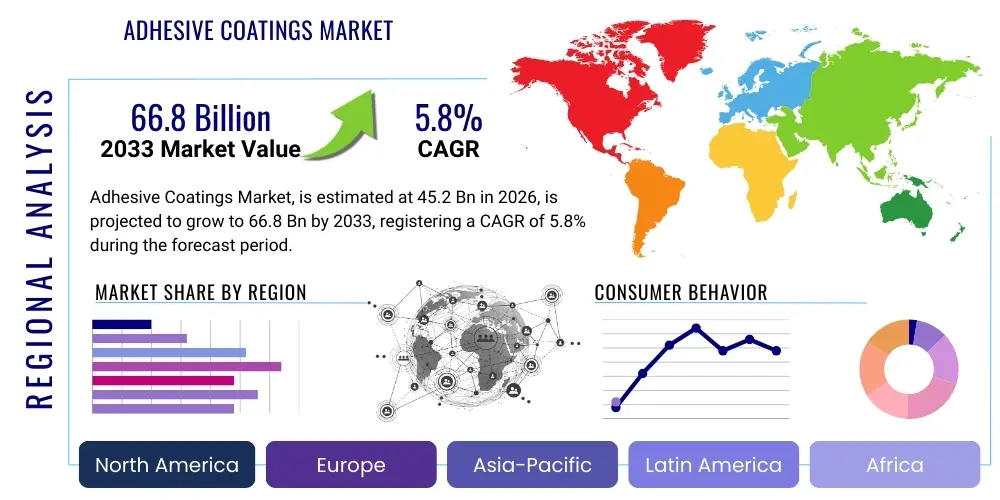

Adhesive Coatings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442020 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Adhesive Coatings Market Size

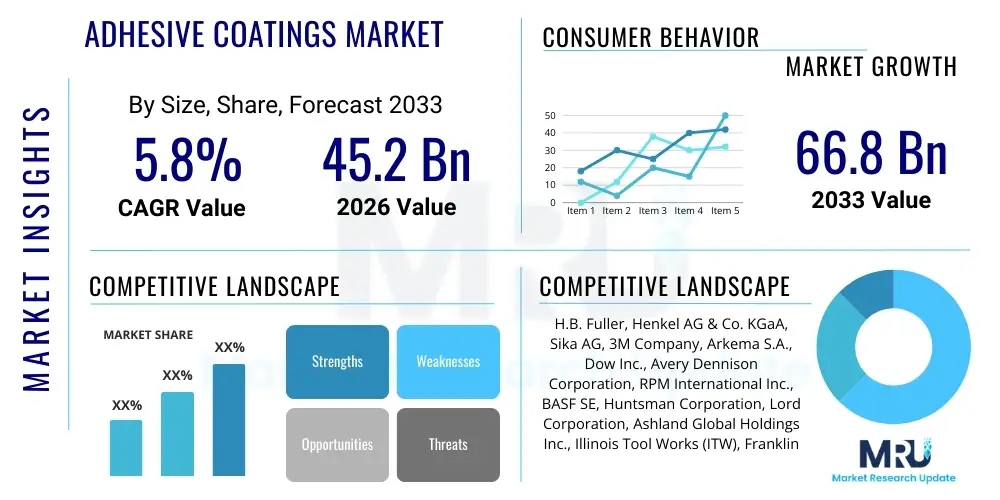

The Adhesive Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 66.8 Billion by the end of the forecast period in 2033.

Adhesive Coatings Market introduction

The Adhesive Coatings Market encompasses a diverse range of polymeric materials applied to substrates to create a strong, durable bond or to provide protective surface characteristics. These materials, often formulated from acrylics, polyurethanes, epoxies, and silicone chemistries, are crucial in modern manufacturing, enabling the joining of dissimilar materials, enhancing product aesthetics, and providing barriers against environmental degradation such as moisture, chemicals, and temperature fluctuations. The primary function of an adhesive coating extends beyond simple adhesion; it acts as a functional layer customized for specific operational demands, particularly in high-stress applications within the automotive, aerospace, and electronics industries.

The product description of adhesive coatings varies significantly based on their dispensing technology and curing mechanism. Hot melt adhesives, solvent-borne systems, and increasingly prevalent water-borne and UV-curable coatings represent the major product types. Water-borne systems are gaining substantial traction due to stringent environmental regulations limiting Volatile Organic Compound (VOC) emissions, offering a sustainable alternative without compromising performance. Major applications span structural bonding in construction, protective layers for metal substrates, electrical insulation in electronics, and specialized tapes and labels in the packaging sector. The ability of these coatings to distribute stress evenly across a joint and provide vibration dampening makes them indispensable across highly demanding technical fields.

Key benefits driving the market include improved product lifespan, reduced manufacturing complexity compared to mechanical fastening methods (like welding or riveting), superior aesthetic results, and weight reduction, particularly vital in the automotive and aerospace sectors seeking fuel efficiency improvements. Driving factors for market expansion are primarily the rapid expansion of the construction industry globally, increasing demand for lightweight vehicles, and the continuous miniaturization and protection requirements in the burgeoning consumer electronics market. Furthermore, advancements in bio-based and renewable raw materials are enhancing the sustainability profile of adhesive coatings, attracting environmentally conscious end-users and stimulating further innovation in high-performance, low-impact formulations.

Adhesive Coatings Market Executive Summary

The Adhesive Coatings Market is characterized by robust growth, driven primarily by technological shifts towards high-performance, sustainable formulations and escalating demand across key industrial sectors. Current business trends indicate a strong focus on developing solvent-free systems, especially UV-curable and 100% solids technologies, to comply with evolving global environmental mandates such as the European Union’s REACH regulation and similar directives in North America and Asia Pacific. Strategic mergers and acquisitions are frequent as large players seek to consolidate market share, acquire specialized material expertise, and optimize global distribution networks. Furthermore, the push toward smart manufacturing and automation necessitates adhesive coatings that offer rapid curing times and precise application characteristics, fueling R&D in automated dispensing systems and reactive chemistry.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption and production volume, primarily attributable to the colossal scale of manufacturing operations in China, India, and Southeast Asia, particularly within the electronics, automotive, and construction sectors. North America and Europe, while exhibiting slower volume growth, lead in innovation, focusing heavily on specialized, high-margin functional coatings for medical devices and aerospace applications, and maintaining strict adherence to sustainability standards. Latin America and the Middle East & Africa (MEA) are emerging markets, showing significant potential driven by infrastructural investments and diversification of manufacturing capabilities, though market penetration remains challenging due to fragmented regulatory landscapes and reliance on imported raw materials.

In terms of segment trends, acrylics maintain the largest market share owing to their versatility, cost-effectiveness, and excellent environmental resistance, serving a wide array of applications from pressure-sensitive tapes to architectural coatings. However, polyurethane coatings are projected to exhibit the highest growth rate due to their superior elasticity and adhesion to difficult substrates, making them ideal for flexible packaging and structural bonding in electric vehicle battery assemblies. The application segment sees packaging and tapes as the largest volume consumer, while the automotive and transportation sector demands the highest value coatings, driven by specifications for thermal management, corrosion resistance, and structural integrity under dynamic stress.

AI Impact Analysis on Adhesive Coatings Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Adhesive Coatings Market frequently center on several critical themes: optimizing material composition for specific end-use properties, enhancing quality control and predictive maintenance in application processes, and accelerating the discovery of novel, sustainable formulations. Users express concerns about the computational cost and data infrastructure required to implement AI models effectively, particularly for small to medium enterprises (SMEs) involved in niche specialty coatings. Expectations are high regarding AI’s potential to dramatically reduce R&D cycles—specifically, the ability to predict polymerization outcomes and adhesion characteristics based on input parameters, thereby minimizing expensive and time-consuming physical experimentation. The integration of Machine Learning (ML) into existing automated dispensing systems to achieve zero-defect application is another recurring theme, highlighting the push towards precision and efficiency in high-volume production lines.

The impact of AI is profound in the research and development phase, where ML algorithms are deployed to screen thousands of potential chemical combinations rapidly. This capability dramatically streamlines the material selection process, ensuring that new formulations meet stringent performance criteria, such as specific thermal stability thresholds or resistance to aggressive chemicals, without extensive traditional trial-and-error testing. By correlating molecular structures with macro-scale performance data, AI minimizes the need for synthesizing unsuccessful compounds, leading to faster time-to-market for specialized coatings addressing emerging industrial needs, particularly in advanced composites and flexible electronics. Furthermore, AI-driven simulations can predict the long-term aging characteristics of coatings under varied environmental stress, providing critical reliability data far more quickly and accurately than standard accelerated testing protocols.

In the manufacturing domain, AI transforms operational efficiency by integrating with Industrial Internet of Things (IIoT) sensors deployed across production lines. AI models analyze real-time data on viscosity, temperature, flow rate, and curing parameters, allowing for immediate, micro-level adjustments to maintain batch consistency and quality. This predictive capability prevents material waste, optimizes energy consumption during curing, and ensures that the final coating thickness and uniformity adhere precisely to specifications. For end-users, especially in the automotive assembly line, AI-powered vision systems are employed for automated inspection of coated surfaces, identifying defects invisible to the human eye, thereby guaranteeing the integrity of structural bonds and protective layers, significantly elevating overall product quality and reducing warranty claims associated with coating failures.

- AI accelerates new material discovery by predicting performance characteristics (adhesion strength, durability) based on molecular structure simulation.

- Machine Learning optimizes manufacturing processes by real-time adjustment of parameters (temperature, viscosity) to ensure consistent batch quality and reduce waste.

- Predictive maintenance driven by AI minimizes unexpected downtime in coating application equipment by forecasting component failure based on operational sensor data.

- AI-enabled computer vision systems provide automated, high-precision quality inspection, detecting microscopic flaws in applied coatings on automotive and electronic components.

- Algorithms optimize supply chain logistics for raw material procurement, forecasting demand fluctuations for specialty polymers and additives.

DRO & Impact Forces Of Adhesive Coatings Market

The dynamics of the Adhesive Coatings Market are dictated by a powerful interplay of drivers, restraints, and opportunities that shape investment decisions and technological trajectories. Key drivers include the global push for lightweighting in transport sectors (automotive and aerospace) to improve fuel efficiency and increase payload capacity, necessitating the substitution of traditional mechanical fasteners with high-strength structural adhesives. The rapid urbanization and infrastructural development, particularly in emerging economies, fuel demand for construction adhesives and protective coatings for steel and concrete structures. Furthermore, increasing consumer demand for flexible packaging and aesthetically pleasing, durable goods drives the innovation in pressure-sensitive adhesives and functional decorative coatings. This synergistic demand across multiple large industries provides a stable foundation for sustained market expansion, making the adhesive segment critical to modern manufacturing efficiency.

Despite robust growth factors, the market faces significant restraints, primarily revolving around regulatory complexities and raw material volatility. Stringent global environmental regulations, particularly those targeting VOC emissions from solvent-borne coatings, force manufacturers into expensive reformulations and process adjustments, slowing product launch cycles. The adhesive industry relies heavily on petrochemical derivatives, making it highly susceptible to volatile crude oil prices and supply chain disruptions, which directly impact production costs and profit margins. Technical challenges also persist, especially in developing high-performance adhesives that can bond low-surface-energy plastics and function reliably under extreme conditions (e.g., high temperatures in engine compartments or cryogenic environments), requiring substantial R&D expenditure and specialized expertise that limits market entry for smaller firms.

Opportunities for growth are concentrated in specialty and sustainable segments. The transition towards electric vehicles (EVs) presents a massive opportunity for thermal management adhesives and coatings used in battery packs and electronic component protection, demanding electrically insulating and thermally conductive materials. The healthcare sector is increasingly adopting biocompatible adhesives for wearable devices and advanced wound care, opening lucrative, high-value niches. The most significant long-term opportunity lies in the continuous development of bio-based and recyclable adhesive formulations that can meet performance requirements while satisfying circular economy principles, potentially mitigating future regulatory risks and catering to the growing consumer preference for sustainable products. These dynamics ensure that the market remains highly competitive, innovation-driven, and intrinsically linked to macroeconomic health and regulatory direction.

Segmentation Analysis

The Adhesive Coatings Market is systematically segmented based on formulation type, material composition, application technology, and end-use industry, providing a granular view of market dynamics and specialized demand characteristics. Understanding these segments is critical for strategic planning, as different applications require vastly divergent performance attributes—for instance, the requirements for automotive structural bonding are entirely distinct from those for pressure-sensitive packaging tapes. The market is increasingly polarizing between high-volume, cost-sensitive segments (like packaging) and niche, high-performance segments (like aerospace and electronics), necessitating specialized manufacturing and distribution strategies tailored to each sector’s specific regulatory and technical demands.

By technology, the market is rapidly shifting toward water-borne and radiation-curable (UV/EB) systems due to environmental pressure, away from traditional solvent-borne formulations, although solvent-borne products retain market relevance in specialized, high-performance industrial applications where rapid drying or specific solubility characteristics are required. Material composition segmentation highlights the dominance of acrylics due to their cost efficiency and excellent resistance properties, while polyurethane and epoxy-based coatings command the structural bonding and high-stress application segments due to their superior strength and durability. This foundational structure dictates investment into specific chemical feedstock production and technological process improvements to maintain competitive advantage in the rapidly evolving regulatory landscape.

- By Formulation Type:

- Water-borne

- Solvent-borne

- Hot Melt

- Reactive (Epoxy, Polyurethane, Silicone)

- Radiation Cured (UV/EB)

- By Material/Resin Type:

- Acrylic

- Polyurethane

- Epoxy

- Silicone

- Cyanoacrylate

- Others (Vinyl, Natural Polymers)

- By Application/Technology:

- Pressure Sensitive Adhesives (PSAs)

- Contact Adhesives

- Structural Adhesives

- Non-Structural Adhesives

- By End-Use Industry:

- Packaging and Paper

- Automotive and Transportation

- Building and Construction

- Electronics and Electrical

- Aerospace

- Medical and Healthcare

- Footwear and Leather

- Woodworking and Furniture

Value Chain Analysis For Adhesive Coatings Market

The Value Chain for the Adhesive Coatings Market is highly complex, beginning with the upstream supply of fundamental petrochemical-derived raw materials. This upstream segment involves the synthesis of key monomers (e.g., acrylic acid, vinyl acetate), specialty polymers (e.g., polyurethanes, silicones), and essential additives such as curing agents, fillers, plasticizers, and tackifiers. Producers in this stage often face challenges related to global commodity price volatility and dependence on oil and gas markets. Key players in the upstream chemical industry are typically large, integrated chemical companies that supply material to the adhesive formulators, and their pricing and supply stability directly impact the manufacturing costs and lead times for finished adhesive coating products.

The core manufacturing and formulation stage is midstream, where specialty chemical companies transform raw ingredients into proprietary adhesive coating products. This involves sophisticated R&D to optimize mixing, blending, curing mechanisms, and delivery systems (e.g., bulk liquid, film, or tape format). Product differentiation at this stage relies heavily on intellectual property regarding customized formulations that meet specific performance criteria (e.g., thermal resistance, flexibility, bond strength) required by end-users like automotive assemblers or medical device manufacturers. Direct distribution channels are often favored for high-volume, structural, or customized industrial coatings, where technical support and quality control require close collaboration between the manufacturer and the end-user, ensuring proper application protocols are followed.

The downstream segment involves the distribution channels and the final end-use application. Distribution is handled through a combination of large global chemical distributors, specialized regional distributors focused on specific industrial sectors (e.g., construction materials, automotive aftermarket), and direct sales forces. Indirect distribution via distributors is common for standardized, lower-volume products like general-purpose industrial adhesives or retail DIY products, leveraging the distributor's extensive inventory management and local market reach. End-users, such as construction companies, packaging firms, or electronics manufacturers, apply the coatings using specialized equipment. The technical service provided at the downstream application phase—training, equipment calibration, and troubleshooting—is crucial for product success and market acceptance, especially for complex two-part or reactive systems.

Adhesive Coatings Market Potential Customers

Potential customers for the Adhesive Coatings Market are globally dispersed across almost every manufacturing and construction sector, characterized by diverse technical needs ranging from high-speed, cost-effective bonding to critical, structural load-bearing applications. The largest volume consumers are typically found in the packaging and labeling industries, where pressure-sensitive adhesives (PSAs) are essential for high-throughput production of consumer goods, requiring excellent adhesion to various substrates (paper, film, glass) and often demanding compliance with food contact regulations. Construction represents another massive consumer base, utilizing coatings for waterproofing membranes, flooring installation, roofing assembly, and protective layers for infrastructure, necessitating products with long-term durability and weather resistance.

The highest value customers are concentrated within the advanced manufacturing sectors, notably Automotive & Transportation and Aerospace. Automotive manufacturers utilize specialized structural adhesives to assemble vehicle bodies, replace spot welding, and bond dissimilar materials in modern, lightweight designs, crucially supporting the trend toward electric vehicle assembly, particularly for battery potting and thermal interface materials. Aerospace customers demand extremely high-specification, certified coatings and sealants for composite bonding, panel attachment, and corrosion prevention, where product failure carries catastrophic risk, justifying premium pricing and necessitating stringent quality assurance protocols and long-term supply contracts.

Furthermore, the Electronics and Medical industries constitute highly specialized, rapidly growing customer segments. Electronics manufacturers require coatings for conformal protection of printed circuit boards (PCBs), thermal management in microprocessors, and bonding of intricate display components, demanding materials that are electrically insulating, heat resistant, and capable of precise dispensing in micro-applications. In the medical field, potential buyers include manufacturers of advanced wound care dressings, surgical tapes, and wearable health monitors, all of which require biocompatible, skin-safe adhesives that adhere to strict regulatory standards (e.g., ISO 10993) and offer reliable performance under physiological conditions, driving demand for silicone and specialized acrylic formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 66.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | H.B. Fuller, Henkel AG & Co. KGaA, Sika AG, 3M Company, Arkema S.A., Dow Inc., Avery Dennison Corporation, RPM International Inc., BASF SE, Huntsman Corporation, Lord Corporation, Ashland Global Holdings Inc., Illinois Tool Works (ITW), Franklin International, Jowat SE, PPG Industries, Momentive Performance Materials, Wacker Chemie AG, DIC Corporation, Bostik (Arkema Group). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adhesive Coatings Market Key Technology Landscape

The technological landscape of the Adhesive Coatings Market is heavily influenced by the imperative to reduce environmental impact while simultaneously enhancing performance capabilities. A critical technological evolution is the widespread adoption of water-borne technology. These systems replace volatile organic solvents with water as the primary carrier, significantly reducing VOC emissions and aligning with global regulatory requirements. Modern water-borne acrylic and polyurethane dispersions offer performance metrics—including adhesion strength, durability, and chemical resistance—that increasingly rival traditional solvent-borne counterparts, making them suitable for demanding applications in automotive interiors, construction sealants, and high-speed packaging lines. Ongoing research focuses on improving the freeze-thaw stability and wetting characteristics of these systems to further broaden their application range and improve storage stability.

Another major transformative technology is radiation curing, primarily utilizing Ultraviolet (UV) or Electron Beam (EB) energy. UV/EB curable coatings are typically 100% solid formulations, eliminating the release of solvents and allowing for extremely rapid curing times (often seconds or fractions of a second). This characteristic significantly boosts production throughput and reduces the physical footprint of curing ovens, offering substantial operational cost savings, particularly in industries like electronics, graphic arts, and specialty packaging. Technological advancements are concentrating on developing UV-curable chemistries that can adhere effectively to challenging, non-porous substrates and penetrate thicker films without loss of cure depth, ensuring suitability for structural applications requiring substantial layer thickness and immediate handling strength.

The development of advanced reactive systems, including two-component (2K) epoxies and polyurethanes, remains central to the structural adhesive market. Recent innovations focus on improving application parameters, such as extending the open time (pot life) while maintaining fast fixture strength. Furthermore, there is a push toward developing thermally conductive and electrically insulating adhesives crucial for managing heat dissipation in high-density electronics and electric vehicle battery modules, where thermal runaway is a critical safety concern. Smart adhesive technologies, incorporating microencapsulated healing agents or color-changing indicators, represent a futuristic edge, enabling self-repairing capabilities or providing visual cues regarding the degree of curing or structural integrity, enhancing the reliability and monitoring capabilities of high-stakes assemblies like wind turbine blades and aircraft components.

Regional Highlights

The Adhesive Coatings Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by local manufacturing bases, regulatory environments, and prevailing construction activity. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share in both production and consumption volume. This dominance is driven by high growth rates in key economies, notably China and India, fueled by massive government investment in infrastructure (roads, bridges, commercial buildings) and the region’s status as a global hub for electronics manufacturing and automotive assembly. The demand in APAC is particularly strong for high-volume, cost-effective adhesives used in packaging and construction, though the regulatory shift toward cleaner, lower-VOC coatings is accelerating the adoption of advanced water-borne systems in this region.

North America and Europe represent mature markets characterized by technological sophistication, strict environmental standards, and high demand for specialized, high-performance coatings. These regions prioritize R&D into functional coatings for aerospace, medical devices, and high-end automotive applications (including EV components). The European market is highly influenced by EU directives like REACH and the push for a circular economy, strongly favoring UV-curable, hot melt, and water-borne formulations over solvent-based alternatives. North America, driven by the revival of domestic manufacturing and massive investments in infrastructure renewal, maintains strong demand for structural epoxy and polyurethane coatings, alongside a significant segment focused on high-quality, durable consumer product adhesives.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by developing infrastructure and increasing industrialization, offering promising growth prospects. In LATAM, growth is tied closely to local automotive production and construction projects, with Brazil and Mexico being the principal consumption hubs. The MEA region is experiencing growth spurred by significant infrastructure investments in Saudi Arabia and the UAE, where protective coatings are essential for combating extreme desert climates and corrosive coastal environments. While the MEA market often lags in adopting the latest sustainable technologies due to less stringent local regulations, the increasing presence of multinational corporations is gradually introducing higher-specification products and advanced application methods.

- Asia Pacific (APAC): Dominant market share due to rapid urbanization, massive electronics and automotive production hubs (China, South Korea), and burgeoning construction sectors (India, Southeast Asia). Focus on high-volume production and increasing shift towards sustainable, low-VOC solutions.

- North America: High-value market focused on innovation in aerospace, advanced automotive (EVs), and medical device adhesives. Strict regulatory compliance drives adoption of sophisticated, specialized formulations.

- Europe: Highly regulated market prioritizing sustainability and circular economy principles. Strong demand for UV-cured and water-borne technologies, particularly in packaging, construction, and high-specification manufacturing.

- Latin America (LATAM): Emerging market growth driven by regional automotive assembly and large infrastructure projects (Brazil, Mexico). Market penetration increases through local manufacturing expansion and foreign investment.

- Middle East and Africa (MEA): Growth tied to diversification away from oil economies, leading to infrastructure development and manufacturing investments. High demand for durable protective coatings suitable for severe climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adhesive Coatings Market.- Henkel AG & Co. KGaA

- H.B. Fuller

- Sika AG

- 3M Company

- Arkema S.A.

- Dow Inc.

- Avery Dennison Corporation

- RPM International Inc.

- BASF SE

- Huntsman Corporation

- Illinois Tool Works (ITW)

- Franklin International

- Jowat SE

- PPG Industries

- Momentive Performance Materials

- Wacker Chemie AG

- DIC Corporation

- Bostik (Arkema Group)

- Ashland Global Holdings Inc.

- Lord Corporation (Parker Hannifin)

Frequently Asked Questions

Analyze common user questions about the Adhesive Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers propelling the growth of the Adhesive Coatings Market?

The primary market drivers include the global demand for lightweight materials in the automotive and aerospace industries, increasing infrastructural development requiring protective and structural bonding, and stringent environmental regulations favoring high-performance, solvent-free coating technologies like water-borne and UV-curable systems.

How do environmental regulations impact the formulation and adoption of adhesive coatings?

Environmental regulations, particularly those concerning Volatile Organic Compounds (VOCs), mandate a strategic shift away from traditional solvent-borne coatings. This accelerates the adoption of low-VOC or zero-VOC alternatives, such as 100% solids, UV-curable, and water-borne adhesive systems, driving innovation and increasing production costs for reformulation.

Which end-use industry holds the largest market share for adhesive coatings?

The Packaging and Paper industry traditionally holds the largest market share by volume due to the high-speed and vast requirements for pressure-sensitive tapes, labels, and flexible packaging bonding. However, the Automotive and Transportation sector commands the highest market value due to the technical complexity and high cost of structural, specialized adhesives used in vehicle assembly and EV battery packs.

What role does Artificial Intelligence (AI) play in the future of adhesive coating development?

AI is crucial for future development, primarily by optimizing R&D cycles. Machine Learning algorithms analyze vast chemical datasets to predict formulation performance, accelerating the discovery of new, specialized materials and optimizing manufacturing processes for improved quality control and energy efficiency in application.

Which resin type is expected to exhibit the fastest growth rate in the forecast period?

Polyurethane (PU) based adhesive coatings are anticipated to demonstrate the highest growth rate, driven by their superior elasticity, durability, and excellent adhesion to diverse substrates, making them ideal for structural applications, high-performance flexible packaging, and crucial components in the rapidly expanding electric vehicle battery market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Adhesive Coatings Market Statistics 2025 Analysis By Application (Industrial & Consumer Goods, Construction & Decoration, Paper & Packing, Others), By Type (Non-Reactive Based Adhesive, Solvent Based Adhesive, Water-based Dispersion Adhesive, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Adhesive Coatings Market Statistics 2025 Analysis By Application (Industrial & Consumer Goods, Construction & Decoration, Paper & Packing), By Type (Non-Reactive Based Adhesive, Solvent Based Adhesive, Water-based Dispersion Adhesive), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager