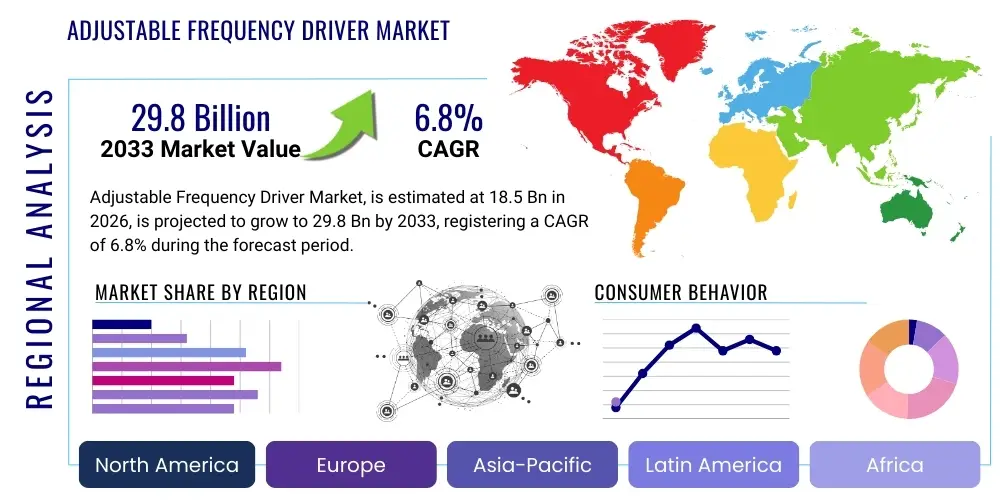

Adjustable Frequency Driver Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441359 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Adjustable Frequency Driver Market Size

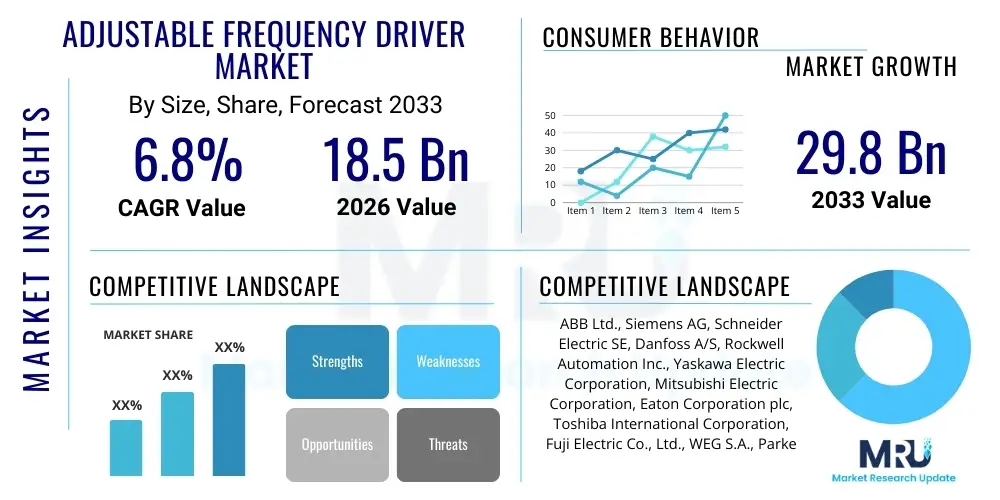

The Adjustable Frequency Driver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033.

Adjustable Frequency Driver Market introduction

The Adjustable Frequency Driver (AFD) Market, often referred to interchangeably with Variable Frequency Drives (VFDs) or inverters, constitutes a critical segment within industrial automation and energy efficiency solutions. An AFD is an electronic device designed to control the speed and torque of an AC motor by varying the frequency and voltage supplied to the motor. This foundational technology is paramount for optimizing energy consumption in industrial processes, as motors, particularly induction motors, consume a significant proportion of global electrical energy. AFDs enable precise control, allowing systems such as pumps, fans, compressors, and conveyors to operate exactly at the speed required for the current process load, rather than running constantly at full speed. This capability not only yields substantial energy savings but also extends the operational life of mechanical equipment by reducing wear and tear.

The core functionality of AFDs involves power electronics, specifically rectifiers and inverters, which convert the incoming AC power to DC, and then invert it back to a variable frequency AC output. Key applications span a vast range of sectors, including HVAC systems in commercial buildings, water and wastewater treatment facilities, oil and gas processing, mining operations, and large-scale manufacturing like cement and pulp & paper. The increasing global focus on sustainability, coupled with stringent governmental regulations concerning energy efficiency, serves as the primary catalyst driving the widespread adoption of AFD technology. Furthermore, the inherent benefits, such as improved process control, reduced maintenance costs, and better power quality management, reinforce their necessity in modern industrial infrastructure.

Driving factors for market expansion include the rapid industrialization across emerging economies, especially in Asia Pacific; the modernization of aging infrastructure in established markets like North America and Europe; and the integration of AFDs with Industrial Internet of Things (IIoT) platforms for predictive maintenance and remote monitoring. The evolution towards medium-voltage and high-power AFDs for heavy industrial applications, alongside the miniaturization and cost reduction of low-voltage drives for smaller systems, broadens the market reach considerably. As industries continue to seek operational excellence and reduced carbon footprints, the Adjustable Frequency Driver market is poised for sustained, robust growth throughout the forecast period.

Adjustable Frequency Driver Market Executive Summary

The Adjustable Frequency Driver (AFD) Market is experiencing significant momentum, primarily propelled by global energy efficiency mandates and the persistent need for operational cost reduction across major industrial verticals. Business trends indicate a strong shift towards intelligent drives equipped with integrated software for diagnostics and seamless communication protocols (like Modbus TCP/IP and EtherNet/IP), facilitating their integration into sophisticated smart factory environments. Major manufacturers are focusing their R&D efforts on developing drives with enhanced reliability, improved power density, and compatibility with various motor types, including synchronous reluctance motors (SynRM) and permanent magnet synchronous motors (PMSM), to address diverse application requirements. Furthermore, competitive strategies are centered on offering comprehensive lifecycle services, including commissioning, maintenance contracts, and advanced optimization algorithms, moving beyond just hardware sales to a full-service business model.

Regionally, the Asia Pacific (APAC) market is forecast to exhibit the fastest growth, largely attributable to massive investments in infrastructure development, rapid urbanization, and the establishment of new manufacturing hubs, particularly in China and India. Europe maintains a strong presence, driven by ambitious decarbonization goals and the necessity to comply with strict EU directives regarding industrial energy performance (e.g., the Energy Efficiency Directive). North America shows steady demand, rooted in the replacement of older, fixed-speed motor systems and substantial adoption in the oil & gas and utilities sectors, focusing on high-horsepower applications. Geopolitical stability and supply chain resilience remain key factors influencing regional market dynamics, pushing companies toward localized manufacturing and sourcing strategies to mitigate risks.

In terms of segment trends, the Low-Voltage AFD segment (up to 690V) dominates the market share due to its wide applicability in commercial HVAC and general manufacturing processes. However, the Medium-Voltage segment (1 kV to 6.6 kV) is projected to experience accelerated growth, driven by expansion in sectors requiring large motor control, such as power generation, mining, and cement processing. By application, the Pumps, Fans, and Compressors category remains the largest consumer of AFD technology, reflecting the vast installed base of these fluid dynamics systems globally. Service revenue, including repair, retrofitting, and cloud-based monitoring services, is also growing faster than hardware sales, reflecting the trend towards digitalization and maintenance optimization within the industrial landscape.

AI Impact Analysis on Adjustable Frequency Driver Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Adjustable Frequency Driver Market frequently center around how AI enhances predictive maintenance, optimizes energy consumption profiles, and improves system integration complexity. Users seek to understand if AI can make traditional PID control obsolete, how machine learning algorithms improve motor fault detection accuracy beyond conventional monitoring, and what the financial justification is for investing in AI-enabled drives versus standard models. Furthermore, there is significant interest in the role of AI in creating truly autonomous industrial processes where AFDs adjust parameters dynamically based on real-time operational feedback, weather conditions, or grid constraints. The consensus theme is that AI represents the evolutionary leap from reactive speed control to proactive, intelligent energy management.

The integration of AI and Machine Learning (ML) algorithms into Adjustable Frequency Drives is fundamentally transforming their operational capabilities, shifting them from simple control mechanisms to highly sophisticated, autonomous system components. AI enables the processing of vast datasets collected from drive parameters (current, voltage, harmonics, temperature) to construct precise operational models. These models allow for advanced anomaly detection, predicting potential motor or drive failures weeks in advance based on subtle deviations from normal operating patterns. This transition from time-based preventative maintenance to condition-based predictive maintenance significantly minimizes downtime, maximizes asset utilization, and reduces unexpected failure costs, a critical value proposition for heavy industrial users.

Beyond diagnostics, AI algorithms are being employed for real-time process optimization. By analyzing historical performance data and current load requirements, AI can dynamically adjust the drive's output frequency and voltage settings to maintain optimal efficiency across varying operational points. This fine-tuning capability often surpasses the optimization achievable through static parameter settings or traditional control loops, leading to tangible additional energy savings—sometimes quantified in double-digit percentages for specific applications like complex pumping networks. Furthermore, AI facilitates seamless integration with broader enterprise resource planning (ERP) systems and cloud platforms, enabling holistic energy management and cross-site performance benchmarking, positioning intelligent AFDs as foundational elements of the next generation of smart manufacturing infrastructure.

- AI enables predictive maintenance by analyzing current harmonics and vibration data to forecast impending motor and drive failures.

- Machine Learning optimizes energy efficiency by dynamically adjusting drive parameters based on real-time load profiles and historical energy usage patterns.

- Improved fault detection accuracy reduces false alarms and targets maintenance interventions precisely.

- AI facilitates enhanced operational autonomy and integration into wider IIoT ecosystems, simplifying remote management and optimization.

- Algorithmic control enhances motor performance across fluctuating loads, improving torque response and stability.

DRO & Impact Forces Of Adjustable Frequency Driver Market

The dynamics of the Adjustable Frequency Driver (AFD) market are heavily influenced by a synergistic interplay of drivers, restraints, and opportunities. The core driver remains the unrelenting global pressure for industrial energy conservation, catalyzed by rising electricity costs and governmental mandates enforcing energy efficiency standards, such as the minimum energy performance standards (MEPS) for motors and related equipment. This push is complemented by the widespread industrial shift toward automation and digitalization, where precise motor control offered by AFDs is essential for complex manufacturing and process control. However, the market faces restraints, predominantly the high initial capital expenditure associated with purchasing and installing medium-voltage and high-power drives, especially for small and medium-sized enterprises (SMEs). Furthermore, the lack of standardized training and technical expertise required for proper drive installation, programming, and maintenance in developing regions poses a significant barrier to faster adoption. Despite these challenges, substantial opportunities exist in the retrofitting of millions of existing fixed-speed motor systems globally, the expansion into specialized markets like renewable energy grid integration (e.g., wind turbine converters), and the continuous technological advancements lowering the cost-performance ratio of low-voltage drives. These factors collectively create a dynamic competitive landscape where efficiency and technological superiority are the primary impact forces.

A detailed examination of the market drivers reveals that the industrial sector's ongoing necessity to comply with strict environmental, social, and governance (ESG) criteria strongly favors AFD adoption. Companies are increasingly reporting on their sustainability metrics, and energy reduction achieved through optimized motor control is a quantifiable and effective metric. Additionally, the rapid development and commercialization of wide-bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN), are enabling the creation of smaller, lighter, and significantly more efficient drives capable of operating at higher temperatures and switching frequencies. This technological leap addresses several historical limitations of traditional silicon-based drives, such as excessive heat generation and size constraints, thereby expanding application possibilities in confined or demanding environments. The economic imperative of reducing operational expenses (OPEX) further accelerates adoption, as the high initial cost of an AFD is rapidly amortized through substantial electricity savings, often achieving payback periods of less than two years in high-usage applications like heavy pumping.

Conversely, market growth is often hampered by the perceived complexity and integration challenges associated with upgrading legacy systems. Many older facilities possess robust, fixed-speed motor control centers (MCCs) which require significant re-engineering and capital outlay to accommodate modern AFD systems. Furthermore, market uncertainty surrounding global economic stability, trade tariffs, and fluctuating commodity prices can temporarily dampen large-scale industrial investment decisions, leading to deferred purchases of high-value equipment like medium-voltage drives. Nonetheless, the most potent opportunities lie in the convergence of AFDs with intelligent networking capabilities (IIoT). Drives that offer advanced onboard diagnostics and cloud connectivity create new revenue streams through subscription-based monitoring and optimization services, fundamentally transforming the traditional hardware sales model into a recurring service relationship, thus maximizing lifetime customer value and solidifying vendor market positions.

Segmentation Analysis

The Adjustable Frequency Driver market is meticulously segmented based on key functional and application characteristics, providing granular insights into market dynamics and growth potential across various industrial spectra. Key segmentation areas include voltage class (low, medium), power range (small, medium, high horsepower), end-user industry (oil & gas, water & wastewater, HVAC, metals & mining), and the type of technology employed (AC drives, DC drives, servo drives). The segmentation by voltage class remains the most impactful determinant of market size and application complexity, with low-voltage drives accounting for the majority of unit shipments due to their ubiquity in general industrial and commercial applications, while medium-voltage drives capture a substantial share of market value due to their higher price points and use in high-power critical infrastructure.

Analysis of the end-user landscape confirms the essential role of AFDs in optimizing utility-intensive operations. The Water & Wastewater Management segment is a foundational pillar of demand, driven by the continuous need to precisely manage pump and blower speeds to match variable flow requirements, achieving immense energy savings in municipal operations. Similarly, the Oil & Gas sector, encompassing upstream, midstream, and downstream activities, relies heavily on medium-voltage drives for critical applications such as pipeline compression and large drilling rigs, where reliability and precise torque control are non-negotiable requirements. The HVAC segment continues its steady growth, supported by the increasing implementation of building automation systems (BAS) in commercial and residential construction, demanding efficient variable air volume (VAV) and fan control systems supplied primarily by low-voltage AFDs. These varied application profiles necessitate specialized drive designs, prompting manufacturers to maintain a diversified product portfolio.

Further segmentation by technology type highlights the dominance of AC drives, particularly utilizing Pulse Width Modulation (PWM) technology, which offers superior power quality and motor control capabilities compared to older control methods. However, the emerging focus is on specialized drives, such as servo drives, which are crucial for high-precision, dynamic applications found in robotics, material handling, and sophisticated machine tools. These technology segments are converging, with advanced sensor-less vector control techniques closing the performance gap between standard AFDs and dedicated servo systems for many applications. This granular segmentation provides a framework for vendors to tailor their marketing and product development strategies, ensuring that performance specifications meet the exact demands of specific industry niches, thereby optimizing market penetration and value capture.

- By Voltage Type: Low Voltage (LV), Medium Voltage (MV)

- By Power Rating: Small (Below 15 kW), Medium (15 kW - 75 kW), High (Above 75 kW)

- By Technology: AC Drives, DC Drives, Servo Drives

- By End-User Industry: Oil & Gas, Water & Wastewater, HVAC, Metals & Mining, Power Generation, Pulp & Paper, Food & Beverage, Others (Textile, Pharmaceutical)

- By Component: Hardware (Inverters, Rectifiers, Control Units), Software & Services

Value Chain Analysis For Adjustable Frequency Driver Market

The value chain for the Adjustable Frequency Driver (AFD) market begins with the upstream supply of specialized raw materials and electronic components, which are crucial for drive manufacturing. Key upstream inputs include sophisticated power semiconductors (IGBTs, MOSFETs, and increasingly SiC/GaN components), microprocessors, capacitors, magnetics, and specialized enclosures. The procurement stage is highly sensitive to global supply chain fluctuations, particularly in the semiconductor market, which directly impacts production costs and lead times. Major drive manufacturers often maintain long-term relationships with Tier 1 semiconductor suppliers to ensure reliable access to critical components. Research and development activities, focusing on improving power density, enhancing control algorithms, and integrating digital communication capabilities, form a significant value-add component at this stage, driving product differentiation and competitive advantage in the highly specialized market environment.

The midstream involves the core manufacturing, assembly, and testing of the AFD units. This stage includes complex processes such as PCB manufacturing, assembly of power modules, integration of cooling systems, and rigorous quality assurance testing to meet international standards (like IEC and UL). Manufacturing scalability, precision engineering, and global logistics capability are vital for market success. For low-voltage drives, production is highly automated to manage large volumes and maintain cost competitiveness. For medium-voltage drives, assembly often involves more customized, project-specific engineering due to the scale and complexity of the components. Effective cost control at this stage, particularly through optimized component sourcing and efficient factory automation, determines the final profitability margins for manufacturers.

The downstream segment encompasses the distribution, installation, and post-sales support, which are critical for customer satisfaction and long-term market penetration. AFDs are primarily distributed through a complex network of authorized distributors, system integrators, and Original Equipment Manufacturers (OEMs). System integrators play a vital role, often bundling AFDs with motors, sensors, and control panels to provide comprehensive solutions tailored to specific industrial processes (e.g., pumping stations). Direct sales channels are typically used for high-value medium-voltage drives or large-scale infrastructure projects where direct technical consultation is required. Post-sales services, including warranty, maintenance contracts, and remote monitoring/diagnostics (often utilizing cloud platforms), are becoming increasingly important revenue streams, offering value through maximizing operational uptime for the end-user.

Adjustable Frequency Driver Market Potential Customers

Potential customers for Adjustable Frequency Drivers span the entire industrial and commercial landscape, unified by the common objective of requiring precise motor control and maximized energy efficiency. The largest concentration of demand originates from operators of heavy rotating equipment, including utilities, municipalities, and large-scale manufacturing conglomerates. Specifically, municipal water and wastewater treatment facilities are perennial major buyers, as AFDs are indispensable for managing the variable flow and pressure demands of pumps, blowers, and aerators, directly translating into massive savings on electricity, which typically constitutes the largest operational cost for these organizations. Similarly, the oil and gas sector, particularly for Electric Submersible Pumps (ESPs) in extraction and large compressors in pipeline transmission, represents a high-value customer base demanding robust, high-reliability medium-voltage drives capable of operating in harsh, remote environments.

Beyond the heavy industrial sectors, commercial building owners and operators, facilitated by HVAC system integrators, represent a rapidly growing customer segment for low-voltage drives. Modern building codes and green building certifications necessitate efficient variable air volume (VAV) systems, utilizing AFDs to modulate fan and pump speeds based on occupancy and temperature setpoints, ensuring optimal climate control with minimal energy waste. Data centers, which require continuous, precisely managed cooling systems, are also significant consumers. The manufacturing sector, including automotive, food and beverage, and metals processing, utilizes AFDs in conveyor systems, mixers, extruders, and machine tools, demanding precise speed and torque control for product quality and throughput optimization. These diverse end-users emphasize that the market for AFDs is highly fragmented yet universally driven by the ROI derived from energy savings and enhanced process stability.

Furthermore, Original Equipment Manufacturers (OEMs) who embed AFDs directly into their machinery constitute a critical indirect customer channel. Manufacturers of specialized machinery, such as industrial fans, industrial pumps, air compressors, and packaging equipment, purchase AFDs in high volume to enhance the efficiency and feature set of their products before they reach the final end-user. This segment requires customized, compact drives designed for seamless integration and specific application profiles. Finally, energy service companies (ESCOs) and engineering consultancies often act as facilitators, procuring AFDs as part of large-scale energy efficiency or retrofitting projects commissioned by governments or large corporations looking to upgrade their legacy motor control infrastructure. These intermediaries focus heavily on the total cost of ownership (TCO) and certified energy performance guarantees when making purchasing decisions, confirming that the customer base is sophisticated and highly sensitive to both technological performance and financial viability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Danfoss A/S, Rockwell Automation Inc., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Eaton Corporation plc, Toshiba International Corporation, Fuji Electric Co., Ltd., WEG S.A., Parker Hannifin Corporation, Delta Electronics, Inc., Hitachi Industrial Equipment Systems Co., Ltd., Vacon Plc (now Danfoss), Emerson Electric Co., Lenze SE, Invertek Drives Ltd., TMEIC Corporation, KEBA AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adjustable Frequency Driver Market Key Technology Landscape

The technology landscape of the Adjustable Frequency Driver (AFD) market is undergoing a fundamental transformation, moving away from legacy control methods towards high-efficiency, digitally-enabled solutions. The most significant technological shift centers on the widespread adoption of advanced semiconductor materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). These Wide-Bandgap (WBG) materials replace traditional silicon-based Insulated Gate Bipolar Transistors (IGBTs), allowing drives to operate at much higher switching frequencies, which dramatically reduces losses, improves energy conversion efficiency, and allows for the design of smaller, lighter drives with superior power density. This reduction in size is critical for space-constrained industrial installations and enhances thermal management capabilities, contributing significantly to device longevity and reliability under stressful operating conditions. The drive towards WBG technology is particularly potent in medium and high-power applications where minimizing system footprint and maximizing efficiency offer the largest operational gains.

In parallel, software and control algorithm advancements are creating "smart drives" that leverage sophisticated control techniques. Field-Oriented Control (FOC) and Direct Torque Control (DTC), which offer highly dynamic and precise control over motor speed and torque, are becoming standard features, enabling AFDs to control complex motor types, including Permanent Magnet Synchronous Motors (PMSM) and Synchronous Reluctance Motors (SynRM), which offer inherent energy efficiency advantages over standard induction motors. The sensor-less vector control technology has matured significantly, reducing the need for costly external sensors while maintaining high control accuracy, simplifying installation and reducing potential failure points. Furthermore, technological focus is intensely centered on power quality; modern AFDs are incorporating Active Front End (AFE) topologies to mitigate harmonic distortion and regenerate energy back into the grid during braking or deceleration cycles, enhancing compliance with increasingly strict utility grid regulations.

The convergence of Operational Technology (OT) and Information Technology (IT) is defining the next generation of AFD technology. Nearly all new high-end drives come equipped with integrated connectivity features, supporting industrial communication protocols such as PROFINET, EtherCAT, and OPC UA. This facilitates seamless integration into Industrial Internet of Things (IIoT) platforms and cloud-based monitoring services. The incorporation of edge computing capabilities allows AFDs to process diagnostic data locally before transmitting only essential information to the cloud, reducing latency and bandwidth requirements. This connectivity supports advanced features like remote parameter tuning, firmware updates, and the deployment of AI-driven optimization algorithms, positioning the AFD not merely as a motor controller but as an intelligent, interconnected asset manager vital for achieving Industry 4.0 objectives across global manufacturing and infrastructure sectors. This digital integration is transforming the competitive landscape, making software features and cyber security paramount considerations for end-users.

Regional Highlights

- Asia Pacific (APAC) Dominance: The APAC region is positioned as the largest and fastest-growing market for Adjustable Frequency Drivers, driven primarily by extensive infrastructure investments and rapid industrialization, particularly in countries like China, India, and Southeast Asian nations. The massive expansion of manufacturing bases, coupled with governmental efforts to improve energy infrastructure and enforce strict energy efficiency standards in sectors like textile, cement, and metal processing, ensures high demand. China, in particular, leads the world in installed industrial capacity, driving both the demand for new equipment and the replacement market for older, inefficient drives. The rising disposable incomes and corresponding growth in commercial real estate also fuel the HVAC segment's demand for low-voltage AFDs.

- North America Market Maturity: North America represents a mature yet highly valuable market, characterized by significant investment in high-power, medium-voltage drives, especially within the Oil & Gas, utilities, and large-scale manufacturing sectors. Market growth here is largely driven by the imperative to upgrade and modernize aging industrial infrastructure (the replacement cycle) and the increasing adoption of AFDs in mission-critical applications where reliability and redundancy are paramount. Stringent environmental regulations and tax incentives for energy-efficient equipment further bolster adoption, promoting the shift towards premium, intelligent drives that offer advanced diagnostics and IIoT capabilities.

- Europe's Sustainability Focus: The European market is heavily influenced by the European Union's ambitious climate goals and energy efficiency directives. The mandatory application of AFDs in many fluid motion control systems (pumps, fans) under various directives ensures a high penetration rate. Germany, Italy, and the Nordic countries are leaders in adopting sophisticated drives for advanced manufacturing, emphasizing drives with low harmonic footprints (AFE technology) and superior energy recovery capabilities. The region is also a key hub for R&D and manufacturing of high-performance drives, driving technological innovation in SiC/GaN components and motor-drive systems integration.

- Latin America's Emerging Potential: Latin America presents significant untapped potential, with growth concentrated in sectors such as mining, water utilities, and agriculture, especially in Brazil and Mexico. The market is increasingly characterized by the need for robust, reliable drives capable of handling inconsistent power quality and harsh environmental conditions often encountered in mining operations. Market expansion is dependent on economic stability and foreign direct investment into industrial modernization projects, driving demand particularly for medium-voltage solutions used in large processing facilities.

- Middle East and Africa (MEA) Investment: The MEA region is experiencing substantial growth tied to diversification efforts away from oil dependence, leading to large infrastructure projects, including water desalination plants, major HVAC installations in megacities, and general industrial expansion. Demand for AFDs is particularly strong in the power generation and water sectors. The inherent complexity and high cost of operating critical infrastructure in extreme heat environments mandate the use of highly efficient and reliable drives, often leading to a preference for globally recognized premium brands that offer comprehensive service and support networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adjustable Frequency Driver Market.- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Danfoss A/S

- Rockwell Automation Inc.

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Toshiba International Corporation

- Fuji Electric Co., Ltd.

- WEG S.A.

- Parker Hannifin Corporation

- Delta Electronics, Inc.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Vacon Plc (now Danfoss)

- Emerson Electric Co.

- Lenze SE

- Invertek Drives Ltd.

- TMEIC Corporation

- KEBA AG

Frequently Asked Questions

Analyze common user questions about the Adjustable Frequency Driver market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Adjustable Frequency Driver (AFD) Market?

The primary factor driving market growth is the global regulatory push for energy efficiency combined with the significant operational cost savings achieved by replacing fixed-speed motor systems. AFDs optimize motor speed to match variable loads, minimizing wasted electricity, which is critical as industrial power costs continue to escalate worldwide and companies seek compliance with energy performance standards.

How do Wide-Bandgap (WBG) semiconductors impact modern Adjustable Frequency Drives?

WBG semiconductors (such as SiC and GaN) fundamentally improve drive performance by allowing higher switching frequencies and reducing power losses compared to traditional silicon IGBTs. This results in AFDs that are smaller, lighter, more energy efficient, capable of handling higher operating temperatures, and offering superior power density, accelerating the deployment of compact and high-performance medium-voltage solutions.

Which end-user segment is the largest consumer of Adjustable Frequency Driver technology globally?

The Water & Wastewater Management and HVAC sectors collectively represent the largest consumer segment. These industries rely heavily on pumps, fans, and blowers, which operate under highly variable load conditions. AFDs are essential for modulating these fluid control systems precisely, ensuring massive energy savings for municipalities and large commercial building operators, thus maximizing market penetration in these critical infrastructure sectors.

What role does AI play in enhancing the functionality of modern Adjustable Frequency Drives?

AI integration transforms AFDs by enabling advanced predictive maintenance capabilities and dynamic process optimization. AI algorithms analyze drive data to forecast potential failures, transitioning maintenance from reactive to proactive. Additionally, AI optimizes control parameters in real-time, achieving energy savings beyond static settings and facilitating deeper integration into Industrial Internet of Things (IIoT) platforms for remote management.

What is the difference in market dynamics between Low-Voltage (LV) and Medium-Voltage (MV) Adjustable Frequency Drives?

Low-Voltage (LV) drives dominate the market volume and unit shipment numbers due to their broad use in general manufacturing and commercial HVAC, focusing on cost-effectiveness and compact size. Medium-Voltage (MV) drives command higher market value per unit, catering to critical, high-horsepower applications in heavy industries like oil & gas, mining, and utilities, where complexity, robustness, and reliability are the primary purchasing criteria.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager