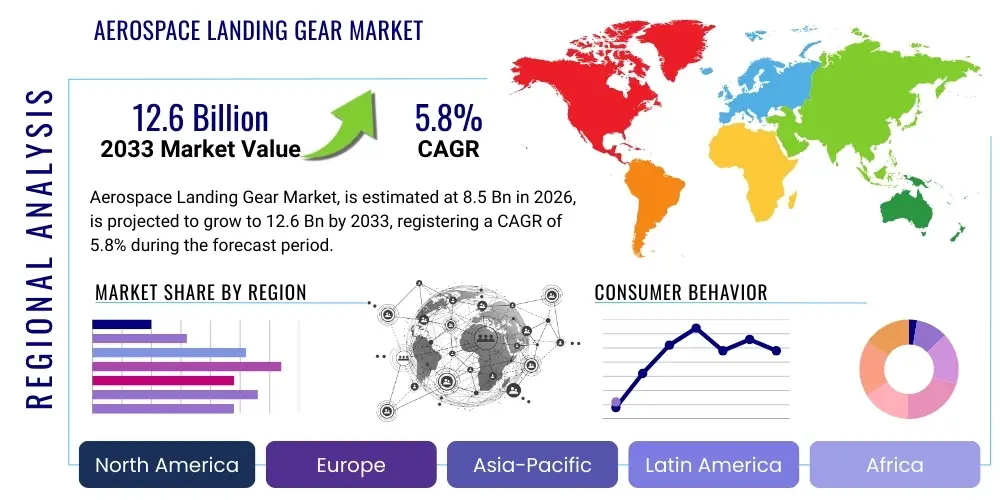

Aerospace Landing Gear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442004 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Aerospace Landing Gear Market Size

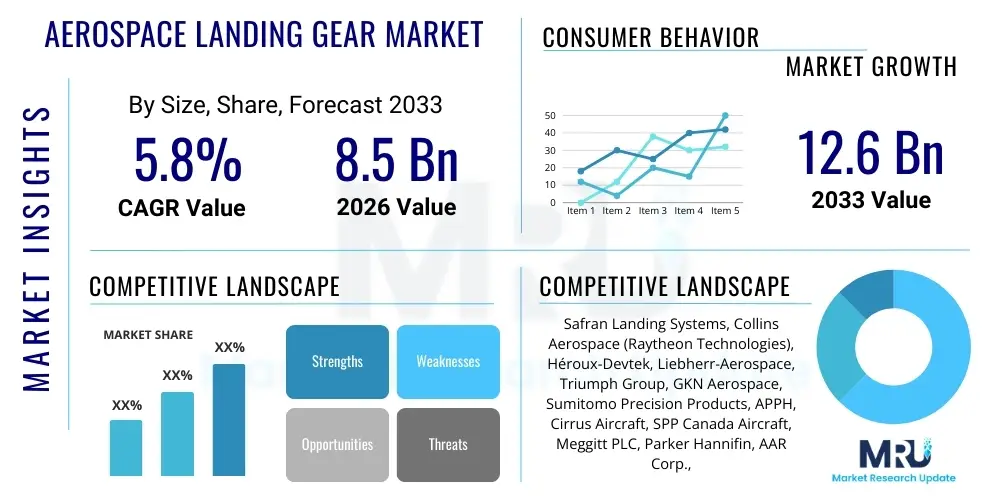

The Aerospace Landing Gear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Aerospace Landing Gear Market introduction

The Aerospace Landing Gear Market encompasses the design, manufacturing, overhaul, and repair of critical systems that support aircraft during taxiing, takeoff, and landing operations. These sophisticated assemblies are fundamental to aircraft safety and operational efficiency, managing immense kinetic energy absorption during touchdown and providing stable ground maneuverability. The market is primarily driven by consistent growth in global air passenger traffic, leading to escalating demand for new commercial aircraft, alongside robust modernization programs within military aviation fleets worldwide. Technological innovation centers on lightweight materials, such as titanium alloys and advanced composites, and the integration of advanced actuation systems like Electro-Hydraulic Actuation (EHA) and Electro-Mechanical Actuation (EMA) to replace traditional, heavier hydraulic systems, aiming for improved fuel efficiency and reduced maintenance complexity.

Major applications of aerospace landing gear span the entire spectrum of aviation, including commercial fixed-wing aircraft (narrow-body, wide-body, regional jets), military aircraft (fighters, bombers, transport planes), and the burgeoning urban air mobility (UAM) and drone sectors. The benefits derived from modern landing gear systems include enhanced structural integrity, optimized shock absorption capability, superior braking efficiency, and extended operational lifecycles. Furthermore, advancements in health monitoring systems integrated into landing gear components allow for predictive maintenance, significantly reducing Aircraft on Ground (AOG) events and lowering overall ownership costs for airlines and operators. The highly specialized nature of this component means that strict regulatory compliance and rigorous certification processes dictate market entry and sustained operation.

Driving factors propelling this market include the global expansion of low-cost carriers (LCCs) demanding highly reliable and low-maintenance components, the necessity for replacement and retrofitting activities in aging aircraft fleets, and the substantial increase in defense spending focused on procuring advanced military transport and combat platforms. Furthermore, the push towards sustainability mandates the development of lighter, more robust landing gear assemblies that contribute directly to reduced fuel consumption and lower operational emissions. The intense competitive landscape is characterized by high barriers to entry due to capital-intensive research and development, necessitating deep integration between original equipment manufacturers (OEMs) and major Tier 1 suppliers specializing in highly engineered metallic and mechanical solutions.

Aerospace Landing Gear Market Executive Summary

The Aerospace Landing Gear Market is poised for steady expansion, fueled significantly by the recovery of commercial aviation post-pandemic and the subsequent surge in aircraft backlog delivery schedules, particularly for single-aisle aircraft optimized for regional travel. Business trends indicate a strong move toward systems integration and MRO (Maintenance, Repair, and Overhaul) services, where suppliers are offering comprehensive lifecycle support rather than just components. Key players are investing heavily in Additive Manufacturing (AM) techniques to produce complex, lightweight components faster and with less material waste, fundamentally reshaping traditional forging and machining processes. The market is witnessing consolidation among MRO providers to offer scale and efficiency, addressing the growing need for specialized component repair capabilities, especially concerning high-pressure hydraulic components and robust shock struts.

Regional trends highlight the Asia-Pacific (APAC) region as the fastest-growing market, driven by massive investments in new airport infrastructure, rising domestic and international air travel volumes, and substantial commercial fleet expansion in nations like China and India. North America and Europe retain their strong positions, primarily due to the presence of leading aircraft OEMs (e.g., Boeing, Airbus) and established defense manufacturing hubs, emphasizing technological sophistication and advanced military landing gear programs. Latin America and the Middle East & Africa (MEA) offer emerging opportunities, characterized by fleet modernization and the procurement of new-generation, fuel-efficient narrow-body aircraft, which require durable and cost-effective landing gear solutions designed for diverse operational environments.

Segmentation trends reveal that the fixed-wing segment dominates the market due to the sheer volume of commercial airliners produced and operated globally, though the rotary-wing segment maintains consistent growth driven by military utility and offshore logistics requirements. In terms of end-use, the OEM segment accounts for the largest revenue share, intrinsically tied to new aircraft deliveries. However, the Aftermarket (MRO) segment is projected to exhibit the highest CAGR, propelled by the necessity for periodic overhaul and repair cycles (typically 6-10 years) required for critical load-bearing components to meet stringent airworthiness directives. Furthermore, the material segment shows a clear shift toward high-strength steel replacements and sophisticated titanium alloys, offering superior strength-to-weight ratios compared to traditional heavy metals.

AI Impact Analysis on Aerospace Landing Gear Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Aerospace Landing Gear Market frequently center on predictive maintenance capabilities, optimization of manufacturing processes, and enhanced design simulation. Users are primarily concerned with how AI can minimize component failure rates, extend TBO (Time Between Overhaul), and reduce the overall cost of MRO operations. There is high expectation regarding the use of machine learning (ML) algorithms to analyze vast datasets collected from integrated sensors—such as strain gauges, temperature monitors, and vibration sensors—to accurately predict potential fatigue crack initiation or hydraulic system degradation before catastrophic failure occurs. Key themes revolve around improving safety standards through automated fault diagnosis and accelerating the design phase by utilizing generative design tools powered by AI to optimize complex structural geometries for minimal weight and maximum stress resistance.

- AI enhances predictive maintenance protocols by analyzing sensor data to forecast component failure, reducing unplanned downtime.

- Machine learning optimizes inventory management for spare parts by accurately predicting demand based on fleet age and usage patterns.

- Generative design AI accelerates the development of lightweight, structurally optimized landing gear components, reducing R&D cycles.

- AI-driven automated quality inspection systems improve manufacturing precision and speed, particularly in complex machining and assembly tasks.

- Deep learning algorithms refine flight load simulations, leading to more robust and accurate testing environments for new designs.

DRO & Impact Forces Of Aerospace Landing Gear Market

The Aerospace Landing Gear Market is shaped by a confluence of powerful drivers (D), significant restraints (R), compelling opportunities (O), and intense external impact forces. The primary drivers include the burgeoning global commercial aircraft order backlog, requiring consistent production volumes from OEMs, and the mandatory, scheduled maintenance and overhaul cycles vital for regulatory compliance and safety assurance. The opportunities are rooted in the shift toward electrically actuated landing gear systems (EMA/EHA) which promise reduced weight and maintenance, coupled with the burgeoning market for specialized landing gear systems tailored for Unmanned Aerial Vehicles (UAVs) and the emerging Urban Air Mobility (UAM) sector. These factors collectively push the market towards innovation and efficiency.

Conversely, significant restraints hinder market momentum, primarily the exceptionally high cost of raw materials, particularly aerospace-grade titanium and high-strength steels, which are subjected to volatile global commodity pricing. Furthermore, the stringent and lengthy regulatory certification processes (e.g., FAA, EASA) for new materials and design changes present substantial barriers to rapid technological adoption. The most pervasive impact forces include intense competitive pricing pressure exerted by airlines demanding lower operating costs, the cyclical nature of the aerospace industry, which is highly sensitive to global economic health and geopolitical events, and the necessity to continuously meet evolving noise reduction standards, particularly during takeoff and landing phases in densely populated areas.

The imperative for constant improvement in safety and reliability acts as a foundational impact force, compelling manufacturers to invest continually in superior materials science and rigorous testing methodologies. The shift towards sustainable aviation also functions as a powerful opportunity, forcing manufacturers to innovate lightweight solutions that directly contribute to the aircraft's fuel efficiency goals. The confluence of these drivers and forces necessitates a strategic approach from market players, focusing on maximizing MRO service revenues and investing in localized manufacturing facilities, especially in high-growth regions like APAC, to mitigate supply chain risks and capture regional demand effectively.

Segmentation Analysis

The Aerospace Landing Gear Market segmentation provides a detailed structural breakdown based on key parameters including aircraft type, actuation system, end-use, and component type. This analysis is essential for understanding specific market dynamics, identifying high-growth niches, and formulating targeted market strategies. The market is complex due to the highly customized nature of landing gear designed for different classes of aircraft, from small business jets requiring relatively simple systems to massive wide-body airliners demanding multi-bogey gear assemblies capable of handling extreme loads and speeds. The ongoing evolution of technology, particularly in hydraulics and electrical systems, further necessitates granular analysis of actuation preferences across different fleet types.

- By Aircraft Type:

- Fixed-Wing Aircraft (Commercial, Military Transport, Business Jets)

- Rotary-Wing Aircraft (Helicopters, Military Utility)

- Unmanned Aerial Vehicles (UAVs)/Drones

- By Component:

- Main Landing Gear

- Nose Landing Gear

- Actuation Systems (Hydraulic Cylinders, Electric Motors)

- Wheels and Brakes (Carbon Brakes, Steel Brakes)

- Struts and Shock Absorbers

- By Actuation System:

- Hydraulic

- Pneumatic

- Electro-Hydraulic (EHA)

- Electro-Mechanical (EMA)

- By End-Use:

- OEM (Original Equipment Manufacturer)

- Aftermarket (MRO, Spares, Overhaul)

- By Material:

- High-Strength Steel

- Aluminum Alloys

- Titanium Alloys

- Composites

Value Chain Analysis For Aerospace Landing Gear Market

The value chain for the Aerospace Landing Gear Market is intricate and highly specialized, beginning with upstream activities focused on the procurement and processing of aerospace-grade materials, such as specialized forging alloys (high-strength steel and titanium). This stage involves rigorous material certification and precise metallurgical treatments to ensure the components can withstand extreme operational stresses and temperatures. Key upstream suppliers include material manufacturers and highly specialized precision forging companies. The complexity of the landing gear system demands deep integration between these suppliers and the primary landing gear manufacturers (Tier 1 integrators), ensuring adherence to extremely tight tolerances and quality control specifications necessary for flight safety and longevity.

The manufacturing phase represents the core of the value chain, involving highly sophisticated machining, surface treatment (e.g., chrome plating alternatives), and system integration of complex hydraulic or electrical sub-assemblies. Downstream activities are dominated by distribution channels and end-use services. Direct distribution is prevalent, where landing gear OEMs supply finished systems directly to major aircraft manufacturers (Airbus, Boeing) under long-term contracts. The indirect channel plays a crucial role in the aftermarket, involving authorized MRO service centers and independent spare parts distributors who manage the global supply of wheels, brakes, and overhaul kits essential for maintaining operational fleets worldwide.

The MRO segment is critical, as landing gear undergoes mandatory heavy checks and overhauls typically every 8,000 to 12,000 flight cycles or approximately 6 to 10 years, depending on the aircraft type and operator specifications. This afterlife service generates substantial, consistent revenue and forms a significant portion of the market value. Maintaining strict control over the MRO process, often requiring OEM approval and specialized tooling, ensures system safety and integrity. Optimization of the value chain is increasingly focused on reducing lead times for replacement parts and implementing predictive maintenance technologies to transition from scheduled maintenance intervals to condition-based servicing, thereby maximizing aircraft utilization rates for end-user airlines.

Aerospace Landing Gear Market Potential Customers

Potential customers for the Aerospace Landing Gear Market are diversified across commercial, defense, and emerging civil aviation sectors. The primary customers are Original Equipment Manufacturers (OEMs) of aircraft, including giants like Boeing, Airbus, Embraer, and Bombardier, who purchase complete landing gear systems for integration into new aircraft production lines. These procurement contracts are typically long-term, high-value agreements governed by strict performance and weight specifications. The selection of a landing gear supplier is a critical decision in the initial design phase of a new aircraft program, forming relationships that can last decades due to the complexity and integration requirements.

The second major customer group comprises global airlines and fleet operators (commercial carriers, cargo operators, and charter companies). While these entities do not purchase new gear directly from the manufacturer for new aircraft, they are the primary consumers of high-margin aftermarket services, including mandatory overhaul, repair, and replacement of consumables like wheels, tires, and brake assemblies. Military and governmental organizations represent another significant customer base, procuring landing gear systems for fixed-wing transport aircraft, fighters, and helicopters, often prioritizing ruggedization, operational resilience, and stealth capabilities depending on the mission profile. The defense sector often requires bespoke, heavy-duty gear systems capable of operating from unprepared runways.

Finally, the growing sectors of rotorcraft operators (oil and gas, EMS, corporate transport) and emerging players in Urban Air Mobility (UAM) and drone manufacturing form a rapidly expanding customer segment. UAM developers require completely novel, lightweight, and often retractable landing systems that minimize aerodynamic drag, necessitating specialized design and materials expertise. Landing gear manufacturers must tailor their offerings—from traditional heavy systems to highly compact, energy-efficient designs—to serve this diverse and technologically demanding customer base effectively, balancing cost, performance, and certification complexity across all segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran Landing Systems, Collins Aerospace (Raytheon Technologies), Héroux-Devtek, Liebherr-Aerospace, Triumph Group, GKN Aerospace, Sumitomo Precision Products, APPH, Cirrus Aircraft, SPP Canada Aircraft, Meggitt PLC, Parker Hannifin, AAR Corp., Barnes Aerospace, Aerospace Industrial Development Corp. (AIDC), Eaton Corporation, UTAS, LISI Aerospace, UTC Aerospace Systems, Magellan Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Landing Gear Market Key Technology Landscape

The technology landscape within the Aerospace Landing Gear Market is undergoing a revolutionary transformation driven by the persistent push for weight reduction, improved reliability, and simplified maintenance procedures. A primary technological shift involves the move away from traditional purely hydraulic actuation systems towards more advanced electrical solutions, specifically Electro-Hydrostatic Actuation (EHA) and pure Electro-Mechanical Actuation (EMA). EHA uses a localized hydraulic circuit powered by an electric motor, eliminating lengthy hydraulic lines and centralized hydraulic reservoirs, resulting in weight savings and reduced risk of leaks. EMA, while still in earlier stages of adoption for primary landing gear deployment on large aircraft, eliminates hydraulics entirely, offering maximum efficiency and robustness, though challenges remain concerning high-load bearing capacity and system cooling.

Material science and manufacturing advancements are equally critical. The adoption of advanced high-strength materials, particularly sophisticated titanium alloys (e.g., Ti-10V-2Fe-3Al) and novel corrosion-resistant steels, is essential for reducing the mass of key structural components like the main fitting and bogie beam without compromising strength. Furthermore, Additive Manufacturing (AM) or 3D printing is rapidly moving from prototyping into production for non-critical, complex components and specialized tooling, offering optimized geometries impossible to achieve through traditional forging and machining. AM allows for integrated features and highly customized designs that enhance performance characteristics and reduce assembly complexity, contributing to the overall strategic goal of lightweighting the entire system.

A third area of intensive technological focus is the integration of advanced sensors and Health Monitoring Systems (HMS) directly into the landing gear structure. These systems utilize fiber optic sensors, accelerometers, and strain gauges to continuously monitor component health, detect early signs of fatigue, corrosion, or thermal stress, and transmit data wirelessly to the central maintenance unit. This shift enables true Condition-Based Maintenance (CBM) or Predictive Maintenance (PdM), moving maintenance activities from fixed schedules to actual component need. This digital integration significantly improves safety margins, reduces unscheduled maintenance events (AOG), and optimizes the MRO schedule, thereby lowering the total cost of ownership for operators and representing a substantial technological leap in operational efficiency.

Regional Highlights

- North America: This region maintains a dominant position, driven by the presence of major aircraft OEMs (Boeing, Lockheed Martin) and Tier 1 landing gear manufacturers (Collins Aerospace, Triumph Group). The market is characterized by high defense spending, leading to consistent demand for sophisticated military landing gear upgrades and procurement. Technological innovation, especially in EMA development and complex material forging, originates largely from this region, supported by robust R&D infrastructure and high regulatory compliance standards.

- Europe: Europe is a substantial market, anchored by Airbus and key system providers like Safran Landing Systems and Liebherr-Aerospace. Growth is underpinned by high production rates for the A320 family and strong regional defense initiatives. The region is a leader in applying stringent noise reduction technologies and sustainable material usage in landing gear design, responding to demanding environmental regulations set by organizations like EASA.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by exponential growth in passenger traffic, the establishment of new airlines, and massive fleet expansion, particularly for narrow-body aircraft in China and India. Localized manufacturing partnerships and MRO joint ventures are becoming increasingly common as global players seek to capitalize on this high-volume growth and mitigate logistical complexities associated with supplying parts across vast distances.

- Latin America: This market shows steady growth driven by fleet modernization, replacing older generation aircraft with fuel-efficient models. While smaller than North America or APAC, regional aircraft manufacturers like Embraer contribute to the local demand for specialized regional jet landing gear systems, focusing on operational durability in diverse environments.

- Middle East and Africa (MEA): Growth in MEA is spurred by substantial investments in flagship carriers and the establishment of world-class aviation hubs. Demand focuses on robust, reliable systems capable of withstanding the challenging high-temperature environments typical of the region, emphasizing MRO services to maintain aircraft utilized intensively for long-haul international routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Landing Gear Market.- Safran Landing Systems

- Collins Aerospace (Raytheon Technologies)

- Héroux-Devtek

- Liebherr-Aerospace

- Triumph Group

- Sumitomo Precision Products

- GKN Aerospace

- Parker Hannifin

- Meggitt PLC

- Eaton Corporation

- APPH

- SPP Canada Aircraft

- Barnes Aerospace

- LISI Aerospace

- UTAS

- AAR Corp.

- Aerospace Industrial Development Corp. (AIDC)

- Magellan Aerospace

- Circor Aerospace

- Curtiss-Wright Corporation

Frequently Asked Questions

Analyze common user questions about the Aerospace Landing Gear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Aerospace Landing Gear Market?

The Aerospace Landing Gear Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by sustained growth in commercial aircraft production and robust aftermarket MRO demand.

Which technological trend is most significantly impacting landing gear design?

The most significant technological trend is the shift toward electrically actuated systems, including Electro-Hydraulic Actuation (EHA) and Electro-Mechanical Actuation (EMA), replacing traditional hydraulics to achieve substantial weight reduction, improve fuel efficiency, and simplify maintenance requirements.

How is the adoption of Additive Manufacturing (AM) affecting the market?

Additive Manufacturing (AM) is being increasingly used for producing non-critical, complex parts, specialized tooling, and prototyping, enabling designers to create lighter, highly optimized geometric structures that reduce material waste and accelerate the overall product development cycle.

Which region is expected to demonstrate the highest growth in the Aerospace Landing Gear Market?

The Asia Pacific (APAC) region is projected to register the highest growth rate, primarily driven by massive expansion of commercial airline fleets, significant investment in new airport infrastructure, and rapidly rising air passenger volumes across countries like China and India.

What is the primary factor driving demand in the Aftermarket segment?

The Aftermarket segment's demand is principally driven by mandatory scheduled maintenance, repair, and overhaul (MRO) cycles, which landing gear components must undergo approximately every 6 to 10 years or after a specific number of flight cycles to maintain airworthiness and compliance with international safety regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager