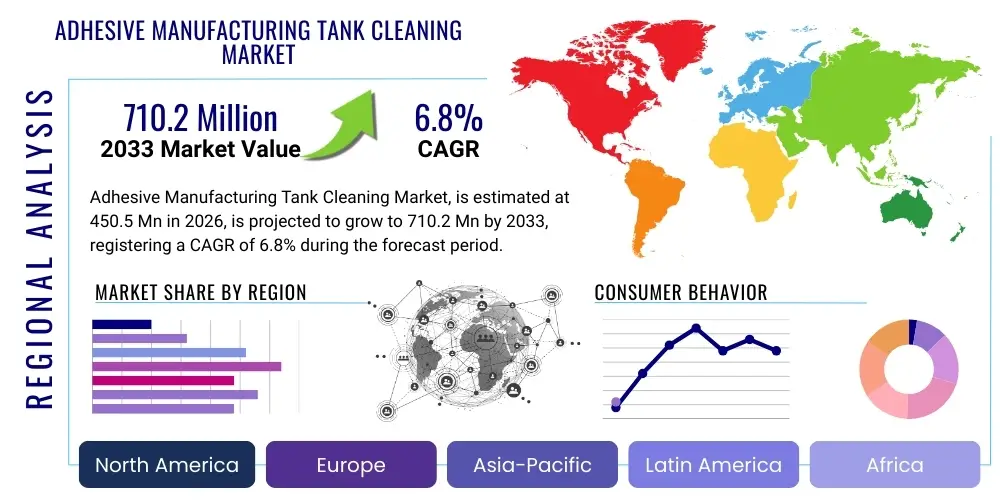

Adhesive Manufacturing Tank Cleaning Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441722 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Adhesive Manufacturing Tank Cleaning Market Size

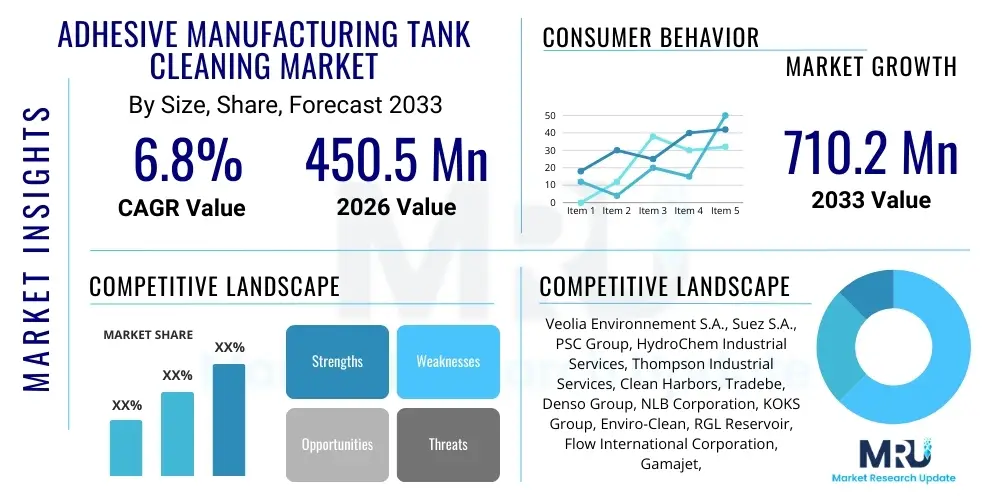

The Adhesive Manufacturing Tank Cleaning Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Adhesive Manufacturing Tank Cleaning Market introduction

The Adhesive Manufacturing Tank Cleaning Market encompasses specialized services, equipment, and chemical solutions designed for the comprehensive cleaning and maintenance of storage and mixing tanks used in the production of various industrial and consumer adhesives, sealants, and coatings. Adhesives, derived from synthetic or natural polymers, often involve highly viscous, temperature-sensitive, and chemically reactive raw materials, resulting in persistent residues (cured or uncured) that necessitate rigorous cleaning protocols. The cleaning process is critical for preventing cross-contamination between batches, maintaining product quality, and ensuring operational efficiency and regulatory compliance, particularly concerning volatile organic compounds (VOCs) and hazardous waste disposal.

The product description spans advanced automated cleaning systems, including Clean-in-Place (CIP) and Clean-out-of-Place (COP) technologies, high-pressure jetting equipment, robotic cleaning mechanisms, and specialized solvent or biodegradable detergent formulations. Major applications are concentrated within sectors requiring high-performance adhesives, such as automotive assembly, aerospace construction, packaging, construction materials, and electronics manufacturing, where purity and consistency of the adhesive product are paramount. The complex nature of adhesive chemistries—ranging from hot melt adhesives (HMA) and pressure-sensitive adhesives (PSA) to reactive polyurethanes and epoxies—drives the demand for customized, effective tank cleaning solutions.

Key benefits of adopting professional tank cleaning services include enhanced production throughput due to reduced downtime, substantial minimization of safety risks associated with manual entry into confined spaces, and strict adherence to environmental and occupational safety regulations (OSHA, EPA, REACH). Driving factors propelling market growth include the rapid expansion of the global packaging and automotive lightweighting industries, which require massive volumes of specialized adhesives, coupled with increasingly stringent quality control standards demanding zero contamination. Furthermore, technological advancements in robotics and high-efficiency, low-solvent cleaning chemicals are making outsourced and automated cleaning solutions economically viable and environmentally preferable compared to traditional manual methods.

Adhesive Manufacturing Tank Cleaning Market Executive Summary

The Adhesive Manufacturing Tank Cleaning Market is characterized by robust growth, driven primarily by globalization of manufacturing supply chains and a heightened focus on automation and industrial safety across the chemical sector. Business trends indicate a strong shift toward digitalization and smart cleaning technologies, incorporating IoT sensors for real-time monitoring of residue levels and optimizing cleaning cycles, thus maximizing asset utilization. There is also a significant trend towards outsourcing tank cleaning operations to specialized vendors who possess expertise in handling diverse hazardous adhesive residues, allowing manufacturers to focus on core production competencies. Furthermore, sustainable practices are reshaping the market, pushing companies to adopt bio-based cleaning agents and closed-loop systems that minimize water usage and chemical waste, attracting environmentally conscious clients.

Regional trends reveal that Asia Pacific (APAC) is the dominant and fastest-growing region, fueled by the massive expansion of automotive, electronics, and packaging manufacturing hubs in China, India, and Southeast Asia, leading to soaring demand for large-scale adhesive production facilities. North America and Europe maintain high market value, characterized by strict regulatory frameworks necessitating advanced, compliant cleaning procedures, driving innovation in automated and environmentally responsible cleaning solutions. The mature markets in the West are focused on retrofitting existing facilities with highly efficient CIP systems and adopting robotics to mitigate labor costs and safety concerns associated with confined space entry.

Segment trends highlight the dominance of the Service segment over the Equipment segment, reflecting the preference for comprehensive, outsourced maintenance contracts. Among adhesive types, the cleaning of tanks handling hot melt adhesives (HMAs) and reactive adhesives (like epoxies and polyurethanes) commands the largest share due to the difficulty in removing highly polymerized and cross-linked residues. The rising complexity of adhesive formulations used in electric vehicle (EV) batteries and structural bonding applications is creating niche, high-value opportunities within the specialized cleaning services segment, requiring tailored chemical and mechanical solutions. This structural evolution underscores the market's trajectory towards specialized, high-tech, and service-intensive operations.

AI Impact Analysis on Adhesive Manufacturing Tank Cleaning Market

Common user questions regarding AI's impact on adhesive tank cleaning often revolve around how artificial intelligence can improve operational efficiency, predict maintenance schedules, and enhance safety protocols, which are historically manual and hazardous processes. Users are keenly interested in the integration of predictive analytics derived from AI algorithms to determine optimal cleaning frequency based on historical batch data, residue composition, and production schedules, moving beyond traditional time-based cleaning. Concerns frequently address the feasibility of deploying machine learning models in environments with complex chemical variability and high data noise, alongside the necessary upfront investment and training required for maintenance staff to manage AI-driven systems. The consensus expectation is that AI will transform tank cleaning from a reactive necessity into a precise, proactive component of the adhesive manufacturing process, significantly reducing unscheduled downtime and improving overall chemical yield.

- AI optimizes scheduling by analyzing production patterns, residue buildup rates, and chemical formulas to initiate cleaning precisely when necessary, maximizing throughput.

- Machine learning algorithms enhance safety by simulating confined space entry scenarios and optimizing robotic cleaning paths, reducing human exposure to hazardous materials.

- Predictive maintenance driven by AI identifies potential equipment failures in pumps, nozzles, and agitation systems within cleaning units, preventing costly breakdowns.

- AI-powered vision systems are used in conjunction with robotics to inspect tanks post-cleaning, verifying cleanliness levels objectively based on image analysis and reducing reliance on subjective visual checks.

- Process optimization through deep learning allows for automated adjustment of cleaning parameters (temperature, flow rate, chemical concentration) for specific adhesive residues, minimizing resource consumption.

DRO & Impact Forces Of Adhesive Manufacturing Tank Cleaning Market

The market is primarily driven by the imperative for stringent quality control in adhesive manufacturing, where even minor contamination can compromise the structural integrity or performance of the final product, especially in critical applications like aerospace and automotive bonding. This quality push is coupled with growing regulatory pressure from bodies like OSHA and the EPA regarding worker safety (confined space entry) and waste management, making highly automated and closed-loop cleaning systems essential. Opportunities lie significantly in developing advanced, biodegradable or highly recyclable solvent alternatives to address increasing environmental concerns and reduce disposal costs associated with hazardous waste. Furthermore, the rising adoption of high-performance and specialty adhesives (e.g., UV-cured or structural acrylics) requires customized cleaning chemistries that conventional methods cannot handle, creating lucrative niches for specialized service providers.

Restraints on market growth include the high initial capital investment required for implementing advanced automated cleaning systems, particularly complex CIP/COP setups, which can be prohibitive for smaller adhesive manufacturers. The technical complexity of dealing with diverse chemical residues, which require unique solvency profiles and temperature parameters for effective removal, presents a continuous challenge for standardization and scaling. Additionally, the operational downtime associated with tank cleaning, regardless of efficiency improvements, still impacts production schedules, incentivizing manufacturers to delay maintenance, which negatively affects the service frequency and market volume.

Impact forces currently shaping the competitive landscape include rapid technological diffusion, particularly in robotics and drone-based inspection, which lowers the cost and risk associated with internal tank inspection. Regulatory impact forces are increasingly driving the switch from solvent-based cleaning to aqueous or bio-based solutions, favoring companies investing heavily in green chemistry R&D. The competitive rivalry is intense among large industrial cleaning service conglomerates and specialized regional firms, focusing on service customization and global footprint expansion. These forces collectively push the market toward advanced, compliant, and efficiency-driven cleaning solutions, transforming a necessary maintenance function into a critical, high-tech service sector.

Segmentation Analysis

The Adhesive Manufacturing Tank Cleaning Market is strategically segmented based on factors crucial to service delivery and technological deployment, ensuring that solutions are tailored to the specific challenges posed by different adhesive types, tank configurations, and operational needs. Key segmentation categories include the Type of Service (Equipment vs. Service), the Type of Adhesive Cleaned (Hot Melt, Water-based, Solvent-based, Reactive), the Cleaning Technology Utilized (CIP, COP, Manual), and the Application Sector (Automotive, Packaging, Construction). This structured approach allows market players to accurately target specific customer needs, for instance, offering specialized robotic solutions for large, complex tanks used for structural epoxy manufacturing in the aerospace sector, or high-volume, continuous CIP solutions for packaging adhesive producers.

The segmentation by cleaning technology is vital, as Clean-in-Place (CIP) systems represent the fastest-growing segment, reflecting the industry's focus on automation, repeatable results, and minimal labor intervention. Conversely, the segmentation by adhesive type clearly delineates the technical difficulty and thus the cost of cleaning; reactive adhesives, once cured, require significantly harsher mechanical or chemical intervention than standard water-based adhesives. Understanding these segments is paramount for developing accurate pricing models and forecasting demand, as environmental regulations differentially impact segments like solvent-based cleaning, pushing manufacturers towards adoption of more expensive, but compliant, aqueous or bio-solvent cleaning methods.

- By Type of Service:

- Equipment (Automated Systems, High-Pressure Washers, Robotics)

- Services (Outsourced Cleaning, Maintenance Contracts, Chemical Supply)

- By Cleaning Technology:

- Clean-in-Place (CIP)

- Clean-out-of-Place (COP)

- Manual/Semi-Automated Cleaning

- By Adhesive Type:

- Hot Melt Adhesives (HMA)

- Water-Based Adhesives

- Solvent-Based Adhesives

- Reactive Adhesives (Epoxy, Polyurethane, Acrylic)

- By Application:

- Packaging

- Automotive & Transportation

- Construction & Infrastructure

- Electronics

- Aerospace & Defense

- Others (Medical, Furniture)

Value Chain Analysis For Adhesive Manufacturing Tank Cleaning Market

The value chain for the Adhesive Manufacturing Tank Cleaning Market begins with upstream suppliers, which include manufacturers of specialized cleaning equipment (pumps, nozzles, robotic components) and providers of advanced cleaning chemistry (solvents, degreasers, biological agents). This upstream phase is critical, as innovations here—such as novel biodegradable solvents or high-efficiency spray nozzles—directly dictate the efficacy and environmental profile of the final cleaning service. Key players often engage in significant R&D to develop proprietary cleaning formulations tailored to specific high-polymer adhesive residues that resist standard detergents. The reliance on sophisticated mechanical and chemical components necessitates strong supplier relationships and rigorous quality control at this initial stage.

The core midstream activity involves the actual provision of tank cleaning services, typically performed by specialized industrial cleaning contractors, engineering firms, or the in-house maintenance departments of large adhesive manufacturers. This stage encompasses the deployment of customized cleaning protocols, including pre-wash, main wash, rinsing, and drying, often integrated into a client's production schedule. Direct channels involve large adhesive producers investing in their own equipment and internal teams (especially for highly proprietary or sensitive formulations), whereas indirect channels involve outsourcing to third-party service providers. Service providers add value through expertise in confined space management, hazardous waste handling, compliance documentation, and rapid response capabilities, minimizing client downtime.

Downstream analysis focuses on the end-users, primarily adhesive manufacturing plants across various sectors (automotive, packaging, construction). The distribution channel for equipment is generally direct or via specialized industrial distributors, while cleaning services are sold directly through contracts and customized service agreements. The efficiency and reliability of the cleaning process directly impact the end-user’s operational KPIs, including batch quality and manufacturing uptime. As environmental scrutiny increases, the downstream preference for service providers utilizing sustainable chemistries and offering certified waste disposal practices dictates purchasing decisions, driving the entire value chain toward sustainable and compliant operations.

Adhesive Manufacturing Tank Cleaning Market Potential Customers

The primary potential customers and end-users of the Adhesive Manufacturing Tank Cleaning Market are large-scale chemical manufacturers that specialize in high-volume production of industrial, structural, and consumer adhesives, sealants, and coatings. These entities operate complex mixing and storage tanks that require regular, thorough cleaning to meet stringent internal quality standards and external regulatory mandates. This customer base spans diverse industrial verticals, making the market resilient to fluctuations in a single sector, though sectors like packaging and automotive remain foundational due to their sheer production scale and the variety of adhesives utilized (from pressure-sensitive to hot melt formulations).

Specific buyer categories include multinational chemical corporations (e.g., those producing acrylics, silicones, and polyurethanes) that often prefer outsourced, contract-based cleaning services to leverage specialized third-party expertise and reduce capital expenditure on non-core equipment. Mid-sized, specialized adhesive formulators, particularly those serving niche markets like aerospace or medical devices, represent high-value customers who demand extremely high levels of cleaning validation and zero residue tolerance, often necessitating the most advanced robotic and CIP technologies. Purchasing decisions are driven not solely by cost but predominantly by compliance assurance, safety track record, minimization of production downtime, and the technical ability of the vendor to handle complex, proprietary chemistries safely and effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environnement S.A., Suez S.A., PSC Group, HydroChem Industrial Services, Thompson Industrial Services, Clean Harbors, Tradebe, Denso Group, NLB Corporation, KOKS Group, Enviro-Clean, RGL Reservoir, Flow International Corporation, Gamajet, Spraying Systems Co., Aqua-Chem, Dynablast, Chem-Star, Vortex Industrial, Tank Tech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adhesive Manufacturing Tank Cleaning Market Key Technology Landscape

The technology landscape of the Adhesive Manufacturing Tank Cleaning Market is rapidly evolving, moving away from rudimentary manual cleaning towards sophisticated automation and chemical innovation. The core technological advancement centers on Clean-in-Place (CIP) systems, which use fixed or rotating spray heads strategically placed inside the tanks to deliver cleaning solutions under high pressure and temperature without the need for disassembly or human entry. Modern CIP systems are integrated with Programmable Logic Controllers (PLCs) and flow meters to ensure precise sequencing, temperature control, and chemical concentration, maximizing cleaning efficacy while minimizing solvent and water consumption. Further refinements include high-impact tank cleaning machines utilizing proprietary nozzle designs that generate powerful, repeatable 360-degree cleaning patterns, essential for tackling highly tenacious cured residues typical of epoxy and polyurethane adhesives.

Robotics and remote operation are increasingly defining the cutting edge of this market, particularly for large storage tanks where confined space hazards are highest. Specialized robotic arms, often mounted on tracks or magnetic wheels, can be deployed remotely to scrape, vacuum, or hydro-blast complex interior surfaces. These robots are frequently equipped with advanced sensors, cameras, and even ultrasonic detectors to assess residual thickness and verify cleanliness status, feeding data back to operators in real time. This technological shift not only enhances worker safety but also dramatically improves the quality consistency of the cleaning process, providing validated results that are crucial for high-specification adhesive manufacturing.

Chemical technology is equally important, witnessing a significant transition towards advanced, environmentally friendly formulations. This includes the development of non-toxic, bio-based solvents, high-performance aqueous degreasers, and phase-transfer catalysts specifically engineered to break down complex polymer chains found in hot melts and reactive resins at lower temperatures. Technologies such as supercritical fluid cleaning, though niche due to high cost, offer residue-free cleaning for ultra-sensitive applications, utilizing CO2 as a solvent substitute. The convergence of hardware automation (robotics, CIP) and green chemistry innovation is the primary technological driver, focused on delivering faster, safer, and more sustainable cleaning solutions to the demanding adhesive manufacturing sector.

Regional Highlights

The market dynamics of adhesive manufacturing tank cleaning are highly heterogeneous across geographies, reflecting variations in industrial activity, regulatory rigor, and technological adoption rates.

- Asia Pacific (APAC): This region dominates the market in terms of volume growth and capacity addition. Countries like China, India, and South Korea are massive manufacturing hubs for automotive, electronics, and packaging sectors, leading to significant investment in new adhesive production plants. The demand is largely driven by rapid industrialization and increasing domestic consumption, although the initial adoption of advanced CIP systems may be slower than in Western economies due to cost considerations.

- North America: Characterized by high compliance standards and a strong focus on worker safety (OSHA regulations), North America represents a mature, high-value market. The region shows robust demand for automated cleaning solutions, robotics, and outsourced services to mitigate confined space risks. Innovation adoption, particularly in AI-driven predictive maintenance and advanced non-hazardous solvents, is highest here.

- Europe: Driven by strict environmental regulations (e.g., REACH), the European market shows a strong preference for sustainable and bio-based cleaning chemistries and closed-loop systems to minimize waste water. Germany, France, and the UK are key markets, emphasizing efficiency and the retrofitting of existing facilities with modern, resource-saving CIP technologies to adhere to EU directives on VOC emissions.

- Latin America (LATAM): The market is emerging, with growth concentrated in industrial centers like Brazil and Mexico. Demand is increasing due to growing automotive assembly and packaging sectors. The market is often cost-sensitive, leading to a mix of manual, semi-automated, and basic high-pressure washing techniques, though modernization is accelerating in compliance-focused multinational operations.

- Middle East and Africa (MEA): Growth is primarily linked to infrastructure development and industrial diversification initiatives, particularly in the UAE and Saudi Arabia. The market for tank cleaning is developing, driven by large petrochemical and construction adhesive producers, often reliant on international service providers for specialized, high-standard cleaning and maintenance contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adhesive Manufacturing Tank Cleaning Market.- Veolia Environnement S.A.

- Suez S.A.

- PSC Group

- HydroChem Industrial Services

- Thompson Industrial Services

- Clean Harbors

- Tradebe

- Denso Group

- NLB Corporation

- KOKS Group

- Enviro-Clean

- RGL Reservoir

- Flow International Corporation

- Gamajet

- Spraying Systems Co.

- Aqua-Chem

- Dynablast

- Chem-Star

- Vortex Industrial

- Tank Tech

Frequently Asked Questions

Analyze common user questions about the Adhesive Manufacturing Tank Cleaning market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Adhesive Manufacturing Tank Cleaning Market?

The market is primarily driven by rigorous quality control requirements in adhesive manufacturing, demanding zero contamination, coupled with increasing regulatory pressure regarding industrial safety (confined space entry) and hazardous waste management, necessitating the adoption of automated cleaning solutions like CIP systems.

How does the cleaning process differ for Hot Melt Adhesives (HMA) versus Reactive Adhesives?

Hot Melt Adhesive cleaning typically relies on thermal methods and specialized solvents to dissolve or melt the residue. Reactive Adhesives (like epoxies or polyurethanes) are much harder to remove once cured and usually require a combination of harsh chemical solvents and aggressive mechanical action, such as high-pressure hydro-blasting or scraping robotics.

What role does automation play in enhancing tank cleaning safety and efficiency?

Automation, particularly through Clean-in-Place (CIP) systems and robotics, eliminates the need for human entry into confined spaces, drastically improving worker safety. Automation also ensures repeatable, validated cleaning cycles, reduces water and chemical consumption, and minimizes production downtime, significantly boosting operational efficiency.

Which geographical region holds the largest market share for tank cleaning services?

The Asia Pacific (APAC) region currently holds the largest market share and exhibits the highest growth rate, driven by the massive expansion of adhesive manufacturing capacity supporting the automotive, electronics, and packaging industries across countries like China and India.

What is the key technological trend impacting future market development?

The most significant trend is the adoption of AI and IoT integration for predictive maintenance and cleaning optimization. AI analyzes historical data to forecast residue buildup and determines the precise time and parameters for cleaning, transitioning the process from reactive scheduling to proactive, resource-efficient management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager