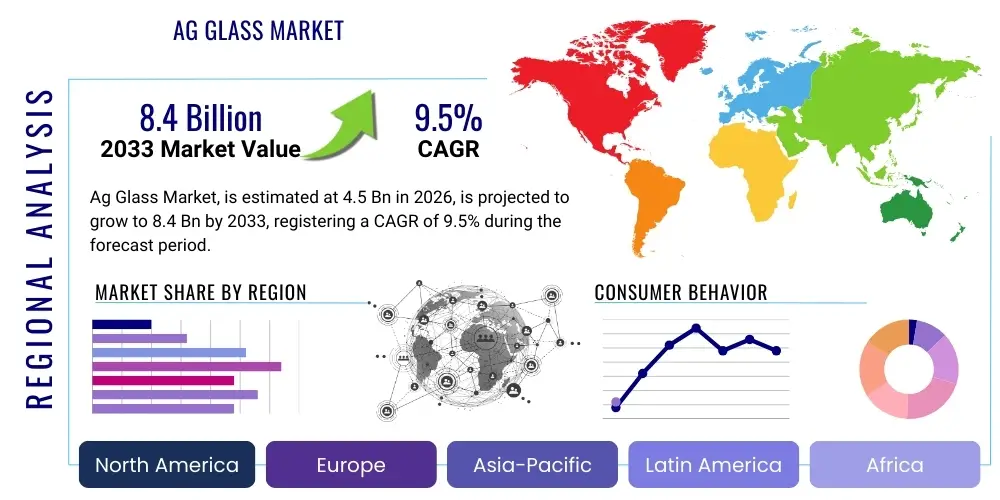

Ag Glass Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442774 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ag Glass Market Size

The Ag Glass Market, primarily driven by the escalating demand for high-performance display solutions across consumer electronics and automotive sectors, is projected for significant expansion. This specialized segment, often encompassing Anti-Glare (AG) treated glass used in touchscreens, monitors, and vehicle dashboards, offers superior light diffusion and reduced eye strain, critical factors in modern user interfaces. The inherent complexity of the etching and coating processes, alongside stringent quality requirements for optical clarity, positions this market as a high-value niche within the broader advanced materials industry. Investment in R&D focusing on ultra-thin, chemically strengthened Ag glass is a major catalyst for market valuation increase, particularly in applications requiring robust performance and aesthetic appeal.

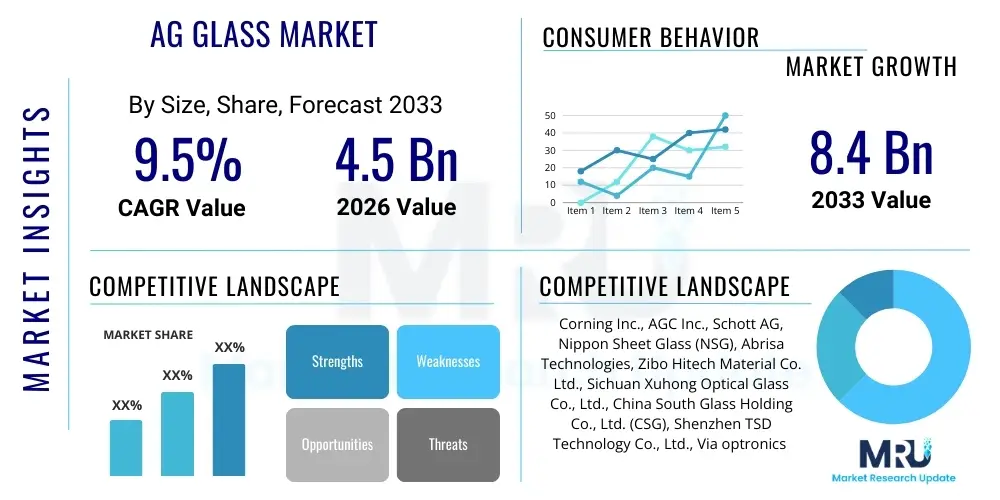

The global Ag Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This consistent upward trajectory is underpinned by massive capital expenditure in semiconductor fabrication facilities and associated display panel manufacturing hubs, predominantly located in Asia Pacific. The adoption rate of advanced display technologies, such as OLED and Micro-LED, which often necessitate specialized surface treatments like AG coatings for optimal performance, further solidifies the market's growth projections. Moreover, the increasing integration of sophisticated infotainment and control displays in electric vehicles (EVs) represents a high-growth vertical for specialized Ag glass solutions.

The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033. This substantial increase reflects not only volumetric expansion driven by mass market adoption of devices like tablets and large-screen televisions but also significant price stabilization and marginal increases due to the enhanced functionality and durability offered by next-generation Ag glass products. Geopolitical factors influencing trade agreements and supply chain resilience concerning raw materials—such as high-purity silica and specific chemical etchants—will play a crucial role in maintaining these projected values, demanding strategic diversification from key market players to mitigate operational risks and ensure continuous supply to Tier 1 device manufacturers.

Ag Glass Market introduction

The Ag Glass Market encompasses the production, distribution, and application of specialized glass substrates treated to reduce glare and reflection, thereby enhancing visual comfort and display readability under varying ambient light conditions. These treatments are typically achieved through sophisticated methods, including chemical etching or the application of anti-glare coatings, resulting in a surface that diffuses incident light. The core product provides a durable, optically superior solution essential for modern human-machine interfaces (HMIs). Key features of Ag glass include high scratch resistance, consistent light transmission, and precisely controlled surface roughness (haze value), which is critical for maintaining display clarity while minimizing disruptive reflections. This glass forms an indispensable component in high-end consumer electronics, professional monitors, and critical industrial display systems.

Major applications of Ag Glass span several high-growth industries. In consumer electronics, it is widely utilized for smartphone cover lenses, tablet screens, laptop displays, and public kiosks where sunlight readability is paramount. The automotive sector represents a rapidly expanding vertical, with Ag glass integral to central information displays (CIDs), digital instrument clusters, and heads-up displays (HUDs), where reducing driver distraction caused by reflections is a major safety and regulatory requirement. Furthermore, Ag glass finds applications in architectural design (e.g., museum display cases, retail windows), medical imaging equipment, and defense-related specialized optics. The primary benefit derived is the substantial improvement in user experience (UX) and overall device functionality by mitigating ambient light interference, coupled with the enhanced durability of the treated glass surface against wear and chemical exposure.

Driving factors propelling the Ag Glass Market include the ubiquitous proliferation of touch-enabled devices globally, coupled with the trend toward larger and higher-resolution displays across all device categories. The shift towards electrification and autonomy in the automotive industry is escalating the demand for integrated, multi-screen cockpits that rely heavily on high-quality Ag glass for optimal viewing. Technological advancements in display manufacturing, such as the transition to thinner, flexible, and more energy-efficient displays, necessitate concomitant improvements in protective glass technology, often favoring specialized treatments like anti-glare etching. Regulatory standards promoting ergonomic design and reducing visual fatigue in professional settings also contribute significantly to the sustained market demand for superior anti-glare solutions.

Ag Glass Market Executive Summary

The Ag Glass Market is characterized by robust business trends driven by technological convergence and increased consumer expectations for visual performance. Manufacturers are strategically investing in vertical integration, aiming to control the entire production process from raw glass formation to specialized surface treatment, which ensures quality consistency and cost competitiveness. A key trend involves strategic partnerships between glass manufacturers and Tier 1 display module assemblers (like BOE, Samsung Display, and LG Display) to co-develop glass specifications optimized for new display technologies, such as advanced OLED and flexible display architectures. Furthermore, sustainability initiatives are influencing business practices, pushing companies towards developing more environmentally friendly etching chemicals and reducing energy consumption in the high-heat manufacturing processes, shaping the corporate landscape and competitive strategies globally.

Regionally, Asia Pacific (APAC) remains the undisputed epicenter of the Ag Glass Market, primarily due to its dominance in global electronics manufacturing and display panel production. Countries like China, South Korea, Taiwan, and Japan house the major fabrication plants and drive the highest volume demand. North America and Europe, while smaller in production volume, represent critical markets for high-margin, specialized applications, including automotive infotainment systems and advanced medical devices, often commanding premium pricing for ultra-high-clarity and chemically hardened variants. Emerging markets, particularly in Southeast Asia and Latin America, are showing increasing adoption rates of consumer electronics, translating into expanding regional demand that market leaders are addressing through localized supply chains and distribution networks to optimize delivery times and circumvent potential trade tariffs.

Segmentation trends highlight the increasing market share of Chemically Etched Ag Glass due to its superior durability and more homogeneous anti-glare properties compared to traditional coated solutions. Application-wise, the Automotive segment is expected to exhibit the fastest growth, underpinned by the industry's massive transformation toward fully digital cockpits and smart surfaces. Within the end-user segment, the shift towards larger format displays (e.g., monitors >27 inches and automotive CIDs >10 inches) is generating demand for high-volume, precision-cut Ag glass substrates. This necessitates manufacturers to upgrade cutting and polishing capabilities to handle larger panel sizes efficiently while maintaining stringent optical specifications, driving innovation in automated manufacturing and quality control systems across all market segments.

AI Impact Analysis on Ag Glass Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ag Glass Market commonly center on three key themes: optimization of manufacturing processes, predictive maintenance for high-value equipment, and the role of Ag glass in supporting AI-driven interfaces like augmented reality (AR) and heads-up displays (HUDs). Users are keen to understand how AI-powered visual inspection systems can detect microscopic surface defects in real-time, improving yield rates in the complex etching and coating phases, which historically have high scrap rates. Another significant area of interest is how AI influences the demand side—specifically, whether advanced user interfaces powered by AI, requiring ultra-precise optics and superior reflection control, will mandate even higher specifications for Ag glass products, thereby driving innovation in material science and surface physics beyond current capabilities.

AI’s influence on the supply chain is also a central concern, particularly concerning demand forecasting and inventory management of specialized chemical inputs and raw glass substrates. Advanced AI algorithms are being deployed to analyze global demand fluctuations in electronics and automotive sectors, providing Ag glass manufacturers with more accurate predictions to optimize production schedules and minimize holding costs. This technological integration aims to enhance operational efficiency, reduce the time-to-market for customized products, and increase the flexibility of production lines to quickly switch between different specifications (e.g., different haze levels or gloss units) required by diverse end-user applications, thereby making the manufacturing process significantly more agile and cost-effective.

Furthermore, AI is instrumental in the quality control and R&D stages. Machine learning models analyze vast datasets derived from production parameters and quality outputs, enabling manufacturers to rapidly identify correlations between input variables (temperature, chemical concentration, etching duration) and the final optical quality (haze, transmittance). This iterative feedback loop accelerates the development of new, high-performance Ag glass formulations and processes. For instance, AI algorithms can simulate the interaction of light with various surface structures, allowing engineers to virtually test and optimize new anti-glare patterns before committing to expensive physical prototyping, leading to faster innovation cycles and the development of next-generation optical solutions tailored for future AI-enabled devices like advanced AR headsets.

- AI-driven Quality Control: Utilizes machine vision for real-time, sub-micron defect detection, substantially boosting manufacturing yield rates.

- Predictive Maintenance: AI algorithms analyze equipment sensor data to forecast potential failures in high-cost etching and coating machinery, minimizing unplanned downtime.

- Supply Chain Optimization: Machine learning models enhance raw material procurement and demand forecasting for end products, improving logistics efficiency.

- Enhanced R&D: AI simulations accelerate the development of new Ag glass formulations and surface structures optimized for specific optical requirements (e.g., high clarity, low reflectivity).

- Support for Advanced Interfaces: Ag glass provides the critical optical foundation for AI-enabled interfaces like robust automotive HUDs and immersive AR/VR displays.

- Process Parameter Optimization: AI analyzes production data to fine-tune chemical concentrations and processing times, ensuring consistent optical performance and batch uniformity.

DRO & Impact Forces Of Ag Glass Market

The Ag Glass Market dynamics are heavily influenced by a triad of structural forces: Drivers, Restraints, and Opportunities. The primary Drivers stem from the unrelenting trend toward digitalization, particularly the increasing reliance on advanced touch interfaces in sectors ranging from healthcare to automotive. The continuous escalation in display size and resolution mandates superior anti-glare and anti-fingerprint properties, pushing demand for premium Ag glass variants. Restraints primarily involve the high complexity and capital intensity of the manufacturing process, which requires specialized facilities and precise chemical handling, leading to elevated barriers to entry for new players. Furthermore, the volatility in the pricing and supply of critical raw materials, such as specific etchant chemicals and specialized glass substrates, poses persistent challenges to margin stability and production predictability across the industry value chain.

Opportunities in the market are abundant, largely revolving around technological innovation and emerging application niches. The rapid commercialization of Augmented Reality (AR) and Virtual Reality (VR) devices presents a high-growth avenue, as these require extremely high-definition optics and lightweight, non-reflective cover glass. Another significant opportunity lies in the burgeoning smart home and architectural glass segments, where integrated displays require aesthetic yet functional glare reduction capabilities. The development of hybrid Ag glass materials that combine anti-glare features with additional functionalities, such as antimicrobial or self-cleaning properties, also opens new market potentials and allows manufacturers to differentiate their product offerings in competitive landscapes, enhancing overall market utility and premium pricing justification.

The impact forces within this market are substantial and interlinked. Increased regulatory scrutiny regarding visual ergonomics and workplace safety standards, particularly in professional monitor usage, exerts positive pressure (Driver) on adopting high-quality Ag glass. Conversely, the intense competition among global display manufacturers drives constant cost reduction pressures (Restraint) down the supply chain, forcing Ag glass suppliers to seek greater manufacturing efficiencies without compromising quality. The ongoing geopolitical shifts affecting international trade policies and technological export controls represent a critical impact force, influencing where manufacturing facilities are strategically located and the resilience of cross-border supply chains for high-tech components. Addressing these forces requires market participants to maintain operational flexibility, invest heavily in process automation, and strategically secure long-term raw material contracts.

Segmentation Analysis

The Ag Glass Market is segmented primarily based on the Type of treatment, the Application, and the geographical region. Analyzing these segments provides crucial insights into demand concentration, technological preferences, and emerging vertical growth areas. The Type segmentation, contrasting chemically etched glass against coated glass, reveals the trade-offs between durability and cost. While chemical etching offers long-lasting, deep anti-glare properties suitable for high-wear environments (like automotive or public kiosks), coating solutions often provide flexibility in achieving specific optical parameters more cost-effectively, catering to consumer electronics where thinner profiles are prioritized. Understanding this dichotomy is essential for strategic product portfolio management and market targeting, ensuring that offerings align with application-specific performance requirements and total cost of ownership considerations.

Application-based segmentation clearly delineates the major consumption drivers. The Display segment, encompassing smartphones, monitors, and televisions, traditionally holds the largest market share but operates under intense price sensitivity and rapid refresh cycles. In contrast, the Automotive segment, though smaller in volume, demands extremely stringent quality and longevity specifications, translating into higher average selling prices (ASPs) and sustained revenue stability. The architectural and industrial segment requires customized, often large-format solutions, relying on project-based demand. Analyzing the growth trajectories across these applications confirms the automotive sector as the primary growth engine over the forecast period, fueled by the shift toward premium, safety-critical digital cockpits and sophisticated electric vehicle designs requiring expansive, glare-free interfaces.

Further granularity in segmentation involves analyzing the Haze Value (the measure of light diffusion), which directly correlates with the glass’s anti-glare effectiveness. Products range from low-haze variants (typically 1-5%) preferred for high-resolution displays where minimal image quality degradation is tolerated, to high-haze variants (10-25%) suitable for intense direct sunlight environments. This level of technical segmentation allows manufacturers to target specific niche markets with optimized products. The increasing demand for customized haze levels driven by proprietary display designs across major OEMs necessitates specialized manufacturing capabilities, enhancing the value proposition for highly capable Ag glass suppliers who can manage precision surface texture control and consistently deliver tight tolerance specifications across high-volume production batches.

- By Type:

- Chemically Etched Ag Glass: High durability, excellent surface hardness, deep anti-glare properties.

- Coated Ag Glass: Cost-effective, suitable for thin applications, highly flexible optical customization.

- By Application:

- Displays (Smartphones, Tablets, Monitors, TVs)

- Automotive (CID, Instrument Clusters, HUDs)

- Architectural & Interior Design (Showcases, Kiosks)

- Industrial & Medical Devices (Control panels, Diagnostic screens)

- By Haze Value:

- Low Haze (1% - 5%): For high-definition, high-fidelity image displays.

- Medium Haze (5% - 15%): General purpose consumer and professional applications.

- High Haze (>15%): For outdoor or high ambient light environments.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ag Glass Market

The Value Chain for the Ag Glass Market is complex, beginning with the highly specialized Upstream Analysis involving the sourcing and processing of raw materials. This phase includes the extraction and purification of high-quality silica sand, followed by the demanding float glass manufacturing process to create the base glass substrate. Critical upstream components also include specialized chemicals (e.g., hydrofluoric acid, sulfuric acid, and various coatings precursors) required for the subsequent etching or coating treatments. Due to the stringent quality requirements for optical glass, few suppliers worldwide meet the required purity and dimensional tolerances. Consequently, the upstream segment is characterized by high capital investment, long production lead times, and significant strategic importance, as the quality of the base substrate fundamentally determines the final product performance, leading to strong reliance on established players like Corning, AGC, and Schott for primary materials.

The Midstream phase involves the core processing steps: cutting, shaping, strengthening (often chemical strengthening like ion exchange), and the anti-glare treatment itself—etching or coating application. This phase adds the most significant value and is highly proprietary, requiring specialized expertise in surface chemistry and process control to achieve consistent haze and gloss specifications. After treatment, the glass undergoes rigorous quality inspection and finishing processes (polishing, edge grinding). Downstream Analysis then focuses on integration. The finished Ag glass substrates are shipped to Tier 1 display module assemblers (ODMs/OEMs) in electronics and automotive sectors. These assemblers integrate the glass with display panels (LCD, OLED, Micro-LED), backlights, sensors, and touch controllers to form the complete display module, which is then incorporated into the final end product (e.g., smartphone, vehicle cockpit).

Distribution Channel analysis reveals a mix of direct and indirect engagement. For high-volume, standard applications in consumer electronics, indirect channels often utilize specialized electronics distributors and material brokers to manage logistics and inventory for large regional manufacturing hubs in APAC. However, for highly customized or specialized applications, particularly in the automotive and industrial sectors where specifications are bespoke and quality validation cycles are long, direct distribution relationships between the Ag glass manufacturer and the OEM are paramount. This direct engagement ensures immediate technical support, tight collaboration on R&D, and secure supply agreements, reflecting the critical nature of the component. The shift towards greater regionalization of supply chains, driven by geopolitical risk mitigation, is prompting more localized midstream processing and distribution centers globally, slightly altering the traditional Asia-centric distribution models.

Ag Glass Market Potential Customers

The primary End-User/Buyers of Ag Glass are categorized based on their manufacturing output and technical requirements, encompassing major players in consumer electronics, automotive manufacturing, and specialized industrial equipment production. Tier 1 Consumer Electronics OEMs, such as Apple, Samsung, and Huawei, represent the largest volume purchasers, requiring vast quantities of highly durable, aesthetically pleasing Ag glass for cover lenses and display integration across their mobile and computing product lines. Their buying criteria are dominated by high-volume capacity, exceptional surface finish quality (often demanding anti-fingerprint and anti-microbial features in addition to anti-glare), and competitive pricing structures dictated by mass market economics. These customers drive innovation toward thinner, lighter, and more complex shaped glass designs, pushing manufacturers to invest heavily in advanced CNC and chemical strengthening technologies.

The Automotive sector, including major original equipment manufacturers (OEMs) like Tesla, BMW, and General Motors, constitutes the highest value-per-unit segment. Customers in this vertical require Ag glass that adheres to rigorous safety standards (e.g., scratch resistance, thermal stability, resistance to environmental factors) and possesses specialized optical properties tailored for driver safety, such particularly low reflectance at varying viewing angles. Their purchasing decisions are heavily influenced by long-term supply assurance, qualification adherence (APQP processes), and the supplier’s capability to handle complex integration requirements for large, curved, and free-form display architectures increasingly common in modern vehicle cockpits. This segment is characterized by extended qualification periods but offers stable, multi-year contracts once a supplier is approved, providing strong revenue predictability for Ag glass manufacturers.

Secondary but significant customers include manufacturers of medical diagnostic equipment, industrial HMIs (Human-Machine Interfaces) for factory automation, and specialized military/aerospace display systems. These buyers prioritize ultra-reliability, optical precision, and conformity to specific industry regulations (e.g., FDA standards for medical devices). Their volume demand is lower than consumer or automotive segments, but they justify extremely high ASPs due to the critical nature of the application where display failure or poor readability can have severe consequences. For these specialized markets, Ag Glass manufacturers must demonstrate exceptional quality control, traceability, and the ability to customize haze, gloss, and transmittance parameters to meet unique operational environments and viewing distance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., AGC Inc., Schott AG, Nippon Sheet Glass (NSG), Abrisa Technologies, Zibo Hitech Material Co. Ltd., Sichuan Xuhong Optical Glass Co., Ltd., China South Glass Holding Co., Ltd. (CSG), Shenzhen TSD Technology Co., Ltd., Via optronics AG, EuroGlass GmbH, Xinyi Glass Holdings Co. Ltd., Guardian Industries, Taiwan Glass Ind. Corp., Luoyang North Glass Technology Co. Ltd., Saint-Gobain S.A., Tianma Microelectronics Co. Ltd., O-film Group Co., Ltd., Fusang Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ag Glass Market Key Technology Landscape

The Ag Glass Market is technologically diverse, primarily characterized by two foundational approaches: chemical etching and specialty coating applications. Chemical etching technology involves immersing the glass substrate in highly controlled acidic solutions to selectively dissolve portions of the surface, creating microscopic roughness that disperses light and reduces glare. This method, often preferred for high-durability applications, is constantly evolving toward more environmentally sustainable processes, minimizing the use of hazardous chemicals and optimizing etchant recycling. Recent technological breakthroughs focus on achieving highly uniform surface texture across very large glass panels (essential for automotive and large format signage) and improving the chemical strengthening process post-etching to ensure maximum impact resistance without compromising the optical clarity or anti-glare effect, demanding tighter process controls and advanced robotics in handling.

Conversely, the coating technology landscape utilizes physical vapor deposition (PVD) or chemical vapor deposition (CVD) processes to apply ultra-thin dielectric layers or micro-particle films onto the glass surface. While these processes are typically faster and less chemically intensive than etching, achieving long-term durability and scratch resistance remains a core technical challenge. Current technological efforts in coatings are centered on multi-functional layers, combining anti-glare properties with anti-reflective (AR), anti-smudge (AF), and even light management functionalities (e.g., polarization control) within a single, integrated stack. The development of hybrid materials that use nano-scale structuring combined with traditional coatings is emerging as a critical trend, allowing manufacturers to fine-tune optical performance precisely for complex requirements such as those found in high-performance binoculars or specialized optical instruments.

Emerging technologies focus on increasing manufacturing efficiency and adapting to next-generation display formats. Laser patterning and advanced lithography techniques are being explored for creating precise anti-glare microstructures without the need for traditional chemical baths, potentially offering greater control over haze and gloss parameters and reducing environmental impact. Furthermore, the integration of Ag glass with flexible substrates, particularly for roll-to-roll processing demanded by flexible OLED and foldable device architectures, requires novel material science solutions capable of maintaining anti-glare integrity under continuous bending stress. The adoption of Industry 4.0 principles, including sensor integration and AI-driven quality inspection throughout the manufacturing line, is also transforming the technological landscape, reducing waste, and guaranteeing exceptionally high levels of batch-to-batch consistency—a necessity for demanding OEM customers worldwide.

Regional Highlights

Regional analysis of the Ag Glass Market reveals distinct consumption patterns, manufacturing dominance, and growth drivers influenced by local industrial concentration and technological adoption rates.

- Asia Pacific (APAC): APAC is the dominant market for Ag glass, accounting for the largest share in terms of both volume production and consumption. This supremacy is directly attributable to the region housing the world's leading display panel manufacturers (South Korea, China, Taiwan) and the largest consumer electronics assembly hubs. China, specifically, drives massive demand due to its large domestic electronics market and its position as the global manufacturing base. The growth here is characterized by high-volume, cost-competitive manufacturing and rapid adoption of new display technologies. Investments in G8.5 and G10.5+ fabrication plants continue to solidify APAC's central role, focusing heavily on optimizing production processes to meet escalating global demand for display panels used in monitors, smart TVs, and mobile devices. The region also acts as a critical hub for specialized chemical and material suppliers essential for the upstream segment of the value chain.

- North America: North America represents a crucial market for high-value, specialized Ag glass applications, particularly in the automotive, aerospace, and medical sectors. While manufacturing capacity is smaller than APAC, the region leads in the adoption and integration of complex digital cockpits in vehicles, requiring premium, safety-rated anti-glare glass. Furthermore, demand is strong from leading technology companies for AR/VR optics and high-end professional monitors where optical fidelity and ergonomic considerations are paramount. Growth is driven less by volume and more by the continuous innovation in end-product design, demanding customized specifications and robust performance standards, supporting high average selling prices for sophisticated Ag glass solutions.

- Europe: Europe is characterized by a strong presence in the automotive and industrial machinery sectors, driving steady demand for durable, integrated Ag glass panels. European automotive OEMs maintain some of the highest quality standards globally, fostering demand for chemically etched glass with superior durability for instrument clusters and central displays. Additionally, the region shows increasing adoption in architectural glass applications (smart buildings, museum displays) and specialized medical imaging equipment. Regulatory focus on environmental standards is influencing manufacturing processes, encouraging European suppliers to lead efforts in developing sustainable etching and coating technologies and focusing on circular economy principles within the glass industry.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with accelerating growth, primarily fueled by increasing consumer electronics penetration and nascent growth in localized automotive assembly and infrastructure projects. While currently relying heavily on imports from APAC, the market potential is significant due to rising disposable incomes and ongoing urbanization. Key growth indicators include the expansion of public information kiosks, retail digital signage, and localized assembly operations for electronic devices, necessitating regional distributors and supply chains capable of meeting modest but rapidly growing demand across diverse economic landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ag Glass Market, emphasizing their strategic positioning, core competencies in manufacturing, and geographical reach.- Corning Inc.

- AGC Inc.

- Schott AG

- Nippon Sheet Glass (NSG)

- Abrisa Technologies

- Zibo Hitech Material Co. Ltd.

- Sichuan Xuhong Optical Glass Co., Ltd.

- China South Glass Holding Co., Ltd. (CSG)

- Shenzhen TSD Technology Co., Ltd.

- Via optronics AG

- EuroGlass GmbH

- Xinyi Glass Holdings Co. Ltd.

- Guardian Industries

- Taiwan Glass Ind. Corp.

- Luoyang North Glass Technology Co. Ltd.

- Saint-Gobain S.A.

- Tianma Microelectronics Co. Ltd.

- O-film Group Co., Ltd.

- Fusang Technology

- Planar Systems

Frequently Asked Questions

Analyze common user questions about the Ag Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ag Glass and how does it reduce glare in displays?

Ag Glass, or Anti-Glare Glass, is a substrate treated via chemical etching or specialized coatings to create a micro-rough surface texture. This texture diffuses incident light rather than reflecting it directly back to the user, significantly reducing glare and improving display readability, especially in bright ambient conditions.

Which application segment drives the highest growth rate for the Ag Glass Market?

The Automotive segment is projected to exhibit the highest CAGR due to the rapid transition toward fully digital cockpits, large centralized information displays (CIDs), and sophisticated heads-up displays (HUDs), all of which require premium, highly durable anti-glare solutions for enhanced driver safety and user experience.

What is the primary difference between chemically etched Ag glass and coated Ag glass?

Chemically etched Ag glass offers superior, long-lasting durability and better resistance to wear and abrasion, making the anti-glare function permanent. Coated Ag glass is generally more cost-effective and flexible in achieving specific optical parameters, but the coating layer may be less durable over time compared to a permanent etched surface.

How is the adoption of AR/VR technology influencing the demand for Ag Glass?

AR/VR technology is driving demand for highly specialized, ultra-lightweight Ag glass with extremely precise optical performance. These devices require superior anti-reflection and anti-glare capabilities within a confined space to ensure visual clarity and prevent distraction in immersive digital environments, positioning it as a significant future growth opportunity.

Which geographical region dominates the global Ag Glass manufacturing and consumption?

Asia Pacific (APAC), particularly China, South Korea, and Taiwan, dominates the global Ag Glass market. This is due to the region's concentration of Tier 1 display panel fabrication plants, robust consumer electronics manufacturing capabilities, and its role as the global supply hub for sophisticated display components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive AG Glass Market Size Report By Type (Etching AG Glass, Coating AG Glass, Other), By Application (Central Display, Dashboard), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ag Glass Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Chemical etching, Spraying, Coating), By Application (Consumer Electronics, Automotive, Industrial Control, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager