Airborne Weapon Delivery Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443353 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Airborne Weapon Delivery Systems Market Size

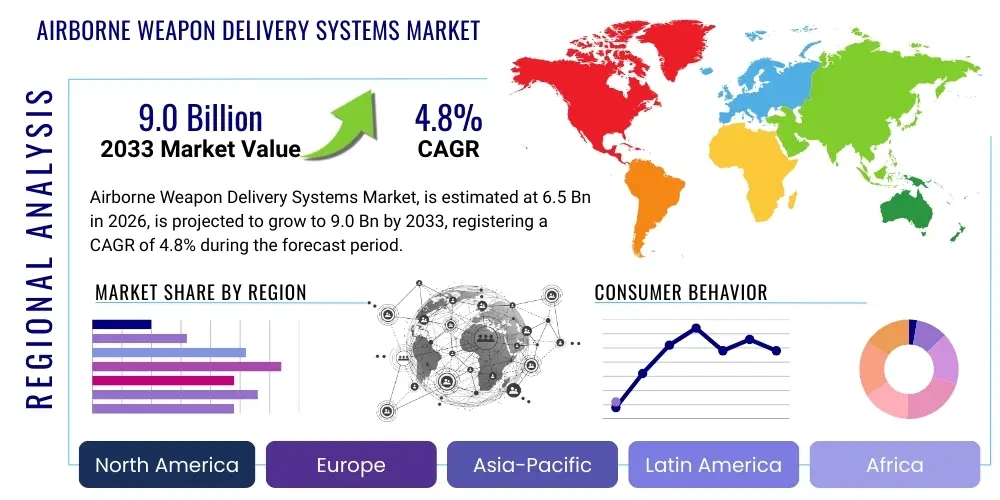

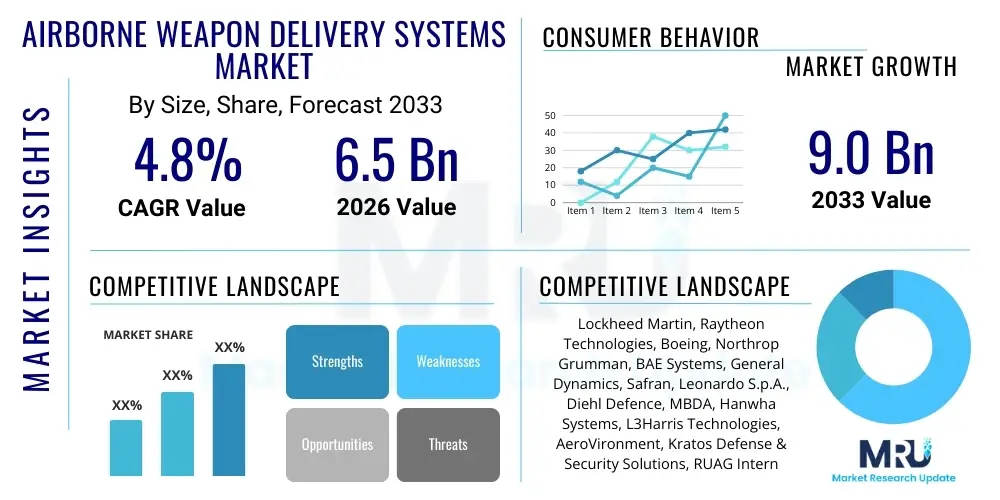

The Airborne Weapon Delivery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Airborne Weapon Delivery Systems Market introduction

The Airborne Weapon Delivery Systems Market encompasses the design, manufacturing, and integration of specialized mechanical, hydraulic, and electronic apparatus essential for safely carrying, arming, and releasing munitions from military aircraft. These critical systems, ranging from simple bomb racks and advanced missile launchers to complex ejector release units (ERUs) and pylons, are indispensable for modern aerial warfare capabilities. They ensure precise weapon synchronization with aircraft avionics, manage thermal and stress loads during high-speed maneuvers, and provide the necessary mechanisms for rapid and reliable weapon deployment across diverse operational environments. Modern systems prioritize interoperability, aiming to accommodate a wide spectrum of weapon types, including guided missiles, smart bombs, and hyper-velocity projectiles, thus enhancing mission flexibility and lethality.

Major applications of these systems span tactical fighter jets, strategic bombers, maritime patrol aircraft, and increasingly, Unmanned Aerial Vehicles (UAVs) utilized for strike missions. The core benefit derived from advanced airborne weapon delivery systems is the optimization of mission effectiveness, achieved through higher payload capacity, reduced weapon release latency, and superior reliability under extreme conditions. Furthermore, contemporary systems integrate sophisticated health monitoring and diagnostic capabilities, significantly reducing maintenance downtime and overall operational costs, contributing directly to higher aircraft availability rates in conflict zones or during readiness exercises. The shift toward networked warfare necessitates delivery systems capable of rapid digital communication and adaptation to real-time targeting updates.

Driving factors for market expansion are fundamentally rooted in global defense modernization initiatives, particularly the accelerated replacement of legacy delivery systems with smart, digital interfaces compliant with Universal Armament Interface (UAI) standards. Geopolitical tensions across key regions necessitate increased defense spending focused on enhancing air superiority capabilities. Technological advancements, such as the adoption of lightweight composite materials and advanced electro-mechanical actuation (EMA) systems replacing traditional hydraulics, contribute significantly to improved performance metrics like weight reduction and increased energy efficiency. The proliferation of stealth platforms also fuels demand for internal carriage systems and specialized conformal delivery mechanisms that minimize radar cross-section (RCS) signatures, driving innovation in structural and mechanical engineering within this sector.

Airborne Weapon Delivery Systems Market Executive Summary

The Airborne Weapon Delivery Systems market is characterized by robust growth driven by escalating global defense expenditure and a pivot toward smart weaponry integration. Current business trends indicate a strong emphasis on modularity and standardization, allowing defense forces to rapidly reconfigure aircraft for various mission profiles using standardized digital interfaces. Key manufacturers are investing heavily in research and development focused on electro-mechanical actuation systems (EMAs) to replace legacy hydraulic and pneumatic components, thereby improving system efficiency, reducing maintenance complexity, and lowering total cost of ownership. Mergers and acquisitions focusing on integrating specialized electronics and software expertise into traditional mechanical system providers are shaping the competitive landscape, pushing the market toward consolidated, high-technology offerings.

Regionally, North America remains the dominant market segment, fueled by massive procurement programs for advanced fighter aircraft (such as the F-35 program) and continuous upgrades to existing fleets. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily due to ambitious military modernization efforts in countries like China, India, and South Korea, coupled with territorial disputes necessitating enhanced aerial deterrence capabilities. Europe is also seeing steady demand, driven by collective defense commitments through NATO and the need to replace aging Cold War-era platforms with next-generation capabilities, placing significant importance on European collaborative defense projects and homegrown technological solutions.

Segment trends reveal that the Unmanned Aerial Vehicles (UAVs) platform segment is experiencing rapid expansion, as militaries worldwide integrate strike capabilities onto larger MALE (Medium-Altitude Long-Endurance) and HALE (High-Altitude Long-Endurance) drones, requiring specialized, lightweight, and digitally integrated delivery systems. Within system types, Ejector Release Units (ERUs) are dominating due to their versatility and critical role in both bomb and missile deployment, particularly the development of multi-store carriers (MSCs) capable of delivering multiple small smart munitions. Furthermore, the component segment is witnessing strong demand for advanced electronics and software that manage sophisticated sequencing, communication protocols, and real-time weapon status monitoring, reflecting the increasing digitization of the airborne battlefield.

AI Impact Analysis on Airborne Weapon Delivery Systems Market

User queries regarding AI's influence on Airborne Weapon Delivery Systems often center on autonomous targeting, predictive maintenance, and operational security. Key themes include how AI can enhance the precision and speed of weapon release sequencing, particularly in highly dynamic environments; the feasibility of utilizing machine learning algorithms for real-time fault detection and predictive health monitoring (PHM) of mechanical and electronic components; and the necessity of robust, certified AI software to manage complex, multi-weapon loadouts autonomously. Users are highly concerned about certification processes, ethical deployment frameworks, and maintaining human-in-the-loop control despite increased automation, reflecting a desire for augmented capability rather than complete autonomy in high-stakes scenarios. The expectation is that AI integration will primarily drive efficiency, reliability, and faster decision cycles regarding weapon selection and launch parameters.

- AI-driven Predictive Maintenance (PHM): Machine learning algorithms analyze sensor data from ERUs and pylons to anticipate mechanical wear, hydraulic failures, or electronic anomalies, significantly increasing mean time between failures (MTBF).

- Autonomous Weapon Release Sequencing: AI optimizes the sequence and timing of weapon launches based on flight dynamics, target maneuvering, and environmental conditions, maximizing hit probability and minimizing expenditure.

- Enhanced Target Recognition and Tracking: AI systems integrated with the fire control mechanism provide superior real-time target identification, enabling delivery systems to adjust alignment and launch parameters milliseconds before release.

- Loadout Optimization and Configuration Management: AI assists ground crews and pilots in recommending optimal weapon loadouts for specific mission parameters, factoring in weight distribution, fuel consumption, and tactical requirements.

- Digital Twin Simulation and Testing: AI powers high-fidelity digital twins of delivery systems, allowing rapid virtual testing of new weapon types or operational stress scenarios before physical prototyping.

DRO & Impact Forces Of Airborne Weapon Delivery Systems Market

The dynamics of the Airborne Weapon Delivery Systems market are shaped by compelling growth drivers, significant operational restraints, and substantial opportunities arising from technological evolution and shifting defense policies. Primary drivers include the global arms race stimulating comprehensive fleet modernization, particularly in Asia Pacific and the Middle East, requiring highly sophisticated, multi-platform compatible delivery mechanisms. The persistent threat of asymmetric warfare and the subsequent demand for highly precise, low-collateral-damage munitions necessitates corresponding upgrades in the delivery systems’ precision control and interface electronics. Furthermore, the push towards developing fifth and sixth-generation fighter aircraft mandates entirely new delivery system architectures, often focusing on internal bays and stealth compatibility, driving innovation across the supply chain.

Restraints primarily revolve around the stringent regulatory and certification requirements imposed by defense agencies, leading to protracted development cycles and high associated costs, especially for systems involving novel materials or complex software integration. Budgetary constraints in certain mature markets, despite high perceived threat levels, sometimes delay major upgrade programs or necessitate piecemeal replacements rather than comprehensive system overhauls. Technical complexities associated with integrating delivery systems across diverse fleets—including legacy platforms requiring digital retrofits—pose significant engineering challenges. The dependency on highly specialized, controlled supply chains for critical electronic and hydraulic components also introduces vulnerability and limits rapid scaling of production during heightened demand periods.

Opportunities are abundant, particularly in the rapid development and deployment of lightweight, Electro-Mechanical Actuation (EMA) systems, offering superior reliability and reduced lifecycle costs compared to traditional hydraulic systems. The expanding market for Unmanned Aerial Vehicles (UAVs) opens a new niche for ultra-lightweight, modular delivery systems optimized for drone payload constraints. Furthermore, the widespread adoption of the Universal Armament Interface (UAI) standard presents a lucrative opportunity for manufacturers who can provide standardized, plug-and-play digital interfaces that simplify weapon integration for end-users, reducing logistical burdens and improving tactical flexibility. The ongoing development of hypersonic weapons necessitates completely new thermal and structural management solutions within the delivery system framework, presenting a high-value technological frontier for specialized innovators.

Segmentation Analysis

The Airborne Weapon Delivery Systems market is systematically segmented based on various technical and application criteria to provide a clear understanding of market dynamics and specialized demand areas. Key segmentation factors include the type of aircraft platform utilized, the specific mechanism employed for weapon carriage and release, the component technologies involved, and the inherent range capabilities of the associated weapons. This structured breakdown highlights the disparity in technological requirements between high-performance tactical aircraft and heavy-lift strategic platforms, as well as the rapidly evolving needs of the unmanned systems sector. Understanding these segments is crucial for manufacturers to tailor their R&D investments toward areas exhibiting the highest growth potential, such as electro-mechanical systems and UAV-specific solutions.

The Platform segmentation, covering fixed-wing, rotary-wing, and UAVs, dictates constraints related to speed, vibration, and space, impacting design choices regarding aerodynamics and structural robustness. System Type segmentation (e.g., Bomb Racks, Missile Launchers, Ejector Release Units) defines the core function, where ERUs often represent the most technologically sophisticated segment due to their requirement for precise timing and multi-weapon adaptability. Component analysis focuses on hardware and software elements—Interface Units, Hydraulics, Mechanics, and Electronics—with the latter two exhibiting the fastest pace of technological innovation driven by digitization and lightweight material adoption. Finally, mechanism and range segmentation influence system robustness and thermal management requirements, especially as weapon speeds and masses increase globally.

- By Platform:

- Fixed-Wing Aircraft (Fighter Jets, Bombers, Transport)

- Rotary-Wing Aircraft (Attack Helicopters, Utility Helicopters)

- Unmanned Aerial Vehicles (UAVs) (MALE, HALE, UCAVs)

- By System Type:

- Bomb Racks and Adaptors

- Missile Launchers (Rail Launchers, Canister Launchers)

- Ejector Release Units (ERUs)

- Pylons and Adapters (Internal/External)

- By Component:

- Mechanical Structures and Mounts

- Hydraulic and Pneumatic Systems (Legacy)

- Electro-Mechanical Actuators (EMA)

- Electronics, Control Software, and Interface Units

- By Mechanism:

- Hydraulic Release

- Pneumatic Release

- Electro-Mechanical Release

- By Range:

- Short-Range (SRAAMs)

- Medium-Range (MRAAMs)

- Long-Range and Strategic Weapons

Value Chain Analysis For Airborne Weapon Delivery Systems Market

The value chain for Airborne Weapon Delivery Systems begins with upstream analysis, primarily dominated by specialized suppliers of high-grade raw materials, advanced composite structures, microprocessors, and proprietary hydraulic or electro-mechanical actuation components. This stage is highly regulated, requiring suppliers to adhere to strict aerospace and defense quality standards (e.g., AS9100). Key activities include the design and production of specialized microelectronics necessary for digital interfacing and the fabrication of lightweight, high-strength alloys or carbon fiber reinforced polymers used in pylon and rack construction. Successful upstream integration requires deep partnerships between material science companies and system integrators to ensure components meet rigorous performance specifications under extreme G-loads and temperature fluctuations.

The midstream segment involves the core activities of design, integration, and manufacturing, dominated by major defense prime contractors and specialized system houses. These entities consolidate components, develop proprietary control software, and perform complex system qualification and testing. Distribution channels are highly direct and controlled: sales are almost exclusively B2G (Business-to-Government), involving direct contracts with national Ministries of Defense (MoD) or through Foreign Military Sales (FMS) programs managed by exporting governments. Indirect sales are limited, typically involving authorized distributors or government-managed export agencies handling system spares, maintenance kits, and technology transfer agreements, particularly in offset contracts related to major aircraft sales.

Downstream analysis focuses on deployment, maintenance, and support. The end-users are military air forces and naval aviation units globally. Activities include system installation onto aircraft platforms, operational training, and long-term sustainment. Maintenance is critical, involving specialized repair depots and field service teams (often provided by the original equipment manufacturer, OEM) that ensure the continued functional integrity and safety of the release mechanisms. The lifecycle support phase, including software updates (especially for UAI-compliant systems) and hardware obsolescence management, generates significant long-term revenue for OEMs, emphasizing the importance of robust product support services in winning initial platform contracts.

Airborne Weapon Delivery Systems Market Potential Customers

The primary end-users and buyers of Airborne Weapon Delivery Systems are governmental military and defense organizations worldwide, specifically air forces, naval aviation commands, and, increasingly, specialized homeland security or border patrol units that operate armed surveillance platforms. The procurement process is heavily centralized and controlled, driven by national defense budgets, geopolitical threat assessments, and the modernization cycles of fighter, bomber, and helicopter fleets. Major programs involving the acquisition or upgrade of high-performance aircraft like the F-35, Rafale, Typhoon, or various domestic Chinese and Russian platforms represent the most substantial opportunities for large-scale system sales and integration contracts globally. Strategic buyers often prioritize interoperability, seeking systems certified to carry multinational weapon inventories (e.g., NATO standards compliant).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, Raytheon Technologies, Boeing, Northrop Grumman, BAE Systems, General Dynamics, Safran, Leonardo S.p.A., Diehl Defence, MBDA, Hanwha Systems, L3Harris Technologies, AeroVironment, Kratos Defense & Security Solutions, RUAG International, Rafael Advanced Defense Systems, Cobham Mission Systems, Curtiss-Wright Corporation, Moog Inc., Marotta Controls. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airborne Weapon Delivery Systems Market Key Technology Landscape

The technology landscape of the Airborne Weapon Delivery Systems market is rapidly transitioning from traditional hydro-mechanical mechanisms to highly integrated, digital, and electro-mechanical solutions. A primary technological driver is the maturation and adoption of Electro-Mechanical Actuation (EMA) systems, which replace heavier, more maintenance-intensive hydraulic components with electrically powered linear and rotary actuators. EMA systems offer precise digital control over the release sequence, improved energy efficiency, and greatly simplified installation and maintenance procedures, directly contributing to reduced aircraft downtime and operational costs. Furthermore, EMA technology is essential for enhancing reliability in the demanding operational envelope of modern fighter aircraft and integrating seamlessly with fly-by-wire and integrated vehicle health management systems (IVHMS).

A second critical area is the implementation of advanced materials science, specifically the use of high-strength, lightweight composite materials (e.g., carbon fiber composites, advanced titanium alloys) in the construction of pylons and missile rails. These materials are crucial for achieving stealth compatibility by reducing the radar cross-section (RCS) of external carriage systems and simultaneously maximizing the weapon payload capacity while minimizing structural weight penalties. The integration of advanced sensor technology, including fiber optic sensors and highly accurate micro-electromechanical systems (MEMS), allows for continuous monitoring of physical parameters such such as structural integrity, temperature, and vibration, feeding into the aircraft’s predictive maintenance systems and enhancing operational safety.

Finally, the standardization of digital interfaces, most notably the implementation of the Universal Armament Interface (UAI) standard (MIL-STD-1760 and derived specifications), is revolutionizing weapon integration. UAI ensures that a new weapon can be quickly and safely integrated onto any certified platform with minimal software and hardware modification, drastically reducing the time and cost traditionally associated with weapon integration programs. This digital backbone facilitates complex communication between the weapon, the delivery system (ERU/pylon), and the aircraft's fire control system, enabling sophisticated features like dynamic targeting updates and complex multi-carriage release sequencing managed by high-speed processing electronics within the delivery unit itself.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the extensive U.S. defense budget and massive, ongoing aircraft procurement programs such as the F-35 Lightning II. The region is a global leader in sophisticated technology, focusing heavily on stealth-compatible internal delivery systems and next-generation EMA technology. High R&D investment ensures continuous technological superiority and standardization across new platforms, maintaining North America's position as the primary hub for system design and manufacturing.

- Europe: Europe is a mature market exhibiting moderate, steady growth. Demand is fueled by major multinational defense collaborations (e.g., Eurofighter Typhoon, Dassault Rafale) and NATO collective defense requirements. Key focus areas include upgrades to existing platforms, integration of European-developed missiles (e.g., MBDA systems), and a strategic emphasis on maintaining an independent industrial base through specialized companies like BAE Systems and Leonardo, often prioritizing robust, tested systems over cutting-edge but unproven technologies.

- Asia Pacific (APAC): APAC represents the fastest-growing market segment globally, driven by escalating geopolitical tensions, particularly in the South China Sea and along the Indian border regions. Countries like China, India, Japan, and South Korea are rapidly modernizing their air fleets, leading to high demand for both licensed foreign systems and domestically developed sophisticated delivery mechanisms, particularly for advanced fighter aircraft and strike-capable UAVs.

- Middle East and Africa (MEA): This region is characterized by high defense spending fueled by oil wealth and regional conflicts. Demand is heavily dependent on imports of U.S. and European platforms and weapons (FMS), leading to substantial requirements for certified, high-performance weapon delivery systems suitable for arid and hot operational environments. The market growth here is volatile but consistently high for advanced, export-controlled technology.

- Latin America: Latin America is the smallest regional market, focusing primarily on maintenance, repair, and overhaul (MRO) of existing legacy platforms and limited procurement of new, often second-hand, tactical aircraft. Growth is constrained by fluctuating defense budgets, prioritizing cost-effective system upgrades and life extension programs rather than major investments in advanced, new-generation weapon delivery architectures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airborne Weapon Delivery Systems Market.- Lockheed Martin Corporation

- Raytheon Technologies Corporation (now RTX Corporation)

- The Boeing Company

- Northrop Grumman Corporation

- BAE Systems plc

- General Dynamics Corporation

- Safran S.A.

- Leonardo S.p.A.

- Diehl Defence GmbH & Co. KG

- MBDA Missile Systems

- Hanwha Systems Co., Ltd.

- L3Harris Technologies, Inc.

- AeroVironment, Inc.

- Kratos Defense & Security Solutions, Inc.

- RUAG International

- Rafael Advanced Defense Systems Ltd.

- Cobham Mission Systems (now part of Eaton)

- Curtiss-Wright Corporation

- Moog Inc.

- Marotta Controls, Inc.

Frequently Asked Questions

Analyze common user questions about the Airborne Weapon Delivery Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological shift occurring in airborne weapon delivery systems?

The primary technological shift involves replacing complex, heavy hydraulic and pneumatic systems with sophisticated, lightweight Electro-Mechanical Actuation (EMA) systems, which offer superior digital control, energy efficiency, and reduced maintenance requirements. This shift supports the integration of advanced smart weapons.

How is the Universal Armament Interface (UAI) standard impacting the market?

UAI (MIL-STD-1760 derivatives) standardizes the digital and electrical interface between the aircraft and the weapon delivery system. This standardization accelerates the integration process for new munitions and reduces long-term software modification costs, driving modularity and platform interoperability.

Which platform segment is expected to show the highest growth rate?

The Unmanned Aerial Vehicles (UAVs) segment is projected to exhibit the highest growth rate due to the global expansion of military strike drone fleets (MALE and HALE) requiring specialized, ultra-lightweight, and digitally integrated weapon carriage and release mechanisms.

What are the key challenges facing manufacturers of delivery systems for stealth aircraft?

Challenges include engineering internal weapon bay launchers and rotary systems that maintain a minimal radar cross-section (RCS), managing high thermal loads generated during high-speed flight, and ensuring rapid, reliable weapon sequencing from confined internal spaces.

How does predictive maintenance (PHM) utilize AI in these systems?

Predictive Health Monitoring (PHM) systems utilize AI and machine learning to continuously analyze data from sensors embedded in the ERUs and pylons. This analysis forecasts potential mechanical or electronic failures before they occur, optimizing scheduled maintenance and maximizing operational readiness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager