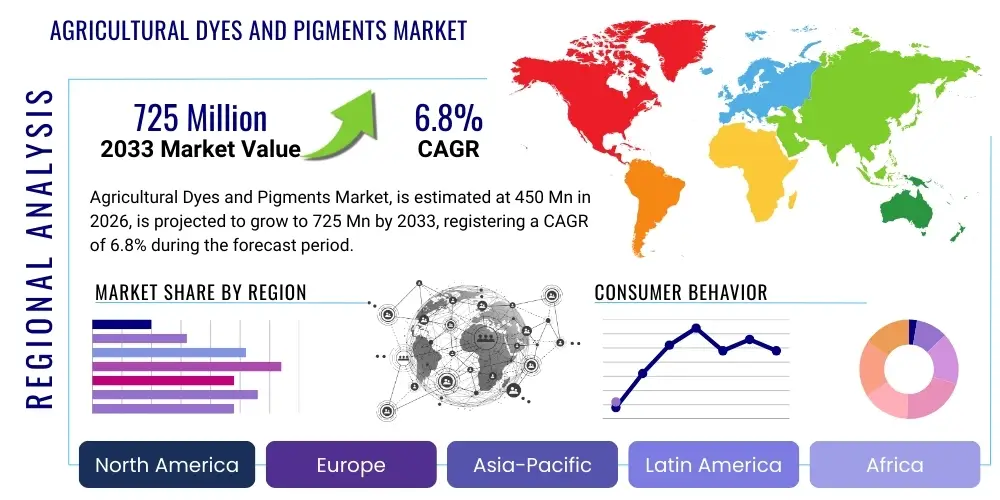

Agricultural Dyes and Pigments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442410 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Agricultural Dyes and Pigments Market Size

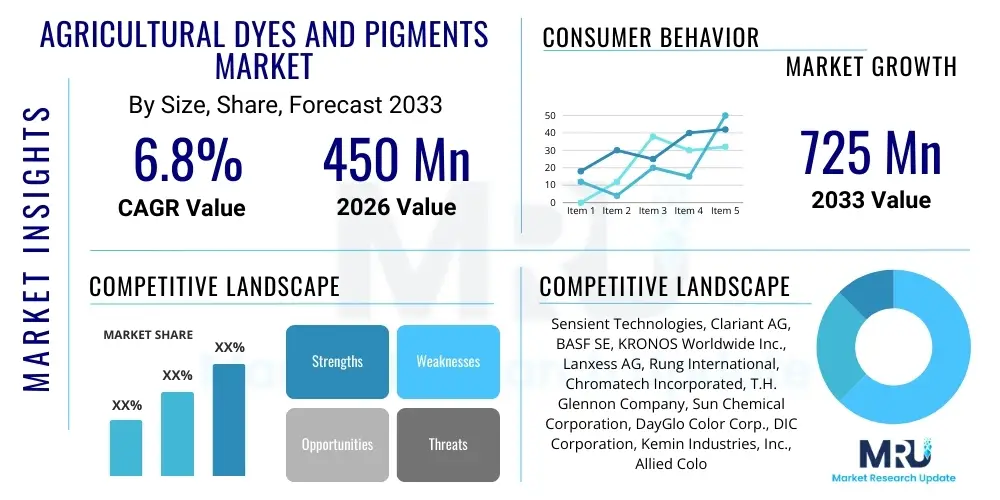

The Agricultural Dyes and Pigments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $725 Million by the end of the forecast period in 2033.

Agricultural Dyes and Pigments Market introduction

The Agricultural Dyes and Pigments Market encompasses specialized colorants utilized primarily for aesthetic enhancement, identification, and functional purposes across various agricultural inputs. These materials are essential components in seed treatment, fertilizer coloration, crop protection chemicals, and flowering applications, providing visual distinction necessary for proper handling, application, and regulatory compliance. The principal products include synthetic dyes, organic pigments, and specialized bio-based colorants, each selected based on specific requirements such as photostability, solubility, and interaction with the base chemical formulations. The widespread adoption of advanced agricultural practices, including precision farming and high-value seed coatings, significantly underpins the demand trajectory for these specialized colorants, ensuring optimal performance and safety in agricultural operations globally.

The fundamental application of these colorants revolves around differentiation and safety. For instance, seed treatment dyes ensure that coated seeds are clearly visible and distinguishable from food grains, mitigating risks of accidental consumption. Similarly, pigments are integrated into liquid fertilizers and pesticides to indicate uniform mixing and application coverage, thereby enhancing efficacy and minimizing waste. Key driving factors include stringent regulatory requirements mandating the unique identification of treated seeds and crop protection products, coupled with the increasing global emphasis on high-quality, traceable agricultural inputs. Furthermore, technological advancements in micro-encapsulation and sustainable coloring solutions are expanding the functional utility and environmental profile of agricultural dyes and pigments, addressing contemporary consumer demand for eco-friendly farming.

The market also benefits significantly from the expansion of high-tech horticulture and floriculture, where specific dyes are used for crop tagging, floral coloring, and soil amendment visibility. Manufacturers are continuously innovating to develop colorants that possess superior lightfastness, excellent chemical compatibility with complex agrochemical matrices, and reduced environmental toxicity. This ongoing research and development focus is crucial, as the performance of the dye or pigment directly impacts the stability and effectiveness of the underlying agricultural product. The transition towards water-based, low-VOC (Volatile Organic Compound) formulations, particularly in developed regions like North America and Europe, reflects the industry’s commitment to sustainability and compliance with increasingly rigorous environmental standards regarding agricultural runoff and soil health.

Agricultural Dyes and Pigments Market Executive Summary

The Agricultural Dyes and Pigments Market demonstrates robust growth driven by escalating demand for treated seeds and the modernization of global agricultural infrastructure, leading to significant business trends centered on sustainability and specialty formulation. Key business trends indicate a strong industry shift toward bio-based and non-toxic colorants, responding to rising regulatory pressures, particularly in the EU and North America, which prioritize environmental safety over traditional synthetic options. Mergers and acquisitions focused on securing specialized proprietary coloring technologies, such as micro-encapsulation techniques that improve color durability and minimize leaching, are becoming common. Furthermore, the increasing integration of supply chain transparency technologies, ensuring the traceability of colorants from synthesis to final application, is reshaping competitive dynamics, favoring manufacturers who offer high purity and consistent product quality.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive agricultural output, rapid adoption of commercial seeds, and increasing mechanization in countries like India and China. Conversely, North America and Europe maintain dominance in innovation, driving demand for premium, high-performance pigments tailored for advanced precision agriculture systems. In these mature markets, regulation surrounding chemical residue and worker safety strictly influences product specifications, pushing companies towards certified organic and highly stable pigment lines. The Middle East and Africa (MEA) and Latin America are emerging growth hubs, driven by government initiatives to enhance food security and the subsequent growth in demand for treated hybrid seeds and specialized fertilizers.

Segmentation trends reveal that seed treatment remains the largest and most critical application segment, due to the global necessity of protecting high-value hybrid seeds from early-stage fungal and pest attacks. Within the product segment, pigments are gaining traction over traditional soluble dyes, owing to their superior stability, lightfastness, and low migration properties, which are critical for long-lasting visual identification on fertilizer granules and seed coatings. The market is also seeing a segment shift towards liquid formulations, which offer ease of integration and high throughput in automated agricultural manufacturing processes compared to powder forms. This focus on performance and application efficiency dictates the strategic investment priorities for leading market participants across the value chain, emphasizing functional coloration rather than purely aesthetic enhancement.

AI Impact Analysis on Agricultural Dyes and Pigments Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Agricultural Dyes and Pigments Market primarily revolve around how AI can enhance efficiency, reduce costs, and accelerate the development of sustainable colorants. Users are keenly interested in predictive modeling for dye stability under varying environmental conditions, optimizing formulation compatibility with complex agrochemical mixtures, and automating quality control processes to ensure color consistency and batch reliability. Key themes emerging from these inquiries include concerns about the environmental impact of current coloring agents, expectations for AI-driven discovery of novel bio-based pigments, and the potential for AI algorithms to minimize waste by predicting optimal application rates in precision farming systems. The synthesis of these queries confirms a high user expectation that AI will transition the market from reactive material testing to proactive, predictive material design and operational efficiency.

AI is already beginning to influence the research and development pipeline by drastically reducing the time required for molecule screening and property prediction for new colorants. Machine learning algorithms analyze vast datasets of chemical structures and environmental interaction data, identifying potential toxicological profiles and compatibility issues before lab synthesis even begins. This accelerates the launch of safer, high-performance pigments that meet stringent global agricultural standards. Furthermore, AI-powered image recognition and spectroscopic analysis are being deployed in manufacturing facilities to perform real-time, highly accurate quality checks on pigment particle size, color strength, and dispersion characteristics, ensuring product homogeneity and minimizing expensive batch rejections due to quality variance.

In terms of application, AI enhances the precision of dye and pigment use through smart spraying and localized treatment systems. Predictive analytics use satellite imagery and ground sensor data, combined with information on the required colorant, to determine the exact amount needed for seed coating or foliar application, avoiding over-application and subsequent environmental leaching. This shift to AI-optimized resource deployment contributes significantly to the sustainability goals of large agribusinesses and reduces input costs for farmers. The overall impact of AI is therefore twofold: optimizing the chemical properties and manufacturing consistency of the product itself, and ensuring its highly efficient, environmentally responsible use in the field.

- AI-driven molecular modeling accelerates the discovery of novel, environmentally friendly bio-pigments.

- Predictive analytics optimize colorant formulation compatibility with complex agrochemical active ingredients.

- Machine learning enhances real-time quality control for color consistency and particle size distribution during manufacturing.

- AI integration into precision agriculture tools optimizes application rates for seed coating and spraying, minimizing chemical waste.

- Automated spectroscopic analysis ensures high-throughput batch inspection, improving supply chain reliability.

DRO & Impact Forces Of Agricultural Dyes and Pigments Market

The market for agricultural dyes and pigments is fundamentally shaped by a confluence of powerful dynamics, encapsulated by its Drivers, Restraints, and Opportunities (DRO). A primary driver is the global proliferation of sophisticated seed treatment technologies, where uniform and reliable coloration is a mandatory prerequisite for product differentiation and safety labeling. As genetically modified (GM) and high-yield hybrid seeds become standard practice across major food crops, the need for specialized, durable pigments to signify treatment status and brand identity escalates. Furthermore, stringent regulatory bodies, particularly the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), increasingly mandate the distinctive coloration of pesticides and treated inputs to prevent accidental ingestion and enhance worker safety, solidifying demand. The continuous global push for enhanced agricultural output efficiency and reduced environmental footprint indirectly boosts the demand for high-performance colorants that do not compromise the efficacy of accompanying active ingredients.

Conversely, significant restraints impede the market’s expansion. The most notable is the severe regulatory scrutiny placed upon synthetic chemical inputs. Specific traditional dyes are facing outright bans or severe restrictions due to concerns over genotoxicity, persistence in the environment, and accumulation in the food chain, compelling manufacturers to undertake costly reformulation efforts. Additionally, the inherent cost sensitivity of agricultural input purchasing, particularly in developing economies, means that premium, high-performance, or bio-based pigments often face resistance due to their higher price point compared to conventional, lower-quality alternatives. Finally, the technical challenge of ensuring color stability against harsh field conditions, UV radiation, and long-term storage requirements poses a significant technical restraint for product developers aiming for superior color durability and consistency over extended periods.

Despite these challenges, substantial opportunities exist, primarily centered around technological innovation and market penetration into sustainable segments. The shift towards bio-based dyes and pigments, extracted from natural sources or derived via microbial fermentation, represents a colossal opportunity to bypass regulatory hurdles and align with sustainability mandates preferred by major global food corporations. Moreover, the increasing adoption of specialized micronutrient fertilizers and complex foliar sprays provides new application areas requiring high-solubility, compatible coloring solutions. The continued investment in smart agriculture technologies, which utilize drones and autonomous spraying systems, necessitates the development of highly visible, high-contrast markers to aid precise tracking and efficacy assessment, opening niche opportunities for specialty functional pigments. These impact forces—regulatory mandates, technological advancements, and economic constraints—collectively dictate the pace and direction of innovation within the agricultural colorants sector.

Segmentation Analysis

The Agricultural Dyes and Pigments market is systematically segmented based on Type, Application, Form, and Geography, providing granular insights into market dynamics and consumer preferences. Segmentation by Type distinguishes between Dyes and Pigments; dyes are generally soluble and used where uniform coloration across a liquid system is required, while pigments are insoluble particulates valued for their lightfastness and opacity, primarily utilized in seed coatings and solid fertilizers. This distinction is critical as it dictates the physical form (liquid concentrates versus powder), the compatibility with active ingredients, and the required stability characteristics against environmental degradation.

Application-based segmentation is perhaps the most crucial determinant of market value, separating the market into Seed Treatment, Fertilizers, Crop Protection Chemicals (Pesticides and Herbicides), and specialized areas like Soil Amendments and Flowering Agents. Seed treatment commands the largest share due to regulatory requirements and the high value attributed to coated seeds, which demand specialized, non-phytotoxic, durable colorants. The increasing complexity and performance demands within the fertilizer segment, particularly for micronutrient blends and controlled-release granular products, drives robust demand for high-stability, non-leaching pigments capable of withstanding various chemical environments over prolonged periods of storage and use.

Furthermore, segmentation by Form separates the offerings into Liquid and Powder. Liquid formulations, often sold as highly concentrated dispersions or solutions, offer superior ease of handling, measuring accuracy, and integration into automated manufacturing lines, making them increasingly popular among large-scale agrochemical producers. Powder forms remain relevant, particularly for direct dry blending into fertilizers or for applications in regions where logistics and storage stability favor solid inputs. Understanding these segments is paramount for market players to tailor their product development, focusing resources on high-growth areas like bio-based liquid pigments for specialized seed coatings, thereby capturing maximum market opportunity while navigating evolving regulatory landscapes.

- By Type:

- Dyes (e.g., Acid Dyes, Basic Dyes, Disperse Dyes)

- Pigments (e.g., Organic Pigments, Inorganic Pigments)

- Natural/Bio-based Colorants

- By Application:

- Seed Treatment (e.g., Fungicides, Insecticides, Bio-stimulants)

- Fertilizers (e.g., Granular, Liquid, Micronutrient Blends)

- Crop Protection Chemicals (e.g., Herbicides, Pesticides)

- Soil Amendments and Hydroseeding

- Flowering and Floriculture Applications

- By Form:

- Liquid Formulations (e.g., Concentrates, Dispersions)

- Powder Formulations (e.g., Granules, Fine Powders)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Agricultural Dyes and Pigments Market

The value chain for the Agricultural Dyes and Pigments Market commences with the upstream analysis, focusing heavily on the sourcing and processing of core raw materials, which vary significantly based on whether the final product is synthetic or bio-based. For synthetic colorants, key inputs include petrochemical intermediates such as benzene derivatives, aromatic amines, and complex synthesis precursors, requiring reliable supply contracts with chemical producers. For bio-based alternatives, the upstream involves cultivation or large-scale fermentation of natural sources (e.g., microalgae, specialized bacteria, botanical extracts), followed by extraction and purification processes. Efficiency at this stage is crucial, as the purity and cost of raw materials directly determine the final product quality and competitiveness, particularly since agricultural inputs operate on tight cost margins. Manufacturers must navigate commodity price volatility and ensure strict adherence to safety standards for all chemical precursors.

The midstream involves the core manufacturing process, which includes synthesis, grinding, dispersion, and formulation. Manufacturers must possess specialized expertise in chemical engineering and formulation science to create stable, highly concentrated, and compatible colorants. Formulation is highly customized, ensuring the dye or pigment maintains stability and performance when mixed with potent active ingredients, polymers for seed coatings, or high-salt fertilizer solutions. The distribution channel analysis highlights a dual approach: Direct and Indirect distribution. Direct distribution involves large, specialized chemical companies selling bulk quantities directly to major global agrochemical corporations (e.g., Bayer, Syngenta, Corteva) that require proprietary, high-volume products for their mass-production lines. This channel emphasizes technical support, customized color matching, and confidentiality agreements.

The indirect channel relies on regional distributors, chemical resellers, and specialized formulators who cater to smaller, localized agricultural input manufacturers or serve as intermediaries to reach diverse regional markets. This downstream analysis involves packaging the colorants in user-friendly formats (e.g., concentrated liquid drums or standardized powder bags) and managing complex logistics to agricultural hubs. End-users, who are primarily seed processors, fertilizer blenders, and crop protection chemical companies, rely on the distribution network for timely supply and technical assistance regarding application efficacy and regulatory compliance. The ultimate success of the product depends on how efficiently the colorant integrates into the customer’s existing manufacturing process without compromising the primary function of the agricultural input, underscoring the necessity for robust technical services and reliable supply chain logistics throughout the value network.

Agricultural Dyes and Pigments Market Potential Customers

The primary consumers, or potential customers, of agricultural dyes and pigments are highly specialized industrial entities operating within the broader agrochemical and seed industry ecosystems. Seed manufacturers, particularly those dealing with high-value hybrid and genetically modified seeds, represent the largest and most critical customer segment. These companies require vast quantities of highly specific colorants for seed coating applications, where the color serves as both a brand identifier and a mandatory safety marker indicating the presence of protective treatments (fungicides, insecticides, bio-stimulants). The color must be durable, non-phytotoxic, and adhere perfectly to the polymer coating without flaking, making them demanding customers who prioritize quality, consistency, and compliance with national seed labeling laws over absolute cost.

Another significant customer segment comprises manufacturers of fertilizers and soil amendments, ranging from large multinational fertilizer conglomerates to regional blending operations. In this segment, pigments are used to color granular fertilizers (especially those containing micronutrients like zinc or boron) to ensure homogeneity, signal specific nutrient profiles, and enhance marketability. For liquid fertilizers, water-soluble dyes are employed to ensure consistent dosing and visual confirmation of successful mixing in large tanks. These customers seek cost-effective, easily dispersed colorants that are stable in high-salt, acidic, or alkaline environments, and which do not precipitate or interfere with the fertilizer’s solubility or nutrient release profile over time.

Furthermore, producers of crop protection chemicals—including herbicides, insecticides, and fungicides—constitute a vital customer base. Regulation often mandates that the final formulated product (e.g., concentrated liquid pesticides) must be uniquely colored for safety purposes and to prevent counterfeiting, making reliable, chemically inert dyes essential components. Emerging customers also include companies focused on specialized applications such as hydroseeding and high-tech greenhouse horticulture, which utilize functional dyes for monitoring application uniformity or coloring irrigation water. All these end-user segments require suppliers who can provide technical data packages, regulatory compliance documentation, and assurance regarding the environmental safety of the colorants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $725 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sensient Technologies, Clariant AG, BASF SE, KRONOS Worldwide Inc., Lanxess AG, Rung International, Chromatech Incorporated, T.H. Glennon Company, Sun Chemical Corporation, DayGlo Color Corp., DIC Corporation, Kemin Industries, Inc., Allied Colour Corporation, Neelikon Food Dyes & Chemicals, Organic Dyes and Pigments, Milliken & Company, Ciba Specialty Chemicals (now part of BASF), Pylam Products Company, Inc., Kolorjet Chemicals Pvt Ltd, Krishna Dyes & Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Dyes and Pigments Market Key Technology Landscape

The technological landscape of the Agricultural Dyes and Pigments Market is characterized by intense innovation aimed at improving product stability, regulatory compliance, and functional performance within complex agrochemical matrices. A critical technological focus is advanced pigment dispersion and stabilization techniques. Manufacturers are increasingly utilizing specialized surface treatment chemistries and high-shear mixing processes to create finely dispersed, highly stable liquid colorant concentrates. This is essential because the performance of a colorant in a seed coating or liquid fertilizer depends on its ability to remain homogeneously suspended without settling or reacting with the active ingredients. Nano-pigment technology is emerging, offering superior color strength and opacity at lower concentration levels, thus reducing input volumes while enhancing overall visual quality and longevity.

Another major technological advancement is in the field of micro-encapsulation, particularly relevant for seed treatment applications. Encapsulation technology involves coating the dye or pigment particles with a protective polymer shell. This shell prevents leaching of the colorant into the soil upon planting, minimizes dust-off during seed handling (a key worker safety concern), and protects the colorant from premature degradation by UV light or humidity during storage. Furthermore, encapsulation allows for controlled release characteristics, ensuring the color marker remains visible for the necessary duration of the crop establishment phase. The shift towards bio-based and natural colorant technologies is also driving significant R&D investment, focusing on optimizing extraction yields, enhancing the intrinsic lightfastness of natural pigments (which are typically less stable than synthetic counterparts), and developing cost-effective, scalable fermentation processes for microbial color production, offering sustainable alternatives to petroleum-derived chemical dyes.

Finally, the integration of advanced analytical chemistry and digital color matching systems defines modern quality control and customization within this sector. Spectrophotometers and digital color formulation software allow manufacturers to precisely match color standards across different batches and substrate types, crucial for maintaining brand consistency globally. This technology minimizes batch-to-batch variation, a core requirement for large-volume customers like multinational seed companies. Furthermore, compatibility testing technologies, utilizing accelerated aging and chemical stress protocols, are paramount to ensuring that the newly developed colorants do not negatively interact with the complex chemistries of modern pesticides and seed treatments. These technological efforts collectively ensure high-performance delivery, safety, and compliance with the specialized needs of modern agriculture.

Regional Highlights

- Asia Pacific (APAC): APAC represents the highest growth potential driven by the extensive agricultural land base, rapid adoption of commercial seeds, and increasing use of specialty fertilizers, particularly in China, India, and Southeast Asian nations. Governments in this region are actively promoting modern farming techniques and hybrid seed varieties, directly fueling the demand for highly colored, traceable agricultural inputs. Regulatory standards, while often less stringent than in the West, are evolving, necessitating localized supply chains and cost-effective formulation solutions. The large population base and subsequent pressure on food production ensure sustained, long-term market expansion.

- North America: North America is characterized by mature markets, high technological adoption, and extremely stringent regulatory oversight (EPA, USDA). This region drives demand for premium, high-performance, and certified low-toxicity colorants, particularly in seed treatment and large-scale hydroseeding applications. The focus here is on innovation, specifically bio-based colorants and advanced micro-encapsulated pigments that align with sustainability metrics and minimize environmental exposure, commanding higher price points than global averages.

- Europe: Europe exhibits leadership in the shift toward sustainable and organic agricultural practices, profoundly impacting the colorants market. The European Union’s REACH regulation and strict restrictions on synthetic chemicals necessitate rapid reformulation towards natural, vegetable-derived, or microbial pigments. While the overall volume growth might be slower than in APAC, the high value and premiumization of certified eco-friendly colorants make Europe a critical hub for innovation and the establishment of global regulatory trends concerning agricultural chemical safety.

- Latin America (LATAM): This region, anchored by Brazil and Argentina, possesses vast tracts of highly productive agricultural land focusing heavily on export crops (soy, corn, sugar cane). The market demand is robust, driven by extensive crop protection chemical usage and the large-scale application of treated seeds. Price competitiveness is key in LATAM, but increasing investment in modern agriculture is pushing demand toward higher-quality, reliable colorants that can withstand tropical climates and large-scale industrial application processes.

- Middle East and Africa (MEA): The MEA region is an emerging market with significant growth expected, particularly due to government focus on diversifying economies and enhancing regional food security through large-scale irrigation and controlled environment agriculture (CEA). Demand is focused on specialized dyes for greenhouse horticulture (e.g., nutrient solution coloring) and high-visibility pigments for fertilizers used in nutrient-poor desert soils, requiring colorants that are resilient to extreme heat and low moisture conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Dyes and Pigments Market.- Sensient Technologies

- Clariant AG

- BASF SE

- KRONOS Worldwide Inc.

- Lanxess AG

- Rung International

- Chromatech Incorporated

- T.H. Glennon Company

- Sun Chemical Corporation

- DayGlo Color Corp.

- DIC Corporation

- Kemin Industries, Inc.

- Allied Colour Corporation

- Neelikon Food Dyes & Chemicals

- Organic Dyes and Pigments

- Milliken & Company

- Ciba Specialty Chemicals (now part of BASF)

- Pylam Products Company, Inc.

- Kolorjet Chemicals Pvt Ltd

- Krishna Dyes & Chemicals

Frequently Asked Questions

Analyze common user questions about the Agricultural Dyes and Pigments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of dyes and pigments in agricultural applications?

The primary function is visual identification and safety. Colorants are mandatory for treated seeds and pesticides to distinguish them from food grains and signal the presence of active chemicals, ensuring regulatory compliance and minimizing accidental ingestion risks by humans and livestock.

How do regulatory changes, particularly in the EU and North America, affect the market?

Stringent regulations, such as REACH in Europe, are phasing out traditional synthetic dyes with known environmental persistence or toxicity, compelling manufacturers to invest heavily in developing and utilizing safer, bio-based, and natural colorant alternatives, thus increasing innovation costs but aligning with global sustainability goals.

Which application segment holds the largest share in the Agricultural Dyes and Pigments Market?

The Seed Treatment segment holds the largest market share. The mandatory requirement for coloring all treated seeds for safety and brand differentiation, coupled with the rapid growth of hybrid and high-value seed adoption globally, drives consistent, high-volume demand in this application area.

What technological advancements are crucial for modern agricultural colorants?

Key advancements include micro-encapsulation technology for improved durability and reduced environmental leaching, and advanced dispersion techniques (nano-pigments) to achieve higher color strength and superior compatibility with complex agrochemical formulations, ensuring product stability and performance in the field.

What are the main advantages of using bio-based pigments over synthetic dyes in agriculture?

Bio-based pigments offer significant advantages in terms of environmental sustainability, reduced toxicity, and easier regulatory approval pathways. They appeal to consumer preferences for eco-friendly farming inputs and help agrochemical companies meet corporate sustainability mandates, mitigating risks associated with chemical scrutiny.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager