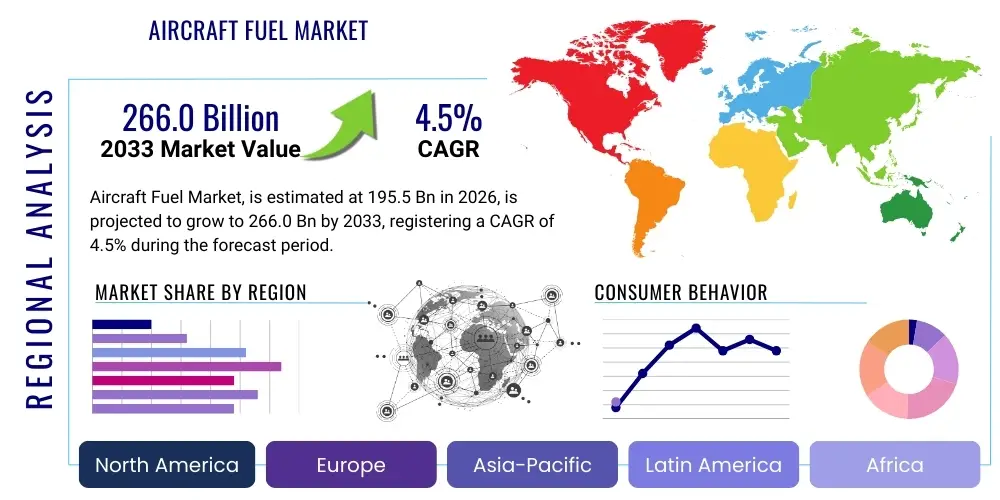

Aircraft Fuel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442409 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Aircraft Fuel Market Size

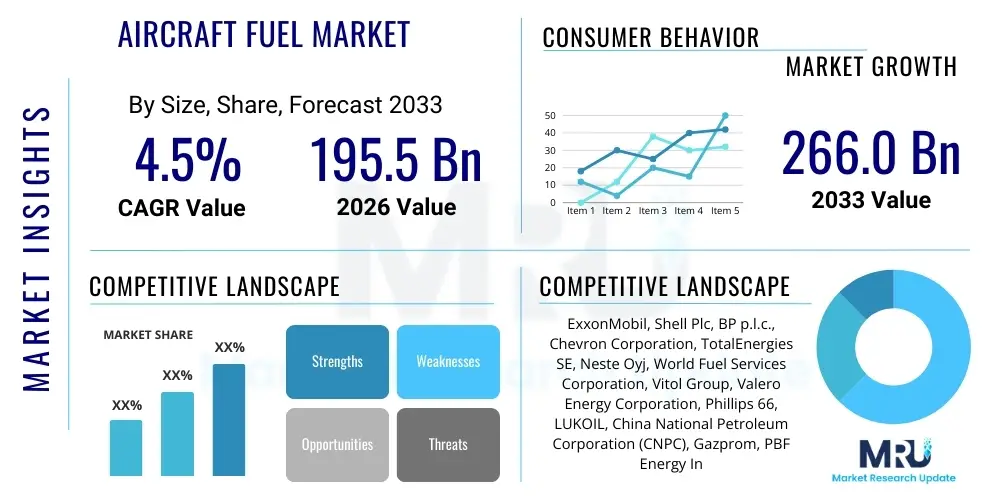

The Aircraft Fuel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 266.0 Billion by the end of the forecast period in 2033.

Aircraft Fuel Market introduction

The Aircraft Fuel Market encompasses the manufacturing, distribution, and consumption of specialized petroleum-based products and alternative energy sources designed to power commercial, military, and general aviation aircraft. This essential commodity is categorized primarily into Jet Fuel (kerosene-based, such as Jet A and Jet A-1) for turbine engines and Avgas (aviation gasoline) for piston-engine aircraft. The performance specifications for aircraft fuel are rigorously defined by international standards (e.g., ASTM, DEF STAN) to ensure operational safety, reliability, and optimal engine performance across varied atmospheric conditions and altitudes. The complexity of fuel supply chains, coupled with stringent environmental regulations concerning carbon emissions, defines the operational landscape of this vital industry.

Major applications of aircraft fuel span scheduled commercial passenger transportation, dedicated air cargo operations, military defense logistics, and private/general aviation activities. The growing global demand for air travel, particularly in emerging economies, is a primary catalyst expanding the consumption volume. Furthermore, the robust expansion of e-commerce necessitates increased air freight capabilities, directly driving demand for jet fuel. Key benefits derived from modern aircraft fuels include high energy density, excellent thermal stability, and low-temperature fluidity, critical for maintaining operational efficiency and safety during long-haul flights and extreme weather conditions. These inherent characteristics support the continuous, long-duration power required by modern turbine engines.

Key driving factors stimulating market expansion include sustained growth in global air traffic volumes, significant defense expenditures by major world powers requiring high volumes of military jet fuel, and the modernization of global aircraft fleets, which often feature more fuel-efficient yet equally demanding engines. Another critical driver is the intensified investment in Sustainable Aviation Fuels (SAF), motivated by industry commitments (such as IATA’s net-zero 2050 goal) and supportive governmental mandates aiming to decarbonize the aviation sector. While traditional fossil fuels remain dominant, the pressure for cleaner alternatives is reshaping procurement strategies and research and development focus across the market ecosystem.

Aircraft Fuel Market Executive Summary

The Aircraft Fuel Market is undergoing a fundamental transformation driven by intense regulatory scrutiny regarding carbon emissions and the parallel resurgence of global air travel demand post-pandemic slowdowns. Business trends indicate a strategic shift toward long-term procurement contracts focusing on price hedging and supply resilience, particularly given the volatility in crude oil markets and geopolitical instability affecting key supply routes. Major oil companies and independent refiners are investing heavily in upgrading facilities to produce cleaner-burning fuels and blending components that meet stricter environmental standards. Furthermore, the market structure is evolving, characterized by increasing collaborations between fuel producers, airlines, and specialized biofuel providers to rapidly scale up the production and distribution of Sustainable Aviation Fuels (SAF).

Regionally, the Asia Pacific (APAC) stands out as the epicenter of growth, driven by burgeoning middle-class populations, expanding airport infrastructure projects, and the rise of low-cost carriers in countries like China and India, leading to unparalleled growth in passenger kilometers flown. North America and Europe, while mature markets, are leading the innovation curve, particularly regarding regulatory frameworks and operational mandates favoring SAF uptake, often necessitating higher investment in alternative fuel logistics. The Middle East maintains strategic importance due to its central geographic location supporting global hub carriers and its significant refining capacity for traditional jet fuel, although diversification into non-fossil fuel production is also gaining momentum in the region.

In terms of segment trends, Jet Fuel (Jet A/A-1) retains overwhelming dominance due to its applicability across commercial and military turbine aircraft, forming the largest volumetric segment. However, the Sustainable Aviation Fuel (SAF) segment, although currently small in volume, is projected to experience the fastest growth rate throughout the forecast period, underpinned by mandatory blending targets and technological advancements in feedstock processing (e.g., HEFA, PtL). Within the application segment, commercial aviation remains the largest consumer, but military consumption provides stable, high-volume demand essential for market stability. The emphasis across all segments is on efficiency improvements, logistics optimization, and meeting the evolving demands for cleaner energy sources.

AI Impact Analysis on Aircraft Fuel Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Aircraft Fuel Market revolve primarily around three core themes: efficiency, sustainability, and risk management. Users are keenly interested in how AI can optimize fuel consumption during flight planning and execution (route optimization, predictive maintenance reducing excess weight/fuel burn), thereby minimizing operational costs. A secondary concern focuses on AI’s role in managing the complex logistics and supply chain volatility associated with both traditional jet fuel and emerging SAF—specifically, predictive analytics for demand forecasting and inventory management at airports. Finally, there is significant user interest in utilizing AI to accelerate the research and development pipeline for advanced biofuels and synthetic fuels, optimizing catalytic processes and feedstock selection to achieve greater scale and cost efficiency.

AI’s influence is substantial, moving beyond simple data analysis to integrated predictive modeling across the entire fuel lifecycle. In the supply chain, machine learning algorithms are utilized to forecast short-term and long-term price fluctuations of crude oil and refined products with greater accuracy than traditional models, enabling better hedging strategies for airlines and suppliers. Operationally, AI-driven digital twins and prescriptive analytics tools are optimizing ground operations, identifying bottlenecks in refueling processes, and maximizing asset utilization (fuel trucks, storage tanks). This proactive approach minimizes downtime and ensures that regulatory compliance, particularly concerning blending mandates for SAF, is maintained efficiently.

Furthermore, AI is instrumental in enhancing the safety and quality control aspects inherent in the distribution of aircraft fuel. Computer vision systems are being deployed for automated inspection of pipelines and storage infrastructure, detecting potential leakages or material degradation before they become critical issues. Data collected from aircraft performance sensors, processed by AI models, provides airlines with actionable insights on ideal fuel loads, taxiing procedures, and flight profiles, resulting in significant micro-level fuel savings that collectively impact the global consumption rate. This comprehensive application ensures both operational profitability and measurable progress toward decarbonization goals.

- AI-driven Predictive Maintenance: Optimizing engine performance and reducing unnecessary fuel weight carriage.

- Dynamic Flight Route Optimization: Using real-time weather and air traffic data to minimize flight path distance and time, reducing fuel burn.

- Supply Chain Demand Forecasting: Machine learning models predicting fuel needs at regional hubs, optimizing inventory levels, and reducing storage costs.

- Refining Process Optimization: AI tuning catalytic conversion processes for higher yield and quality in both fossil fuels and SAF production.

- Carbon Emission Tracking and Reporting: Automated systems ensuring accurate, real-time compliance tracking for regulatory bodies and internal sustainability reports.

- Price Volatility Hedging: Predictive analytics assisting procurement departments in securing favorable long-term fuel contracts.

DRO & Impact Forces Of Aircraft Fuel Market

The dynamics of the Aircraft Fuel Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces influencing strategic decision-making and market trajectory. Primary drivers include the robust recovery and expansion of global commercial air passenger traffic, particularly in high-growth markets, alongside continuous investments in new, fuel-efficient aircraft fleets that still require massive volumes of energy. These demand-side forces are balanced against significant restraints, notably the inherent volatility of crude oil prices driven by geopolitical events and OPEC+ decisions, which creates cost uncertainty for airlines, and the stringent, increasingly costly environmental regulations demanding substantial investment in low-carbon alternatives.

Opportunities for growth are concentrated within the nascent Sustainable Aviation Fuel (SAF) sector, where technological advancements in feedstock pathways (e.g., biomass, municipal solid waste, power-to-liquids) promise a pathway to significant emission reduction and diversification away from fossil dependence. Governments globally are establishing supportive policy mechanisms, such as tax credits and mandated blending quotas, creating a guaranteed demand floor for SAF production. These opportunities encourage massive capital expenditure from both established energy majors and specialized cleantech startups, accelerating innovation and capacity build-out, though feedstock availability and cost parity remain structural challenges.

The central Impact Forces dictating market change stem from the tension between economic growth and environmental stewardship. The increasing pressure from international bodies like ICAO and domestic regulators (e.g., EU's Fit for 55) pushes the market toward decarbonization, which necessitates higher initial costs and substantial infrastructure overhauls (Impact Force: Regulatory Environment). Simultaneously, consumer willingness to fly, regardless of ticket price fluctuations, ensures sustained baseline demand (Impact Force: Consumer Travel Resilience). The ongoing war in Ukraine and other global conflicts underscore the extreme sensitivity of the energy supply chain (Impact Force: Geopolitical Instability), mandating supply diversification and resilience as key strategic priorities for all stakeholders in the aircraft fuel value chain, thus requiring agile and predictive supply management capabilities to mitigate risks effectively.

Segmentation Analysis

The Aircraft Fuel Market is comprehensively segmented based on fuel type, end-user application, and regional distribution, allowing for granular analysis of demand trends and strategic positioning. Segmentation by fuel type reveals the established dominance of kerosene-based Jet Fuel but simultaneously highlights the rapid emergence and growth potential of Sustainable Aviation Fuel (SAF) as the aviation sector prioritizes decarbonization. Application segmentation distinguishes between the high-volume, cost-sensitive demands of commercial aviation versus the stable, specification-driven requirements of the military sector, providing insight into distinct market dynamics and procurement processes. Understanding these segments is crucial for fuel suppliers to tailor products and logistics solutions effectively, meeting the diverse operational needs of different aviation consumers worldwide.

The commercial aviation segment, covering scheduled passenger and cargo flights, is the primary volume driver, characterized by intense price sensitivity and high demand for operational efficiency. Conversely, the general aviation segment, utilizing a higher proportion of Avgas, presents localized, specialized demand. The military segment focuses on high-performance fuels (like JP-8) that must operate reliably under extreme tactical conditions, often prioritizing security of supply and performance characteristics over cost optimization. Analyzing these structural distinctions is key to forecasting technological shifts, such as the gradual phase-out of leaded Avgas (100LL) and the accelerated integration of bio-jet alternatives across all operational spheres.

Geographic segmentation is paramount, reflecting differences in regulatory environments, refining capacities, and air traffic saturation levels. Asia Pacific leads in growth volume due to market liberalization and demographic expansion, whereas Europe and North America drive innovation and mandatory SAF uptake through policy instruments. These segmented views provide a critical framework for market participants—from refiners and distributors to policymakers—to allocate resources, plan infrastructural investments, and navigate the complex, multi-faceted requirements of the global aviation energy landscape, ensuring both market competitiveness and alignment with global sustainability goals.

- By Fuel Type:

- Jet Fuel (Jet A, Jet A-1)

- Aviation Gasoline (Avgas)

- Sustainable Aviation Fuel (SAF)

- Biofuels

- Synthetic Fuel

- By Application:

- Commercial Aviation (Passenger and Cargo)

- Military Aviation

- General Aviation

- By Aircraft Type:

- Fixed-Wing Aircraft (Narrow-Body, Wide-Body)

- Rotary-Wing Aircraft (Helicopters)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Aircraft Fuel Market

The Aircraft Fuel market value chain is extensive and highly integrated, beginning with upstream activities focused on the extraction and processing of raw materials. For traditional jet fuel, this involves the exploration, drilling, and production of crude oil, followed by its transportation via pipelines or tankers to refineries. For Sustainable Aviation Fuel (SAF), the upstream process involves the cultivation, harvesting, or sourcing of diverse feedstocks, such as oilseeds, algae, agricultural waste, or municipal solid waste. Efficiency and stability at the upstream level are crucial, as fluctuations in crude supply or feedstock availability directly impact the cost structure and supply security for the entire downstream market. Advanced technologies in resource management and extraction, including enhanced oil recovery and sophisticated biomass processing, define competitiveness in this initial stage.

Midstream activities encompass the complex refining and manufacturing processes where crude oil is fractionated into jet kerosene or, in the case of SAF, where feedstocks undergo hydroprocessing (HEFA), Fischer-Tropsch (FT) synthesis, or other chemical conversion methods to yield drop-in jet fuel substitutes. Rigorous quality control and adherence to precise military and commercial specifications are mandatory during this stage. Following production, the refined fuel is transported through a sophisticated network of dedicated pipelines, storage terminals, and specialized rail or truck logistics to regional distribution hubs, often located adjacent to major airports. The efficiency of this logistics network, particularly pipeline connectivity, is a significant determinant of final delivery cost and environmental footprint.

Downstream activities center on the final distribution to the end-users. This involves the storage of the fuel in airport tank farms, the use of dedicated hydrants or fleet of refueling vehicles (bowsers), and the precise delivery into the aircraft wings (wing-tip delivery). Distribution channels are highly regulated, with direct sales dominating, where major oil companies or specialized joint ventures (JVs) manage the entire airport supply infrastructure. Indirect distribution may occur through smaller regional resellers for general aviation. The final stage also includes critical services like quality assurance testing (e.g., freezing point, flash point verification) and the documentation required for operational safety and regulatory compliance. The shift toward higher SAF mandates is necessitating substantial investment in new blend-stock logistics and storage infrastructure within the downstream segment to handle different fuel types safely and efficiently.

Aircraft Fuel Market Potential Customers

The primary customers in the Aircraft Fuel Market are segmented based on their operational profiles, resulting in distinct procurement behaviors and volume demands. The largest segment by volume is Commercial Aviation, encompassing major international airlines (flag carriers), regional airlines, and dedicated air cargo operators. These customers are highly sensitive to operational costs, making fuel hedging and securing long-term supply contracts crucial elements of their financial strategy. Their procurement decisions prioritize high volume discounts, reliability of supply at major global hubs, and, increasingly, access to certified Sustainable Aviation Fuels (SAF) to meet corporate sustainability goals and jurisdictional mandates, such as those imposed by the EU’s ReFuelEU Aviation initiative.

A secondary, yet profoundly stable and critical customer base, is Military Aviation and Defense Forces globally. These customers require fuels (like JP-8, JP-5) manufactured to exceptionally high, robust military specifications, often prioritizing supply security, strategic redundancy, and high performance in extreme operational scenarios over marginal cost savings. Procurement typically occurs through large, long-term government contracts, often managed by national petroleum reserves or defense logistics agencies. Their demand remains resilient regardless of commercial economic cycles, providing an essential ballast to the overall market stability and driving requirements for specific high-specification additive packages.

The third major group consists of General Aviation and Private Aircraft operators, including small charter companies, flight schools, agricultural sprayers, and private jet owners. This segment predominantly drives demand for Aviation Gasoline (Avgas) and smaller volumes of jet fuel, utilizing a more decentralized distribution network often supplied by Fixed Base Operators (FBOs) at smaller, regional airports. While lower in total volume compared to commercial demand, this segment generates specialized requirements, notably the imminent transition away from leaded Avgas (100LL) to unleaded alternatives, which necessitates new product certification and specialized blending capabilities from suppliers to meet these tailored operational needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 266.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell Plc, BP p.l.c., Chevron Corporation, TotalEnergies SE, Neste Oyj, World Fuel Services Corporation, Vitol Group, Valero Energy Corporation, Phillips 66, LUKOIL, China National Petroleum Corporation (CNPC), Gazprom, PBF Energy Inc., ADNOC, Repsol, Gevo, Inc., SkyNRG, Honeywell International Inc. (UOP technologies), and Sasol Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Fuel Market Key Technology Landscape

The technological landscape of the Aircraft Fuel Market is undergoing a rapid evolution, primarily driven by the imperative to reduce carbon intensity and enhance fuel efficiency across the board. The traditional refining process, involving catalytic cracking and hydrotreating of crude oil to produce Jet A-1, remains foundational but is constantly optimized through advanced process control technologies, often leveraging AI and machine learning for predictive maintenance and throughput maximization. However, the most disruptive technological shift centers on the production pathways for Sustainable Aviation Fuels (SAF). Key established pathways include Hydroprocessed Esters and Fatty Acids (HEFA), which converts waste fats, oils, and greases into jet fuel, offering significant lifecycle emission reductions. This process requires specialized hydroprocessing units capable of handling diverse and often challenging feedstocks while ensuring the resulting product meets strict ASTM D7566 specifications for use as a "drop-in" fuel.

Beyond HEFA, emerging technologies are rapidly gaining ground, particularly those focused on exploiting non-biomass resources or more sustainable biomass sources. Alcohol-to-Jet (AtJ) technology, which converts sugars and starches derived from agricultural waste or industrial gases into jet fuel, is crucial for diversifying the feedstock base and reducing land-use competition. Furthermore, the development of Power-to-Liquids (PtL) or Synthetic E-Fuels represents a major long-term decarbonization strategy. This process utilizes renewable electricity to synthesize hydrogen and capture carbon dioxide (CO2) from the atmosphere or industrial sources, converting them into synthetic kerosene. While PtL is currently extremely expensive and energy-intensive, it holds the ultimate promise of near-zero lifecycle emissions and is attracting substantial investment from technology developers and energy majors seeking truly scalable, sustainable solutions for the distant future.

In addition to production advancements, significant technological effort is directed toward operational efficiencies. This includes the widespread adoption of specialized fuel additives (e.g., anti-icing, anti-static, corrosion inhibitors) that improve fuel performance and engine longevity under various conditions. Ground-based technologies are also vital; automated tank gauging systems, precision blending technology for SAF integration, and sophisticated filtration systems that maintain fuel cleanliness and prevent microbiological contamination are standard requirements. The integration of digital platforms for supply chain transparency, allowing airlines to track the certified sustainability attributes of their fuel purchases (e.g., feedstock origin, emission reduction verified through blockchain), represents the modernization of the regulatory and operational tracking framework within the industry, ensuring verifiable progress toward decarbonization targets.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Aircraft Fuel Market, driven by unprecedented growth in domestic and regional air travel, fueled by urbanization and rising disposable incomes in India, China, and Southeast Asian nations. The region is seeing massive investments in new airport infrastructure and fleet expansion. While demand for traditional Jet A-1 is soaring, regulatory efforts toward mandated SAF blending are lagging behind Europe and North America, though voluntary commitments from large carriers are increasing. Key challenges include ensuring a stable, high-volume supply chain to meet rapid demand growth and developing local SAF production capacity.

- North America: North America represents a mature, high-volume market characterized by sophisticated logistics and a leading role in SAF policy development. Driven by federal initiatives, such as the SAF Grand Challenge in the U.S. and various tax credits (e.g., Inflation Reduction Act), the region is seeing significant capital deployment for domestic SAF production facilities utilizing corn stover, oilseed crops, and municipal waste feedstocks. The market here is highly competitive, with major oil companies and specialized biofuel producers racing to secure long-term offtake agreements with major airlines, maintaining robust demand for both commercial and military grade fuels.

- Europe: Europe is the global frontrunner in setting mandatory, legally binding targets for SAF integration through the ReFuelEU Aviation initiative, which requires increasing percentages of sustainable fuels to be blended into jet fuel supplied at EU airports starting from 2025. This regulatory pressure is a dominant market driver, forcing airlines and fuel suppliers to restructure their supply contracts and logistics operations. While this creates a predictable market for SAF, it also introduces significant procurement and cost challenges for airlines, often relying on imported feedstock or European HEFA production capabilities, maintaining a highly dynamic and policy-sensitive environment.

- Middle East and Africa (MEA): The Middle East is critical due to its massive refining capacity, strategic location serving as a global transit hub, and the presence of world-leading hub carriers that consume vast amounts of jet fuel. While historically focused on traditional fossil fuel exports, regional producers, particularly in the UAE and Saudi Arabia, are initiating pilot projects and feasibility studies for SAF production to diversify their energy portfolio and align with global sustainability expectations. Africa presents a market of high potential growth, though constrained by infrastructural deficits, requiring significant investment in airport tank farms and reliable distribution networks to support expanding carriers.

- Latin America: This region exhibits variable growth, driven primarily by domestic and regional travel, particularly in Brazil and Mexico. Brazil holds unique potential due to its massive biofuel industry, centered around sugarcane-derived ethanol, which provides a strong, established feedstock base for potential Alcohol-to-Jet (AtJ) pathway production. The market is increasingly focused on developing local production capacity to reduce reliance on imported refined jet fuel, addressing long-term goals of supply resilience and energy independence through targeted national aviation sustainability programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Fuel Market, covering their operational strategies, technological investments, and market positioning.- ExxonMobil

- Shell Plc

- BP p.l.c.

- Chevron Corporation

- TotalEnergies SE

- Neste Oyj

- World Fuel Services Corporation

- Vitol Group

- Valero Energy Corporation

- Phillips 66

- LUKOIL

- China National Petroleum Corporation (CNPC)

- Gazprom

- PBF Energy Inc.

- ADNOC

- Repsol

- Gevo, Inc.

- SkyNRG

- Honeywell International Inc. (UOP technologies)

- Sasol Limited

Frequently Asked Questions

Analyze common user questions about the Aircraft Fuel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand growth in the Aircraft Fuel Market?

The primary driver is the sustained recovery and long-term projected growth of global commercial air passenger traffic, particularly within high-growth developing economies in the Asia Pacific region, coupled with expansion in global e-commerce necessitating increased air cargo capacity.

How significant is Sustainable Aviation Fuel (SAF) currently, and what is its growth trajectory?

While SAF currently constitutes less than 1% of total jet fuel consumption, it is the fastest-growing segment. Regulatory mandates in Europe and strong governmental incentives in North America are positioning SAF for exponential adoption, potentially reaching 10-20% penetration in key regions by 2035, driven by HEFA and emerging Power-to-Liquid technologies.

What are the main risks associated with the Aircraft Fuel supply chain?

The chief risks include extreme volatility in crude oil pricing driven by geopolitical instability and OPEC+ decisions, infrastructure challenges related to scaling SAF logistics (pipeline compatibility and storage), and regulatory uncertainty concerning global carbon taxation and blending mandates.

Which geographical region is leading the innovation and regulatory adoption of low-carbon fuels?

Europe is leading in regulatory adoption through mandatory blending quotas (ReFuelEU Aviation), creating a pull market for SAF. North America, however, leads in fiscal incentives and production scaling capabilities, utilizing frameworks like the U.S. Inflation Reduction Act to drive technological deployment.

What is the difference between Jet A-1 and Aviation Gasoline (Avgas), and their primary applications?

Jet A-1 is a kerosene-based fuel used predominantly in turbine engines for commercial, cargo, and military aircraft (fixed-wing and rotary). Avgas is gasoline-based (similar to high-octane automotive fuel) used exclusively in piston-engine aircraft, typically found in the smaller general aviation sector.

How does AI contribute to improving efficiency within the Aircraft Fuel Market?

AI significantly contributes by optimizing flight planning (dynamic route optimization to reduce distance), enhancing supply chain logistics (predictive demand forecasting at hubs), and improving refining efficiency by fine-tuning catalytic processes, ultimately minimizing overall fuel consumption and cost.

What technological pathways are most utilized for commercial SAF production today?

The most mature and commercially deployed technological pathway today is Hydroprocessed Esters and Fatty Acids (HEFA), which converts fats, oils, and greases (FOGs) into certified drop-in jet fuel. Emerging pathways like Alcohol-to-Jet (AtJ) and Power-to-Liquids (PtL) are gaining traction for long-term scalability.

How does the military sector influence demand for aircraft fuel?

The military sector provides a stable, high-volume demand base, requiring specific, high-performance fuels (e.g., JP-8) with stringent specifications and an emphasis on security of supply and strategic redundancy. Their procurement cycles are long-term and generally resilient to short-term commercial market fluctuations.

What role do pipeline networks play in the distribution of aircraft fuel?

Pipeline networks are the most efficient and cost-effective method for bulk transport of jet fuel from refineries to airport tank farms and major distribution hubs. Expansion and maintenance of this specialized infrastructure are critical, particularly for future compatibility with SAF blends.

What is the estimated market size for the Aircraft Fuel Market by 2033?

The Aircraft Fuel Market is projected to reach an estimated value of USD 266.0 Billion by the end of the forecast period in 2033, reflecting a robust Compound Annual Growth Rate (CAGR) driven by global air travel expansion.

How is the concept of 'net-zero 2050' impacting procurement strategies for airlines?

The net-zero 2050 commitment requires airlines to aggressively integrate SAF into their operational fuel mix, shifting procurement focus from purely cost-based buying to long-term partnerships with SAF producers, involving pre-purchase agreements and significant investment in new generation aircraft capable of optimized fuel burn.

What are the challenges associated with the scale-up of Power-to-Liquids (PtL) technology?

The main challenges for PtL include the extremely high capital expenditure required for synthesis plants, the current high energy input requirement (making it non-cost-competitive), and ensuring a consistent, massive supply of truly renewable electricity and captured CO2 feedstock.

Which type of aircraft fuel is expected to see the highest growth rate?

Sustainable Aviation Fuel (SAF) is unequivocally expected to register the highest growth rate during the forecast period, driven by global mandatory blending requirements and corporate sustainability targets across the commercial aviation sector.

What are the key components of the downstream segment of the aircraft fuel value chain?

The downstream segment includes airport tank farm storage, specialized hydrant fueling systems, mobile refueling vehicles (bowsers), rigorous quality control and filtration processes, and the final wing-tip delivery to the aircraft.

How is the demand for Avgas changing in the global market?

Demand for traditional Avgas (100LL, leaded) is declining as environmental regulations push for unleaded alternatives. The market is actively researching and certifying new unleaded Avgas formulations to support piston-engine aircraft while phasing out lead content.

What factors contribute to the regional dominance of the Asia Pacific market?

Dominance is attributed to rapid urbanization, the emergence of substantial middle-class populations leading to unprecedented demand for air travel, and heavy government investment in expanding air travel infrastructure, including new airports and fleet modernization programs.

How do hedging strategies mitigate risks for airlines in this market?

Fuel hedging strategies, utilizing futures contracts, options, and swaps, allow airlines to lock in predictable fuel costs for future consumption, minimizing exposure to the inherent volatility of crude oil prices and ensuring more stable operational budgeting.

Describe the role of independent refiners versus integrated oil majors in the market.

Integrated oil majors (e.g., ExxonMobil, Shell) control the entire value chain from crude extraction to wing-tip delivery and often lead SAF research. Independent refiners (e.g., Valero, PBF) focus primarily on the midstream processing and wholesale supply of refined products, including jet fuel, to major distributors and airlines.

What is the impact of geopolitical instability on aircraft fuel prices?

Geopolitical instability, particularly conflicts or trade disruptions in major oil-producing regions (e.g., the Middle East, Eastern Europe), immediately increases crude oil costs, disrupts shipping routes, and injects significant risk premium into refined jet fuel prices due to perceived supply scarcity and heightened uncertainty.

Which segment, commercial or military, is more price-sensitive?

Commercial aviation is significantly more price-sensitive, as fuel typically accounts for 25% to 40% of an airline's operational expenditure, making marginal cost differences critical for profitability. Military procurement, while cost-conscious, prioritizes performance and assured supply over short-term price optimization.

How is carbon emission tracking managed in the modern aircraft fuel supply chain?

Advanced digital platforms and sometimes blockchain technology are employed to track the origin of the feedstock, the pathway used for production, and the certified lifecycle emission reduction of SAF batches, providing auditable data for airlines to comply with jurisdictional reporting schemes like CORSIA or ReFuelEU.

What are the current limitations of feedstock supply for Sustainable Aviation Fuel?

Current limitations include the finite availability of scalable, truly sustainable waste fats, oils, and greases (FOGs), competition for agricultural land if crop-based feedstocks are used, and the high cost and logistical complexity of sourcing and aggregating diverse biomass materials for large-scale conversion.

What key attributes make Jet Fuel (Jet A-1) suitable for aviation use?

Key attributes include high energy density per unit mass, a low freezing point (critical for high-altitude flight), good thermal stability to withstand engine heat, and reliable fluidity at low temperatures, ensuring safe and efficient operation across global routes.

How are government tax credits influencing the market in North America?

Government tax credits, such as those provided by the U.S. Inflation Reduction Act (IRA) for SAF production and blending, significantly reduce the economic cost gap between conventional jet fuel and SAF, accelerating investment in domestic production capacity and encouraging broader market uptake by lowering procurement costs for airlines.

What is the primary objective of implementing fuel additives in aircraft fuel?

Fuel additives are primarily used to enhance safety and performance, fulfilling roles such as anti-icing (preventing water crystallization), anti-static (reducing spark risk during fueling), corrosion inhibition, and improving the thermal stability of the fuel under extreme operational temperatures.

What impact does fleet modernization have on overall fuel consumption?

Fleet modernization, involving the introduction of newer generation aircraft like the A320neo or 787 Dreamliner, generally leads to a reduction in fuel burn per passenger kilometer (better efficiency). While this reduces overall fuel demand per flight, the continuous increase in flight volumes often offsets these individual efficiency gains on a macro level.

Define the Upstream activities for traditional jet fuel production.

Upstream activities involve the exploration, drilling, extraction, and initial transportation (via pipeline or tanker) of crude oil from the production site (wellhead) to the refinery gate, defining the raw material supply and fundamental cost base.

Why is the quality control process so rigorous in aircraft fuel distribution?

The process is rigorous because fuel quality directly impacts flight safety. Contamination (water, particulates, microbiological growth) or incorrect specifications (e.g., incorrect flash point or freezing point) can lead to catastrophic engine failure or operational issues, mandating stringent testing at multiple points in the supply chain.

What are the competitive advantages of an integrated oil major in this market?

Integrated oil majors benefit from vertical integration, controlling resource extraction, refining, logistics, and distribution, which allows for robust supply assurance, superior cost management, and the flexibility to rapidly deploy capital into new, high-growth areas like large-scale SAF production.

How does the shift to Sustainable Aviation Fuel affect airport infrastructure requirements?

The SAF shift necessitates modifications to existing airport infrastructure, including new storage tanks and dedicated pipelines/blending facilities capable of handling various certified SAF blends, ensuring compatibility with existing systems while preventing cross-contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aircraft Fuel System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Aircraft Fuel Pumps Market Statistics 2025 Analysis By Application (Commercial Aviation, Military Aviation, Business and General Aviation), By Type (Dynamically Responsive Fuel Pumps, Fuel Transfer Pump, Fuel Booster Pump), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aircraft Fuel Tanks Market Statistics 2025 Analysis By Application (Civil, Military), By Type (Flexible Tank, Rigid Tank), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aircraft Fuel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Avgas, Jet Fuel), By Application (Military, Civil), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Aircraft Fuel Tanks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Internal Tanks, External Tanks), By Application (Military, Civilian), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager