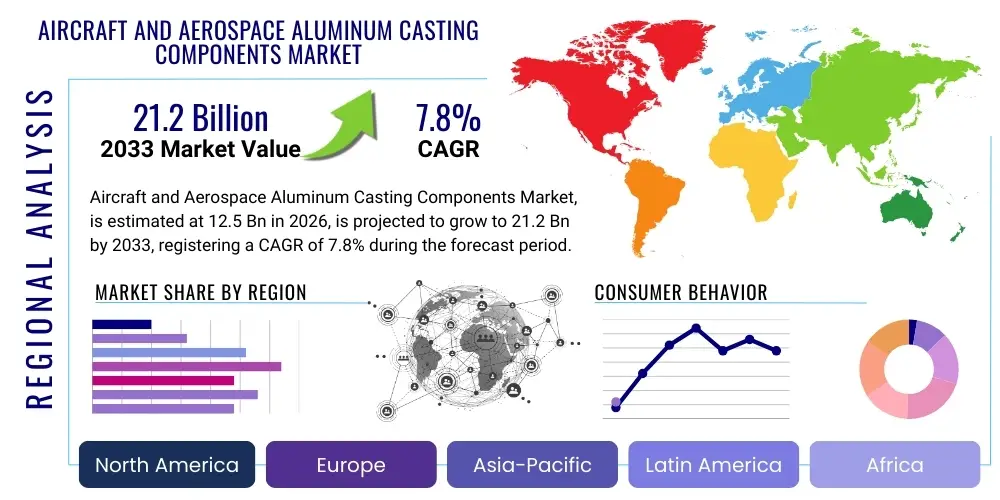

Aircraft and Aerospace Aluminum Casting Components Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442160 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Aircraft and Aerospace Aluminum Casting Components Market Size

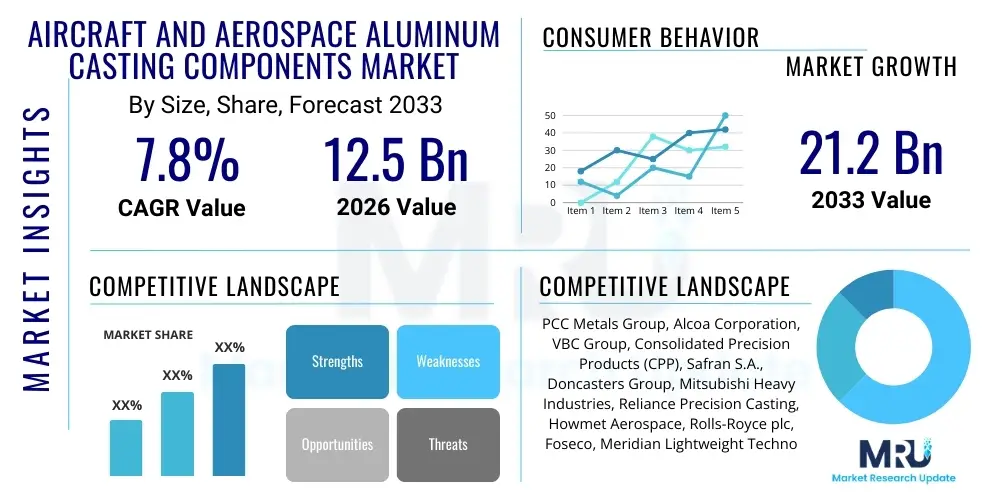

The Aircraft and Aerospace Aluminum Casting Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 21.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for lightweight, fuel-efficient aircraft across commercial, military, and general aviation sectors. Aluminum castings are essential for minimizing overall aircraft weight while maintaining the structural integrity and thermal resistance required in high-stress environments.

The transition toward next-generation aircraft programs, such as narrow-body replacements and increased production rates for established models, significantly fuels the market. Aerospace manufacturers consistently seek components that adhere to stringent quality and performance specifications, making advanced aluminum casting techniques—such as investment casting and permanent mold casting—critical enablers. Furthermore, the rising adoption of specialized aluminum alloys, optimized for fatigue resistance and high-temperature operation in engine parts and airframe structures, solidifies the market's trajectory through 2033, benefiting component suppliers who invest in automation and quality control certifications.

Aircraft and Aerospace Aluminum Casting Components Market introduction

The Aircraft and Aerospace Aluminum Casting Components Market encompasses the manufacturing and supply of complex metallic parts derived from aluminum alloys using various casting processes tailored specifically for aviation applications. These components are fundamental to nearly every major system within an aircraft, including engine housings, gearboxes, control surfaces, brackets, structural fittings, and interior parts. Aluminum's inherent properties—low density, excellent strength-to-weight ratio, and corrosion resistance—make it indispensable in aerospace engineering, where minimizing weight is paramount for enhancing fuel efficiency and maximizing payload capacity. The high standards of regulatory compliance (such as AS9100 and NADCAP) dictate the specialized production techniques employed in this market, ensuring components meet the rigorous demands of safety-critical applications.

Major applications of aluminum cast components span commercial airliners (A320neo, 737 MAX, regional jets), military aircraft (fighters, cargo planes, helicopters), space vehicles, and general aviation craft. Benefits derived from using these components include substantial weight reduction compared to steel or titanium alternatives, superior heat dissipation properties crucial for engine components, and the ability to produce near-net-shape complex geometries, thereby minimizing machining costs and material waste. Driving factors for market growth include accelerating global passenger traffic leading to higher aircraft production schedules, the imperative for fleet modernization prioritizing fuel-efficient designs, and continuous innovation in casting alloys and process automation (e.g., additive manufacturing integration into mold production) that allows for the creation of stronger, lighter, and more durable components suitable for high-performance aerospace systems.

Aircraft and Aerospace Aluminum Casting Components Market Executive Summary

The Aircraft and Aerospace Aluminum Casting Components Market is characterized by intense focus on precision, quality assurance, and supply chain resilience. Current business trends indicate a strong move towards long-term supply agreements between tier-one component suppliers and major OEMs, driven by the need for predictable capacity planning amidst fluctuating production ramps. Investment in advanced manufacturing techniques, specifically automated quality inspection using CT scanning and robotic fettling, is standard practice among leading market players to maintain zero-defect standards required for flight safety. Furthermore, sustainability initiatives are influencing material choices, with increased emphasis on using recycled aluminum alloys that still meet strict aerospace specifications, offering an advantage to suppliers prioritizing eco-friendly manufacturing footprints while optimizing material costs.

Regionally, North America remains the dominant market segment, fueled by the presence of major aerospace prime contractors (Boeing, Lockheed Martin) and a well-established supply chain of specialized foundries. However, the Asia Pacific region is demonstrating the highest growth trajectory, propelled by increasing defense spending, rapid expansion of commercial aviation fleets, particularly in China and India, and corresponding government investments in establishing localized MRO (Maintenance, Repair, and Overhaul) capabilities. Segment-wise, the Engine Components category leads the market due to the high stress and thermal requirements necessitating complex, high-precision cast aluminum parts. Investment Casting continues to be the fastest-growing process segment, valued for its ability to produce highly intricate shapes with excellent surface finish and tight dimensional tolerances, crucial for modern aerospace designs demanding optimized aerodynamic and structural performance.

AI Impact Analysis on Aircraft and Aerospace Aluminum Casting Components Market

User inquiries regarding AI's impact on the Aircraft and Aerospace Aluminum Casting Components Market frequently revolve around three core themes: enhancing quality control, optimizing complex design parameters, and predicting equipment failure or maintenance needs within the foundry process. Users are highly interested in how machine learning algorithms can analyze vast datasets from X-rays, ultrasonic testing, and geometric scans to automatically identify micro-defects invisible to human inspectors, thereby significantly reducing scrap rates and ensuring AS9100 compliance. Expectations are high that AI will streamline the highly complex gating and runner system design in investment and sand casting, minimizing porosity and shrinkage defects through predictive modeling and simulation. Furthermore, manufacturers are exploring AI-driven scheduling and predictive maintenance for expensive casting equipment (furnaces, die casting machines) to maximize uptime and operational efficiency in a high-volume production environment.

AI's role is rapidly transitioning from a theoretical tool to a practical necessity for competitive differentiation in this highly regulated industry. By leveraging deep learning models, suppliers can achieve higher consistency and repeatability in their casting processes, which is essential when dealing with safety-critical components. The integration of digital twins, powered by AI, allows foundries to simulate thousands of casting scenarios before physical production, fine-tuning variables like mold temperature, pouring speed, and cooling rates, thereby accelerating the qualification timeline for new components. This shift ensures that the stringent dimensional accuracy and metallurgical standards required by aerospace OEMs are met consistently, positioning AI as a critical enabler for scaling production efficiently while maintaining zero-defect tolerances.

- AI-driven automated defect detection (radiography, CT scans) improving quality assurance protocols.

- Machine learning optimization of casting simulations (mold flow, solidification modeling) reducing design iterations.

- Predictive maintenance scheduling for high-cost casting equipment minimizing unplanned downtime.

- Generative design using AI to create topologically optimized component geometries that reduce material usage.

- Real-time process monitoring and control using sensor data and neural networks to ensure metallurgical consistency.

DRO & Impact Forces Of Aircraft and Aerospace Aluminum Casting Components Market

The market dynamics are governed by a complex interplay of internal and external forces, collectively summarized as Drivers, Restraints, and Opportunities. A primary driver is the pervasive industry trend toward lighter aircraft structures, necessitating high-performance aluminum alloys and precision casting techniques to achieve significant weight savings essential for meeting stringent global carbon emission reduction targets and lowering operational costs associated with fuel consumption. This driver is amplified by robust order backlogs from major commercial aircraft manufacturers (e.g., Airbus and Boeing), demanding increased output and reliability from the entire component supply chain. Furthermore, escalating geopolitical tensions and continuous modernization programs within military aviation globally ensure a stable demand floor, particularly for specialized, high-integrity aluminum castings used in defense platforms where performance under extreme conditions is non-negotiable.

However, significant restraints temper this growth trajectory. The most pronounced restraint is the extremely rigorous regulatory environment, requiring lengthy and costly qualification cycles (e.g., FAA, EASA certifications) for new materials, processes, and component designs, which delays time-to-market. Additionally, the industry faces persistent supply chain volatility, including fluctuating raw material (aluminum ingot) prices and shortages of highly skilled labor specializing in advanced casting and non-destructive testing (NDT) techniques. The high capital expenditure required for automated casting machinery, especially for investment and permanent mold casting processes, acts as a barrier to entry for smaller firms, concentrating market power among established, financially robust suppliers capable of sustained investment in technology and compliance infrastructure.

Opportunities for expansion are abundant, particularly in embracing cutting-edge manufacturing technologies. The integration of 3D printing (Additive Manufacturing) for creating complex sand molds and cores offers an opportunity to produce geometries previously deemed impossible or too expensive using traditional methods, opening new design possibilities for optimized aerospace components. Another major opportunity lies in expanding MRO service offerings globally, especially as aging aircraft fleets require specialized cast replacement parts tailored for legacy platforms. Finally, the shift toward electric and hybrid-electric aircraft propulsion systems presents a novel demand stream for highly specialized, lightweight aluminum castings optimized for thermal management within battery housing and electric motor assemblies, requiring suppliers to rapidly develop alloys suitable for novel thermal cycling environments.

Segmentation Analysis

The Aircraft and Aerospace Aluminum Casting Components market is strategically segmented based on crucial factors including Casting Process, Component Type, End-User, and geographical region, offering granular insights into specific market dynamics and growth pockets. Understanding these segmentations is vital for suppliers to tailor their manufacturing capabilities and market penetration strategies. The segmentation by Casting Process distinguishes between highly precise methods like investment casting and permanent mold casting, which command premium pricing due to superior dimensional accuracy and surface finish, and more cost-effective methods like sand casting and die casting, used predominantly for less critical, larger structural parts or high-volume non-critical components.

Component Type segmentation highlights the criticality of different aircraft systems. Engine components, encompassing parts like turbine housings, compressor components, and gearbox casings, constitute the largest and most value-intensive segment, demanding the highest quality specifications due to extreme operating conditions (high temperature and stress). In contrast, airframe components, such as brackets, structural ribs, and wing fittings, prioritize weight reduction and fatigue resistance. End-User segmentation separates demand derived from commercial aircraft manufacturing, which is volume-driven, from defense and military aviation, which is specification-driven and focused on bespoke, high-performance applications, and the fast-growing general aviation sector which often requires more flexible production runs.

- By Casting Process:

- Investment Casting (Lost Wax)

- Permanent Mold Casting (Gravity Die Casting)

- Sand Casting

- Die Casting (High Pressure and Low Pressure)

- By Component Type:

- Engine Components (e.g., Housings, Gearboxes)

- Airframe Components (e.g., Brackets, Ribs, Fittings)

- Landing Gear Components

- Interior Components

- By End-User:

- Commercial Aviation

- Military Aviation

- General Aviation

- Space and Satellite

- By Application:

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

Value Chain Analysis For Aircraft and Aerospace Aluminum Casting Components Market

The value chain for aerospace aluminum casting components is highly specialized, beginning with upstream activities focused on raw material procurement and alloy formulation. Upstream suppliers are typically primary aluminum producers or secondary recyclers, providing high-purity aluminum ingots and specialized master alloys (e.g., silicon, copper, magnesium). Critical elements in this stage involve strict material traceability and compliance with aerospace-specific metallurgical standards (e.g., A356, A357). Suppliers often partner closely with foundries to develop proprietary or optimized alloy compositions that meet demanding performance criteria, such as enhanced ductility or high-temperature creep resistance, necessary for modern engine components.

The core manufacturing stage involves the foundries, which are responsible for mold design, pouring, solidification, and initial non-destructive testing (NDT). This is where value is added through precision engineering, utilizing techniques like investment casting for complex engine parts or permanent mold casting for higher volume structural components. Midstream activities also include extensive heat treatment (T6 treatment) to achieve required mechanical properties and subsequent machining operations to meet final dimensional tolerances. Distribution channels are predominantly direct, involving Tier 1 suppliers shipping finished, certified components directly to the major aerospace Original Equipment Manufacturers (OEMs) like Boeing, Airbus, or engine makers like GE Aviation and Rolls-Royce. Indirect distribution is minimal but occasionally involves specialized distributors or MRO providers managing spare parts logistics for global fleets.

Downstream activities center on the integration of these certified components into final aircraft assembly lines and subsequent lifecycle support, including maintenance and repair operations (MRO). The long service life of aircraft means that the demand for replacement cast parts continues decades after the initial aircraft delivery, creating a resilient aftermarket revenue stream for component manufacturers. Successful downstream strategy relies heavily on maintaining rigorous quality documentation and certifications throughout the component lifecycle, ensuring compliance with airworthiness directives and maintaining long-term supplier relationships built on trust and demonstrated reliability, given the safety-critical nature of the final application.

Aircraft and Aerospace Aluminum Casting Components Market Potential Customers

The primary customers and end-users of aircraft and aerospace aluminum casting components are the major global aerospace Original Equipment Manufacturers (OEMs), who constitute the bulk of initial equipment demand. These include commercial aircraft giants such as The Boeing Company and Airbus SE, military aircraft producers like Lockheed Martin and Northrop Grumman, and major engine manufacturers such as GE Aviation, Pratt & Whitney, and Rolls-Royce. These entities require components in high volumes, demanding adherence to extremely strict quality standards (AS9100) and often requiring suppliers to be NADCAP certified for processes like heat treating and NDT. Long-term contracts with these OEMs are highly sought after as they ensure stable revenue streams and necessitate substantial investment in dedicated production capacity and quality infrastructure by the casting suppliers.

Secondary but crucial customer segments include Tier 1 system integrators and specialized maintenance, repair, and overhaul (MRO) organizations. Tier 1 integrators, who supply complete systems like landing gear, actuators, or auxiliary power units to the OEMs, frequently source customized cast components. MRO providers, whether independent or airline-affiliated, represent the aftermarket demand, requiring replacement parts for aircraft undergoing heavy maintenance checks. This segment often demands quicker turnaround times and precise reverse-engineering capabilities for older, out-of-production parts, posing unique logistical and technical challenges. Furthermore, emerging manufacturers in the Urban Air Mobility (UAM) and drone sectors are rapidly becoming viable customers, seeking lightweight aluminum castings optimized for electric propulsion and complex structural requirements in novel air vehicle architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PCC Metals Group, Alcoa Corporation, VBC Group, Consolidated Precision Products (CPP), Safran S.A., Doncasters Group, Mitsubishi Heavy Industries, Reliance Precision Casting, Howmet Aerospace, Rolls-Royce plc, Foseco, Meridian Lightweight Technologies, HITCO Carbon Composites, Ametek Inc., Precision Castparts Corp., Spirit AeroSystems, Shaanxi Aerospace Power, Arconic, Metalwerks Aerospace, Firth Rixson. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft and Aerospace Aluminum Casting Components Market Key Technology Landscape

The technology landscape governing the Aircraft and Aerospace Aluminum Casting Components Market is centered around achieving metallurgical purity, dimensional precision, and optimizing component performance under extreme operational loads. Advanced casting processes represent a core technological area, with ongoing refinements in investment casting techniques to handle larger and more intricate geometries while minimizing wall thickness variations. Vacuum-assisted melting and pouring systems are increasingly standard, particularly for high-integrity components, to reduce gas porosity and inclusion defects, thereby maximizing the ultimate fatigue life and structural integrity of the final part. Suppliers are heavily investing in specialized heat treatment equipment, implementing highly controlled processes and quenching methods to ensure the exact temper and mechanical properties (e.g., T6 condition) mandated by aerospace specifications are consistently achieved across all production batches, a process critical for maintaining predictable structural reliability throughout the component's operational lifespan.

Automation and digitalization are rapidly transforming the traditional foundry environment. Key technological advancements include the widespread adoption of real-time monitoring systems that utilize sensors to track variables such as molten metal temperature, mold filling dynamics, and cooling rates, integrating this data into process control feedback loops. Furthermore, Non-Destructive Testing (NDT) technologies have become exponentially more sophisticated; advanced digital radiography, industrial Computed Tomography (CT) scanning, and sophisticated ultrasonic inspection systems are now mandatory tools for verifying internal integrity and dimensional accuracy without causing damage. These digital verification methods are essential for achieving the zero-defect tolerance required for safety-critical components, providing comprehensive, traceable digital records that satisfy stringent regulatory audit requirements and dramatically accelerating the final component certification process compared to manual inspection techniques.

Materials science innovation plays a pivotal role, with continuous research focused on developing next-generation aluminum alloys suitable for higher temperature operations and enhanced corrosion resistance, particularly relevant for engine and hot section components. Suppliers are collaborating with research institutions to leverage novel alloy compositions, often incorporating scandium or lithium, which offer superior strength-to-weight ratios and improved metallurgical properties compared to traditional aerospace alloys like A356. Complementing material advancement is the growing synergy with Additive Manufacturing (AM). While AM is not typically used for mass-producing large aluminum castings, it is proving invaluable for rapid prototyping complex mold cores and tooling inserts, significantly compressing the development cycle for new casting designs and allowing for quick iteration on complex internal cooling channels or optimized stress distribution features before committing to expensive, long-lead production tooling, ensuring the final cast component is optimized for performance.

Regional Highlights

North America currently dominates the global Aircraft and Aerospace Aluminum Casting Components Market, primarily due to the established operational bases of major aerospace and defense primes such as Boeing, Lockheed Martin, and Bombardier. The region benefits from substantial government investment in military modernization programs and a mature, highly specialized casting supply chain equipped with advanced NADCAP-certified facilities. The strong emphasis on domestic content regulations within defense contracts further ensures robust internal demand, driving continuous technological investment in precision casting technologies and quality control systems within the United States and Canada. This regional stronghold is supported by a significant MRO infrastructure that generates continuous demand for replacement cast components for large existing fleets.

Europe represents the second-largest market, anchored by the presence of Airbus, Safran, and Rolls-Royce, alongside a dense network of high-technology Tier 1 and Tier 2 suppliers, particularly in countries like the United Kingdom, France, and Germany. The focus here is heavily concentrated on sophisticated investment casting for engine and high-stress structural parts, driven by flagship European aerospace programs (e.g., Eurofighter Typhoon and A350 programs). European suppliers excel in implementing highly automated production lines and rigorous quality management systems mandated by EASA, making the region a global benchmark for high-integrity aerospace manufacturing and contributing significantly to innovation in advanced aluminum alloy development tailored for severe operating environments.

The Asia Pacific (APAC) region is projected to register the fastest growth rate over the forecast period. This accelerated growth is attributed to massive fleet expansion in rapidly developing economies such as China and India, driven by surging domestic and international passenger traffic. Furthermore, increasing defense budgets and regional ambitions to develop indigenous aircraft manufacturing capabilities (e.g., COMAC in China) are stimulating substantial investment in localized casting facilities. While the APAC supply chain is still maturing compared to Western counterparts, the region is rapidly adopting modern casting technologies and quality certifications, often through joint ventures and technology transfer agreements, aiming to reduce reliance on foreign suppliers and meet burgeoning domestic aerospace demand efficiently.

- North America: Dominant market share; driven by Boeing and defense programs; concentration of NADCAP-certified suppliers.

- Europe: Strong second position; anchored by Airbus and engine manufacturers; focus on high-precision investment casting and advanced automation.

- Asia Pacific (APAC): Highest CAGR; fueled by fleet expansion in China and India; increasing localization of manufacturing capabilities.

- Latin America (LATAM): Emerging market; growth tied to regional airline fleet modernization and MRO activities; smaller, localized defense sector.

- Middle East and Africa (MEA): Growth driven by major airline fleet expansion (e.g., Emirates, Qatar Airways) and strategic defense spending; relies heavily on imports and MRO hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft and Aerospace Aluminum Casting Components Market.- Precision Castparts Corp. (PCC)

- Alcoa Corporation

- Consolidated Precision Products (CPP)

- Howmet Aerospace

- Safran S.A.

- Doncasters Group

- VBC Group

- Rolls-Royce plc

- Mitsubishi Heavy Industries (MHI)

- Reliance Precision Casting

- Firth Rixson

- Meridian Lightweight Technologies

- Shandong Aerospace Power Co., Ltd.

- Spirit AeroSystems

- Ametek Inc.

- Metalwerks Aerospace

- Arconic

- Foseco

Frequently Asked Questions

Analyze common user questions about the Aircraft and Aerospace Aluminum Casting Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for aluminum casting components in aerospace?

The primary driver is the critical need for weight reduction across all aircraft platforms, as aluminum casting components offer an excellent strength-to-weight ratio, directly translating to enhanced fuel efficiency and lower operational costs for commercial carriers and improved performance for military aviation.

Which casting process is most critical for high-integrity aerospace engine parts?

Investment casting, often referred to as lost-wax casting, is the most critical process for high-integrity engine components due to its superior ability to produce intricate, near-net-shape geometries with extremely tight dimensional tolerances and excellent internal soundness required for high-stress, high-temperature applications.

How does regulatory compliance affect the aluminum casting components market?

Regulatory compliance, governed by standards like AS9100 and NADCAP, imposes strict requirements for process control, material traceability, and quality assurance. This necessitates high capital investment in certified facilities and lengthy component qualification cycles, acting as a major barrier to entry and a constant operational cost.

What role does automation play in the future of aerospace aluminum casting?

Automation is crucial for improving consistency and reducing defects. Advanced robotics are used in mold handling and finishing, while AI-driven NDT technologies (like CT scanning) are automating quality inspection, ensuring zero-defect standards are met efficiently in high-volume aerospace production runs.

Which geographic region is expected to experience the fastest growth in this market?

The Asia Pacific (APAC) region is projected to show the fastest growth rate, primarily driven by rapid commercial fleet expansion, escalating air travel demand, and increasing defense expenditures in major economies such as China and India, leading to substantial investment in local aerospace manufacturing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager