Advanced Copper Alloy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440691 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Advanced Copper Alloy Market Size

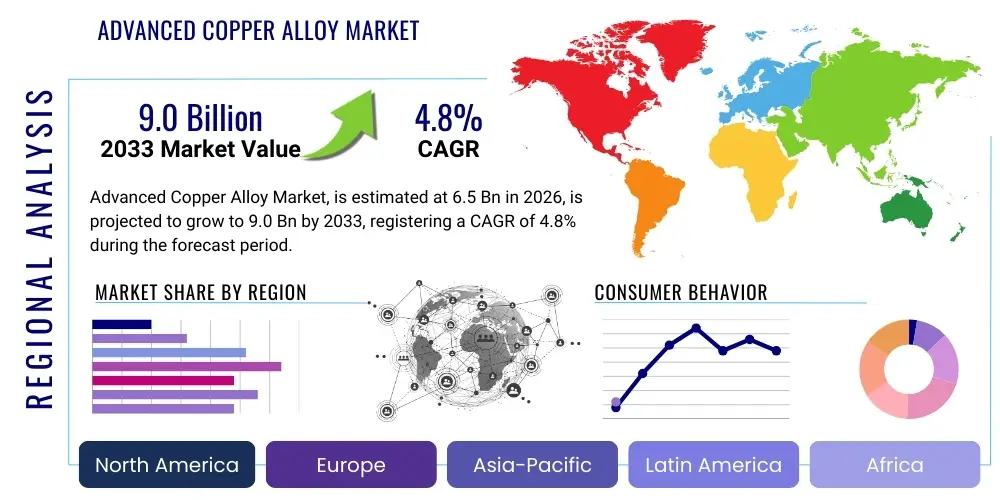

The Advanced Copper Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Advanced Copper Alloy Market introduction

The Advanced Copper Alloy Market encompasses specialized copper-based materials engineered to possess superior mechanical, thermal, and electrical properties compared to conventional coppers. These alloys, which include materials like beryllium copper, chromium copper, and high-strength brasses, are crucial in environments requiring high conductivity coupled with excellent fatigue resistance, high-temperature stability, and corrosion resistance. The complexity of modern electronic systems, the rigorous demands of electric vehicle (EV) battery packs, and the necessity for reliable interconnects in telecommunications infrastructure necessitate the use of these advanced materials. Their tailored characteristics allow them to bridge the gap between pure copper's high conductivity and the mechanical robustness offered by traditional structural metals, driving innovation across multiple industrial sectors. The performance attributes of advanced copper alloys, particularly their ability to maintain structural integrity under extreme thermal cycling and mechanical stress, distinguish them as mission-critical components in high-reliability applications, forming the foundation of modern high-performance engineering.

Major applications for advanced copper alloys span high-performance connectors, switches, relays, heat exchangers, resistance welding components, and critical structural parts in aerospace and defense. In the burgeoning electric vehicle sector, these alloys are indispensable for busbars, charging interfaces, and sophisticated thermal management systems within battery modules and power electronic converters, capitalizing on their low electrical resistance and exceptional thermal transfer capabilities. Furthermore, the relentless trend toward miniaturization in consumer electronics and high-speed computing requires materials that can handle increasing power densities and operate at higher frequencies without compromising size, reliability, or signal integrity, making alloys like beryllium copper and advanced phosphor bronze ideal for miniaturized spring contacts, shielding, and lead frames. The maritime and defense industries utilize specialized copper-nickel alloys (e.g., CuNi 90/10 and 70/30) for superior fouling and corrosion resistance in harsh saltwater environments, demonstrating the broad spectrum of tailored benefits inherent in this highly specialized market segment where material failure can lead to catastrophic system downtime or safety hazards.

Key driving factors propelling the growth of the Advanced Copper Alloy Market include the global expansion of electric vehicle manufacturing, significant government and private sector investments in 5G and future 6G telecommunications infrastructure, requiring millions of high-speed, durable connectors, and stringent regulatory standards demanding greater energy efficiency across industrial, residential, and consumer products. The global transition toward sustainable energy systems, including large-scale solar farms, wind turbines, and high-voltage DC (HVDC) power transmission networks, also markedly increases demand for durable, highly conductive components used in power conversion and reliable transmission systems. Benefits realized by adopting these alloys include drastically reduced component failure rates, significantly enhanced overall system energy efficiency, prolonged service life under extreme mechanical and thermal load, and the ability to operate complex systems at substantially higher power levels or elevated temperatures than possible with standard materials. This superior performance translates directly into improved total cost of ownership and increased operational resilience for end-users, fueling continuous research and development into novel alloy compositions with even greater performance metrics.

Advanced Copper Alloy Market Executive Summary

The Advanced Copper Alloy Market is characterized by robust and sustainable growth driven primarily by fundamental structural shifts in global manufacturing, notably the accelerated electrification of transportation platforms and the pervasive digital transformation requiring next-generation data communication infrastructure. Current business trends indicate a strong focus on developing advanced lead-free copper alloys and high-entropy alloys that offer superior combinations of strength, ductility, and conductivity, primarily responding to global regulatory pressures (such as RoHS and REACH concerning toxic substances like Beryllium) and the ever-increasing need for materials that can perform reliably under extreme conditions. Consolidations through mergers and acquisitions are increasingly common, focused on securing stable raw material supply chains, acquiring specialized metallurgical expertise, and expanding geographical manufacturing footprints to serve regional EV and electronics production hubs efficiently. Furthermore, there is a discernible trend toward customized alloy formulations, leveraging advanced processing methods like powder metallurgy and specialized rolling techniques to create complex, near-net-shape components efficiently, catering specifically to highly specialized, high-reliability industrial requirements, particularly in demanding fields like medical imaging and advanced radar systems.

Regionally, the Asia Pacific (APAC) region solidifies its position as the largest consumer and the fastest-growing market globally. This exponential growth is overwhelmingly attributed to the unprecedented scale of electronics manufacturing, dominant global share of automotive production (especially in the electric vehicle supply chain across China, Japan, and South Korea), and immense government-backed infrastructure development programs spanning from smart grids to high-speed rail. In contrast, North America and Europe maintain strong positions focused on high-margin, niche applications such as commercial and military aerospace, high-frequency communications, and specialized medical equipment, underpinned by extremely stringent quality standards and established R&D capabilities that drive innovation in non-toxic, ultra-high-performance alloys. The regulatory environment, particularly the influence of European directives, acts as a powerful catalyst for technological change, consistently pushing manufacturers globally towards the immediate adoption of sustainable, compliant, and technologically superior material alternatives, differentiating the competitive landscape based on innovation rather than merely volume production.

Segment trends within the market reveal that while the beryllium copper segment maintains a critical role in niche applications demanding the highest possible strength and hardness coupled with good conductivity, alternative high-performance brasses and advanced copper-nickel-silicon alloys are experiencing accelerated adoption rates due to superior processability, lower lifecycle costs, and better regulatory profiles. By application, the Electrical and Electronic components sector retains the largest revenue share, a segment driven by the universal proliferation of smart devices, industrial automation, and exponential data center expansion globally. Crucially, the Automotive segment, fueled entirely by the accelerating transition to electric and hybrid vehicles, demonstrates the most dynamic year-over-year growth, with demand heavily concentrated on alloys specifically optimized for efficient heat dissipation, minimal resistive loss, and high current carrying capacity within battery management systems. This strong sectional growth validates the market’s resilience and its deep embedding within core global technological megatrends, unequivocally confirming the essential and expanding role of advanced copper alloys in enabling next-generation engineering solutions across diverse critical infrastructure platforms worldwide.

AI Impact Analysis on Advanced Copper Alloy Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Advanced Copper Alloy Market frequently center on its potential to drastically optimize the material discovery pipeline, accurately predict component service life under dynamic operational stress, and substantially enhance the efficiency and precision of complex manufacturing processes. Key themes consistently emerging from user analysis include the application of sophisticated machine learning (ML) models for simulating novel alloy compositions, particularly in the challenging domain of high-entropy copper alloys, with the objective of dramatically reducing costly and time-consuming traditional physical experimentation. Users are also significantly interested in AI's foundational role in enabling predictive maintenance within high-value, critical systems (such as high-power utility grids, aerospace engines, or critical medical equipment) that fundamentally rely on the consistent performance of advanced copper components, seeking improved reliability forecasting and failure mitigation capabilities. Expectations are high that AI will not only accelerate the material development cycle for alloys customized to specific, extreme environments but also lead to the proliferation of personalized material solutions and optimized, self-adjusting supply chains capable of instantaneous correction based on real-time quality control data and dynamic market demand signals, creating a paradigm shift in metallurgical R&D efficiency.

The seamless integration of AI algorithms, particularly deep learning models and generative adversarial networks (GANs), is fundamentally revolutionizing the material science domain relevant to advanced copper alloys. Historically, identifying new alloys or optimizing existing ones to meet new performance specifications required exhaustive, trial-and-error laboratory work. Currently, ML models can rapidly analyze vast, multi-dimensional datasets of existing elemental combinations, complex thermodynamic properties, stress test results, and processing parameters to accurately predict the optimal chemical composition and precise processing routes (e.g., specific heat treatment regimes) required for new high-performance copper alloys. This computational capability significantly cuts down the R&D timeline from several years to mere months, offering a critical competitive edge. This acceleration is especially vital in the ongoing development of sustainable substitutes for incumbent, non-compliant critical alloys (such as non-Beryllium high-strength alloys) or in the targeted design of bespoke materials specifically needed for disruptive emerging technologies, including highly efficient thermal sinks required by next-generation quantum computing hardware or extreme-temperature conductors, ensuring a responsive pathway for material innovation.

Beyond the R&D lab, AI is proving instrumental in optimizing every stage of the manufacturing process for advanced copper alloy components, ensuring unmatched consistency and quality. AI-driven systems analyze real-time streaming data collected from sensors embedded in casting furnaces, rolling mills, heat treatment ovens, and finishing equipment to ensure stringent defect prevention, minimize variations, and maintain consistent material quality, which is fundamentally critical for zero-tolerance applications in aerospace, defense, and specialized medical instrumentation. Predictive modeling capabilities help manufacturers proactively identify potential equipment failures, deviations in material microstructure, or slight shifts in dimensional tolerances before they result in scrapped products, thereby minimizing material waste, maximizing yield rates, and reducing energy consumption associated with reworks. This comprehensive application of AI moves the industry decisively toward 'smart factories,' where metallurgical processes are autonomously monitored and adjusted to fluctuating input variables, leading to unparalleled precision in producing complex, high-reliability advanced copper alloy products efficiently, sustainably, and cost-effectively, significantly improving the overall competitiveness and responsiveness of advanced alloy providers globally.

- AI accelerates new copper alloy discovery and optimization through machine learning simulations, reducing physical R&D cycles substantially.

- Predictive maintenance algorithms improve component longevity, reliability, and system uptime in critical infrastructure utilizing complex copper alloy parts.

- AI optimizes manufacturing processes, including precision casting and controlled heat treatment, ensuring superior quality control and minimizing structural defects.

- Generative design tools utilize AI to optimize the component geometry for maximum efficiency in specialized applications like complex heat exchange mechanisms.

- AI enhances supply chain resilience and cost management by accurately predicting demand fluctuations and optimizing inventory levels for specialized alloy precursors and finished products.

DRO & Impact Forces Of Advanced Copper Alloy Market

The trajectory of the Advanced Copper Alloy Market is powerfully shaped by a dynamic and often conflicting interplay of Drivers (D), Restraints (R), and strategic Opportunities (O), which collectively define the overarching Impact Forces. Key fundamental drivers include the overwhelming global demand stemming from the aggressive electrification shift in the automotive industry, where high-conductivity copper alloys are absolutely non-negotiable for efficient high-current and thermal management systems in EVs. Coupled with this is the relentless growth of data centers and the widespread deployment of 5G and 6G communication networks, which demand increasingly high-speed, durable, and reliable connectors and thermal interface materials. Conversely, significant restraints primarily involve the high initial capital investment and operational costs associated with specialized alloy production, the inherent volatility in global raw copper pricing, and increasingly rigorous global environmental regulations, particularly concerning alloys containing toxic or regulated elements like Beryllium or Lead, which necessitates substantial and continuous investment in R&D for compliant, high-performance alternatives.

Opportunities for strategic and long-term market growth are substantial and are primarily centered around the proliferation and maturity of additive manufacturing (3D printing) for metallic components. AM opens completely new pathways for highly customized, complex copper alloy parts previously considered impossible or prohibitively expensive to manufacture using conventional techniques, allowing for rapid iteration and tailored performance. Furthermore, the burgeoning global hydrogen economy, particularly technologies related to proton exchange membrane (PEM) fuel cells and solid oxide fuel cell (SOFC) stacks, represents a substantial future demand niche requiring entirely new classes of specialized copper alloys capable of operating reliably under elevated temperatures, unique chemical environments, and specific pressure profiles. The development and commercialization of next-generation materials like high-entropy copper alloys, offering unprecedented combinations of strength, ductility, and electrical conductivity, presents a truly transformative opportunity, enabling materials with truly bespoke properties tailored precisely to extreme engineering requirements in sectors like deep-sea exploration, defense, and high-energy physics, thereby maintaining high market dynamism and continuous metallurgical innovation.

The collective impact forces demonstrate a market definitively moving towards premiumization and the delivery of highly application-specific, high-value solutions. While commodity price volatility and rapidly evolving regulatory hurdles pose constant operational challenges for manufacturers, the fundamentally indispensable nature of advanced copper alloys in enabling core global technological megatrends—including global electrification, pervasive digitalization, industrial automation, and advanced defense modernization—ensures sustained, high-value, and inelastic demand. To thrive, manufacturers must strategically navigate the restraints by focusing intensely on vertical integration, maximizing operational efficiency, securing stable long-term supply agreements for critical raw materials, and prioritizing investment in sustainable, next-generation high-performance substitute alloys. The net impact of these comprehensive forces is the reinforcement of the advanced copper alloy market's high-value status, strategically shifting production emphasis decisively from high volume towards exceptional quality, functional superiority, and technological specialization, guaranteeing robust long-term growth anchored firmly in technological necessity.

Segmentation Analysis

The Advanced Copper Alloy Market is meticulously segmented based on material type, end-use application, and processing technology, providing the necessary granularity for tailored market strategies, precise competitive benchmarking, and accurate assessment of heterogeneous demand drivers. Segmentation by type critically differentiates between alloys based on their primary strengthening mechanisms and resulting property profiles, broadly categorized into high-strength alloys (e.g., Beryllium Copper and CuNiSi), high-conductivity alloys (e.g., Chromium Copper and Copper-Zirconium), and specialized corrosion-resistant alloys (e.g., Copper-Nickel alloys used in marine environments). This granular material classification is paramount because the required performance properties vary vastly across end-use industries (e.g., aerospace versus consumer electronics), dictating distinct manufacturing requirements, specialized supply chain routes, and specific technical specifications that must be met by suppliers. Understanding the subtle nuances within these segments allows leading suppliers to effectively focus their multi-million dollar R&D efforts on materials that are poised to meet future regulatory compliance and next-generation performance benchmarks in their identified target industries, ensuring maximum market penetration and sustainable competitive differentiation in a technologically complex field.

The end-use application segment represents the largest division, dominated unequivocally by the Electrical and Electronic components sector, followed closely by the rapidly accelerating Automotive segment (driven largely by high-value EV battery and power electronic components) and the consistent demand from Industrial Machinery manufacturers (e.g., resistance welding equipment). The market landscape is further complexly divided by processing technology, distinguishing between wrought alloys, which are formed through extensive processes like rolling, drawing, or extrusion to produce sheets, strips, and wires, and cast alloys, which are utilized for complex shapes, large forgings, and specialized component castings. Crucially, the increasing prominence of advanced powder metallurgy and sophisticated additive manufacturing (AM) techniques as viable processing methods is fundamentally beginning to disrupt traditional manufacturing segmentation, creating an entirely new category of high-performance components with highly tailored microstructures, often exhibiting superior performance characteristics specifically for small-batch, extremely high-value components required in demanding environments like advanced satellite technology, high-vacuum systems, or highly specialized medical instrumentation.

- By Type:

- Beryllium Copper (BeCu) Alloys

- Chromium Copper (CrCu) and Chromium-Zirconium Copper Alloys (CrZrCu)

- Copper-Nickel-Silicon (CuNiSi) Alloys

- Copper-Zirconium (CuZr) Alloys

- High-Performance Brasses (e.g., C72900, Naval Brass)

- Phosphor Bronze (CuSn) Alloys

- Copper-Nickel (CuNi) Alloys (e.g., CuNi 90/10, 70/30)

- By End-Use Application:

- Electrical and Electronic Components (Connectors, Switches, Relays, Lead Frames, Busbars, IC sockets)

- Automotive (EV Battery Systems, Power Electronics Cooling, Terminals, Heat Sinks)

- Industrial Machinery (Resistance Welding Electrodes, High-Performance Bearings, Molds for plastics)

- Aerospace and Defense (Landing Gear Components, Bushings, Electrical Contacts in Avionics)

- Marine and Offshore (Heat Exchangers, Specialized Piping, Submersible Pump Components)

- Medical Devices (Surgical Tools, MRI components, Diagnostic Equipment)

- Consumer Goods and Appliances (Thermostats, Springs)

- By Product Form:

- Wrought Products (Sheets, Plates, Rods, Wires, Strips, Tubes)

- Cast Products (Ingots, Forgings, Specialized Castings)

- Powder Metallurgy Products (Used for Additive Manufacturing)

Value Chain Analysis For Advanced Copper Alloy Market

The value chain for the Advanced Copper Alloy Market is highly intricate, specialized, and capital-intensive, commencing upstream with the procurement and processing of high-purity raw materials. This primarily involves high-grade copper cathodes, complemented by strategic and often scarce alloying elements such as Beryllium, Chromium, Nickel, Silicon, and specialized transition metals. The upstream segment involves highly controlled mining, smelting, and refining operations, where the exceptional quality, consistency, and stability of the supply of these alloying metals are absolutely paramount to the final material performance and microstructure. Given the performance-critical nature of the finished alloys—where even trace impurities can severely compromise electrical conductivity or mechanical integrity—manufacturers rely heavily on established, certified suppliers to ensure full material traceability and purity. Strategic long-term partnerships and hedging mechanisms with primary metal producers are vital for managing volatile commodity price risks and securing stable input security, particularly for rare or strategically important elements. Furthermore, the increasing global focus on circularity and sustainability necessitates integrating recycled high-ppurity copper sources into the value chain, requiring advanced, expensive sorting and refining technologies to successfully maintain the uncompromising purity levels demanded by advanced alloy specifications, posing a unique technical challenge in full circular economy implementation efforts.

The midstream activities encompass the complex manufacturing and metallurgical transformation processes, including advanced melting (often utilizing vacuum induction melting, VIM, to prevent oxidation), highly controlled continuous casting, homogenization, severe plastic deformation (hot working), subsequent cold working (e.g., precision rolling, drawing, extrusion), and finally, precise, multi-stage heat treatment (such as solution treating and age hardening) designed to achieve the final desired crystalline structure and optimal property set. This conversion stage adds the most significant value, relying on proprietary metallurgical expertise, advanced computational modeling for process control, and substantial capital investment in highly specialized equipment. Advanced copper alloy manufacturers frequently pursue vertical integration to maintain exceptionally tight control over every aspect of the microstructure and mechanical properties of the finished product, from ingot to final strip. Process optimization, increasingly leveraging industrial IoT sensors and AI-driven data analytics, is key to minimizing energy consumption, reducing variability, and ensuring consistent, high-specification quality across enormous production batches. Quality assurance and certification, particularly for materials destined for regulated sectors like aerospace, medical, and nuclear applications, form an intensive and critical component of this stage, involving rigorous non-destructive evaluation (NDE), mechanical testing, and exhaustive compliance checks against international standards (e.g., Nadcap, ASTM, ISO), which significantly influence the material's premium market price and act as a substantial technological and regulatory barrier to entry.

The downstream distribution channels for advanced copper alloys are strategically organized and generally bifurcated into direct sales channels and indirect distribution networks. Direct sales are primarily executed to large, specialized Original Equipment Manufacturers (OEMs) in the automotive, aerospace, defense, and semiconductor industries, used for high-volume, custom-designed alloys where extensive technical collaboration between the alloy producer's metallurgists and the end-user's engineers is absolutely necessary to finalize intricate specifications and performance guarantees. Indirect channels cater to the broader base of smaller fabricators, maintenance operations, and regional markets, typically utilizing specialized global distributors and service centers that provide essential services such as sophisticated inventory management, localized precision cutting, and just-in-time delivery services for standard stock forms (rods, plates, tubes, and strips). Highly effective logistics, including specialized protective packaging and temperature-controlled storage to prevent surface contamination or mechanical damage during complex international transit, is crucial given the high cost, surface sensitivity, and stringent quality demands of these high-performance materials. The overall efficiency and responsiveness of the distribution network, particularly its capacity to handle complex material specifications, adhere to local import/export regulations, and rapidly adjust to fluctuating global production schedules, directly and significantly impacts market penetration, brand reputation, and ultimate customer satisfaction for these critical high-performance materials globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wieland Group, KME Germany GmbH, Materion Corporation, Lebronze alloys SAS, AMPCO METAL, Sumitomo Metal Mining Co., Ltd., Mitsubishi Materials Corporation, Nippon Mining & Metals Co., Ltd., Luvata Oy, Aviva Metals, IBC Advanced Alloys, National Bronze Manufacturing, Powerway Alloy Co., Ltd., Dowa Metals & Mining Co., Ltd., Metrod Holdings Berhad, Aurubis AG, Farmers Copper Ltd., A.J. Oster Co., Advanced Alloys Inc., Hitachi Metals, Ltd. (now Proterial) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advanced Copper Alloy Market Potential Customers

The primary customer base for advanced copper alloys is heavily concentrated in sophisticated, high-reliability industries that fundamentally prioritize exceptional component performance, critical thermal management capabilities, and superior electrical efficiency under sustained, demanding operational conditions. End-users within the global Automotive sector, particularly the rapidly scaling manufacturers of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), represent the most dynamic and voluminous buying segment. These companies require high-conductivity alloys for crucial components such as battery cell interconnects, high-voltage power distribution busbars, charging interface components, and highly efficient cooling systems for power electronic converters. Their purchasing specifications are predominantly driven by the non-negotiable need to maximize vehicle energy efficiency, prolong battery cycle life, and ensure absolute electrical and thermal safety during rapid charging and extreme thermal cycling, making performance consistency and material reliability far more critical criteria than minor differences in upfront material cost.

The global Electronics and Telecommunications industry constitutes another immensely crucial customer segment. This broad category includes producers of high-frequency and high-density connectors for the rapidly expanding 5G and future 6G infrastructure, manufacturers of complex semiconductor fabrication equipment, producers of high-layer-count printed circuit boards (PCBs), and hyperscale data center infrastructure providers (e.g., server racks, high-speed cable assemblies, and IC sockets). These technologically demanding customers require alloys with exceptional stress relaxation resistance, high yield strength, and superior formability to support continuous miniaturization efforts and ensure the long-term reliability and signal integrity of critical data pathways operating at multi-gigahertz frequencies. They frequently opt for fine-grain, precipitation-hardened alloys to meet micron-level tolerances and stringent mechanical stability standards necessary to resist vibrational and thermal fatigue within dense electronic packaging, establishing a highly lucrative niche for specialized advanced copper alloy suppliers.

Other significant high-value buyers include specialized Aerospace and Defense contractors, who require materials for precision aircraft actuators, navigational system components, specialized non-magnetic bearings, and complex munitions components, where mechanical failure carries severe safety and operational consequences. Similarly, Medical Device manufacturers represent a critical high-value customer segment, utilizing advanced alloys for highly specialized components in MRI machine coils, precision surgical instruments, minimally invasive delivery systems, and sophisticated diagnostic equipment. These sectors demand highly specialized material characteristics, including non-magnetic properties, stringent biocompatibility, high corrosion resistance, and verified extreme reliability, often procuring materials based on long-term contracts tied directly to rigorous quality and technical certifications (e.g., AS9100 and ISO 13485). This purchasing behavior heavily emphasizes material consistency, comprehensive material property data, and complete traceability throughout the entire supply chain, often involving multiple third-party audits and stringent internal certification processes to ensure absolute compliance with highly regulated industry standards worldwide.

Advanced Copper Alloy Market Key Technology Landscape

The technological landscape driving innovation within the Advanced Copper Alloy Market is strategically concentrated on three key areas: optimizing primary melting and casting techniques for superior purity, developing precise thermo-mechanical processing methodologies for tailored microstructures, and aggressively integrating cutting-edge additive manufacturing (AM) for complex geometry realization. In terms of primary production, the adoption of continuous casting technologies, often paired with highly controlled atmosphere or vacuum induction melting (VIM), is critical for minimizing undesirable impurities, managing gaseous defects, and ensuring the highly homogeneous distribution of all alloying elements. This homogeneity is fundamental to achieving the peak performance characteristics required by advanced applications, particularly for high-purity copper-chromium-zirconium alloys utilized in critical high-speed electrical contacts and demanding resistance welding applications. The integration of advanced computational fluid dynamics (CFD) modeling and real-time sensor monitoring (IoT) systems is now standard practice in the melting process to ensure extremely tight control over solidification rates, which directly controls the final grain structure and prevents micro-defects that could fatally compromise the material's integrity in mission-critical systems.

Thermo-mechanical processing, which fundamentally includes sophisticated methods like severe plastic deformation (SPD) techniques such as high-ratio rolling, deep drawing, and equal channel angular pressing (ECAP), represents the core technology for mass-producing wrought products (strips, sheets, wires) with superior combined strength, ductility, and fatigue life. These advanced processing methods are purposefully engineered to refine the internal grain structure down to the ultra-fine or even nanometer scale, substantially enhancing the material's mechanical properties, such as yield strength and stress relaxation resistance, critically without significantly sacrificing the alloy's necessary electrical conductivity—a common and difficult trade-off in traditional metallurgy. Precise computer-aided control over the cold working percentage and the subsequent crucial age hardening (precipitation hardening) process is essential. This precise control, often guided by complex computational simulation models, is required to tailor the alloy's specific stress relaxation resistance and thermal fatigue life to the exact requirements of specific applications, especially in highly miniaturized electronic connectors subjected to persistent mechanical strain and elevated operating temperatures in modern smart devices and power electronics.

Additive Manufacturing (AM), particularly sophisticated techniques like Laser Powder Bed Fusion (L-PBF) and Binder Jetting, is rapidly emerging as a potentially transformative manufacturing technology. While traditional L-PBF faces challenges with pure copper due to its high laser reflectivity, specialized, customized copper alloy powders—often pre-alloyed with small amounts of elements like Nickel, Iron, or Zirconium to increase laser absorption—are being successfully utilized to 3D print complex, optimized geometries. Examples include intricate, internal lattice structures for lightweight components or complex fluid channels for highly efficient, customized heat exchangers or biomedical components, often with dramatic reductions in material waste and lead times. This AM capability significantly reduces lead times and enables the production of component designs previously deemed impossible or prohibitively expensive using conventional subtractive machining or casting. The successful industrial integration of AM requires rigorous, continuous control over the alloy powder's spherical geometry and composition, along with tight control over the processing atmospheric conditions and build chamber temperature to ensure the resulting component achieves the required density, internal integrity, and mechanical performance, firmly positioning AM as a key enabling technology for the future of highly customized, high-value advanced copper alloy parts in the aerospace and advanced computing sectors.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Electronics The APAC region currently holds the largest market share and is forecast to maintain the highest Compound Annual Growth Rate (CAGR) globally for advanced copper alloys. This commanding position is fundamentally driven by the enormous scale of industrialization in key economies, including China, Japan, South Korea, and Taiwan, which function as critical global manufacturing hubs for consumer electronics, advanced semiconductors, and the massive electric vehicle supply chain. The region benefits from robust government support for high-tech manufacturing, deep integration across the regional supply chain, and substantial investments in critical infrastructure, such as the construction of major battery gigafactories and widespread 5G/6G network deployments. This concentration of high-growth, high-tech industry necessitates vast quantities of specialized, high-performance copper alloys for power management, thermal dissipation, and high-speed signal transmission components.

- North America: Focus on Aerospace, Defense, and High-End Specialty Alloys North America, primarily driven by the United States, represents a mature, high-value market characterized by an intense focus on highly specialized, low-volume, ultra-high-reliability applications. Demand is strongly concentrated in sectors with stringent quality and performance requirements, including aerospace (both commercial and military), specialized defense systems, and advanced medical device manufacturing. The region leads in the consumption of specialized alloys such as Beryllium Copper (for its specific strength) and high-performance, non-magnetic copper-nickel-silicon alloys, strictly adhering to complex military and aviation specifications (e.g., Mil-Specs). A core driver is continuous innovation and R&D investment aimed at developing next-generation, environmentally compliant substitute alloys and integrating state-of-the-art processing techniques like certified additive manufacturing into the production of complex, safety-critical components for defense platforms and advanced computing hardware.

- Europe: Strict Regulatory Compliance Driving Innovation and Sustainable Alternatives The European market's trajectory is profoundly shaped by rigorous environmental and substance regulations, most notably the REACH and RoHS directives, which necessitate a rapid and proactive innovation pipeline focused on sustainable, lead-free, and beryllium-free copper alloy solutions. Major manufacturing economies like Germany, France, and Italy are significant consumers, driven by their powerful automotive manufacturing base (undergoing rapid EV conversion) and world-class precision engineering sectors. European suppliers are specializing in high-performance brasses and advanced Copper-Nickel-Silicon (CuNiSi) alloys that offer excellent mechanical properties and conductivity while guaranteeing full compliance with evolving regulatory standards. The European market places a strong emphasis on achieving sustainable production processes, verifiable energy efficiency, and detailed lifecycle assessment of materials used in critical infrastructure and renewable energy systems, positioning European innovation as the global leader in environmentally responsible high-performance metallurgy.

- Latin America (LATAM): Emerging Industrial Demand and Infrastructure Investment The LATAM market represents a developing yet high-potential growth opportunity, largely spurred by increasing government and private sector investments in modernized power generation, smart grid deployment, and transmission infrastructure across major economies, particularly Brazil and Mexico. Expanding industrialization, coupled with growth in consumer goods manufacturing and sophisticated resource extraction activities, fuels the underlying demand for standard and moderately advanced copper alloys used in electrical components, industrial machinery, and robust corrosion-resistant piping systems. While the market size is currently smaller and less focused on highly specialized alloys compared to APAC or North America, the region is poised for significant accelerated growth as foreign direct investment enhances local high-tech manufacturing capabilities and improves energy access and efficiency across the subcontinent, gradually shifting demand toward more performance-critical and specialized copper alloy components.

- Middle East and Africa (MEA): Energy Sector and Large-Scale Urban Development Projects In the MEA region, the demand for advanced copper alloys is intimately linked to two primary economic drivers: massive, complex oil and gas projects requiring specialized materials, and large-scale, high-capital urban development and diversification initiatives (e.g., Saudi Arabia's Vision 2030 projects). Countries within the GCC (Gulf Cooperation Council) invest significantly in massive desalination plants and conventional and solar power generation facilities, creating intense demand for specialized corrosion-resistant copper-nickel (CuNi) alloys for heat exchangers and piping systems operating under high-salinity and high-temperature conditions. The region’s strategic commitment to diversifying its energy mix, coupled with the need to host major international events and build complex financial hubs, necessitates substantial investment in high-standard telecommunication and internal power distribution infrastructure, generating steady, high-specification demand, although procurement volume remains concentrated within specific, highly visible, and high-capital infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advanced Copper Alloy Market.- Wieland Group

- KME Germany GmbH

- Materion Corporation

- Lebronze alloys SAS

- AMPCO METAL

- Sumitomo Metal Mining Co., Ltd.

- Mitsubishi Materials Corporation

- Nippon Mining & Metals Co., Ltd.

- Luvata Oy

- Aviva Metals

- IBC Advanced Alloys

- National Bronze Manufacturing

- Powerway Alloy Co., Ltd.

- Dowa Metals & Mining Co., Ltd.

- Metrod Holdings Berhad

- Aurubis AG

- Farmers Copper Ltd.

- A.J. Oster Co.

- Advanced Alloys Inc.

- Hitachi Metals, Ltd. (now Proterial)

Frequently Asked Questions

Analyze common user questions about the Advanced Copper Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates advanced copper alloys from standard copper and brass materials?

Advanced copper alloys are metallurgical products precisely engineered through specialized alloying and controlled thermo-mechanical processing to offer drastically superior combinations of physical properties not achievable with standard commodity materials. Key differentiators include significantly enhanced mechanical strength, exceptional fatigue life, superior stress relaxation resistance, and high-temperature stability, all while rigorously maintaining high electrical and thermal conductivity. These optimized properties are essential for high-reliability, mission-critical applications in sectors like electric vehicle power distribution, advanced high-frequency electronics, and aerospace systems where component failure risk must be absolutely minimized, justifying their higher cost premium.

Which key applications are driving the demand for Beryllium Copper substitutes?

The increasing global demand for Beryllium Copper (BeCu) substitutes is fundamentally driven by stringent global health, safety, and regulatory compliance requirements, as BeCu dust presents significant occupational hazards during processing. Industries requiring the highest strength and conductivity in precision components, such as micro-connectors, miniature switches, and high-performance spring contacts in consumer electronics and industrial machinery, are rapidly transitioning away from BeCu. Leading, compliant substitutes include advanced Copper-Nickel-Silicon (CuNiSi) alloys and specialized high-performance brasses, which are specifically designed to offer comparable mechanical properties and equivalent electrical performance without the severe regulatory burden, high handling costs, and significant health risks associated with beryllium usage.

How is the growth of Electric Vehicles (EVs) impacting the Advanced Copper Alloy market?

The accelerated global pivot toward Electric Vehicles (EVs) is serving as the single most powerful, transformative growth driver for the Advanced Copper Alloy Market. EVs inherently require massive volumes of specialized, high-conductivity, and high-strength alloys for critical, high-current applications, primarily within battery busbars, high-power charging ports, high-efficiency motor windings, and sophisticated power distribution units. This necessitates high volumes of chromium copper and robust copper-nickel alloys that are specifically optimized for maximum electrical efficiency, superior thermal management, and robust mechanical performance under repeated vibration and high-power cycling. The relentless focus on battery range and faster charging speeds guarantees sustained, increasing demand for these performance-optimized materials.

What role does Additive Manufacturing play in the future of copper alloy production?

Additive Manufacturing (AM), particularly techniques such as Laser Powder Bed Fusion (L-PBF) using specialized copper powders, is playing a pivotal role in the future by enabling the production of highly customized, complex component geometries. AM allows for the creation of components, such as intricate cooling channels within heat sinks or advanced internal structures for lightweight aerospace parts, that are metallurgically and geometrically impossible or cost-prohibitive to achieve via traditional methods. This technology significantly reduces material waste, accelerates the research-to-production lifecycle, and facilitates the immediate use of novel alloy designs in specialized, low-volume, performance-critical applications, thereby offering unprecedented design freedom to engineers.

Which geographical region exhibits the fastest growth potential for advanced copper alloys?

The Asia Pacific (APAC) region, spearheaded by the colossal manufacturing output in China, South Korea, and India, consistently exhibits the fastest and most dynamic growth potential. This rapid expansion is underpinned by unparalleled domestic and export-oriented manufacturing dominance in high-growth sectors, including electronics, semiconductors, and electric vehicles, combined with aggressive governmental investment in new physical and digital infrastructure (e.g., smart grids, 5G/6G networks, and high-speed rail projects). APAC's central position in global high-tech supply chains and its aggressive technological adoption rates make it the undeniable leading geographical source of volume growth and new application demands for advanced copper alloy materials globally for the foreseeable future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager