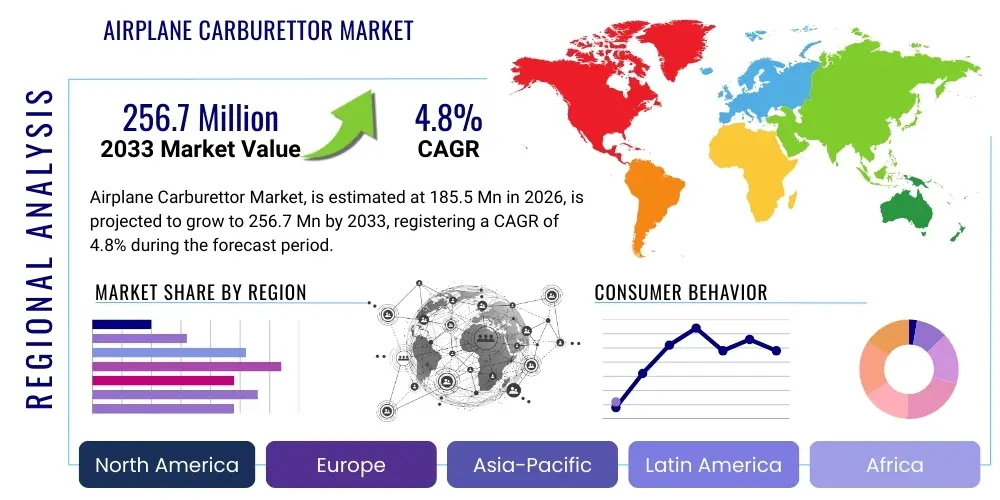

Airplane Carburettor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443274 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Airplane Carburettor Market Size

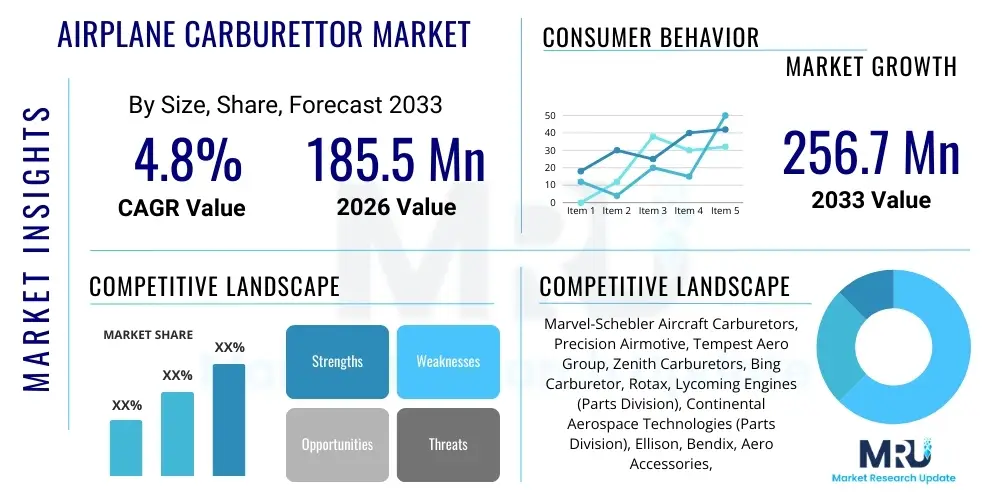

The Airplane Carburettor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $256.7 Million by the end of the forecast period in 2033.

Airplane Carburettor Market introduction

The Airplane Carburettor Market encompasses the manufacturing, distribution, and maintenance of specialized fuel delivery devices used predominantly in piston-engine aircraft, particularly within the General Aviation (GA) sector, including light sport aircraft, trainers, and older fixed-wing platforms. These mechanical devices are crucial for mixing air and fuel in the correct stoichiometric ratio before combustion in the engine cylinders, ensuring optimal engine performance, efficiency, and altitude operation capabilities. Unlike modern turboprop or jet engines which rely on complex Fuel Control Units (FCUs) or electronic fuel injection (EFI) systems, carburettors provide a simpler, robust, and cost-effective solution for many smaller aircraft, underpinning their continued demand in specific segments of the aviation industry.

Major applications of airplane carburettors are concentrated within recreational flying, flight training operations, aerial work (such as crop dusting), and maintenance operations for legacy aircraft fleets globally. The primary benefits of using carburettors include their mechanical simplicity, ease of maintenance, tolerance for varying fuel quality, and lower initial manufacturing costs compared to electronic fuel delivery systems. They are particularly favored in markets where ruggedness and simplicity outweigh the marginal fuel efficiency gains offered by electronic injection systems, especially in remote operational environments or developing economies with limited access to sophisticated maintenance infrastructure.

Key driving factors supporting the market growth include the steady demand for new piston aircraft for flight school operations, the exceptionally long lifecycle of existing GA aircraft fleets requiring constant maintenance and replacement components, and the growth in private recreational flying activities in regions such as North America and Europe. Furthermore, advancements in specialized carburettor design, aimed at addressing traditional issues like carburettor icing through optimized heating mechanisms and materials, continue to sustain the relevance of these components despite the gradual shift towards electronic fuel metering in newer aircraft models.

Airplane Carburettor Market Executive Summary

The Airplane Carburettor Market exhibits resilience driven primarily by the sustained operational volume of the global General Aviation fleet and the necessity for mandatory scheduled component replacement. Business trends indicate a focus on aftermarket services and MRO activities, as the initial equipment (OEM) segment faces moderate contraction due to the increased adoption of Electronic Fuel Injection (EFI) in newly certified aircraft platforms. However, the immense installed base of legacy piston engines ensures a robust replacement cycle, positioning specialized manufacturers and rebuilders as critical stakeholders. Strategic partnerships focusing on inventory management and authorized repair services are defining competitive success within this mature market landscape.

Regional trends highlight North America as the dominant market, owing to the massive concentration of GA aircraft, comprehensive regulatory framework necessitating routine component overhaul, and a deeply entrenched culture of private and flight school aviation. The Asia Pacific region, particularly countries like China and India, presents a high-growth opportunity, driven by increasing investment in flight training academies and the subsequent procurement of training aircraft, which often utilize carbureted engines due to cost efficiency and ease of repair. European demand remains stable, influenced by strict adherence to airworthiness directives and a growing enthusiasm for antique and vintage aircraft restoration, which necessitates original or certified replacement carburettors.

Segment trends underscore the enduring dominance of the Aftermarket segment over the OEM segment, largely due to the cyclical replacement needs and overhaul requirements mandated by operational hours. Diaphragm Carburettors, which offer improved performance in aerobatic and fluctuating G-load conditions, are showing marginal growth compared to the traditional Float Carburettors, primarily due to their increasing specification in high-performance or specialized GA applications. The segmentation by aircraft type remains heavily skewed toward the General Aviation Piston Aircraft class, representing the core demand driver for all types of airplane carburettors.

AI Impact Analysis on Airplane Carburettor Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Airplane Carburettor Market primarily center on two key areas: the potential for AI-driven predictive maintenance and overhaul scheduling, and the role of AI in quality control during the manufacturing or rebuilding process. Users are concerned about whether AI integration could lead to the premature obsolescence of mechanical systems or, conversely, if AI could extend the effective lifespan of carbureted engines by optimizing fuel mixture settings remotely or diagnosing subtle operational irregularities before catastrophic failure. A secondary theme involves leveraging machine learning algorithms to analyze extensive engine performance data collected via digital logbooks, allowing MRO facilities to accurately forecast when specific components, like jets or floats, will require adjustment or replacement, thereby minimizing aircraft downtime.

While the mechanical nature of the carburettor itself limits direct AI integration into its fundamental operation, AI significantly influences the supporting ecosystem. For instance, sophisticated diagnostic tools utilizing AI can analyze engine sensor data (e.g., Exhaust Gas Temperature, Cylinder Head Temperature) far more rapidly than human technicians, identifying anomalies that might indicate improper carburettor tuning or incipient failure, such as icing risks. This shift towards data-driven maintenance planning, although not replacing the physical component, enhances the safety and efficiency of carbureted aircraft operations, making them more competitive against electronically managed platforms. Furthermore, AI-powered computer vision systems are increasingly being used in the inspection phase of rebuilt carburettors, ensuring dimensional accuracy and surface integrity adherence to stringent aviation standards.

The core expectation from the industry is that AI will transform the servicing model rather than the component itself. The application of machine learning in optimizing supply chains for replacement parts, analyzing global failure rates across different operational climates, and personalizing maintenance schedules based on individual aircraft usage profiles are critical areas of development. This enhances operational reliability for aircraft owners and streamlines the inventory and service provisioning for MRO providers, ultimately contributing to better safety compliance and lower overall operating costs for carbureted aircraft.

- AI-driven Predictive Maintenance: Optimizing overhaul schedules and timing based on sensor data analysis to prevent unexpected failures in carbureted engines.

- Manufacturing Quality Assurance: Utilizing machine vision and AI algorithms for high-precision dimensional and integrity checks during carburettor rebuilding and new unit assembly.

- Engine Performance Optimization: Employing machine learning to analyze engine operational parameters (e.g., CHT/EGT) to recommend immediate, fine-tuned adjustments to mixture settings.

- Supply Chain Efficiency: Forecasting demand for specific replacement components (e.g., gaskets, needle valves) based on global fleet utilization data, minimizing stockouts.

- Digital Twin Modeling: Creating virtual models of carburettor behavior under various environmental conditions (altitude, temperature) using AI to enhance training and diagnostic capabilities.

DRO & Impact Forces Of Airplane Carburettor Market

The Airplane Carburettor Market is subject to a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which dictate its trajectory. Primary drivers include the massive installed base of existing piston engines requiring mandatory overhaul and component replacement, alongside the continued cost-effectiveness of carbureted systems for light training and recreational aircraft. Key restraints encompass the accelerating regulatory push towards cleaner, more fuel-efficient engines, favoring electronic fuel injection systems, and the inherent maintenance challenges associated with carburettor icing and altitude adjustments. Opportunities exist in developing advanced materials for enhanced icing resistance, expanding MRO network coverage in emerging aviation markets, and capitalizing on the vintage and classic aircraft restoration segment which demands period-correct components.

The Impact Forces shaping this market are multifaceted, operating both technologically and economically. The ongoing technological pressure from EFI systems represents a significant external force that limits OEM growth, pushing manufacturers to innovate within the carburettor design to maintain relevance. Economic forces, such as fluctuating aviation fuel prices and disposable incomes for recreational flying, directly influence the operational hours of the GA fleet and, consequently, the demand for replacement components. Regulatory adherence, particularly relating to airworthiness directives (ADs) and Mandatory Service Bulletins (MSBs), acts as a powerful, non-negotiable force driving demand for certified replacement parts and specialized maintenance services.

The combination of these factors dictates a stable but fundamentally maintenance-driven market. The high impact forces of regulation and the competitive threat from superior technologies compel market participants to invest heavily in certification, quality control, and superior after-sales support. Successful entities focus on managing the longevity of existing engine platforms through certified repair and rebuild programs, rather than relying solely on high-volume new unit sales, thus ensuring steady revenue streams despite the underlying technological shift.

Segmentation Analysis

The Airplane Carburettor Market segmentation provides granular insights into demand patterns across various operational categories, product types, and end-user requirements. The market is primarily dissected based on the physical characteristics and design of the carburettor (e.g., Float vs. Diaphragm), the operational platform (the specific type of aircraft), and the crucial distinction between initial sale (OEM) and maintenance/replacement (Aftermarket). This analysis is vital for stakeholders to align production and service capabilities with the most active and profitable segments, especially considering the heavy reliance on the replacement cycle within General Aviation.

- By Aircraft Type:

- Light Aircraft (LSA, Ultralight)

- General Aviation Piston Aircraft (Single-Engine, Multi-Engine)

- Training Aircraft

- By Product Type:

- Float Carburettors (Gravity-Feed Systems)

- Diaphragm Carburettors (Pressure Carburettors)

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket (MRO, Independent Mechanics, Individual Owners)

- By Material:

- Aluminum Alloy Carburettors

- Specialized Alloy Carburettors (for specific performance requirements)

Value Chain Analysis For Airplane Carburettor Market

The value chain for the Airplane Carburettor Market commences with Upstream Analysis, focusing intensely on specialized material procurement. This involves sourcing high-grade, aerospace-certified aluminum alloys, precision-machined brass components for jets and needle valves, and specific polymer composites for floats and seals that must withstand extreme temperature, vibration, and fuel exposure. Given the strict airworthiness requirements, suppliers must maintain rigorous traceability and quality standards. Component manufacturing is often done in-house or through highly specialized sub-contractors that possess AS9100 certification and experience in micro-tolerance machining, essential for ensuring the reliable functioning of metering systems and pressure regulation components.

The manufacturing and assembly phase involves complex calibration and testing protocols. For new OEM units, the carburettors are delivered directly to piston engine manufacturers (e.g., Lycoming, Continental) for integration into new engine packages destined for aircraft OEMs (e.g., Cessna, Piper). However, a vast portion of the market flows through the Downstream Analysis, specifically the Aftermarket segment. Here, distributors and authorized service centers play a critical role, holding inventory of fully rebuilt units, repair kits, and individual components. The certification of rebuilt units, often requiring FAA-PMA approval or equivalent regional certification, adds significant value and complexity to the distribution process.

Distribution channels are segmented into Direct and Indirect sales. Direct sales are prevalent in OEM agreements and large MRO contracts where major airlines or military operators deal straight with the manufacturer or authorized rebuilder. Indirect channels dominate the broader GA market, relying on a global network of specialized aviation parts distributors (e.g., Aviall, Aircraft Spruce), FBOs (Fixed-Base Operators), and independent certified repair stations. The reliance on indirect distribution necessitates strong inventory management and robust technical support from the manufacturers to ensure the global availability of parts and expertise, critical for the airworthiness of widely dispersed GA aircraft fleets.

Airplane Carburettor Market Potential Customers

The primary end-users and buyers of airplane carburettors span across several distinct aviation sectors, all sharing a common requirement for reliable piston engine operation. The largest immediate customers are the Maintenance, Repair, and Overhaul (MRO) facilities and independent certified repair shops, which purchase replacement units, rebuild kits, and overhaul services on a constant, high-volume basis to service the extensive existing GA fleet. These customers are driven by mandatory scheduled maintenance requirements and unexpected field failures, making component availability and certification paramount in their purchasing decisions. Engine overhaul facilities specifically require a steady supply of certified replacement carburettor units or the component parts necessary for a complete engine overhaul.

Another significant customer base comprises Original Equipment Manufacturers (OEMs) of piston aircraft engines, such as Textron Lycoming and Continental Aerospace Technologies. Although these companies are increasingly transitioning to electronic fuel injection for new engine models, they still require carburettors for specific legacy or entry-level engine packages and maintaining spare parts inventories for engines still under factory warranty. Their purchasing decisions are heavily influenced by long-term supply contracts, quality consistency, and rigorous regulatory compliance, often requiring close technical collaboration with the carburettor manufacturer.

The third major category includes flight training academies, aerial work operators (e.g., banner towing, agriculture spraying), and individual private aircraft owners. Flight schools, in particular, generate high component turnover due to the intense usage and demanding operational environment of trainer aircraft. Individual owners and vintage aircraft enthusiasts seek specialized suppliers who can provide certified, often hand-crafted, components necessary for restoring or maintaining classic airframes. These buyers value technical support, ease of installation, and documented authenticity for their specific aircraft models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $256.7 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marvel-Schebler Aircraft Carburetors, Precision Airmotive, Tempest Aero Group, Zenith Carburetors, Bing Carburetor, Rotax, Lycoming Engines (Parts Division), Continental Aerospace Technologies (Parts Division), Ellison, Bendix, Aero Accessories, Inc., Avstar, Sky Dynamics, Volare Carburetors, Bogert Aviation, Inc., Facet Srl, Walbro, Tillotson, Gardner Inc., Aircaft Carburetor Repair & Supply. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airplane Carburettor Market Key Technology Landscape

The technology landscape within the Airplane Carburettor Market is characterized less by revolutionary electronic advancements and more by continuous material science improvements and precision engineering optimization aimed at enhancing reliability and mitigating traditional operational risks, such as icing. A core technology focus involves the application of advanced anti-corrosion coatings and treatments on internal metal components to withstand corrosive aviation gasoline (AVGAS) additives and environmental moisture. This includes specialized anodizing and chemical vapor deposition processes that extend the functional life of the mixing chamber, floats, and jets, thereby reducing maintenance frequency and enhancing flight safety margins. Furthermore, the increasing use of Computer Numerical Control (CNC) machining allows for manufacturing parts with extremely tight tolerances, critical for precise fuel metering across varying atmospheric conditions.

A second major technological area is the development of optimized heat exchanger systems incorporated into the carburettor assembly to combat induction icing. While traditional carburettor heat relies on pulling heated air from around the exhaust, newer designs focus on integrating more efficient heat transfer mechanisms or using lighter, high-thermal-conductivity materials in the intake manifold adjacent to the venturi. These subtle but impactful engineering refinements aim to widen the operational envelope under icing conditions without significantly increasing weight or complexity, a crucial consideration for light aircraft. Additionally, sophisticated test rigs utilizing digital sensors and data logging capabilities are now standard in manufacturing and MRO facilities to ensure that every unit, whether new or rebuilt, meets strict calibration curves across a full range of operational air pressures and temperatures.

The regulatory environment, particularly stringent airworthiness requirements, drives the adoption of advanced non-destructive testing (NDT) technologies, such as ultrasonic inspection and radiographic analysis, to verify the integrity of critical structural components during the overhaul process. While electronic fuel injection systems represent the competing modern technology, carburettor manufacturers focus on providing components that are compatible with modern AVGAS alternatives and ethanol-blended fuels, ensuring compliance and backward compatibility for the existing fleet. This continuous adaptation through material science and precision manufacturing, rather than electronics, defines the technology trajectory of the airplane carburettor sector, ensuring that certified performance standards are met consistently across a diverse and aging fleet.

Regional Highlights

- North America (United States & Canada): Dominates the global market share due to the highest concentration of General Aviation piston aircraft globally and a well-established infrastructure of MRO facilities. Regulatory requirements mandate frequent inspections and component replacement, ensuring a stable, high-volume aftermarket demand. The U.S. remains the core hub for certified carburettor overhaul and manufacturing expertise.

- Europe (Germany, UK, France): Characterized by mature aviation regulations and a strong emphasis on flight training and recreational flying. Demand is driven by the adherence to European Union Aviation Safety Agency (EASA) directives and a significant presence of older, classic aircraft requiring highly specialized and certified repair services for legacy components.

- Asia Pacific (China, India, Australia): Emerging as the fastest-growing region, fueled by massive government and private investment in establishing new flight training academies to meet the surging demand for commercial pilots. This influx requires procurement of light training aircraft, which often utilize cost-effective carbureted engines, driving OEM sales and future aftermarket potential.

- Latin America (Brazil, Mexico): Exhibits steady demand linked to agricultural aviation (aerial spraying) and regional air taxi services, which rely heavily on robust and easily maintainable piston aircraft. Local MRO capabilities are expanding, increasing the regional demand for repair kits and rebuild services directly from authorized international distributors.

- Middle East and Africa (MEA): Represents a smaller but growing niche market, primarily driven by utility aviation, resource exploration support, and humanitarian aid flights. The demand here is highly focused on rugged, reliable diaphragm carburettors that perform well under harsh environmental conditions and remote operational settings, prioritizing durability over sophisticated features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airplane Carburettor Market.- Marvel-Schebler Aircraft Carburetors (Facet Srl)

- Precision Airmotive (a subsidiary focused on rebuilding)

- Tempest Aero Group

- Zenith Carburetors (Historical significance, parts still in market)

- Bing Carburetor (Focus on LSA/Ultralight segments)

- Rotax (Engine manufacturer specifying specific carburettors)

- Lycoming Engines (Parts Division)

- Continental Aerospace Technologies (Parts Division)

- Ellison Fluid Systems

- Bendix (Legacy brand, parts highly relevant in aftermarket)

- Aero Accessories, Inc.

- Avstar Fuel Systems

- Sky Dynamics

- Volare Carburetors

- Bogert Aviation, Inc.

- Walbro (Relevant for smaller utility engines)

- Tillotson (Niche market focus)

- Gardner Inc.

- Aircraft Carburetor Repair & Supply

- R&D Carburetor Repair

Frequently Asked Questions

Analyze common user questions about the Airplane Carburettor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued demand for airplane carburettors despite the rise of fuel injection?

The continued demand is primarily driven by the massive installed base of existing General Aviation piston aircraft (legacy fleet) which legally require certified carburettors for operation, generating a constant and robust aftermarket demand for replacement and overhaul services.

How do airplane carburettors differ from standard automotive carburettors, and why are they more expensive?

Airplane carburettors must compensate for extreme changes in altitude, air density, and G-forces (especially diaphragm types). They are significantly more expensive due to the requirement for highly precise calibration, rigorous aerospace certification (FAA/EASA), and the use of specialized, traceable materials for airworthiness.

Which geographical region dominates the global Airplane Carburettor Market?

North America, specifically the United States, holds the largest market share due to having the world's most extensive General Aviation fleet and a deeply entrenched ecosystem of private flying and flight training operations necessitating frequent carburettor maintenance and replacement.

What is the most significant technological constraint facing carburettor usage in modern aircraft?

The most significant constraint is carburettor icing, which can cause total power loss if not managed correctly. This, combined with less precise fuel metering at various altitudes compared to Electronic Fuel Injection (EFI), limits their adoption in newer, high-performance platforms.

Is the Aftermarket or the OEM segment larger in the Airplane Carburettor Market?

The Aftermarket segment (MRO and replacement parts) is significantly larger and more dominant than the OEM segment. This dominance is sustained by the long operational lifecycles of GA aircraft and mandatory periodic component overhauls required by aviation regulators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager