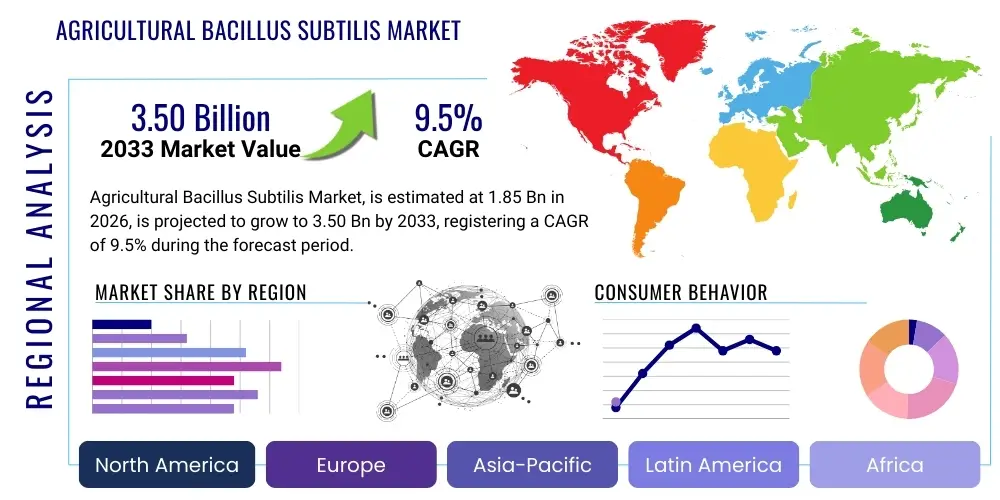

Agricultural Bacillus Subtilis Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442262 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Agricultural Bacillus Subtilis Market Size

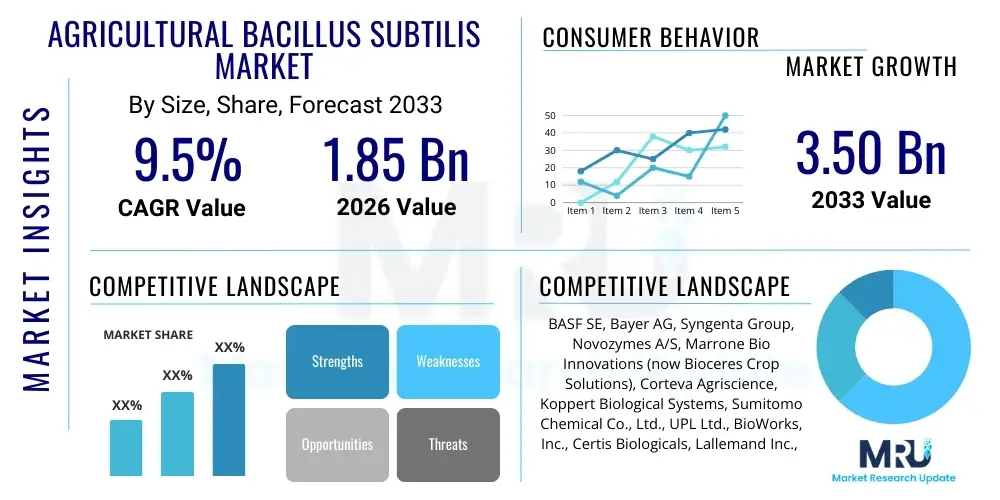

The Agricultural Bacillus Subtilis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.50 Billion by the end of the forecast period in 2033.

Agricultural Bacillus Subtilis Market introduction

The Agricultural Bacillus Subtilis market encompasses the production, distribution, and utilization of formulations based on the beneficial bacterium Bacillus subtilis for crop protection, plant growth promotion, and soil health improvement. Bacillus subtilis, a naturally occurring soil bacterium, is widely recognized as a highly effective biological control agent (biocontrol agent) due to its capacity to produce a diverse array of secondary metabolites, including antibiotics, lipopeptides, and enzymes, which enable it to suppress plant pathogens, induce systemic resistance (ISR) in host plants, and compete effectively with harmful microorganisms in the rhizosphere. This market segment is intrinsically linked to the broader agricultural biotechnology and biopesticide industries, experiencing rapid expansion fueled by the global mandate to reduce reliance on synthetic chemical inputs and transition toward sustainable farming practices, often mandated by stringent regulatory frameworks in developed economies like the European Union and specific regions within North America.

Products derived from Bacillus subtilis are available in various forms, including wettable powders, liquid concentrates, and granules, tailored for diverse application methods such as seed treatments, foliar sprays, soil drenching, and incorporation into irrigation systems. Major applications span across field crops, high-value horticultural crops (fruits and vegetables), ornamentals, and turf management. Key benefits driving adoption include enhanced crop yields through improved nutrient uptake and disease suppression, reduced environmental toxicity compared to traditional pesticides, lower instances of pathogen resistance development, and compliance with organic farming standards, making it an indispensable tool for both conventional growers seeking integrated pest management (IPM) strategies and fully organic operations. The non-toxic nature and short pre-harvest interval (PHI) associated with these biological products further solidify their position as preferred alternatives for food safety-conscious markets, especially those catering to fresh produce.

The principal driving factors propelling market growth include the escalating global demand for organic and residue-free food, supportive governmental policies and subsidies promoting biofertilizers and biopesticides, and increasing farmer awareness regarding the long-term ecological and economic advantages of microbial solutions. Furthermore, advancements in strain isolation, fermentation technology, and formulation stability have significantly improved the efficacy and shelf-life of Bacillus subtilis-based products, overcoming historical barriers to commercial adoption. The persistent challenges posed by fungicide resistance in major diseases, coupled with rising consumer scrutiny regarding chemical residues, establish a strong foundational demand for effective and reliable biological alternatives like those offered by Bacillus subtilis preparations.

Agricultural Bacillus Subtilis Market Executive Summary

The Agricultural Bacillus Subtilis market is currently navigating a period of robust expansion, characterized by significant shifts in business trends focusing on strategic mergers, acquisitions, and collaborations aimed at integrating advanced microbial genomics and delivery systems. Major industry players are heavily investing in proprietary strain development to enhance temperature stability, broad-spectrum efficacy against multiple pathogens, and compatibility with standard farm equipment and other agricultural chemicals. A pivotal business trend involves the shift towards customized blends and consortia, combining Bacillus subtilis with other beneficial microorganisms (such as mycorrhizae or other Bacillus species) to offer multi-functional products that address both plant protection and nutritional needs simultaneously, thereby increasing the value proposition for the end-user. Furthermore, the development of encapsulated formulations designed for precision agriculture applications, minimizing waste and maximizing effectiveness, represents a critical area of technological focus and market differentiation.

Regionally, the market exhibits strong divergence, with North America and Europe leading in terms of revenue share, primarily due to established regulatory support for biological products and high adoption rates of sustainable farming and organic practices. Asia Pacific (APAC), however, is emerging as the fastest-growing region, driven by substantial governmental initiatives in countries like India and China to boost agricultural productivity while addressing high levels of pesticide usage, coupled with increasing farmer education facilitated by local extension services. The high volume of cereal and rice cultivation in APAC provides a massive potential application base for seed treatment formulations. Latin America, particularly Brazil and Argentina, represents a mature but expanding market, heavily focused on large-scale row crops (soybeans and corn), where the utilization of biological inputs is increasingly seen as essential for managing resistance and maintaining competitiveness in global commodity markets, often leveraging locally adapted microbial strains.

Segmentation trends highlight the dominance of the Biopesticide segment, specifically for disease control (biofungicides), driven by widespread issues like fusarium, powdery mildew, and botrytis, which require persistent control in high-value crops. Simultaneously, the Biofertilizer segment is demonstrating accelerated growth, propelled by the documented benefits of Bacillus subtilis in solubilizing phosphates and facilitating nitrogen fixation, thereby reducing the dependency on expensive synthetic fertilizers. Application-wise, seed treatment remains the largest segment due to the cost-effectiveness and ease of application at the planting stage, offering early-stage protection and vigor. However, soil treatment and foliar spray segments are catching up as growers recognize the need for seasonal, continuous protection and tailored intervention strategies throughout the crop lifecycle, leveraging advancements in microbial stability under various environmental stresses.

AI Impact Analysis on Agricultural Bacillus Subtilis Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Agricultural Bacillus Subtilis Market predominantly center on how AI can optimize the efficiency of microbial production, enhance strain selection accuracy, and improve the predictability and efficacy of field applications. Users frequently ask about AI's role in genomics (identifying superior, novel B. subtilis strains with enhanced efficacy or stability), precision fermentation (optimizing bioreactor conditions for maximum yield and viability), and formulation development (predicting optimal stabilizer combinations). Furthermore, significant interest lies in AI-driven diagnostic tools that can correlate specific pathogen threats, soil microbial profiles, and environmental conditions to recommend the precise B. subtilis product and application timing required for maximum benefit. Key themes emerging from these analyses include the expectation that AI will dramatically reduce R&D timelines, minimize production costs through enhanced process control, and significantly improve end-user success rates by integrating biological data with existing precision agriculture platforms, moving biocontrol beyond generalized application methods toward predictive, site-specific management.

- AI-driven optimization of industrial fermentation parameters (temperature, pH, nutrient feed rate) to maximize B. subtilis sporulation and biomass yield, reducing manufacturing costs.

- Application of Machine Learning algorithms to analyze extensive microbial genomic data for the rapid identification and selection of novel, highly effective, and robust strains with superior antagonistic properties or growth-promoting traits.

- Integration of AI and computer vision systems in precision agriculture platforms to monitor pathogen pressure and plant stress, enabling prescriptive, variable-rate application of B. subtilis biopesticides only where and when necessary, enhancing efficacy.

- Utilization of predictive modeling for optimizing product formulation stability and shelf life, testing interactions between active microbial ingredients and various inert carriers under simulated environmental conditions.

- AI analysis of complex soil microbiome data to tailor specific B. subtilis consortia recommendations based on site-specific microbial ecology and soil nutrient deficiencies, maximizing biofertilization benefits.

DRO & Impact Forces Of Agricultural Bacillus Subtilis Market

The market for Agricultural Bacillus Subtilis is primarily driven by escalating regulatory pressures against synthetic chemicals and the intrinsic shift towards sustainable and organic agriculture worldwide. Government mandates and consumer preference for pesticide-free food, coupled with the proven efficacy of B. subtilis as a broad-spectrum biocontrol agent and plant growth promoter, serve as foundational drivers. These drivers are complemented by technological advancements that ensure the long-term viability and stability of microbial products, making them practical for large-scale farming operations, thereby accelerating market penetration. The primary restraints include the inherent variability of biological products compared to chemical counterparts, sensitivity to adverse environmental conditions (UV radiation, temperature extremes), and challenges related to maintaining quality control across complex distribution chains, particularly in developing regions. Furthermore, the specialized knowledge required for proper handling and application sometimes presents an adoption barrier for conventional farmers.

Opportunities for significant market expansion are concentrated in developing novel application methods, particularly sophisticated seed coatings that ensure long-term viability and controlled release of the bacterium, and in expanding applications into high-value specialty crops and commodity crop rotations (e.g., corn and soybean). The burgeoning demand for biofortification and soil carbon sequestration technologies provides a synergistic opportunity for B. subtilis, leveraging its capabilities in enhancing nutrient availability and improving soil structure. Key impact forces include stringent regulatory regimes that necessitate the withdrawal of existing chemical active ingredients (pushing growers toward biocontrol), volatile global commodity prices that influence farmer investment capacity in premium biological inputs, and continued breakthroughs in fermentation science that enhance product concentration and cost-effectiveness. The rising prevalence of pesticide resistance in target pathogens further compels the industry to adopt microbial alternatives, establishing a critical pull factor.

The core drivers center on the immediate need for sustainable intensification of agriculture, where maximizing yield per unit of land must be balanced with minimal environmental impact. The ability of B. subtilis to serve dual roles—as both a protective agent (biofungicide/bactericide) and a beneficial agent (biofertilizer)—provides unparalleled versatility that few chemical products can match. The confluence of favorable regulatory environments in key consuming markets (North America, Western Europe) and the accelerating adoption in high-growth markets (APAC, Latin America) ensures sustained market momentum. However, long-term success requires overcoming the perception that biological products are less reliable or slower acting than synthetic chemicals, necessitating rigorous field trial data and enhanced educational initiatives targeting agricultural advisors and end-users, ensuring that the impact forces remain overwhelmingly positive for biological solutions.

Segmentation Analysis

The Agricultural Bacillus Subtilis market is meticulously segmented based on product type, application type, crop type, and formulation, providing granular insights into specific high-growth niches and end-user demands. The segmentation facilitates the understanding of market dynamics by distinguishing between the use of B. subtilis for biopesticide activities (primarily fungicidal and nematicidal) and its role in biofertilization (enhancing phosphorus solubilization and overall nutrient utilization efficiency). Crop type segmentation reveals significant investment flowing into row crops due to their vast acreage, while the high profitability of horticultural crops drives demand for specialized, high-potency formulations. Formulation segmentation reflects the technological challenge of delivering a living organism effectively, highlighting the prevalence of liquid and wettable powder formulations designed for ease of use and maximum microbial stability under storage conditions.

- By Product Type:

- Biopesticides (Biofungicides, Biobactericides, Bionematicides)

- Biofertilizers (Phosphate Solubilizing Bacteria, Nitrogen Fixation)

- By Application Type:

- Seed Treatment

- Soil Treatment (In-furrow, Drench)

- Foliar Spray

- Post-Harvest Application

- By Crop Type:

- Fruits & Vegetables (Horticultural Crops)

- Cereals & Grains (Wheat, Rice, Corn)

- Oilseeds & Pulses (Soybean, Canola)

- Turf & Ornamentals

- By Formulation:

- Liquid Formulations (Suspension Concentrates, Aqueous Solutions)

- Dry Formulations (Wettable Powders, Granules, Dusts)

Value Chain Analysis For Agricultural Bacillus Subtilis Market

The value chain for the Agricultural Bacillus Subtilis market is highly specialized, beginning with intensive upstream research and development focusing on strain isolation, characterization, and genetic enhancement to identify strains with superior antagonistic or growth-promoting characteristics. This R&D phase feeds directly into the manufacturing stage, which involves high-precision, large-scale fermentation processes utilizing complex bioreactors to produce high titers of viable bacterial cells, followed by critical downstream processing steps such as harvesting, drying, and stabilization. Upstream complexity is marked by the need for quality control, ensuring the purity and viability of the active ingredient, often requiring specialized microbiological expertise and infrastructure that limits the number of effective manufacturers.

The midstream involves the crucial formulation stage, where the concentrated microbial biomass is combined with various inert carriers, stabilizers, and protective agents (e.g., UV protectants, osmotolerants) to create stable, user-friendly commercial products like wettable powders or liquid suspensions. Formulation technology dictates product efficacy and shelf life. Distribution channels are complex, involving both direct sales to large agricultural cooperatives and indirect sales through extensive networks of agricultural distributors, dealers, and retailers who possess the necessary technical knowledge to advise farmers on the correct use of biologicals. Direct channels are often utilized for large, high-volume seed treatment contracts, while indirect channels serve the broader retail farm supply market, ensuring comprehensive geographical coverage.

Downstream analysis focuses on end-user application, involving farmers, greenhouse operators, and integrated pest management specialists who utilize the products through various methods such as existing spray equipment, specialized seed treaters, or irrigation systems. The effectiveness of the product is heavily reliant on appropriate handling and application timing. The value chain culminates in the provision of technical support and extension services by the manufacturers or distributors, which is essential for ensuring successful field performance and garnering farmer confidence. Efficient logistics, minimizing temperature fluctuations during storage and transit, are paramount, as they directly influence the viability and ultimate performance of the live microbial product at the point of application.

Agricultural Bacillus Subtilis Market Potential Customers

Potential customers for Agricultural Bacillus Subtilis products are diverse, spanning the entire spectrum of agricultural operations from small organic farms to multinational agribusiness conglomerates involved in commodity crop production. The primary end-users or buyers are large-scale row crop farmers (corn, soybean, wheat) who require high-volume, cost-effective seed treatments to enhance early-season vigor and manage endemic soil-borne diseases. These customers are driven by maximizing yield and minimizing resistance risks associated with conventional chemistries. A rapidly growing segment of potential customers includes producers of high-value horticultural crops such as fruits, vegetables, and grapes, where the need for residue-free produce mandates the use of biological control agents for continuous disease and pest management, particularly in controlled environments like greenhouses and vineyards, where strict food safety standards are enforced.

Other significant buyers include seed companies and agricultural cooperatives that incorporate B. subtilis directly into their proprietary seed treatments or recommend them as standard components in Integrated Pest Management (IPM) packages to their member farmers. Additionally, professional turf and ornamental managers (golf courses, nurseries, landscape companies) represent a stable customer base, valuing the non-toxic nature and environmental safety profile of biological products for use in public-facing or environmentally sensitive areas. In essence, any agricultural entity seeking effective disease control, enhanced crop nutrient utilization, and compliance with increasingly rigorous sustainability standards constitutes a key potential customer, viewing B. subtilis as a vital component of future agricultural production systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.50 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Syngenta Group, Novozymes A/S, Marrone Bio Innovations (now Bioceres Crop Solutions), Corteva Agriscience, Koppert Biological Systems, Sumitomo Chemical Co., Ltd., UPL Ltd., BioWorks, Inc., Certis Biologicals, Lallemand Inc., Stockton Group, Chr. Hansen Holding A/S, Rizobacter Argentina S.A., Nufarm Ltd., Isagro S.p.A., FMC Corporation, Arysta LifeScience (now part of UPL), T. Stanes and Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Bacillus Subtilis Market Key Technology Landscape

The technology landscape for the Agricultural Bacillus Subtilis market is heavily dominated by advancements in microbial strain engineering and industrial fermentation methodologies aimed at enhancing product stability, potency, and cost-effectiveness. A crucial technology involves high-throughput screening and genomic sequencing, which allows researchers to rapidly identify and select superior wild-type strains or genetically modified variants of B. subtilis that exhibit enhanced efficacy against specific pathogens (e.g., increased production of surfactin or fengycin lipopeptides) or superior survival capabilities under harsh field conditions, such as tolerance to high salinity or drought. Optimized submerged and solid-state fermentation techniques are continually refined to maximize the yield of viable spores or active metabolites within industrial bioreactors, thereby minimizing production cycles and lowering the unit cost of the active ingredient.

A second major technological area focuses on advanced formulation science, which addresses the fundamental challenge of delivering a living organism from the factory to the field with minimal loss of viability. Key technologies include microencapsulation and specialized coating processes (such as fluidized bed drying and spray drying), which encapsulate the spores in protective matrices composed of polymers, sugars, or clays. These matrices shield the bacteria from environmental stressors, particularly UV radiation and desiccation, while ensuring controlled, rapid release upon application. Developing formulations that are compatible with existing chemical pesticides and fertilizers (tank-mix compatibility) is also a critical technological hurdle being overcome to facilitate easier integration into conventional farming systems, expanding the addressable market beyond strictly organic operations.

Furthermore, digital technologies are playing an increasing role, particularly in quality assurance and application precision. Sophisticated sensor technology and automated process controls are integrated into fermentation units to monitor biomass growth and metabolite production in real-time, ensuring batch-to-batch consistency—a common challenge for biological products. Downstream, the integration of these products with specialized precision agriculture delivery equipment, such as electrostatically charged nozzles or drone-based application systems, allows for targeted, efficient delivery of the biopesticide or biofertilizer. This technological integration transforms the application of B. subtilis from a generalized input into a highly precise, data-driven agricultural intervention, significantly boosting perceived and actual efficacy among advanced growers.

Regional Highlights

- North America: This region holds a dominant market share, driven primarily by the rapid adoption of sustainable farming practices in the US and Canada, regulatory support (e.g., expedited approval for biologicals by the EPA), and the high penetration of Integrated Pest Management (IPM) strategies in high-value specialty crops. The US market benefits from large-scale adoption of B. subtilis as a crucial seed treatment for corn and soybeans, optimizing early plant establishment and managing soil-borne diseases. Innovation is centered on developing stable liquid formulations tailored for large-acreage farm equipment.

- Europe: The European market is characterized by stringent chemical reduction mandates (e.g., the Farm to Fork strategy) that have led to the withdrawal of numerous synthetic fungicides, creating a significant regulatory "pull" for effective biological alternatives like B. subtilis. Market growth is strong in Western Europe, particularly in countries like Germany, France, and the Netherlands, focusing heavily on horticultural crops and protected cultivation systems where residue-free production is essential. The region emphasizes robust R&D for cold-tolerant strains suitable for temperate climates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by massive agricultural acreage, increasing governmental focus on soil health, and substantial subsidies for biofertilizers and biopesticides, particularly in populous countries such as India and China. While cost sensitivity remains a factor, the enormous production volume of staple crops (rice, wheat) presents vast potential for seed treatment applications. Market entry strategies often focus on localized strain isolation to ensure regional adaptability and efficacy against indigenous pathogens.

- Latin America: This region, particularly Brazil and Argentina, represents a mature market for agricultural biologicals due to high pressure from resistance development in major commodity crops. B. subtilis is extensively used for soybean and sugarcane protection. The market dynamics are strongly influenced by the need for products that can withstand high temperatures and intense growing seasons. Manufacturers often partner with local distributors to ensure effective technical support and adaptation to tropical farming conditions.

- Middle East and Africa (MEA): The MEA market is currently smaller but exhibits high growth potential, driven by food security concerns, increasing investment in protected agriculture (greenhouses) in arid regions, and initiatives to improve soil fertility and water use efficiency. Adoption rates are gradually increasing, supported by international aid projects and governmental efforts to modernize agricultural practices, favoring biological solutions that improve crop resilience under stress conditions common in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Bacillus Subtilis Market.- BASF SE

- Bayer AG

- Syngenta Group

- Novozymes A/S

- Marrone Bio Innovations (now Bioceres Crop Solutions)

- Corteva Agriscience

- Koppert Biological Systems

- Sumitomo Chemical Co., Ltd.

- UPL Ltd.

- BioWorks, Inc.

- Certis Biologicals

- Lallemand Inc.

- Stockton Group

- Chr. Hansen Holding A/S

- Rizobacter Argentina S.A.

- Nufarm Ltd.

- Isagro S.p.A.

- FMC Corporation

- Arysta LifeScience (now part of UPL)

- T. Stanes and Company Limited

Frequently Asked Questions

Analyze common user questions about the Agricultural Bacillus Subtilis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Bacillus subtilis in agriculture?

Bacillus subtilis serves dual roles: primarily as a biopesticide (biofungicide and biobactericide) by competing with pathogens and producing antimicrobial compounds, and secondarily as a biofertilizer by solubilizing essential nutrients like phosphate, thereby enhancing plant growth and systemic resistance.

How does the Agricultural Bacillus Subtilis market compare to chemical pesticide markets?

The Bacillus subtilis market offers a sustainable, residue-free alternative to chemical pesticides, growing significantly faster due to favorable regulations and increasing consumer demand for organic produce. While chemicals offer rapid, broad-spectrum control, B. subtilis provides long-term, ecological benefits and resistance management, making it preferred in IPM strategies.

What are the main application methods for Bacillus subtilis products?

The main application methods include seed treatments, which provide early-stage protection and vigor; soil treatments (in-furrow or drenching) for sustained root zone defense; and foliar sprays, used for above-ground disease control and seasonal intervention throughout the crop lifecycle.

Which regions are driving the highest growth in the Bacillus subtilis market?

Asia Pacific (APAC) is projected to exhibit the fastest growth, fueled by government subsidies and massive acreage of staple crops. However, North America and Europe currently maintain the largest market share due to mature regulatory frameworks, established organic markets, and high farmer awareness regarding biological solutions.

What are the key technological challenges in commercializing Bacillus subtilis products?

Key challenges include ensuring product stability and shelf life, maintaining microbial viability under various environmental stresses (heat, UV), achieving batch-to-batch consistency during large-scale fermentation, and developing formulations that are highly compatible with conventional farming equipment and chemistries.

The strategic importance of Bacillus subtilis in contemporary agriculture cannot be overstated, particularly as global food systems grapple with the dual challenges of climate change resilience and minimizing environmental impact. The versatility inherent in various B. subtilis strains allows for their deployment across virtually all major crop types and in various geographic and climatic zones, reinforcing their position as a fundamental pillar of the biocontrol arsenal. Research continues to identify novel strains that are hyper-producers of specific antimicrobial peptides, such as bacillomycin or mycosubtilin, which provides targeted control against difficult-to-manage fungal pathogens, thereby reducing the necessity for multiple synthetic fungicide applications. This targeted efficacy is crucial for integrated resistance management programs, preventing the selection pressure that often leads to treatment failures in chemical regimes. The ongoing investment in genomics, particularly metagenomics studies of the rhizosphere, is elucidating the complex interactions between B. subtilis and native microbial communities, informing the development of superior microbial inoculants designed for specific soil types and nutrient compositions.

Furthermore, the economic viability of utilizing Bacillus subtilis is continually improving, making it increasingly accessible to farmers across varying income brackets. The development of advanced, high-density fermentation protocols has driven down the cost of producing viable biomass, while improved formulations reduce the necessary application rate per hectare while maintaining high field efficacy. This enhanced cost-efficiency is pivotal for its adoption in high-volume commodity crops, where input costs are tightly scrutinized. Regulatory bodies are recognizing the inherent safety profile of B. subtilis, often streamlining the approval process for new strains and products compared to the protracted timelines associated with synthetic chemicals. This regulatory environment acts as a positive feedback loop, encouraging further private sector investment in novel biocontrol agents and delivery systems. The convergence of consumer ethics, regulatory mandates, technological improvements, and demonstrable field efficacy positions the Agricultural Bacillus Subtilis Market for sustained, double-digit growth throughout the forecast period, transitioning it from a niche solution to a mainstream agricultural input across global farming operations.

Future market expansion is expected to be significantly influenced by its role in sustainable land management and carbon farming initiatives. Certain strains of B. subtilis are recognized for their ability to improve soil structure, enhance aggregation, and contribute indirectly to carbon sequestration by promoting healthier, larger root systems that deposit more organic matter into the soil profile. As global efforts intensify to mitigate climate change through agricultural practices, the demand for microbial inputs that support soil health metrics and sustainable intensification will invariably surge. This includes the development of multi-functional products that deliver pest control, nutrient solubilization, and abiotic stress tolerance (e.g., drought or heat stress mitigation) in a single application. The synergy between B. subtilis products and newly developed biostimulants, often derived from seaweed extracts or humic substances, is becoming a key area of product innovation, promising farmers comprehensive crop health solutions that address biological, chemical, and physical aspects of soil and plant productivity simultaneously, defining the next wave of biocontrol commercialization.

The robust development cycle in the Agricultural Bacillus Subtilis Market also encompasses continuous improvements in quality assurance and standardization. Historically, variability in product efficacy due to environmental factors or inconsistent formulation stability presented a significant barrier. Modern manufacturing practices, leveraging principles of pharmaceutical-grade quality control, are minimizing these inconsistencies. Companies are now implementing rigorous spore count verification, viability testing post-storage, and standardized efficacy trials across diverse environmental conditions before product release. This commitment to standardization builds crucial farmer trust and ensures that the biological activity promised on the label translates consistently into effective performance in the field, further solidifying the market’s reliability. This standardization process is critical for competing effectively against the consistent performance metrics traditionally associated with synthetic chemical inputs, ensuring that the transition to biologicals is perceived as a reliable, rather than risky, investment for growers facing tight margins and high yield expectations.

Within the highly competitive landscape, market participants are increasingly differentiating themselves not merely on strain efficacy but on the sophistication of their delivery systems. For instance, developing liquid formulations that remain stable even when stored at ambient temperatures for extended periods represents a substantial technological advantage, especially in regions lacking consistent cold chain infrastructure. Similarly, the integration of B. subtilis into granular fertilizers or specialized controlled-release packets for targeted soil application minimizes microbial mortality during application and maximizes colonization of the plant root zone. These formulation breakthroughs are paramount, as the effective deployment of a living organism relies heavily on protecting it from the moment it leaves the bioreactor until it establishes itself in the intended ecological niche, highlighting formulation technology as a key competitive battlefield in this market sector.

The regional dynamics are further refined by specific crop demographics. In North America, the focus is increasingly extending beyond row crops to specialty crops such as almonds, potatoes, and wine grapes, where high consumer and regulatory pressure exists to eliminate chemical residues. In these high-value segments, growers are willing to pay a premium for highly effective biological alternatives. Conversely, in the APAC region, the widespread use of B. subtilis in rice paddies for disease suppression and enhanced nutrient uptake (especially phosphorus) is a dominant application segment, requiring high-volume, low-cost inputs suitable for water-based delivery systems. These distinct regional needs necessitate tailored product development and marketing strategies, preventing a one-size-fits-all approach and requiring global companies to maintain robust regional R&D and field trial capabilities to ensure product relevance and performance in highly diverse agricultural systems across continents.

Furthermore, the competitive strategy of key players involves aggressive intellectual property protection surrounding novel strains and proprietary fermentation processes. Patenting robust, high-performing B. subtilis strains—often identified through extensive bioprospecting or utilizing advanced mutation and screening techniques—ensures market exclusivity and justifies the substantial investment required for regulatory approval and large-scale commercialization. The ability to patent a unique mode of action, such as an exceptionally effective secondary metabolite profile, provides a significant advantage. This focus on proprietary technology encourages vertical integration within major agricultural firms, often leading them to acquire smaller, innovative biotech startups specializing in microbial discovery and genomics, cementing the trend of consolidation within the broader biocontrol industry.

The evolution of agricultural practices, driven by global sustainability goals and economic pressures, continues to underscore the value proposition of Bacillus subtilis. As farmers seek solutions that offer crop protection without the negative externalities associated with resistance development and environmental impact, B. subtilis stands out as a reliable, ecologically sound choice. Its adaptability to various farming scales and compatibility with organic standards ensures its continued central role in the transition toward resilient and sustainable global food systems, securing its projected high growth trajectory over the forecast period and beyond, defining it as a foundational biotechnology input.

The strategic deployment of Bacillus subtilis products is becoming increasingly sophisticated, moving away from reactive treatments toward preventative, proactive applications. In perennial crops, for example, systematic applications are employed to establish a persistent beneficial microbial community in the rhizosphere and phyllosphere, providing continuous protection against seasonal pathogen outbreaks. This proactive approach significantly enhances yield stability and reduces the risk of crop failure. For annual crops, the integration of B. subtilis into early-stage inputs, such as seed treatments combined with nutrient packages, ensures the plant starts with a maximized defense system and optimal nutritional status, crucial for achieving high yields in competitive farming environments.

Finally, the growing awareness and adoption of biologicals are heavily supported by digital education platforms and sophisticated data analytics. Companies are providing growers with digital tools that use weather data, historical disease pressure information, and soil parameters to accurately model the risk of pathogen outbreaks and recommend the precise application schedule for their B. subtilis products. This move towards data-driven recommendation engines significantly mitigates the perceived risk associated with switching from conventional chemicals to biologicals, empowering farmers to use these sophisticated tools optimally and enhancing the overall performance reputation of Bacillus subtilis formulations in diverse farming ecosystems globally.

The market faces ongoing technological demands related to formulation quality, particularly the challenge of ensuring viability when tank-mixed with conventional chemical inputs. Many farmers require the flexibility to integrate biologicals with standard fertilizers or pesticides, necessitating extensive R&D into formulation chemistry that prevents the degradation or death of the Bacillus spores upon mixing. Overcoming issues of flocculation, sedimentation, and chemical incompatibility is vital for widespread commercial acceptance, especially in high-volume agricultural regions where complex tank mixes are standard operating procedure for efficiency. Successful innovation in this area directly translates to expanded market share and reduces application barriers for the end-user.

Furthermore, the development of unique, strain-specific regulatory data packages remains a high cost element for market entrants. Although the overall regulatory process for biologicals may be faster than for synthetics, securing registration often requires extensive, specific toxicological and efficacy data for each proprietary strain of B. subtilis, especially concerning mammalian and environmental safety. Companies must invest significantly in generating this data across multiple jurisdictions, which creates a competitive advantage for large multinational corporations with existing global regulatory infrastructure. This cost structure indirectly acts as a barrier to entry for smaller, specialized biotech firms, influencing market consolidation trends.

The long-term success of the Agricultural Bacillus Subtilis market is intrinsically tied to addressing global food loss, especially in the post-harvest segment. Specific strains of B. subtilis are proving highly effective in controlling common post-harvest fungal rots (e.g., Penicillium and Botrytis) in fruits and vegetables, extending shelf life without requiring chemical fungicides. This application area presents a critical growth opportunity, particularly for products destined for long-distance transport or export, where preserving quality and reducing spoilage are primary economic concerns. Expanding the use of these biological controls post-harvest helps meet consumer demand for safer food products while significantly reducing economic losses across the supply chain, adding substantial value to the biocontrol proposition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager