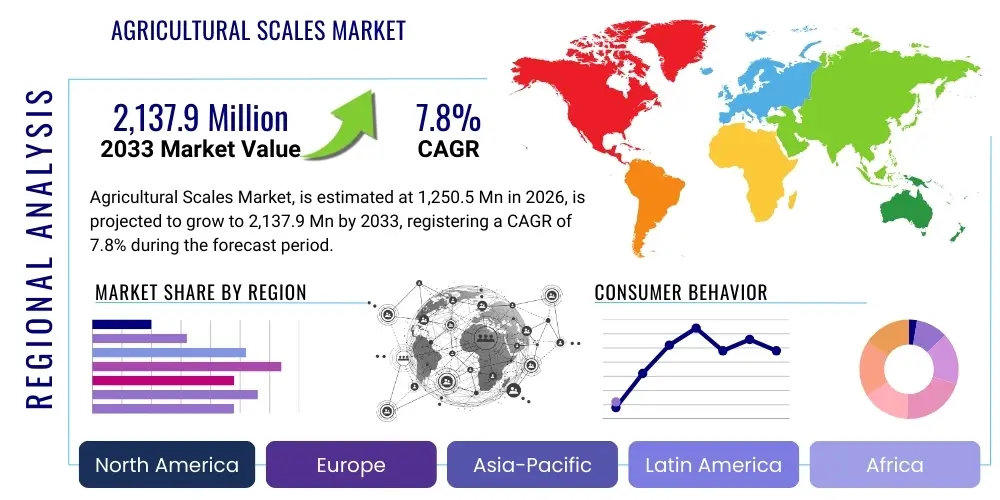

Agricultural Scales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442303 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Scales Market Size

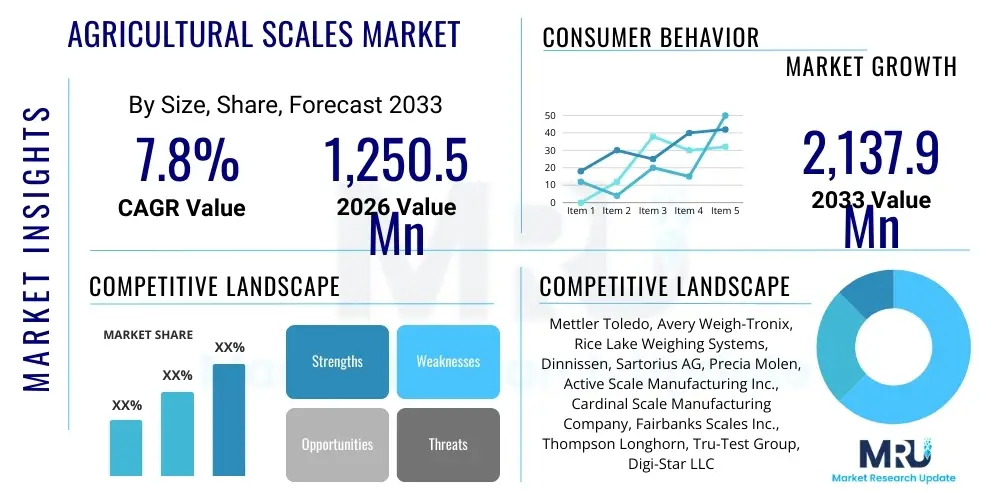

The Agricultural Scales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1,250.5 Million in 2026 and is projected to reach USD 2,137.9 Million by the end of the forecast period in 2033.

Agricultural Scales Market introduction

The Agricultural Scales Market encompasses the design, manufacturing, distribution, and utilization of weighing equipment specifically engineered for various farming and agribusiness applications. These devices are crucial instruments for precision agriculture, enabling farmers and agricultural entities to accurately measure commodities, livestock, feed, and equipment loads. The precision offered by modern agricultural scales is paramount for optimizing resource allocation, ensuring compliance with trade regulations, and maximizing profitability across the entire agricultural value chain. The product category spans a wide range of devices, from small bench scales used for chemical mixtures and seed counting to large truck scales utilized for quantifying harvested crops or managing livestock weight for optimal market timing.

Major applications of these scales include pre-harvest yield monitoring, post-harvest grain weighing, accurate dosage measurement for pesticides and fertilizers, and continuous tracking of livestock growth and health metrics. The integration of advanced digital technologies, such as IoT connectivity and cloud-based data analytics, is rapidly transforming traditional mechanical scales into sophisticated farm management tools. This technological shift allows for seamless data integration with existing farm management software, providing real-time insights into inventory levels, yield performance variability across fields, and animal welfare parameters, thereby enhancing operational efficiency significantly. Furthermore, the global drive towards sustainable farming practices necessitates precise measurement systems to minimize waste and ensure traceability of produce from farm to consumer.

The primary driving factors propelling the growth of this market include the increasing adoption of precision farming techniques globally, spurred by the need to feed a growing world population with limited resources. Governments and international organizations are promoting smart agriculture initiatives that rely heavily on accurate data acquisition, making advanced weighing systems indispensable. Additionally, stringent quality control standards and commercial requirements for accurate settlement in commodity trading, particularly for high-value crops and livestock, further solidify the demand for certified, high-accuracy agricultural scales. The robustness and durability of these scales are continuously improving, allowing them to withstand harsh agricultural environments, contributing to a longer service life and better return on investment for end-users.

Agricultural Scales Market Executive Summary

The Agricultural Scales Market is undergoing significant evolution, transitioning from basic mechanical devices to highly sophisticated, connected smart scales, fueled by the global adoption of precision agriculture methodologies. Business trends highlight a strong focus on merging hardware reliability with software intelligence, leading to the proliferation of IoT-enabled scales that offer real-time data synchronization, diagnostics, and predictive maintenance capabilities. Key industry players are aggressively investing in research and development to enhance scale accuracy under dynamic conditions, such as high moisture or temperature variability, and to develop solutions integrated directly into farm vehicles and machinery, such as grain cart scales and integrated feeding systems. Consolidation within the market is also observed, with larger manufacturers acquiring specialized technology providers to expand their service portfolios and regional footprint, particularly targeting emerging agricultural markets in Asia Pacific and Latin America where mechanization rates are accelerating.

Regionally, North America and Europe maintain leading market shares due to high rates of technology adoption, substantial governmental support for smart farming initiatives, and the presence of large, technologically advanced farming operations that require high-capacity, legally certified scales. However, the Asia Pacific region is anticipated to register the fastest growth rate, driven by the rapid modernization of agriculture in countries like India, China, and Southeast Asian nations. This growth is supported by increased commercial pressure on local farmers to improve efficiency and meet global export quality standards, leading to increased demand for robust, affordable digital weighing solutions. Investments in agricultural infrastructure, including improved roads and logistics networks, are also boosting demand for specialized vehicle and axle scales across developing regions.

Segment trends reveal that the Digital Scales segment, particularly those incorporating cloud connectivity (Smart/IoT Scales), is dominating the market due to their superior accuracy, ease of data integration, and labor-saving capabilities compared to traditional mechanical counterparts. Among applications, Livestock Weighing is experiencing robust growth, driven by advanced animal health monitoring systems and the optimization of feeding cycles, which directly impacts profitability. Furthermore, the demand for Truck and Axle Scales remains fundamentally strong, indispensable for large-scale crop producers and cooperatives managing high volumes of incoming feed and outgoing harvested commodities. The market is increasingly segmenting based on precision level and environmental ruggedness, catering specifically to either research-grade needs or heavy-duty commercial applications.

AI Impact Analysis on Agricultural Scales Market

Common user questions regarding AI's impact on agricultural scales frequently revolve around how artificial intelligence can move the equipment beyond simple measurement into proactive decision support systems. Users are keenly interested in the potential for AI algorithms to automatically detect anomalies during the weighing process, such as signs of disease in livestock based on weight fluctuations or inconsistencies in feed mixture weights, which could indicate equipment calibration issues or supply chain discrepancies. Furthermore, there is significant user interest in AI's role in optimizing predictive maintenance schedules for scales, minimizing downtime, and ensuring legal metrology compliance. The prevailing user expectation is that AI integration will transform static weight data into actionable, automated farm intelligence, allowing for dynamic adjustments in feeding, irrigation, and harvesting strategies without constant human intervention.

The integration of Artificial Intelligence (AI) into agricultural scales represents a pivotal shift, moving weighing systems from passive data collectors to intelligent decision-making tools. AI algorithms can process vast datasets generated by connected scales—including weight, time series data, environmental conditions, and GPS location—to derive sophisticated insights that are unattainable through traditional methods. For instance, in livestock management, AI can analyze weight gain patterns against feeding protocols, environmental factors, and genetics to predict optimal market readiness or diagnose early stages of illness, significantly improving herd management efficiency and reducing risks associated with delayed intervention. This capability is transformative, enabling proactive rather than reactive farming management.

Moreover, AI enhances the accuracy and operational reliability of the scales themselves. By continuously analyzing sensor readings and comparing them against known operational baselines, AI can identify drift or calibration issues well before they lead to inaccurate measurements, automatically triggering alerts or self-correction procedures where possible. For commodity weighing, machine learning models are being developed to instantly classify and grade crops based on weight density and consistency, streamlining post-harvest processing. This evolution towards intelligent weighing systems underscores the market's move toward complete automation and data-driven farming environments, where measurement precision directly translates into optimized business outcomes and enhanced compliance tracking.

- Enhanced Predictive Maintenance: AI analyzes usage patterns and sensor data to predict component failure, reducing scale downtime and maintenance costs.

- Automated Diagnostics: Algorithms automatically identify and compensate for environmental factors (e.g., wind, vibration) influencing measurement accuracy.

- Optimized Livestock Management: AI links individual animal weights over time to feeding schedules, predicting health issues and market timing.

- Yield Prediction and Optimization: Integration of scale data (harvested weight) with GIS and historical data to refine yield models and resource allocation for future seasons.

- Real-Time Compliance Verification: AI systems automatically generate required audit trails and certification documentation based on accurate weight data.

DRO & Impact Forces Of Agricultural Scales Market

The dynamics of the Agricultural Scales Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the overall Impact Forces within the industry. The primary driver is the accelerating global imperative for food security coupled with the necessity of maximizing yield per unit area, pushing farmers toward adopting precision agriculture technologies where accurate weight measurement is foundational. This trend is strongly supported by technological advancements, specifically the maturation of IoT and cloud computing, which make sophisticated, data-logging scales accessible and cost-effective. These factors create strong upward pressure on market growth, particularly in emerging economies modernizing their farming practices.

However, the market faces significant restraints. High initial investment costs associated with advanced smart weighing systems, especially large-capacity truck and livestock scales, remain a substantial barrier for small and mid-sized farms globally, particularly in regions with limited access to agricultural credit or subsidies. Furthermore, the rugged operational environment of agriculture—characterized by dirt, moisture, temperature extremes, and rough handling—poses ongoing challenges to the long-term reliability and calibration maintenance of electronic components, requiring manufacturers to continuously innovate robust sealing and protective technologies. A lack of standardized data protocols among different agricultural technology vendors also creates friction in integrating scale data into holistic farm management systems, slowing full adoption in certain segments.

Opportunities for market expansion are abundant, particularly through the development of specialized, affordable, and modular scale systems that cater to niche agricultural applications, such as drone-based payload weighing or highly accurate scales for vertical farming and hydroponics. The burgeoning legal and operational requirements for traceability in the food supply chain also present a massive opportunity, as scales capable of tagging and tracking weighted items from the field to the processing plant become mandatory tools. Moreover, offering comprehensive service contracts, including remote diagnostics and calibration services leveraging connectivity capabilities, allows manufacturers to capture recurring revenue streams and address the key restraint of maintenance complexity, thereby exerting a net positive impact force on the market trajectory.

Segmentation Analysis

The Agricultural Scales Market is comprehensively segmented based on Type, Technology, Application, and End-User, reflecting the diverse requirements of the global agricultural sector. Analyzing these segments provides a clear map of market demand pockets and technological preferences. The classification by Type, ranging from highly portable bench scales to heavy-duty vehicle scales, addresses the varying capacity and mobility needs of different farming operations, directly influencing purchasing decisions based on farm size and specialization. The Technology segmentation (Mechanical, Digital, Smart/IoT) highlights the ongoing transition towards digitally enabled systems capable of advanced data capture and integration, which are critical for precision agriculture initiatives and maximizing operational transparency.

Segmentation by Application is crucial, differentiating systems used for high-value activities such as livestock health management and yield optimization (grain weighing) versus fundamental logistical tasks (vehicle weighing). Growth is particularly robust in applications where immediate data insights yield significant economic benefits, such as optimizing feed-to-weight ratios in commercial livestock operations. Finally, the End-User segment differentiates between large commercial farms, cooperatives, research institutions, and smallholder farmers, each presenting unique demands regarding scale ruggedness, required accuracy standards, and affordability. This granular analysis is essential for market players to tailor product development, distribution strategies, and pricing models effectively.

- By Type:

- Bench Scales

- Floor Scales (Pallet Scales)

- Axle/Truck Scales (Weighbridges)

- Hopper Scales (Tank Scales)

- Livestock Scales (Cattle Scales, Hog Scales)

- Portable Scales (Suspended Scales)

- By Technology:

- Mechanical Scales

- Digital Scales

- Smart/IoT Scales (Connected Scales)

- By Application:

- Grain & Produce Weighing (Post-harvest)

- Livestock Weighing and Health Monitoring

- Feed & Ingredient Weighing and Batching

- Vehicle Weighing and Load Management

- Soil and Chemical Measurement

- By End-User:

- Large Commercial Farms

- Medium and Small Farms

- Agricultural Cooperatives

- Agribusinesses (Processors, Traders)

- Research Institutions and Laboratories

Value Chain Analysis For Agricultural Scales Market

The value chain for the Agricultural Scales Market begins with the upstream suppliers of raw materials and core electronic components, including high-grade steel and aluminum for structural integrity, advanced load cells (often strain gauge or hydraulic types), and sophisticated microprocessors and sensor technology for digital systems. Reliability of these upstream components is paramount, as the scales must maintain accuracy under continuous, heavy use in demanding environments. Manufacturers often establish long-term relationships with certified suppliers to ensure consistent component quality and traceability. Key activities in the upstream segment include material sourcing, precision machining, and the rigorous testing of load cells to meet required metrology standards, which are often country-specific.

The midstream segment involves the core manufacturing process, encompassing design, assembly, calibration, and final product integration, often including the development of proprietary software for data logging and connectivity in smart scales. Distribution channels form a critical part of the downstream segment, typically comprising a mix of direct sales teams focused on large agribusinesses and cooperatives, and indirect channels such as specialized agricultural equipment dealers, distributors, and integrators. Due to the requirement for installation and periodic calibration service, authorized service partners play a significant role in maintaining the product lifecycle, providing localized support, and ensuring regulatory compliance for the end-users. The choice of channel often depends on the scale type; large truck scales require direct sales and specialized installation, while portable livestock scales often utilize dealer networks.

The direct channel ensures manufacturers maintain tight control over brand representation and service quality, which is crucial for complex, high-value smart scales that require software integration. The indirect channel, through specialized farm equipment dealers, provides wider geographical reach and leverages existing relationships farmers have with their local suppliers. These dealers often bundle weighing systems with other essential farm machinery. Successful value chain management hinges on maintaining high-quality manufacturing standards (crucial for accurate measurement certification) and establishing efficient, technically capable downstream service networks to support calibration, maintenance, and software updates, ultimately maximizing the customer’s return on investment and ensuring long-term satisfaction.

Agricultural Scales Market Potential Customers

The potential customer base for agricultural scales is highly diverse, ranging from individual smallholder farmers needing basic portable scales for direct market sales to multinational agribusinesses demanding integrated, high-capacity weighbridges and automated feed batching systems. The primary end-users are large commercial farms specializing in staple crops (grain, corn, soybean) and high-value commodities (fruits, vegetables), who rely on truck scales and hopper scales for precise inventory management and commercial transaction settlement. These entities require legally certified scales that can handle high throughput and integrate seamlessly with Enterprise Resource Planning (ERP) systems, making data accuracy and reliability the top purchasing criteria. For grain producers, cooperative storage facilities (silos) and major commodity traders are also essential buyers, needing robust systems for bulk weighing and quality control.

Another rapidly growing customer segment comprises commercial livestock operations, including dairy farms, cattle ranches, hog confinements, and poultry producers. These buyers prioritize specialized livestock scales, often equipped with features for dynamic weighing, individual animal identification (RFID integration), and software for monitoring weight gain velocity. The investment in these smart scales is driven by the desire to optimize feed efficiency, identify sick animals early, and ensure animals meet target weights before transport, thereby maximizing auction value. Furthermore, agricultural research institutions, universities, and government agencies constitute a niche but important customer base, purchasing highly precise bench and platform scales for laboratory work, soil testing, and controlled experimental crop and feed studies where minute accuracy is non-negotiable.

Finally, the growing segment of agricultural technology integrators and equipment manufacturers represent indirect, yet crucial, customers who purchase scales or load cells for integration into their own equipment, such as grain carts, feed mixers, and specialized harvesting machinery. These manufacturers demand robust, embedded weighing solutions that can withstand the stresses of mobile operation. The key purchasing drivers for all customer segments are accuracy, durability (especially against environmental factors), compliance with trade regulations, and increasingly, the ability of the scale system to provide meaningful, actionable data for farm optimization, positioning the "smart" functionality as a critical deciding factor over basic weighing capability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250.5 Million |

| Market Forecast in 2033 | USD 2,137.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Avery Weigh-Tronix, Rice Lake Weighing Systems, Dinnissen, Sartorius AG, Precia Molen, Active Scale Manufacturing Inc., Cardinal Scale Manufacturing Company, Fairbanks Scales Inc., Thompson Longhorn, Tru-Test Group, Digi-Star LLC, Shekel Brainweigh Ltd., Essae-Teraoka Ltd., B-TEK Scales, A&D Company, Ohaus Corporation, Perten Instruments, J&R Scales, Salter Brecknell |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Scales Market Key Technology Landscape

The technological landscape of the Agricultural Scales Market is rapidly shifting towards smart, connected systems, moving beyond traditional mechanical levers and balances. The foundational technology remains the load cell, primarily strain gauge technology, which converts force (weight) into measurable electrical signals. However, advancements in digital signal processing (DSP) and high-resolution analog-to-digital converters (ADCs) have dramatically improved the accuracy and stability of these readings, minimizing environmental noise interference, which is crucial in dynamic agricultural settings. The key innovation focus is on developing robust, hermetically sealed load cells and indicators with high ingress protection (IP) ratings to withstand corrosive chemicals, water exposure, and extreme temperatures encountered on farms. Furthermore, wireless data transmission capabilities (Wi-Fi, Bluetooth, cellular) are now standard in high-end scales, enabling seamless integration with cloud platforms and mobile applications for remote monitoring and management.

A significant technological driver is the integration of Internet of Things (IoT) sensors and connectivity modules directly into the scale indicator, transforming it into a network endpoint. These Smart/IoT scales are designed not only to measure weight but also to communicate autonomously with other farm technologies, such as climate sensors, RFID readers for animal identification, and automated feeding machinery. This connectivity allows for sophisticated data analytics, enabling features like automated inventory tracking in silos, real-time comparison of feed consumption versus weight gain, and instantaneous alerts for discrepancies. Cloud-based software architecture is becoming essential, providing centralized data storage, regulatory compliance documentation, and predictive maintenance algorithms based on usage telemetry collected from the distributed scale network across the farm or cooperative. This centralization is key to maximizing efficiency for large-scale operations.

Emerging technologies, including advanced computational scales utilizing machine vision and Artificial Intelligence (AI), are starting to penetrate niche segments. For example, AI-driven weight analysis can differentiate between desired products and foreign materials during post-harvest sorting based on weight characteristics, or accurately estimate biomass in unconventional farming environments like vertical farms. The convergence of measurement precision, durable hardware, and intelligent software marks the future direction of the market. Manufacturers are also focusing on improving battery life and power management systems in portable and vehicle-mounted scales to ensure reliable operation in remote locations without consistent access to power infrastructure, optimizing the overall utility and user experience in diverse agricultural settings.

Regional Highlights

The global Agricultural Scales Market exhibits significant regional variation in terms of maturity, technological adoption, and growth trajectory. North America dominates the market in terms of technology penetration and market value, primarily driven by large-scale, commercial farming operations that have rapidly adopted precision agriculture techniques. The region benefits from substantial investments in farm automation and favorable government policies supporting the use of certified weighing equipment for both domestic commerce and international exports. The high capacity and integration requirements of large US and Canadian farms ensure sustained demand for high-end truck scales and sophisticated integrated feed systems, positioning the region as a leader in smart scale technology adoption.

Europe represents a mature market characterized by stringent regulations regarding animal welfare, food safety, and environmental impact, which mandate the use of highly accurate and traceable weighing systems. The European market sees strong demand for specialized livestock scales and integrated systems used in dairy and intensive crop management. Growth in this region is propelled by technological upgrades and the replacement cycle of older mechanical equipment with modern, connected digital scales, especially in Western European countries focused on sustainability and detailed record-keeping. Eastern Europe, while adopting digital solutions, shows sustained demand for cost-effective, durable mechanical scales due to ongoing agricultural modernization efforts.

Asia Pacific (APAC) is projected to be the fastest-growing market, primarily due to the rapid industrialization of agriculture in countries like China, India, and Australia. The sheer volume of agricultural output and the ongoing transition from subsistence farming to large-scale commercial agribusinesses necessitates the deployment of modern weighing technology to manage logistics, ensure quality control, and facilitate commodity trade. Government initiatives aimed at improving supply chain efficiency and farmer income through technology adoption are key catalysts. Latin America, particularly Brazil and Argentina, also shows robust growth, driven by massive grain and cattle operations that require heavy-duty weighing infrastructure (truck scales and large livestock systems) to handle substantial export volumes, emphasizing ruggedness and high capacity.

- North America: Market leader in smart scale adoption, driven by large commercial farms and high regulatory compliance standards for commodity trading, especially for grain and beef exports.

- Europe: High demand for specialized scales used in quality control and livestock welfare monitoring, supported by strict EU regulations on food traceability and animal husbandry practices.

- Asia Pacific (APAC): Highest expected growth rate, fueled by rapid agricultural modernization, increasing farm size, and government support for high-tech farming in China, India, and Southeast Asia.

- Latin America (LATAM): Strong focus on high-capacity truck and axle scales due to large-scale commodity production (soy, corn, cattle) and infrastructure investment needs for export logistics.

- Middle East & Africa (MEA): Emerging market with increasing demand for basic digital scales and livestock weighing solutions as countries invest in improving local food security and reducing post-harvest losses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Scales Market.- Mettler Toledo

- Avery Weigh-Tronix

- Rice Lake Weighing Systems

- Dinnissen

- Sartorius AG

- Precia Molen

- Active Scale Manufacturing Inc.

- Cardinal Scale Manufacturing Company

- Fairbanks Scales Inc.

- Thompson Longhorn

- Tru-Test Group

- Digi-Star LLC

- Shekel Brainweigh Ltd.

- Essae-Teraoka Ltd.

- B-TEK Scales

- A&D Company

- Ohaus Corporation

- Perten Instruments

- J&R Scales

- Salter Brecknell

Frequently Asked Questions

Analyze common user questions about the Agricultural Scales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of agricultural scales utilized in modern farming operations?

Modern farming utilizes several types of scales, primarily categorized by capacity and application. Key types include heavy-duty Truck/Axle Scales (for harvested crops and vehicles), Livestock Scales (for animal health and weight tracking), Hopper Scales (for measuring feed and ingredients), and portable Bench/Platform Scales (for small-batch inputs and research).

How is precision agriculture driving demand for smart agricultural scales?

Precision agriculture relies fundamentally on accurate data for resource optimization. Smart scales, equipped with IoT connectivity, provide real-time, precise weight measurements of yield, feed, and livestock, directly feeding into farm management software, enabling data-driven decisions regarding efficiency, input reduction, and profitability maximization.

What is the most significant technological trend impacting the Agricultural Scales Market?

The most significant trend is the integration of Smart/IoT technology. This shift moves scales beyond simple measurement devices into connected data hubs, allowing for remote diagnostics, automated data logging, cloud-based reporting, and integration with AI for predictive analytics, significantly reducing manual effort and improving compliance traceability.

What are the main challenges limiting the adoption of high-end agricultural scales?

The main challenges are the high initial capital investment required for certified, durable smart scales and the ongoing maintenance requirements due to the harsh environmental conditions on farms (moisture, dust, temperature variations). Additionally, ensuring the technical expertise for data integration and ongoing calibration can be a barrier for smaller farming operations.

Which geographical region exhibits the fastest growth potential in the market?

The Asia Pacific (APAC) region is projected to demonstrate the fastest market growth. This rapid expansion is attributed to the widespread agricultural modernization efforts in key countries like China and India, increasing commercialization of farming, and substantial governmental investments aimed at improving supply chain efficiency and reducing post-harvest losses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager