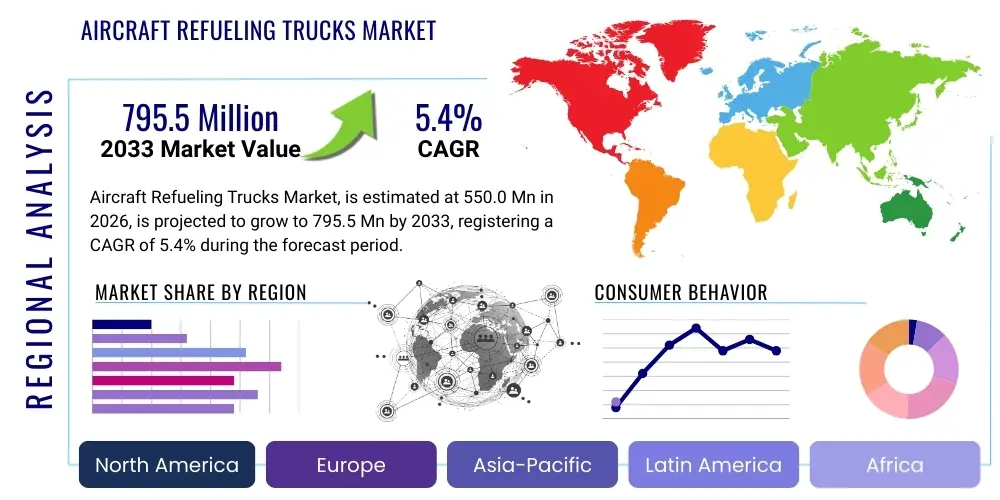

Aircraft Refueling Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443652 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Aircraft Refueling Trucks Market Size

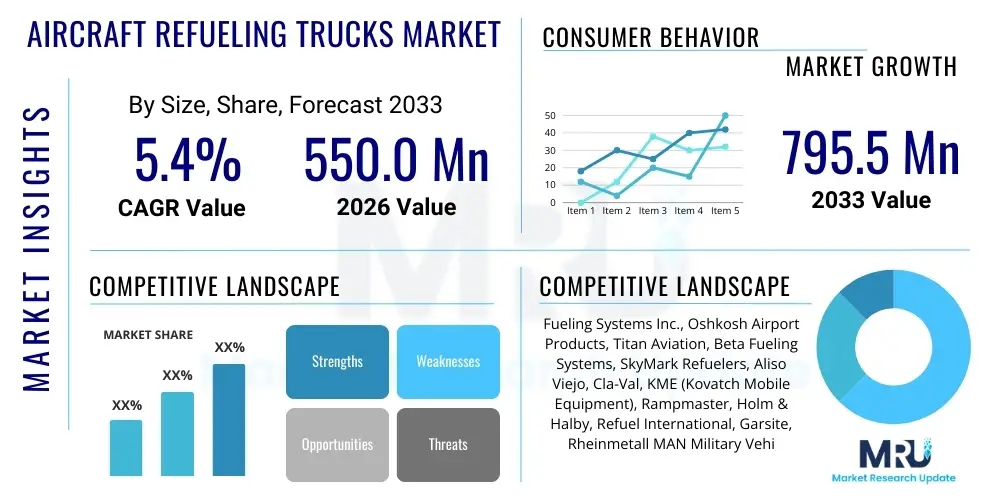

The Aircraft Refueling Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2026 and 2033. The market is estimated at $550.0 Million in 2026 and is projected to reach $795.5 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the persistent expansion of global commercial aviation, coupled with significant investments in upgrading aging airport infrastructure, particularly across emerging economies in the Asia Pacific region. The necessity for advanced, high-capacity refueling equipment that complies with stringent international safety and environmental regulations is a core factor driving market valuation upward over the forecast horizon.

The valuation reflects the increasing demand for specialized ground support equipment (GSE) capable of handling different fuel types, including traditional Jet A/A-1 and the burgeoning Sustainable Aviation Fuel (SAF). Modern refueling trucks are integral to efficient airport operations, minimizing turnaround times and ensuring fuel quality integrity. The market’s size is influenced not only by new truck procurements but also by the aftermarket maintenance, repair, and overhaul (MRO) services associated with these complex vehicle systems, which often require scheduled replacements of filters, pumps, and metering units to maintain operational safety standards.

Aircraft Refueling Trucks Market introduction

The Aircraft Refueling Trucks Market encompasses the design, manufacturing, distribution, and maintenance of specialized heavy-duty vehicles engineered for the safe and precise delivery of aviation fuel (kerosene-based or SAF) from bulk storage facilities to aircraft at airports and military installations worldwide. These vehicles, often referred to as fuel bowsers or dispensers, are critical components of airport ground support infrastructure, ensuring timely and compliant fueling operations essential for maintaining flight schedules. They incorporate sophisticated pumping systems, advanced filtration apparatus, precise metering devices, and multiple interlocking safety mechanisms to prevent spills, contamination, and operational errors, adhering strictly to global aviation safety standards set by organizations like the IATA and Joint Inspection Group (JIG).

Major applications of aircraft refueling trucks span across commercial airports serving passenger and cargo traffic, dedicated military air bases requiring rapid deployment capabilities, and general aviation fields catering to smaller private or corporate aircraft. The spectrum of products ranges from small capacity (under 10,000 liters) trucks used for smaller regional jets and helicopters to massive semi-trailer or articulated refuelers (over 60,000 liters) designed for wide-body aircraft such as the Boeing 777 or Airbus A380. Key benefits derived from modern refueling trucks include enhanced operational efficiency due to faster pumping rates, superior fuel quality assurance through multi-stage filtration, and improved occupational safety measures integrated into the vehicle design, such as deadman controls and automated pressure regulation systems.

Driving factors for this specialized market include the consistent growth in global air passenger traffic, leading to increased flight frequencies and higher fuel throughput requirements at major hubs. Furthermore, the mandatory replacement cycles for aging fleet vehicles, stringent environmental directives pushing for lower emissions from GSE (favoring electric or hybrid models), and the geopolitical necessity for military fleet modernization significantly contribute to market momentum. The development of next-generation aircraft requiring larger fuel loads and the global transition towards adopting SAF necessitate specialized truck designs capable of handling varying fuel viscosities and densities, ensuring market resilience and continuous innovation.

Aircraft Refueling Trucks Market Executive Summary

The Aircraft Refueling Trucks Market is experiencing a pivotal shift driven by sustainability mandates and technological integration, positioning manufacturers to focus on delivering high-efficiency, low-emission solutions. Business trends indicate a strong move towards modular designs that facilitate easier maintenance and component replacement, alongside an increased appetite for integrated telematics and fleet management systems that provide real-time data on fuel consumption, truck location, and maintenance status. Leading manufacturers are investing heavily in material science to produce lighter, more durable tanks, improving payload capacity and fuel efficiency. Furthermore, strategic mergers and acquisitions among regional providers are consolidating market presence, allowing for better access to global distribution networks and technology sharing, particularly in emerging Asian markets.

Regional trends clearly delineate the Asia Pacific (APAC) region as the fastest-growing market, propelled by massive investments in new airport construction and the expansion of domestic and international carrier fleets, particularly in China and India. North America and Europe, while mature, are characterized by high replacement demand for compliance with strict environmental regulations (e.g., Euro 6 standards and EPA mandates), favoring the adoption of electric and hybrid refueling trucks. Conversely, Latin America and the Middle East continue to prioritize capacity and ruggedness, often requiring highly customized truck solutions due to extreme climate variations and dispersed operational sites, reflecting ongoing infrastructure development linked to global logistics hubs.

Segment trends underscore the rising preference for high-capacity refueling trucks (over 30,000 liters) driven by the prevalence of large-body aircraft used in long-haul routes, particularly in major international airports. In terms of technology, the electrically powered segment is gaining traction, albeit slowly, due to challenges related to battery range and charging infrastructure at large airfields, yet represents the key long-term growth opportunity. The military application segment maintains stable demand, driven by fixed governmental procurement cycles focused on tactical mobility and compliance with specialized NATO or equivalent defense fuel standards, demanding specialized filtration and ruggedized components distinct from commercial requirements.

AI Impact Analysis on Aircraft Refueling Trucks Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Aircraft Refueling Trucks Market reveals a strong focus on operational efficiency, safety enhancement, and predictive maintenance capabilities. Users frequently inquire about the feasibility of implementing AI for optimizing refueling schedules and vehicle routing across sprawling airport campuses to minimize idle time and fuel consumption (of the truck itself). Key concerns revolve around the cybersecurity implications of connecting refueling systems to central airport networks and the regulatory hurdles associated with autonomous refueling procedures. Furthermore, there is significant interest in how AI-driven diagnostics can predict failures in critical components like pumps, meters, and filtration units, thereby reducing costly unexpected downtime and ensuring compliance with stringent safety checks.

The central themes emerging from user inquiries highlight an expectation that AI will transition refueling operations from reactive maintenance schedules to proactive, data-driven systems. Users anticipate that machine learning algorithms will be deployed to analyze real-time sensor data from the truck's various sub-systems—including pressure, flow rate, and temperature—to assess the health of the equipment. This transition is expected to drastically improve overall asset utilization. While fully autonomous refueling is considered a long-term goal, the immediate expectation is for AI to assist human operators through advanced decision support systems, optimizing truck deployment based on live flight schedules, gate availability, and fuel inventory levels, significantly enhancing the efficiency of the entire ground handling ecosystem.

The industry is actively exploring AI integration, recognizing its potential to address labor shortages and increase the accuracy of fuel delivery, mitigating human error which is a significant safety risk in fueling operations. The market is thus shifting towards 'smart' refueling trucks equipped with edge computing capabilities to process data locally before transmitting critical metrics. This advancement is essential for maintaining the high levels of safety and precision demanded in aviation environments, particularly concerning quality control and preventing fuel cross-contamination, which AI monitoring systems are uniquely positioned to manage by analyzing subtle operational anomalies during the refueling process.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast potential failures in pumps, hoses, and filtration units, minimizing unplanned service interruptions.

- Optimized Fleet Routing and Scheduling: Machine learning algorithms determine the most efficient paths for trucks across the airfield, reducing travel time and fuel consumption.

- Autonomous Guided Vehicles (AGV) Integration: Long-term potential for semi-autonomous refueling operations, relying on AI for precise positioning and safety interlock activation.

- Enhanced Safety Monitoring: AI systems continuously monitor operational parameters (pressure, flow rate) against established norms, instantly flagging deviations that could indicate a safety breach or equipment malfunction.

- Fuel Quality Assurance: AI algorithms analyze fuel sample data and sensor readings to detect contamination or variances in density in real time during transfer.

DRO & Impact Forces Of Aircraft Refueling Trucks Market

The dynamics of the Aircraft Refueling Trucks Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting as powerful Impact Forces influencing strategic decision-making and investment cycles. Primary drivers include the relentless expansion of global air travel, particularly in emerging economies leading to infrastructural development and increased demand for new or replacement GSE. The regulatory pressure for higher safety standards, such as those mandated by the JIG, necessitates the periodic upgrade or replacement of older trucks with modern units featuring advanced safety interlocks, metering precision, and sophisticated filtration systems. Furthermore, the global military aircraft modernization programs consistently generate steady demand for specialized, ruggedized refueling capabilities crucial for defense logistics.

However, the market faces significant restraints. The exceptionally high initial capital investment required for purchasing modern, compliant refueling trucks acts as a barrier, especially for smaller airport operators or regional fuel suppliers. Furthermore, the operational environment is burdened by exceedingly strict regulatory compliance requirements regarding hazardous materials handling, emissions, and fire safety, which drives up complexity and manufacturing costs. The shortage of highly skilled technicians capable of maintaining and repairing these complex hydraulic, electronic, and mechanical systems poses an ongoing operational restraint, impacting fleet uptime and efficiency, particularly in remote or less developed regions.

Opportunities for growth are largely centered around technological innovation and sustainability mandates. The accelerating adoption of Sustainable Aviation Fuels (SAF) presents a market opportunity for specialized trucks designed to handle the slightly different physical characteristics of these fuels while ensuring strict segregation and quality control. The transition towards electrification and alternative power sources (e.g., hybrid and battery-electric refueling vehicles) offers a pathway for manufacturers to meet increasingly stringent airport emission goals. Finally, the integration of IoT, telematics, and AI in fleet management creates opportunities for service providers to offer value-added solutions centered on predictive diagnostics and optimized operational scheduling, enhancing the overall lifecycle profitability of the equipment.

Segmentation Analysis

The Aircraft Refueling Trucks Market is systematically segmented based on various technical and application characteristics, enabling a granular understanding of purchasing behaviors and technological priorities across different end-user groups. Segmentation by capacity is crucial as it directly correlates with the type of aircraft serviced, ranging from smaller regional jets requiring limited volume deliveries to wide-body transcontinental aircraft demanding high-flow, high-volume refueling. The segmentation based on Tank Type distinguishes between rigid trucks, which utilize a single chassis for the tank, and semi-trailer/articulated units, offering significantly higher capacities suitable for hub airports. Understanding these distinct segments is vital for manufacturers tailoring product specifications to meet specialized operational demands, such as maneuverability in congested airports or extended range at large military bases.

Further segmentation by Application—Commercial, Military, and General Aviation—reflects the differing procurement cycles, performance requirements, and regulatory adherence. The commercial segment is driven by efficiency and cost of ownership, while the military segment prioritizes ruggedization, tactical mobility, and compliance with defense fuel standards (e.g., ability to handle specialized military jet fuels). The General Aviation segment, though smaller, requires flexibility and lower capacity units. This multi-layered segmentation analysis helps in identifying niche market demands, such as the growing requirement for high-throughput defueling capabilities and the regional differences in adoption rates of advanced safety features like electronic grounding systems and overfill protection mechanisms.

- By Capacity

- Small Capacity (Under 10,000 Liters)

- Medium Capacity (10,000 – 30,000 Liters)

- High Capacity (Over 30,000 Liters)

- By Tank Type

- Rigid Refuelers

- Semi-Trailer Refuelers

- By Chassis Type

- Conventional Chassis

- Custom/Dedicated Chassis

- By Power Source

- Diesel/Gasoline Powered

- Electric/Hybrid Powered

- Alternative Fuel Powered (e.g., CNG, Hydrogen)

- By Application

- Commercial Aviation (Passenger & Cargo)

- Military Aviation

- General Aviation

- By Technology

- Conventional Pumping Systems

- Automated/Smart Refueling Systems (with telematics)

Value Chain Analysis For Aircraft Refueling Trucks Market

The Value Chain for the Aircraft Refueling Trucks Market begins with the Upstream component suppliers, encompassing the procurement of foundational materials and complex system components. This stage involves sourcing heavy-duty commercial chassis (often from major truck manufacturers like Volvo, Mercedes, or PACCAR), specialized aluminum or stainless steel alloys for the fuel tanks (requiring welding expertise to meet pressure vessel standards), and critical fluid transfer equipment such as high-precision metering devices, pumps, filtration units, and specialized hoses designed for aviation fuel compatibility and high pressure. The quality and traceability of these upstream components are paramount, as they directly influence the safety and longevity of the final product, demanding strict vetting of suppliers for compliance with aerospace and hazardous goods standards.

The Midstream phase involves the core manufacturing and integration processes, where the specialized bodywork, fuel storage tanks, pumping machinery, and safety systems are integrated onto the commercial chassis. This stage requires highly specialized engineering expertise to ensure compliance with fuel handling regulations (e.g., NFPA, API) and local roadworthiness standards. Key activities include precise tank calibration, installation of sophisticated electronic control systems, safety interlocking mechanisms, and rigorous hydrostatic testing. Distribution channels then move the finished product to the end-user. Direct distribution, involving manufacturers selling directly to major airlines or national defense departments, is common for high-value contracts and customized units, offering closer customer relationship management and tailored aftermarket support. Indirect channels involve regional dealers or specialized GSE leasing companies who manage sales, financing, and localized MRO services for smaller customers or generalized airport tenders.

Downstream activities focus on the operational deployment and sustained maintenance of the refueling trucks. End-users, such as fuel farm operators or airline ground handling divisions, are responsible for daily operations, including ensuring driver training and compliance with fueling protocols. Aftermarket services are a significant component of the value chain, covering scheduled maintenance, emergency repairs, periodic re-certification (required for pressure vessels and metering systems), and technology upgrades (e.g., updating metering software or filtration systems). The entire chain is heavily regulated, meaning compliance auditing and certification processes are constant features, adding complexity and cost but ensuring the absolute safety required in the aviation environment.

Aircraft Refueling Trucks Market Potential Customers

The primary potential customers and end-users of aircraft refueling trucks are diverse organizations whose core operations rely on reliable and timely aviation fuel delivery. Commercial Airport Fuel Operators, often entities independent of the airport authority (such as Joint Ventures like Airport Fuel Consortiums or specialized subsidiaries of major oil companies like Shell, ExxonMobil, or BP), constitute the largest purchasing group. These operators require a mixed fleet ranging from high-capacity semi-trailers for large international hubs to medium-capacity rigid units for regional terminals. Their purchasing decisions are driven by fleet age, optimization targets, and stringent requirements for fuel quality control and environmental compliance, demanding features like automated product segregation and advanced leak detection systems.

National Defense Departments and Military Air Bases represent another critical customer segment. These governmental bodies procure trucks under specific, long-term contracts, prioritizing ruggedness, off-road capability (in tactical environments), and adherence to military specifications (MIL-SPEC). Unlike commercial users, military procurement cycles are often rigid and tied to budget allocations and strategic fleet replacement programs, focusing on durability and specialized features such as Chemical, Biological, Radiological, and Nuclear (CBRN) compatibility or rapid deployment readiness. The demand here is less sensitive to immediate economic fluctuations but highly dependent on geopolitical stability and defense spending trends, often requiring higher levels of customization regarding pump redundancy and power sources.

Furthermore, major international airlines with extensive ground handling operations and large cargo carriers may purchase or lease their own dedicated refueling fleet, although this is less common than relying on centralized airport fueling services. Lastly, specialized Ground Support Equipment (GSE) Leasing and Rental Companies form a growing customer base, providing operational flexibility to airports and smaller regional carriers without requiring massive upfront capital expenditure. These leasing companies require versatile, standardized truck models that are easy to maintain and comply with a wide range of operational standards across different airport locations, demanding high reliability and broad aftermarket support from the original equipment manufacturer (OEM).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.0 Million |

| Market Forecast in 2033 | $795.5 Million |

| Growth Rate | 5.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fueling Systems Inc., Oshkosh Airport Products, Titan Aviation, Beta Fueling Systems, SkyMark Refuelers, Aliso Viejo, Cla-Val, KME (Kovatch Mobile Equipment), Rampmaster, Holm & Halby, Refuel International, Garsite, Rheinmetall MAN Military Vehicles, HDT Global, Fort Vale Engineering, Flowserve Corporation, TPL Tanker, Kässbohrer, Westmor Industries, and VSE Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Refueling Trucks Market Key Technology Landscape

The technology landscape of the Aircraft Refueling Trucks Market is rapidly evolving, driven by the need for increased safety, precision, and environmental compliance. A core technological focus revolves around the sophistication of the metering and filtration systems. Modern trucks incorporate high-precision electronic metering devices, often utilizing Coriolis flowmeters, which offer superior accuracy in measuring mass flow regardless of temperature or density changes, a critical feature for managing different grades of aviation fuel and the complex characteristics of SAF blends. Simultaneously, filtration technology is becoming increasingly specialized, moving beyond basic coalescers to advanced micro-filtration and clay treatment systems designed to remove particulate matter and surfactants, ensuring that fuel delivered to the aircraft meets the extremely high cleanliness standards mandated by original equipment manufacturers (OEMs) and regulatory bodies.

Another crucial technological advancement is the integration of advanced safety interlocks and electronic control systems. These systems utilize programmable logic controllers (PLCs) to manage the entire fueling operation, ensuring that critical safety steps—such as mandatory grounding, pressure regulation, and overfill prevention—are automatically verified and maintained before, during, and after fuel transfer. Modern trucks feature 'deadman' systems and high-response pressure control valves that automatically shut down fuel flow instantaneously upon detecting abnormal conditions or operator incapacitation, drastically reducing the risk of hazardous spills or aircraft damage due to excessive pressure. These integrated electronic systems also facilitate real-time diagnostics, simplifying troubleshooting and minimizing the need for manual checks.

The most transformative trend in the technology landscape is the push toward sustainable power sources and connectivity. While diesel remains dominant, manufacturers are aggressively developing electric and hybrid refueling trucks, particularly for use within heavily regulated environments like European and North American airports aiming for carbon neutrality. These electric trucks utilize high-density battery packs to power both the chassis movement and the pumping system, requiring specialized battery management systems and robust thermal protection. Furthermore, the integration of telematics and IoT devices allows for remote monitoring of truck performance, fuel inventory, and maintenance requirements. This connectivity facilitates proactive fleet management, optimizing deployment and maximizing asset utilization across complex, high-throughput airport operations.

Regional Highlights

The global Aircraft Refueling Trucks market exhibits distinct regional dynamics influenced by varying levels of air traffic growth, infrastructure investment, and environmental regulations. North America, characterized by mature aviation infrastructure and high operational standards, represents a significant market for both replacement and advanced technology adoption. The demand here is driven by the need to upgrade existing fleets to meet strict EPA emission standards and incorporate modern safety technology, such as advanced vapor recovery systems and sophisticated electronic dispensing controls. Major carriers and large fueling consortia in the US and Canada focus procurement on high-capacity refuelers suitable for the heavy international traffic handled by major hubs like Atlanta, Chicago, and Dallas. Market saturation leads to sustained but steady demand, often leaning towards long-term maintenance and service contracts.

Europe mirrors North America in terms of regulatory rigor, with the primary market impulse being the shift toward electric and hybrid refueling solutions to comply with stringent European Union emission targets and airport-specific carbon reduction mandates. Airports such as Amsterdam Schiphol and Frankfurt are pioneering the adoption of low-emission GSE, pushing manufacturers to innovate in battery technology and operational efficiency. The European market, while fragmented due to varying national standards, prioritizes advanced safety features and precision metering systems to ensure compliance with the Joint Inspection Group (JIG) standards, which are highly influential across the continent. Procurement decisions are increasingly weighed against the total cost of ownership (TCO) over the vehicle's lifespan, favoring durability and energy efficiency.

Asia Pacific (APAC) stands out as the fastest-growing region globally, fueled by massive government investments in new airport development (e.g., in China, India, and Southeast Asia) and the rapid expansion of middle-class air travel. This region demands high volumes of new trucks, often requiring high-capacity units to support the exponential growth in both passenger and cargo traffic. While initial procurement decisions may be driven by lower acquisition costs, there is a growing recognition of the necessity for modern, reliable systems to maintain high operational standards at new mega-hubs. Japan and Australia, being technologically advanced markets within APAC, lead the adoption of sophisticated safety and automation features, setting a benchmark for the rest of the region, which is currently focused on sheer fleet expansion capacity.

Latin America presents a market characterized by volatility and localized demand, driven primarily by infrastructure projects aimed at improving connectivity and modernizing outdated facilities in countries like Brazil and Mexico. Procurement cycles can be lengthy, heavily influenced by currency stability and government budgeting for state-owned airport infrastructure. The demand often focuses on rugged, reliable diesel-powered units capable of handling diverse environmental conditions and fuel quality issues prevalent across the region. Maintenance and spare parts availability are critical purchasing factors, often leading to preference for manufacturers with strong regional support networks.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, exhibits strong demand driven by the development of massive international transit hubs (e.g., Dubai, Doha, and Riyadh) and significant military investment. The procurement emphasis is on high-throughput, customized refueling trucks designed to operate effectively in extreme heat conditions while maintaining large fuel capacities essential for servicing international wide-body fleets. Africa, meanwhile, presents a disparate market, with demand concentrated in major economic centers and oil-producing nations, often requiring robust, easily maintainable equipment suitable for less developed infrastructure and challenging operating environments.

- North America: Focus on regulatory compliance (EPA, CARB) and replacement of aging fleets; high demand for integrated safety systems and telematics.

- Europe: Driven by strict environmental mandates (EU regulations); pioneering adoption of electric and hybrid refueling trucks.

- Asia Pacific (APAC): Highest growth region due to new airport construction and rapid fleet expansion in China, India, and Southeast Asia; increasing integration of automated systems.

- Middle East & Africa (MEA): Demand for high-capacity, heavy-duty trucks optimized for extreme heat; significant military sector procurement in the GCC.

- Latin America: Focus on cost-effectiveness and rugged design; slow but steady replacement demand linked to infrastructural upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Refueling Trucks Market.- Fueling Systems Inc.

- Oshkosh Airport Products

- Titan Aviation

- Beta Fueling Systems

- SkyMark Refuelers

- Garsite

- KME (Kovatch Mobile Equipment)

- Rampmaster

- Aliso Viejo

- Cla-Val

- Holm & Halby

- Refuel International

- Rheinmetall MAN Military Vehicles

- HDT Global

- Fort Vale Engineering

- Flowserve Corporation

- TPL Tanker

- Kässbohrer

- Westmor Industries

- VSE Corporation

Frequently Asked Questions

Analyze common user questions about the Aircraft Refueling Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-capacity aircraft refueling trucks?

The primary factor is the increasing number of wide-body aircraft (e.g., A380, B777, B747) operating long-haul international routes, requiring single, high-volume fuel loads delivered efficiently to minimize aircraft turnaround time at major global hubs.

How are environmental regulations impacting the design and procurement of new refueling trucks?

Environmental regulations, particularly in Europe and North America, mandate lower emissions from ground support equipment, accelerating the market shift toward developing and adopting electric, hybrid, and alternative fuel (e.g., CNG) powered refueling trucks to reduce airport carbon footprints.

What role does automation or AI play in modern aircraft refueling operations?

Automation and AI primarily enhance safety and operational efficiency through predictive maintenance diagnostics, optimized fleet scheduling and routing, and advanced safety interlocks that ensure precise pressure control and prevent human error during the complex fueling sequence.

What is Sustainable Aviation Fuel (SAF) and how does it affect truck technology requirements?

SAF is aviation fuel derived from sustainable sources (like biomass or waste oils). Its adoption requires modern refueling trucks to incorporate updated filtration and metering systems capable of handling varying fuel densities and viscosities while maintaining strict product segregation and quality control standards.

Which geographical region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by massive investments in new airport infrastructure development, increasing domestic and international air passenger traffic, and fleet expansion across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager