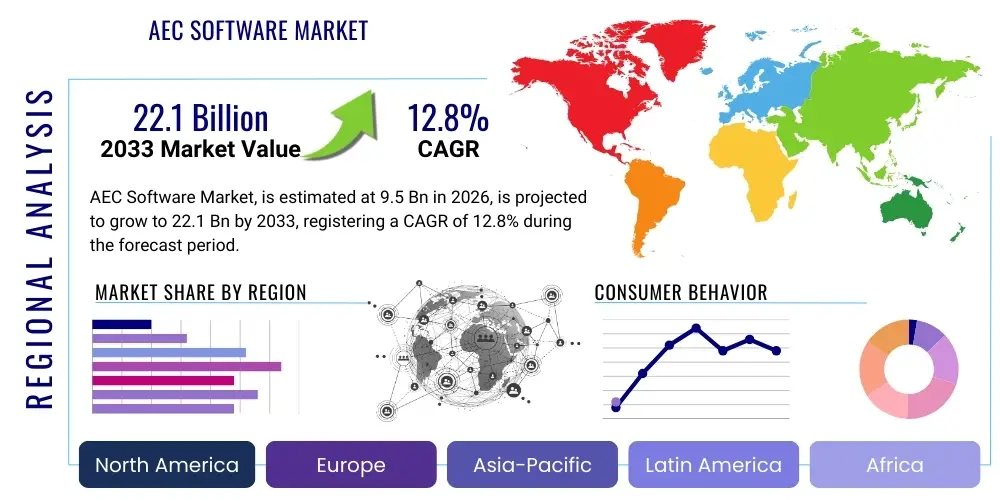

AEC Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442990 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

AEC Software Market Size

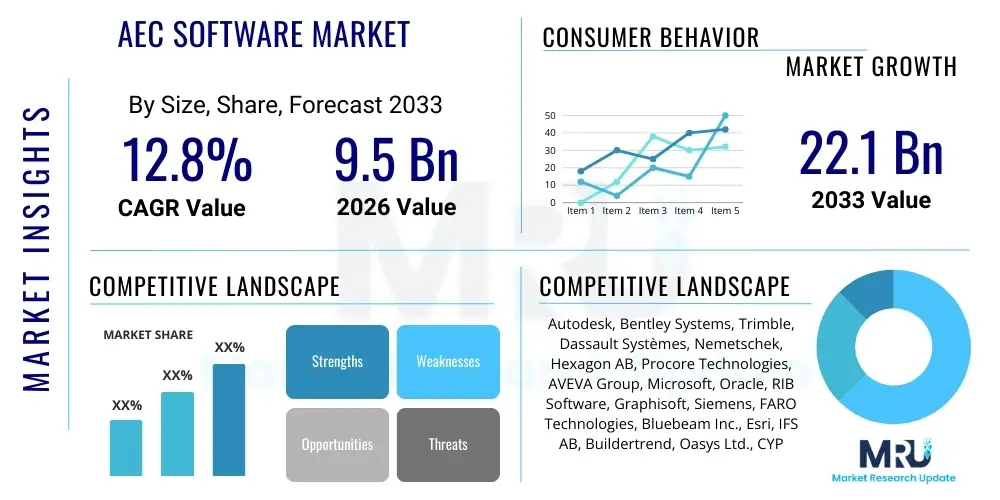

The AEC Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 22.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for efficient, sustainable construction practices and the mandatory implementation of Building Information Modeling (BIM) standards across major developed and developing economies. The transition from traditional 2D design methods to integrated 3D modeling and data management platforms forms the backbone of this market trajectory, ensuring significant investment in advanced AEC solutions capable of optimizing the entire project lifecycle, from conceptual design through facility management.

AEC Software Market introduction

The AEC Software Market encompasses specialized digital tools and platforms designed to support the entire workflow of the Architecture, Engineering, and Construction (AEC) industry. These products range from sophisticated Building Information Modeling (BIM) software and Computer-Aided Design (CAD) applications to project management systems, collaboration platforms, and structural analysis tools. Major applications include architectural design, infrastructure planning, cost estimation, construction simulation, and facilities management. The primary benefit of utilizing AEC software is the enhancement of project accuracy, reduction in material waste, acceleration of timelines, and improvement of interdisciplinary collaboration, leading to higher quality and more sustainable built assets. Key driving factors fueling this market include rapid urbanization, stringent governmental mandates promoting digital construction standards, and the widespread necessity for infrastructure modernization globally, pushing firms toward digital transformation.

AEC Software Market Executive Summary

The AEC Software Market Executive Summary confirms robust growth driven primarily by technological maturity and mandatory industry adoption of digital workflows. Business trends indicate a strong shift towards cloud-based and Software-as-a-Service (SaaS) deployment models, offering scalability and improved accessibility for smaller and mid-sized firms, alongside increasing merger and acquisition activities focused on integrating niche technologies like reality capture and generative design capabilities into existing platforms. Regionally, North America and Europe maintain dominance due to established infrastructure and stringent BIM mandates, while the Asia Pacific region is demonstrating the highest growth trajectory, spurred by massive infrastructure investment in countries like China and India and increasing adoption of modular and pre-fabricated construction methods that necessitate advanced digital planning. Segment trends highlight Building Information Modeling (BIM) software as the leading component category, characterized by rapid advancements in interoperability and real-time data synchronization across various construction phases, underscoring the shift from disparate tools to integrated project lifecycle management solutions.

AI Impact Analysis on AEC Software Market

Common user questions regarding AI's impact on the AEC Software Market frequently center on themes of automation displacing human designers, the reliability of generative design outputs, the ethical implications of data-driven decision-making, and the feasibility of achieving true predictive project management. Users are specifically concerned about how AI will enhance efficiency in tasks such as structural optimization, risk analysis, code compliance checking, and clash detection, while simultaneously seeking clarification on the learning curve required for successful integration. There is a high expectation that AI will transition AEC software from being mere documentation tools to powerful proactive assistants capable of simulating complex environmental and structural scenarios, thereby significantly reducing design iterations and material consumption.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into AEC software is fundamentally transforming the design and construction landscape by enabling levels of complexity management and predictive analysis previously unattainable. Generative design, powered by AI algorithms, allows architects and engineers to explore thousands of design permutations based on defined constraints (cost, sustainability, structural integrity) in minutes, leading to optimized, high-performance building solutions that might not have been conceived through traditional processes. Furthermore, AI is central to enhancing project risk mitigation by analyzing vast datasets of past projects, identifying potential delays, budget overruns, and safety hazards long before they materialize on the construction site, thus shifting project management from reactive response to proactive intervention.

Moreover, AI is playing a critical role in automating tedious, time-consuming tasks, thereby allowing highly skilled AEC professionals to focus on complex problem-solving and creative endeavors. Applications such as automated quantity takeoff, visual recognition for quality control during construction (using drones and site imagery), and sophisticated predictive maintenance modeling in the operational phase are becoming standard features in modern AEC software suites. This widespread deployment of AI capabilities is not only increasing operational efficiency and reducing human error but is also driving the necessity for new standards regarding data quality and security, ensuring that the AI models are trained on reliable, unbiased information pertinent to complex global construction environments.

- Generative Design Optimization: AI automates design exploration, optimizing structures for performance, cost, and sustainability based on complex constraints.

- Automated Code Compliance: AI reviews designs against local and international building codes instantaneously, dramatically reducing approval timelines and errors.

- Predictive Risk Management: Machine Learning algorithms analyze historical project data to forecast potential delays, cost overruns, and supply chain disruptions.

- Construction Progress Monitoring: AI processes drone and sensor data for real-time tracking of site progress against the BIM model, identifying deviations instantly.

- Enhanced Interoperability: AI facilitates seamless data exchange between disparate software tools and systems by automating data mapping and cleaning processes.

- Digital Twin Creation and Management: AI algorithms update and refine digital twins based on live operational data, ensuring accurate representations for facility management and maintenance planning.

DRO & Impact Forces Of AEC Software Market

The AEC Software Market expansion is significantly propelled by key Drivers (D) such as global government mandates promoting BIM adoption, the necessity for efficient project delivery in response to rapid urbanization, and technological advancements enabling cloud-based collaborative workflows. However, this growth is tempered by substantial Restraints (R), including the high initial licensing costs and the steep learning curve associated with complex software, as well as persistent interoperability issues between solutions offered by different vendors. Significant Opportunities (O) arise from the emerging applications of AI in generative design, the integration of IoT for smart city development, and the growing demand for sustainable construction requiring sophisticated analysis tools. These interconnected factors collectively shape the Impact Forces, defining the market's velocity and direction, pushing the industry toward holistic digitalization while challenging vendors to simplify user experience and reduce implementation barriers.

A primary driver is the demonstrable return on investment (ROI) achieved through digital processes. Firms leveraging AEC software report substantial reductions in rework, material waste, and time-to-completion, making the investment crucial for maintaining competitiveness in global markets. Specifically, mandatory adoption policies, such as those implemented in the UK, Europe, and parts of Asia, have created a non-negotiable demand floor for advanced BIM platforms. Conversely, one of the most critical restraints impeding faster adoption, particularly among smaller and medium-sized enterprises (SMEs), remains the prohibitive cost of enterprise-level software suites and the substantial expenditure required for training specialized personnel. Furthermore, the fragmented nature of the construction industry, with numerous subcontractors using diverse systems, exacerbates the challenge of achieving true, seamless digital data flow.

The market impact forces are strongly influenced by the dual pressures of regulatory requirements for sustainability and the technological push towards integration. The opportunity inherent in leveraging digital twins for entire city planning and operational efficiency represents a long-term growth vector far beyond traditional building design. The overall impact is a fundamental restructuring of traditional AEC workflows: the increasing complexity of modern projects (e.g., highly sustainable, net-zero buildings) necessitates advanced simulation capabilities that only specialized software can provide. Thus, while cost and skills gaps present short-term hurdles, the overarching trend driven by efficiency and regulatory compliance ensures sustained, high-level growth across the forecast period.

- Drivers:

- Global BIM Mandates and Regulatory Support for Digital Construction.

- Increasing Complexity of Modern Infrastructure and Building Projects.

- Need for Enhanced Collaboration and Real-time Data Sharing across Project Teams.

- Focus on Sustainable Building Practices and Energy Efficiency Analysis.

- Restraints:

- High Initial Software Licensing and Implementation Costs.

- Interoperability Challenges Among Diverse Software Ecosystems.

- Steep Learning Curve and Shortage of Skilled Digital AEC Professionals.

- Resistance to Change in Traditional Construction Workflows.

- Opportunities:

- Integration of Artificial Intelligence (AI) and Machine Learning (ML) for Generative Design.

- Expansion of Cloud-based and SaaS Delivery Models for Accessibility.

- Growth of Digital Twin Technology for Asset Performance Monitoring.

- Adoption of Virtual and Augmented Reality (VR/AR) for Site Visualization and Training.

Segmentation Analysis

The AEC Software Market segmentation provides a detailed structural breakdown based on component type, deployment model, application utility, and specific end-user category, offering critical insights into market dynamics and growth potential across diverse operational needs within the construction lifecycle. The component segment differentiates between core software licenses and essential services (consulting, maintenance, training), highlighting the growing reliance on subscription-based service models. Deployment segmentation, splitting the market into on-premise and cloud-based solutions, underscores the ongoing migration towards flexible, accessible cloud platforms that facilitate remote collaboration. Analyzing the market through these well-defined segments allows stakeholders to accurately gauge technological adoption rates and identify high-growth niches driven by evolving industry requirements, such as the accelerated uptake of BIM in specialized infrastructure projects.

The application segmentation is crucial as it reveals where digital investment is most concentrated, with Building Information Modeling (BIM) currently holding the dominant share due to its foundational role in integrated project delivery (IPD) and compliance mandates. This segment is closely followed by project management and collaboration software, essential for managing complex supply chains and ensuring timely project execution. Understanding the End-User segmentation—comprising architects, structural engineers, contractors, and asset owners—is vital for vendors to tailor their products, addressing specific pain points; for instance, owners increasingly demand digital twin capabilities for long-term facility optimization, contrasting with the contractor’s primary need for construction simulation and clash detection tools.

This layered approach to market segmentation not only illustrates the current landscape but also forecasts future shifts, particularly the increasing convergence of design and construction software. The integration facilitated by cloud platforms and unified data environments is blurring traditional segment boundaries, leading to holistic, end-to-end solutions. This trend necessitates strategic development of platforms that can serve multiple user types across the project timeline, reinforcing the market movement away from siloed applications toward comprehensive digital ecosystems that improve efficiency and reduce data fragmentation throughout the entire asset lifecycle, ultimately maximizing user value.

- Component:

- Software (Design, Analysis, Management)

- Services (Consulting, Implementation, Support, Training)

- Deployment Type:

- On-premise

- Cloud-based/SaaS

- Application:

- Building Information Modeling (BIM)

- Computer-Aided Design (CAD)

- Project Management and Collaboration

- Resource and Field Management

- Analysis and Simulation (Structural, Energy)

- End-User:

- Architects

- Engineers (Structural, MEP)

- Contractors and Builders

- Owners and Developers (Facility Management)

Value Chain Analysis For AEC Software Market

The Value Chain Analysis for the AEC Software Market begins at the upstream level with raw technology providers, including companies specializing in foundational algorithms, cloud infrastructure services (like AWS or Azure), and proprietary kernel development essential for geometric modeling engines. These inputs are procured by the core software developers (e.g., Autodesk, Bentley Systems) who focus on R&D, application development, and platform integration, adding significant value through specialized features such as generative design, simulation capabilities, and secure data handling protocols. The midstream involves distribution and sales, where vendors utilize both direct sales teams and an extensive network of Value-Added Resellers (VARs) and integrators who provide crucial localization, customization, and implementation support, particularly important for complex BIM deployments and regional regulatory compliance requirements.

Moving downstream, the value chain involves the implementation and consumption of the software by the end-users—architects, engineers, and contractors—who apply these tools to create tangible value in real-world construction projects. The final stage involves post-sales services, including continuous technical support, training, and software updates, which are essential for maintaining user proficiency and ensuring compliance with evolving standards. The distribution channel structure heavily relies on indirect channels, specifically certified partners who not only sell licenses but also bundle them with specialized consulting services tailored to specific industry verticals (e.g., infrastructure vs. vertical construction). Direct sales are generally reserved for large enterprise accounts seeking customized, globally deployed platform agreements.

The effectiveness of the value chain is increasingly dependent on high levels of interoperability and cloud infrastructure support. Software vendors must collaborate closely with technology providers to maintain compatibility with evolving hardware and operating systems, while simultaneously fostering open standards (like IFC) to ensure their products function effectively within the broader digital ecosystem of a construction project. This integration of upstream technology with efficient downstream service delivery, facilitated by both direct engagement and expert VAR networks, is crucial for maximizing market reach and user satisfaction, especially given the global complexity and varying digital maturity across different regional construction markets.

AEC Software Market Potential Customers

Potential customers for the AEC Software Market are segmented broadly into professionals and organizations involved at every stage of the built environment lifecycle, from conceptual planning to long-term facility operation. The primary customer base includes architecture firms, structural engineering consultants, Mechanical, Electrical, and Plumbing (MEP) specialists, and large general contracting companies, all of whom utilize the software for core design, analysis, and construction documentation tasks. These professional service firms require highly specialized tools for complex tasks like structural analysis, energy performance modeling, and multi-trade coordination, focusing on achieving design intent while ensuring constructability and compliance with stringent local regulations.

A rapidly expanding customer segment comprises infrastructure owners, public works agencies, and private real estate developers. These entities often act as the final buyers and long-term operators of the assets. Their software needs are shifting towards platforms that enable sophisticated portfolio management, asset visualization (Digital Twins), and facilities management (FM) integration. They require solutions that extend beyond the construction phase, allowing them to leverage the BIM data created upstream to optimize maintenance schedules, manage energy consumption, and plan future renovations, thereby extracting maximum lifecycle value from their investment and demanding seamless handover of digital project information.

Furthermore, specialized segments such as material suppliers, fabrication specialists, and regulatory bodies are emerging as significant potential customers. Material suppliers use AEC software features to integrate their product specifications directly into BIM models, aiding in accurate material selection and procurement. Fabrication specialists rely on advanced software for modular construction planning and prefabrication workflows. Educational institutions and training centers also form a persistent customer base, essential for preparing the next generation of AEC professionals fluent in the latest digital tools, ensuring the industry has the necessary human capital to sustain the ongoing digital transformation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 22.1 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autodesk, Bentley Systems, Trimble, Dassault Systèmes, Nemetschek, Hexagon AB, Procore Technologies, AVEVA Group, Microsoft, Oracle, RIB Software, Graphisoft, Siemens, FARO Technologies, Bluebeam Inc., Esri, IFS AB, Buildertrend, Oasys Ltd., CYPE Ingenieros. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AEC Software Market Key Technology Landscape

The technology landscape of the AEC Software Market is currently dominated by the convergence of several advanced digital platforms, primarily centered around Building Information Modeling (BIM) as the central data repository and collaborative environment. Core technological developments involve moving BIM from a purely geometric modeling tool to an integrated data management system encompassing 4D (schedule), 5D (cost), 6D (sustainability), and 7D (facilities management) capabilities. Key technologies enabling this comprehensive integration include highly sophisticated geometric kernels, cloud-native architectures utilizing serverless computing and microservices, and standardized data exchange protocols like Industry Foundation Classes (IFC) to facilitate open BIM workflows, reducing vendor lock-in and improving project transparency across diverse software platforms.

Beyond core BIM development, the market is profoundly influenced by emerging technologies that enhance data capture, simulation, and real-world application. This includes the widespread integration of reality capture technologies, such as LiDAR scanning, photogrammetry, and drone mapping, which rapidly translate physical site conditions into highly accurate digital models that can be instantly integrated into the design environment. Furthermore, the application of high-performance computing (HPC) and advanced simulation software is critical for complex structural, seismic, wind, and energy analysis, allowing engineers to test and validate designs under extreme conditions virtually, ensuring the safety and long-term sustainability performance of the final asset long before construction commences.

The most transformative current technological shift involves the application of Artificial Intelligence (AI) and Machine Learning (ML) across the design and construction phases. AI is used in generative design to rapidly optimize solutions based on performance criteria, in project management for predictive analytics regarding risk and resource allocation, and in automation tools like automated clash detection and compliance checking. Complementary technologies such as Virtual Reality (VR) and Augmented Reality (AR) are also vital, enabling immersive design reviews and overlaying digital construction information onto the physical job site, thereby improving communication, reducing errors, and accelerating decision-making processes, marking a clear trajectory toward fully digitized and automated construction site management.

Regional Highlights

North America remains a significant revenue contributor in the AEC Software Market, characterized by high technological maturity, extensive adoption of advanced BIM level 2 and 3 standards, and a robust private sector focused on complex commercial and residential development. The United States and Canada are frontrunners, driven by massive infrastructure spending initiatives and the necessity for efficiency improvements in a high-labor-cost environment. The region’s market strength is bolstered by the presence of global AEC software headquarters and a strong culture of innovation, particularly in integrating emerging technologies like cloud computing, AI for generative design, and advanced construction robotics management solutions. The demand here focuses heavily on comprehensive project management platforms and solutions that enhance supply chain optimization and field execution efficiency, reflecting the industry's push toward integrated project delivery (IPD) models.

Europe represents the second largest market, distinguished by strict governmental mandates that often push the boundaries of digital construction standards, particularly regarding sustainability and energy performance. Countries like the UK, Germany, and the Nordic nations have implemented mandatory BIM usage for publicly funded projects, creating a steady, high-volume demand for software compliant with these rigorous standards. European firms prioritize software with deep capabilities in sustainability analysis (6D BIM) and facility management (7D BIM), aligning with the EU's Green Deal ambitions and requiring meticulous documentation of building performance throughout its lifecycle. The market is also heavily influenced by regulatory compliance software designed to harmonize diverse national building codes across the continent, requiring flexibility and localization from global software providers.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the forecast period, fueled by unprecedented infrastructure development, rapid urbanization, and massive housing demands in major economies such as China, India, Japan, and Southeast Asian nations. While the region is characterized by varying levels of digital maturity, governments are increasingly recognizing the efficiency gains offered by digital transformation, leading to accelerating investment in BIM adoption and smart city initiatives. Market growth is particularly explosive in construction management software as firms seek to manage large, fast-paced projects with fewer delays. The challenge in APAC lies in adapting global software standards to local construction practices and language requirements, although the sheer volume of new construction projects ensures that this region will be the primary driver of new software license adoption globally.

Latin America and the Middle East and Africa (MEA) regions are emerging markets with significant, though uneven, growth potential. In the Middle East, particularly the Gulf Cooperation Council (GCC) nations, large-scale, visionary mega-projects (such as Neom in Saudi Arabia) are mandating the use of the most advanced AEC technologies, including extensive use of digital twins and integrated design platforms, pushing demand for sophisticated enterprise-level software. In Latin America and Africa, growth is more fragmented but is rising sharply in countries undergoing significant infrastructure upgrades (e.g., Brazil, Mexico, South Africa). The key growth driver in these areas is the urgent need for cost-effective, scalable, and often cloud-based AEC solutions that can be rapidly deployed to improve project control and oversight in environments frequently challenged by regulatory complexity and volatile construction costs. The expansion of mobile field management applications is especially vital for maximizing site efficiency across geographically dispersed projects in these emerging markets.

- North America: Dominance due to advanced BIM adoption, high labor costs driving automation, and strong presence of leading software vendors.

- Europe: High growth driven by stringent governmental mandates for BIM usage (Levels 2/3) and an intense focus on sustainable building standards (6D BIM).

- Asia Pacific (APAC): Fastest growing region fueled by rapid urbanization, massive infrastructure spending, and increasing governmental support for digital transformation in China, India, and ASEAN nations.

- Middle East & Africa (MEA): Significant investment driven by large-scale, high-technology mega-projects demanding cutting-edge digital twin and project control software.

- Latin America: Rising adoption, focused on cloud-based solutions to manage complex infrastructure projects and improve cost predictability in volatile economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AEC Software Market.- Autodesk

- Bentley Systems

- Trimble

- Dassault Systèmes

- Nemetschek SE

- Hexagon AB

- Procore Technologies

- AVEVA Group

- Microsoft

- Oracle

- RIB Software (Schneider Electric)

- Graphisoft

- Siemens

- FARO Technologies

- Bluebeam Inc. (Nemetschek Group)

- Esri

- IFS AB

- Buildertrend

- Oasys Ltd.

- CYPE Ingenieros

Frequently Asked Questions

Analyze common user questions about the AEC Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of AEC software?

The primary driver is the mandatory adoption of Building Information Modeling (BIM) standards by governments globally, coupled with the industry's critical need to improve project efficiency, reduce construction waste, and manage the complexity of modern, sustainable infrastructure projects effectively.

How is cloud computing impacting the future of AEC software deployment?

Cloud computing is making AEC software more accessible, affordable (via SaaS models), and collaborative. It enables real-time data synchronization among geographically dispersed teams and facilitates the handling of large BIM models, overcoming historical barriers related to high-performance local hardware requirements.

Which application segment holds the largest share in the AEC Software Market?

Building Information Modeling (BIM) software holds the largest share, as it serves as the foundational platform for integrated design, analysis, documentation, and handover processes across architecture, engineering, and construction phases, essential for integrated project delivery.

What role does Artificial Intelligence (AI) play in current AEC software development?

AI is increasingly integrated for advanced capabilities such as generative design (optimizing structures), automated clash detection, predictive project risk analysis, and enhancing the accuracy of digital twin models through real-time operational data processing.

What are the main challenges facing the AEC Software Market growth?

The primary challenges include the high initial capital expenditure for licensing and implementation, persistent technical issues related to software interoperability between different vendor platforms, and the industry shortage of adequately trained personnel capable of leveraging advanced digital tools efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager