Adult Incontinence Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441997 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Adult Incontinence Products Market Size

The Adult Incontinence Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 26.0 Billion by the end of the forecast period in 2033.

Adult Incontinence Products Market introduction

The Adult Incontinence Products Market encompasses a wide range of absorbent and protective solutions designed for individuals experiencing involuntary leakage of urine or feces. These essential hygiene products include adult diapers, protective pull-up underwear, shaped pads, bed liners, and other supplementary containment items aimed critically at enhancing the quality of life, maintaining stringent hygiene standards, and preserving the dignity of the users globally. The necessity of these sophisticated products is fundamentally driven by the global demographic shift toward an unprecedented aging population, given that the prevalence of urinary and fecal incontinence increases exponentially with age. Beyond senescence, various chronic medical conditions such as severe mobility limitations, neurological disorders (e.g., advanced dementia, spinal cord injuries), poorly managed diabetes, prostate issues, and complications arising from major pelvic surgeries contribute substantially to the foundational demand base for effective containment solutions. The market serves a critical function, bridging the gap between clinical necessity and social participation for millions of individuals.

The core product offerings are continually being refined and segmented based on multiple technical parameters: absorbency levels (ranging from light protection for stress incontinence to severe/overnight capacity), material composition (with an increasing emphasis on breathable, textile-like back sheets and environmentally sustainable inputs), and ergonomic design specific to user mobility and gender. The market is increasingly characterized by rapid ongoing innovation, particularly in developing thinner, more discreet, and exceptionally high-performing absorbent core technologies, often leveraging advanced superabsorbent polymers (SAPs) that can lock away high volumes of fluid rapidly while neutralizing odors. Major applications span both acute and chronic institutional care settings, including high-dependency units in hospitals, dedicated geriatric nursing homes, and long-term residential care facilities, alongside rapidly increasing consumption within the private home healthcare and self-care segments. The professionalization of geriatric care, coupled with an imperative emphasis on patient comfort, skin health maintenance, and reducing caregiver burden, are pivotal factors shaping current product development and marketing trajectories within this highly competitive global landscape, favoring products with high retention capacity and skin-friendly features.

The primary, multi-faceted benefits derived from the consistent use of modern adult incontinence products include superior effective moisture management, critical odor control, proactive skin protection against moisture-associated dermatitis (MASD) and pressure ulcers, and, most importantly, restoration of psychological comfort, social confidence, and mobility for the user. These benefits directly translate into reduced morbidity and improved overall well-being. Key driving factors accelerating market expansion include the substantial rise in global health expenditure allocated to geriatric care, improved public and professional awareness regarding effective incontinence management (shifting away from viewing it as an inevitable part of aging), improved product accessibility through discreet e-commerce channels, and the growing incidence of chronic, lifestyle-related diseases that predispose individuals to bladder or bowel control issues. These confluence of pervasive demographic and clinical factors ensures a steady, essential, and increasingly sophisticated demand curve for adult incontinence solutions across both developed and emerging economies alike, positioning the market as fundamentally robust and resilient even amidst broader economic fluctuations.

Adult Incontinence Products Market Executive Summary

The global Adult Incontinence Products Market is experiencing sustained high growth, propelled fundamentally by irresistible global demographic shifts, primarily the accelerated increase in the geriatric population across all major continents. Current business trends emphatically indicate a strong movement towards product premiumization; consumers are now demonstrating a clear willingness to pay more for solutions offering enhanced levels of discretion, superior comfort, and sophisticated, value-added features such as integrated wetness indicators, advanced leak guards, and effective odor neutralization systems. In response, leading global manufacturers are aggressively focusing significant portions of their research and development budgets on twin imperatives: achieving sustainability goals, specifically integrating bio-based, biodegradable components and optimizing material utilization, while simultaneously perfecting supply chain efficiencies to successfully manage the recurring volatility in key raw material costs, such such as high-purity fluff pulp and superabsorbent polymers. Strategic mergers and acquisitions remain a consistent, high-impact strategy among major companies, aiming to consolidate fragmented market share, rapidly gain access to specialized textile and core technologies, and crucially, expand their geographical penetration, particularly targeting the vast, untapped high-growth potential markets situated throughout the Asia Pacific region.

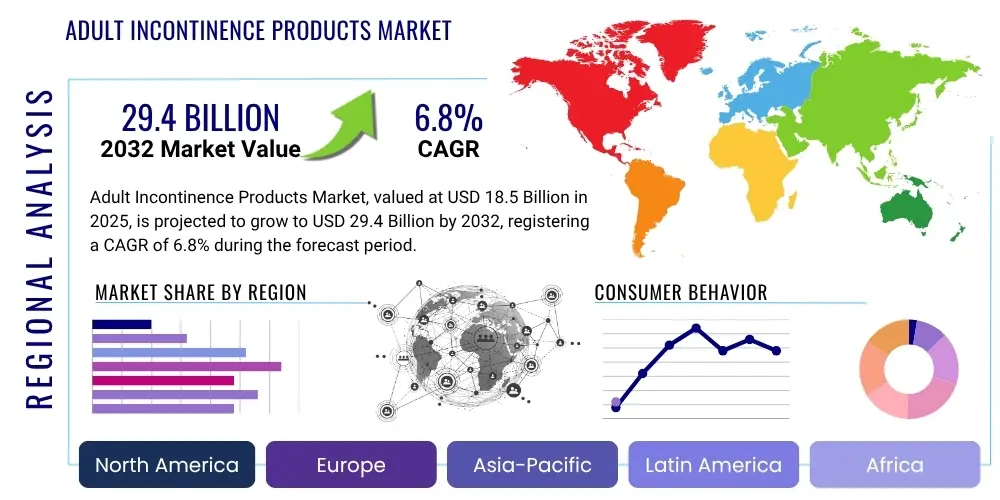

From a geographical perspective, the regions of North America and Western Europe currently maintain a combined dominance over the market in terms of absolute revenue, a position underpinned by their long-established, sophisticated healthcare infrastructure, exceptionally high consumer awareness levels resulting from decades of public health campaigning, and significantly large elderly populations with high purchasing power. However, intensive analysis suggests that the Asia Pacific (APAC) region is unequivocally forecast to register the steepest and fastest growth rate throughout the entire projection period. This accelerated projected expansion is primarily attributed to rising average disposable incomes across major economies, increasingly widespread access to modern, quality healthcare facilities, and a gradual but profound shift in long-held cultural perceptions, moving away from viewing the use of incontinence aids with stigma towards recognizing them as necessary health and wellness tools. Furthermore, governmental bodies and regional health ministries in many rapidly developing nations are belatedly but actively recognizing the urgent need for codified, high-standard geriatric care, which in turn acts as a powerful indirect stimulus, substantially boosting institutional demand for high-quality, clinical-grade incontinence products in bulk volumes.

A detailed segmentation analysis consistently reveals that the disposable products category—comprising pads, liners, and sophisticated disposable protective underwear—firmly retains the largest market share by value, driven by overwhelming convenience, operational cleanliness, and universal acceptance in all professional clinical settings. Nevertheless, the reusable products segment, while currently possessing a significantly smaller total market footprint, is experiencing accelerating interest and traction, primarily driven by heightened global environmental consciousness, reinforced by the compelling cost-effectiveness advantage it offers in long-term, continuous care settings. When analyzing the end-user segmentation, the home care setting is notably expanding at a rapid pace, directly reflecting the broader global healthcare paradigm shift towards de-institutionalization, promoting ‘aging-in-place’ models, and favoring personalized home health services. This macro-trend creates a compelling requirement for manufacturers to offer products optimized for retail purchase, ease of use by non-professional caregivers, and robust integration with discreet subscription-based delivery models. Technological advancements focusing on 'smart' incontinence solutions, which incorporate sophisticated sensor technology to accurately predict leakage events or monitor saturated capacity, represent a future market disruptor, poised to revolutionize patient care monitoring, drastically improve product efficiency, and offer significant opportunities for highly differentiated and value-added market offerings.

AI Impact Analysis on Adult Incontinence Products Market

User interest regarding AI in the Adult Incontinence Products Market centers primarily on leveraging artificial intelligence for enhanced patient monitoring, personalized product recommendations, and optimized inventory management in high-volume healthcare facilities. Common questions and expectations revolve around the practical use of smart, flexible sensors integrated seamlessly into protective products for instantaneous, real-time wetness detection, thereby allowing for the accurate prediction of potential skin integrity risks and significantly reducing the labor-intensive frequency of unnecessary checks conducted by nursing and care staff. Consumers and caregivers are also intensely keen to understand precisely how advanced AI algorithms can accurately personalize absorbency levels, product geometry, and sizing specifications based on individual patient physiological data, unique chronic conditions, established consumption patterns, and dynamic mobility levels. Additionally, supply chain stakeholders, particularly large-scale geriatric care organizations, are actively inquiring about the deployment of robust AI-driven demand forecasting systems to accurately predict usage spikes, minimize product waste and obsolescence, and ensure the reliable, timely delivery of these essential, life-sustaining supplies, thereby optimizing logistics and reducing operational overhead. The critical, unifying theme across all stakeholders is the rapid application of AI and machine learning capabilities to fundamentally transition incontinence care management from a traditionally reactive, generalized service model to a highly proactive, streamlined, exceptionally efficient, and deeply personalized patient-centric solution.

AI's profound influence extends deeply into optimizing the highly complex and material-sensitive manufacturing process itself, enhancing both quality and sustainability metrics. Advanced Machine Learning (ML) algorithms are being rigorously applied to high-speed quality control systems, utilizing sophisticated computer vision and anomaly detection techniques to identify minute material defects, inconsistent bonding, or structural flaws in production lines with substantially higher accuracy, speed, and consistency compared to traditional human inspection methods. This systematic implementation of AI ensures consistent, clinical-grade product reliability and performance across massive production batches. Furthermore, AI is becoming indispensable in analyzing vast, multidimensional datasets related to clinical outcomes, comparative product performance, and user feedback, helping manufacturers to precisely identify specific material compositions, ergonomic properties, or distinct product design features that statistically correlate with superior skin health indicators, reduced leakage events, and significantly higher measured patient satisfaction rates. This data-driven, rapid product refinement cycle allows global companies to quickly develop and introduce high-performance, validated products that are meticulously tailored to meet highly specific, niche needs within the diverse geriatric and chronic patient populations, thereby profoundly accelerating the speed and relevance of innovation in this traditionally conservative hygiene sector.

In the crucial domain of patient interaction, purchasing discretion, and distribution efficacy, AI-powered conversational chatbots and sophisticated virtual assistants are increasingly being strategically deployed to provide instantaneous, confidential, and highly empathetic consultation for potential buyers who might be navigating sensitive product choices. These digital tools accurately guide users through the complex product differentiation matrix, recommending appropriate solutions based on the reported severity level, specific lifestyle considerations, and overall mobility. This application of AI not only significantly improves the speed and quality of customer service delivery but also effectively addresses and mitigates the psychological and social sensitivity often strongly associated with the public purchasing or discussion of incontinence products. Overall, the integration of AI technology is functioning as a powerful, multi-pronged catalyst for achieving unprecedented levels of operational efficiency, true patient personalization, and continuous operational excellence across the entire value chain. This ensures that the market structure evolves sustainably towards offering technologically smarter, materially safer, highly sustainable, and ultimately more profoundly patient-centric incontinence solutions, thereby fundamentally and significantly enhancing the overall value proposition of modern adult incontinence aids.

- Implementation of smart sensors and IoT devices in products for real-time leakage detection and automated alerting.

- AI-driven predictive analytics for accurately forecasting individual patient usage needs and optimizing efficient changing schedules in high-volume institutional settings.

- Machine learning optimization of global supply chain logistics, precise inventory management, and demand forecasting, significantly reducing material waste and preventing stockouts.

- Personalized product recommendation engines developed for consumers, leveraging clinical profiles, severity indicators, and lifestyle data for optimal selection.

- Enhanced manufacturing quality control utilizing advanced computer vision and AI algorithms to instantly detect minute material flaws and assembly inconsistencies.

- Development of sophisticated AI models to analyze microclimate and skin health data, providing predictive insights to anticipate and mitigate the risk of moisture-associated skin damage (MASD).

DRO & Impact Forces Of Adult Incontinence Products Market

The operational dynamics of the Adult Incontinence Products Market are fundamentally defined by a powerful and complex interplay between strong market drivers (D), persistent and sensitive market restraints (R), and compelling structural opportunities (O), all of which are continuously molded by overarching macro-economic and demographic impact forces. Chief among the key market drivers is the unstoppable, exponential increase in the global elderly population (the 65+ demographic), which directly and inevitably raises the statistical prevalence of all forms of incontinence. This is coupled with a much greater societal and professional healthcare awareness and acceptance, successfully transitioning these products from specialty items to recognized, essential medical aids. Crucially, simultaneous technological advancements, such as the introduction of significantly highly absorbent core materials, enhanced textile breathability, and the practical integration of sophisticated smart sensor technology (IoT integration), continually refresh consumer interest, improve product efficacy, and encourage broader product adoption across diverse user groups, including younger individuals with chronic conditions. Furthermore, supportive government initiatives focusing on subsidized geriatric care and clearer reimbursement policies in developed economies consistently strengthen and solidify the underlying demand base, ensuring the market's trajectory remains stable and predictable throughout the forecast period.

Conversely, the robust market expansion encounters several enduring restraining forces that must be strategically mitigated. The pervasive social and cultural stigma still strongly associated with incontinence and the subsequent need to use containment products remains a significant psychological and purchasing barrier in many social and cultural settings, frequently leading to delays in seeking formal diagnosis, product adoption hesitation, and inconsistent usage. Financial constraints and pervasive cost sensitivity, particularly evident in low and middle-income regions or for individual consumers requiring expensive long-term daily usage, actively limit the widespread adoption and retention of premium, high-performance product lines. Additionally, the significant environmental impact of disposable hygiene products poses an intensifying regulatory and ethical consumer concern, compelling manufacturers to invest heavily and costly into R&D for more sustainable materials, such as bio-based polymers or compostable elements. Finally, consistent fluctuations and inherent unpredictability in the global commodity pricing for core raw materials, especially high-quality fluff pulp and essential superabsorbent polymers, introduce ongoing operational and profit margin pressures that critically affect the pricing and production strategies across the entire value chain.

The most lucrative opportunities for market penetration and sustained growth stem directly from the burgeoning, untapped demand evident in high-potential emerging economies, where rapid improvements in healthcare access coincide with vast populations entering the elderly demographic bracket for the first time. Moreover, focused innovation and successful commercialization in reusable and certified eco-friendly product lines present a substantial, future-proof growth avenue, perfectly aligning with increasingly mandatory global sustainability mandates and appealing profoundly to the growing segment of environmentally conscious consumers and institutional buyers. Furthermore, strategic market penetration through non-traditional, discreet distribution channels, such as specialized digital health platforms, confidential direct-to-consumer (D2C) models, and highly convenient, personalized subscription services, represents a critical strategic opportunity to capture highly loyal market share. The overall impact forces are adjudged to be universally high; the demand for adult incontinence products is fundamentally driven by irresistible, irreversible demographic mega-trends and possesses a crucial, inelastic nature inherent to essential hygiene and medical products, rendering the market exceptionally resilient despite localized cost pressures or minor societal hurdles, ensuring long-term profitability and stability for core players.

Segmentation Analysis

The Adult Incontinence Products Market is comprehensively segmented based on product type, absorbency level, end-user, and distribution channel, enabling granular analysis of consumer behavior, procurement processes, and specific market trends globally. Product segmentation is crucial as it accurately reflects the widely varying clinical needs of patients, ranging from managing light, occasional leakage using small pads and liners to addressing heavy, severe absorbency requirements handled by highly sophisticated adult diapers (briefs) and ergonomic protective underwear (pull-ups). The classification by absorbency level directly dictates the required product technology, material composition (especially SAP content), and consequently, the unit cost, thus influencing product pricing strategies and application suitability across diverse clinical scenarios. Furthermore, end-user classification effectively distinguishes between institutional demand (hospitals, long-term care facilities) and highly decentralized individual home care, highlighting divergent needs concerning packaging, procurement volume, and essential product preferences, where discretion is highly valued.

The dominant segment by product type remains disposable products due to their unparalleled convenience, guaranteed single-use hygiene, and near-universal acceptance within clinical and professional care settings globally. Within this expansive category, the protective underwear (pull-ups) segment is demonstrably experiencing the most accelerated growth trajectory, primarily driven by their close functional and visual similarity to regular undergarments, which offers markedly superior comfort, user independence, and required discretion for mobile or semi-mobile users compared to the traditional, bulkier taped adult diapers. Analysis of segmentation by end-user consistently shows a rapid, continuous rise in the home care segment, directly reflecting the broader global demographic trend of 'aging-in-place' and the parallel availability of increasingly sophisticated, professional home nursing and health services. This macro-level shift strongly emphasizes the critical need for retail-optimized packaging, highly discreet and easy-to-use products, and robust integration with reliable subscription-based purchasing options, requiring manufacturers to strategically recalibrate their packaging, distribution logistics, and marketing communication efforts away from traditional bulk institutional supply models.

Geographic segmentation remains paramount for strategic market planning, as it accurately differentiates between highly mature markets characterized primarily by replacement demand, high product penetration, and high unit price elasticity (e.g., Western Europe, North America) and high-growth, high-volume emerging markets (e.g., China, India, Brazil) where quickly increasing healthcare accessibility and expanding product awareness are simultaneously fueling exponential rates of first-time usage. Consequently, successful international market strategies must be inherently localized and highly sensitive to regional context, addressing significant variations in average disposable income, culturally specific acceptance levels, and local regulatory frameworks governing medical device classification, product labeling, and mandatory hygiene standards. This rigorously multifaceted segmentation analysis allows all key stakeholders to precisely identify specific, high-potential pockets of structural growth and effectively tailor their research, product development, distribution, and targeted marketing efforts for maximum commercial impact and sustainable long-term success.

- By Product Type:

- Disposable Products (Pads & Liners, Protective Underwear, Adult Diapers/Briefs, Others)

- Reusable Products (Washable Underwear, Reusable Pads, Bed Pads)

- By Absorbency Level:

- Light

- Moderate

- Heavy/Severe

- By End-User:

- Hospitals & Clinics

- Nursing Homes & Long-Term Care Centers

- Home Care

- By Distribution Channel:

- Retail Pharmacies/Drug Stores

- Online Channels (E-commerce)

- Supermarkets & Hypermarkets

- Institutional Sales (Direct Procurement)

Value Chain Analysis For Adult Incontinence Products Market

The value chain for adult incontinence products commences with crucial upstream activities, which fundamentally involve the global sourcing, transportation, and preliminary processing of key raw materials. The primary essential inputs include highly refined fluff pulp (a specialized cellulose fiber), high-performance superabsorbent polymers (SAPs), specialized non-woven fabrics for top sheets, various elastic materials, and industrial-grade adhesives. The entire market structure is critically sensitive to global commodity pricing and the reliable availability of these core materials, particularly high-quality fluff pulp, which frequently faces supply chain volatility due to environmental protection regulations, natural disasters, and geopolitical factors directly impacting global forestry management and processing capacity. Effective, proactive upstream management demands the establishment of robust, long-term supplier relationships, coupled with strategic forward contracts and price hedging mechanisms, specifically designed to mitigate raw material price risk and simultaneously ensure the consistent quality and flow of inputs, as the clinical performance and user safety of the final product depend heavily on the quality and precise quantity of SAPs used for absorption efficiency and overall material breathability.

The midstream segment activities are complex, encompassing high-volume manufacturing, specialized conversion processes, and standardized packaging operations. This stage is notably capital-intensive, requiring substantial investment in highly specialized, automated, high-speed machinery capable of precision assembly of multiple functional layers (including the acquisition, distribution, and absorbent core layers) and the precise, consistent application of ergonomic fasteners, elastic leg cuffs, and anti-leak barriers. Manufacturing innovation at this stage is hyper-focused on achieving two conflicting goals: minimizing the total material usage per unit while aggressively maximizing the product's ultimate absorbency capacity and user comfort profile. Leading manufacturers strategically invest massive resources into perfecting patented core technologies, such as channel formation or micro-bead SAP deployment systems, specifically designed to differentiate their product lines based on performance. Downstream activities, encompassing the highly complex distribution channels, form the final, crucial link to the end-user. Distribution routes are highly varied, consisting of high-volume direct sales to large institutional clients (major hospitals, national nursing home chains) and indirect sales facilitated through large regional retail chains, specialized pharmacies, and, increasingly, specialized e-commerce platforms. The complexity inherent in this segment stems from the necessity for discreet, yet highly efficient, high-volume logistics.

The direct distribution channel is overwhelmingly favored and structurally necessary for institutional sales, where bulk volume purchasing, customized logistical support, and just-in-time delivery schedules are essential operational requirements, typically managed through competitive national tenders and multi-year supply contracts. Conversely, the indirect channel, primarily utilizing global retail stores, pharmacies, and robust online vendors, primarily addresses the vastly diverse needs of the decentralized home care segment and individual consumers. E-commerce platforms are proving to be fundamentally disruptive, offering consumers superior anonymity, highly competitive pricing structures, and convenient, automated subscription models that significantly enhance customer loyalty and retention by ensuring consistent, effortless supply. The accelerating shift towards discreet online purchasing effectively minimizes the significant psychological barrier and social discomfort often associated with buying sensitive incontinence products publicly. Therefore, effective downstream market strategies require not only comprehensive physical shelf placement optimization in traditional retail environments but also massive investment in robust digital marketing, highly sophisticated SEO, and targeted AEO campaigns to aggressively capture high search engine visibility from consumers actively seeking solutions discreetly and confidentially online.

Adult Incontinence Products Market Potential Customers

The primary and largest customer base for adult incontinence products is profoundly diverse but demonstrably centered on the global geriatric population. Individuals aged 65 years and above constitute the single largest segment of consumers, driven overwhelmingly by inevitable age-related physiological changes that statistically increase the risk and prevalence of various forms of urinary or fecal incontinence. This essential demographic segment encompasses two distinct groups: those living actively and independently in their own homes, who require ultra-discreet, flexible, and high-performance products to maintain their active lifestyles; and residents within high-dependency institutional settings, who necessitate heavy-duty, maximum-absorbency protection and products specifically tailored for ease of application and removal by professional caregivers. Furthermore, individuals afflicted with chronic neurological conditions such as advanced Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, and stroke victims represent a critical, high-need end-user group requiring consistently high-absorbency, secure solutions throughout their lengthy, comprehensive care duration.

A secondary, yet rapidly expanding and significant, customer segment encompasses individuals experiencing temporary, event-related, or long-term chronic incontinence resultant from specific medical events, surgical procedures, or underlying health conditions. This segment critically includes women who develop temporary stress incontinence following childbirth or long-term pelvic floor weakness post-menopause; men recovering extensively from complex prostate surgery (e.g., radical prostatectomy); and patients managing severe mobility impairments, poorly controlled diabetes, or high body mass index (obesity), all of which can significantly compromise fundamental bladder and bowel control mechanisms. Healthcare purchasing providers and large institutional buyers, such as national nursing home corporations and regional hospital procurement consortia, function as major primary procurement entities. They engage in purchasing vast bulk volumes, with their decisions meticulously based on stringent criteria including proven clinical efficacy, demonstrated long-term cost-effectiveness, staff preference for ease of use, and overall product reliability and leakage prevention statistics.

Finally, the complex ecosystem of caregivers—both skilled professional staff (nurses, certified aged care staff) and non-professional, dedicated family members—serves as pivotal decision-influencers and, often, the direct purchasers and end-users of the product for the primary patient. Their specific needs are deeply centered around four critical requirements: ease of application and rapid removal, total leakage prevention reliability, superior odor management features, and effective skin health maintenance for the patient to prevent painful MASD. Consequently, successful product design must meticulously cater not only to the comfort, dignity, and primary protection requirements of the end-user but also must rigorously address the logistical requirements, time constraints, and operational efficiency sought by the care provider. Therefore, strategic marketing efforts are increasingly targeting these highly influential intermediary buyers, emphatically emphasizing clinically validated superiority, advanced odor neutralization capabilities, and compelling overall cost-in-use effectiveness calculated over extended periods of time, securing long-term brand loyalty within professional care environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimberly-Clark Corporation, Essity AB, Procter & Gamble (P&G), Ontex Group NV, Unicharm Corporation, First Quality Enterprises Inc., Attends Healthcare Products Inc., Principle Business Enterprises (Drylock Technologies), Medline Industries LP, Coloplast A/S, Domtar Corporation, Kawanoe Zoki Co., Ltd., TZMO SA, Abena A/S, Tranquility Products (PBE), Hollister Incorporated, DSG International, Nobel Hygiene Private Limited, Nippon Paper Industries Co., Ltd., Kao Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adult Incontinence Products Market Key Technology Landscape

The Adult Incontinence Products Market is undergoing a rapid technological evolution, shifting its focus well beyond simple fluid absorbency to integrate complex smart features, utilize advanced material science for superior comfort, and prioritize enhanced environmental sustainability. A foundational technological focus involves the continual refinement and innovative application of Super Absorbent Polymer (SAP) chemistry, aiming for dramatically increased absorption capacity, exceptionally rapid liquid uptake (acquisition speed), and effective fluid distribution across the core. These SAP breakthroughs enable the production of significantly thinner, more flexible, and highly discreet products that do not compromise on severe absorbency requirements, which is crucial for maintaining performance consistency and user dignity. Manufacturers are developing highly sophisticated, multi-layer core structures, featuring specialized acquisition and distribution layers (ADLs) that efficiently manage fluid transfer, preventing pooling and ensuring the rapid sequestration of fluid deep within the core. This complex engineering effectively maintains a continuously dry surface layer, which is critical for proactive skin integrity protection against Moisture-Associated Dermatitis (MASD) and subsequent complications, thereby representing a significant technological step forward in quality-of-life enhancements.

The most genuinely transformative technology infiltrating this sector is the commercialization and integration of Smart Incontinence solutions, underpinned by sophisticated hardware and software derived from the Internet of Things (IoT). These advanced products strategically incorporate ultra-thin, moisture-sensing conductive strips or discreet embedded flexible electronic sensors that establish real-time, wireless communication with a centralized mobile application or a dedicated caregiver alert system via Bluetooth or WiFi networks. This highly granular monitoring technology diligently tracks the product's wetness level, accurately identifies the saturation point, and, in some high-end clinical models, measures the microclimate parameters like temperature and localized humidity within the product environment. This capability empowers clinical settings to transition care protocols radically: moving from inefficient, fixed time-based checking regimes to highly efficient, needs-based changing protocols. This paradigm shift dramatically reduces the overall usage of supplies, minimizes labor expenditure for overburdened nursing home staff, and, most importantly, ensures that patients are changed immediately upon need, significantly elevating overall hygiene standards, comfort, and clinical outcomes. Although currently recognized as a niche, premium segment due to production costs, the smart incontinence market segment is positioned for accelerated commercialization as sensor technology costs decline and usability interfaces become more intuitive and integrated with existing Electronic Health Records (EHR) systems.

Beyond the functional performance and patient monitoring aspects, manufacturing technology is placing immense strategic importance on optimizing production efficiency, minimizing material waste, and achieving ambitious sustainability goals. State-of-the-art automated production lines are now heavily reliant on high-speed robotics and intricate, continuous quality control systems—often enhanced by AI-driven machine vision—to ensure absolute product standard consistency and zero-defect output at extremely high production volumes. Environmentally conscious technologies, such as the innovative use of certified bio-based plastics for outer back sheets, the integration of certified biodegradable materials for core components, and refined processes to maximize the utilization of fluff pulp sourced exclusively from certified sustainable forestry programs, are profoundly defining the future direction of new product development. Leading global corporations are aggressively investing in deep R&D to source viable, cost-effective alternatives to conventional petroleum-based plastics and to further refine reusable fabric technologies that offer military-grade protection and clinical efficacy while drastically reducing consumer contribution to landfill waste. This sustainability push is not merely a marketing trend but a response to stringent European and North American governmental waste management mandates and the strong ethical demand from institutional and eco-conscious consumer groups, driving structural changes across the manufacturing base.

Regional Highlights

A meticulous regional market analysis reveals distinct maturity levels, competitive landscapes, and differential growth drivers across the major geographical segments globally. North America, encompassing the U.S. and Canada, commands a substantial and economically valuable market share, which is principally characterized by exceptionally high consumer per capita expenditure on healthcare, highly sophisticated and accessible healthcare infrastructure, and widespread private and governmental insurance coverage for necessary medical supplies, including incontinence aids. The U.S. market, in particular, is fiercely competitive, dominated by the strategic positioning and robust marketing efforts of major global conglomerates, and consistently demonstrates a strong, established adoption rate of premium, highly discreet, and technologically advanced products, such as protective pull-up underwear offering maximum mobility and minimal profile. The region is a global leader in the rapid uptake and commercial scaling of innovative solutions, including the initial deployment of smart incontinence monitoring products and the full maturity of convenient, confidential direct-to-consumer (D2C) subscription delivery models, effectively capitalizing on high internet penetration and a culture of home-based care for the elderly population over institutionalization.

Europe constitutes another exceptionally mature, high-value, and complex market, with its trajectory fundamentally driven by comprehensive, often universal, healthcare coverage systems across key Western European nations and the highest concentration globally of the population aged 65 and over. Countries such as Germany, the UK, France, and the Nordics possess highly formalized and heavily regulated long-term care systems, which collectively ensure a persistent, high-volume, and non-negotiable institutional demand for clinical-grade products procured through national tendering processes. Importantly, this region exhibits a significantly pronounced and growing preference for demonstrably environmentally friendly and sustainable product formulations, including both highly efficacious reusable items and disposable options utilizing bio-based materials. This trend is consistently reinforced by increasingly stringent European Union environmental waste management directives and exceptionally strong ethical consumer advocacy for corporate sustainability and circular economy principles. The competitive landscape in Europe is notably fragmented, successfully hosting not only the dominant global giants but also numerous strong local and specialized manufacturers who strategically cater to specific national regulatory standards, localized reimbursement schemes, and unique clinical and cultural preferences, necessitating highly tailored product portfolios.

The Asia Pacific (APAC) region is decisively projected to secure the highest Compound Annual Growth Rate (CAGR), distinguishing it as the primary global growth engine for the forecast period. This explosive growth is robustly fueled by massive demographic changes, particularly the accelerating pace of aging in highly populous nations like China, India, and Indonesia, alongside the already established mature market of Japan, which has the world's oldest population profile. While Japan possesses a highly established market with near-universal product penetration and high demand for specialized geriatric care items, the immense emerging markets of China and India are observing exponential volume growth, driven by swiftly increasing public awareness, significant expansions in general healthcare access, and steadily rising household disposable incomes allowing for product affordability. The primary market entry challenge in APAC often revolves around pervasive initial price sensitivity, leading to significant consumption of cost-effective, basic functional solutions; however, the burgeoning and rapidly urbanizing middle class is swiftly transitioning its purchasing behavior to adopt mid-to-high-range and premium products. Successful global manufacturers operating in APAC are strategically focusing on localized product sizing adjustments, highly targeted digital marketing campaigns addressing cultural sensitivities, and optimizing localized manufacturing and supply chains to effectively overcome cultural hesitancy and rapidly penetrate the vast consumer base.

- North America: Dominance in premium segment adoption; high technological integration (smart products); mature subscription service infrastructure and extensive insurance coverage.

- Europe: Driven by aging population and high institutional demand; increasing preference for sustainable and eco-friendly disposable alternatives; adherence to strict environmental regulatory frameworks.

- Asia Pacific (APAC): Highest projected CAGR due to rapid aging in China and India; growing product awareness and improving economic status; intense competition in the value and mid-range segments.

- Latin America (LATAM): Growth driven by expanding healthcare access and urbanization; high sensitivity to pricing; market hindered by economic volatility and underdeveloped geriatric care services.

- Middle East and Africa (MEA): Nascent market characterized by low penetration; growth linked to expanding hospital infrastructure and rising health tourism sectors; low consumer awareness outside major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adult Incontinence Products Market.- Kimberly-Clark Corporation

- Essity AB

- Procter & Gamble (P&G)

- Ontex Group NV

- Unicharm Corporation

- First Quality Enterprises Inc.

- Attends Healthcare Products Inc.

- Principle Business Enterprises (Drylock Technologies)

- Medline Industries LP

- Coloplast A/S

- Domtar Corporation

- Kawanoe Zoki Co., Ltd.

- TZMO SA

- Abena A/S

- Tranquility Products (PBE)

- Hollister Incorporated

- DSG International

- Nobel Hygiene Private Limited

- Nippon Paper Industries Co., Ltd.

- Kao Corporation

Frequently Asked Questions

Analyze common user questions about the Adult Incontinence Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Adult Incontinence Products Market?

The Adult Incontinence Products Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2026 and 2033, driven largely by global demographic aging and enhanced product acceptance across various clinical settings.

Which product segment holds the largest share in the incontinence market?

The disposable products segment, encompassing protective underwear, pads, and adult diapers, currently holds the largest market share due to its superior convenience, guaranteed hygiene, and overwhelming widespread acceptance in institutional care settings worldwide.

How is technology impacting the future of adult incontinence care?

Technology is driving innovation through the development of "smart" incontinence products utilizing integrated IoT sensors for real-time wetness detection, improving patient dignity, optimizing caregiver efficiency, and enhancing preventative skin health monitoring.

Which region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapidly increasing elderly populations in countries like China and India, coupled with improving healthcare infrastructure and rising public awareness of effective incontinence management solutions.

What are the primary challenges limiting market penetration?

The primary challenges include the enduring social stigma associated with incontinence, which often delays product adoption and usage, and the significant cost sensitivity among consumers in developing regions, particularly concerning the necessary long-term purchase commitment for these essential products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Adult Incontinence Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Adult Incontinence Products Market Statistics 2025 Analysis By Application (Health Care, Astronauts, Other), By Type (Adult Diaper, Adult Underpad), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager