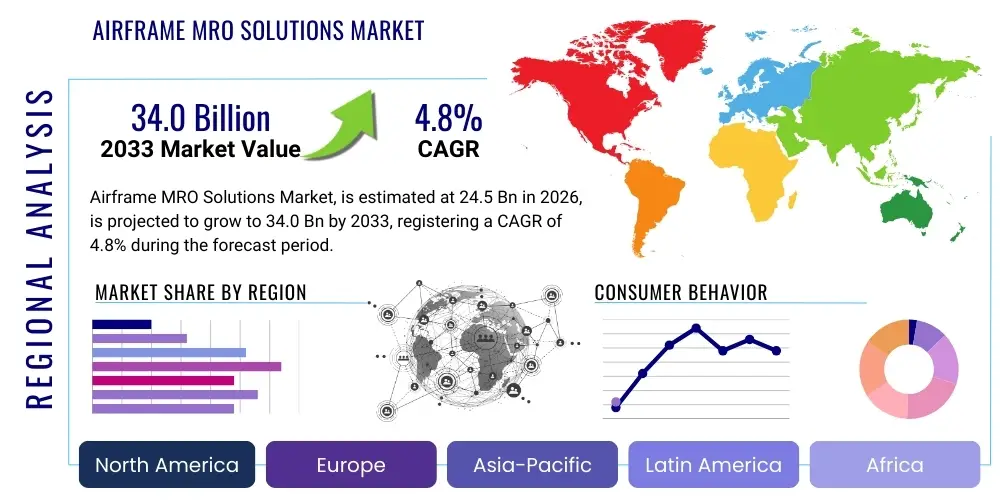

Airframe MRO Solutions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442694 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Airframe MRO Solutions Market Size

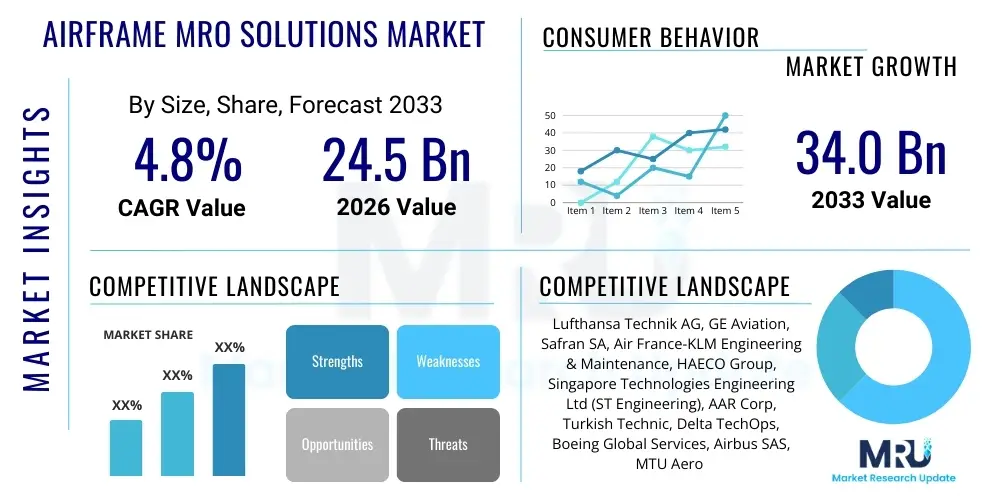

The Airframe MRO Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $34.0 Billion by the end of the forecast period in 2033.

Airframe MRO Solutions Market introduction

The Airframe Maintenance, Repair, and Overhaul (MRO) Solutions Market encompasses the comprehensive services required to ensure the continued airworthiness and operational safety of aircraft airframes throughout their lifespan. These essential services range from routine line maintenance performed during quick turnarounds to complex heavy maintenance checks (C-checks and D-checks) that involve extensive disassembly, inspection, repair, and reassembly of major structural components. The market’s operational landscape is defined by stringent regulatory requirements set forth by bodies such as the FAA and EASA, demanding meticulous adherence to original equipment manufacturer (OEM) specifications and certified repair procedures to maintain flight safety and extend aircraft service life.

Major applications of Airframe MRO solutions are primarily driven by the scheduled maintenance cycles of commercial airlines, cargo operators, and military fleets. These services are critical not only for regulatory compliance but also for optimizing asset utilization and minimizing Aircraft on Ground (AOG) time, which directly impacts operator profitability. Key benefits derived from robust MRO solutions include enhanced aircraft reliability, reduced long-term operational costs through proactive component replacement, and improved fuel efficiency resulting from structural integrity maintenance. Furthermore, the longevity of aging aircraft fleets, particularly in developing regions, continues to create sustained demand for detailed structural inspections and extensive corrosion control procedures, thereby solidifying the necessity of specialized airframe MRO providers.

The market is predominantly driven by the significant expansion of the global commercial aircraft fleet, particularly the continuous deliveries of new-generation, technologically advanced narrow-body and wide-body jets that require specialized tooling and digitally-enabled MRO processes. Additionally, the increasing average age of existing fleets worldwide necessitates more frequent and complex heavy maintenance interventions, acting as a major growth catalyst. Supporting factors include the geopolitical stability driving air travel demand, the expansion of low-cost carriers (LCCs) requiring high fleet utilization, and the constant regulatory pressure to implement new safety mandates, which often require extensive airframe modifications and Service Bulletin (SB) compliance tasks.

Airframe MRO Solutions Market Executive Summary

The Airframe MRO Solutions Market is experiencing a pivotal shift driven by strong business trends focusing on vertical integration and technological adoption. Airlines are increasingly relying on sophisticated independent MRO providers and OEM service arms to handle heavy maintenance due to high capital expenditure requirements for in-house facilities and specialized skilled labor shortages. The industry trend leans heavily toward digitalization, integrating predictive maintenance powered by AI and machine learning to optimize maintenance scheduling, reducing unscheduled grounding risks, and enhancing operational efficiency across the maintenance ecosystem.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the most substantial growth, fueled by massive fleet expansion driven by burgeoning middle classes, economic growth, and the proliferation of new airport infrastructure, making it the primary focal point for heavy checks and component repairs. Conversely, North America and Europe, while mature, remain dominant centers for high-value modifications, engineering services, and the implementation of advanced digital twin technologies for airframe structural health monitoring. Regulatory harmonization efforts, particularly regarding certification and standards across major aviation hubs, are further shaping cross-regional service delivery models.

Segment trends highlight the dominance of heavy maintenance checks (D-checks) and structural modifications, which command the highest revenue share due to their complexity, duration, and reliance on highly specialized labor and tooling. Narrow-body aircraft MRO remains the largest segment volume-wise, reflecting the sheer number of Boeing 737 and Airbus A320 family aircraft in service globally, while the Wide-body segment drives high-value contracts. Furthermore, the market is seeing increased emphasis on composite material repair capabilities, necessitating significant investment in new repair techniques and specialized curing facilities among leading MRO providers.

AI Impact Analysis on Airframe MRO Solutions Market

Common user questions regarding AI’s influence on the Airframe MRO market typically center on its practical application in defect detection, predictive scheduling accuracy, and optimizing the massive amounts of sensor data generated by modern aircraft. Users frequently inquire about the reliability of AI-driven non-destructive testing (NDT) techniques, the required infrastructure investment for deployment, and the extent to which AI can truly reduce unplanned maintenance costs and labor hours. There is also significant concern regarding data privacy, cybersecurity risks associated with networked aircraft systems, and the retraining requirements for MRO technicians who will transition from traditional inspection methods to AI-augmented decision support systems, highlighting a desire for demonstrable ROI and robust ethical frameworks.

- Predictive Maintenance Optimization: AI algorithms analyze real-time flight data, engine parameters, and structural stress readings to forecast component failure probabilities, allowing MRO providers to shift from fixed calendar-based maintenance to condition-based interventions, thus maximizing aircraft availability.

- Automated Inspection Systems: Integration of computer vision and machine learning with drone or robotic inspection systems allows for faster, more precise detection of airframe defects, such as minor corrosion, stress cracks, or paint damage, far beyond human visual capability, significantly speeding up complex checks.

- Supply Chain Efficiency: AI optimizes inventory management for critical airframe parts (e.g., fuselage panels, wing spars, landing gear components) by predicting demand fluctuations based on maintenance schedules and fleet age profiles, minimizing warehousing costs and reducing lead times for critical AOG events.

- Maintenance Documentation and Compliance: Natural Language Processing (NLP) is used to rapidly parse and structure vast libraries of maintenance manuals, Service Bulletins, and regulatory updates, ensuring technicians have immediate access to the most current, relevant procedures, enhancing compliance and reducing administrative burden.

- Digital Twin Simulation: AI feeds into digital twin models of specific aircraft tail numbers, simulating the effects of operational stress, environmental exposure, and proposed modifications on airframe integrity, enabling proactive structural reinforcement strategies and validating complex repairs before physical implementation.

DRO & Impact Forces Of Airframe MRO Solutions Market

The Airframe MRO market is defined by a dynamic interplay of driving forces and inherent restraints, balanced against significant opportunities for growth. Key drivers include the global expansion and increasing complexity of the commercial aircraft fleet, particularly the rise of new-generation aircraft built with advanced composite materials demanding specialized MRO skills. Alongside this, regulatory demands for stricter adherence to airworthiness standards and safety mandates necessitate continuous MRO intervention and modification programs, guaranteeing sustained market activity. However, the high capital intensity required for establishing or upgrading MRO facilities, coupled with chronic global shortages of highly skilled, certified MRO technicians, acts as a primary restraining factor, limiting rapid scaling of heavy maintenance capacity.

Significant opportunities are emerging from the integration of Industry 4.0 technologies, specifically the adoption of Augmented Reality (AR) for technician guidance and drone-based automated inspections, which dramatically improve inspection accuracy and reduce turnaround times. The sustained trend toward outsourcing heavy maintenance by airlines, particularly in high-cost regions, presents independent MROs with large contract opportunities, driving consolidation and specialization within the market. Furthermore, the lifecycle management of aging aircraft provides a lucrative niche market for structural repair and modification programs focused on extending service life, particularly within cargo conversion segments.

Impact forces currently shaping the market include high fuel price volatility, which indirectly influences airline profitability and their subsequent budget allocations for non-essential MRO upgrades. Geopolitical instability, leading to trade route disruptions or sanctions on specific aircraft fleets, significantly alters global MRO flow and capacity utilization in affected regions. The market structure is moderately consolidated, where a few global MRO giants and OEMs hold significant pricing power, necessitating that smaller independent providers specialize heavily or focus intensely on regional niche services to remain competitive and mitigate the impact of dominant market forces.

Drivers:

- Global Fleet Expansion: Rapid growth in the commercial aircraft fleet, especially in Asia and the Middle East, requiring scheduled maintenance services.

- Aging Fleet Structure: Increasing average age of aircraft globally necessitates more intensive and frequent heavy maintenance checks (D-checks) and structural repairs.

- Strict Regulatory Requirements: Continuous compliance with stringent global airworthiness directives and safety standards mandated by authorities like FAA and EASA.

- Technological Advancements in Materials: Increased utilization of advanced composite materials in modern airframes demands specialized, high-precision repair techniques and accredited MRO services.

Restraints:

- Shortage of Skilled Labor: A chronic deficit of certified and experienced airframe MRO technicians globally, increasing labor costs and constraining MRO facility capacity.

- High Capital Investment: Requirement for substantial upfront capital expenditure for new MRO facilities, specialized tooling, composite repair shops, and digital infrastructure integration.

- Extended Service Downtime: Heavy maintenance checks require lengthy aircraft grounding, directly impacting airline revenue generation and heightening the cost sensitivity of MRO procurement.

Opportunities:

- Digitalization and Automation: Implementation of robotic inspection, digital work instructions, and condition-based monitoring systems driven by IoT and AI to enhance efficiency.

- Growth in Aircraft Modification Programs: Increasing demand for cabin reconfiguration, system upgrades (e.g., avionics modernization), and freighter conversions, requiring specialized airframe work.

- Focus on Sustainability: MRO services related to fuel efficiency modifications (e.g., winglet installations) and sustainable repair practices (e.g., materials recycling) offer new market avenues.

Segmentation Analysis

The Airframe MRO Solutions Market segmentation provides a crucial framework for understanding the diverse operational requirements and service delivery models within the industry. Services are fundamentally segmented by the type of maintenance activity—ranging from high-frequency, low-duration line maintenance essential for daily operations, to the infrequent yet deep, resource-intensive heavy maintenance (like D-checks) that dictates an aircraft's structural longevity. Segmentation by aircraft type clearly differentiates the MRO needs of narrow-body jets (high volume, standardized procedures) versus wide-body aircraft (complex structures, specialized hangar requirements) and regional jets.

Further granularity is achieved by segmenting based on the provider structure, distinguishing between Original Equipment Manufacturers (OEMs), who hold proprietary technical data and specialized tooling; independent MRO organizations, known for competitive pricing and flexibility; and airline MROs, focused on supporting their parent company fleets but often offering third-party services to utilize excess capacity. This intricate segmentation allows stakeholders to accurately gauge market concentration, predict investment areas, and tailor service offerings to meet specific fleet requirements and geographic operational dynamics, thereby maximizing resource utilization and ensuring optimal compliance with regulatory frameworks worldwide.

- By Service Type:

- Heavy Maintenance (D-Check, Extensive Structural Inspection)

- Line Maintenance (Transit Checks, A-Checks, Minor Repairs)

- Component Repair and Overhaul (Structural components, flight controls)

- Modifications and Upgrades (Cabin reconfigurations, system upgrades)

- By Aircraft Type:

- Narrow-body Aircraft (e.g., A320 Family, B737)

- Wide-body Aircraft (e.g., B787, A350, B777)

- Regional Jets

- Turboprops and General Aviation Aircraft

- By Provider Type:

- Original Equipment Manufacturer (OEM) MRO

- Independent MRO Organizations

- Airline MROs (In-house)

- By End-User:

- Commercial Airlines

- Cargo Operators

- Military and Government Operators

- Leasing Companies

Value Chain Analysis For Airframe MRO Solutions Market

The Airframe MRO value chain is inherently complex, starting with the upstream phase involving critical suppliers. These upstream participants include raw material providers (aluminum alloys, composite materials, specialized coatings), sophisticated tooling manufacturers, and intellectual property holders—primarily the aircraft OEMs who provide the crucial maintenance manuals, engineering drawings, and Service Bulletins necessary for certified repairs. The quality and timeliness of these initial inputs directly dictate the efficiency and regulatory compliance of the core MRO service delivery process. Strong partnerships with specialized component manufacturers and technology vendors providing NDT equipment and digital inspection tools are also foundational to maintaining high service standards.

The core MRO phase involves the execution of maintenance tasks, which can be distributed across various operational models: specialized independent MRO centers focusing exclusively on heavy airframe checks, airline MROs handling their fleet’s line maintenance, and OEM service centers offering high-value proprietary repairs. Distribution channels for these services are generally direct, involving long-term, high-value contracts negotiated directly between the MRO provider and the airline operator or aircraft lessor. Indirect distribution is minimal but occurs when MRO services are bundled as part of a larger asset management or lease agreement provided by third-party financial institutions or specialized brokers who manage a portfolio of aircraft assets requiring scheduled maintenance.

The downstream component of the value chain focuses heavily on the operational feedback loop and continuous improvement. This includes post-maintenance flight testing, the generation of comprehensive compliance documentation required for airworthiness release, and the subsequent integration of maintenance data back into predictive modeling systems. Effective downstream management ensures that the operator receives a fully compliant, airworthy asset efficiently, maximizing the aircraft’s utilization. Furthermore, the handling and certification of used serviceable materials (USM) recovered from retired aircraft, which are often used in repairs, represent a growing segment within the downstream economy, focusing on reducing overall material costs and supporting sustainability goals within the MRO ecosystem.

Airframe MRO Solutions Market Potential Customers

Potential customers for Airframe MRO solutions are overwhelmingly dominated by commercial airline operators, encompassing major flag carriers, regional airlines, and the rapidly expanding segment of low-cost carriers (LCCs). These entities require robust, reliable MRO services to minimize AOG time and ensure the structural integrity and regulatory compliance of their extensive fleets. LCCs, in particular, demand high fleet utilization and rely heavily on optimized line maintenance services and competitively priced heavy check solutions, often preferring outsourced services to avoid large, fixed overhead costs associated with in-house heavy maintenance hangars.

Beyond passenger carriers, major buyers include dedicated air cargo operators, who often utilize older, converted wide-body airframes that necessitate highly specialized and complex structural repairs and anti-corrosion treatments to manage the intense stress associated with frequent high-payload operations. Another significant customer segment comprises aircraft leasing companies, which hold ownership of substantial portions of the global fleet. These lessors require comprehensive MRO oversight and record-keeping to maintain asset residual value and ensure that leased aircraft meet defined return conditions upon contract expiry, often mandating specific MRO providers or requiring adherence to stringent quality assurance protocols for all airframe work performed.

Finally, government and military aviation sectors represent a niche but highly stable market for specialized MRO services. These customers often require highly customized, high-security MRO solutions for specialized airframes, including surveillance, transport, and fighter jets. Military MRO often involves unique requirements such as stealth material repair or complex mission system integration, usually contracted through performance-based logistics (PBL) arrangements, demanding providers with high-level security clearances and specific defense industry certifications. The diversity across these customer segments underscores the need for MRO providers to offer a flexible range of service contracts and technical capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $34.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lufthansa Technik AG, GE Aviation, Safran SA, Air France-KLM Engineering & Maintenance, HAECO Group, Singapore Technologies Engineering Ltd (ST Engineering), AAR Corp, Turkish Technic, Delta TechOps, Boeing Global Services, Airbus SAS, MTU Aero Engines, Chromalloy Gas Turbine Corporation, IAI (Israel Aerospace Industries), SR Technics, MRO Holdings, Spirit AeroSystems, HEICO Corporation, StandardAero, Evergreen Aviation Technologies Corp (EGAT) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airframe MRO Solutions Market Key Technology Landscape

The Airframe MRO market is rapidly transforming through the adoption of cutting-edge technologies aimed at improving efficiency, precision, and minimizing aircraft downtime. A cornerstone of this digital transformation is the integration of predictive analytics and condition monitoring systems. These technologies utilize thousands of sensors embedded in modern airframes (IoT devices) to stream operational performance data. Advanced data processing models, often cloud-based, analyze this telemetry to detect subtle deviations indicative of potential structural or system failures long before they become critical. This proactive approach facilitates true condition-based maintenance, allowing MRO centers to procure necessary parts and schedule labor hours precisely when required, drastically reducing the economic impact of unscheduled maintenance events and optimizing the use of highly expensive hangar space.

Another crucial technological development involves the deployment of robotic and automated inspection systems. Drone technology, equipped with high-resolution cameras, thermal imaging, and laser scanning capabilities, is increasingly used to conduct visual inspections of large airframes, especially for routine line checks and initial damage assessment following an incident. These autonomous systems can complete exterior checks in hours, a fraction of the time required by manual human inspection, while generating precise, geo-referenced digital records of findings. Furthermore, Augmented Reality (AR) and Virtual Reality (VR) tools are revolutionizing technician training and task execution. AR overlays digital work instructions, 3D models, and procedural guidance directly onto the physical airframe component being worked on, minimizing errors, accelerating task completion, and enhancing the productivity of relatively less experienced staff by providing critical real-time visual support during complex disassembly or installation tasks.

The transition toward advanced material repair capabilities also demands technological innovation. As new-generation aircraft heavily incorporate carbon fiber reinforced polymer (CFRP) composites, specialized MRO facilities are investing heavily in automated non-destructive testing (NDT) methodologies such as phased array ultrasonic testing (PAUT) and advanced thermography to ensure the structural integrity of these complex structures without causing further damage. Furthermore, the application of Additive Manufacturing (3D Printing) is gaining traction, particularly for producing non-critical, on-demand replacement parts, specialized tooling, and temporary fixtures used during major airframe repairs. This decentralized manufacturing capability helps mitigate supply chain delays and reduces reliance on distant OEM supply hubs for less complex components, streamlining the entire repair workflow and enhancing service resilience.

Regional Highlights

The geographical distribution of MRO demand and capability is highly varied, reflecting differences in fleet size, economic development, and labor costs. Regional analysis is critical for MRO providers targeting expansion or strategic partnerships.

- Asia Pacific (APAC): This region is characterized by the fastest fleet growth globally, driven by emerging economies like China and India, making it the primary demand center for airframe MRO, especially heavy maintenance. Major hubs like Singapore and Hong Kong maintain high-capacity, advanced MRO infrastructure, serving both regional and international fleets. The region is heavily investing in new large MRO parks to accommodate projected growth, focusing particularly on narrow-body maintenance volume.

- North America: A mature MRO market, dominant in technological innovation, high-value modifications, and defense-related MRO services. North America is characterized by large, integrated airline MROs (e.g., Delta TechOps, American MRO) and leading independent providers. The emphasis here is on digitalization, predictive maintenance integration, and maintaining the structural integrity of a relatively aging fleet alongside managing the entry of new-generation aircraft.

- Europe: This region is a major hub for complex engineering services, engine MRO, and structural modifications. Key players like Lufthansa Technik and Air France-KLM E&M offer comprehensive, high-quality, vertically integrated services. Europe is focusing heavily on regulatory compliance related to sustainability, demanding MRO services for fuel-efficient upgrades and end-of-life aircraft solutions.

- Middle East: Defined by modern, young fleets of wide-body aircraft operated by major long-haul carriers. MRO demand centers around line maintenance, rapid turnarounds, and sophisticated component repair capabilities tailored to the newest generation of wide-body airframes (B777X, A350, B787). Investment is high in state-of-the-art facilities located near major airline hubs (e.g., Dubai, Abu Dhabi).

- Latin America (LATAM) & Middle East & Africa (MEA): These regions present significant opportunities for growth, primarily through outsourcing heavy maintenance to external providers due to limited in-house capacity and expertise. Growth is slower but steady, focusing on supporting regional jet and mid-sized narrow-body fleets, with increasing reliance on specialized component MRO centers established through joint ventures with global players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airframe MRO Solutions Market.- Lufthansa Technik AG

- GE Aviation

- Safran SA

- Air France-KLM Engineering & Maintenance

- HAECO Group

- Singapore Technologies Engineering Ltd (ST Engineering)

- AAR Corp

- Turkish Technic

- Delta TechOps

- Boeing Global Services

- Airbus SAS

- MTU Aero Engines

- Chromalloy Gas Turbine Corporation

- IAI (Israel Aerospace Industries)

- SR Technics

- MRO Holdings

- Spirit AeroSystems

- HEICO Corporation

- StandardAero

- Evergreen Aviation Technologies Corp (EGAT)

Frequently Asked Questions

Analyze common user questions about the Airframe MRO Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for heavy Airframe MRO checks globally?

The primary driver is the increasing average age of the global commercial aircraft fleet. As aircraft surpass certain flight hour and cycle thresholds, regulatory mandates require intensive, periodic heavy maintenance (D-Checks) to assess and restore structural integrity, ensuring prolonged airworthiness and compliance.

How is digitalization impacting the turnaround time for airframe maintenance?

Digitalization, particularly through automated robotic inspections, drone technology, and Augmented Reality (AR) work instructions, significantly reduces maintenance turnaround time (TAT). These technologies enhance inspection precision and speed up complex repair executions by eliminating manual data entry and providing real-time technical guidance.

Which geographical region exhibits the highest growth potential in the Airframe MRO market?

The Asia Pacific (APAC) region demonstrates the highest growth potential, fueled by the massive expansion of commercial fleets in emerging economies, robust air travel demand, and subsequent investment in localized, high-capacity maintenance, repair, and overhaul facilities.

What challenges do specialized composite material repairs pose for MRO providers?

Composite material repairs require specialized technical expertise, high-cost tooling (e.g., autoclaves, clean rooms), and advanced non-destructive testing (NDT) methods like ultrasonic testing. These requirements necessitate significant capital investment and specialized technician training, limiting the number of providers capable of complex composite airframe work.

Are airlines generally shifting toward in-house or outsourced Airframe MRO services?

The predominant global trend is a shift toward outsourcing heavy airframe MRO services to independent MRO specialists or OEM service arms. This strategy allows airlines, particularly low-cost carriers, to minimize fixed capital costs associated with specialized hangars and focus their resources on core operational activities and line maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager