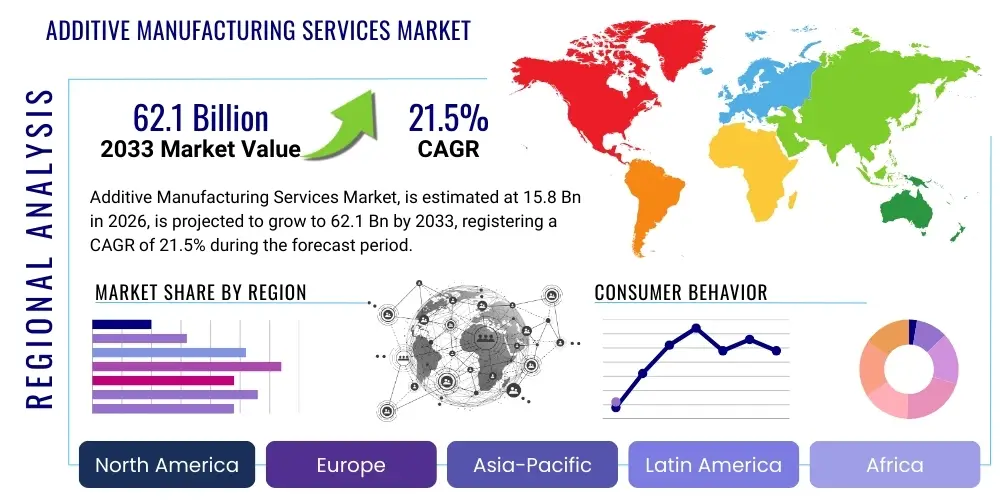

Additive Manufacturing Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442364 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Additive Manufacturing Services Market Size

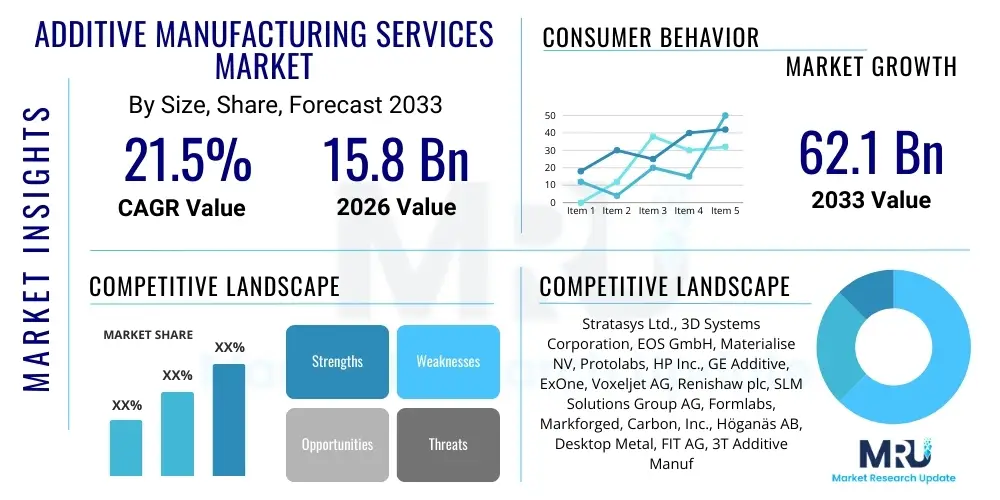

The Additive Manufacturing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 62.1 Billion by the end of the forecast period in 2033.

Additive Manufacturing Services Market introduction

The Additive Manufacturing (AM) Services Market encompasses the provision of professional services related to 3D printing, including design optimization, rapid prototyping, tooling, and direct part production across various materials like polymers, metals, and ceramics. This market serves as a critical bridge for industries looking to leverage the transformative potential of AM without incurring massive capital expenditures for in-house equipment and specialized expertise. Key product descriptions include on-demand manufacturing solutions, comprehensive post-processing services, and highly specialized engineering consultation focused on Design for Additive Manufacturing (DfAM), ensuring components are optimally configured for the specific AM technology utilized. The operational flexibility, significant reduction in material waste, and the unparalleled capability to produce complex, consolidated geometries rapidly are central benefits driving widespread industrial adoption, fundamentally changing how products are conceived and brought to market. Service bureaus often manage complex multi-step workflows, integrating scanning, CAD modeling, printing, and final finishing to deliver ready-to-use components.

Major applications of AM services span highly regulated sectors such as Aerospace and Defense, where lightweight, structurally optimized components, essential for fuel efficiency and performance, are critically sourced via service bureaus specializing in certified metal AM processes. The Healthcare sector is another immense consumer, utilizing AM services extensively for customized medical devices, patient-specific prosthetics, anatomical models for surgical planning, and complex dental alignments, valuing the precision and personalization capabilities. Furthermore, the Automotive industry relies on these services to drastically accelerate iteration cycles for prototypes, conduct intricate functional testing, and efficiently supply low-volume functional parts or specialized tooling, particularly for electric vehicle platforms where weight reduction is a premium mandate. The fundamental benefit provided by these outsourced services is the drastic acceleration of product development timelines, facilitating agile response to market demands, and enabling previously impossible designs, allowing end-users to concentrate on their core business strategy while leveraging external expertise for advanced manufacturing.

The primary driving factors propelling the accelerated growth of this market include the increasing global demand for highly customized products across both consumer and industrial sectors, significant breakthroughs and continued investment in material science broadening the range of viable high-performance applications (such as high-temperature thermoplastics and refractory metals), and the continuous evolution of AM hardware leading to faster, larger, and more reliable machines with enhanced repeatability. Moreover, the strategic global push towards building resilient, localized, and digitally integrated supply chains, prominently highlighted by recent global disruptions, positions decentralized AM services as a vital, robust alternative to traditional centralized mass production models. This reinforces AM services’ role in future manufacturing resilience. The ongoing reduction in the cost per part for certain high-volume polymer AM processes, facilitated by economies of scale and automation within service bureaus, is making the economic proposition increasingly competitive, even challenging traditional methods for medium-volume production runs.

Additive Manufacturing Services Market Executive Summary

The Additive Manufacturing Services Market is experiencing a period of exponential expansion, fundamentally driven by a significant strategic pivot from solely basic concept prototyping toward certified, critical end-use parts production, marking a decisive shift toward industrial maturity. Business trends clearly indicate a strong market gravitation toward specialized vertical offerings, particularly services incorporating advanced, certified materials such as aerospace-grade superalloys, medical-grade titanium, and high-performance engineering polymers. These offerings are frequently bundled with sophisticated consulting services, integrating Artificial Intelligence (AI) and machine learning tools for topological optimization and robust, auditable quality assurance protocols necessary for meeting stringent certifications like AS9100, ISO 13485, and Nadcap. The competitive landscape is defined by strategic capital investments in large-format, high-throughput systems and crucial partnerships between specialized material developers, hardware original equipment manufacturers (OEMs), and high-volume independent service providers, designed to expand service capability and geographical reach while offering clients holistic, end-to-end solutions covering the entire digital manufacturing lifecycle from concept to certified installation.

From a geographical perspective, the mature economies of North America and Western Europe continue to command the largest market share, predominantly sustained by high levels of deep technological penetration, sustained governmental and private R&D expenditure, and the long-established presence of high-value, highly regulated end-use industries—specifically aerospace, sophisticated medical device manufacturing, and high-performance motor vehicle sectors that inherently require precision, high complexity, and rigorous traceability. However, the Asia Pacific (APAC) region, strategically led by manufacturing powerhouses like China, the Republic of Korea, and Japan, demonstrates the most significant and highest Compound Annual Growth Rate (CAGR) globally. This rapid acceleration in APAC is powerfully fueled by extensive governmental support and national policy objectives aimed at modernizing domestic manufacturing capabilities (Industry 4.0 initiatives), coupled with the explosive rising demand from the rapidly scaling consumer electronics, robust automotive aftermarket, and general industrial tooling sectors, all seeking more flexible, cost-effective, and rapid manufacturing alternatives. Substantial infrastructure investments in regional AM service hubs are critically defining the future competitive strategy across the continent.

Analysis of market segmentation trends unequivocally highlights the rapidly increasing prominence and financial contribution of metal additive manufacturing services, encompassing critical technologies such as Direct Metal Laser Sintering (DMLS), Selective Laser Melting (SLM), and Electron Beam Melting (EBM). These metal AM services are essential for delivering components required in high-stress, high-temperature, and mission-critical applications within the energy, defense, and aerospace verticals. Concurrently, the application segmentation reveals a transformative transition: the revenue contribution derived from the manufacturing of functional, ready-to-install end-use parts is demonstrably and rapidly surpassing traditional, volume-limited prototyping services. This trend signifies the unequivocal industrial acceptance, reliability validation, and ultimate maturity of AM technology as a true production method. Within the material segment, the adoption of high-performance engineering polymers, notably PEEK, Nylon 12, and Ultem, is experiencing a remarkable uptake due to their exceptional thermal stability, chemical resistance, and favorable mechanical strength-to-weight ratios, thereby substantially driving segment value across demanding industries such as clinical healthcare and specialized industrial machinery where failure is not an option.

AI Impact Analysis on Additive Manufacturing Services Market

User inquiries frequently center on how Artificial Intelligence (AI) can fundamentally enhance the operational efficiency, geometric feasibility, and overall reliability of outsourced additive manufacturing services, specifically focusing on critical areas such as end-to-end process automation, predictive quality control assurance, and the rigorous optimization of complex designs. Common concerns expressed by industrial customers revolve around the technical integration difficulty of sophisticated AI algorithms with heterogeneous AM machine fleets, establishing the predictive accuracy of machine learning models for proactive maintenance of highly specialized and expensive capital equipment, and navigating the sensitive intellectual property (IP) and licensing implications when leveraging black-box generative design AI tools hosted by external service bureaus. Fundamentally, users maintain high expectations for AI to dramatically reduce design iteration time, drastically minimize material consumption and waste through intelligent nesting and structural optimization, and crucially, enforce highly repeatable, certifiable quality standards for critical, serialized parts, thereby positioning AM services as significantly more competitive against entrenched traditional manufacturing methods for medium-to-high production volumes.

The strategic implementation of AI and machine learning algorithms significantly improves the internal operational efficiency for service providers by automating highly complex, time-consuming tasks that traditionally necessitate intensive expert human oversight. This includes highly detailed optimization of build orientation to achieve both minimal material support requirements and maximum print speeds, sophisticated predictive maintenance scheduling derived from machine sensor telemetry to minimize disruptive equipment downtime, and utilizing advanced computer vision and thermal monitoring systems for rigorous real-time quality assurance throughout the entire print process. Furthermore, AI-powered Generative Design (GD), wherein algorithms explore vast design spaces based on specified constraints (e.g., load requirements, material properties, cost targets), allows specialized service bureaus to offer substantially enhanced value propositions. By collaborating with clients to create lighter, stronger, and inherently manufacturable parts optimized specifically for the nuances of AM processes, these bureaus generate superior functional performance and critical material savings that effectively offset the premium costs associated with advanced service provision, establishing a powerful competitive differentiator.

Crucially, sophisticated AI algorithms are indispensable for effectively managing and extracting actionable intelligence from the massive, multi-dimensional datasets generated by modern AM machines (e.g., melt pool data, layer-by-layer scanning, thermal signatures), thereby facilitating truly closed-loop quality control and rigorous process validation for highly regulated industries. By continuously analyzing real-time sensor data, high-resolution thermal images, and melt pool dynamics across every printed layer, AI systems possess the capacity to identify and classify microscopic defects or subtle process deviations instantaneously, allowing for automated corrective action or immediate flagging for human intervention. This enhanced level of comprehensive, data-driven traceable quality assurance, powered by intelligent computational systems, fundamentally builds greater client confidence and reliability in outsourced AM services. Such advancements are essential for encouraging broader industrial adoption for mission-critical components, which ultimately drives substantial growth in the total addressable market size and expands the application scope for specialized, high-reliability service providers worldwide, enabling them to handle production runs previously deemed too risky for AM.

- AI-driven Generative Design (GD) accelerates part optimization and topology creation, leveraging simulation to achieve optimal strength-to-weight ratios, drastically reducing engineering time.

- Predictive maintenance schedules proactive machine servicing based on sensor data analysis, maximizing critical uptime and throughput for high-demand service bureaus.

- Real-time quality monitoring using machine learning vision systems ensures process stability, detects anomalies instantly, and verifies compliance with strict regulatory standards (e.g., AS9100 and ISO 13485).

- Automated build preparation, including intelligent part nesting and sophisticated support structure generation algorithms, minimizes material use, maximizes build plate density, and reduces post-processing labor.

- Enhanced data analysis capabilities provide comprehensive digital documentation and certification records for every component, ensuring full traceability required by defense and aerospace clients.

DRO & Impact Forces Of Additive Manufacturing Services Market

The Additive Manufacturing Services Market operates within a complex matrix of propelling and constraining forces, where the relentless industrial demand for rapid iteration, customized components, and digital inventory acts as a powerful primary Driver, contrasting sharply with structural limitations such as the high initial investment required for high-end metal AM systems and inherent material property constraints that often serve as key Restraints. The most significant strategic Opportunity lies in the industrial expansion into certified end-use part production and the deep penetration of highly regulated industries—notably personalized medicine, energy infrastructure, and certified aerospace component manufacturing—by leveraging AM’s unique capacity to produce incredibly complex, customized components on demand and closer to the point of consumption. These countervailing forces, when synthesized, create a profound transformative Impact Force that systematically pushes the traditional global manufacturing industry toward decentralized, highly digital, and agile supply chains, thereby significantly challenging and often displacing long-established legacy production models. This environment necessitates continuous, intense innovation in advanced material science, process monitoring efficiency, and industrial automation to sustainably capitalize on the compelling economic and operational advantages offered by outsourced AM services.

Key Drivers underpinning robust market expansion include the increasing global industry recognition of the strategic value of decentralized manufacturing models, which inherently favor agile, on-demand production geographically closer to the end point of consumption, thereby dramatically reducing international logistics complexity, transportation costs, and vulnerability to external shocks. The unparalleled intrinsic capability of AM services to facilitate highly complex geometric designs—often functionally impossible to fabricate via standard subtractive or formative methods—and the significant competitive advantage of rapid time-to-market for iterative product development cycles further solidify the market’s high growth trajectory. Furthermore, the intensifying global mandate for lightweighting in transportation sectors, particularly in the civil aviation and electric vehicle battery housing markets, to meet stringent fuel efficiency and enhanced performance targets, acts as a fundamental, high-value demand generator for specialized metal and advanced polymer AM services, effectively justifying the premium pricing associated with these highly technical, precision-engineered offerings.

Conversely, critical structural Restraints persist and must be addressed for sustained growth, primarily centered around the acute need for a highly specialized, technically proficient labor pool capable of operating, maintaining, and certifying specialized AM equipment and executing complex post-processing steps (like HIP or thermal stress relief), which currently creates a persistent, high-cost bottleneck in rapid, global scaling. Additionally, significant ethical and legal concerns surrounding robust intellectual property protection when commissioning complex, proprietary designs to external service providers remain a psychological barrier for some major OEMs. The existing and undeniable limitations on material volume throughput and production speed, particularly when benchmarking against conventional ultra-high-volume methods like high-cavity injection molding or die casting, occasionally restrict widespread industrial adoption in pure mass-market, commoditized consumer goods. Lastly, the inherently high, fluctuating cost of specialized, certified AM metal powders and high-performance filaments, especially those approved for use in tightly regulated aerospace and clinical medical environments, continues to represent a substantial economic barrier, particularly hindering adoption among smaller and medium-sized enterprises seeking accessible services.

Significant Opportunities for market expansion are abundant and strategically focused on deeper integration of AM services within the broader Industry 4.0 and digital manufacturing ecosystems, leveraging highly scalable cloud-based platforms for automated file submission, instant quotation, simulation, and real-time project tracking, which substantially enhances both the user experience and global scalability. The burgeoning and potentially transformative field of bioprinting, regenerative medicine, and highly personalized medical applications presents a long-term, extremely high-value opportunity, where AM services are fundamentally indispensable for the production of patient-specific surgical guides, customized drug delivery systems, and unique bio-scaffolds. Furthermore, service providers who strategically invest in achieving superior process repeatability, automation, and the requisite industrial certification standards (e.g., ISO 9001, AS9100) for highly regulated industries stand to gain substantial, defensible market share, successfully transitioning the market focus beyond traditional low-value prototyping toward genuine, industrial-scale mass-customization and complex supply chain disruption solutions globally.

Segmentation Analysis

The Additive Manufacturing Services Market is intricately segmented based on technology employed, the type of material processed, the primary application, and the specific end-use industry being served, reflecting the diverse range of needs and technical requirements inherent in modern industrial outsourcing. Technology segmentation is vital as it dictates the achievable tolerances, material suitability, and throughput rates, ranging from polymer-based FDM for quick concept models to advanced DMLS for critical metal components requiring superior mechanical properties. Material segmentation underscores the increasing industrial acceptance of high-performance engineering plastics and specialized, certified metal alloys. The segmentation by application clearly delineates the strategic shift from predominantly prototyping activities toward sophisticated tooling and, crucially, direct production of end-use parts, which now represents the highest value and fastest-growing revenue segment within the total market, driven by the necessity for low-volume flexibility and design freedom.

- By Technology:

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- PolyJet/MultiJet Modeling (MJM)

- Binder Jetting (BJT)

- Direct Metal Laser Sintering (DMLS) / Selective Laser Melting (SLM)

- Electron Beam Melting (EBM)

- Digital Light Processing (DLP)

- By Material:

- Polymers (Plastics, Thermoplastics, Resins, High-performance Nylons)

- Metals (Steel, Aluminum, Titanium, Nickel Alloys, Cobalt-Chrome)

- Ceramics (Zirconia, Alumina, High-Temperature Composites)

- Composites (Carbon Fiber-reinforced, Glass-filled materials)

- By Application:

- Prototyping and Concept Modeling (Early stage)

- Tooling and Jigs & Fixtures (Manufacturing Aids)

- Manufacturing Parts (Low-to-Medium Volume Production)

- By End-Use Industry:

- Aerospace & Defense (Flight components, MRO, Tooling)

- Automotive (Prototyping, Aftermarket, Specialty Vehicles)

- Healthcare (Medical Devices, Dental, Biomedical, Surgical Guides)

- Consumer Goods and Electronics (Custom parts, Aesthetics)

- Industrial Machinery and Heavy Equipment

- Construction and Architecture

- Education and Research

Value Chain Analysis For Additive Manufacturing Services Market

The highly specialized value chain for Additive Manufacturing Services initiates rigorously with the Upstream activities, which are focused on the secure and quality-controlled sourcing of primary manufacturing resources. This stage involves specialized material suppliers—responsible for providing verified, high-quality metal powders, photosensitive specialized resins, and engineering-grade filaments—and the original hardware manufacturers (OEMs) who supply the sophisticated AM machines (3D printers). Critical quality control, rigorous material certification (e.g., particle size distribution and chemical composition), and performance validation of feedstock materials are paramount at this foundational stage, as material integrity directly dictates the mechanical properties, performance, and regulatory compliance of the final printed components. The reliability and resilience of the supply chain heavily rely on strong, collaborative relationships with reliable material developers, often requiring intense technical collaboration with service bureaus to precisely optimize process parameters for newly introduced, unique application-specific materials.

The central and most critical node of the entire value chain involves the Service Bureau itself (the core market segment), which receives proprietary client designs, performs essential and highly skilled Design for Additive Manufacturing (DfAM) consultation to ensure printability and optimization, utilizes proprietary printing expertise and certified machine time, and executes rigorous post-processing steps (e.g., chemical cleaning, complex heat treatment, specialized surface finishing, and quality inspection). Service providers strategically utilize both Direct distribution channels, engaging immediately and directly with large-scale industrial clients and OEMs through dedicated sales teams and advanced digital platforms, and Indirect channels, leveraging digital manufacturing marketplaces or specialized software resellers that embed AM services into broader engineering software packages for wider reach. This core processing stage fundamentally defines the quality assurance standards, production lead time reliability, and the overall competitiveness and service cost structure.

Downstream activities involve the meticulous distribution and delivery of the final manufactured components to the End-Users/Original Equipment Manufacturers (OEMs) or specialized industrial clients. For functional, end-use production parts, the provision of comprehensive certification packages, detailed quality reports, and meticulous documentation of the entire build process are critical components of the final delivery and invoicing process. The operational efficiency of this final delivery stage, coupled with effective, digitally integrated supply chain management (e.g., enabling just-in-time inventory or spare parts delivery), significantly enhances the overall value proposition of AM services compared to traditional long-lead supply chains. The mandatory implementation of digital tracking, advanced sensing, and validation systems throughout the entire AM process ensures critical transparency and regulatory compliance, further strengthening the essential trust between the specialized service provider and the discerning end customer, particularly within highly regulated and risk-averse sectors like medical device manufacturing and certified aerospace applications.

Additive Manufacturing Services Market Potential Customers

Potential customers for Additive Manufacturing Services represent a highly diverse and expansive group, encompassing virtually every industrial sector that seeks unparalleled geometric customization, profound design freedom, accelerated product development cycles, or supply chain resilience through digital inventory strategies. The primary high-value end-users include major multinational corporations (MNCs) and large Original Equipment Manufacturers (OEMs) strategically embedded in specialized, capital-intensive sectors such as certified aerospace and precision medical device manufacturing. These organizations consistently require highly certified, high-performance parts in low-to-medium batch volumes, often leveraging outsourced services for complex, non-standard tooling, functional prototypes, and mission-critical flight or patient-contact components, demanding the highest quality standards. Simultaneously, Small and Medium-sized Enterprises (SMEs) represent a crucial and rapidly growing buyer segment, utilizing AM services to iterate prototypes quickly and access advanced manufacturing capabilities—otherwise inaccessible due to high equipment cost—thus democratizing high-end production technology and fostering innovation.

Specifically, the global healthcare sector is currently the largest and most dynamic consumer segment, purchasing AM services for the production of patient-specific, anatomically correct implants, complex custom prosthetics, intricate dental aligners, and highly precise surgical planning models, benefiting immensely from the personalization and speed capabilities inherent in AM. Within the vast automotive industry, both specialized Tier 1 suppliers and major global manufacturers procure AM services extensively for the rapid iteration of complex engine components, detailed testing of interior aesthetics and functionality prototypes, and the efficient production of certified legacy vehicle spare parts on demand, utilizing the digital inventory model. Furthermore, consumer electronics and diversified industrial machinery manufacturers critically rely on these outsourced services for rapid functional prototyping, custom-designed complex jigs and fixtures that streamline assembly line efficiency, and specialized thermal management components, highlighting the broad, deep, and indispensable applicability of outsourced AM capabilities across the entire industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 62.1 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, Protolabs, HP Inc., GE Additive, ExOne, Voxeljet AG, Renishaw plc, SLM Solutions Group AG, Formlabs, Markforged, Carbon, Inc., Höganäs AB, Desktop Metal, FIT AG, 3T Additive Manufacturing, Xometry, Sculpteo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Additive Manufacturing Services Market Key Technology Landscape

The technology landscape underpinning the Additive Manufacturing Services Market is defined by a rapidly advancing, heterogeneous suite of distinct printing processes, with each mechanism meticulously optimized for specific material sets, functional requirements, and production throughputs. Polymer-based vat photopolymerization technologies, principally Stereolithography (SLA) and Digital Light Processing (DLP), offer superior resolution, micron-level precision, and exceptionally smooth surface finishes, rendering them ideal for precise visual prototypes, intricate casting patterns, and complex medical models where aesthetic detail is paramount. Fused Deposition Modeling (FDM), while generally offering lower resolution, remains critically important for delivering cost-effective, robust functional prototypes and durable basic tooling due to its exceptional material robustness, wide material selection, and unparalleled ease of use and maintenance, making it a workhorse for rapid concept iteration.

In the high-value metal component segment, the technological landscape is overwhelmingly dominated by sophisticated powder bed fusion (PBF) techniques, primarily encompassing Direct Metal Laser Sintering (DMLS)/Selective Laser Melting (SLM) and the thermal process of Electron Beam Melting (EBM). DMLS/SLM is the industry standard, highly preferred for its capability to rapidly produce highly dense, certified parts from both reactive and non-reactive metals (e.g., Titanium, Aluminum, Inconel), which is critically necessary for aerospace engine components, certified medical implants, and high-performance industrial tooling requiring stringent mechanical properties and high fatigue life. EBM, while typically characterized by a slower build rate, is uniquely valued for producing parts with significantly minimized residual internal stress and superior material microstructures, particularly beneficial for specialized titanium alloys used in orthopedics, as it operates in a vacuum at high temperatures. Service providers are now aggressively increasing investment in metal Binder Jetting (BJT) technology, which promises a paradigm shift in throughput capacity and dramatically reduced cost per part for large-volume metal component manufacturing, directly addressing the historical constraint of slower PBF systems.

Furthermore, the strategic technological focus is rapidly expanding beyond basic hardware to include enhanced system integration, sophisticated post-processing automation, and comprehensive in-situ process monitoring software. Significant advancements in simulation software, precise parameter control systems, and automated quality validation tools are proving to be equally important as the core hardware improvements. To maintain a competitive edge, large service bureaus are implementing advanced multi-laser PBF systems to drastically increase build speeds and are strategically exploring innovative hybrid manufacturing solutions that seamlessly combine AM with high-precision subtractive techniques (such as post-print CNC milling) to simultaneously achieve extremely tight dimensional tolerances and superior surface quality finishes. This continuous, holistic technological refinement across the entire AM ecosystem—encompassing hardware efficiency, certified materials, and integrated software—ensures that specialized AM services can consistently meet the increasingly stringent quality, reliability, and volume demands of industrial production clients globally, critically reinforcing their strategic competitive advantage over traditional methods.

Regional Highlights

The market dynamics for Additive Manufacturing Services are highly heterogeneous across the global regions, with growth and specialization dictated by regional industrial maturity, established regulatory frameworks, local technological infrastructure, and varying levels of capital investment and adoption rates.

- North America (NA): Commands the largest global market share, fueled by high, sustained R&D investment, the rapid and extensive early adoption across the dominant aerospace, defense (ITAR/EAR compliance requirements), and complex medical device manufacturing sectors, and the influential presence of global AM hardware manufacturers and leading specialized service bureaus. The demand is strategically focused on certified, high-value, complex metal parts.

- Europe: Represents a highly mature and technologically sophisticated market, characterized by extremely robust high-value manufacturing bases, particularly in Germany (specializing in Automotive, Tooling, and Industrial machinery) and the UK/France (Aerospace and highly specialized Medical applications). Strict regulatory adherence and quality certification requirements across the EU strongly foster specialization in high-end, traceable, and validated AM services, often linked to Industry 4.0 initiatives.

- Asia Pacific (APAC): Exhibits the fastest and highest growth rate globally (CAGR), primarily propelled by massive regional industrialization efforts, strong centralized government backing and national policies (e.g., aimed at modernizing domestic manufacturing), and explosive demand from rapidly expanding sectors including automotive components, high-volume consumer electronics, and complex mold/die manufacturing in key nations like China, Japan, and South Korea. The market focus is rapidly transitioning from low-cost prototyping toward high-volume, cost-effective industrial solutions.

- Latin America (LATAM): Currently classified as an emerging market with adoption primarily centered on initial conceptual prototyping needs and basic tooling solutions in the localized automotive, energy, and general industrial sectors of Brazil and Mexico. Market penetration and growth are significantly constrained by variable economic investment levels, infrastructure limitations, and skilled talent availability, but the region holds substantial untapped long-term potential for industrial growth.

- Middle East and Africa (MEA): Constitutes a niche adoption market, with demand strategically driven by the high-value oil & gas sector (requiring on-demand spare parts and MRO solutions for remote sites) and major national healthcare and high-tech infrastructure projects, principally concentrated in the UAE, Israel, and Saudi Arabia. Market expansion remains selective, prioritizing high-utility, mission-critical industrial applications over broad commercial adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Additive Manufacturing Services Market.- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- Materialise NV

- Protolabs

- HP Inc.

- GE Additive

- ExOne

- Voxeljet AG

- Renishaw plc

- SLM Solutions Group AG

- Formlabs

- Markforged

- Carbon, Inc.

- Höganäs AB

- Desktop Metal

- FIT AG

- 3T Additive Manufacturing

- Xometry

- Sculpteo

Frequently Asked Questions

Analyze common user questions about the Additive Manufacturing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary cost components of outsourced Additive Manufacturing services?

The primary cost components include specialized material consumption (often the largest single factor, especially for certified metal powders and high-performance polymers), dedicated machine time/labor, extensive required post-processing (e.g., stress relief, CNC finish, inspection), and the complexity and critical application of the part design.

How does Additive Manufacturing Services differ fundamentally from traditional CNC machining services?

AM services offer superior geometric complexity, rapid prototyping cycles, true mass customization capabilities, and drastically lower material waste compared to subtractive CNC machining. However, CNC generally provides superior surface finish quality and is more cost-effective for extremely high volumes or simple, structurally blocky geometries.

Which end-use industry is demonstrating the fastest CAGR in the AM services market?

The Healthcare sector (specifically patient-specific medical devices and highly customized implants) and the global Aerospace & Defense industry are currently the fastest-growing and highest-value segments, driven by regulatory approval of AM components and the critical need for lightweight, customized, and traceable high-performance parts.

What critical role does intellectual property (IP) protection play when utilizing AM service bureaus?

IP protection is a paramount client concern. Reputable service bureaus typically implement robust non-disclosure agreements (NDAs), utilize highly secure digital manufacturing platforms, and enforce strict, traceable data security protocols to protect proprietary client design files and process parameters from external threats.

What key technological advancements are most significantly influencing service bureau growth and competitive strategy?

Key advancements include the rapid commercialization and adoption of metal Binder Jetting (BJT) for high-throughput, low-cost metal parts, seamless integration of AI/ML for generative design and automated quality control, and the continuous development and certification of new high-performance engineering materials and specialized metal alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager