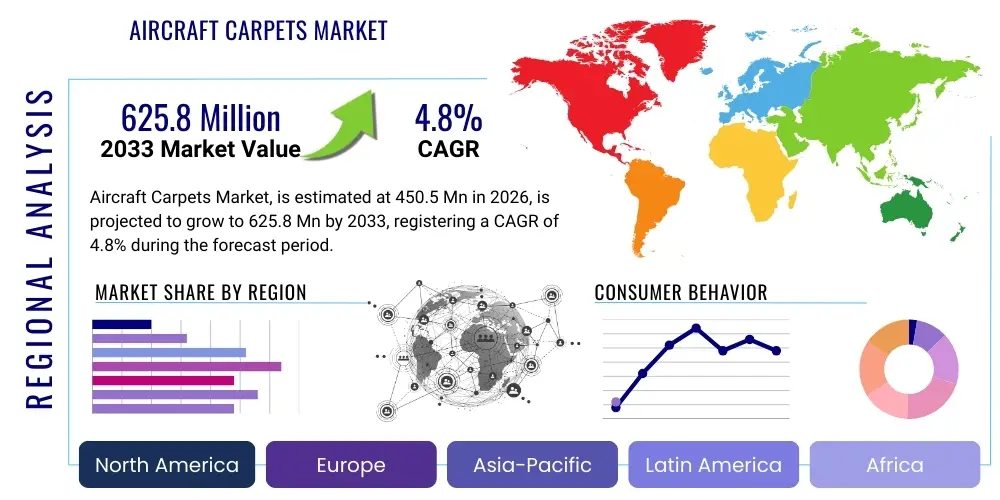

Aircraft Carpets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442979 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Aircraft Carpets Market Size

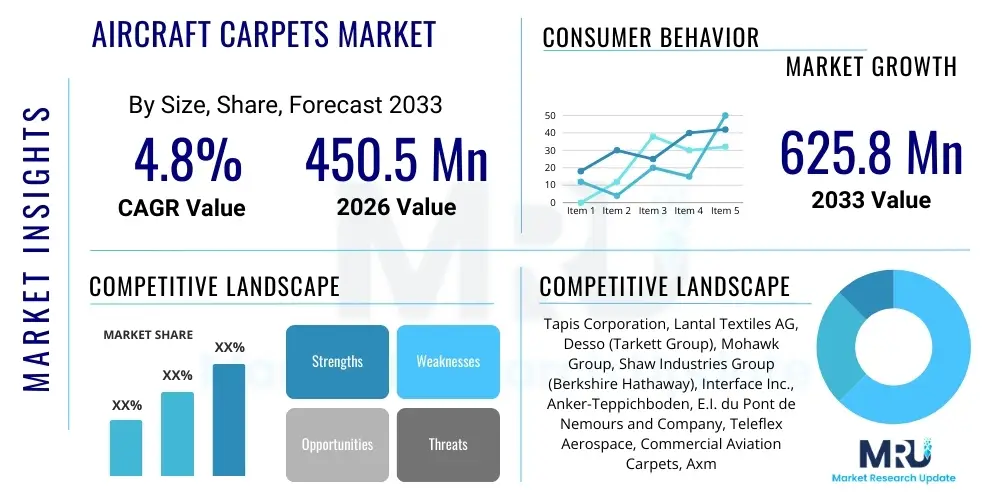

The Aircraft Carpets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 625.8 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the robust expansion of the global commercial aircraft fleet, coupled with cyclical interior refurbishment activities undertaken by major airlines seeking to enhance passenger experience and maintain regulatory compliance regarding flammability and wear resistance. The valuation reflects the high premium placed on specialized, lightweight, and durable materials required for aviation standards.

Aircraft Carpets Market introduction

The Aircraft Carpets Market encompasses the manufacturing, supply, and installation of specialized textile flooring solutions designed exclusively for the stringent operational and safety environments within commercial, military, and general aviation aircraft cabins. These products are critical components of the aircraft interior, offering not only aesthetic enhancement and noise reduction but also indispensable functional attributes such as extreme fire resistance, low smoke emission characteristics, and robust durability against high foot traffic. Due to rigorous aviation safety standards set by bodies like the FAA and EASA, these carpets utilize advanced materials, often incorporating blends of wool, nylon, or custom synthetic fibers that meet specific thermal and structural requirements, ensuring minimal impact on aircraft weight and fuel efficiency. Major applications span across passenger cabins, galleys, lavatories, and cockpit areas, where customized design and regulatory adherence are paramount.

Product description for aircraft carpets highlights key material science achievements in aviation textiles. These carpets are distinguished from standard commercial flooring by their specialized construction, typically involving tightly woven, low-pile structures treated with anti-microbial and stain-resistant finishes. The core objective is to deliver products that maintain structural integrity and aesthetic appeal over long service intervals, minimizing maintenance downtime for airlines. The inherent benefits include superior acoustic damping, crucial for passenger comfort, excellent thermal insulation, and exceptional resistance to accelerated wear and tear characteristic of confined, high-traffic environments. Furthermore, modern aircraft carpets are increasingly focusing on sustainability, incorporating recycled content and lighter material weights to contribute to airline efforts toward reduced carbon footprints and operational costs.

Driving factors propelling this market include the unprecedented surge in global air travel, particularly in the Asia-Pacific region, necessitating the delivery of thousands of new aircraft annually. This direct correlation between new aircraft orders and market demand provides a stable growth platform. Simultaneously, the cyclical nature of cabin modernization programs—where airlines refresh their interiors every 5 to 8 years to remain competitive—ensures consistent demand in the aftermarket segment (MRO). The ongoing emphasis on passenger comfort, premium cabin designs, and compliance with continually evolving safety regulations regarding interior materials further solidifies the need for specialized, high-performance aircraft carpet solutions across all aviation sectors.

Aircraft Carpets Market Executive Summary

The Aircraft Carpets Market is characterized by intense focus on compliance, innovation in lightweight materials, and consolidation among key suppliers capable of meeting global supply chain demands and rigorous certification requirements. Current business trends indicate a significant shift towards sustainable product lines, including bio-based polymers and recycled materials, driven by major OEMs’ net-zero commitments and increasing environmental scrutiny from regulators and consumers. Furthermore, digitalization in manufacturing, particularly advanced loom technology and precision cutting, is enabling greater customization, allowing airlines to integrate complex branding elements and unique color schemes directly into the flooring design while optimizing material usage and minimizing waste. The competitive landscape is defined by the necessity for long-term certification partnerships with airframe manufacturers, securing positions on critical supply lists for new aircraft programs.

Regionally, the market dynamics are heavily influenced by fleet size and aircraft utilization rates. North America and Europe currently represent the largest revenue generators due to their mature aviation infrastructures, vast existing fleets, and frequent cabin refurbishment cycles mandated by competitive pressure. However, the fastest growth is anticipated in the Asia Pacific (APAC) region, spurred by rapidly expanding low-cost carriers (LCCs) and national flag carriers acquiring next-generation aircraft at an accelerating pace. These APAC markets are not only driving demand for new installations but are also increasingly adopting premium cabin configurations that utilize high-end, customized carpet solutions, representing a major opportunity for suppliers specializing in luxury and unique designs. The Middle East remains a key, albeit concentrated, market focused almost exclusively on luxurious, high-specification materials for premium long-haul carriers.

Segment trends reveal a sustained dominance of the Commercial Aircraft segment, particularly the narrow-body and wide-body sub-segments, owing to sheer volume. Material-wise, Nylon remains a core foundation due to its excellent durability-to-cost ratio, though the demand for wool and wool-blend carpets is seeing a resurgence in first and business class cabins where superior aesthetics and haptics are prioritized. The aftermarket (MRO) segment consistently accounts for a substantial portion of revenue, driven by necessary replacement cycles due to wear and tear. A critical trend across all segments is the increasing sophistication of fire-blocking technology integrated into the carpet backing, ensuring compliance with the latest vertical testing standards (e.g., 14 CFR 25.853), thereby placing material engineering expertise at the forefront of product development.

AI Impact Analysis on Aircraft Carpets Market

User queries regarding AI's influence in the Aircraft Carpets Market predominantly revolve around how artificial intelligence and machine learning (ML) can optimize complex manufacturing processes, enhance material integrity, and streamline the highly regulated supply chain. Key concerns address the use of predictive analytics for assessing carpet wear rates in real-time based on operational data (e.g., flight hours, routes, passenger density), enabling proactive maintenance planning and reducing unnecessary premature replacement. Users also seek information on AI-driven quality control systems that can automatically detect minute flaws in weaving or material treatment, ensuring every batch meets rigorous aviation standards without manual inspection delays. The overarching expectation is that AI will introduce unprecedented efficiency and traceability, particularly in managing the thousands of different color, pattern, and material combinations required by diverse airline customers globally.

The deployment of AI and ML algorithms is proving transformative in material science development for aviation textiles. Researchers utilize AI to simulate the performance of novel fiber blends under extreme conditions (temperature, pressure, abrasion), accelerating the R&D cycle for lightweight, fire-resistant, and highly durable carpet materials. This capability allows manufacturers to quickly iterate designs and compositions, meeting the dual requirements of stringent safety regulations and airline demands for fuel efficiency through weight reduction. Furthermore, AI contributes significantly to demand forecasting, helping manufacturers manage inventory of specialized raw materials (like aramid fibers or fire-retardant chemicals) which often have long lead times, thus ensuring production responsiveness during peak refurbishment seasons.

In logistics and post-sale services, AI facilitates highly optimized cutting and installation planning. Utilizing 3D scanning data of specific aircraft cabins, AI can calculate the most efficient cutting layout of carpet rolls, drastically minimizing expensive material wastage—a crucial factor given the high cost of certified aviation textiles. Beyond manufacturing, predictive maintenance frameworks powered by AI analyze fleet utilization data to predict exactly when individual carpet sections in an aircraft require replacement, shifting airlines from time-based replacement schedules to condition-based maintenance, thereby maximizing the lifespan of the flooring asset and reducing operational costs related to unplanned interior repairs.

- AI optimizes material composition design for reduced weight and enhanced flammability compliance.

- Machine Learning (ML) algorithms drive predictive quality control during manufacturing, identifying weaving defects instantly.

- Predictive maintenance uses flight data to forecast carpet wear and schedule optimal replacement times.

- AI-driven nesting software minimizes expensive material waste during the precise cutting phase for aircraft floor plans.

- Automated inspection systems ensure traceability and compliance documentation for all textile batches.

DRO & Impact Forces Of Aircraft Carpets Market

The Aircraft Carpets Market is simultaneously driven by mandatory aircraft fleet expansion and restrained by the high barriers to entry imposed by stringent regulatory compliance and volatile raw material costs. The principal driver is the consistently high volume of global aircraft deliveries, which creates foundational demand for initial installations (OEM market). Coupled with this is the opportunity presented by airlines prioritizing passenger experience through frequent cabin upgrades, necessitating high-quality, aesthetically superior, and often custom-designed carpet replacements (MRO market). However, the critical restraining factors revolve around the need for specialized fire-retardant treatments and long, complex certification processes required for any new product introduction, significantly increasing R&D investment and time-to-market. Additionally, the industry is perpetually exposed to volatility in the petrochemical supply chain, impacting the cost of synthetic fibers like nylon and polyester, thereby pressuring manufacturer margins.

Opportunities for growth are abundant in the sustainability and technological innovation arenas. There is a burgeoning market for eco-friendly aircraft carpets utilizing bio-based or fully recycled content, offering a strong competitive differentiator for suppliers. Furthermore, advancements in digital printing technology allow for incredibly intricate, photorealistic designs, providing airlines with unprecedented customization capabilities while maintaining necessary durability. The continuous development of ultra-lightweight carpet solutions, achieved through specialized fiber structures and backing materials, directly addresses the airline industry's persistent drive for reduced fuel consumption, presenting a lucrative niche for innovators. These factors collectively push the industry toward specialized, value-added products rather than commoditized offerings.

The primary impact forces shaping the competitive environment include the intense power of buyers (major OEMs and Tier 1 interior suppliers) who demand highly specialized products at competitive prices, often negotiating long-term contracts. Supplier power, conversely, remains moderate, as specialized fiber and chemical suppliers are few, yet carpet manufacturers possess proprietary finishing technologies that differentiate them. The threat of new entrants is remarkably low due to the immense capital required for R&D, certification (especially FAR 25.853 and related tests), and establishing trusted relationships within the highly consolidated aerospace supply chain. Finally, substitute materials, such as specialized rubber flooring, pose a threat mainly in utility areas like galleys and cargo zones, but carpets remain indispensable for aesthetic and acoustic reasons in passenger cabins.

Segmentation Analysis

The Aircraft Carpets Market is comprehensively segmented based on material type, aircraft type, application area, and sales channel, allowing for granular analysis of demand drivers and competitive strongholds. Material segmentation is crucial as it dictates performance characteristics, cost, and suitability for specific cabin classes, ranging from basic synthetics for economic zones to premium wool blends for VIP interiors. Segmentation by aircraft type—narrow-body, wide-body, regional jets, and business jets—reflects the varying volume and specification requirements, with narrow-bodies generating the highest unit demand and business jets requiring the highest levels of customization and luxury. Application segmentation helps suppliers target specific performance requirements, distinguishing between high-traffic aisles and static seating areas.

The primary division of the market lies between the OEM segment, which provides initial installations for newly manufactured aircraft, and the aftermarket (MRO) segment, responsible for replacements and refurbishments. The aftermarket segment generally represents a more stable, recurring revenue stream, driven by mandatory maintenance cycles and airline branding updates. Understanding the dominant sales channel—whether directly to OEMs, through major interior integrators (Tier 1 suppliers), or via independent MRO service providers—is essential for optimizing distribution strategies. Each segment has unique procurement cycles, quality documentation requirements, and negotiation dynamics, compelling market players to tailor their product offerings and certification packages accordingly. The increasing lifespan of current-generation aircraft further bolsters the aftermarket segment's importance.

The continuous focus on weight reduction and enhanced passenger experience drives innovation across all segments. For instance, the narrow-body segment is seeing heightened demand for ultra-lightweight, high-durability synthetic carpets to maximize fuel savings on short-haul routes. Conversely, the wide-body segment, particularly in first and business class, demands high-end, customized material treatments, prioritizing feel, acoustic dampening, and sophisticated visual patterns enabled by modern digital printing technologies. Suppliers must therefore maintain a diversified portfolio capable of addressing the high-volume, cost-sensitive demands of one segment while simultaneously fulfilling the bespoke, premium requirements of another.

- By Material Type: Nylon/Polyamide, Wool, Wool/Nylon Blends, Polyester, Others (Aramid, Specialty Synthetics)

- By Aircraft Type: Narrow-Body Aircraft, Wide-Body Aircraft, Regional Jet Aircraft, Business Jet & General Aviation

- By Application: Cockpit, Passenger Cabin (Aisleways, Seating Areas), Galley & Service Areas, Lavatories

- By Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket/MRO (Maintenance, Repair, and Overhaul)

Value Chain Analysis For Aircraft Carpets Market

The value chain for the Aircraft Carpets Market is characterized by highly specialized stages, beginning with the sourcing of highly regulated raw materials and culminating in certified installation within the aircraft cabin. Upstream analysis focuses on the procurement of specialized synthetic fibers, particularly fire-resistant nylon (FR Nylon 6 or 6,6) and high-quality wool, alongside proprietary fire-retardant chemicals and backings (often made from high-density foams or aramids). Manufacturers at this stage must maintain rigorous quality control and traceability, as the base materials must possess intrinsic properties necessary for passing crucial flammability tests. The strong influence of regulatory bodies at the material sourcing stage elevates the barrier to entry and concentrates power among a few certified chemical and fiber suppliers.

The midstream segment involves the core manufacturing process: weaving or tufting, dyeing (often using advanced digital methods for color accuracy), and, crucially, applying the necessary chemical treatments to achieve flame resistance, stain protection, and static dissipation. This stage adds significant value through proprietary finishing technologies and certifications. Key distribution channels include direct sales to major airframe OEMs (e.g., Boeing, Airbus) for new production lines, sales to specialized Tier 1 cabin interior integrators (who bundle carpets with seating and monuments), and supply directly to global airlines or MRO facilities for replacement and refurbishment contracts. Direct sales to OEMs involve long qualification periods but ensure stable, high-volume contracts, while MRO sales are more transactional and require quick turnaround capabilities.

Downstream activities center on installation and maintenance. Direct distribution channels involve the carpet manufacturer supplying the finished product to the OEM's assembly line, where it is installed as part of the initial cabin fit-out. Indirect channels are prevalent in the MRO segment, where products are distributed via authorized dealers or MRO service providers who handle the removal of old carpets, precision cutting of the new material, and certified installation. The complexity of cutting and fitting customized carpets to specific floor plans (which vary even within the same aircraft model) necessitates specialized training and detailed documentation. The entire process requires robust traceability records, linking the installed carpet serial number back to its raw material source and flammability test results, underscoring the critical nature of compliance management throughout the entire value chain.

Aircraft Carpets Market Potential Customers

Potential customers in the Aircraft Carpets Market are categorized into three main groups: Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) organizations, and the airlines themselves, each possessing distinct procurement needs and purchasing power. OEMs, such as Airbus and Boeing, are the primary buyers in the initial installation phase, setting the core specifications and demanding extremely high volumes with guaranteed long-term supply stability. Suppliers must invest heavily in technical alignment and qualification processes to become an approved vendor for OEM programs, often requiring years of collaboration before securing a contract for a new aircraft platform. This relationship is critical as it dictates the standard carpet specification for that aircraft model for decades.

Airlines (End-Users/Buyers) represent the most frequent and diverse segment of buyers, driving the aftermarket segment through cyclical refurbishment projects and general wear-and-tear replacement. Major international carriers, regional operators, and Low-Cost Carriers (LCCs) all require carpets, but their specifications vary drastically: flag carriers often demand premium wool blends and custom designs for competitive differentiation, while LCCs prioritize extreme durability, lightweight synthetics, and cost-effectiveness. The airline’s interior design and procurement teams dictate the aesthetic choices, but their engineering and maintenance teams enforce the regulatory compliance and durability standards, necessitating a complex sales approach that satisfies both design and technical requirements.

MRO facilities and independent interior modification specialists serve as vital intermediaries, especially for older aircraft fleets or mid-life cabin upgrades. These entities purchase carpets either directly from the manufacturer or through authorized distributors to service various airline clients. Their need is often characterized by rapid delivery times, comprehensive certification packages for retrofits, and flexibility in small-batch custom orders. Furthermore, specialist segments like military aircraft integrators and executive/VIP completion centers also constitute high-value buyers, demanding exceptionally durable, often fire- and chemical-resistant materials for military use, or bespoke luxury materials for private jets, respectively. The consistent requirement across all customer types is comprehensive regulatory documentation (Certificate of Conformance) for every roll of material supplied.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 625.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tapis Corporation, Lantal Textiles AG, Desso (Tarkett Group), Mohawk Group, Shaw Industries Group (Berkshire Hathaway), Interface Inc., Anker-Teppichboden, E.I. du Pont de Nemours and Company, Teleflex Aerospace, Commercial Aviation Carpets, Axminster Carpets Ltd., Scott Group Custom Carpets, Spectra Interior Products, CAV Aerospace, Custom Carpet Company, Milliken & Company, C&C Carpets, TenCate Advanced Composites, AIM Altitude, Saint-Gobain Sully. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Carpets Market Key Technology Landscape

The technology landscape in the Aircraft Carpets Market is overwhelmingly focused on optimizing material performance to meet aviation's non-negotiable trifecta: safety, weight reduction, and durability. A critical technological advancement involves the development and application of proprietary fire-blocking chemistries and backings, ensuring textiles not only meet but exceed the stringent Federal Aviation Regulation (FAR) 25.853 requirements for vertical burn, heat release, and smoke density. Manufacturers are employing specialized weaving and tufting techniques that integrate these flame-retardant elements directly into the fiber structure and backing material, moving beyond superficial chemical treatments. Furthermore, the integration of advanced anti-microbial and stain-resistant finishes, often utilizing nanotechnology or plasma treatment, significantly extends the carpet’s operational life and reduces the frequency of deep cleaning, directly minimizing maintenance costs for airlines and improving cabin hygiene.

A second crucial technological vector is lightweighting, driven by the aerospace industry’s relentless pursuit of fuel efficiency. Innovators are developing ultra-low-density carpet backings, replacing traditional heavy rubber or latex with specialized lightweight foam or thermoplastic materials that provide necessary cushioning and stability while drastically cutting per-square-meter weight. This focus on material engineering involves using advanced synthetic polymers, like aramid fibers or proprietary nylon blends, which offer superior strength and abrasion resistance at lower material density. The adoption of these lightweight solutions is particularly critical in large wide-body fleets, where marginal weight savings translate into millions of dollars in annual fuel expenditure savings, making this technology a major competitive differentiator for suppliers.

Finally, digital manufacturing technologies are revolutionizing customization and production efficiency. Advanced digital printing allows manufacturers to reproduce complex, photo-quality patterns and custom color schemes directly onto the carpet surface with exceptional color fastness and precision, enabling airlines to implement sophisticated branding and interior design concepts that were previously impossible with traditional dyeing methods. Complementary to printing, computer-aided manufacturing (CAM) and specialized robotic cutting systems utilize precise digital aircraft floor plans to cut carpet sections, maximizing material yield (nesting optimization) and guaranteeing perfect fit during installation. This integration of digital workflow from design to cutting dramatically reduces lead times and waste, enhancing the overall efficiency of the carpet supply chain.

Regional Highlights

The global distribution of the Aircraft Carpets Market is heterogeneous, dictated primarily by aircraft manufacturing hubs, airline fleet sizes, and MRO activity. North America holds a commanding share of the market, primarily due to the presence of large commercial aircraft manufacturers, robust domestic air travel, and a massive installed fleet base necessitating high volumes of MRO refurbishment. The region is characterized by early adoption of advanced materials, driven by stringent FAA regulations and a strong emphasis on continuous cabin modernization to cater to highly demanding passenger expectations. The consistent demand from major US and Canadian carriers for high-durability, long-lifecycle products ensures sustained market stability in this region.

Europe represents another mature and significant market, characterized by key regional aircraft manufacturers (Airbus) and a major concentration of Tier 1 interior suppliers. The European market places a particularly high emphasis on sustainable materials, driven by EASA standards and strong European environmental mandates, leading to increased adoption of recycled and eco-certified carpet products. Additionally, the region’s strong presence of high-end business jet completion centers drives specialized demand for luxury, bespoke carpet solutions incorporating high-quality natural fibers like wool and silk blends, tailored for VIP aviation interiors.

Asia Pacific (APAC) is projected to be the fastest-growing market segment throughout the forecast period. This rapid expansion is fundamentally fueled by high GDP growth, increasing urbanization, and the resulting proliferation of new aircraft orders placed by rapidly expanding regional airlines and LCCs, especially in China, India, and Southeast Asia. Unlike North America and Europe, the APAC market is dominated by demand for initial installations (OEM sales) on new aircraft deliveries. While cost sensitivity remains a factor for LCCs, the increasing focus on premium travel segments, particularly in major international hubs, is simultaneously boosting demand for higher-specification, customized carpet materials.

The Middle East and Africa (MEA) region, though smaller in volume, accounts for disproportionately high-value demand. The Middle Eastern carriers are globally renowned for their luxurious, high-specification cabin interiors, resulting in demand for the most premium, customized, and technologically advanced carpet solutions for their First and Business Class cabins. Procurement cycles are often centered around long-haul wide-body aircraft, requiring materials that offer superior acoustic properties and aesthetic longevity under intense use. Latin America demonstrates moderate growth, tied closely to the fluctuating economic conditions and fleet expansion cycles of major regional carriers, focusing primarily on efficient, durable synthetic materials.

- North America: Largest market share due to extensive fleet base, major MRO activity, and large OEM presence (Boeing). Focus on FAA compliance and durable synthetics.

- Asia Pacific (APAC): Fastest growth driven by rapid fleet expansion, new aircraft deliveries, and rising demand from emerging LCCs and full-service carriers.

- Europe: High focus on sustainability (EASA regulations), recycled materials, and strong demand from regional aircraft manufacturers and business jet completion centers (Airbus).

- Middle East & Africa (MEA): High-value market segment characterized by demand for ultra-premium, bespoke, luxury carpet solutions for flagship long-haul carriers.

- Latin America: Moderate growth tied to economic stability and regional fleet modernization cycles, prioritizing cost-effective durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Carpets Market.- Tapis Corporation

- Lantal Textiles AG

- Desso (Tarkett Group)

- Mohawk Group

- Shaw Industries Group (Berkshire Hathaway)

- Interface Inc.

- Anker-Teppichboden

- E.I. du Pont de Nemours and Company

- Teleflex Aerospace

- Commercial Aviation Carpets

- Axminster Carpets Ltd.

- Scott Group Custom Carpets

- Spectra Interior Products

- CAV Aerospace

- Custom Carpet Company

- Milliken & Company

- C&C Carpets

- TenCate Advanced Composites

- AIM Altitude

- Saint-Gobain Sully

Frequently Asked Questions

Analyze common user questions about the Aircraft Carpets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in commercial aircraft carpets?

The predominant material used in commercial aircraft carpets is specialized Nylon or Polyamide, often blended with wool in premium cabins. These materials are chosen for their exceptional durability, lightweight properties, and their ability to be chemically treated to meet strict flammability standards (FAR 25.853).

How often do aircraft carpets need to be replaced (MRO cycle)?

Aircraft carpets are typically replaced on a rotational cycle driven by heavy wear and tear, usually every 3 to 5 years, though this can vary depending on the airline's operational tempo, aircraft type (narrow-body versus wide-body), and specific cabin location (aisleways wear fastest). Predictive maintenance analytics are increasingly optimizing this replacement schedule.

What are the most critical safety regulations governing aircraft carpets?

The most critical safety regulation is the Federal Aviation Regulation (FAR) 25.853, specifically sections covering flammability, heat release, and smoke density. All aircraft interior textiles must pass rigorous vertical burn tests before they can be certified for installation.

Which segment accounts for the highest demand in the Aircraft Carpets Market?

The Commercial Narrow-Body Aircraft segment accounts for the highest unit volume demand due to the sheer number of these aircraft globally. However, the Aftermarket/MRO sales channel, covering replacement and refurbishment cycles, generates the most consistent and recurring revenue for the market.

How is sustainability impacting the selection of aircraft flooring materials?

Sustainability is driving demand for lightweight carpets and those incorporating recycled content (e.g., recycled Nylon) or bio-based polymers. Airlines are prioritizing eco-certified materials to align with corporate environmental goals and reduce overall aircraft weight, thereby lowering fuel consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager