes the growing area of Point-of-Care Testing (POCT) systems, which rely on immunochromatographic or microfluidic technologies to deliver rapid results outside a centralized lab environment. Although early POCT solutions often struggle to match the analytical performance of CLIA or MS, significant R&D efforts are targeting enhanced sensitivity and stability for HoloTC measurement in handheld devices. The success of POCT technology depends heavily on developing reliable, calibration-free assays that can be performed by non-technical staff in primary care settings. The eventual convergence of high-specificity assays with user-friendly POCT interfaces will be critical for driving the next phase of market expansion, especially in resource-limited settings where centralized testing is logistically challenging, thereby expanding the overall diagnostic reach of Active B12 testing.

Regional Highlights

The global distribution of the Active B12 Test Market reflects established diagnostic maturity in Western economies and rapid infrastructural development in Asia. North America remains the dominant region, characterized by a high prevalence of chronic diseases, sophisticated healthcare IT integration, strong reimbursement frameworks, and a large population actively engaged in preventive health screening. The United States, in particular, drives substantial demand due to the early adoption of HoloTC testing protocols in specialized clinics and the pervasive presence of major IVD manufacturers headquartered within the region, fostering continuous innovation and widespread clinical training on advanced testing methodologies.

Europe holds the second-largest market share, driven primarily by Germany, the UK, and France. These countries benefit from universal healthcare systems that increasingly cover specialized diagnostic tests, an aging demographic profile, and robust regulatory oversight that promotes the adoption of high-quality, standardized assays. Scandinavian countries often lead in population-wide nutritional monitoring, establishing high utilization rates for B12 diagnostics. However, varying reimbursement policies and different clinical practice guidelines across individual European Union nations necessitate tailored market entry strategies for diagnostic companies targeting this complex, fragmented landscape.

Asia Pacific (APAC) is projected to exhibit the fastest growth over the forecast period. This rapid expansion is attributed to colossal populations, rising disposable incomes leading to increased private healthcare access, and large-scale government initiatives aimed at improving maternal and child health, where B12 deficiency poses a severe public health risk. Countries like China and India are rapidly establishing large private diagnostic laboratory networks that are immediately adopting cutting-edge automated CLIA technology. Investments in local manufacturing and localized supply chains are key strategic moves defining the competitive dynamics within the APAC market, enabling lower-cost production and rapid dissemination of Active B12 test kits across both urban and expanding secondary healthcare centers.

- North America: Market dominance, driven by robust reimbursement and high prevalence of age-related and medication-induced B12 deficiency; emphasis on advanced automation and integration into EHRs.

- Europe: Strong foundational market, with growth steered by centralized healthcare systems, stringent regulatory standards, and high demand from geriatric care segments; focus on achieving cross-border assay harmonization.

- Asia Pacific (APAC): Highest CAGR, fueled by massive population base, expanding healthcare infrastructure investment, and significant public health focus on nutritional disorders in populous nations like China and India; increasing adoption of advanced CLIA instruments.

- Latin America: Emerging growth market, concentrated in major economies (Brazil, Mexico); expanding middle-class demand for better quality diagnostics; market penetration often relies on strategic local partnerships and addressing affordability constraints.

- Middle East and Africa (MEA): Growth centered around GCC countries due to high healthcare spending and development of specialized tertiary hospitals; often serves as a key area for high-end technology imports for early adopters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active B12 Test Market.- Roche Diagnostics (A Division of Roche Holding AG)

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (Labcorp)

- DiaSorin S.p.A.

- Fujirebio Diagnostics, Inc.

- Maccura Biotechnology Co., Ltd.

- Tosoh Bioscience, Inc.

- Ortho Clinical Diagnostics (A QuidelOrtho Company)

- Randox Laboratories Ltd.

- Eiken Chemical Co., Ltd.

- ALPCO (American Laboratory Products Company)

- Biorbyt Ltd.

- Creative Diagnostics

- Wako Diagnostics (A FUJIFILM Company)

- Immundiagnostik AG

Frequently Asked Questions

Analyze common user questions about the Active B12 Test market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Active B12 testing and traditional Total B12 testing?

Active B12 testing specifically measures Holotranscobalamin (HoloTC), the biologically functional fraction of Vitamin B12 bound to transcobalamin. Total B12 measures both active HoloTC and the inactive B12 bound to haptocorrin, which often leads to misleadingly high results in functionally deficient patients. HoloTC is recognized as a more sensitive and specific early biomarker for true B12 deficiency.

Which technologies are predominantly used for measuring Active B12 in clinical laboratories?

The predominant commercial technologies are automated Chemiluminescence Immunoassay (CLIA) and Enzyme-Linked Immunosorbent Assay (ELISA) due to their suitability for high-volume processing. For research and confirmatory testing requiring ultimate precision, Liquid Chromatography-Mass Spectrometry (LC-MS/MS) is utilized, though it is generally more expensive and labor-intensive than immunoassays.

How is the adoption of Active B12 testing being influenced by global demographic trends?

Global demographic trends, particularly the rapidly expanding geriatric population, significantly influence adoption. Older adults are highly susceptible to malabsorption issues, making them prone to B12 deficiency. Active B12 testing provides a necessary tool for early detection and intervention in this high-risk and high-volume patient demographic, driving sustained demand globally.

What are the key barriers hindering the rapid expansion of the Active B12 Test Market?

Key barriers include the higher cost of advanced HoloTC assays compared to older B12 tests, which impacts budget-constrained healthcare systems. Furthermore, achieving global standardization of HoloTC measurement and establishing uniform reference ranges across different proprietary platforms remains a technical challenge that slows universal clinical adoption and payer acceptance.

Is there an emerging trend towards Point-of-Care (POC) testing for Active B12, and how reliable are these methods?

Yes, there is a strong emerging market trend focused on developing POCT solutions for Active B12 to enable rapid diagnosis in primary care settings. While these methods offer unparalleled speed, their current analytical performance, particularly sensitivity, often needs further technological enhancement to match the gold standard precision of centralized laboratory immunoassay and mass spectrometry platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager