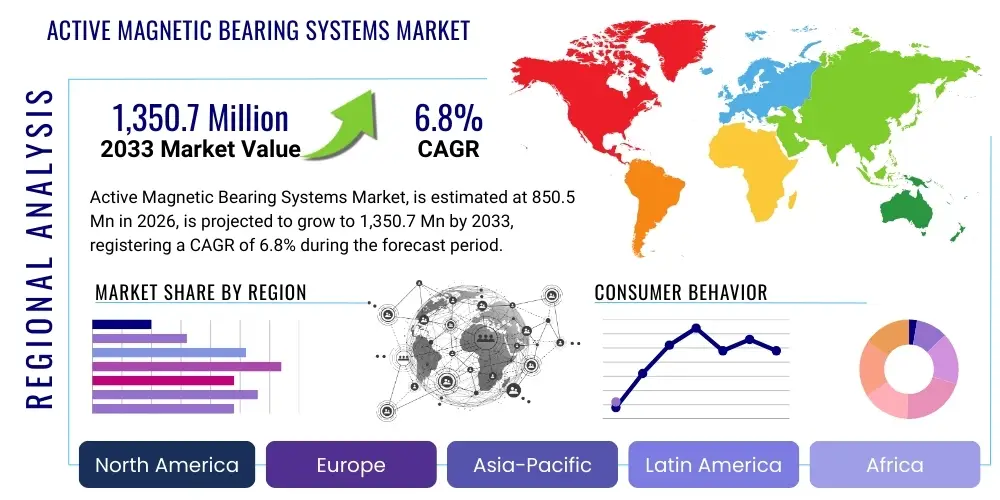

Active Magnetic Bearing Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440991 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Active Magnetic Bearing Systems Market Size

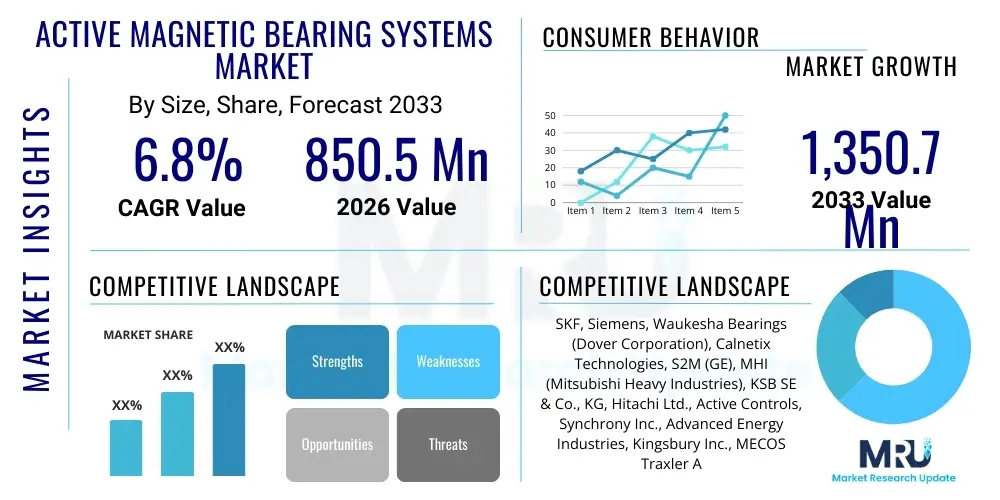

The Active Magnetic Bearing Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,350.7 Million by the end of the forecast period in 2033.

Active Magnetic Bearing Systems Market introduction

The Active Magnetic Bearing (AMB) Systems Market encompasses sophisticated electromechanical systems that utilize magnetic fields to levitate rotating components without mechanical contact. This frictionless operation eliminates wear and tear, requires no lubrication, and significantly enhances the reliability and operational efficiency of high-speed machinery. AMBs consist primarily of electromagnets, sensors to monitor position, power amplifiers, and a high-speed digital controller that dynamically adjusts the magnetic field intensity to maintain rotor stability. These systems are crucial for applications where precision, high rotational speeds, and maintenance-free operation are paramount, setting them apart from conventional fluid or rolling element bearings.

Major applications for AMB systems are concentrated in sectors requiring extreme performance, such such as turbomachinery (high-pressure compressors, turbo expanders), power generation equipment, high-speed machine tools, and vacuum pumps used in semiconductor manufacturing. The inherent advantages of AMBs—including the ability to handle higher rotational speeds, reduce energy consumption due to lack of friction, and provide real-time diagnostics and vibration control—drive their adoption across these industrial verticals. Furthermore, the capacity for active damping allows AMBs to mitigate potential instabilities and critical speeds often encountered in flexible rotor dynamics, a feature unattainable by passive bearing technologies.

The market growth is fundamentally driven by the global imperative toward energy efficiency and the increasing demand for high-performance, compact industrial equipment. Stricter environmental regulations necessitate the deployment of oil-free and lubricant-free technologies, where AMBs offer a direct and compelling solution. Additionally, the proliferation of digital transformation within industrial assets—facilitated by integrated control systems that allow for precise magnetic levitation control and predictive maintenance capabilities—further catalyzes market expansion. These benefits collectively reinforce the value proposition of AMBs as critical enabling technology for next-generation industrial processes.

Active Magnetic Bearing Systems Market Executive Summary

The Active Magnetic Bearing Systems Market is poised for substantial growth, primarily fueled by robust industrial investments in energy-efficient turbomachinery and advanced manufacturing technologies globally. Business trends indicate a shift towards fully integrated, modular AMB solutions that are easier to deploy and maintain, reducing total cost of ownership (TCO) for end-users. Strategic partnerships between bearing manufacturers and original equipment manufacturers (OEMs) specializing in compressors and high-speed centrifuges are crucial for market penetration. Furthermore, ongoing research focuses on enhancing control algorithms and reducing the physical footprint of the control electronics, thereby broadening the application scope of AMBs into smaller, more dynamic machines. The integration of advanced diagnostics through edge computing is rapidly becoming a standard offering, moving AMBs beyond simple mechanical support to sophisticated process control elements.

Regionally, North America and Europe currently dominate the market due to established infrastructure in oil & gas, aerospace, and stringent environmental policies driving the adoption of clean technologies like oil-free compressors. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, propelled by rapid industrialization, massive investments in power generation capacity (including gas turbines), and the surging demand from the high-tech manufacturing sector, particularly semiconductor fabrication and advanced robotics. China, India, and South Korea are key drivers within APAC, focusing on localizing AMB technology production and application expertise to support their expanding industrial bases and modernize existing infrastructure, emphasizing efficiency and uptime.

Segmentation trends highlight the increasing demand for Radial AMB systems due to their versatility in supporting radial loads in high-speed rotating equipment. From a component perspective, controllers and associated power electronics segments are experiencing rapid innovation, as digital control systems become more sophisticated, offering enhanced stability and fault tolerance. Application-wise, the Oil & Gas industry remains the largest consumer, primarily in pipeline compressors and subsea pump systems, where reliability under extreme conditions is non-negotiable. Concurrently, the HVAC industry is showing accelerating adoption as manufacturers integrate AMBs into centrifugal chillers to improve efficiency and minimize noise, aligning with green building standards and demanding high efficiency ratios.

AI Impact Analysis on Active Magnetic Bearing Systems Market

Common user questions regarding AI's impact on Active Magnetic Bearing Systems predominantly revolve around predictive maintenance capabilities, control optimization, and system reliability enhancement. Users inquire how AI algorithms can anticipate bearing failures long before traditional monitoring systems, ensuring near-zero unplanned downtime. Furthermore, there is significant interest in AI's role in fine-tuning the complex, high-frequency control loops necessary for stable levitation, particularly under transient loads or variable operating conditions, seeking to push the performance envelope of speed and load capacity. Concerns often touch upon the cybersecurity implications of connecting these critical control systems to external monitoring platforms and the necessity of robust, interpretable AI models that operators can trust during critical machinery operations. Expectations are high for AI to transform AMBs from passive support elements into fully autonomous, self-optimizing electromechanical systems.

The core influence of Artificial Intelligence (AI) and Machine Learning (ML) on the AMB market lies in revolutionizing the control and monitoring architecture. Traditional AMB controllers rely on fixed proportional-integral-derivative (PID) or adaptive control schemes, which, while effective, often struggle to perfectly compensate for non-linear dynamics, thermal drift, or sudden shifts in operational parameters. AI introduces sophisticated non-linear modeling capabilities, allowing the control system to learn the rotor-bearing system's complex behavior across its entire operating envelope. This deep learning approach leads to smoother operation, reduced control effort, and significantly higher levels of precision during high-speed transients, directly translating into better machinery performance and extended bearing life across challenging industrial environments.

Furthermore, AI-driven diagnostics are transforming the maintenance paradigm. By analyzing vast streams of high-frequency sensor data—including displacement, current draw, and vibration signatures—ML models can identify subtle anomalies indicative of component degradation or impending system instability with unprecedented accuracy. This transition from condition monitoring to genuine predictive maintenance maximizes asset utilization and minimizes costly, intrusive physical inspections. The integration of these intelligent features enhances the overall value proposition of AMB systems, positioning them as essential components of Industry 4.0 initiatives that demand high reliability and autonomous decision-making capabilities at the component level.

- AI enables highly adaptive and robust control algorithms, significantly improving rotor stability and dampening capacity, especially at critical speeds.

- Machine Learning models predict bearing failure by analyzing subtle changes in vibration patterns and power consumption, achieving superior predictive maintenance schedules.

- AI optimizes energy consumption by dynamically adjusting magnetic field strength based on real-time load conditions, enhancing overall system efficiency.

- Generative modeling is utilized to simulate complex operational scenarios for testing and validating controller robustness before deployment.

- Improved anomaly detection using unsupervised learning enhances cybersecurity measures for networked AMB control systems.

- Automated system tuning and calibration using reinforcement learning reduces commissioning time and minimizes human error during setup.

DRO & Impact Forces Of Active Magnetic Bearing Systems Market

The Active Magnetic Bearing Systems Market is principally driven by the stringent global focus on energy efficiency, compelling industries like oil & gas and power generation to adopt frictionless, high-speed technologies that reduce parasitic losses. Restraints include the high initial capital expenditure associated with AMB technology and the requirement for highly specialized technical expertise for installation, commissioning, and sophisticated control system tuning. Opportunities are vast, particularly in the rapidly emerging fields of high-altitude aerospace propulsion systems, energy storage flywheels, and advanced industrial turbomachinery, driven by continuous advancements in power electronics and digital control algorithms that reduce system complexity and cost. The market is subject to intense impact forces from environmental regulations pushing for oil-free operations and the competitive threat posed by incremental improvements in traditional high-performance fluid film bearings.

Drivers: The fundamental driver for AMB adoption is the pursuit of operational excellence across critical industrial assets. AMBs offer distinct advantages over conventional bearings, including zero mechanical friction leading to reduced power consumption, elimination of lubricating oil systems (reducing environmental risk and maintenance complexity), and the capability to operate at extremely high speeds, far surpassing mechanical limitations. The rising demand for smaller, lighter, and more powerful rotating machinery, particularly in advanced compressors and high-speed motor applications, heavily favors AMB integration. Furthermore, the capacity for integrated health monitoring and active vibration suppression appeals directly to Industry 4.0 paradigms focused on maximizing uptime and minimizing operational variance.

Restraints: Despite the technological superiority, the high barrier to entry remains a significant restraint. The initial investment for an AMB system, encompassing the electromagnets, sophisticated control hardware, high-speed sensors, and power amplifiers, substantially exceeds that of traditional bearings. This cost profile often restricts adoption to mission-critical or high-value applications where the return on investment through energy savings and reduced maintenance is guaranteed over the lifecycle. Additionally, the inherent complexity of the control system necessitates specialized engineers and highly trained maintenance staff, which can be a significant hurdle for smaller or less technologically advanced industrial operators, thus slowing widespread market diffusion.

Opportunities: Technological breakthroughs in power electronics, particularly GaN (Gallium Nitride) and SiC (Silicon Carbide) semiconductors, are leading to more compact, efficient, and cost-effective AMB power amplifiers and controllers. This reduction in size and cost opens up new opportunities in medium-load applications previously considered uneconomical. Significant untapped potential exists in new applications such as high-temperature environments (e.g., geothermal turbines) and highly contamination-sensitive industries (e.g., medical devices and advanced material processing). Government mandates and subsidies promoting energy conservation and sustainable industrial practices further create favorable market conditions for AMB system suppliers globally.

Segmentation Analysis

The Active Magnetic Bearing Systems Market segmentation provides a detailed structural view based on the type of bearing, the components utilized, the specific applications, and the industry verticals served. Analyzing these segments is crucial for understanding specific market dynamics, identifying high-growth niches, and tailoring product development strategies. The market is primarily categorized by the functional configuration of the bearing (Radial, Thrust, Combined), reflecting different load management requirements in rotating machinery. Furthermore, component analysis reveals the critical role of advanced sensors and high-performance controllers in overall system performance and cost. The application and industry breakdowns highlight the dominance of turbomachinery within oil & gas, but also the rapid expansion into sectors like HVAC and electric vehicles, reflecting a growing appreciation for the non-contact, high-efficiency advantages of AMBs across diverse industrial landscapes.

- By Type: Radial AMBs, Thrust AMBs, Combined AMBs.

- By Component: Sensors, Power Electronics/Amplifiers, Controllers, Actuators/Electromagnets.

- By Application: High-Speed Machinery, Turbomachinery (Compressors, Turbines), Vacuum Pumps, Chillers, Medical Equipment, Electric Motors/Generators, Energy Storage Flywheels.

- By Industry Vertical: Oil & Gas, Power Generation, Aerospace & Defense, Industrial Manufacturing, HVAC (Heating, Ventilation, and Air Conditioning).

Value Chain Analysis For Active Magnetic Bearing Systems Market

The value chain for the Active Magnetic Bearing Systems Market is complex, beginning with highly specialized material sourcing and culminating in the delivery of fully integrated, customized industrial solutions. The upstream segment involves the procurement of high-purity magnetic materials (soft iron, high-grade electrical steel), advanced semiconductor components (for power electronics and control chips), and precision sensors (proximity probes, accelerometers). Critical value is added at this stage through R&D in materials science and component miniaturization, which directly impacts the performance ceiling of the final AMB system. Suppliers specializing in high-speed, high-power density electronics hold a particularly strong position in the value chain, as controller performance dictates system reliability and responsiveness.

The midstream process, dominated by core AMB manufacturers, involves the intricate design, finite element analysis (FEA), and integration of these disparate components. This phase includes the precise winding of electromagnets, the development of proprietary control software and algorithms, and the assembly of the complete system, which is often customized based on the OEM’s rotor dynamics and operational environment. Direct distribution channels are prevalent, especially for large-scale, mission-critical applications (such as oil and gas compressors), where manufacturers deal directly with the end-user or the Original Equipment Manufacturer (OEM) to ensure highly specialized integration and post-installation support. This direct model is preferred due to the technical complexity and the necessity for performance guarantees.

Downstream activities focus on the installation, commissioning, maintenance, and lifetime support of the AMB systems. Indirect distribution channels, often involving specialized system integrators or authorized regional distributors with deep technical knowledge, cater to smaller industrial manufacturing clients or niche applications like HVAC chillers, where standardized, pre-packaged solutions are more common. The ongoing service component—including remote diagnostics, software updates, and predictive maintenance contracts—represents a significant and growing revenue stream. The successful integration of these systems into existing industrial infrastructure, followed by effective remote monitoring and troubleshooting, solidifies the manufacturer’s position and ensures long-term customer retention and high-value aftermarket services.

Active Magnetic Bearing Systems Market Potential Customers

The primary end-users and buyers of Active Magnetic Bearing Systems are large industrial corporations operating highly critical and capital-intensive machinery where system reliability and energy efficiency offer substantial economic benefits. The Oil & Gas sector, encompassing both upstream exploration and midstream pipeline transport, represents a cornerstone customer base, utilizing AMBs in large-scale centrifugal compressors, natural gas pipelines, and cryogenic pump applications. These customers seek reduced lifecycle costs, eliminated risk of oil contamination in process gas, and enhanced uptime, justifying the significant initial investment in AMB technology.

Another rapidly expanding customer segment is the Power Generation industry, particularly operators of gas turbines, steam turbines, and specialized high-speed generators. AMBs are increasingly favored in these environments for their ability to manage complex rotor dynamics and harsh operating conditions, including high temperatures and transient loads. Furthermore, industrial Original Equipment Manufacturers (OEMs) specializing in centrifugal chillers (HVAC) and semiconductor manufacturing equipment (vacuum pumps and precision machine tools) constitute a crucial customer group, integrating AMBs directly into their final products to market superior efficiency and cleanliness standards.

Emerging customers include companies developing advanced kinetic energy storage systems (flywheels) and next-generation industrial compressors that require extreme rotational speeds for efficiency maximization. These buyers prioritize the zero-wear, high-speed capabilities and the integrated diagnostic features of AMBs. The aerospace and defense sectors, requiring specialized turbo-pumps and high-power density rotating electrical machines, also represent a high-value, albeit volume-limited, customer segment focusing on custom-engineered, ruggedized AMB solutions capable of withstanding extreme environmental and dynamic stress profiles throughout the operational lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,350.7 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Siemens, Waukesha Bearings (Dover Corporation), Calnetix Technologies, S2M (GE), MHI (Mitsubishi Heavy Industries), KSB SE & Co., KG, Hitachi Ltd., Active Controls, Synchrony Inc., Advanced Energy Industries, Kingsbury Inc., MECOS Traxler AG, Celeroton AG, Schaeffler AG, ABB Ltd., JTEKT Corporation, Tenneco Inc. (Clevite Elastomers), Hyper Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Magnetic Bearing Systems Market Key Technology Landscape

The technological backbone of the Active Magnetic Bearing Systems market is centered on advanced mechatronics, high-speed digital signal processing (DSP), and power electronics, which collectively ensure stable, contactless rotation. A critical component is the magnetic actuator system, typically comprising heteropolar or homopolar electromagnets, which must be precisely designed to deliver high force density while minimizing power consumption and heat generation. Materials engineering plays a vital role here, especially in selecting lamination steels that reduce eddy current losses at high flux rates. The integration of high-resolution proximity sensors, often eddy current sensors, is essential for providing continuous feedback on the rotor position, typically at micron-level precision, feeding data into the control loop at sample rates exceeding 10 kHz.

The control technology represents the highest value-add and differentiation point in the AMB landscape. Modern systems utilize high-speed digital controllers based on powerful DSPs or Field-Programmable Gate Arrays (FPGAs). These controllers execute complex proprietary algorithms—such as Linear Quadratic Gaussian (LQG) control or robust adaptive control techniques—to simultaneously manage the five or more degrees of freedom (DOF) of the rotor (two radial directions at each end, and one thrust direction). Continuous innovation is focused on enhancing the robustness of these algorithms against system disturbances, minimizing control spillover, and integrating self-learning features through embedded machine learning for optimal performance tuning across varying operational envelopes, crucial for deployment in highly dynamic environments.

Power electronics are experiencing rapid technological evolution, moving towards wide-bandgap semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials enable power amplifiers to switch at significantly higher frequencies and handle higher power densities with greater efficiency than traditional silicon-based devices. The result is smaller, lighter, and more efficient control cabinets, facilitating integration into compact industrial machinery and remote, space-constrained installations like subsea compressors. This advancement is pivotal for reducing the overall system footprint and cost, making AMB technology more accessible to medium-sized machinery applications and driving the development of fully integrated, ‘smart’ motor/bearing units that simplify installation and minimize external cabling requirements for industrial deployment.

Regional Highlights

The Active Magnetic Bearing Systems market demonstrates distinct regional maturation and growth characteristics driven by varying levels of industrial development, regulatory environments, and investment in critical infrastructure.

- North America: Dominates the market share, primarily due to the extensive presence of major players in the Oil & Gas sector and high levels of investment in advanced aerospace and defense technologies. Stringent environmental protection laws and a strong push toward energy efficiency in pipeline compression systems and industrial manufacturing drive consistent demand. The region benefits from established research and development centers focusing on high-speed rotor dynamics and advanced control system design.

- Europe: Represents a mature market characterized by early adoption of AMBs in power generation (especially combined cycle gas turbines) and advanced industrial manufacturing (high-speed machine tools). Regulatory frameworks, such as the European Union’s energy efficiency directives, compel industries to transition towards lubricant-free, highly efficient rotating equipment. Germany, with its strong engineering base, and Switzerland, known for precision component manufacturing, are key centers of innovation and deployment.

- Asia Pacific (APAC): Projected to be the fastest-growing region. This growth is fueled by massive infrastructure projects, rapid industrialization in China and India, and significant investments in high-tech manufacturing, particularly semiconductor fabrication plants (requiring ultra-clean vacuum pumps). The escalating need for power capacity expansion and modernization of existing industrial fleets drives the adoption of energy-efficient turbomachinery featuring AMBs, often through technology transfer and localized manufacturing initiatives.

- Middle East and Africa (MEA): Growth is tied directly to large-scale oil and gas projects. AMBs are vital for enhancing the reliability and efficiency of critical gas compressors and processing equipment in remote desert and offshore installations, where maintenance access is challenging and reliability is paramount. Saudi Arabia and the UAE are major demand centers, investing heavily in pipeline infrastructure modernization.

- Latin America: Holds moderate market share, with growth linked to investments in refining and petrochemical industries, particularly in Brazil and Mexico. The market is slowly maturing, driven by the need to upgrade aging industrial infrastructure with modern, high-efficiency equipment, focusing on long-term operational cost reduction rather than just initial capital outlay.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Magnetic Bearing Systems Market.- SKF

- Siemens

- Waukesha Bearings (Dover Corporation)

- Calnetix Technologies

- S2M (GE)

- MHI (Mitsubishi Heavy Industries)

- KSB SE & Co., KG

- Hitachi Ltd.

- Active Controls

- Synchrony Inc.

- Advanced Energy Industries

- Kingsbury Inc.

- MECOS Traxler AG

- Celeroton AG

- Schaeffler AG

- ABB Ltd.

- JTEKT Corporation

- Tenneco Inc. (Clevite Elastomers)

- Hyper Tech

Frequently Asked Questions

Analyze common user questions about the Active Magnetic Bearing Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and key advantage of Active Magnetic Bearing Systems?

The primary function of AMBs is to levitate a rotating shaft using controlled magnetic fields, eliminating mechanical contact and friction. The key advantage is superior operational efficiency, zero lubrication requirement, high-speed capability, and active vibration control, leading to minimal maintenance and extended machinery life.

In which industries are Active Magnetic Bearings most commonly used?

AMBs are predominantly utilized in the Oil & Gas industry (for high-pressure compressors and pipelines), Power Generation (turbines and generators), Industrial Manufacturing (high-speed machine tools), and the HVAC sector (centrifugal chillers) due to the need for high reliability and efficiency.

What are the main factors restraining the wider adoption of AMB technology?

The main restraining factors are the high initial capital cost of the system compared to conventional bearings and the requirement for highly specialized technical expertise to design, install, and commission the complex digital control and power electronics hardware.

How do advancements in AI and Machine Learning influence AMB performance?

AI and ML significantly enhance AMB performance by enabling self-optimizing control algorithms for greater stability and by facilitating highly accurate predictive maintenance through real-time analysis of sensor data, thereby maximizing equipment uptime and operational efficiency.

Which geographical region is expected to experience the fastest growth in the AMB market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by rapid industrialization, massive investments in power generation, and increasing demand from high-tech sectors like semiconductor manufacturing in countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager