Aerospace Electrical Insert Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442313 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Aerospace Electrical Insert Market Size

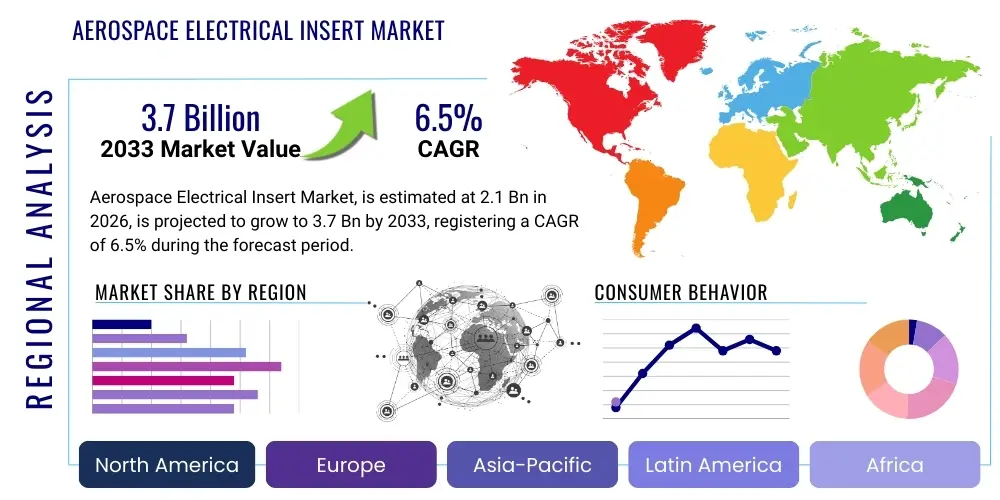

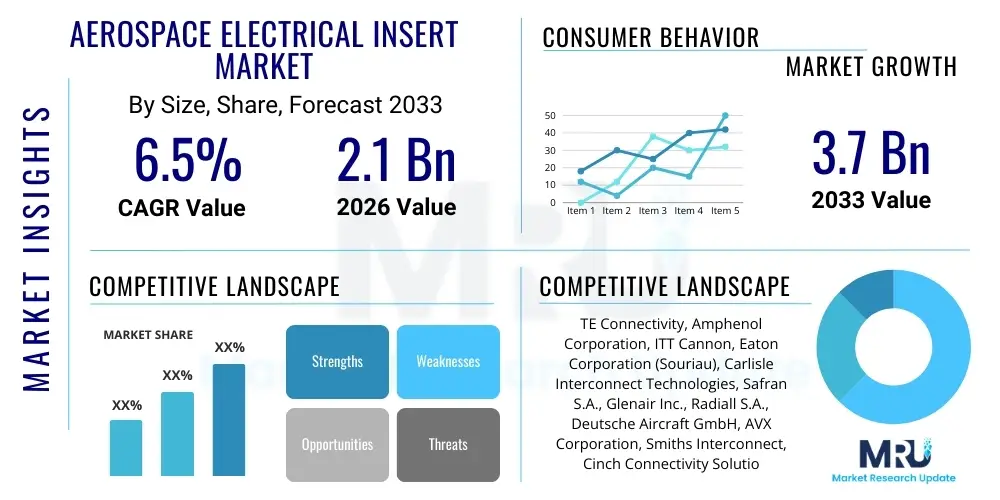

The Aerospace Electrical Insert Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.7 Billion by the end of the forecast period in 2033.

Aerospace Electrical Insert Market introduction

The Aerospace Electrical Insert Market encompasses specialized components critical for establishing secure, reliable electrical connections within harsh operational environments characteristic of aircraft, spacecraft, and satellite systems. These inserts are foundational elements of circular and rectangular connectors, providing the crucial mechanical and electrical interface that ensures power, signal, and data integrity under extreme conditions, including wide temperature variations ranging from -65°C to over 200°C, high vibration loads prevalent during takeoff and turbulent flight, and exposure to corrosive fluids such as de-icing agents, hydraulic oils, and specialized aviation fuels. The components are typically manufactured from high-performance dielectric materials, often incorporating advanced metals for contacts (such as beryllium copper or specialized brass alloys, frequently plated with gold or nickel for minimized contact resistance and long-term stability), ensuring low electrical resistance and exceptional durability over the extended operational lifecycles mandated by rigorous aviation safety standards and military specifications (MIL-SPEC). The reliability of these inserts is non-negotiable, given their direct involvement in flight-critical systems.

The primary applications of aerospace electrical inserts span various critical systems, demonstrating their ubiquitous presence across the aerospace vehicle. These systems include complex avionics bays hosting flight management computers and navigation systems, engine control units (ECUs) subjected to extreme heat and vibration, landing gear mechanisms requiring high shock resistance, in-flight entertainment (IFE) and cabin comfort systems, and crucial navigation and communication equipment relying on high-fidelity signal transmission. The market growth is fundamentally propelled by the relentless expansion of the global commercial aircraft fleet, driven by increased passenger traffic, especially in emerging economies, and the subsequent, inevitable high demand for Maintenance, Repair, and Overhaul (MRO) activities required to maintain aging aircraft integrity and compliance. This MRO segment drives consistent aftermarket demand for certified replacement inserts, sustaining market stability and providing a reliable revenue stream for specialized component manufacturers.

Furthermore, the defense sector's focus on modernization programs, including the development and deployment of stealth aircraft and high-altitude, long-endurance (HALE) Unmanned Aerial Systems (UAS), is driving demand for highly specialized, ruggedized electrical insert technology. These modern platforms necessitate superior components capable of handling significantly higher density wiring bundles, supporting faster data rates (e.g., 10 Gigabit Ethernet), and maintaining signal integrity in electromagnetically congested environments (EMI/RFI shielding). Key benefits derived from utilizing high-quality aerospace electrical inserts include enhanced system reliability (reducing Mean Time Between Failures - MTBF), minimized aircraft downtime for maintenance due to connection failures, and superior resistance to environmental degradation over the aircraft's operational lifespan. Driving factors include stricter regulatory requirements for component traceability and flight safety, the ongoing technological trend toward aircraft electrification (More Electric Aircraft - MEA) drastically increasing electrical load requirements, and continuous material science advancements leading to lighter, smaller, and more robust insert designs compatible with modern, space-constrained aircraft architectures demanding improved power-to-weight ratios.

Aerospace Electrical Insert Market Executive Summary

The Aerospace Electrical Insert Market is currently characterized by robust business trends centered on technological imperatives: miniaturization, demanding higher pin density in smaller form factors; the necessity for high-speed data transfer capabilities to support advanced sensor suites and modular avionics; and the accelerated integration of composite materials (like carbon fiber reinforced polymers and specialized thermoplastics) to achieve overall system weight reduction. Strategic partnerships between specialized insert manufacturers and Tier 1 avionics systems suppliers (e.g., integrators of cockpit displays or engine control systems) are becoming increasingly critical to co-develop custom, pre-certified solutions tailored specifically for next-generation platforms, such as replacements for legacy narrow-body aircraft or sophisticated military aerial vehicles. The industry’s renewed emphasis on supply chain resiliency, exacerbated by geopolitical instability and pandemic-related disruptions, has led many leading industry participants to implement dual-sourcing strategies and focus on establishing redundant, regional manufacturing centers, thereby ensuring local compliance with stringent aerospace quality management systems (AS9100) and reducing reliance on singular global production hubs. Furthermore, industry-wide sustainability initiatives are influencing material choices, pushing manufacturers towards developing lighter, potentially recyclable polymers and optimizing production processes to minimize waste and energy consumption in line with broader environmental, social, and governance (ESG) goals.

Regionally, North America maintains its established dominance in the market landscape, primarily due to the overwhelming presence of major aerospace Original Equipment Manufacturers (OEMs) such as Boeing and Gulfstream, coupled with historically substantial defense procurement budgets and maintenance spending by the US Department of Defense. This segment consistently drives demand for highly advanced, military-grade electrical inserts that comply rigorously with MIL-STD and MIL-DTL specifications. Conversely, the Asia Pacific (APAC) region is demonstrating the highest projected growth trajectory over the forecast period. This rapid expansion is fueled by significant government investments in civil aviation infrastructure development, a burgeoning middle class driving dramatically increased domestic air travel, and the strategic establishment of new, large-scale Maintenance, Repair, and Overhaul (MRO) facilities, particularly in rapidly industrializing nations like China, India, and Southeast Asia. European nations, backed by cooperative defense programs (e.g., future combat air systems) and strong industrial aerospace players like Airbus, Leonardo, and Safran, represent a mature yet highly specialized market segment, frequently prioritizing technological sophistication and rigorous compliance with European Aviation Safety Agency (EASA) regulations, often leading innovations in niche areas such as hermetically sealed, high-pressure, and extreme high-temperature resistant inserts for engine applications.

Analysis of segment trends reveals a notable market preference toward composite-based circular inserts, which offer a superior strength-to-weight ratio and enhanced corrosion resistance compared to traditional metallic shelled connectors, making them ideal for modern airframes seeking weight optimization. Within the broader application segmentation, the commercial aircraft MRO segment is experiencing rapid organic expansion due to the increasing average age of the global fleet, which necessitates more frequent and extensive overhaul cycles and component replacement, thus driving consistent aftermarket demand for reliable replacement electrical inserts. The material segment is characterized by accelerated innovation in polymers such as PEEK (Polyether ether ketone) and specialized thermoset resins, which are being optimized for enhanced fire resistance (low smoke, low toxicity), improved dielectric performance, and heightened thermal endurance in high-power applications. This material evolution is directly supportive of the broader market transition towards electrified aircraft systems, which crucially demand electrical interconnects capable of reliably handling high voltage (HV) and high current (HC) loads without premature failure or insulation breakdown, thereby ensuring overall flight safety and operational efficiency.

AI Impact Analysis on Aerospace Electrical Insert Market

User queries regarding the impact of Artificial Intelligence (AI) on the Aerospace Electrical Insert Market commonly revolve around themes of manufacturing optimization, predictive maintenance integration, and quality assurance enhancement throughout the product lifecycle. Users frequently ask how AI-driven machine vision systems can improve non-destructive defect detection during the high-precision insert molding process, specifically targeting microscopic flaws or dimensional non-conformities that are nearly invisible to human inspectors, thus minimizing scrap rates and ensuring zero-defect components critical for maintaining high standards of flight safety and airworthiness. Another key concern centers on the use of sophisticated machine learning algorithms trained on flight data to predict the Remaining Useful Life (RUL) of electrical connectors in active aircraft, thereby optimizing MRO schedules, reducing reliance on time-based maintenance, and minimizing unscheduled maintenance events caused by unexpected insert degradation or electrical failure. Expectations are high that AI will significantly streamline complex design processes, allowing for faster iterative prototyping and highly customized optimization of electrical inserts to meet unique platform specifications, particularly those related to managing electromagnetic compatibility (EMC) requirements and ensuring robust high-frequency signal transmission in future aircraft designs characterized by extensive sensing and networking capabilities.

- AI-driven predictive maintenance models utilize operational telemetry data (e.g., temperature, resistance fluctuations) to accurately forecast connector failure probabilities, significantly reducing unscheduled maintenance events.

- Machine learning algorithms optimize complex manufacturing parameters (e.g., injection molding temperature profiles, pressure cycles, curing time) in real-time to ensure maximum material integrity and consistent quality of dielectric inserts.

- AI-powered automated vision inspection systems enhance precision defect detection, identifying minute cracks, tool marks, or tolerance deviations in complex insert geometries at high production throughput rates exceeding human capability.

- Generative design tools, guided by AI, assist specialized engineers in rapidly creating lighter, structurally optimized electrical insert designs tailored for rigorous environmental challenges, improving performance-to-weight ratios.

- AI facilitates supply chain resilience and optimization by accurately predicting localized demand fluctuations for specific insert types used across various commercial and military platforms, ensuring timely inventory management and reducing stock-outs.

DRO & Impact Forces Of Aerospace Electrical Insert Market

The Aerospace Electrical Insert Market is governed by a dynamic interplay of powerful drivers, stringent restraints, and significant long-term opportunities that collectively define its trajectory and growth potential. Primary drivers include the massive and enduring global backlogs for commercial aircraft (currently extending over a decade for major models), necessitating high-volume production rates from OEMs and their supply chains. A critical technological driver is the continuous and pervasive push towards the More Electric Aircraft (MEA) architecture, which fundamentally increases the required number and sophistication of electrical interconnect solutions throughout the airframe. This shift means traditional hydraulic and pneumatic systems are being replaced by electrical counterparts, demanding specialized, high-reliability, and high-power density electrical inserts. Moreover, the consistent and substantial expenditure on military aerospace modernization globally, particularly regarding the development of fifth- and sixth-generation fighters, sophisticated surveillance platforms, and high-altitude Unmanned Aerial Systems (UAS), further necessitates the deployment of specialized, highly ruggedized electrical inserts capable of enduring extreme environmental stresses, including intense shock, vibration, and extreme altitude pressure differentials, often dictated by strict military specifications (MIL-DTL series).

Despite these strong drivers, the market faces notable and inherent restraints, chiefly the extremely prolonged and capital-intensive qualification and certification cycles mandated by global regulatory bodies such as the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and various national defense standards agencies. Introducing any new material or design modification, particularly into flight-critical systems, necessitates extensive, often years-long testing and auditing, which significantly increases the time-to-market for innovative products and substantially raises development costs. Furthermore, the inherent susceptibility of complex, high-density inserts to assembly issues, such as damage from Foreign Object Debris (FOD) during harness installation, and the engineering challenge of managing material compatibility to prevent thermal expansion mismatch between the insert and the connector shell under extreme temperature cycling, pose continuous manufacturing hurdles. The highly specialized nature of the supply chain also imposes constraints, leading to a reliance on a limited number of certified raw material suppliers (especially for aerospace-grade PEEK and specialized composites), thereby creating market vulnerability to geopolitical events and raw material price volatility, potentially impacting production schedules and profitability across the value chain.

Significant opportunities for lucrative growth are increasingly concentrated in the burgeoning commercial satellite and space launch sector, which is experiencing exponential private investment and governmental focus globally. This sector demands bespoke, ultra-reliable, radiation-hardened electrical inserts and associated interconnect solutions optimized for reliable operation in the vacuum and extreme radiation environment of Low Earth Orbit (LEO) and beyond. Furthermore, the industry-wide shift toward modular aircraft design philosophies and the increasing digitization and networking of avionics systems create significant long-term demand for easily maintainable, field-repairable, and high-speed data interconnect inserts, supporting protocols like ARINC 800 and Ethernet-based backbones. The collective impact forces—comprising intense regulatory scrutiny over component airworthiness, the accelerating rate of technological obsolescence for legacy electrical components, and the continuous industry imperative for reducing overall aircraft weight to improve fuel efficiency—compel manufacturers to constantly invest heavily in R&D, prioritizing material science breakthroughs, enhanced manufacturing precision, and optimized thermal management techniques to maintain competitive relevance and expand their market share globally. This competitive environment ensures continuous innovation in insert design and manufacturing standards.

Segmentation Analysis

The Aerospace Electrical Insert Market is meticulously segmented based on key criteria including material type, application, end-user, and insert geometry, reflecting the diverse and highly specialized needs of the aerospace sector. This detailed segmentation allows market participants to tailor their offerings—whether standard components or highly customized solutions—to specific operational and environmental requirements demanded by various platforms, from commercial wide-bodies to military fighters and launch vehicles. The analysis of these segments is crucial for understanding demand elasticity, identifying critical technological adoption gaps, and predicting which product innovations, such as enhanced high-temperature resistance materials or increased high-density pin configurations, will primarily drive future market expansion within the commercial aviation, defense, and nascent space industries. This granular view informs strategic R&D investments and targeted sales strategies.

- By Material Type:

- Thermoset Resins (e.g., Epoxy, Phenolic)

- Thermoplastics (e.g., PEEK, Ultem)

- Ceramic Materials

- By Application:

- Avionics and Communication Systems

- Engine and Power Systems

- Cabin and Interior Systems (IFE, Lighting)

- Flight Control Surfaces

- Landing Gear and Braking Systems

- By Aircraft Type:

- Commercial Aviation (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighters, Helicopters, Transport)

- General Aviation

- Space and Satellites

- By Connector Type:

- Circular Connectors

- Rectangular Connectors

- Fiber Optic Connectors (Hybrid Inserts)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) Providers

- Aftermarket Suppliers

Value Chain Analysis For Aerospace Electrical Insert Market

The value chain for the Aerospace Electrical Insert Market begins at the upstream segment with the highly specialized sourcing and processing of core raw materials. This segment involves securing high-performance engineering plastics, predominantly aerospace-grade Polyether ether ketone (PEEK), customized polyimide formulations, and thermosetting resins like high-grade epoxies, alongside high-purity conductive metals, typically copper alloys (like brass or bronze) meticulously plated with gold, palladium, or nickel to ensure minimum contact resistance and maximum corrosion protection. Upstream players, including specialized chemical and material processors, face the demanding challenge of not only meeting standard industrial requirements but also adhering to stringent aerospace material specifications (e.g., MIL-SPEC, UL 94 V-0 flame rating, low smoke and toxicity standards) and maintaining stable pricing amid fluctuating global commodity markets. Material preparation, including specialized compounding, pelletizing, and final molding preparations, requires substantial capital investment in highly controlled manufacturing environments to guarantee absolute material consistency, which is critically important for maintaining the dielectric strength, thermal characteristics, and precise dimensional stability of the final electrical insert component under operational stress.

The core of the value chain is the midstream manufacturing process, where material input transitions into the final, highly complex product through precision injection molding, multi-axis CNC machining, and automated micro-assembly of the inserts, contacts, and retention clips. This stage demands exceptional precision engineering and advanced quality control protocols, as manufacturing tolerances for aerospace electrical inserts are often extremely tight—measured in microns—to ensure perfect, reliable mating with both the connector shell and the corresponding contact pins or sockets. Direct distribution channels are typically employed by large, established specialized interconnect manufacturers selling directly to major aerospace OEMs (such as Airbus, Boeing, and their engine and system integrators) for integration during new aircraft production cycles. This direct relationship necessitates complex, long-term contractual agreements, strict compliance with continuous quality audits (e.g., AS9100/AS9120), and usually involves extensive co-development efforts where the insert manufacturer designs bespoke connector solutions tailored precisely for unique platform specifications, such as high vibration zones near engines or pressurized cabin areas.

Downstream analysis highlights the crucial role of certified Maintenance, Repair, and Overhaul (MRO) providers and specialized aerospace component distributors in the indirect market channel. These authorized distributors maintain highly controlled, certified stock inventories and manage the complex, time-sensitive logistics required to supply replacement inserts, repair kits, and spare components to global airlines, military aviation depots, and independent third-party MRO facilities. This indirect channel is particularly vital for sustaining the aftermarket segment, where demand is driven by predictable, periodic scheduled maintenance cycles, unscheduled repairs, and the need to support the long operational longevity of commercial and military aircraft. The effectiveness and legitimacy of the distribution channel are heavily dependent on maintaining meticulous quality traceability, ensuring that every electrical insert supplied possesses comprehensive certification documentation (e.g., Certificates of Conformance) proving compliance with the required airworthiness standards throughout its entire existence, thereby supporting both the initial integration phase and subsequent replacement needs over the aircraft’s multi-decade lifecycle, underpinning safety and reliability standards across the fleet.

Aerospace Electrical Insert Market Potential Customers

Potential customers for aerospace electrical inserts fall into distinct categories, primarily segmented by their role in the aircraft lifecycle, ranging from initial design and manufacturing to long-term maintenance and system upgrades. Original Equipment Manufacturers (OEMs) such as Airbus, Boeing, Bombardier, and their defense counterparts (e.g., Northrop Grumman, BAE Systems) are the primary consumers for new aircraft production. These customers require massive volumes of standard and custom-designed inserts that meet the initial certification requirements of new platforms, focusing heavily on weight minimization, absolute reliability, and comprehensive compatibility with the aircraft's advanced electronic architecture, including specialized requirements for high-frequency or high-power applications. OEMs typically drive the adoption of the latest technological innovations, such as higher density inserts and composite material solutions designed for next-generation platforms seeking optimal performance metrics.

The second major customer group is the global network of Maintenance, Repair, and Overhaul (MRO) providers, along with airlines operating their own in-house maintenance shops. These customers generate consistent, high-value demand for replacement and spare parts necessary for routine scheduled checks (A, C, D checks), component repair, and mid-life aircraft upgrades (e.g., cabin modernization). Unlike the cyclical nature of OEM demand, MRO demand is often driven by the need for exact form, fit, and function replacements compatible with legacy systems already certified on aging aircraft, meaning component longevity, guaranteed availability through certified distributors, and rapid delivery logistics are paramount concerns. MRO customers often prioritize cost-effectiveness and quick fulfillment to minimize critical aircraft downtime, often leading them to rely on established, certified aftermarket suppliers.

Additionally, specialized customers, including national space agencies (like NASA, ESA, JAXA) and the rapidly growing sector of private space companies (e.g., SpaceX, Blue Origin, Rocket Lab), represent a high-growth, niche market segment. These specialized buyers require bespoke electrical inserts tailored for the extreme operational demands of launch vehicles and sensitive satellite systems, necessitating specific engineering attributes such as resistance to extreme radiation, high vacuum, micro-meteoroid impact resilience, and precise thermal cycling stability. Furthermore, specialized avionics system integrators and Tier 1 sub-system suppliers (e.g., Collins Aerospace, Honeywell, Safran Electrical & Power) also act as significant direct buyers, procuring electrical inserts for the complex sub-systems they manufacture (e.g., flight decks, hydraulic pump controls, engine sensors) before delivering the integrated unit to the final airframer, demanding strict adherence to sub-system performance specifications and proprietary interface standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, ITT Cannon, Eaton Corporation (Souriau), Carlisle Interconnect Technologies, Safran S.A., Glenair Inc., Radiall S.A., Deutsche Aircraft GmbH, AVX Corporation, Smiths Interconnect, Cinch Connectivity Solutions, Bel Fuse Inc., Huber+Suhner, Molex LLC, Fischer Connectors, Positronic, LEMO S.A., Esterline Technologies, Times Microwave Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Electrical Insert Market Key Technology Landscape

The technological landscape of the Aerospace Electrical Insert Market is undergoing continuous transformation, driven primarily by the escalating demand to manage ever-increasing power loads, support ultra-high data rates, and ensure operational resilience within the constraint of extremely limited space and weight budgets. A crucial technological focus area remains rooted in advanced material science, specifically the development and utilization of high-performance dielectric materials. This includes advanced PEEK, customized polyimide formulations, and specialized ceramic compounds, all of which are selected for their superior thermal stability, drastically reduced outgassing properties in vacuum environments (essential for satellite and deep-space applications), and exceptional chemical resistance to corrosive aerospace fluids like hydraulic oil, aggressive solvents, and specialized jet fuel variants. These cutting-edge materials allow electrical inserts to function reliably at significantly higher operational temperatures (up to 250°C) and higher voltages, critically supporting the widespread adoption of 270V DC power systems and other high-voltage components necessitated by modern More Electric Aircraft (MEA) architectures, directly addressing the industry's continuous need for improved power density and efficiency.

A second significant technological advancement centers intensely on optimizing the internal geometry and contact density to improve signal integrity and support ultra-high-speed data transmission required for modern sensor fusion and communication systems. This involves the meticulous design and manufacturing of specialized inserts compatible with aerospace standards such as ARINC 600 (rack and panel), ARINC 800 series (fiber optic and high-speed copper), and the highly ubiquitous MIL-DTL-38999 circular connectors. These modern high-speed inserts are meticulously engineered using advanced simulation and testing protocols to minimize detrimental effects such as crosstalk, signal reflections (VSWR), and insertion loss at frequencies supporting 10 Gigabit Ethernet, Fibre Channel, and future high-definition video data links. Manufacturers are increasingly leveraging sophisticated manufacturing techniques, including high-precision micro-molding, complex automated contact loading, and five-axis CNC machining, to achieve the exceptionally tight tolerances and complex geometrical features necessary for these high-density, multi-contact configurations. This manufacturing precision is fundamental to guaranteeing reliable physical and electrical performance under the intense vibration, mechanical shock, and cyclic fatigue inherent to extended aerospace operational profiles.

Furthermore, the integration of hybridization and advanced sealing technology represents a rapidly maturing technological niche. Hybridization involves combining electrical contacts (for power and standard signals) with delicate fiber optic termini (for high-bandwidth data) or even fluidic contacts within a single, modular connector body utilizing a common insert. This technological convergence simplifies the overall aircraft harness assembly process, significantly reduces the total weight and footprint of wiring systems, and minimizes the number of individual connection points required throughout the airframe, thereby improving overall system reliability and simplifying complex maintenance routines. Simultaneously, the adoption of advanced sealing technologies—such as specialized fluoroelastomers, customized silicone gaskets, and robust glass-to-metal hermetic sealing techniques—is critical. These sealing methods ensure superior environmental protection against moisture penetration, dust ingress, and severe pressure differentials encountered during rapid ascent and descent, particularly crucial for external applications, engine interfaces, and pressurized cabin bulkheads. The continuous refinement of these sealing and hybridization technologies firmly establishes reliability and robustness as the non-negotiable cornerstone of contemporary aerospace electrical insert development and deployment across all civil and military platforms globally.

Regional Highlights

- North America: Dominates the global market due to the massive presence of key aircraft manufacturers (Boeing, Lockheed Martin, General Dynamics), major defense contractors, and a highly mature R&D infrastructure focused on next-generation military aviation, including sophisticated electronic warfare systems and advanced space programs (e.g., Artemis). High defense spending, substantial government procurement, and significant commercial MRO activities drive consistent, high-volume demand for high-reliability, MIL-SPEC certified electrical inserts. The region is a leader in adopting specialized high-speed inserts for advanced avionic architecture upgrades, maintaining a large technological lead.

- Europe: A significant contributor, driven by the strong manufacturing base of pan-European companies like Airbus, major engine manufacturers (Safran, Rolls-Royce), and robust multinational space programs supported by the European Space Agency (ESA). The European market exhibits high growth in niche, specialized areas, focusing heavily on technological innovation, specifically in lightweight composite connectors and hermetically sealed solutions compliant with strict EASA environmental and safety standards. Collaborative defense initiatives (e.g., FCAS) will sustain high-end demand.

- Asia Pacific (APAC): Expected to exhibit the fastest growth rate over the forecast period, fueled by substantial economic expansion, booming passenger traffic leading to large, long-term aircraft order backlogs, and increasing strategic investment in domestic aircraft manufacturing capabilities (e.g., COMAC in China). Expanding Maintenance, Repair, and Overhaul (MRO) capabilities and intensive regional military modernization efforts in key nations like India, Japan, and South Korea are rapidly accelerating the demand for certified, reliable electrical components across both civil and defense sectors.

- Latin America (LATAM): A smaller, emerging market primarily driven by existing commercial airline fleet modernization efforts, increased regional airline operations, and selective military procurement. Demand is heavily reliant on imports from established North American and European suppliers, with growth intrinsically tied directly to the overall economic stability and continued civil aviation development in large economies such as Brazil, Mexico, and Chile.

- Middle East and Africa (MEA): Growth is primarily fueled by large-scale, state-backed commercial aviation investments by major regional flag carriers (Emirates, Qatar Airways, Etihad) expanding and modernizing their long-haul fleets, requiring substantial procurement of high-tech aircraft components, including certified electrical inserts, and significant ongoing military modernization programs focused heavily on high-tech imports from Western nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Electrical Insert Market.- TE Connectivity

- Amphenol Corporation

- ITT Cannon

- Eaton Corporation (Souriau)

- Carlisle Interconnect Technologies

- Safran S.A.

- Glenair Inc.

- Radiall S.A.

- Deutsche Aircraft GmbH

- AVX Corporation

- Smiths Interconnect

- Cinch Connectivity Solutions

- Bel Fuse Inc.

- Huber+Suhner

- Molex LLC

- Fischer Connectors

- Positronic

- LEMO S.A.

- Esterline Technologies

- Times Microwave Systems

Frequently Asked Questions

Analyze common user questions about the Aerospace Electrical Insert market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Aerospace Electrical Insert Market?

The Aerospace Electrical Insert Market is projected to grow at a robust CAGR of 6.5% between 2026 and 2033, primarily driven by increasing global commercial aircraft production rates, significant military modernization programs, and the continuous technological push towards comprehensive aircraft electrification.

Which material types are dominant in the production of aerospace electrical inserts?

High-performance thermoplastics like PEEK and specialized thermoset resins such as epoxy and polyimide dominate the market due to their superior dielectric properties, high thermal endurance, low smoke emission, and strict compliance with stringent aerospace flame and toxicity standards required for flight certification.

How does the trend toward More Electric Aircraft (MEA) impact the electrical insert market?

The MEA trend significantly increases the total addressable market by necessitating electrical interconnects capable of handling higher density wiring, higher voltage (up to 270V DC), and greater current loads, driving critical innovation in high-power contact and insulation material design for engine and distribution systems.

Which geographical region holds the largest market share for aerospace electrical inserts and why?

North America currently holds the largest market share, attributed to the presence of all major aerospace Original Equipment Manufacturers (OEMs), consistently substantial government defense spending on advanced aerial platforms, and a large, established certified Maintenance, Repair, and Overhaul (MRO) infrastructure.

What are the key technological challenges currently facing electrical insert manufacturers?

Key challenges include achieving precise dimensional stability in complex, high-density inserts, managing material thermal expansion mismatch in extreme temperature environments, and developing cost-effective, high-speed inserts capable of supporting 10 Gigabit Ethernet data rates without signal degradation across extended flight cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager