Air Suspension Seat Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443377 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Air Suspension Seat Market Size

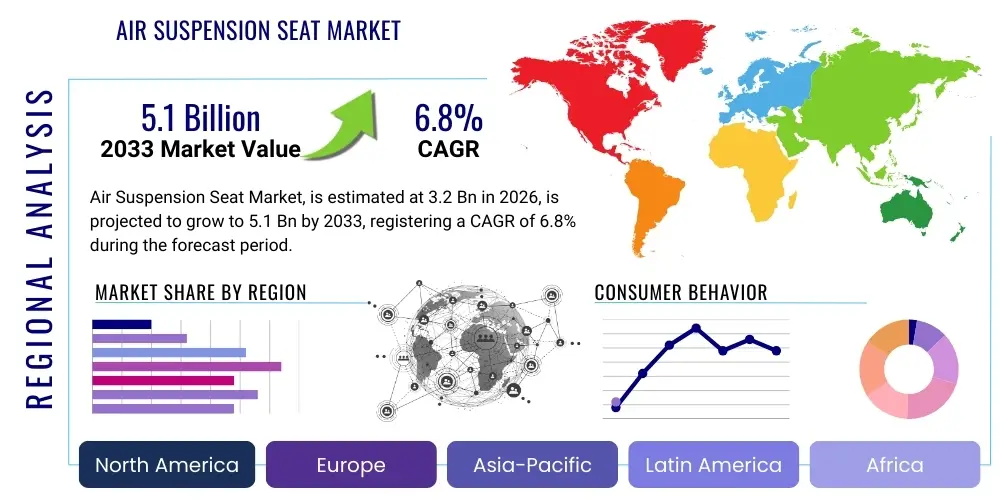

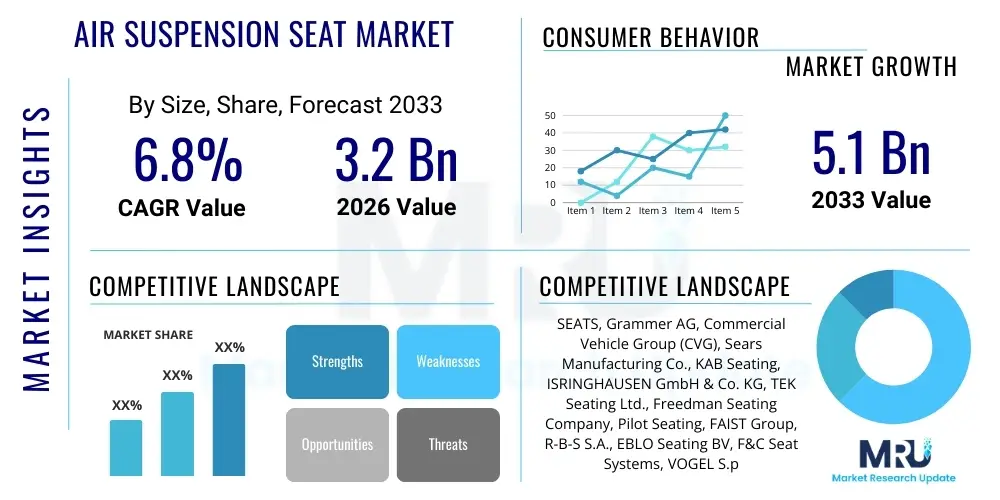

The Air Suspension Seat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.1 Billion by the end of the forecast period in 2033.

Air Suspension Seat Market introduction

The Air Suspension Seat Market encompasses seating systems primarily designed for heavy-duty vehicles, including trucks, buses, construction equipment, and agricultural machinery, that utilize compressed air technology to provide superior shock absorption and vibration isolation. Unlike traditional mechanical suspension seats, air suspension systems dynamically adjust to the occupant’s weight and the specific driving conditions, significantly enhancing ergonomic support and reducing driver fatigue. These seats are critical components in industries where operators spend long hours exposed to harsh vibrations, which can lead to musculoskeletal disorders and decrease productivity. The core mechanism involves an air bladder, a compressor, and a sophisticated valve system that maintains a constant seat height and damping characteristic, regardless of the road surface or load variation. Product innovation focuses heavily on integration with vehicle electronics for predictive suspension adjustments and improved material science for enhanced durability and comfort, aligning with stricter occupational health standards globally.

Major applications for air suspension seats span a wide range of mobility and industrial sectors. In the commercial vehicle segment, heavy-duty trucks and long-haul coaches represent a primary adoption area, driven by regulations requiring higher standards of driver welfare and reduced non-accidental injuries. Furthermore, the robust construction and mining industries rely heavily on these specialized seats to mitigate the extreme jarring and vibrations encountered in off-road environments, protecting operators of excavators, dozers, and dump trucks. The agricultural sector, including high-horsepower tractors and harvesters, is rapidly adopting air suspension technology to improve the comfort of farmers during extended operational periods in fields. The benefits derived from these seats are substantial, encompassing not only improved driver health and safety but also an increase in operational efficiency due to decreased downtime caused by driver discomfort or injury. This correlation between improved ergonomics and measurable productivity gains is a major factor driving demand across all major application sectors.

Key driving factors propelling the growth of the air suspension seat market include stringent governmental regulations in regions like North America and Europe concerning occupational safety and health standards for professional drivers and machine operators. These regulations often specify maximum allowable vibration exposure levels, which standard seats cannot meet, thereby necessitating the adoption of advanced air suspension systems. Additionally, the overall growth in the global heavy-duty trucking and construction equipment markets, particularly in emerging economies undergoing massive infrastructure development, fuels the demand for new vehicles equipped with these superior seating solutions. Technological advancements, such as the introduction of semi-active and fully active air suspension systems that incorporate electronic controls and sensors for real-time damping adjustments, are further enhancing the value proposition of these products, moving them from optional luxuries to essential components for vehicle manufacturers focused on premium and high-performance models.

Air Suspension Seat Market Executive Summary

The global Air Suspension Seat Market is exhibiting robust growth, fundamentally driven by escalating safety regulations for heavy vehicle operators and a pronounced industry focus on ergonomics and reducing occupational health risks associated with whole-body vibration. Business trends are characterized by fierce competition among established Tier 1 suppliers who are heavily investing in smart seating technologies, integrating features such as heating, cooling, massage functions, and telematics compatibility into their air suspension platforms. There is a discernible shift towards lightweight composite materials and modular designs to facilitate easier customization and installation across diverse vehicle platforms, addressing OEM demand for supply chain flexibility and reduced vehicle weight for fuel efficiency gains. Furthermore, strategic mergers and acquisitions, along alongside vertical integration, are common strategies employed by market leaders to consolidate market share and control key component supplies, particularly related to air compressors and electronic control units (ECUs). The aftermarket segment is also demonstrating strong vitality, driven by operators seeking to upgrade older vehicles with modern air suspension systems, recognizing the long-term cost benefits related to driver retention and reduced medical claims.

Regional trends indicate that North America and Europe currently dominate the market in terms of value, primarily due to established regulatory frameworks mandating stringent vibration control in professional transport and high rates of technological adoption among truck and equipment manufacturers. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by massive infrastructure projects in countries like China and India, leading to high-volume production of commercial and construction vehicles. Increasing awareness regarding driver health in APAC, alongside rising disposable incomes enabling fleet owners to invest in premium features, is rapidly elevating the demand curve in this region. Latin America and the Middle East & Africa (MEA) are emerging as critical markets, particularly as global heavy equipment manufacturers expand their assembly and distribution footprints in these territories. Localization of manufacturing, offering region-specific seat adjustments tailored to local operator demographics and environmental conditions, is becoming a key competitive strategy for vendors targeting these diverse geographical areas.

Segmentation trends highlight the increasing preference for fully automatic air suspension seats, which offer superior comfort and minimal manual input compared to semi-automatic variants, especially in long-haul applications. In terms of application, the Truck & Bus segment remains the largest revenue contributor globally, reflecting the sheer volume of commercial transportation activities worldwide. However, the Construction & Mining Equipment segment is projected to show accelerated growth due to the severe environmental stress and prolonged operating hours inherent in these applications, demanding the highest level of shock mitigation. The End-User analysis confirms that Original Equipment Manufacturers (OEMs) represent the dominant channel, as manufacturers increasingly integrate sophisticated seating systems directly into their vehicle assembly lines to differentiate their products and comply with baseline safety standards. Nevertheless, the Aftermarket segment is growing steadily, driven by fleet renewal cycles and the increasing longevity of heavy vehicles, necessitating replacement or upgrade of older mechanical seating systems with modern, air-cushioned alternatives to maintain operator satisfaction and compliance.

AI Impact Analysis on Air Suspension Seat Market

User queries regarding the impact of Artificial Intelligence (AI) on the Air Suspension Seat Market primarily revolve around four key themes: the potential for truly personalized and predictive comfort systems, the integration of AI for advanced diagnostics and maintenance, the role of machine learning (ML) in optimizing suspension performance based on real-time biomechanical data, and the application of AI in manufacturing processes. Users are specifically concerned about how AI can move beyond simple sensor-based adjustments to create truly active suspension seats that anticipate road conditions and driver fatigue before they impact comfort or safety. There is significant interest in systems that can learn individual driver preferences, adjust lumbar support and dampening settings proactively, and potentially offer warnings based on detected physiological stress markers. Furthermore, questions often focus on the efficiency gains AI can bring to manufacturing, particularly in automating quality control processes and optimizing material usage, thereby reducing costs and improving product reliability in these complex mechanical-electronic systems.

The integration of AI, specifically Machine Learning (ML) algorithms, will fundamentally transform air suspension seats from reactive devices into proactive, intelligent ergonomic platforms. Current systems use pressure sensors to react to weight and immediate vibrations; however, AI will enable predictive dampening. By analyzing data streams from vehicle telematics—including GPS, accelerometer readings (for road roughness mapping), and historical driver input—AI models can predict upcoming terrain changes and pre-adjust air pressure and damping coefficients milliseconds before the impact occurs, optimizing comfort seamlessly. This shift to predictive control significantly enhances vibration reduction effectiveness, extending the operational lifespan of the seat mechanism and components, while providing unparalleled levels of operator comfort, minimizing the physiological stress associated with sustained periods of driving heavy machinery.

Beyond dynamic performance, AI algorithms are crucial for developing advanced diagnostic capabilities within the seat system itself. By monitoring wear patterns on air bladders, compressors, and valve solenoids, ML models can identify subtle anomalies indicative of impending failure. This allows for predictive maintenance alerts, enabling fleet managers to schedule repairs before catastrophic failure occurs, thereby maximizing vehicle uptime and reducing costly emergency repairs. Furthermore, AI facilitates highly personalized user experience (UX) profiles. Using internal sensors that track posture, pressure distribution, and minor shifts in seating position over time, the AI can learn the optimal ergonomic settings for an individual operator under varying conditions, automatically adjusting features like lateral support, seat cushion firmness, and lumbar contours, essentially creating a 'smart' seat that continuously adapts to the occupant's biomechanical needs throughout the shift.

- AI enables Predictive Suspension Adjustment (PSA) by analyzing telematics data and road maps to pre-emptively adjust air pressure settings.

- Machine Learning optimizes real-time damping characteristics based on dynamic load variation and terrain profiling, enhancing overall vibration isolation.

- Advanced diagnostics and predictive maintenance are facilitated by AI monitoring component wear and anomaly detection in compressor and valve performance.

- Personalized Ergonomics (PE) driven by AI learns individual operator posture and comfort preferences for continuous, tailored seat contour adjustments.

- AI improves manufacturing efficiency through automated quality control checks of air bladder sealing and suspension functionality during assembly.

- Integration with driver monitoring systems allows AI to detect signs of fatigue or postural stress, triggering automatic adjustments or alerts.

DRO & Impact Forces Of Air Suspension Seat Market

The Air Suspension Seat Market is governed by a dynamic interplay of growth drivers, structural restraints, and emerging opportunities, all of which contribute to the overall impact forces shaping its trajectory. The primary growth drivers center around global governmental mandates prioritizing operator safety and ergonomics, particularly in the trucking and construction industries, leading to non-negotiable demand for high-performance vibration control solutions. Simultaneously, the market faces restraints, chiefly high initial capital costs associated with sophisticated air suspension mechanisms and the ongoing maintenance requirements of pneumatic components, which can deter smaller fleet operators from adopting the technology. However, the market is poised to capitalize on substantial opportunities stemming from the rapid expansion of electric and autonomous commercial vehicles, which require advanced seating to redefine cabin comfort and potentially integrate with vehicle control systems. These collective forces result in strong market expansion pressure, despite underlying economic sensitivities and technological barriers to entry.

Key drivers include the rigorous enforcement of ISO 2631 standards concerning whole-body vibration (WBV) exposure and the growing awareness among fleet managers regarding the long-term economic benefits derived from improved driver retention and reduced injury claims. The premium pricing and complexity of air suspension seats act as primary restraints; these systems require specialized servicing and are susceptible to failure in harsh, dusty environments if not maintained meticulously. Furthermore, the limited availability of high-quality, aftermarket parts in developing regions can hinder widespread adoption. Opportunities are abundant in the development of hybrid suspension systems that combine air technology with adaptive magnetorheological fluids, offering enhanced damping performance and lower power consumption. The shift towards lightweight materials, such as carbon fiber composites in seat frames, also presents an opportunity to increase fuel efficiency, appealing directly to OEM sustainability goals.

The impact forces influencing the market are multifaceted, combining regulatory push with technological pull. Regulatory compliance acts as an accelerating force, mandating adoption even in price-sensitive sectors. The rising cost of skilled labor and driver shortages globally push companies to invest in superior ergonomic environments to attract and retain talent, exerting positive market pressure. Conversely, economic downturns or fluctuating raw material costs (especially steel and plastics used in seat frames and compressors) can act as temporary deceleration forces, slowing down capital expenditure by fleet owners. Overall, the market impact is overwhelmingly positive, driven by the non-discretionary nature of safety requirements and continuous innovation in sensor technology and electronic control units (ECUs) that enhance the performance and reliability of the suspension systems, solidifying their position as necessary components in modern heavy-duty vehicles.

Segmentation Analysis

The Air Suspension Seat Market is segmented based on several critical dimensions, including the type of mechanism utilized, the specific vehicle application, and the end-user channel. The mechanism segmentation differentiates between simpler semi-automatic systems, which require some manual adjustment, and advanced fully automatic systems, which utilize electronic controls and sensors for continuous, real-time optimization of the suspension settings. Application segmentation provides insights into the highest demand sectors, ranging from heavy-duty commercial transport (trucks and buses) to specialized off-highway machinery (construction, mining, and agriculture), each presenting unique vibration challenges and load requirements. Analyzing the market through the End-User lens highlights the dynamic between Original Equipment Manufacturers (OEMs), who incorporate the seats during initial vehicle assembly, and the Aftermarket, which drives replacement and upgrade demand, offering distinct opportunities for pricing and distribution strategies.

- By Mechanism:

- Semi-automatic Air Suspension Seats

- Fully automatic Air Suspension Seats

- By Application:

- Truck & Bus

- Construction & Mining Equipment

- Agricultural Tractors and Machinery

- Forestry Equipment

- Specialty Vehicles (e.g., Military, Rail)

- By Component:

- Seat Structure and Frame

- Air Compressor and Air Tank

- Air Springs/Bellows

- Control Valves and ECUs

- Dampers and Shock Absorbers

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Value Chain Analysis For Air Suspension Seat Market

The value chain for the Air Suspension Seat Market is intricate, starting with complex upstream sourcing of highly specialized materials and components, moving through multi-stage manufacturing and assembly processes, and finally reaching the end-user via dual distribution channels. The upstream segment is critical and involves the sourcing of essential raw materials such as high-grade steel and aluminum for seat frames, specialized polymers and textiles for cushioning and covers, and precision-engineered pneumatic components like compressors, air bellows, and solenoid valves, often sourced from highly specialized electrical and pneumatic sub-suppliers. The cost and quality of these components significantly influence the final product price and performance. Maintaining robust supply chain relationships and implementing rigorous quality control at this stage is paramount, as the reliability of the air system hinges on the precision of these internal mechanical and electronic elements.

The core manufacturing and assembly stage involves the integration of the sourced components, including welding the frame, integrating the pneumatic and electronic control units (ECUs), mounting the air springs, and applying the finished upholstery. This midstream process requires specialized fabrication techniques and often utilizes advanced robotic assembly lines to ensure consistency and compliance with safety standards, such as crush resistance and airbag integration (where applicable). Downstream activities primarily focus on distribution and post-sale service. Distribution channels are bifurcated into direct sales to OEMs, which involve long-term supply agreements and just-in-time delivery models customized to the vehicle assembly schedule, and indirect sales through a vast network of authorized distributors, service centers, and specialized parts retailers that cater to the demanding aftermarket segment. Effective inventory management and rapid fulfillment capabilities are vital for serving the replacement market, particularly for mission-critical components like compressors and air springs.

The distribution channel strategy varies significantly between the OEM and aftermarket sectors. Direct distribution to OEMs requires significant scale, localized production facilities near major vehicle manufacturing hubs, and deep collaborative engineering support to ensure seamless integration of the seat into the vehicle chassis and electrical architecture. In contrast, the indirect distribution model for the aftermarket relies heavily on establishing strong partnerships with independent service operators and regional parts wholesalers. These distributors provide immediate availability of replacement seats and components, alongside necessary technical support and installation guidance for end-users seeking upgrades or repairs. Both channels require robust service networks; however, the aftermarket often relies more on standardized product offerings and competitive pricing, while the OEM channel focuses on custom specifications and high-volume efficiency.

Air Suspension Seat Market Potential Customers

The primary consumers and end-users of air suspension seats are organizations and individuals operating heavy-duty machinery and commercial vehicles where driver comfort, safety, and regulatory compliance are critical operational priorities. The largest volume of potential customers falls within the Original Equipment Manufacturer (OEM) category, specifically global manufacturers of Class 8 heavy trucks, transit buses, motor coaches, and producers of large agricultural tractors and high-payload construction equipment (e.g., Caterpillar, Volvo, Daimler, John Deere). These customers integrate the air suspension seats directly into their new vehicle models as a standard feature or a high-value upgrade, recognizing that superior seating is a core competitive differentiator that affects brand loyalty and perception of quality. OEMs require suppliers to meet stringent quality certifications, comply with complex integration protocols, and demonstrate high capacity for consistent, high-volume supply.

A second major segment comprises Fleet Operators, ranging from large logistics companies running thousands of long-haul trucks to regional public transit authorities and major mining corporations. These customers are driven by total cost of ownership (TCO) calculations, viewing air suspension seats not merely as comfort features but as investments that mitigate long-term costs associated with driver sick leave, injury compensation, and high attrition rates. For fleet operators, purchasing decisions involve assessing both initial acquisition cost and the reliability and serviceability of the seat for the aftermarket. They often purchase seats directly through authorized service centers for retrofitting existing vehicles or for replacement during scheduled maintenance cycles, prioritizing robust designs that can withstand continuous, heavy usage and require minimal specialized upkeep.

Finally, the market targets specialized niche end-users, including governmental and defense organizations for specialized military vehicles, railway operators for locomotive and passenger rail control cabs, and marine vessel operators for demanding offshore and commercial shipping applications. These specialized customers often require highly customized air suspension seats built to withstand extreme environmental conditions, comply with unique safety standards (e.g., fire resistance, shock load tolerance), and integrate advanced features like operator presence sensing or specialized restraint systems. While these segments represent lower volume compared to general commercial trucking, they offer opportunities for high-margin, specialized product development, requiring suppliers to engage in highly specific engineering collaborations tailored to unique operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEATS, Grammer AG, Commercial Vehicle Group (CVG), Sears Manufacturing Co., KAB Seating, ISRINGHAUSEN GmbH & Co. KG, TEK Seating Ltd., Freedman Seating Company, Pilot Seating, FAIST Group, R-B-S S.A., EBLO Seating BV, F&C Seat Systems, VOGEL S.p.A., United Group, Tiffin Seating, DUX DUCIS, Shanghai Beite Seat Manufacturing Co., Ltd., Shaanxi Fast Gear Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Suspension Seat Market Key Technology Landscape

The technological evolution within the air suspension seat market is moving rapidly towards sophisticated mechatronic systems, shifting away from purely pneumatic or mechanical designs. A crucial technological advancement is the widespread adoption of Electronic Control Units (ECUs) and sensor arrays, which enable "smart" seating capabilities. These ECUs process data from multiple sources, including acceleration sensors measuring vertical seat movement and pressure transducers monitoring the air spring dynamics, allowing for high-frequency adjustments. This integration facilitates semi-active or fully active suspension control, where damping is adjusted instantaneously based on the vehicle's dynamic state and road inputs, dramatically improving the seat's ability to isolate low-frequency, high-amplitude vibrations common in heavy equipment operations. Furthermore, sophisticated software modeling is now used during the design phase to predict the human body's response to various vibration profiles, optimizing the seat's geometry and component placement for maximum physiological benefit and fatigue reduction.

Material science innovation plays a pivotal role, particularly in reducing the overall weight of the seating system without compromising structural integrity or durability. Manufacturers are increasingly utilizing advanced composite materials, such as specialized fiberglass and carbon fiber reinforced polymers, for the seat frame and base structure. These materials not only reduce mass, contributing to better vehicle fuel efficiency and payload capacity, but also offer inherent vibration absorption characteristics superior to traditional steel. Concurrently, advancements in air spring technology involve the use of high-performance elastomers and multi-chamber bellows designs, providing a greater range of travel and finer tunability for customized comfort across different operator weights and heights. The development of miniaturized, energy-efficient air compressors is also central, ensuring fast inflation/deflation cycles and reduced power draw on the vehicle’s electrical system, which is especially critical in battery-electric vehicle applications.

Connectivity and integration technologies are defining the next generation of air suspension seats. Modern seats are being developed with standardized digital communication protocols (e.g., CAN bus integration) to seamlessly communicate with the vehicle's central telematics and control systems. This connectivity enables features such as memory functions for multiple drivers, integration with vehicle speed controls for automated height adjustments based on speed limits, and remote diagnostics access for fleet maintenance management. Moreover, novel sensor technologies are being implemented within the seating surface itself to measure pressure mapping and posture. This biomechanical data feeds into the control logic, allowing the seat to proactively make subtle adjustments to lumbar support and cushion tilt, effectively combating driver slouching and promoting healthier, less fatiguing seating positions over extended periods of operation, positioning the seat as an integrated health monitoring and ergonomic device.

Regional Highlights

The global distribution of the Air Suspension Seat Market showcases clear segmentation in terms of adoption maturity, regulatory influence, and growth potential, defining strategic imperatives for global suppliers. North America, anchored by the stringent Federal Motor Carrier Safety Administration (FMCSA) regulations and a highly industrialized heavy-duty trucking sector, represents a high-value, mature market characterized by early adoption of advanced features like active vibration cancellation and integrated climate control. The large demand for Class 8 trucks and high-horsepower agricultural machinery drives consistent OEM purchasing volumes, supported by a strong aftermarket segment focused on high-quality upgrades and parts replacement for aging fleets. Key market activity in this region revolves around technological partnerships between seat manufacturers and local truck OEMs to co-develop customized, digitally integrated seating platforms.

Europe, driven by strict European Union directives regarding driver health (e.g., EN ISO 2631 standards) and the high standards set by premium manufacturers (Daimler, Volvo Group, Scania), is another dominant market segment. European demand is characterized by a strong emphasis on sustainability and modular design, favoring lightweight, easily recyclable materials. The implementation of enhanced safety features, such as integrated seatbelt systems and driver proximity sensors, is nearly universal. Furthermore, Eastern European countries are experiencing rapid modernization of their commercial vehicle fleets, presenting high growth potential for air suspension seats as fleets replace older, mechanically suspended vehicles to meet updated cross-border transportation standards.

Asia Pacific (APAC) stands out as the highest-growth region, primarily fueled by massive infrastructural investments in countries like China, India, and Southeast Asian nations, leading to booming production and utilization of construction equipment and long-haul commercial vehicles. While pricing sensitivity remains a factor in certain segments, the increasing focus on fleet standardization, driven by large state-owned enterprises and global manufacturers establishing local assembly plants, is quickly elevating the demand for high-quality air suspension seats. Manufacturers in this region are strategically focusing on producing cost-effective, yet reliable, semi-automatic systems while simultaneously introducing advanced fully automatic models to cater to the premium segment of newly established international logistics and mining companies.

- North America: Dominant market share due to stringent safety regulations, large fleet size, and rapid adoption of digitally connected, active suspension systems.

- Europe: High demand driven by strict EU ergonomic standards and focus on sustainable, lightweight componentry; strong growth in Eastern European fleet modernization.

- Asia Pacific (APAC): Fastest growing region, propelled by infrastructure development, rising driver welfare awareness, and high-volume commercial vehicle production in China and India.

- Latin America: Emerging market driven by expansion in mining and resource extraction sectors, leading to increased demand for robust, heavy-duty seating in harsh environments.

- Middle East & Africa (MEA): Growth linked to oil and gas exploration, large-scale construction projects, and the need for durable seating systems capable of operating reliably in high heat and dusty conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Suspension Seat Market.- Grammer AG

- Commercial Vehicle Group (CVG)

- ISRINGHAUSEN GmbH & Co. KG

- Sears Manufacturing Co.

- KAB Seating

- SEATS

- TEK Seating Ltd.

- Freedman Seating Company

- Pilot Seating

- FAIST Group

- R-B-S S.A.

- EBLO Seating BV

- F&C Seat Systems

- VOGEL S.p.A.

- United Group

- Tiffin Seating

- DUX DUCIS

- Shanghai Beite Seat Manufacturing Co., Ltd.

- Shaanxi Fast Gear Co., Ltd.

- Hefei Yamei Mechanical & Electrical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Air Suspension Seat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Air Suspension Seats in commercial vehicles?

The primary driver is the stringent enforcement of occupational health and safety regulations (such as ISO 2631 standards) across major regions, which mandate minimizing whole-body vibration (WBV) exposure for professional operators to prevent musculoskeletal injuries and ensure driver retention and productivity.

How do fully automatic air suspension seats differ significantly from semi-automatic variants?

Fully automatic seats incorporate advanced Electronic Control Units (ECUs) and sensors to continuously monitor and adjust air pressure, damping, and height in real-time based on road conditions and vehicle dynamics, whereas semi-automatic systems typically require manual adjustment for weight and initial firmness settings.

What impact does the shift towards Electric Vehicles (EVs) have on the Air Suspension Seat Market?

The EV transition provides a significant opportunity, as quieter electric powertrains expose road noise and vibration more acutely, necessitating superior suspension seating. Furthermore, manufacturers are exploring integration opportunities between air suspension ECUs and EV battery management systems for enhanced energy efficiency and diagnostic capabilities.

Which geographical region is projected to experience the fastest growth rate in the market, and why?

The Asia Pacific (APAC) region, specifically China and India, is forecast to exhibit the fastest growth. This acceleration is driven by massive infrastructure development projects, leading to high-volume production of heavy equipment and commercial vehicles, coupled with increasing governmental focus on driver safety standards.

What are the main restraints hindering the broader adoption of air suspension seating technology?

The main restraints include the relatively high initial capital expenditure compared to mechanical seats, complexity of installation and integration, and higher maintenance requirements related to the air compressor unit, air bellows, and associated pneumatic components, which can be sensitive to moisture and particulate contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager