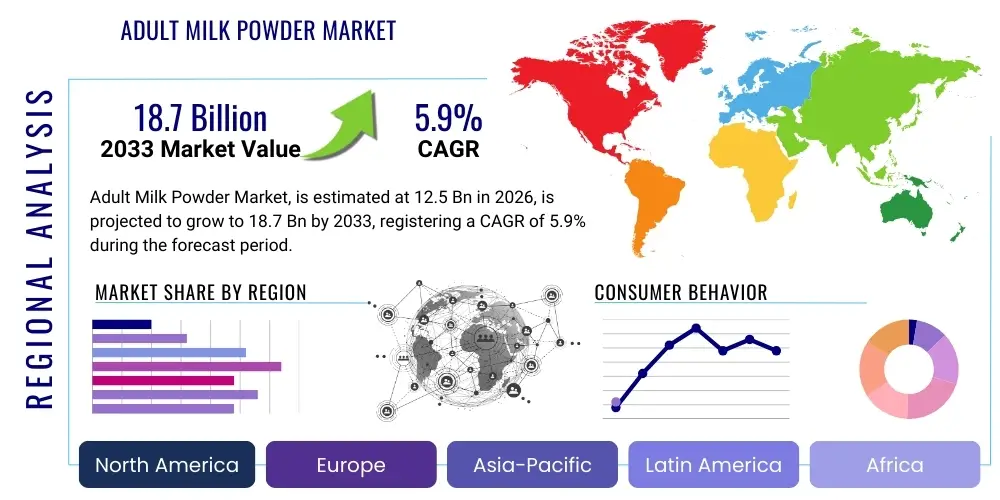

Adult Milk Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442601 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Adult Milk Powder Market Size

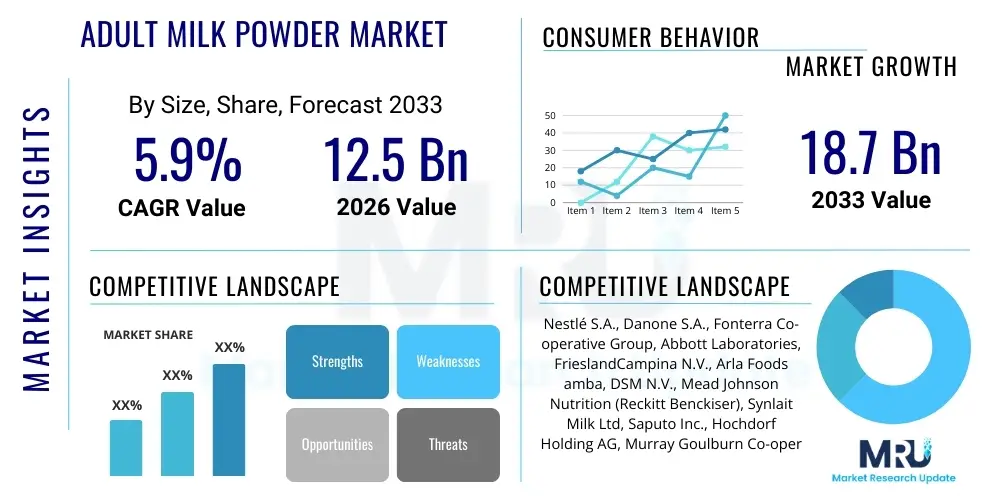

The Adult Milk Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.85% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global demographic shifts, notably the rapid increase in the aging population segment requiring specialized nutritional support, coupled with heightened awareness regarding proactive health management among middle-aged and young adult consumers. Furthermore, the convenience, extended shelf life, and versatility of milk powder formulations compared to liquid dairy products solidify its position as a preferred nutritional supplement in highly urbanized environments where consumption patterns demand efficiency and portability.

Adult Milk Powder Market introduction

The Adult Milk Powder Market encompasses specialized dairy-based formulations designed to meet the unique nutritional requirements of individuals above the age of 18. These products differ significantly from conventional infant or standard household milk powders, often being fortified with functional ingredients such as high levels of protein, calcium, vitamins (especially D and B series), minerals, prebiotics, and probiotics. The product is typically categorized based on fat content (whole or skim) and specialized function, including formulations targeting bone health, muscle recovery, immune support, and energy management, providing a concentrated, stable, and easily digestible source of essential nutrients necessary for adult well-being and mitigating age-related decline.

Major applications of adult milk powder span across general nutritional supplementation, clinical dietetics, and specialized sports nutrition. For general wellness, it serves as a convenient dietary booster for individuals with busy lifestyles or those suffering from insufficient nutrient intake. In clinical settings, fortified milk powders are crucial components of medical nutrition therapy for patients recovering from illness, surgery, or those experiencing malabsorption issues. The driving factors propelling market growth include the global shift towards preventive healthcare, increasing disposable incomes in emerging economies enabling consumers to afford premium fortified products, and significant advancements in processing technologies like microencapsulation that enhance flavor, stability, and bioavailability of sensitive ingredients, making these powders more palatable and effective for consistent adult consumption.

The inherent benefits of adult milk powder, such as its extended shelf life and reduced storage requirements compared to fresh milk, facilitate widespread distribution across diverse geographies, including remote areas. This longevity, coupled with concentrated nutritional content, positions adult milk powder as a highly efficient and economical method of delivering vital micronutrients and macronutrients to large populations. Moreover, the increasing prevalence of lifestyle diseases and the growing understanding of the importance of maintaining muscle mass (sarcopenia prevention) and bone density (osteoporosis prevention) in older adults are critical pillars supporting the sustained demand for specialized, high-quality adult milk powder formulations that address these specific health concerns effectively.

Adult Milk Powder Market Executive Summary

The Adult Milk Powder Market is characterized by robust growth, fueled by several overarching business and demographic trends. Business expansion is primarily observed through intense product innovation, focusing on age-specific needs such as high protein content for older adults and specialized recovery formulas for fitness enthusiasts. Strategic collaborations between dairy producers and nutritional science firms are accelerating the introduction of new functional ingredients, driving premiumization. The market structure remains competitive, with established global players leveraging extensive distribution networks and strong brand recognition, while regional manufacturers capitalize on localized sourcing and adherence to regional dietary preferences, often leading to competitive pricing strategies in high-volume developing markets.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine due to its massive and rapidly aging populations, particularly in China and Japan, coupled with a cultural predisposition toward specialized nutritional supplements. North America and Europe demonstrate mature market characteristics, emphasizing premium, organic, and highly specialized segments, often driven by sophisticated marketing around sports performance and clinically validated health claims. Segmentation trends highlight the dominance of specialized nutrition, particularly products targeting geriatric health (e.g., high calcium, Vitamin D, and HMB), followed closely by the sports nutrition segment which demands high whey or casein protein concentration for muscle synthesis. Distribution channel analysis indicates a significant shift towards e-commerce platforms and specialized health food stores, reflecting changing consumer purchasing behavior favoring convenience and access to detailed product information.

Overall, the market trajectory suggests continued strong investment in research and development to improve flavor profiles and nutrient stability, alongside increasing scrutiny of sustainability practices within the dairy supply chain. Manufacturers are increasingly utilizing digital marketing and consumer data analytics to tailor product offerings and promotional campaigns to highly specific demographic cohorts, optimizing market penetration and maximizing consumer loyalty. The regulatory landscape, while generally supportive, is becoming increasingly stringent regarding health claims, compelling manufacturers to provide rigorous scientific evidence to substantiate the purported benefits of their fortified adult milk powder products.

AI Impact Analysis on Adult Milk Powder Market

Analysis of common user questions regarding AI's impact reveals a strong interest in personalized nutrition, supply chain efficiency, and quality assurance. Users frequently ask how AI can tailor milk powder formulations to individual genetic or lifestyle data, whether AI can predict and prevent supply chain disruptions affecting raw material sourcing, and how machine learning algorithms improve the consistency and safety of the final product. Key themes center around customization, optimization, and the expectation that AI integration will lead to higher quality, more effective, and potentially more affordable nutritional solutions. The consensus expectation is that AI will move the market from mass production towards hyper-personalized consumer health offerings, transforming the interface between manufacturer and consumer.

- AI-driven optimization of dairy farm operations, predicting yield variations and ensuring stable, high-quality raw milk supply.

- Machine learning algorithms utilized for personalized formulation recommendations based on consumer biometric data, health goals, and dietary restrictions.

- Predictive maintenance analytics applied to spray drying and packaging machinery, minimizing downtime and ensuring continuous production efficiency.

- Enhanced quality control through image processing and sensor data analysis, automatically detecting inconsistencies or contaminants in the powder structure.

- Improved consumer engagement via AI-powered chatbots and virtual assistants offering instant advice on product usage and nutritional benefits.

- Optimization of supply chain logistics, using AI to forecast demand fluctuations regionally and reduce inventory holding costs and spoilage risks.

- Development of novel functional ingredients through AI-assisted research and development, accelerating the discovery of synergistic nutritional combinations.

DRO & Impact Forces Of Adult Milk Powder Market

The Adult Milk Powder Market is driven primarily by the escalating demand for convenient, high-protein food sources globally, especially among the burgeoning fitness community and the rapidly expanding cohort of elderly individuals seeking solutions for age-related muscular and skeletal issues. Restraints include the persistent consumer preference for fresh milk in certain traditional markets, coupled with intense competition from plant-based protein powders and nutritional shakes which often appeal to consumers with lactose intolerance or ethical dietary preferences. Significant opportunities exist in the development of highly specific, clinically tested functional formulations (e.g., incorporating ingredients like collagen peptides or specialized fatty acids) and aggressive penetration into untapped rural and semi-urban areas in developing economies where nutritional deficiencies are often high and shelf-stable products are highly valued.

The most potent impact force stems from demographic dynamics, specifically the longevity trend globally, which directly increases the consumer base requiring specialized geriatric nutrition to maintain vitality and prevent chronic conditions. Technological impact forces are also significant, notably advancements in microencapsulation techniques that allow manufacturers to mask the sometimes metallic or chalky flavors associated with high-mineral or vitamin content, thereby improving product adherence and consumer acceptance. Furthermore, regulatory forces, including stricter labeling standards for nutritional claims and mandatory adherence to food safety protocols, necessitate significant investment from manufacturers but ultimately build consumer trust and differentiate premium products.

The market faces pressure from substitution threats, particularly the successful marketing and adoption of nutrient-dense ready-to-drink (RTD) beverages and specialized solid food supplements, requiring milk powder manufacturers to continuously innovate on packaging, convenience, and functional benefits to retain market share. The bargaining power of buyers remains moderate; while large retail chains exert pricing pressure, the specialized nature and perceived health benefits of high-quality adult milk powder formulations allow manufacturers of premium products to maintain relatively stable profit margins, provided they effectively communicate the superior value proposition of their ingredients and production standards.

Segmentation Analysis

The Adult Milk Powder Market is comprehensively segmented across several critical dimensions, including product type, application, distribution channel, and geography, each reflecting distinct consumer needs and market dynamics. This detailed segmentation allows manufacturers to precisely target specific demographic groups with tailored formulations and marketing strategies, moving beyond generic offerings toward specialized nutritional solutions. Segmentation by product type reveals that specialized and fortified variants, particularly those designed for bone health or high-protein muscle support, are gaining significant traction compared to standard whole or skim milk powder, driven by health-conscious consumers and medical recommendations. The application spectrum underscores the duality of market demand, equally strong in the preventive health sector (daily supplementation) and the therapeutic/performance sector (sports and medical nutrition), necessitating diverse product pipelines from leading industry players to capture these varied consumer groups effectively.

Analyzing the market by distribution channel highlights the critical role of modern trade and the accelerating importance of digital platforms. While supermarkets and hypermarkets remain essential for mass consumer reach and impulse buying, the e-commerce segment is experiencing disproportionately high growth, primarily because it offers consumers direct access to niche brands, detailed ingredient information, and peer reviews, crucial factors for purchasing health-related products. Furthermore, the specialized medical channel, including pharmacies and clinical distributors, maintains its importance for prescription-based or physician-recommended nutritional therapies. Geographic segmentation confirms Asia Pacific's volume dominance contrasted with North America and Europe's value dominance, owing to higher average selling prices (ASPs) for specialized and organic certifications in Western markets.

This granular approach to segmentation is vital for future market strategies, enabling precise inventory management, regional flavor profile adaptation, and focused regulatory compliance. For instance, understanding the specific micronutrient deficiencies prevalent in Southeast Asia versus the demand for sustainably sourced, grass-fed dairy products in Western Europe dictates sourcing decisions and marketing spend allocation. The continuous evolution of consumer dietary trends, such as the increasing demand for lactose-free or A2 protein variants within the adult milk powder category, further mandates that companies maintain flexibility and agility in their product development cycles to capitalize on emerging sub-segments effectively before they reach saturation.

- By Product Type:

- Whole Milk Powder

- Skim Milk Powder

- Specialized/Fortified Milk Powder (High Protein, High Calcium, Low Fat)

- Organic Milk Powder

- By Application:

- General Nutritional Supplementation

- Sports and Performance Nutrition

- Medical and Clinical Nutrition

- Weight Management

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online Retail Channels

- Specialty Health Food Stores

- By End User:

- Geriatric Population

- Middle-Aged Adults

- Young Adults/Fitness Enthusiasts

Value Chain Analysis For Adult Milk Powder Market

The value chain for the Adult Milk Powder Market commences with highly specialized upstream activities centered on dairy farming, emphasizing the quality and nutritional profile of the raw milk. Unlike standard dairy production, the raw material for premium adult formulas often requires stringent quality control regarding herd diet, animal welfare, and potential absence of antibiotics or growth hormones, driving up the initial sourcing cost. Processing involves complex, energy-intensive stages such as ultra-filtration, pasteurization, concentration, and finally, spray drying—the critical process that converts liquid milk into a stable powder while preserving essential nutrients. Manufacturers must invest heavily in advanced drying technologies and blending capabilities to incorporate functional ingredients (vitamins, minerals, prebiotics) homogenously before packaging.

The downstream activities involve intricate logistics and distribution channels tailored to the product's classification. Direct channels include specialized e-commerce platforms managed by the brand, allowing for direct-to-consumer relationships and higher margin capture, particularly for niche or personalized formulas. Indirect channels are more voluminous, utilizing extensive networks comprising third-party logistics providers, large-scale retailers (supermarkets), and specialized health distributors (pharmacies/clinics). Effective cold chain management, although less critical than for liquid milk, is still necessary for certain fortified ingredients that may be sensitive to heat and moisture, demanding reliable warehousing and transport logistics throughout the supply chain to maintain product integrity and efficacy until it reaches the end consumer.

The entire chain is heavily influenced by quality assurance and regulatory compliance at every stage. Traceability systems, increasingly incorporating blockchain technology, are becoming essential for verifying the origin and handling of the dairy components, addressing growing consumer demand for transparency and ethical sourcing. The distribution strategy must also account for regional regulatory differences concerning health claims and ingredient limitations, requiring localization of packaging and marketing materials. Optimization of this value chain focuses on reducing the high energy consumption associated with the drying process, ensuring sustainable sourcing practices, and strategically positioning the product through the most trusted channels relevant to the targeted adult demographic (e.g., medical endorsement for clinical nutrition or influencer marketing for sports nutrition).

Adult Milk Powder Market Potential Customers

The core potential customers for the Adult Milk Powder Market are fundamentally segmented based on age, lifestyle, and specific nutritional needs. The most significant demographic driver is the geriatric population (individuals aged 60 and above), who require increased calcium and Vitamin D to combat osteoporosis, high-quality protein to mitigate sarcopenia (muscle loss), and fiber for digestive health. For this group, adult milk powder is perceived not just as a supplement but as a medical necessity or a cornerstone of proactive healthy aging, driving demand for specialized, easily digestible, and often lactose-reduced formulations marketed with clinical backing and doctor recommendation.

A second major segment comprises fitness enthusiasts and athletes (typically young to middle-aged adults). These buyers prioritize high-concentration protein powders (whey or casein) designed for rapid muscle recovery, sustained energy release, and mass building. They are sophisticated consumers, highly informed about ingredient quality, protein efficiency ratios (PER), and amino acid profiles, and they frequently rely on specialized sports nutrition stores or direct-to-consumer online channels for purchase. This segment demands innovation in flavor profiles and functional stacking (e.g., added creatine or BCAAs), pushing the boundaries of traditional dairy-based products toward performance-enhancing supplements.

The third substantial group includes busy urban professionals and individuals with specific dietary challenges, such as recovery from illness, restrictive diets, or poor absorption. For the urban professional, adult milk powder offers a convenient, quick, and complete meal replacement or supplement, fitting into demanding, time-constrained schedules. For those with medical needs, the powder serves as an essential component of clinical nutrition, often mandated by healthcare providers to ensure adequate caloric and nutrient intake during periods of high physiological stress or recovery. Manufacturers target this diversity of buyers through tailored product features, packaging sizes, and distribution strategies that align with the purchasing behaviors and nutritional literacy of each distinct end-user group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.7 Billion |

| Growth Rate | 5.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Fonterra Co-operative Group, Abbott Laboratories, FrieslandCampina N.V., Arla Foods amba, DSM N.V., Mead Johnson Nutrition (Reckitt Benckiser), Synlait Milk Ltd, Saputo Inc., Hochdorf Holding AG, Murray Goulburn Co-operative, Meiji Holdings Co., Ltd., Yili Group, Mengniu Dairy, Gujarat Cooperative Milk Marketing Federation (Amul), Glanbia plc, Kerry Group plc, Bright Food Group, Tatura Milk Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Adult Milk Powder Market Key Technology Landscape

The technological evolution within the Adult Milk Powder Market is primarily focused on optimizing processing efficiency, enhancing nutrient stability, and ensuring rigorous quality control. Spray drying remains the foundational technology, but advancements now emphasize lower temperature and faster drying cycles to minimize thermal degradation of sensitive ingredients like certain vitamins, probiotics, and functional peptides. Next-generation spray drying techniques, including variations like fluid bed drying post-spray drying, are being adopted to achieve highly uniform particle size distribution, which significantly impacts the solubility and mixability of the final powder—a crucial consumer quality metric, especially for fortified products consumed as beverages.

Microencapsulation technology represents a critical advancement, essential for incorporating highly sensitive or taste-challenging functional ingredients, such as omega-3 fatty acids, certain minerals (iron), and probiotics, into the milk powder matrix without compromising their efficacy or flavor profile. This technology protects the active ingredients from oxidation and heat degradation during processing and storage, ensuring they are delivered effectively upon consumption. Furthermore, advanced analytical instrumentation, including near-infrared (NIR) spectroscopy and hyper-spectral imaging, is increasingly being integrated into production lines for real-time quality assurance, allowing manufacturers to instantly monitor moisture content, fat levels, and protein concentration across large batches, ensuring strict compliance with nutritional claims on the packaging.

Beyond processing, digital technologies are playing a transformative role. The adoption of specialized Enterprise Resource Planning (ERP) systems combined with IoT sensors in the manufacturing environment facilitates unprecedented levels of process automation and data collection, allowing for predictive maintenance and highly efficient batch tracking. Moreover, the integration of blockchain technology is beginning to establish verifiable traceability records from the dairy farm to the consumer. This transparency addresses consumer concerns regarding ethical sourcing, organic status verification, and food safety, providing a competitive edge for premium brands by offering immutable proof of origin and processing standards throughout the adult milk powder supply chain.

Regional Highlights

The global consumption and production patterns for the Adult Milk Powder Market are highly diversified, reflecting varying demographic structures, income levels, and cultural attitudes toward dietary supplementation.

- Asia Pacific (APAC): Dominates the market volume and exhibits the highest growth rate. This region is driven by rapidly expanding economies, a massive and growing aging population (especially in China, Japan, and South Korea), and a cultural acceptance of nutritional supplements. High levels of urbanization and increasing disposable incomes in countries like India and Indonesia further boost the demand for convenient, shelf-stable, and fortified products targeting bone health and general vitality.

- North America: Characterized by maturity and high value, focusing heavily on specialized segments like sports nutrition (high-protein powders) and clinically regulated medical nutrition. Consumers here demand premiumization, organic certification, clean labels, and specialized claims, driving higher Average Selling Prices (ASPs). The market is highly innovative, with strong penetration of e-commerce channels.

- Europe: Similar to North America, the European market emphasizes quality, sustainability, and stringent regulatory adherence (e.g., EU food safety standards). Western European countries show strong demand for grass-fed and A2 protein variants, while Eastern Europe represents an emerging opportunity, driven by improving economic conditions and increased awareness of preventive healthcare benefits associated with specialized milk powders.

- Latin America (LATAM): Exhibits steady growth fueled by increasing awareness of protein and calcium deficiencies, particularly in urban centers. Economic volatility remains a restraint, but large countries like Brazil and Mexico are seeing rising consumption of fortified powders for general family health and specialized senior nutrition.

- Middle East & Africa (MEA): This region is heavily reliant on imports, with significant demand centered in the GCC countries due to high disposable incomes and a preference for international brands. Growth in Africa is more restrained but presents long-term opportunities, particularly for affordable, basic fortified powders addressing widespread nutritional gaps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Adult Milk Powder Market.- Nestlé S.A.

- Danone S.A.

- Fonterra Co-operative Group

- Abbott Laboratories

- FrieslandCampina N.V.

- Arla Foods amba

- DSM N.V.

- Mead Johnson Nutrition (Reckitt Benckiser)

- Synlait Milk Ltd

- Saputo Inc.

- Hochdorf Holding AG

- Murray Goulburn Co-operative

- Meiji Holdings Co., Ltd.

- Yili Group

- Mengniu Dairy

- Gujarat Cooperative Milk Marketing Federation (Amul)

- Glanbia plc

- Kerry Group plc

- Bright Food Group

- Tatura Milk Industries

Frequently Asked Questions

Analyze common user questions about the Adult Milk Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Adult Milk Powder Market globally?

The primary drivers are the rapid global increase in the aging population requiring specialized nutrition for bone and muscle health, coupled with growing consumer awareness regarding proactive preventive healthcare and the need for convenient, nutrient-dense food solutions in modern urban lifestyles. The long shelf life and portability of milk powder also contribute significantly to its expanding appeal over liquid dairy products.

How do specialized adult milk powder formulations differ from standard household milk powder?

Specialized adult milk powders are highly fortified and functional, containing significantly higher concentrations of specific nutrients like protein, calcium, Vitamin D, prebiotics, and functional ingredients (e.g., Omega-3s, collagen peptides) tailored to address adult health concerns such as sarcopenia, osteoporosis, immune system support, and intense athletic recovery, making them dietary supplements rather than general food staples.

Which geographical region holds the most significant market potential for adult milk powder manufacturers?

The Asia Pacific (APAC) region currently represents the largest market volume and is projected to exhibit the highest growth rate. This dominance is attributed to large demographic cohorts, particularly in China and India, facing rapid aging and urbanization, leading to increased demand for accessible, shelf-stable, and health-specific nutritional products targeting senior wellness and general vitality.

What are the main restraints impacting the growth of the Adult Milk Powder Market?

Key restraints include increasing consumer preference for competing plant-based dairy and protein alternatives due to rising rates of lactose intolerance and ethical concerns, as well as the high production costs associated with advanced fortification and quality control required for premium functional milk powder products, which can limit affordability in price-sensitive markets.

How is technology, such as AI and microencapsulation, transforming the production of adult milk powder?

Technology is enhancing the market through two main avenues: Microencapsulation protects sensitive functional ingredients (like probiotics and vitamins) from degradation during processing and storage, ensuring efficacy. AI and machine learning optimize supply chains, predict consumer demand, and facilitate the development of hyper-personalized nutritional formulations based on large-scale consumer data analysis and advanced quality control systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager