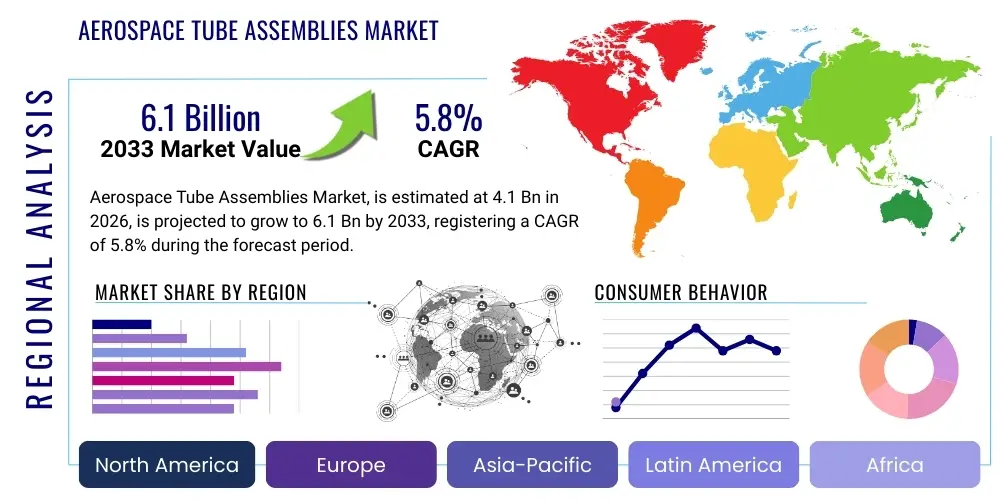

Aerospace Tube Assemblies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441735 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Aerospace Tube Assemblies Market Size

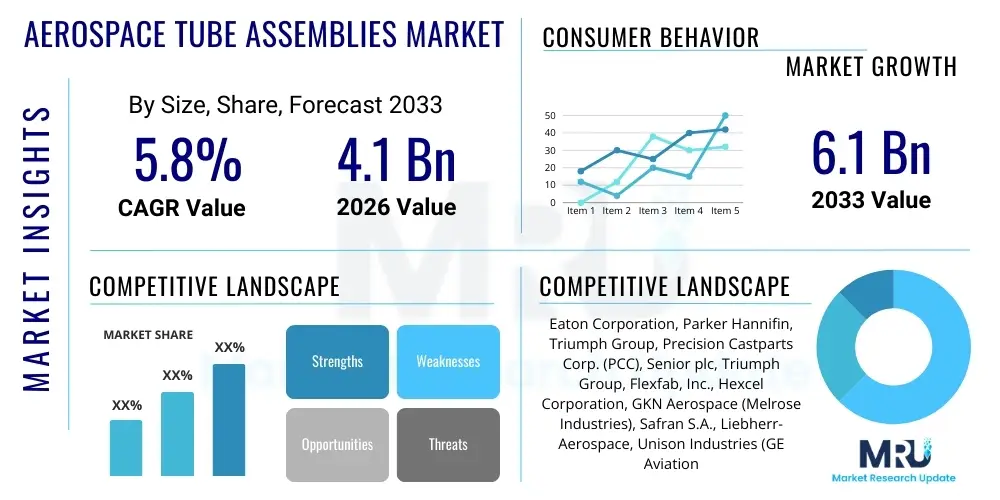

The Aerospace Tube Assemblies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Aerospace Tube Assemblies Market introduction

Aerospace tube assemblies constitute critical components within aircraft and spacecraft, providing pathways for fluids (fuel, hydraulics, coolants), gases (air, oxygen), and electrical wiring protection across diverse systems. These assemblies are integral to structural integrity and functional reliability, operating under extreme conditions including high pressure, vibration, temperature fluctuations, and exposure to corrosive agents. Key applications span engine fuel lines, hydraulic control systems, environmental control systems (ECS), and pneumatic systems utilized across commercial airliners, military jets, helicopters, and general aviation. The market growth is primarily driven by the increasing global demand for new commercial aircraft, coupled with extensive maintenance, repair, and overhaul (MRO) activities required to sustain aging fleets.

The product description encompasses straight tubes, complex bends, flexible hoses, rigid pipes, and integrated fittings, fabricated primarily from high-performance materials such as titanium, stainless steel, aluminum alloys, and specialized composites, chosen based on the specific operational requirements of the system they support. The precision and quality control standards in manufacturing these assemblies are exceptionally rigorous, governed by strict regulatory bodies like the FAA and EASA, demanding zero-defect tolerance. The benefits derived from advanced tube assemblies include enhanced performance efficiency, reduced weight (critical for fuel economy), improved durability, and minimization of leakage risks. This meticulous engineering ensures the safety and long-term operational viability of mission-critical aerospace systems globally.

Major applications of aerospace tube assemblies are concentrated in crucial areas where fluid or pressure transmission is essential. In hydraulic systems, they transmit high-pressure fluids necessary for flight control surfaces (ailerons, flaps) and landing gear operation. Within propulsion systems, complex tube networks deliver fuel precisely to the engine combustion chambers and manage lubrication and cooling functions. Furthermore, the expansion of global defense spending on military modernization programs, necessitating the replacement of older aircraft with new, sophisticated models, acts as a significant driving factor. The ongoing development of space exploration technologies and the rise of Urban Air Mobility (UAM) platforms also promise new avenues for specialized, lightweight tube assembly demand.

- Product Description: Rigid and flexible piping systems, ducts, and lines used for transmitting fluids, gases, and protecting electrical harnesses in aerospace vehicles.

- Major Applications: Hydraulic actuation systems, fuel delivery and venting, engine lubrication, environmental control systems (ECS), and brake systems.

- Benefits: High mechanical strength, corrosion resistance, lightweight structure, reliable fluid containment, and high-pressure tolerance.

- Driving Factors: Increase in aircraft production rates, rise in MRO activities, and technological advancements in additive manufacturing for complex geometries.

Aerospace Tube Assemblies Market Executive Summary

The Aerospace Tube Assemblies Market is experiencing robust growth fueled by cyclical upswings in commercial aircraft orders and a strategic shift towards materials science innovation aimed at weight reduction and durability. Business trends emphasize supply chain resilience and vertical integration among key manufacturers to maintain stringent quality control and manage volatile raw material costs, particularly titanium and high-grade stainless steel. Segment trends show a pronounced shift towards high-pressure hydraulic and fuel line assemblies due to the adoption of advanced, more efficient turbofan engines requiring complex routing. Geographically, Asia Pacific is emerging as the fastest-growing region, driven by massive investments in new airline infrastructure, coupled with China’s ambitious indigenous aircraft manufacturing programs, while North America remains the largest market due to the presence of major OEMs and established defense contractors.

The business landscape is characterized by intense competition focused on precision engineering, rapid prototyping, and compliance with strict AS9100 quality management standards. Suppliers are increasingly partnering with system integrators early in the design phase to optimize tube routing, minimizing system weight and simplifying installation procedures during final assembly. Furthermore, the trend toward MRO services highlights the necessity for readily available spare parts and specialized repair techniques, driving revenue streams outside of initial equipment manufacturing (OEM). Companies that invest in automation, specifically robotic welding and bending, are gaining a competitive advantage by achieving tighter tolerances and higher throughput necessary to meet accelerated production schedules from Boeing and Airbus.

Regional trends indicate divergent growth patterns. While established markets like the U.S. and Europe focus on defense upgrades and sophisticated narrow-body aircraft production, the emerging markets of India, China, and the Middle East are heavily investing in expanding their commercial fleets to meet rising passenger traffic. This diversification of demand ensures market stability across various economic cycles. Segment performance reveals that the materials segment—specifically high-strength, lightweight materials like Inconel for high-temperature applications near the engine—is seeing the highest growth rate, reflecting the industry's continuous push for performance enhancement and fuel efficiency improvements mandated by environmental regulations and rising fuel costs.

- Business Trends: Focus on lightweight material adoption (titanium, composites), increased vertical integration, and automation in precision bending and welding processes.

- Regional Trends: Dominance of North America and Europe in defense and high-end manufacturing, rapid commercial market expansion in the Asia Pacific region.

- Segments Trends: High growth in rigid tube assemblies for hydraulic and fuel systems, increasing integration of sensors for health monitoring and diagnostics.

AI Impact Analysis on Aerospace Tube Assemblies Market

Common user questions regarding AI's influence on the Aerospace Tube Assemblies Market typically revolve around optimizing complex routing paths, predicting assembly failure points, automating quality inspection, and integrating predictive maintenance into MRO cycles. Users seek clarity on how AI algorithms can shorten the design-to-production timeline for intricate tube geometries, particularly concerning clash detection and stress analysis in congested aircraft sections. Furthermore, there is significant interest in leveraging AI-driven data analysis to improve material traceability and regulatory compliance documentation, thereby mitigating human error and enhancing overall component reliability throughout the product lifecycle.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the manufacturing and operational lifecycle of aerospace tube assemblies. In the design phase, generative design algorithms powered by AI are capable of exploring thousands of potential tube routing solutions far faster than traditional methods, optimizing pathways for minimal weight and maximum accessibility while ensuring structural integrity under vibration and thermal stress. This capability is critical for modern aircraft where space constraints are severe, particularly around engine pylons and landing gear bays. By simulating operational loads and environmental conditions, AI models predict potential points of fatigue failure, allowing engineers to reinforce critical sections before physical prototyping begins, significantly reducing development costs and time-to-market.

In manufacturing and quality control, AI-enabled computer vision systems are deployed for non-destructive testing (NDT) inspection. These systems analyze high-resolution images of welds, flares, and bends, identifying subtle defects that might be missed by human inspectors, ensuring unparalleled precision and conformity to AS9100 standards. Operationally, predictive maintenance systems utilize ML algorithms to analyze real-time sensor data—such as pressure and temperature fluctuations within hydraulic lines or fuel systems—to forecast component degradation or potential leakage events. This shift from time-based maintenance to condition-based monitoring dramatically improves aircraft utilization rates, reduces unscheduled downtime, and minimizes the risk of catastrophic system failure stemming from tube assembly compromise.

- AI-driven Generative Design for optimal lightweight tube routing and complex bend definition.

- Machine Learning (ML) algorithms used for predictive maintenance (CBM) of hydraulic and fuel line assemblies, identifying early signs of wear or fatigue.

- AI-enabled Computer Vision for automated, high-precision quality inspection of welds, brazing, and component surface integrity.

- Optimization of manufacturing parameters (e.g., robotic bending pressures, heat treatment cycles) through continuous feedback loops driven by ML analysis.

- Enhanced supply chain transparency and material traceability using blockchain and AI for strict regulatory compliance management.

DRO & Impact Forces Of Aerospace Tube Assemblies Market

The dynamics of the Aerospace Tube Assemblies Market are governed by a robust set of Drivers, Restraints, and Opportunities (DRO), collectively influenced by significant impact forces from the global aviation ecosystem. The primary drivers include escalating global demand for new commercial aircraft, the mandatory requirement for enhanced safety standards leading to replacement cycles, and substantial MRO demands stemming from the large installed base of aging aircraft. Conversely, the market faces restraints such as the stringent regulatory environment necessitating high certification costs, extreme volatility in the price and supply chain of specialized raw materials like titanium, and the requirement for highly skilled labor and specialized machinery for precision manufacturing. Opportunities emerge through technological innovation, particularly the adoption of additive manufacturing (3D printing) for complex geometries and the development of new, high-performance composite materials for lightweight applications. These internal and external forces continuously shape market expansion strategies.

Drivers: The sustained recovery and expansion of commercial air traffic post-pandemic necessitate higher production rates from major OEMs such as Airbus and Boeing, directly translating into increased demand for tube assemblies used in all airframe and engine systems. Furthermore, global defense modernization programs, especially in North America and Asia, allocate significant budgets toward advanced military aircraft acquisition and sustainment, requiring high-specification, durable tube components. The increasing complexity and fuel efficiency targets of new engine platforms, such as geared turbofans, demand equally sophisticated and durable hydraulic and fuel lines capable of handling higher operating pressures and temperatures, cementing demand for advanced material usage.

Restraints: The most significant hurdle is regulatory compliance. Each assembly must meet extremely high safety standards, involving protracted qualification and testing processes (often taking years), which raises the barrier to entry for new market participants. Economic volatility affects aerospace production schedules, and geopolitical risks can disrupt the supply chain of critical specialty metals. Moreover, the specialized nature of tube bending, flaring, and welding for aerospace applications requires substantial capital investment in advanced machinery and specialized human expertise, which can limit scalability and profitability, particularly for smaller firms in the supply chain.

Opportunities: The advent of Urban Air Mobility (UAM) and drone technology presents a burgeoning sector requiring novel, ultra-lightweight, and miniaturized tube assemblies for electric propulsion and thermal management systems. Additive manufacturing offers a paradigm shift by enabling the creation of consolidated, complex assemblies that previously required multiple joints and welds, thereby reducing potential leak points and overall weight. Furthermore, the increasing focus on sustainable aviation fuels (SAF) necessitates tube assemblies capable of handling potentially different chemical properties than traditional jet fuels, driving material research and development efforts.

- Drivers: High global demand for new narrow-body aircraft; Increased defense spending; Mandatory MRO and fleet maintenance cycles.

- Restraints: Stringent regulatory certification requirements (FAA/EASA); High raw material cost volatility (titanium, nickel alloys); Need for highly specialized manufacturing infrastructure.

- Opportunity: Growth in the space exploration sector and satellite deployment; Adoption of Additive Manufacturing (AM) for complex geometry production; Emerging UAM and eVTOL markets.

- Impact Forces: Strict government regulations enforcing material traceability; Technological obsolescence of older manufacturing techniques; Global economic stability affecting airline profitability and investment capacity.

Segmentation Analysis

The Aerospace Tube Assemblies Market is strategically segmented based on factors including Material Type, System Type, Aircraft Type, and End-User, providing granular insights into demand patterns and technological requirements across the industry. This segmentation reveals distinct growth trajectories: metal-based materials like titanium alloys maintain dominance due to their superior strength-to-weight ratio and temperature resistance, essential for engine and hydraulic applications, while composites are gaining traction in non-critical fluid transfer and air ducting systems where weight saving is paramount. System type segmentation highlights the high-value nature of hydraulic and fuel assemblies, which are non-negotiably critical and require the highest level of precision and material durability, compared to pneumatic or structural assemblies.

Analyzing the market by Aircraft Type shows that the Commercial Aviation segment, driven by high volume production of narrow-body jets (A320neo, B737 MAX), generates the highest demand volume. Conversely, the Military Aircraft segment, while lower in volume, demands extremely specialized, high-performance, and often custom-designed assemblies for fighter jets and strategic airlift carriers, translating into higher average selling prices and focusing on components resilient to extreme G-forces and stealth requirements. The End-User segmentation further differentiates the market between OEM demand (initial aircraft build) and MRO demand (lifecycle support and replacement), where MRO typically requires a broader inventory of older component designs and specialized field repair kits.

The segmentation based on Material Type underscores the ongoing research into new alloys and manufacturing techniques. Stainless steel and aluminum assemblies, being cost-effective, dominate non-critical, lower-temperature applications, but the trend clearly favors advanced materials like Inconel and titanium for newer aircraft programs aimed at maximizing operational efficiency. The hydraulic system assemblies segment is particularly sensitive to pressure requirements, necessitating components that can withstand pressures exceeding 5,000 psi, driving material science innovation and demanding ultra-high precision welding techniques to prevent catastrophic failure under flight conditions. Understanding these segments is crucial for strategic investment and product development focus within the aerospace supply chain.

- By Material Type:

- Titanium Alloys

- Stainless Steel

- Aluminum Alloys

- Nickel-Based Alloys (Inconel)

- Composites and Others

- By System Type:

- Hydraulic Systems Assemblies

- Fuel Systems Assemblies

- Pneumatic Systems Assemblies

- Environmental Control Systems (ECS) Ducting

- Lubrication and Cooling Systems

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighter Jets, Transport, Helicopters)

- General Aviation (GA)

- Spacecraft and Launch Vehicles

- By End-User:

- Original Equipment Manufacturers (OEM)

- Maintenance, Repair, and Overhaul (MRO)

Value Chain Analysis For Aerospace Tube Assemblies Market

The value chain for the Aerospace Tube Assemblies Market is intricate and highly regulated, starting from specialized raw material suppliers and extending through precision manufacturing to aircraft integration and lifecycle support. Upstream activities are dominated by a limited number of specialized metal suppliers providing high-grade titanium, nickel alloys, and aerospace-certified aluminum. These materials undergo rigorous testing and certification before reaching the core manufacturers. Midstream, precision component manufacturers perform specialized processes such as tube bending (CNC controlled), hydroforming, welding, brazing, and integration of fittings. This stage is capital-intensive and requires compliance with dozens of stringent aerospace standards, acting as a major bottleneck and value-add step in the chain.

Downstream activities involve the distribution channel, which is typically bifurcated into direct sales to Original Equipment Manufacturers (OEMs) for new aircraft production, and indirect distribution through authorized aftermarket distributors and MRO providers for replacement parts and service requirements. Direct relationships with OEMs, such as Boeing, Airbus, and Lockheed Martin, are highly prized due to long-term contract stability. Indirect channels are vital for supporting the global fleet, requiring sophisticated inventory management and rapid logistics capabilities to minimize aircraft grounding time. The traceability and documentation throughout the entire chain—from material provenance to final inspection—are mandatory for compliance and quality assurance.

The structural complexity of the tube assemblies market means that integration and testing form the final critical layer of the value chain. Tube assembly manufacturers often collaborate closely with Tier 1 system integrators (e.g., Parker Hannifin, Safran) who incorporate these components into larger sub-systems (e.g., complete hydraulic powerpacks or fuel distribution manifolds). The direct sales route emphasizes technical collaboration and supply chain efficiency, while the indirect channel, managed by specialized aerospace parts distributors, focuses on inventory breadth, quick delivery, and competitive pricing for maintenance customers. The increasing trend of vertical integration sees major OEMs or Tier 1 suppliers acquiring specialized tube fabricators to internalize the complex manufacturing expertise and secure supply integrity.

Aerospace Tube Assemblies Market Potential Customers

The potential customer base for aerospace tube assemblies is highly concentrated, primarily revolving around global Original Equipment Manufacturers (OEMs), large military defense contractors, and major Maintenance, Repair, and Overhaul (MRO) service providers globally. OEMs, including airframe builders like Boeing, Airbus, Embraer, and COMAC, represent the largest segment of buyers, requiring thousands of new assemblies per aircraft across various systems (engine, flight control, environmental). These customers seek suppliers capable of high-volume production, impeccable quality consistency, and adherence to tight delivery schedules aligned with high-rate aircraft assembly lines.

Military and defense contractors, such as Lockheed Martin, Northrop Grumman, and BAE Systems, constitute another significant customer group. These customers typically require smaller volumes but demand components built to extremely high specifications, capable of surviving severe operational stresses unique to combat aircraft, space vehicles, and advanced missile systems. Their purchasing decisions are often influenced by long-term government contracts, security requirements, and the need for specialized material treatments and component longevity rather than solely cost optimization.

The third major group consists of MRO organizations, including airline-affiliated MRO shops (e.g., Lufthansa Technik, Air France Industries KLM Engineering & Maintenance), independent MRO providers, and dedicated component repair shops. These buyers focus on replacement parts, specialized repair kits, and modification solutions for existing fleets. The MRO sector is driven by fleet age, utilization rates, and regulatory mandates for scheduled maintenance, creating a steady, predictable demand stream for certified replacement tube assemblies that must meet form, fit, and function requirements of legacy aircraft designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin, Triumph Group, Precision Castparts Corp. (PCC), Senior plc, Triumph Group, Flexfab, Inc., Hexcel Corporation, GKN Aerospace (Melrose Industries), Safran S.A., Liebherr-Aerospace, Unison Industries (GE Aviation), Meggitt PLC (Parker Hannifin), Ducommun Incorporated, Stellar Technologies, Marotta Controls, Inc., FACC AG, Ametek Inc., CPI Aerostructures, Inc., Daher. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Tube Assemblies Market Key Technology Landscape

The manufacturing of aerospace tube assemblies relies heavily on advanced precision engineering technologies aimed at achieving zero-defect products, lightweight construction, and rapid production cycles. Key technologies center around CNC tube bending and forming, which utilizes multi-axis machinery to create complex, repeatable bends with high accuracy, minimizing material waste and stress points. Automated welding and brazing techniques, including orbital welding and electron beam welding, are crucial for joining high-strength materials like titanium and nickel alloys, ensuring hermetic seals capable of withstanding extreme internal pressures and thermal cycling without failure. Furthermore, hydroforming technology is employed to shape tubes using fluid pressure, allowing for intricate internal geometries and optimized flow characteristics, especially relevant in fuel and hydraulic manifolds.

Material science innovation forms a crucial part of the technology landscape, focusing on the development of specialized alloys offering superior performance. The use of advanced titanium grades (e.g., Ti-6Al-4V) and nickel-based superalloys (Inconel 718) is standard for high-temperature and high-pressure applications near the engine. A growing trend is the application of additive manufacturing (AM), particularly Laser Powder Bed Fusion (L-PBF), to produce complex manifold assemblies in a single piece. AM significantly reduces part count, eliminates joints (potential leak points), and allows for geometric optimization that is impossible with conventional forming methods, resulting in substantial weight savings and improved reliability for critical systems.

Integrated quality control technologies, often leveraging smart manufacturing principles, are essential for compliance. Non-destructive testing (NDT) techniques such as ultrasonic testing, fluorescent penetrant inspection (FPI), and high-resolution radiographic inspection are universally mandated to verify internal material integrity and weld quality. Increasingly, manufacturers are deploying in-line measurement systems, including laser scanning and coordinate measuring machines (CMMs), immediately following the bending and forming processes to ensure that finished parts meet highly precise geometric tolerances before they proceed to final assembly. This integration of digital measurement and automated inspection is fundamental to maintaining the high quality standards required by the aerospace sector.

Regional Highlights

- North America: North America, led by the United States, represents the largest and most mature market for Aerospace Tube Assemblies globally, primarily due to the dominant presence of major global OEMs like Boeing and defense giants such as Lockheed Martin and Northrop Grumman. The region benefits from substantial investment in next-generation military platforms and a high rate of commercial aircraft production, supported by a dense ecosystem of Tier 1 and Tier 2 suppliers specializing in advanced materials and high-precision manufacturing. The continuous replacement of aging military aircraft and strong MRO activity further solidify this region's market leadership. The focus here is on developing lightweight titanium and composite assemblies for advanced engine applications and sophisticated defense systems, driven by strong R&D spending and robust government defense budgets.

- Europe: Europe holds the second-largest market share, principally driven by the formidable presence of Airbus, one of the world's largest commercial aircraft manufacturers. Countries like France, Germany, and the UK form the core of the European aerospace supply chain, excelling in systems integration and advanced material expertise. The European market focuses heavily on hydraulic and environmental control systems (ECS) components for the extensive Airbus fleet, as well as significant defense programs supported by NATO members. Stringent environmental regulations in Europe are accelerating the demand for lightweight, fuel-efficient components, driving innovation in composite and advanced metal assemblies.

The market environment in Europe is highly competitive, emphasizing collaboration between member states to secure large government and commercial contracts. Key trends include the adoption of 'More Electric Aircraft' (MEA) architectures, which require specialized thermal management tubing and high-reliability components to handle increased electrical loads. European suppliers are world leaders in precision machining and complex welding techniques, adhering strictly to EASA certification standards. The region also benefits from a robust MRO sector, serving European legacy carriers and global airlines operating large fleets of European-built aircraft. The recovery of the regional aviation sector following the pandemic contributes significantly to the demand for tube assemblies.

Investment in R&D, particularly concerning sustainable aviation technology and the integration of smart components (e.g., embedded sensors in tubes for real-time monitoring), is a strategic priority. While facing challenges related to supply chain disruptions post-Brexit and the need to manage rising energy costs, the foundational strength of major OEMs and Tier 1 suppliers ensures steady demand. The European defense industrial base also provides consistent, though cyclical, demand for specialized, high-specification tube assemblies for platforms like the Eurofighter and future fighter programs, ensuring the resilience and technological sophistication of the regional supply chain.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market during the forecast period, fueled by unprecedented growth in air passenger traffic, massive fleet expansion by regional airlines, and significant government investment in indigenous aircraft manufacturing capabilities, particularly in China (COMAC) and India. The rapid urbanization and expanding middle class across Southeast Asia and China drive massive orders for narrow-body commercial aircraft, directly increasing the OEM demand for tube assemblies. This high growth rate is attracting significant foreign direct investment from global suppliers looking to establish local manufacturing and service hubs.

China's ambitious commercial aviation programs, coupled with aggressive modernization of its military air force, are primary catalysts for market expansion. The country is not only a major buyer but is rapidly becoming a significant producer of aerospace components, emphasizing technology transfer and self-sufficiency. Similarly, India's "Make in India" initiative encourages local sourcing for defense and commercial aerospace requirements, creating substantial opportunities for both local players and international suppliers willing to partner and comply with localization mandates. The high air traffic density and the resulting high utilization rates of regional fleets also generate robust MRO demand for tube assemblies.

The APAC market is characterized by a need for cost-competitive solutions and shorter lead times. While the focus remains heavily on the commercial sector, the burgeoning space programs in countries like Japan, South Korea, and India are creating niche demands for specialized, high-reliability assemblies suitable for launch vehicles and satellite systems. Challenges in this region include navigating complex regulatory frameworks and ensuring quality control across a rapidly expanding, diverse supply chain. However, the sheer volume of aircraft orders and the demographic dividend supporting long-term air travel growth make APAC the critical engine for global market expansion.

The North American market is characterized by stringent adherence to FAA regulations and a strong emphasis on technological superiority. Key growth drivers include the ramp-up of narrow-body production lines and high capital expenditure in space exploration programs, which require highly reliable, custom-engineered fluid transfer solutions. Furthermore, the region is pioneering the integration of Additive Manufacturing (AM) into the aerospace supply chain, particularly for low-volume, high-complexity parts used in military and space applications. The presence of leading material science companies and advanced manufacturing research centers ensures continuous innovation in component design and durability, maintaining the region's competitive edge in the global aerospace components sector.

The large installed base of commercial and military aircraft necessitates continuous MRO support, providing a stable revenue stream for tube assembly suppliers. Companies in this region focus on optimizing their supply chain for rapid delivery and certification, catering both to high-rate OEM demand and the complex logistical requirements of the aftermarket. Regulatory certainty and a stable economic environment continue to attract global investment into the aerospace manufacturing base in the United States and Canada, ensuring sustained market dominance throughout the forecast period, albeit at a slightly slower growth rate compared to rapidly developing regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Tube Assemblies Market.- Eaton Corporation

- Parker Hannifin

- Precision Castparts Corp. (PCC)

- Senior plc

- Triumph Group

- Flexfab, Inc.

- GKN Aerospace (Melrose Industries)

- Safran S.A.

- Liebherr-Aerospace

- Unison Industries (GE Aviation)

- Meggitt PLC (Parker Hannifin)

- Ducommun Incorporated

- Stellar Technologies

- Marotta Controls, Inc.

- FACC AG

- Ametek Inc.

- CPI Aerostructures, Inc.

- Daher

- Kaman Corporation

- Vacco Industries

Frequently Asked Questions

Analyze common user questions about the Aerospace Tube Assemblies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are commonly used in aerospace tube assemblies?

High-performance materials are essential, primarily including titanium alloys (for high strength and low weight), stainless steel (for corrosion and heat resistance), and nickel-based superalloys like Inconel (for extreme temperature engine zones). Aluminum alloys are used for lower-pressure, less temperature-critical applications.

How does Additive Manufacturing (AM) impact the production of tube assemblies?

AM technology, specifically metal 3D printing, allows for the consolidation of multiple components into single, complex manifolds. This reduces part count, eliminates joints (minimizing leak risks), optimizes internal flow geometry, and significantly reduces the overall assembly weight and production complexity.

Which aircraft systems are most dependent on reliable tube assemblies?

Critical flight safety systems are most dependent, including hydraulic actuation systems (controlling flight surfaces and landing gear), engine fuel delivery systems, and Environmental Control Systems (ECS) which manage cabin pressure and temperature. Failure in these assemblies can compromise aircraft operation.

What is the key difference in demand between OEM and MRO segments?

The OEM (Original Equipment Manufacturer) segment demands high-volume production for new aircraft builds, focusing on precision and rapid delivery aligned with assembly line rates. The MRO (Maintenance, Repair, and Overhaul) segment requires certified replacement parts for aging fleets, emphasizing quick logistics, durability, and a broad inventory of legacy component designs.

What is the primary driving factor for market growth in the Asia Pacific region?

The primary driver is the rapid expansion of commercial air travel, leading to massive fleet growth and high-volume orders for new commercial aircraft, particularly narrow-body jets, coupled with substantial government investments in indigenous aerospace manufacturing capabilities in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aerospace Tube Assemblies Market Statistics 2025 Analysis By Application (Commercial Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft, Others), By Type (Fuel System, Hydraulic System, Instrumentation, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aerospace Tube Assemblies Market Statistics 2025 Analysis By Application (Civil & Cargo Aircraft, Helicopter, Military Aircraft), By Type (Aluminium Alloys, Titanium Alloys, Nickel Alloys), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager