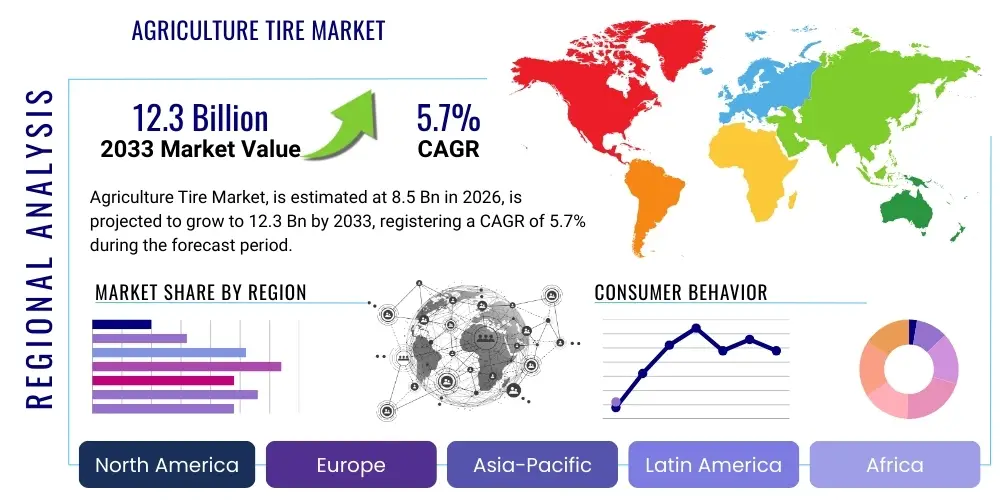

Agriculture Tire Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442886 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Agriculture Tire Market Size

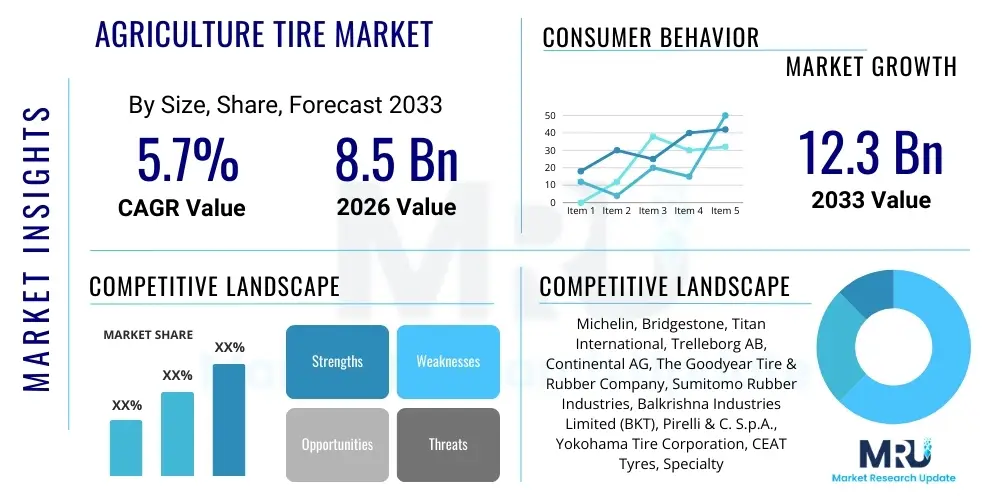

The Agriculture Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 8.5 billion in 2026 and is projected to reach USD 12.3 billion by the end of the forecast period in 2033.

Agriculture Tire Market introduction

The Agriculture Tire Market encompasses the global trade, manufacturing, and innovation associated with specialized traction and flotation devices designed for farm vehicles and complex agricultural machinery. These tires are fundamentally different from standard automotive tires due to their requirement to operate efficiently under extremely high loads, across varied and often challenging terrains, while simultaneously adhering to stringent performance standards regarding traction efficiency, minimal soil disturbance, and long-term durability. The product portfolio includes bias-ply tires, standard radial tires, and increasingly, advanced radial technologies such as Increased Flexion (IF) and Very High Flexion (VF) tires, which are engineered to carry greater weight at lower inflation pressures, a crucial feature for preserving soil structure and maximizing crop yields. Major applications span high-horsepower tractors, combine harvesters, self-propelled sprayers, and various implements, forming the backbone of mechanized global food production systems. The sustained demand for agricultural tires is inextricably linked to global population growth, which necessitates increased agricultural output, driving continuous investment in sophisticated, highly efficient farming equipment that demands corresponding premium tire solutions. Furthermore, governmental initiatives worldwide supporting farm modernization and the replacement of older, inefficient machinery contribute significantly to the underlying market momentum.

The core benefits delivered by modern agricultural tires extend beyond mere vehicular mobility, directly influencing operational economics and environmental outcomes on the farm. Optimized tire design, incorporating specialized tread bar geometry, flexible sidewall construction, and proprietary rubber compounds, ensures superior power transfer, minimizing wheel slippage and thereby achieving significant reductions in fuel consumption—a major operating cost for farmers. The primary technical benefit, however, lies in soil compaction mitigation. Excessive soil compaction impedes root growth, restricts water infiltration, and dramatically reduces crop yields. Advanced tire structures, particularly VF technology, distribute the vehicle load over a substantially wider footprint, reducing ground bearing pressure by often more than 25% compared to conventional tires. This preservation of soil health provides a compelling return on investment for farmers adopting premium tire solutions, despite the higher initial acquisition cost. Moreover, the enhanced durability and resistance to punctures characteristic of high-quality radial tires translate directly into maximized operational uptime during critical planting and harvesting seasons, bolstering the market appeal for robust, reliable components capable of sustained performance across intensive agricultural cycles and diverse global climate zones. Manufacturers are therefore concentrating substantial R&D expenditure on compound resilience and carcass integrity to meet these rigorous demands.

Driving factors propelling the expansion of the Agriculture Tire Market are multidimensional, rooted in macroeconomic trends and specific technological shifts. The global consolidation of farmlands into larger commercial operations means farmers are investing in larger, heavier, and higher-horsepower equipment, which intrinsically requires larger, more durable, and specialized tires capable of handling increased axle weights and speeds. Simultaneously, the accelerating adoption of precision agriculture techniques, including GPS-guided tractors and variable rate application systems, mandates tires with extremely consistent performance characteristics and the ability to integrate with vehicle telematics systems. Regulatory regimes, particularly in the European Union and North America, impose increasingly strict standards regarding environmental protection, including mandates to minimize agricultural runoff and soil degradation, directly boosting demand for low-pressure flotation and advanced IF/VF tires. These systemic factors are complemented by macroeconomic support, such as favorable credit policies and subsidies in emerging economies (e.g., India, Brazil) aimed at stimulating mechanization, which ensures that both the Original Equipment Manufacturer (OEM) segment and the high-volume replacement aftermarket segment continue to experience robust, long-term demand growth throughout the forecast period. This confluence of technological pull and regulatory push establishes a solid foundation for market expansion, favoring manufacturers capable of delivering technologically advanced and high-efficiency tire solutions.

Agriculture Tire Market Executive Summary

The Executive Summary for the Agriculture Tire Market underscores a profound shift towards high-technology solutions, driven by efficiency mandates and environmental stewardship. Business trends emphasize significant strategic investments by Tier 1 manufacturers in expanding their radial tire production capacities globally, notably focusing on the lucrative and rapidly growing Very High Flexion (VF) segment, which commands premium pricing due to its superior soil compaction characteristics. The market is becoming increasingly competitive, marked by aggressive pricing strategies from Asian manufacturers targeting the mid-range replacement segment, forcing established Western players to solidify their dominance in the high-performance OEM and premium aftermarket sectors. Crucially, the integration of smart technology—embedding sensors within tires to monitor pressure, temperature, and wear—is transitioning from a niche offering to a standard expectation, aligning the industry with the broader digital transformation occurring in precision agriculture. Companies are focused on securing long-term supply agreements with major agricultural machinery manufacturers (OEMs) to ensure consistent revenue streams and rapid deployment of innovative tire designs integrated with the latest tractor models, while simultaneously optimizing global logistics chains to mitigate the persistent volatility in natural rubber and petroleum-derived raw material costs, which heavily influence profitability margins across the industry.

Regional dynamics exhibit notable divergence in adoption maturity and growth rates. North America and Europe remain the primary consumers of high-specification, premium tires, necessitated by strict soil preservation regulations, large average farm sizes, and the necessity to achieve maximum operational efficiency due to high labor costs. The European market, specifically, showcases high demand for specialized tires used in niche applications like vineyard and forestry machinery, alongside robust regulatory support for tire retreading and recycling programs. In contrast, the Asia Pacific (APAC) region stands out as the engine of volumetric growth. Countries such as China, India, and Southeast Asian nations are undergoing rapid agricultural mechanization, translating into explosive demand for basic to mid-range radial tires, especially for low- to medium-horsepower tractors. This burgeoning APAC market presents a massive opportunity for volume sales, although it requires manufacturers to develop cost-competitive, highly durable products suited to diverse and often challenging operational environments. Latin America follows a similar growth trajectory, driven by expansion in large commodity crops like soybeans, pushing demand for heavy-duty flotation tires capable of handling substantial equipment weight in variable climatic conditions, thus confirming a globally segmented but universally growing demand profile.

Segmentation trends confirm the ascendancy of the radial tire structure, which now accounts for the majority of market value and is projected to capture increasing share across all horsepower categories, systematically replacing the dated bias-ply technology, although bias tires maintain relevance in extremely cost-sensitive or very small-scale applications. The replacement market segment, by volume, dominates the industry due to the inherent wear characteristics and multi-year lifecycle of tires on existing farm fleets. However, the Original Equipment Manufacturer (OEM) segment consistently demonstrates higher growth in value, reflecting the trend towards increasingly expensive, technologically complex, and larger-diameter tires fitted onto new-generation agricultural machines. Among application segments, the Tractor Tire category maintains its position as the largest revenue generator, fundamental to agricultural operations worldwide. The fastest growth, however, is observed in specialized tires for harvesters and self-propelled sprayers, as these machines carry immense loads, requiring the most advanced IF/VF solutions to prevent severe soil compaction and maximize payload efficiency. These segmental trends dictate strategic priorities, steering R&D towards maximizing performance features in premium tires while maintaining robust, cost-effective alternatives for high-volume emerging markets, balancing innovation with accessibility across the agricultural value chain.

AI Impact Analysis on Agriculture Tire Market

The common user discourse surrounding Artificial Intelligence (AI) integration in the Agriculture Tire Market centers on optimizing operational parameters, facilitating advanced maintenance, and enabling autonomous vehicle functionality. Users are keenly interested in how machine learning algorithms can interpret complex sensor data—ranging from internal tire pressure and temperature to external variables like soil moisture, texture, and vehicle speed—to provide instantaneous, prescriptive adjustments. The key themes summarized from user questions include the expectation of AI to significantly reduce the human error factor in setting optimal tire pressure, thus guaranteeing consistent soil preservation and fuel efficiency regardless of the operator's skill level. Users express concerns about the cost and complexity of implementing AI-enabled smart tire systems, inquiring about data security protocols and the necessity of seamless integration with existing heterogeneous farm management platforms. Furthermore, the role of AI in moving from scheduled maintenance to genuine predictive failure modeling—where AI anticipates a tire breach or structural failure days or weeks in advance based on accumulated usage anomalies—is a major focus, representing a tangible and high-value proposition for minimizing critical field downtime during crucial farming windows.

The practical application of AI technologies serves as a profound disruptive force within the agriculture tire sector, elevating the tire from a passive component to an active, intelligent node within the farm ecosystem. AI algorithms perform multi-variate analysis on telemetry streams generated by embedded tire sensors (measuring physical characteristics) combined with GPS and operational data (measuring context). For instance, an AI system can determine, based on soil resistance measurements and current vehicle load, that a tire pressure adjustment of 0.2 Bar is required to maintain the optimal footprint and traction for a specific plowing operation, initiating this change through an automatic central tire inflation system (CTIS) without human intervention. This optimization capability is crucial, as mismanaged tire pressure can lead to excessive slippage, consuming up to 30% more fuel and causing severe soil damage. Moreover, in the realm of predictive maintenance, machine learning models are trained on millions of miles of usage data, allowing them to identify subtle deviations in rolling resistance or temperature profiles that pre-empt catastrophic failure. This anticipatory capability drastically reduces operational risk and maintenance costs, justifying the investment in smart tire technology and solidifying the necessity for tire manufacturers to develop core competencies in data science and software development.

Looking forward, AI is fundamental to the industry's progression toward fully autonomous agricultural vehicles. Autonomous tractors and machinery rely on absolute data integrity and component reliability; AI ensures that the tire performance remains within strict tolerances required for safe, accurate, and efficient navigation and operation. The intelligence embedded in the tire, managed by AI, allows the vehicle's central control unit to make informed decisions regarding speed, traction control, and path planning, ensuring optimal ground interaction. Beyond operational efficiency, AI is deeply influencing the manufacturing and R&D processes. Generative design AI is utilized to simulate thousands of potential tire designs, optimizing tread geometry and compound mixtures for specific applications (e.g., highly abrasive soils, deep mud) much faster than traditional physical prototyping methods. This accelerates time-to-market for specialized products and enables manufacturers to respond rapidly to changing agricultural needs and regulatory pressures. The long-term implication is a market where the value of a tire is increasingly tied to the data and intelligence it provides, rather than solely its material composition, positioning AI as the central technology enabling the next generation of high-performance, precision-farming tire solutions globally.

- AI-driven real-time pressure adjustment minimizes soil compaction and optimizes traction under varying load conditions.

- Machine learning algorithms enable predictive maintenance, significantly reducing unexpected component failures and costly field downtime.

- Integration of embedded tire sensors (Smart Tires) facilitates seamless data exchange with centralized farm management systems and telematics platforms.

- AI simulation accelerates the R&D cycle for designing specialized tread patterns and advanced rubber compounds customized for specific soil mechanics.

- Optimization of fuel consumption is achieved through continuous analysis of operational efficiency metrics and reduction of wheel slippage.

- Enables essential performance verification and dynamic load management for fully autonomous agricultural vehicle platforms, ensuring high reliability.

- AI assists in dynamic load management calculations for complex harvesting machinery, balancing efficiency with soil pressure limits.

DRO & Impact Forces Of Agriculture Tire Market

The trajectory of the Agriculture Tire Market is powerfully dictated by a triad of fundamental forces: Drivers, Restraints, and Opportunities (DRO), which collectively form the critical Impact Forces guiding industry strategy and investment. The primary drivers are deeply rooted in global imperatives, notably the persistent need for enhanced global food security, which compels continual investment in agricultural mechanization and high-output machinery requiring robust, specialized tires. This need is amplified by the widespread adoption of technological advancements, particularly the shift toward radial, IF, and VF tire structures, which demonstrably improve farm efficiency and ROI. Regulatory pressure in developed nations focusing on ecological responsibility, specifically mandates to minimize soil compaction and prevent erosion, further institutionalizes the demand for premium, low ground-pressure tire technologies. These drivers create a compelling and non-negotiable demand pathway, ensuring continuous upgrade cycles and favoring manufacturers capable of technological innovation and adherence to escalating performance standards across diverse global farming landscapes, establishing a baseline for sustained market growth.

Despite the strong demand drivers, the market faces significant structural and economic restraints that modulate its pace of expansion. The foremost challenge remains the extreme volatility and generally upward trend in the price of key raw materials, including natural rubber, synthetic polymers derived from petrochemicals, and carbon black. Since raw material costs constitute a substantial portion of the total manufacturing cost, these fluctuations directly impact profit margins and necessitate frequent price adjustments, potentially deterring cost-sensitive small and medium farmers from upgrading to superior technologies. Furthermore, the high initial capital outlay required for advanced tire technologies (such as IF/VF radials) often poses a barrier to entry, particularly in developing markets where access to agricultural credit may be limited, leading to prolonged reliance on cheaper, less efficient bias-ply alternatives and slowing the overall adoption rate of premium products. The cyclical nature of agricultural commodity prices and unpredictable weather events introduces market uncertainty, influencing farmers' discretionary spending on replacement parts and creating seasonal demand troughs that complicate inventory and production planning for global manufacturers, requiring complex hedging strategies to manage financial exposure effectively.

Conversely, the market is replete with significant opportunities for strategic expansion and value creation. Geographically, the massive, ongoing mechanization of agriculture across Asia Pacific (APAC) and Latin America represents an unparalleled opportunity for volume market penetration, requiring customized product lines that balance performance and affordability. Technologically, the pervasive integration of the Internet of Things (IoT) and Artificial Intelligence (AI) through "Smart Tires" offers a profound opportunity to move beyond merely selling a physical product to providing recurring data services, creating high-margin revenue streams centered on operational intelligence and predictive maintenance consulting. Manufacturers can also capitalize on the growing global emphasis on sustainability by developing and aggressively marketing eco-friendly tires utilizing bio-based or recycled content, attracting environmentally conscious customers and securing preferential positioning in regulated markets. Strategic mergers, acquisitions, and partnerships with AgTech firms specializing in autonomous vehicles and farm management software are critical opportunities for securing future technological leadership and ensuring that tire innovation remains perfectly aligned with the evolving needs of advanced, data-driven farming practices, ultimately broadening the market's reach and profitability horizon.

Segmentation Analysis

Segmentation analysis of the Agriculture Tire Market is paramount for dissecting the complex matrix of supply and demand, allowing manufacturers and investors to target specific, high-growth niches effectively based on operational requirements and customer purchasing power. The market is fundamentally categorized by tire structure, vehicle application, and sales channel. The structural segmentation, differentiating between traditional Bias-ply tires and modern Radial tires (including the performance-enhancing IF and VF subcategories), highlights the industry's technological evolution, where radials dominate the value metrics due to their superior efficiency and soil-preservation capabilities. This delineation is critical for understanding regional maturity, as developed markets have nearly completed the transition to radial technologies, while emerging markets are currently driving explosive growth in radial adoption rates, albeit often in the mid-range performance bracket. This analysis guides R&D investment towards next-generation radial platforms, while maintaining optimized production for legacy bias products still required in smaller, cost-sensitive sectors globally.

Application-based segmentation reveals that tractors represent the foundational demand generator, covering a spectrum of requirements from small utility tractors to high-horsepower articulated models, dictating the largest share of market volume. However, the fastest market acceleration in terms of value is observed in the specialized segments of Harvesters/Combines and Self-Propelled Sprayers. These machines are inherently heavier and operate under more extreme loads, necessitating the most advanced, large-diameter VF and flotation tires to prevent excessive localized ground pressure, thereby commanding significantly higher average selling prices. This concentration of high-value demand in specialized equipment underscores the importance of close collaboration between tire manufacturers and leading machinery OEMs to ensure optimal performance matching. Understanding these application nuances allows manufacturers to prioritize capacity expansion in facilities capable of handling the large molds and sophisticated rubber compounds required for high-end specialized equipment tires, maximizing margin capture.

Distribution channel segmentation, separating Original Equipment Manufacturer (OEM) sales from the Aftermarket (Replacement) segment, highlights differing strategic priorities. The OEM channel is characterized by high volume, rigorous technical specifications, long lead times, and intense price competition, yet it provides crucial visibility and market validation for new technologies. Conversely, the Aftermarket segment, while lower in average volume per transaction, generates the majority of overall revenue and is highly influenced by branding, durability reputation, localized dealer networks, and service quality. Success in the Aftermarket requires robust inventory management, rapid supply chain response, and effective penetration into regional distribution centers to ensure immediate availability when tires fail. Geographically, the segmentation confirms that while North America and Europe lead in consumption of premium radial tires (Large Rim Size category), the Asia Pacific market dominates the small and medium rim size segments, reinforcing the necessity for a highly diversified and geographically tailored product and distribution strategy across the global market landscape.

- By Structure:

- Bias

- Radial (IF - Increased Flexion, VF - Very High Flexion)

- By Application/Vehicle Type:

- Tractors (2WD, 4WD)

- Harvesters/Combines

- Sprayers and Floaters

- Trailers and Implements

- Tillage Equipment

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement)

- By Diameter/Rim Size:

- Small (Under 28 Inches)

- Medium (28–38 Inches)

- Large (Above 38 Inches)

Value Chain Analysis For Agriculture Tire Market

The Value Chain for the Agriculture Tire Market initiates with the crucial upstream activities involving raw material procurement, a phase highly susceptible to global commodity market dynamics. Key raw inputs include natural rubber, the price of which is influenced by planting cycles and geopolitical factors in major producing regions (Southeast Asia); synthetic rubber and petrochemical derivatives; specialized carbon black for structural reinforcement; and high-tensile steel cords for radial tire belts. Manufacturing companies prioritize secure, diversified sourcing strategies and often vertically integrate or establish long-term contractual relationships to stabilize supply and mitigate cost volatility, which can severely impact margins. R&D activities are deeply integrated into this phase, focusing on material science innovations such as developing bio-based or synthetic alternatives to reduce reliance on volatile natural resources, while also optimizing rubber compounds for specific agricultural requirements like enhanced cut resistance, heat dissipation, and reduced rolling resistance, thereby building competitive advantage through superior material performance.

The core midstream phase involves manufacturing and logistics, where significant capital expenditure is required for highly automated production facilities capable of producing large, complex radial and IF/VF tires. This stage transforms raw inputs into finished products through compounding, calendering, assembly, and vulcanization (curing). Distribution channels diverge here, serving two distinct customer groups: the OEM segment and the Replacement segment. Sales to OEMs are typically direct and high-volume, characterized by rigorous quality audits, just-in-time delivery schedules, and co-development partnerships to ensure the tire perfectly complements the machinery. Conversely, the Aftermarket distribution relies heavily on indirect channels, utilizing expansive networks of national and regional wholesalers, specialized agricultural equipment dealerships, and independent service centers. Efficient management of this indirect channel is vital, demanding robust inventory systems to manage a vast array of specialized Stock Keeping Units (SKUs) and timely delivery to geographically dispersed agricultural regions, often requiring localized warehousing close to major farming hubs to minimize delivery times and capture replacement demand rapidly.

The downstream activities focus on market penetration, sales execution, and critical post-sale service delivery. For the end-user (the farmer), the value proposition extends beyond the physical tire to encompass expert technical support regarding optimal tire selection, load calculation, and precise inflation pressure management, often provided by specialized dealer networks. Given that incorrect pressure can negate the benefits of advanced tire technology, comprehensive technical guidance and training represent a crucial value-add that reinforces brand loyalty. Increasingly, the value chain incorporates the end-of-life management of tires, driven by environmental responsibility and regulatory compliance. Major manufacturers are investing in tire retreading operations—particularly for expensive, large casings—and promoting recycling programs, thereby offering a sustainable, cost-effective option for extending asset utility. This integrated approach, linking material science innovation upstream with sophisticated service and sustainability downstream, is essential for maintaining competitive parity and maximizing the total lifetime value proposition offered to the global agricultural customer base.

Agriculture Tire Market Potential Customers

The primary cohort of potential customers for the Agriculture Tire Market consists of large-scale commercial farming operations and multinational corporate farms, which represent the highest value segment of the replacement market. These professional agricultural entities operate fleets of high-horsepower, modern machinery (often exceeding 300 HP) and view tires as critical performance inputs rather than mere components. Their purchasing decisions are highly sophisticated, prioritizing advanced technologies like VF radials due to their proven capacity to minimize soil compaction, increase fuel efficiency, and enhance crop yield. These customers are guided by total cost of ownership (TCO) metrics, demanding stringent warranties, comprehensive technical support, and proven durability records. They frequently engage in direct relationships or use specialized agricultural cooperatives to procure high volumes, requiring manufacturers to maintain impeccable quality control and offer bespoke product solutions tailored to specific regional soil and climatic conditions, making them the most demanding yet rewarding segment for premium tire producers globally.

The second essential customer base is the Original Equipment Manufacturer (OEM) sector, encompassing global leaders in agricultural machinery manufacturing such as John Deere, CNH Industrial, AGCO Corporation, and Kubota. These companies represent the primary point of entry for tire technologies into the market, buying in extremely high volumes for factory installation on new tractors, combines, and sprayers. OEMs require long-term contractual security, adherence to exacting quality and safety standards, and often collaborate with tire partners on co-development initiatives to ensure tires are perfectly integrated with vehicle design, load distribution, and electronic control systems (e.g., CTIS integration). Securing these OEM contracts is paramount for tire manufacturers, as it establishes brand credibility, guarantees large-scale foundational sales, and ensures that the manufacturer remains at the technological forefront, aligning innovation cycles directly with the rapid advancements in agricultural vehicle engineering and design. The competitive pressure in this segment is intense, relying heavily on trust, logistics excellence, and cost-effectiveness at scale.

A third, rapidly expanding customer category includes independent agricultural contractors, equipment rental companies, and governmental agricultural departments. Contractors and rental firms utilize their machinery intensively across diverse geographical locations and client tasks, requiring highly versatile, robust, and durable tires that can withstand varied abuse and minimize maintenance-related downtime, making the replacement cycle frequent and necessity-driven. Their focus is overwhelmingly on product reliability and rapid availability of replacement stock to maximize fleet uptime and service delivery. Furthermore, government agencies, particularly those in emerging markets responsible for national food security or subsidized farm modernization projects, frequently issue large tenders for entry-level to mid-range tires required for national tractor distribution programs. These buyers prioritize cost-effectiveness and volume availability, often opening up opportunities for strong mid-tier and regional manufacturers. Targeting these diverse potential customers—from the sophisticated corporate farm demanding premium performance to government tenders focused on volume and value—necessitates a highly adaptable manufacturing and sales strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone, Titan International, Trelleborg AB, Continental AG, The Goodyear Tire & Rubber Company, Sumitomo Rubber Industries, Balkrishna Industries Limited (BKT), Pirelli & C. S.p.A., Yokohama Tire Corporation, CEAT Tyres, Specialty Tires of America, Mitas (Trelleborg Group), Zhongce Rubber Group Co., Ltd. (ZC Rubber), Shandong Linglong Tire Co., Ltd., Carlisle Companies Incorporated, J.K. Tyre & Industries Ltd., Apollo Tyres, Maxam Tire International, Triangle Tyre Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agriculture Tire Market Key Technology Landscape

The technological evolution defining the Agriculture Tire Market is centered on radical structural enhancements and pervasive digital integration, aiming to maximize output efficiency while minimizing environmental footprint. The cornerstone of current innovation is the widespread commercialization and adoption of Increased Flexion (IF) and Very High Flexion (VF) tire technology. These advanced radial constructions utilize specialized bead and sidewall compounds, allowing them to bear significantly greater loads—up to 40% more than a standard radial at the same inflation pressure—or carry standard loads at considerably reduced inflation pressures, sometimes by 40% less. This dual capability directly addresses the most pressing operational challenge: the increasing weight of modern agricultural machinery paired with the critical need to preserve soil health. VF technology ensures a substantially larger footprint, optimally distributing the load to mitigate subsoil compaction, thereby securing improved fuel economy through optimized traction and dramatically enhancing overall agricultural sustainability, positioning it as the technological imperative for high-horsepower equipment globally.

A second transformative technological domain is the integration of digital intelligence, resulting in the development of "Smart Tires" and associated operational systems. This technology involves embedding micro-electronic sensors, pressure transducers, and RFID tags directly into the tire structure during the manufacturing process. These sensors continuously monitor vital parameters such as internal pressure, temperature, and actual tread wear depth, transmitting this data wirelessly via telematics to the tractor's cabin display or cloud-based farm management platforms. This connectivity enables the deployment of Central Tire Inflation Systems (CTIS) controlled by sophisticated algorithms, allowing for dynamic pressure adjustments on the fly—increasing pressure for stable road travel and decreasing it instantaneously upon entering the field. This precise, real-time management, often facilitated by AI systems analyzing operational context, ensures that the tire consistently operates at its ideal specification for maximum traction and minimal compaction, eliminating the historical inefficiency associated with static or manually adjusted inflation levels and paving the way for fully data-driven precision farming operations.

Further innovation is being channeled into material science and manufacturing processes to enhance durability and environmental compliance. Advances in rubber compound formulations are producing materials with superior resistance to cutting, chipping, and heat degradation, extending service life in abrasive environments and high-speed road use. Simultaneously, manufacturers are employing advanced computer simulation techniques, such as Finite Element Analysis (FEA), to model the complex stresses on new tread designs and carcass architectures, significantly accelerating the research and development cycle. This permits rapid iteration of specialized tire patterns optimized for niche applications, such as flotation tires for wetland rice cultivation or narrow tires for high-speed row-cropping. The convergence of these technological streams—structural integrity via VF, digital intelligence via sensors and AI, and sustainable material innovation—establishes a technology landscape focused intensely on optimizing the tire's functional contribution to overall farm productivity and aligning with stringent global environmental regulatory requirements, marking a shift from mere mechanical provision to integrated, intelligent agricultural solution provision.

Regional Highlights

- North America: This mature market is characterized by enormous farm sizes, high capital investment in state-of-the-art machinery, and strict adherence to best practices for environmental management. North America is the primary consumer of premium, large-diameter radial tires, especially IF and VF technologies, driven by the necessity for operational speed and efficiency. The region exhibits high acceptance of integrated digital solutions, including CTIS and Smart Tires, positioning it as a leading innovation hub and strong market for advanced replacement cycles.

- Europe: Europe is defined by its maturity, ecological sensitivity, and regulatory complexity. Demand is highly fragmented, requiring specialized tire offerings for various agricultural niches, including stringent standards for narrow tires (row crops) and robust flotation tires. The EU’s focus on sustainability mandates the use of highly efficient, low-compaction tires and supports a strong retreading industry for large farm tires. Germany, France, and Italy are key demanding nations that emphasize quality, sustainability certifications, and long-term TCO.

- Asia Pacific (APAC): APAC is the global volume growth leader, experiencing rapid transition from subsistence farming to commercial mechanization, fueled by favorable government policies and increased corporate investment. While cost-sensitive, the market is quickly moving from bias-ply to radial tires, driven primarily by China and India. China also acts as a globally significant manufacturing hub, offering competitive alternatives across all tire categories, creating intense market rivalry and supply chain expansion opportunities across Southeast Asian nations undergoing rapid agricultural infrastructure upgrades.

- Latin America: Focused on large-scale commodity exports (soybeans, maize, sugar cane), this region requires extremely durable, heavy-duty tires capable of handling challenging soil conditions, high temperatures, and long transport distances. Brazil and Argentina are the major consumers, driving demand for robust radial and flotation tires suitable for vast land coverage. Market growth is closely tied to global commodity prices, but sustained agricultural expansion guarantees robust long-term demand for high-load capacity tire solutions.

- Middle East and Africa (MEA): This region offers substantial long-term potential, driven by government initiatives to enhance food security and diversify economies through large-scale, irrigated farming projects. The demand profile is currently skewed towards durable, mid-range, and heat-resistant tires suitable for harsh environments. Market penetration requires overcoming logistical challenges and establishing reliable distribution networks, but the foundational driver of rapidly increasing agricultural investment ensures this region remains a critical frontier for market growth over the next decade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agriculture Tire Market.- Michelin

- Bridgestone

- Titan International

- Trelleborg AB

- Continental AG

- The Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries

- Balkrishna Industries Limited (BKT)

- Pirelli & C. S.p.A.

- Yokohama Tire Corporation

- CEAT Tyres

- Specialty Tires of America

- Mitas (Trelleborg Group)

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Shandong Linglong Tire Co., Ltd.

- Carlisle Companies Incorporated

- J.K. Tyre & Industries Ltd.

- Apollo Tyres

- Maxam Tire International

- Triangle Tyre Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Agriculture Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of radial tires over bias tires in agriculture?

The primary driver is the superior performance of radial tires, particularly their ability to maintain a larger footprint and operate at lower pressures. This significantly reduces soil compaction, which is critical for maximizing crop yield, while also offering improved traction, fuel efficiency, and a longer service life compared to traditional bias-ply structures.

How do IF and VF technologies contribute to sustainable farming?

Increased Flexion (IF) and Very High Flexion (VF) technologies are essential for sustainable farming because they enable heavy agricultural machinery to minimize ground bearing pressure. By carrying the same load at lower inflation rates, they prevent subsoil damage and compaction, ensuring better soil aeration and water retention, thereby supporting overall environmental and yield sustainability.

Which geographical region is projected to exhibit the highest growth rate for agricultural tires?

The Asia Pacific (APAC) region, driven by extensive government-supported farm mechanization programs, especially in developing economies like China and India, is projected to experience the highest growth rate. This growth is fueled by the rapid expansion of mechanized fleets and the ongoing modernization of farming practices.

What role does Artificial Intelligence play in modern agriculture tire management?

AI facilitates "Smart Tire" capabilities by analyzing real-time data from embedded sensors regarding pressure, temperature, and wear. AI systems use this data to dynamically optimize inflation settings for precise field conditions, enabling predictive maintenance and significantly enhancing operational efficiency and tire longevity, particularly for autonomous equipment.

What are the main distribution channels utilized in the Agriculture Tire Market?

The market utilizes two main channels: the Original Equipment Manufacturer (OEM) channel, involving direct sales to machinery producers (e.g., John Deere, AGCO) for new vehicles, and the Aftermarket (Replacement) channel, which relies on a vast network of specialized agricultural dealers, distributors, and independent repair shops for replacing worn-out tires.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager