Adult and Pediatric Hemoconcentrators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443094 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Adult and Pediatric Hemoconcentrators Market Size

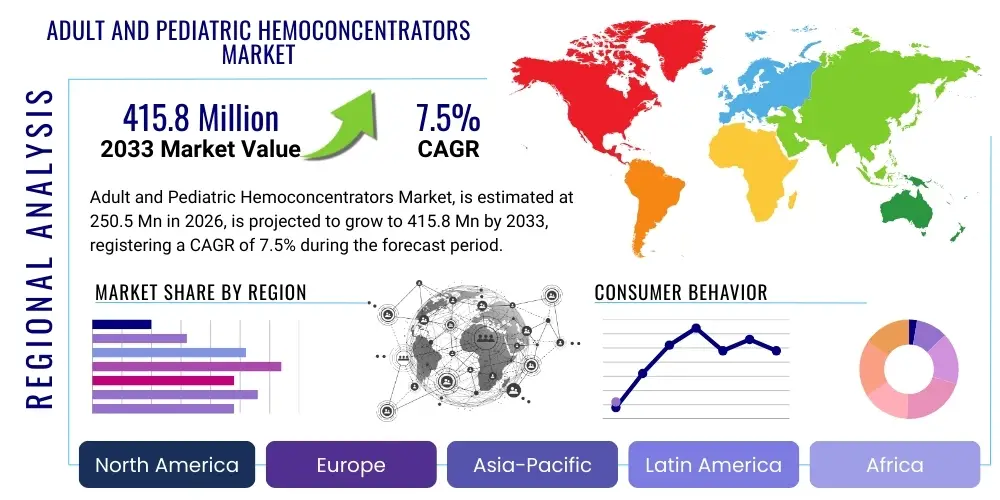

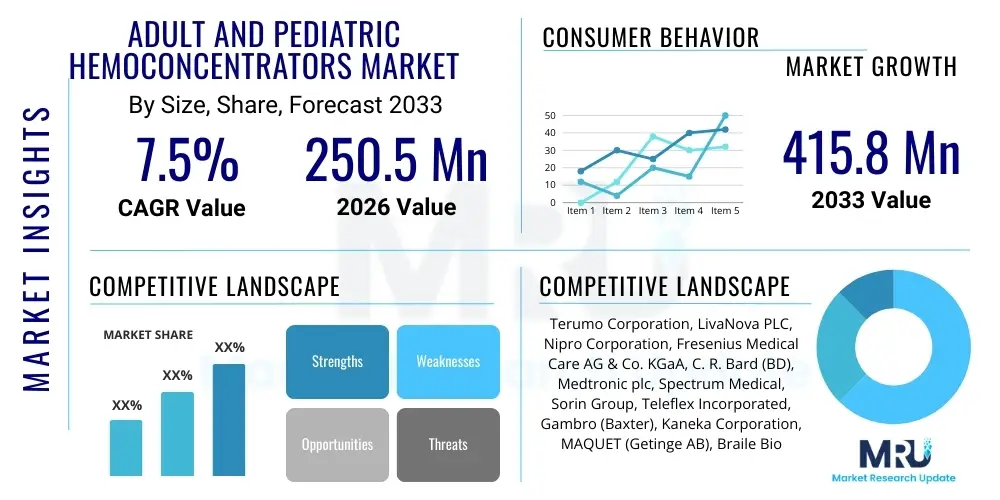

The Adult and Pediatric Hemoconcentrators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $250.5 Million USD in 2026 and is projected to reach $415.8 Million USD by the end of the forecast period in 2033.

Adult and Pediatric Hemoconcentrators Market introduction

The Adult and Pediatric Hemoconcentrators Market encompasses specialized medical devices designed for ultrafiltration during procedures such as cardiopulmonary bypass (CPB) surgery, critical care, and kidney failure treatment. Hemoconcentrators function by removing excess plasma water and low molecular weight solutes from the circulating blood, effectively concentrating the red blood cells (RBCs) and improving hematocrit levels. This process is crucial in minimizing hemodilution associated with CPB prime volume, leading to reduced postoperative blood loss, decreased need for blood transfusions, and overall improved patient outcomes, particularly in vulnerable pediatric populations where small volume changes can be critical. The core technology relies on semi-permeable membranes, typically made of polysulfone or polyethersulfone, optimized for high water permeability and excellent biocompatibility, ensuring efficient removal of unnecessary fluid without compromising essential blood components or triggering a significant inflammatory response.

The primary applications of these devices are centered around cardiac surgical units and intensive care environments. In adult cardiac surgery, hemoconcentration is standard practice to manage fluid overload post-bypass and to conserve packed RBCs. For pediatric patients, especially neonates and infants undergoing complex cardiac repair, hemoconcentrators are indispensable for managing the significantly large prime-to-patient volume ratios inherent in pediatric CPB, aiding in fluid balance restoration and mitigating the risks associated with high transfusion loads. The market growth is inherently tied to the rising global incidence of cardiovascular diseases requiring surgical intervention, coupled with increasing awareness among healthcare professionals regarding the substantial clinical and economic benefits of advanced fluid management strategies and blood conservation protocols.

Key driving factors accelerating the adoption of hemoconcentrators include stringent guidelines promoting blood management strategies, technological advancements leading to miniaturized and more efficient devices suitable for lower-volume circuits, and an increased focus on cost-effectiveness by reducing the utilization of expensive blood products. Furthermore, the development of integrated CPB systems that seamlessly incorporate hemoconcentration capabilities enhances workflow efficiency and reduces complexity for perfusionists. The emphasis on minimizing systemic inflammatory response syndrome (SIRS) post-surgery further positions hemoconcentrators as vital tools in improving patient recovery trajectories across various intensive care settings beyond traditional cardiac surgery.

Adult and Pediatric Hemoconcentrators Market Executive Summary

The Adult and Pediatric Hemoconcentrators Market is poised for substantial growth, driven fundamentally by the escalating volume of complex cardiac surgical procedures worldwide and the critical emphasis on patient blood management (PBM) initiatives. Business trends indicate a strong move toward developing disposable, single-use, high-performance hemoconcentrator systems that offer enhanced safety and reduce the risk of cross-contamination, directly influencing procurement decisions in major hospital networks. Strategic acquisitions and collaborations focusing on integrating hemoconcentration technology into existing cardiopulmonary equipment are common competitive maneuvers, allowing manufacturers to offer comprehensive solutions. The market exhibits a clear demand for products optimized for ultra-low volume requirements, reflecting the increasing prevalence of minimal invasive surgery and tailored pediatric interventions.

Regional trends highlight North America and Europe as dominant revenue contributors, characterized by established healthcare infrastructure, high adoption rates of advanced surgical technologies, and proactive implementation of PBM guidelines. However, the Asia Pacific region is projected to register the fastest CAGR, fueled by massive investments in healthcare infrastructure, rapidly increasing patient pools suffering from chronic heart diseases, and the expansion of specialized surgical centers in developing economies like China and India. Access to advanced perfusion training and the growing affordability of single-use devices are key enabling factors in these emerging markets, shifting the focus from initial cost to long-term clinical utility and improved throughput in cardiac centers.

Segment-specific trends underscore the continued dominance of the adult hemoconcentrator segment due to the sheer volume of coronary artery bypass grafting (CABG) and valve repair surgeries. Nevertheless, the pediatric segment is showing accelerated growth, primarily due to the increasing survival rates of infants with congenital heart defects (CHDs) and the subsequent demand for highly precise, specialized filtration devices that minimize blood manipulation and volume loss. Technology-wise, membrane filtration advancements, particularly regarding pore size homogeneity and biocompatibility of the hollow fibers, remain a crucial area of research and development, aiming to optimize ultrafiltration rates while minimizing platelet activation and protein loss.

AI Impact Analysis on Adult and Pediatric Hemoconcentrators Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize precision fluid management during and after cardiopulmonary bypass, specifically regarding the optimal timing and rate of hemoconcentration. Common concerns revolve around whether AI algorithms can predict patient-specific fluid removal needs, thereby mitigating the risks associated with both over- and under-filtration, and how AI can seamlessly integrate real-time blood parameters (like hematocrit, electrolytes, and plasma volume) to automate adjustments to the hemoconcentrator flow. Key themes emerging from user interest include leveraging machine learning for personalized PBM protocols, enhancing the safety of CPB through predictive monitoring of hemodynamic stability, and automating documentation and decision support for perfusionists. Users expect AI to move hemoconcentration from a protocol-driven process to a truly adaptive, patient-centric intervention, significantly improving resource utilization and clinical outcomes, especially in complex pediatric cases.

- AI-driven Predictive Analytics: Utilizing machine learning models to forecast real-time fluid shifts and patient-specific ultrafiltration requirements during CPB, reducing manual intervention variability.

- Automated Hemodynamic Stabilization: Integration of AI into CPB machines to automatically modulate hemoconcentrator flow rates based on continuous monitoring of cardiac output, blood pressure, and central venous pressure.

- Optimized Transfusion Management: AI algorithms analyzing preoperative patient data and intraoperative fluid removal volumes to predict postoperative transfusion needs with higher accuracy, thereby supporting PBM goals.

- Enhanced Pediatric Care Precision: AI tailoring hemoconcentration parameters to minute physiological variations inherent in neonates, ensuring safer and more precise volume control in low-volume circuits.

- Real-time Data Integration and Decision Support: Providing perfusionists with immediate, synthesized insights from vast datasets (including blood gas analysis, vital signs, and ultrafiltration output) to guide timely adjustment of the device settings.

- Supply Chain and Inventory Forecasting: AI optimizing inventory levels for specialized adult and pediatric disposable hemoconcentrator kits based on surgical scheduling demands and procedural complexity profiles.

DRO & Impact Forces Of Adult and Pediatric Hemoconcentrators Market

The market dynamics for Adult and Pediatric Hemoconcentrators are shaped by a complex interplay of increasing clinical necessity, economic pressures, and technological innovation. The primary driver is the rising global burden of cardiovascular diseases requiring complex surgical management, particularly in aging populations, alongside a simultaneous, critical need for blood conservation strategies to address dwindling blood bank supplies and the known risks associated with allogeneic blood transfusions. These clinical imperatives create a continuous demand floor for effective, reliable hemoconcentration devices. Furthermore, technological progress in membrane design, resulting in devices that offer higher filtration efficiencies and reduced risk of biocompatibility issues, is fueling replacement cycles and new installations in healthcare facilities committed to superior outcomes. Government initiatives and professional society guidelines heavily promoting Patient Blood Management (PBM) protocols act as powerful external catalysts, mandating the use of blood-sparing technologies like hemoconcentrators in standard surgical practice.

However, the market faces significant restraints that slow broader adoption, especially in low-to-middle-income countries. The initial cost of high-quality, single-use hemoconcentration cartridges, coupled with the sophisticated peripheral equipment required for optimal use (perfusion circuits, pumps), represents a substantial capital expenditure hurdle. Furthermore, the market requires highly skilled personnel—certified clinical perfusionists—to operate CPB circuits where these devices are integrated. A shortage of these specialized professionals, particularly in emerging regions, limits the effective deployment and utilization of hemoconcentration technology. Regulatory scrutiny surrounding Class II and Class III medical devices adds complexity and extends the timeline for new product launches, posing a barrier to rapid innovation and market entry.

Opportunities for growth are concentrated in the development of highly integrated, miniaturized systems specifically tailored for neonatal and infant patients, where the current technology still presents significant challenges regarding dead space volume and priming requirements. Another major opportunity lies in expanding the application scope beyond CPB to encompass continuous renal replacement therapy (CRRT) adjuncts in ICU settings for volume management, and leveraging portable systems for remote or emergency cardiac procedures. The impact forces are predominantly driven by technological shifts, where competition centers on improving hollow fiber performance metrics (e.g., Kuf—ultrafiltration coefficient), reducing internal volume, and improving ease of sterile connectivity. Supply chain resilience, particularly the sourcing of specialized biocompatible polymers, is also an impactful force, especially in the context of recent global disruptions, compelling companies to diversify their manufacturing footprints and solidify long-term supplier contracts to ensure stable market delivery.

Segmentation Analysis

The Adult and Pediatric Hemoconcentrators Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse clinical environments and patient needs requiring ultrafiltration. The segmentation by product type typically differentiates between devices designed specifically for adult circuits and those meticulously engineered for low-volume pediatric and neonatal circuits, which require higher precision and minimal extracorporeal volume. Application segmentation highlights the device's utility primarily in critical cardiovascular surgeries utilizing cardiopulmonary bypass (CPB), but also acknowledges growing use in non-CPB settings such as rapid fluid removal in intensive care units (ICU) and general critical care for managing acute fluid overload in post-operative patients. This structured segmentation is vital for manufacturers to tailor their product offerings, sales strategies, and regulatory submissions to specific clinical niches, maximizing both penetration and clinical relevance.

Analyzing the segmentation allows for a precise understanding of market growth vectors. For instance, the demand drivers for adult CPB applications are highly dependent on the incidence of atherosclerotic heart disease and the volume of elective surgeries, whereas the pediatric segment growth is highly sensitive to advancements in diagnosing and treating congenital heart defects. End-user segmentation, primarily hospitals and specialized cardiac centers, reflects where the purchasing power and clinical expertise reside. Hospitals, particularly large academic medical centers, account for the majority of the market share due to their high volume of complex surgeries and dedicated perfusion departments, which necessitates a continuous supply of disposable hemoconcentrators and associated tubing sets. Ambulatory Surgical Centers (ASCs), while minor contributors currently, present a potential opportunity as certain less complex adult cardiac procedures begin migrating to these settings in highly developed healthcare markets.

Further granularity in segmentation often addresses the type of membrane material used, although polysulfone and polyethersulfone dominate the landscape due to their established hemocompatibility and performance profiles. Market participants are continually focusing on optimizing these segments through iterative design improvements, such as enhanced coating technologies to reduce complement activation and protein fouling, which is especially critical in longer duration procedures. Understanding these granular segments helps in forecasting shifts in demand, particularly as technology enables smaller, more efficient devices that blur the lines between traditional adult and pediatric applications, leading toward universal, adaptable hemoconcentrator designs capable of handling a broader range of patient sizes and fluid requirements with superior control.

- By Product Type:

- Adult Hemoconcentrators

- Pediatric Hemoconcentrators

- By Application:

- Cardiopulmonary Bypass (CPB) Procedures (Adult)

- Cardiopulmonary Bypass (CPB) Procedures (Pediatric & Neonatal)

- Critical Care/ICU Fluid Management

- Other Applications (e.g., Hemodialysis Adjuncts)

- By End-User:

- Hospitals (Large-scale Cardiac Centers)

- Specialized Cardiac Clinics

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Adult and Pediatric Hemoconcentrators Market

The value chain for the Adult and Pediatric Hemoconcentrators Market starts robustly with the upstream supply of specialized raw materials. This includes high-grade, highly specialized, biocompatible polymers like polysulfone (PS) and polyethersulfone (PES), essential for the fabrication of the semi-permeable hollow fiber membranes. Manufacturers rely heavily on a specialized cluster of chemical and polymer suppliers, whose expertise in membrane filtration technology determines the performance metrics (e.g., ultrafiltration rate, sieving coefficient) of the final device. Securing consistent quality and supply chain integrity for these critical polymers is paramount, often involving long-term strategic partnerships to mitigate risks associated with material scarcity or price volatility, which can significantly impact manufacturing costs and device pricing strategies. The manufacturing stage itself is highly capital-intensive, requiring cleanroom environments, precision winding and potting techniques to assemble the fiber bundles, and rigorous quality control measures to ensure sterility and integrity of the ultrafiltration unit.

The downstream component of the value chain is dominated by distribution channels that connect manufacturers to the ultimate end-users—hospitals and specialized cardiac centers. Distribution typically follows a hybrid model: direct sales channels are employed for high-volume accounts and specialized academic centers where direct clinical support and technical servicing are required, leveraging highly trained sales representatives and clinical specialists (often perfusion experts) to drive product adoption and training. Indirect distribution involves partnering with major medical device distributors and Group Purchasing Organizations (GPOs), particularly in fragmented markets or regions where local presence is crucial. GPOs play an increasingly significant role in negotiating large volume contracts, influencing hospital procurement decisions based on pricing efficiency and standardization of consumables within their network, thereby streamlining the logistical complexity associated with stocking and managing these disposable devices across multiple hospital systems.

The clinical utilization phase, involving perfusionists and cardiac surgeons, represents the final critical link in the value chain. Feedback from these end-users is crucial for continuous product improvement, driving iterative designs toward enhanced ease of use, better clinical performance, and improved safety profiles, especially concerning pediatric applications. The shift towards disposable hemoconcentrators has simplified the downstream utilization process by eliminating the need for sterilization or reprocessing, though it places consistent pressure on supply chain logistics to maintain uninterrupted availability. Effective training and clinical education programs are integrated into the distribution model, ensuring that the hemoconcentrators are used optimally according to standardized Patient Blood Management protocols, thereby maximizing the perceived value and driving recurring purchase orders for the consumables.

Adult and Pediatric Hemoconcentrators Market Potential Customers

The primary and most significant potential customers for Adult and Pediatric Hemoconcentrators are institutions that perform high-acuity cardiovascular procedures, namely cardiac surgical departments within large general hospitals and specialized, standalone cardiac care centers. Within these institutions, the purchasing decisions and usage are heavily influenced by clinical perfusionists, who are the direct users and technical experts responsible for managing the cardiopulmonary bypass circuit and related blood handling devices. Cardiac surgeons and intensivists also play a key role, setting clinical protocols and advocating for technologies that demonstrably improve post-operative recovery, reduce transfusion rates, and manage fluid balance effectively in complex patients, making them essential decision influencers.

A rapidly growing segment of potential customers includes specialized Pediatric Intensive Care Units (PICUs) and Neonatal Intensive Care Units (NICUs) that manage congenital heart defect (CHD) patients, both pre- and post-surgery. These units require pediatric-specific hemoconcentrators characterized by extremely low priming volumes and high precision to handle the minute blood volumes involved in these delicate procedures. As diagnosis and surgical capabilities for CHD improve globally, the demand from these specialized pediatric centers is accelerating, shifting procurement focus towards smaller, more specialized device inventories capable of handling the entire spectrum of pediatric patient sizes, from preterm neonates to adolescents.

Furthermore, critical care units (CCUs) treating patients with acute kidney injury (AKI) or severe sepsis that leads to significant fluid overload are emerging as secondary potential customers. While traditional CRRT devices manage fluid balance, hemoconcentrators can be utilized as effective, rapid adjuncts for isolated ultrafiltration in cases where immediate volume reduction is necessary without requiring full dialysis setup. This broadens the customer base beyond the traditional operating room setting and provides opportunities for manufacturers to penetrate the broader critical care environment with versatile filtration solutions. Strategic targeting of Group Purchasing Organizations (GPOs) remains crucial, as they serve as influential buyers standardizing equipment across vast networks of hospitals, effectively consolidating the purchasing power of numerous potential end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.5 Million USD |

| Market Forecast in 2033 | $415.8 Million USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Terumo Corporation, LivaNova PLC, Nipro Corporation, Fresenius Medical Care AG & Co. KGaA, C. R. Bard (BD), Medtronic plc, Spectrum Medical, Sorin Group, Teleflex Incorporated, Gambro (Baxter), Kaneka Corporation, MAQUET (Getinge AB), Braile Biomedica, CardioFocus, Inc., Haemotex Inc., Medivators Inc. (Cantel Medical), Eurosets, Scitech, Vascular Innovations, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adult and Pediatric Hemoconcentrators Market Key Technology Landscape

The technological landscape of the Adult and Pediatric Hemoconcentrators Market is rapidly evolving, driven primarily by the pursuit of enhanced efficiency, superior hemocompatibility, and reduced device size, which is critical for pediatric applications. Central to this evolution is the refinement of membrane technology. The majority of modern hemoconcentrators utilize hollow fibers crafted from synthetic polymers such as Polysulfone (PS) or Polyethersulfone (PES). Recent advancements focus on optimizing the pore size distribution and the inner diameter of these fibers to achieve maximum ultrafiltration rates (high Kuf value) while rigorously ensuring minimal leakage of essential plasma proteins and maintaining the integrity of platelets and other cellular components. New membrane coatings, often hydrophilic or bio-inert, are being developed to reduce surface activation, thereby lowering the risk of systemic inflammatory response syndrome (SIRS) and potential thrombosis during prolonged use, a factor highly valued in complex, long-duration cardiac procedures.

Another significant technological trend is the drive toward complete integration and standardization within the cardiopulmonary bypass circuit. Modern hemoconcentrators are increasingly designed with features that allow for sterile, quick-connect luer fittings and standardized housing geometries, facilitating seamless integration into pre-assembled, proprietary CPB tubing kits. This shift simplifies the perfusionist's setup process, reduces the risk of connection errors, and minimizes blood air interface exposure. Manufacturers are also focusing on designing systems that require ultra-low priming volumes, making them suitable for the smallest pediatric patients without excessive hemodilution upon initiation. This requires innovative housing design and micro-scale fiber bundles, pushing the limits of current biocompatible polymer processing technologies to manage fluid dynamics effectively within minimal space.

Furthermore, the development of sophisticated monitoring and control systems represents a critical area of innovation. While current devices are passive, future iterations are moving toward semi-automated or closed-loop systems, potentially leveraging microprocessors and AI (as previously discussed) to continuously monitor transmembrane pressure, hematocrit levels, and ultrafiltrate output. These advanced systems aim to provide real-time feedback to the perfusionist, allowing for precise, dynamic adjustment of filtration rates to maintain optimal fluid balance and hematocrit targets throughout the procedure, thereby maximizing the clinical effectiveness of the hemoconcentrator. The relentless focus on reducing manufacturing tolerances and ensuring the highest levels of sterility for disposable units remains a foundational element of the technological competition within this highly specialized medical device sector.

Regional Highlights

North America maintains its leadership position in the Adult and Pediatric Hemoconcentrators Market, primarily due to the region's highly advanced healthcare infrastructure, high per capita healthcare spending, and widespread adoption of stringent clinical guidelines, particularly those related to Patient Blood Management (PBM) implemented by organizations like The Society of Thoracic Surgeons (STS). The U.S. market benefits from robust R&D investment, leading to the rapid uptake of next-generation, high-efficiency, disposable hemoconcentrators. The high volume of complex cardiac surgeries performed annually, coupled with sophisticated reimbursement policies that often favor blood conservation strategies, ensures sustained demand. Key market participants often launch their most innovative products here first, capitalizing on the readiness of academic medical centers to pilot and integrate new technologies.

Europe represents the second-largest market, characterized by standardized surgical procedures across major economies like Germany, the UK, and France, often influenced by harmonized EU medical device regulations. Adoption rates are high, driven by well-established cardiac centers and a culture of emphasizing long-term patient outcomes, where minimizing transfusions is a key performance indicator. While economic pressures can sometimes lead to preference for cost-effective solutions, the demand for specialized pediatric devices remains strong, particularly in centers specializing in congenital heart disease management. Regulatory approval via CE Marking provides a unified pathway, facilitating market entry for both local European manufacturers and international players targeting this sophisticated clinical landscape.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth trajectory throughout the forecast period. This rapid expansion is underpinned by dramatic improvements in healthcare access, significant government investments in establishing specialized cardiac care facilities, and a burgeoning medical tourism sector focused on high-quality, specialized surgeries. Countries such as China, India, and Japan are driving this growth. While Japan and South Korea possess technologically mature markets similar to North America, the vast, underserved populations in China and India are rapidly increasing their capacity for complex cardiac surgery, leading to explosive demand for basic and advanced hemoconcentrator consumables. Challenges remain regarding regulatory fragmentation and the need for comprehensive training of perfusion staff, but the sheer volume potential makes APAC a central strategic focus for global market leaders.

- North America: Dominant market share fueled by high surgical volumes, established PBM protocols, robust R&D spending, and early adoption of premium, disposable hemoconcentrator systems.

- Europe: Mature market with strong clinical standardization; growth driven by standardization directives and a steady demand from specialized congenital heart centers focusing on pediatric interventions.

- Asia Pacific (APAC): Highest CAGR expected, driven by expanding healthcare infrastructure, rising incidence of cardiac diseases, and increasing affordability of advanced medical technologies in densely populated countries.

- Latin America: Moderate growth potential; market expansion constrained by economic instability and variable public health spending, but focused investment in key metropolitan surgical hubs creates localized opportunities.

- Middle East & Africa (MEA): Emerging market; growth tied to investment in high-end medical facilities, particularly in the GCC states, emphasizing quality and modern surgical techniques to attract medical tourists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adult and Pediatric Hemoconcentrators Market.- Terumo Corporation

- LivaNova PLC

- Nipro Corporation

- Fresenius Medical Care AG & Co. KGaA

- C. R. Bard (BD)

- Medtronic plc

- Spectrum Medical

- Sorin Group

- Teleflex Incorporated

- Gambro (Baxter)

- Kaneka Corporation

- MAQUET (Getinge AB)

- Braile Biomedica

- CardioFocus, Inc.

- Haemotex Inc.

- Medivators Inc. (Cantel Medical)

- Eurosets

- Scitech

- Vascular Innovations, Inc.

- Dideco (LivaNova)

Frequently Asked Questions

Analyze common user questions about the Adult and Pediatric Hemoconcentrators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a hemoconcentrator during cardiac surgery?

The primary function of a hemoconcentrator is ultrafiltration—the removal of excess plasma water and low molecular weight solutes from the blood during cardiopulmonary bypass (CPB) or in the immediate post-operative phase. This process effectively concentrates the patient's red blood cells, raises the hematocrit level, and helps manage fluid balance, minimizing the need for allogeneic blood transfusions.

Why are pediatric hemoconcentrators distinct from adult devices?

Pediatric hemoconcentrators are critical because they are specifically engineered for minimal priming volume and internal dead space. Given the small absolute blood volume in infants and neonates, the device must minimize the volume of blood held outside the patient's body to prevent severe hemodilution and maintain precise volume control essential for safe, effective pediatric cardiac surgery.

Which technological factors are driving innovation in the hemoconcentrators market?

Key technological factors driving innovation include the development of advanced biocompatible membrane materials (e.g., optimized Polysulfone/Polyethersulfone) for higher ultrafiltration efficiency (Kuf), minimization of device size to reduce priming volume, and the integration of these devices into disposable, sterile, and user-friendly CPB circuit kits to enhance safety and workflow efficiency.

What is the main driver of market growth in the Asia Pacific region (APAC)?

The main driver of market growth in APAC is the massive expansion and modernization of healthcare infrastructure, coupled with the rising incidence of cardiovascular diseases linked to an aging population and lifestyle changes. Increased healthcare expenditure and government focus on specialized surgical centers are enabling higher adoption rates of these advanced fluid management tools.

How does the use of hemoconcentrators support Patient Blood Management (PBM) initiatives?

Hemoconcentrators are foundational to PBM by efficiently reducing hemodilution caused by the CPB prime solution, thereby increasing the patient’s hematocrit concentration at the end of the procedure. This strategic fluid management directly lowers the clinical threshold and need for administering donor blood products, significantly improving clinical outcomes and reducing associated transfusion risks and costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager