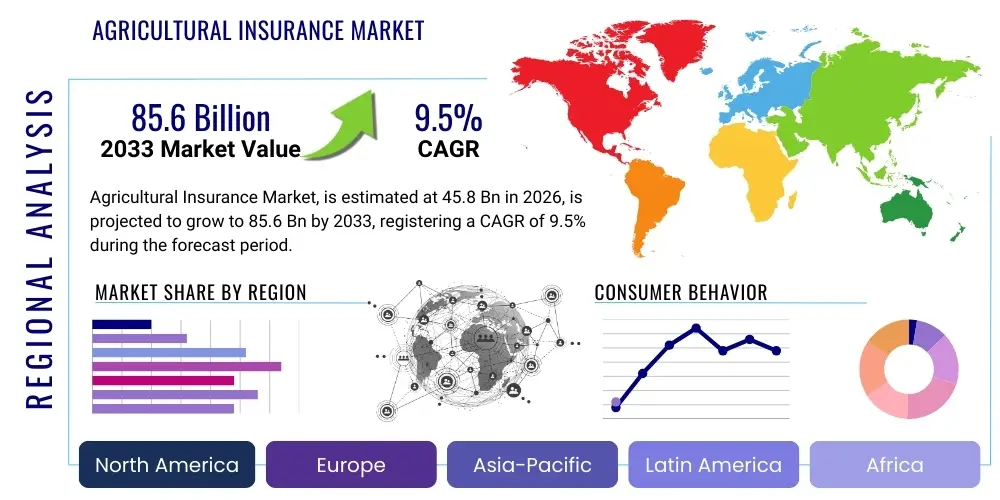

Agricultural Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443275 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Agricultural Insurance Market Size

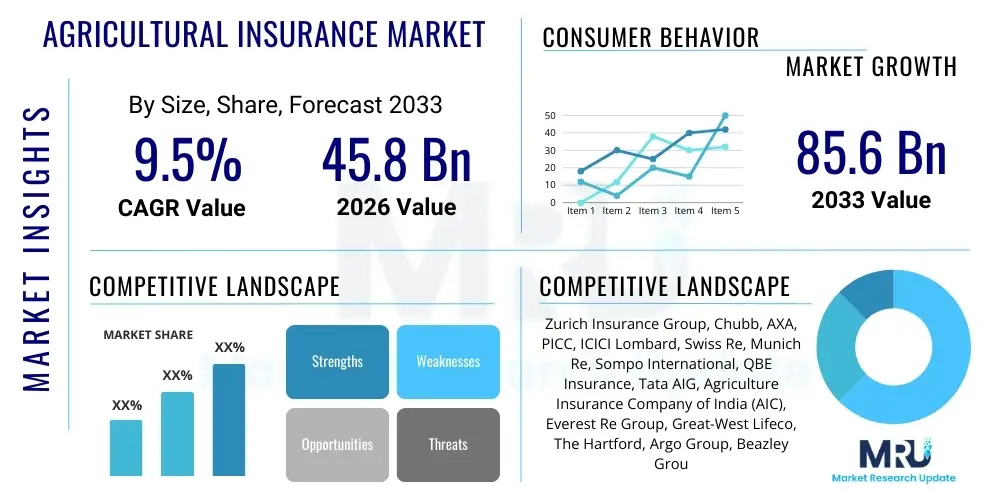

The Agricultural Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 45.8 billion in 2026 and is projected to reach USD 85.6 billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by increasing global climate volatility, demanding robust risk mitigation tools for agricultural producers, coupled with enhanced governmental support through subsidies and mandatory insurance schemes designed to protect food security and farmer livelihoods in developing and developed economies alike. The rising adoption of advanced parametric insurance products, which utilize satellite data and remote sensing for objective claims assessment, contributes significantly to market scalability and operational efficiency, attracting both traditional reinsurers and insurtech providers to this rapidly evolving sector.

The transition toward sustainable farming practices and the urgent need to address the systemic risks associated with biodiversity loss and extreme weather events are major accelerators for market valuation. Large-scale farming operations, particularly in regions prone to catastrophic events like droughts, floods, or severe pest infestations, are increasingly relying on comprehensive multi-peril crop insurance (MPCI) and index-based livestock insurance to stabilize financial performance. Furthermore, technological integration, involving the deployment of Internet of Things (IoT) devices and advanced machine learning models for predictive risk modeling, reduces informational asymmetries and expedites the claims process, thereby enhancing trust and uptake among the farming community. The market's size growth reflects a critical shift from traditional loss-adjustment models to proactive, technology-driven risk management solutions that secure the global agricultural supply chain against increasing environmental uncertainties.

Geographic market growth is unevenly distributed, with significant potential observed in emerging economies across Asia Pacific and Latin America, where a large percentage of the population depends on subsistence farming, making them highly vulnerable to climate shocks. Government initiatives in countries like India and China, mandating or heavily subsidizing crop insurance, drive massive policy volume growth, while regulatory clarity regarding reinsurance structuring and public-private partnerships further stabilizes the financial mechanisms supporting this market. The continuous refinement of agricultural risk metrics, coupled with global efforts to standardize loss assessment methodologies, positions the agricultural insurance market not merely as a compensatory tool but as an essential element of modern food production infrastructure, ensuring resilience against exogenous shocks and facilitating necessary investments in farm modernization and sustainable intensification.

Agricultural Insurance Market introduction

The Agricultural Insurance Market encompasses financial risk management products designed to protect farmers, agribusinesses, and related stakeholders against losses resulting from adverse weather conditions, natural disasters, disease outbreaks, price fluctuations, and yield reduction. These specialized insurance products act as a critical safety net, stabilizing the income of agricultural producers and ensuring the continuity of the food supply chain. Products range from traditional crop yield insurance, which compensates for physical loss, to sophisticated weather index insurance (parametric insurance), which triggers payouts based on predefined climatic metrics like rainfall or temperature deviations, minimizing the need for costly field visits. Major applications include protection for staple crops (corn, wheat, rice), high-value horticulture, aquaculture, and livestock operations, mitigating risks specific to biological and climate volatility inherent in the primary sector. The market's robust growth is underpinned by critical factors such as escalating climate change impacts, which necessitate proactive financial shielding, increasing regulatory support through mandatory insurance policies and subsidies, and the rapid deployment of satellite imagery, drones, and AI analytics that enhance accuracy and accessibility of coverage across vast geographical areas. The core benefit provided is financial stability, allowing farmers to recover quickly from unforeseen events, secure bank financing, and invest confidently in modern farming technologies, thereby fostering long-term resilience and productivity in the face of global environmental challenges.

The complex nature of agricultural risk—characterized by high spatial variability, moral hazard concerns, and catastrophic potential—demands specialized underwriting and pooling mechanisms, often involving significant public-sector participation or state-backed reinsurance schemes to ensure market stability and affordability. The product description spans various policy types, including Multi-Peril Crop Insurance (MPCI), which covers a broad spectrum of risks including pests, diseases, and meteorological events; Revenue Insurance, which protects against losses due to both yield reduction and commodity price decline; and Specific Peril Insurance, targeting highly localized risks such as hailstorms or frost. Driving factors include the need for farmers to comply with lending requirements, as agricultural insurance often serves as collateral, the increasing globalization of commodity markets which amplifies price volatility, and the strategic importance of national food security, prompting governments worldwide to incentivize widespread coverage. Furthermore, rising awareness among smallholder farmers regarding the economic necessity of risk transfer, often facilitated by mobile technology and digital platforms, is expanding the addressable market, moving coverage beyond large commercial farms into traditionally underserved segments. The integration of advanced geospatial technology is transforming policy administration, making it faster, cheaper, and more transparent, fundamentally altering the operating landscape for insurers.

Key market participants include global reinsurers, specialized agricultural insurance providers, and regional cooperatives, often operating in collaboration with governmental agencies to manage systemic risk exposure. The evolution of the market is marked by innovation in delivery mechanisms, moving towards digitally-enabled sales processes and automated claims payouts, dramatically reducing the administrative burden and improving the customer experience. Benefits extend beyond direct financial compensation; agricultural insurance facilitates sustainable development by encouraging farmers to adopt less risky, yet productive, farming methods, knowing that catastrophic downside risks are managed. The growing demand for specialized coverage for emerging risks, such as cyber threats to precision farming systems or pandemic-related supply chain disruptions affecting farm labor, showcases the market's adaptability. The confluence of climate necessity, technological capability, and supportive regulatory frameworks positions agricultural insurance as a cornerstone of future resilient food systems, driving substantial investment in both product development and infrastructural capabilities necessary to support global agricultural activities facing unprecedented environmental stress.

Agricultural Insurance Market Executive Summary

The Agricultural Insurance Market is experiencing vigorous growth, driven fundamentally by the amplified frequency and severity of climate-related risks and supportive legislative environments globally. Business trends indicate a strong pivot towards digitalization, with insurance providers investing heavily in remote sensing capabilities, satellite imagery analysis, and machine learning algorithms to improve underwriting accuracy, assess risk concentration, and automate the traditionally labor-intensive claims process. This technological integration is lowering the operational cost ratio and enabling the profitable expansion into previously inaccessible or uninsurable regions, particularly those characterized by smallholder farming. The shift toward parametric insurance models, which provide rapid, objective payouts based on verifiable external indices rather than subjective damage assessment, is a defining trend, enhancing liquidity for farmers immediately following a catastrophic event. Furthermore, there is an increasing trend of convergence between traditional agricultural insurers and technology firms (Insurtechs), creating hybrid business models focused on providing bundled risk management and advisory services alongside core insurance products, thus transitioning the market role from merely reactive compensation to proactive risk prevention and mitigation planning.

Regional trends highlight Asia Pacific (APAC) as the dominant growth engine, propelled by massive government initiatives in countries like India (Pradhan Mantri Fasal Bima Yojana - PMFBY) and China, which are deploying large-scale, state-subsidized schemes to achieve food security objectives and protect rural economies. These programs introduce millions of farmers to formalized insurance, although they simultaneously pose challenges related to data management and scheme viability due to immense scale. North America and Europe maintain maturity, characterized by sophisticated, multi-layered risk programs, focusing heavily on specialized covers (e.g., margin protection, farm income stabilization) and integrating advanced precision agriculture data into policy pricing. Latin America is emerging rapidly, driven by the expansion of large commercial farming enterprises requiring robust coverage for export-oriented crops, utilizing sophisticated actuarial modeling to address localized climate risks. Policy differences across regions—ranging from mandatory comprehensive coverage in parts of APAC to voluntary, subsidized frameworks in the U.S. and EU—significantly dictate local market penetration rates, complexity of product offerings, and the balance between public and private capital deployment in risk bearing.

Segment trends emphasize the escalating demand for crop yield insurance, which remains the largest segment, but is increasingly being augmented by Revenue Insurance products that offer protection against volatile commodity prices alongside physical loss. Peril segmentation shows a growing need for specialized coverage against non-traditional risks such as cyber risk affecting farm management systems, and extreme heat stress impacting livestock productivity. Distribution trends lean towards direct digital sales channels and strategic partnerships with agri-input suppliers, cooperatives, and financial institutions (banks) to leverage existing farmer relationships and distribution networks, especially in rural areas. Technology segmentation clearly favors the adoption of Big Data analytics and GIS-based platforms, crucial for accurate index calculation and geo-tagging of insured parcels. The livestock insurance segment is also diversifying beyond mortality coverage to include production losses related to disease (e.g., African Swine Fever) and environmental factors, supported by enhanced remote monitoring technology. Overall, the market's future trajectory is defined by innovation aimed at making policies transparent, highly customized, and instantaneously responsive to climatic events, underpinned by robust governmental regulatory support.

AI Impact Analysis on Agricultural Insurance Market

User queries regarding the impact of Artificial Intelligence (AI) on the Agricultural Insurance Market commonly center around three core themes: the potential for AI to dramatically enhance the accuracy and speed of risk modeling, concerns about job displacement for traditional claims adjusters, and the capability of AI to minimize fraudulent activities. Users frequently ask how machine learning (ML) can translate satellite imagery and hyperspectral data into actionable underwriting decisions, and whether the resulting increased automation will lower premium costs, making insurance affordable for smallholder farmers. There is also significant interest in the reliability of AI-driven predictive models to forecast localized climate extremes, moving insurance from a reactive mechanism to a genuinely predictive one. The consensus expectation is that AI will be the primary technological catalyst for market modernization, enabling hyper-localization of risk assessment and automated contract execution via smart insurance policies (e.g., leveraging blockchain for automated payout triggers), though regulatory frameworks must evolve to address algorithmic transparency and accountability.

The integration of deep learning and neural networks allows insurers to process colossal volumes of heterogeneous data—including weather station readings, soil moisture metrics, historical yield data, and real-time drone surveillance—to create highly nuanced and dynamic risk profiles for individual farm parcels. This granular risk assessment surpasses traditional statistical models, significantly reducing adverse selection and moral hazard. Furthermore, AI systems are crucial in claims processing, analyzing before-and-after satellite images to instantly verify losses across large areas, thus speeding up settlement times from weeks to days, which is vital for farmers requiring immediate capital for replanting or operational recovery. This technological capability not only improves farmer satisfaction but also dramatically enhances the efficiency and profitability metrics for insurance providers, optimizing their reserve management and reinsurance strategies based on superior predictive insights.

However, the successful deployment of AI necessitates substantial investment in data infrastructure and talent acquisition, posing a barrier to entry for smaller insurance providers. Ethical and regulatory concerns also arise regarding data privacy and the potential for algorithmic bias, particularly when using proprietary algorithms to determine policy eligibility or premium rates in diverse agricultural landscapes. Despite these challenges, AI's role in fraud detection is transformative; ML models can rapidly identify anomalies in historical claims patterns, inconsistencies between reported data and remotely sensed evidence, or suspicious clustering of claims following minor events, thereby saving insurers substantial financial losses. Ultimately, AI systems are poised to democratize access to sophisticated risk management tools, transforming agricultural insurance into a precision service tailored to the specific microclimate and operational practices of every policyholder, fundamentally redefining the market dynamics and product offerings.

- Precision Underwriting: AI uses satellite and IoT data for granular, parcel-level risk assessment, leading to fairer and more accurate premium pricing.

- Automated Claims Processing: Machine learning analyzes remote sensing data (drones, satellite) to verify losses and trigger near-instantaneous, objective parametric payouts.

- Fraud Detection and Mitigation: Deep learning models identify sophisticated patterns of fraudulent claims by cross-referencing vast datasets and historical behaviors.

- Predictive Risk Modeling: AI systems forecast localized weather anomalies and pest outbreaks, allowing insurers to offer preventative advisories alongside coverage.

- Product Customization: Algorithms facilitate the creation of highly customized, dynamic insurance products tailored to specific crop types, soil conditions, and microclimates.

- Operational Efficiency: Automation of policy administration and regulatory reporting reduces administrative costs significantly, improving the overall loss ratio.

DRO & Impact Forces Of Agricultural Insurance Market

The dynamics of the Agricultural Insurance Market are intensely shaped by a convergence of powerful drivers, structural restraints, and emerging opportunities, all interacting to form critical impact forces that dictate market momentum and direction. Primary drivers include the undeniable acceleration of climate change, manifested through increased frequency and severity of extreme weather events such as prolonged droughts, catastrophic flooding, and unprecedented heatwaves, which systematically increase the underlying financial vulnerability of farming operations globally. This heightened risk profile necessitates robust financial protection, making insurance a non-negotiable tool for managing enterprise risk. Furthermore, significant governmental support, often through mandates, subsidies, and public-private partnerships (PPPs), acts as a fundamental market propeller, making policies financially accessible to a broader farmer base and guaranteeing the solvency required to cover large-scale, catastrophic events that private capital alone might struggle to absorb. These forces collectively ensure sustained demand, stabilizing the market against inherent price sensitivity among end-users.

Conversely, the market faces notable restraints that temper its expansion rate and limit penetration in certain geographies. The most significant structural challenge is the persistent issue of low risk awareness and affordability among smallholder farmers, particularly in emerging markets, compounded by inadequate infrastructure for reliable data collection and verification, which is essential for accurate underwriting. Actuarial complexity, especially the difficulty in modeling covariance risk across large areas—where multiple policyholders suffer losses simultaneously from a single catastrophic event—presents a major hurdle for reinsurers seeking to manage aggregate exposure. Furthermore, issues related to moral hazard and adverse selection remain prevalent, where farmers with higher expected risks are more likely to purchase insurance, requiring sophisticated technological solutions like remote monitoring to mitigate these systemic inefficiencies and ensure the long-term sustainability of insurance pools. These restraints necessitate innovative delivery models and targeted educational outreach to overcome adoption resistance.

Opportunities for future growth are predominantly centered around technological innovation and geographic expansion into underserved markets. The rapid maturity of high-resolution satellite imagery, drone technology, IoT sensor deployment, and blockchain application presents a unique opportunity to drastically reduce data collection costs, enhance transparency, and enable the scalable deployment of parametric insurance, eliminating the slow and costly field-based loss assessment process. The development of specialized insurance products catering to emerging risks, such as business interruption due to infectious animal diseases, supply chain failure, and yield loss from declining pollinator populations, opens new revenue streams beyond traditional crop and livestock coverage. The transition towards mandatory environmental, social, and governance (ESG) reporting and sustainable finance initiatives further creates opportunities for insurers to offer premium incentives or specialized coverage for farmers adopting sustainable practices (e.g., regenerative agriculture), integrating risk management with broader sustainability goals, thus aligning insurance products with global climate mitigation efforts and securing future market relevance.

- Drivers:

- Increasing global climate variability and frequency of extreme weather events.

- Strong governmental support through subsidies and mandatory insurance schemes promoting food security.

- Rapid adoption of technological solutions (remote sensing, AI) enhancing policy efficiency and reducing costs.

- Growing corporate agribusiness reliance on risk management for supply chain stability.

- Restraints:

- High operational complexity and modeling difficulty for catastrophic, covariate risks.

- Low affordability and poor risk awareness among smallholder farmers in developing regions.

- Prevalence of moral hazard and adverse selection issues requiring advanced mitigation techniques.

- Lack of standardized, high-quality historical agricultural and weather data across many jurisdictions.

- Opportunity:

- Development and scaling of parametric (index-based) insurance products leveraging digital platforms.

- Expansion into emerging markets (Africa, Southeast Asia) through mobile-enabled distribution channels.

- Integration of insurance with broader climate financing and regenerative agriculture initiatives.

- Offering specialized coverage for non-traditional risks like cyber threats and biodiversity loss impacts.

- Impact Forces:

- Climate Volatility: Heightens the demand for catastrophic risk transfer and necessitates higher capital reserves.

- Technological Disruption: Lowers transaction costs and increases policy transparency, accelerating market adoption.

- Regulatory Policy: Subsidies and mandates exert immediate, significant influence on market penetration and premium volume.

Segmentation Analysis

The Agricultural Insurance Market is highly diversified and segmented based on the type of coverage provided, the nature of the agricultural entity insured, and the distribution channel utilized, reflecting the myriad risks inherent in modern agriculture. Key segmentations include categorization by Crop Type (e.g., cereals, oilseeds, fruits/vegetables), which determines the specific perils and valuation metrics applied; Coverage Type (e.g., yield-based, revenue-based, parametric index), defining the trigger mechanism for payouts; and geographical boundaries, recognizing that regulatory environments and climate risks vary dramatically by region. The dominant segment remains crop insurance due to the vast global acreage dedicated to staple food production and the high exposure of crops to climate variability throughout the growing season. However, livestock insurance and aquaculture coverage are rapidly gaining traction, driven by industrialization in animal husbandry and the escalating risk of mass disease outbreaks and environmental degradation. Understanding these segment dynamics is crucial for insurers to develop actuarially sound products that manage localized risk effectively while maintaining portfolio diversification against systemic, covariate losses.

Product sophistication is a primary driver of segmentation evolution. Traditional indemnity-based policies, which require physical damage assessment, continue to serve as the baseline, especially for large, sophisticated commercial farms. However, the future growth is clearly anchored in parametric and index-based insurance products. Parametric segmentation, based on objectively verifiable metrics (such as rainfall deficit or temperature spikes measured by remote sensors), offers superior scalability and efficiency, making it the preferred method for covering smallholder farmers in data-scarce regions where traditional loss adjustment is prohibitively expensive. This shift is not merely technological but structural, changing how risk is defined, measured, and transferred. Furthermore, the segmentation by distribution channel is crucial; while agents and brokers dominate sales to large commercial operations, digital platforms and collaborations with Non-Governmental Organizations (NGOs) and microfinance institutions are vital for reaching the vast, fragmented market of small and marginal farmers, requiring tailored product design and simplified policy language.

The increasing complexity of modern agribusiness also necessitates segmentation based on the scope of coverage, moving beyond simple yield protection. Revenue insurance, which protects against the combined risk of low yields and low market prices, represents a significant value-added segment for farmers engaged in dynamic global commodity markets. Specialty insurance for high-value agricultural assets, such as greenhouses, irrigation equipment, or precision machinery, forms another niche segment driven by capital-intensive farming operations. The ability of market participants to successfully segment their offerings based on risk type, farm size, technological access, and regional regulatory compliance determines their competitive positioning. As climate risk intensifies, the granularity of segmentation will continue to increase, with customized offerings based on real-time data inputs becoming the market standard for effective risk management and competitive differentiation.

- By Coverage Type:

- Multi-Peril Crop Insurance (MPCI)

- Specific Peril Crop Insurance (Hail, Frost, Wind)

- Revenue Insurance

- Index-Based/Parametric Insurance (Weather Index, Yield Index)

- Livestock Insurance (Mortality, Disease, Productivity Loss)

- By Crop Type:

- Cereals (Wheat, Rice, Maize)

- Oilseeds and Pulses

- Fruits and Vegetables

- Cash Crops (Cotton, Sugarcane, Tobacco)

- Horticulture and Permanent Crops

- By Stakeholder:

- Smallholder Farmers

- Commercial Farmers and Agribusinesses

- Lending Institutions and Cooperatives

- By Distribution Channel:

- Agents and Brokers

- Banks and Financial Institutions (Bancassurance)

- Direct Sales and Digital Platforms

- Government Schemes and Public-Private Partnerships (PPPs)

Value Chain Analysis For Agricultural Insurance Market

The value chain for the Agricultural Insurance Market is complex, involving multiple specialized entities working synergistically, starting from data origination and risk assessment (upstream) through to policy delivery and claims settlement (downstream). Upstream activities are critically dependent on advanced technology providers and data vendors, including meteorological services, remote sensing firms, satellite operators, and specialized data aggregators that supply the high-resolution, geo-referenced information necessary for accurate actuarial modeling and localized risk pricing. Reinsurers also sit upstream, providing the essential capital capacity and expertise to pool and absorb large-scale catastrophic risks, which are too volatile for primary insurers to manage independently. This initial stage defines the technical capability and financial stability of the entire insurance offering, heavily reliant on sophisticated risk modeling software and deep climatic knowledge.

The midstream segment is dominated by primary insurance carriers and specialized agricultural underwriters who translate the raw risk data and reinsurance capacity into marketable products, designing policy structures, setting premiums, and managing regulatory compliance across diverse jurisdictions. Distribution channels are the critical link between the insurer and the farmer (downstream). Distribution is facilitated through diverse paths, including direct channels (insurers selling directly to large commercial clients via dedicated sales teams or digital portals), indirect channels involving agents and brokers who provide personalized advice and manage client relationships, and crucial non-traditional channels like bancassurance and cooperative agreements, especially vital for reaching scattered rural populations. Government agencies and mandated scheme administrators also constitute a significant distribution vector in subsidized markets, leveraging public infrastructure for mass enrollment and premium collection.

Downstream activities center on post-sales service, notably claims handling and settlement, which is the ultimate test of the policy's value proposition. The efficiency of this stage is being revolutionized by technology; AI-driven claims processing, utilizing remote sensing and smart contracts, minimizes dispute potential and speeds up payouts, a crucial element for farmer financial recovery. The distribution channel’s effectiveness is directly measured by its ability to collect premiums efficiently and disseminate information regarding policy triggers and claims procedures transparently. The shift towards digitization streamlines both upstream data acquisition and downstream claims servicing, fundamentally compressing the value chain and reducing operational latency. Successful participants maintain robust partnerships across the chain, ensuring reliable data flow upstream, adequate capital capacity midstream, and trustworthy, efficient delivery downstream, optimizing the overall farmer experience.

Agricultural Insurance Market Potential Customers

The Agricultural Insurance Market serves a broad and heterogeneous customer base, fundamentally comprising any entity whose financial stability is exposed to biological, climatic, or market risks associated with agricultural production. The primary and largest segment consists of commercial farmers and large agribusiness corporations managing extensive tracts of land or sophisticated livestock operations. These customers require comprehensive, high-limit policies such as Multi-Peril Crop Insurance (MPCI) and specialized revenue protection, viewing insurance as an essential enterprise risk management tool necessary to secure investments in technology, high-value inputs, and export logistics. Their demand is driven by the need to maintain stable financial performance for shareholders and secure preferential financing terms from lending institutions, which often mandate insurance coverage as a prerequisite for issuing agricultural loans, thus making banks crucial indirect drivers of demand in this segment.

A second crucial segment includes smallholder and subsistence farmers, predominantly concentrated in Asia Pacific, Latin America, and Africa. While individually purchasing low-premium policies, their sheer numbers make them a critical volume market, highly sensitive to price and requiring accessible, index-based products distributed via digital or governmental channels. These farmers rely on insurance not for high returns, but for survival and poverty reduction, ensuring they have the minimal capital required to replant or recover after a moderate loss event. Their needs dictate product simplification, low transaction costs, and reliance on trusted community-based distribution networks for education and enrollment. The third significant customer group comprises agricultural financiers, lenders, and input suppliers. These institutions are indirect beneficiaries and often the primary drivers of insurance uptake, as they use the policy as collateral against loans extended for seeds, fertilizer, machinery, or operational credit, mitigating their own exposure to agricultural default risk arising from unforeseen production losses.

Furthermore, governments, regional agricultural cooperatives, and commodity trading firms constitute important institutional customers. Governments are often the largest policyholders, underwriting mass schemes to achieve food security and social welfare objectives, acting as the ultimate risk bearer or subsidizer. Cooperatives purchase bulk policies or group insurance to protect their members, leveraging collective bargaining power. Commodity traders and food processing companies also require specialized insurance solutions, such as forward contract risk insurance or supply chain disruption coverage, to safeguard their raw material supply against systemic production shortfalls caused by regional climatic events. The diversity in customer needs, ranging from stabilizing corporate earnings to ensuring subsistence income, nece

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 billion |

| Market Forecast in 2033 | USD 85.6 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zurich Insurance Group, Chubb, AXA, PICC, ICICI Lombard, Swiss Re, Munich Re, Sompo International, QBE Insurance, Tata AIG, Agriculture Insurance Company of India (AIC), Everest Re Group, Great-West Lifeco, The Hartford, Argo Group, Beazley Group, Mapfre, Tokio Marine Holdings, Fidelidade, Farmers Edge. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Insurance Market Key Technology Landscape

The technological landscape within the Agricultural Insurance Market is defined by the synergistic integration of advanced sensing, data analytics, and distributed ledger technologies, fundamentally transforming risk assessment and claims management. Remote sensing, incorporating high-resolution satellite imagery (e.g., Sentinel, Landsat), drone-based visual and multispectral data, and aerial photography, forms the backbone of modern underwriting. These technologies provide precise, real-time data on crop health (Normalized Difference Vegetation Index - NDVI), soil moisture, land use classification, and damage extent across vast geographical areas, enabling insurers to verify farm parameters and assess loss triggers without costly, time-consuming physical inspection. The scalability and objectivity provided by remote sensing are critical enablers for parametric insurance, allowing automated contract execution based on verifiable external indices rather than subjective claims adjustments, thereby dramatically lowering the administrative cost structure and reducing the opportunity for fraud across large portfolios.

Complementing sensing technology are Big Data analytics and Artificial Intelligence (AI) platforms, which process the influx of meteorological, historical yield, and remote sensing data. Machine learning algorithms are applied to build highly sophisticated predictive risk models that can forecast the probability and severity of localized weather events or pest outbreaks, informing actuarial pricing at a micro-level (farm-parcel specific). These AI systems also manage the entire policy lifecycle, from automated quoting based on farm geolocation and historical performance to rapid fraud detection by cross-referencing claim submissions against multiple data layers. Furthermore, the Internet of Things (IoT) sensors deployed on farms—measuring localized temperature, humidity, soil pH, and machinery performance—provide insurers with ground-truth data, enhancing the accuracy of index calculations and allowing for proactive risk mitigation advice to policyholders, shifting the insurer’s role towards active risk partnership rather than just compensation provider.

Finally, Blockchain technology is emerging as a powerful component, particularly for enhancing transparency and streamlining policy execution. Smart contracts built on decentralized ledgers can be programmed to automatically trigger payouts when pre-agreed conditions (e.g., rainfall deviation confirmed by a recognized weather service) are met, eliminating manual intervention and enhancing trust in the claims process, which is often cited as a weakness in traditional indemnity insurance. This use of distributed ledger technology not only guarantees the immutability of policy records and payment triggers but also facilitates micro-insurance schemes by significantly reducing the administrative overhead associated with managing numerous small policies. The convergence of these technologies—remote data capture, intelligent analytics, and decentralized execution—is creating a future where agricultural insurance is instant, hyper-personalized, fully auditable, and seamlessly integrated into the farmer’s operational management system.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, predominantly driven by governmental interventions aiming to secure national food supply and support rural populations. Countries like India, through schemes such as the PMFBY, and China, with its extensive subsidized programs, mandate or heavily incentivize insurance, resulting in massive policy uptake volumes. The challenge in this region lies in managing the sheer scale of the schemes, ensuring data integrity, and reaching remote smallholder farmers. Technological adoption of satellite-based parametric insurance is vital for scalability. Growth is focused on volume expansion and achieving universal coverage, leveraging public-private coordination and mobile technology distribution strategies.

- North America: This region, particularly the United States, is characterized by a mature, highly subsidized, and complex market structure, largely dominated by Multi-Peril Crop Insurance (MPCI) and specialized revenue protection policies. Risk management is sophisticated, closely linked to federal farm bill policies and commodity price fluctuations. The key focus here is on integrating precision agriculture data (from farm machinery and GIS systems) into underwriting models for personalized, dynamic pricing. Innovation centers around high-value coverage options, risk modeling sophistication, and maximizing operational efficiency through advanced technology.

- Europe: The European market is mature but fragmented, influenced by diverse national regulations and the European Union’s Common Agricultural Policy (CAP). Subsidies vary significantly, leading to heterogeneous penetration rates. The market is shifting towards integrating climate-related sustainability targets, with increasing demand for specialized coverage for environmental risks and organic farming. Parametric products are gaining ground, especially for localized risks like hail and frost. The emphasis is on maintaining high service standards, robust reinsurance capacity, and compliance with stringent EU data protection regulations.

- Latin America: This region is characterized by high growth potential, driven by the expansion of large, sophisticated commercial agricultural operations focused on export crops (soy, maize, coffee). Market development is heavily dependent on overcoming currency volatility and achieving sufficient reinsurance capacity to cover high-value crops in climate-volatile areas. Brazil and Argentina are leading the adoption of private-sector-led indemnity and revenue insurance, often utilizing satellite data due to infrastructural challenges, seeking robust protection against climate shocks that affect export quotas and global pricing.

- Middle East and Africa (MEA): The MEA market is nascent but critical due to high climate vulnerability and a large subsistence farming population. Growth is concentrated around pilot programs, often supported by international development banks and NGOs, focusing almost exclusively on micro-insurance and index-based products (e.g., drought index insurance). Challenges include lack of meteorological data infrastructure, political instability, and overcoming deeply ingrained cultural reluctance towards formal financial risk tools. Digital distribution through mobile money platforms is the primary accelerator for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Insurance Market.- Zurich Insurance Group

- Chubb

- AXA

- PICC (People’s Insurance Company of China)

- ICICI Lombard

- Swiss Re

- Munich Re

- Sompo International

- QBE Insurance

- Tata AIG

- Agriculture Insurance Company of India (AIC)

- Everest Re Group

- Great-West Lifeco

- The Hartford

- Argo Group

- Beazley Group

- Mapfre

- Tokio Marine Holdings

- Fidelidade

- Farmers Edge

Frequently Asked Questions

Analyze common user questions about the Agricultural Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Agricultural Insurance Market?

The primary driver is the accelerating frequency and severity of climate change-related events, such as droughts, floods, and extreme temperature variations, which increase the financial risk exposure for farmers globally. This necessity is heavily supported by government subsidies and mandatory insurance schemes designed to ensure national food security and farmer income stability.

How is parametric insurance different from traditional crop insurance, and why is it important?

Parametric insurance pays out based on the occurrence of a pre-defined, objectively measurable index (like rainfall level or temperature spike) rather than the actual estimated financial loss. It is crucial because it utilizes satellite and remote sensing data for automated, rapid, and transparent claims settlement, significantly reducing the operational costs and time associated with traditional field-based loss adjustment, thereby making insurance scalable for smallholder farmers.

What role does Artificial Intelligence (AI) play in modern agricultural insurance?

AI is pivotal for modernizing the market through precision underwriting, using machine learning to analyze massive datasets (weather, historical yield, remote sensing) to create hyper-localized risk models. It also powers automated claims processing, instantly verifies losses using imagery analysis, and significantly enhances fraud detection capabilities, thereby increasing overall market efficiency and reducing loss ratios.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly due to the vast scale of state-sponsored, subsidized agricultural insurance programs in highly populous countries like India and China. These government mandates introduce millions of farmers into the formal insurance structure, driving massive premium volumes despite often lower average premium values per policy.

What are the main hurdles preventing widespread agricultural insurance adoption among smallholder farmers?

The main hurdles are low affordability, insufficient risk awareness and financial literacy, and lack of reliable, high-quality data infrastructure necessary for accurate underwriting in rural areas. Overcoming these requires low-cost, simplified, index-based products distributed via digital platforms and supported by targeted governmental subsidies and educational outreach programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Agricultural Insurance Market Size Report By Type (Crop/MPCI, Crop/Hail, Livestock, Others), By Application (Banks, Insurance Companies, Brokers/Agents, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Agricultural Insurance Market Size Report By Type (Crop/MPCI, Crop/Hail, Livestock, Others), By Application (Bancassurance, Digital & Direct Channel, Broker, Agency), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager