Alkyl Naphthalene Sulfonates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440822 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Alkyl Naphthalene Sulfonates Market Size

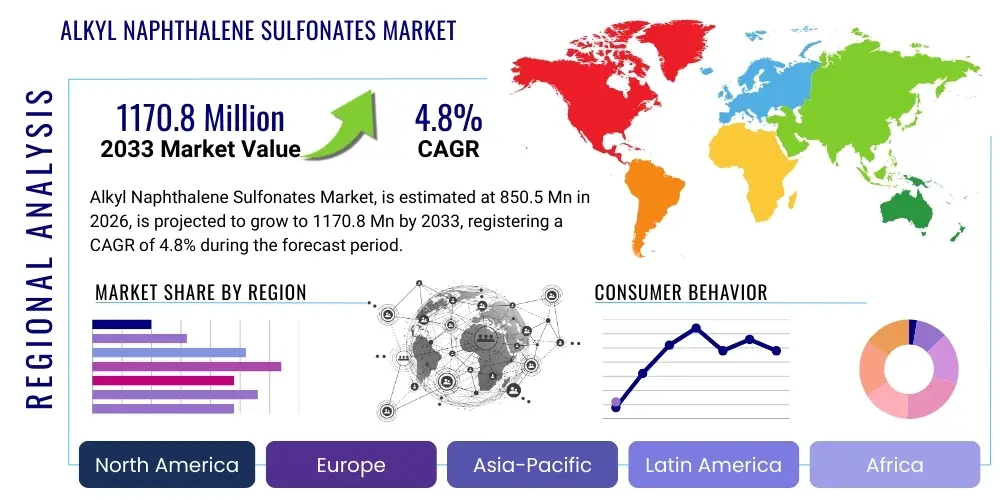

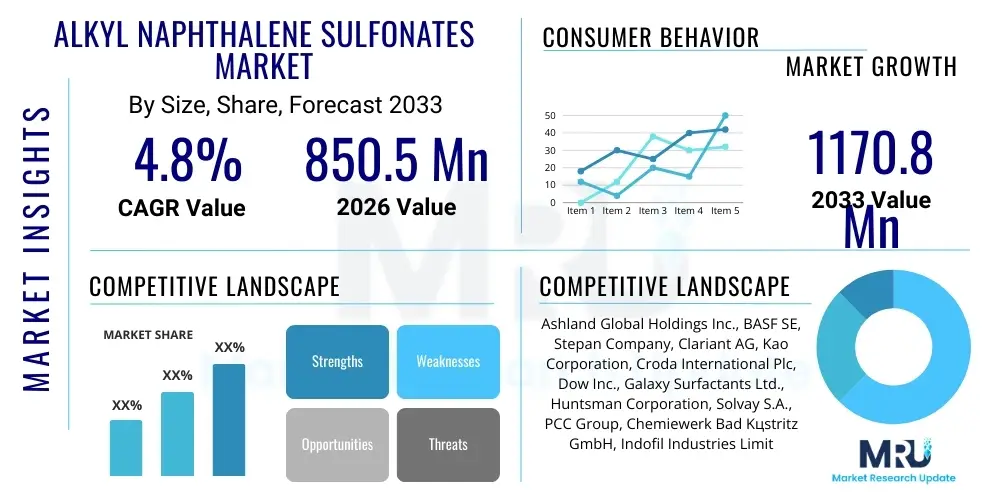

The Alkyl Naphthalene Sulfonates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1170.8 Million by the end of the forecast period in 2033. This substantial growth trajectory is attributed to the increasing demand from a diverse array of end-use industries, particularly agriculture, construction, and oil & gas, where Alkyl Naphthalene Sulfonates (ANS) play a critical role as highly effective wetting agents, dispersants, and emulsifiers. The robust expansion reflects the indispensable nature of these chemical compounds in enhancing the performance and stability of various industrial formulations globally. The market's valuation highlights its significance within the broader specialty chemicals sector, underpinned by continuous innovation and strategic investments in production capacities to meet evolving industrial requirements. Factors such as urbanization, infrastructure development, and the necessity for improved agricultural yields are consistently fueling this market expansion, underscoring the sustained importance of ANS in modern industrial applications, driving both volume and value growth across key regions.

Alkyl Naphthalene Sulfonates Market introduction

Alkyl Naphthalene Sulfonates (ANS) represent a crucial class of synthetic anionic surfactants, distinguished by their exceptional surface-active properties which include superior wetting, powerful dispersing capabilities, and effective emulsification. These chemical compounds are systematically synthesized through the alkylation of naphthalene, followed by a controlled sulfonation process, resulting in a unique molecular structure that allows them to significantly lower the surface tension of aqueous solutions. The versatility of ANS makes them indispensable across a broad spectrum of industrial applications, serving vital functions in sectors such as agrochemicals, where they enhance the efficacy of pesticides and herbicides; in construction, where they act as high-performance concrete admixtures; and in the textile industry, improving dyeing processes. Furthermore, they are widely employed in the production of dyes and pigments, leather processing, and crucial oilfield operations, underscoring their broad utility and functional importance across diverse manufacturing and processing industries.

The primary benefits associated with Alkyl Naphthalene Sulfonates include their remarkable stability under harsh conditions, such as high temperatures and in the presence of hard water, making them suitable for demanding industrial environments. Their excellent compatibility with a wide range of other surfactants and formulation ingredients allows for their seamless integration into complex chemical systems, leading to optimized product performance and stability. The driving factors behind the sustained growth of the ANS market are multifaceted and deeply intertwined with global economic and demographic trends. A significant contributor is the ever-increasing global demand from the agricultural sector, which continuously seeks advanced formulations to maximize crop yields, protect against pests, and ensure efficient nutrient delivery. Similarly, the rapid expansion of the construction industry, particularly in developing economies, fuels the need for sophisticated concrete additives that improve workability, strength, and durability for infrastructure and urban development projects. Ongoing technological advancements in chemical synthesis and formulation, coupled with a rising emphasis on developing more sustainable and environmentally friendly ANS variants, are further propelling market growth, fostering innovation and broadening their application scope in various specialized domains and emerging industrial needs.

Alkyl Naphthalene Sulfonates Market Executive Summary

The global Alkyl Naphthalene Sulfonates market is currently undergoing a period of dynamic evolution, characterized by significant shifts in business trends, regional consumption patterns, and segment-specific growth trajectories. Key business trends indicate a strong emphasis on sustainable chemistry, with manufacturers increasingly investing in research and development to produce bio-based and environmentally benign ANS alternatives, driven by escalating environmental regulations and growing consumer preference for green products. Strategic collaborations, joint ventures, and mergers and acquisitions are becoming prevalent as leading market players seek to consolidate their market presence, gain access to advanced technologies, and expand their operational footprints across high-growth regions. There is also a notable trend towards customization, where manufacturers are offering tailor-made ANS formulations designed to meet the precise performance requirements of niche applications within specific end-use industries, thereby maximizing product efficacy and customer value. This focus on specialty solutions underscores the competitive nature of the market and the relentless drive towards product differentiation and value addition, adapting to the complex demands of a global industrial landscape.

From a regional perspective, Asia Pacific continues to dominate the Alkyl Naphthalene Sulfonates market, propelled by its booming agricultural sector, unprecedented rates of urbanization, and extensive infrastructure development projects, especially within economic powerhouses like China and India. These factors collectively create a robust demand for ANS in agrochemicals and concrete admixtures. North America and Europe, while representing more mature markets, are witnessing sustained demand for high-performance and specialty ANS formulations, primarily driven by stringent regulatory frameworks that mandate high environmental standards and a strong focus on advanced materials and sustainable practices. Latin America and the Middle East & Africa regions are emerging as significant growth hubs, spurred by increasing investments in agriculture, oil and gas exploration, and burgeoning construction activities, offering considerable untapped market potential and promising future expansion. The segmentation analysis reveals that the agrochemicals sector remains a cornerstone of ANS consumption, critical for enhancing the effectiveness of crop protection products and fertilizer efficiency. The construction chemicals segment is experiencing vigorous expansion due to global urbanization trends and large-scale public and private infrastructure investments. Furthermore, the textile and leather industries continue to be substantial users, relying on ANS for their critical role in processing and dyeing. The oil & gas sector's demand is also notable, driven by enhanced oil recovery efforts and drilling operations, solidifying the diverse industrial reliance on Alkyl Naphthalene Sulfonates across a spectrum of critical applications.

AI Impact Analysis on Alkyl Naphthalene Sulfonates Market

The integration of Artificial Intelligence (AI) and machine learning technologies is poised to fundamentally transform various facets of the Alkyl Naphthalene Sulfonates market, addressing common user questions related to efficiency, sustainability, and innovation. Users are keenly interested in how AI can optimize complex chemical synthesis processes, leading to reduced energy consumption and higher yields in ANS manufacturing. There is significant curiosity about AI's potential in predicting raw material price volatility and managing intricate global supply chains more effectively, thereby minimizing risks and ensuring operational continuity. Furthermore, stakeholders anticipate that AI can accelerate the discovery and development of novel ANS derivatives with enhanced performance characteristics and improved environmental profiles, responding to the growing demand for sustainable chemical solutions. Concerns often center around the substantial initial capital investment required for AI infrastructure, the necessity for a highly skilled workforce proficient in both chemical engineering and data science, and the broader societal implications regarding workforce automation. However, expectations remain high for AI's capacity to revolutionize everything from personalized product formulation for specific applications to advanced market analytics, offering unprecedented insights into demand patterns and competitive landscapes, ultimately enhancing the market's responsiveness and strategic foresight.

- AI-driven optimization of chemical reaction parameters in ANS synthesis, resulting in higher product purity, reduced processing times, and significant energy savings, thereby enhancing manufacturing efficiency and lowering operational costs, contributing to a more sustainable production footprint.

- Predictive analytics for more accurate forecasting of raw material availability and pricing fluctuations, enabling proactive procurement strategies and mitigating supply chain disruptions caused by market volatility or geopolitical events, ensuring a stable and cost-effective supply chain.

- Accelerated research and development through AI algorithms that can analyze vast datasets of chemical structures and properties, facilitating the rapid identification and design of new Alkyl Naphthalene Sulfonate formulations with superior performance attributes, such as improved dispersibility, enhanced wetting, or reduced ecotoxicity, driving product innovation.

- Enhanced quality control systems utilizing machine vision and AI-powered sensors for real-time monitoring and anomaly detection during production, ensuring consistent product specifications and minimizing off-spec batches, thereby improving overall product reliability and reducing waste generation.

- Advanced market intelligence and demand forecasting capabilities, leveraging AI to analyze global economic indicators, industry trends, and customer behavior data, allowing manufacturers to make more informed strategic decisions regarding production volumes, inventory management, and market entry, optimizing resource allocation.

- Optimization of logistics and distribution networks through AI algorithms that identify the most efficient routes and transportation methods, leading to reduced fuel consumption, lower shipping costs, and a decreased carbon footprint across the supply chain, promoting environmental responsibility.

- Development of smart applications and digital twins for ANS production facilities, enabling remote monitoring, predictive maintenance, and simulation of various operational scenarios to optimize performance, prevent costly downtimes, and improve overall plant safety and reliability.

- Personalized product development and customer engagement facilitated by AI, offering tailored ANS solutions based on specific client requirements and application needs, enhancing customer satisfaction and fostering stronger client relationships through customized offerings and technical support.

- Integration of AI in environmental impact assessments, providing sophisticated models to analyze the life cycle of ANS products, from raw material extraction to end-of-life, supporting the development of more sustainable and circular economy practices within the industry, aligning with global sustainability goals.

- Automated regulatory compliance checks and risk assessments, where AI can quickly process and interpret complex chemical regulations across different regions and jurisdictions, ensuring that ANS products meet all necessary safety, health, and environmental standards, reducing compliance risks.

DRO & Impact Forces Of Alkyl Naphthalene Sulfonates Market

The Alkyl Naphthalene Sulfonates (ANS) market is dynamically shaped by a confluence of intricate drivers, inherent restraints, and compelling opportunities, all of which contribute to the impact forces that dictate its current trajectory and future growth prospects. Foremost among the

drivers

is the relentless expansion of key end-use industries, including a booming global agricultural sector that necessitates highly efficient agrochemical formulations for optimal crop protection and yield enhancement to feed an ever-growing global population. Similarly, the burgeoning construction industry, propelled by rapid urbanization and massive infrastructure projects worldwide, drives substantial demand for ANS as crucial components in concrete admixtures that improve workability, strength, and durability of building materials. The textile and leather industries also represent significant demand centers, relying on ANS for superior dyeing and processing capabilities. Furthermore, ongoing technological advancements in chemical synthesis and formulation continue to yield improved ANS products with enhanced performance characteristics and greater environmental compatibility, thereby sustaining and accelerating market penetration into new and existing applications.Despite these powerful drivers, the market faces several significant

restraints

that could potentially impede its growth. The volatility of raw material prices, particularly for naphthalene derivatives and various alkylating agents, poses a persistent challenge, leading to unpredictable production costs and potential erosion of profit margins for manufacturers. Increasingly stringent environmental regulations globally regarding the production, use, and disposal of chemical surfactants exert considerable pressure on manufacturers, necessitating substantial investments in research and development to formulate eco-friendly alternatives and comply with evolving standards. Intense competition from a diverse array of alternative surfactants, which may offer similar functional benefits at competitive prices or with different environmental profiles, also acts as a notable restraint, compelling ANS producers to continually innovate and differentiate their offerings. Geopolitical instability and trade disputes can further disrupt supply chains and impact the global flow of raw materials and finished products, adding a layer of complexity to market operations.However, these challenges are counterbalanced by numerous compelling

opportunities

that promise future market expansion and value creation. The growing global emphasis on sustainability and green chemistry presents a significant avenue for the development of bio-based or biodegradable Alkyl Naphthalene Sulfonates, which can attract environmentally conscious consumers and command premium pricing, aligning with global environmental objectives. Emerging markets in Asia Pacific, Latin America, and Africa, characterized by rapid industrialization, increasing disposable incomes, and untapped application areas, offer immense growth potential for ANS manufacturers seeking to expand their geographical footprint and diversify their customer base. Furthermore, continuous innovation in specialty ANS formulations tailored for niche, high-value applications, such as advanced materials, specialized coatings, and enhanced oil recovery techniques, can unlock new revenue streams and elevate market value. The ongoing digitalization of industrial processes and the adoption of smart manufacturing technologies also provide opportunities to optimize production and supply chain efficiencies, further solidifying the strategic importance of ANS within the global chemical landscape and ensuring its long-term viability.Segmentation Analysis

The Alkyl Naphthalene Sulfonates market is meticulously segmented to offer a granular and comprehensive understanding of its intricate structure, enabling stakeholders to discern specific trends, growth catalysts, and competitive dynamics across various categories. This detailed segmentation is instrumental for market players to formulate precise strategies, tailor product development efforts, and identify lucrative expansion avenues. The market’s segmentation typically delineates categories based on product type, reflecting different chemical compositions and performance profiles; application, highlighting the diverse functional roles ANS play; and end-use industry, indicating the broad range of sectors reliant on these versatile surfactants. Such a layered analysis provides a robust framework for assessing market attractiveness, benchmarking competitive performance, and anticipating future demand shifts, allowing for a more nuanced and targeted approach to market penetration and growth.

Understanding these distinct segments is paramount for strategic planning and decision-making within the Alkyl Naphthalene Sulfonates industry. For instance, analyzing the market by product type reveals preferences for specific anionic forms like Sodium Alkyl Naphthalene Sulfonates due to their cost-effectiveness and broad utility, versus other specialized types that offer niche performance. Application-based segmentation provides insights into which functionalities, such as dispersing or wetting, are experiencing the highest growth, guiding research and development towards high-demand areas and innovative product solutions. Similarly, segmenting by end-use industry allows for a clear visualization of which sectors, like agrochemicals or construction, are the primary drivers of consumption, informing targeted marketing and sales strategies and resource allocation. This holistic approach to segmentation not only illuminates current market dynamics but also provides a forward-looking perspective on potential shifts, technological impacts, and emerging opportunities, ensuring that market participants are well-equipped to navigate the complexities and capitalize on the growth potential of the global ANS landscape.

- By Type:

- Sodium Alkyl Naphthalene Sulfonates: Widely used due to their excellent dispersibility and wetting properties, cost-effectiveness, and broad applicability across agrochemicals, construction, and textile industries. They exhibit high efficacy in various aqueous formulations and are a cornerstone of the ANS market due to their balanced performance and economic viability.

- Calcium Alkyl Naphthalene Sulfonates: Primarily utilized as emulsifiers and dispersants in oil-based systems, especially prominent in pesticide formulations and oilfield chemicals due to their enhanced oil solubility and ability to stabilize water-in-oil emulsions, providing crucial functional benefits in non-polar environments.

- Ammonium Alkyl Naphthalene Sulfonates: Employed in specific applications where compatibility with ammonium ions is desired, often found in certain industrial cleaning agents, metalworking fluids, and specialty formulations requiring a particular cationic interaction profile, offering versatile performance characteristics.

- Other Types (e.g., Potassium, Magnesium): Include various other cation salts offering niche performance benefits or catering to specific regulatory requirements and formulation needs in specialized industrial processes. These variants allow for fine-tuning of solubility, electrolyte compatibility, and surface activity for highly specific applications.

- By Application:

- Dispersing Agents: Critical for preventing particle agglomeration in suspensions and emulsions, widely used in agrochemicals (pesticides, herbicides), pigments, dyes, and concrete admixtures to ensure uniform distribution, enhancing product stability, and improving application efficiency.

- Wetting Agents: Enhance the spreading and penetration of liquids on solid surfaces, vital in textile processing, pulp & paper, and cleaning formulations to improve efficiency and performance. They reduce surface tension, allowing liquids to spread more effectively and penetrate porous materials.

- Emulsifying Agents: Stabilize immiscible liquid mixtures, crucial in oil & gas (drilling fluids, enhanced oil recovery) and certain personal care products, ensuring homogenous and stable formulations over extended periods by creating stable interfaces between phases.

- Defoaming Agents: Used to control and reduce foam formation in industrial processes such as pulp & paper, fermentation, and water treatment, improving operational efficiency, preventing overflows, and ensuring product quality by eliminating entrapped air.

- Other Applications (e.g., Leveling Agents, Solubilizers): Encompass roles in textile dyeing to ensure uniform color absorption and preventing streaks, and as solubilizers to enhance the solubility of poorly soluble compounds in aqueous systems, expanding the range of compatible ingredients.

- By End-Use Industry:

- Agrochemicals: Largest consumer, utilizing ANS as dispersants and wetting agents in pesticides, herbicides, and fertilizers to improve efficacy, rain fastness, and stability of active ingredients, thereby optimizing crop yield and protection.

- Construction (Concrete Admixtures): Extensive use as superplasticizers and water reducers to enhance concrete workability, strength, and durability for various infrastructure projects, reducing the water-cement ratio while maintaining fluidity, leading to stronger concrete.

- Textiles & Leather: Employed as dyeing auxiliaries, leveling agents, and tanning aids, ensuring consistent coloration, preventing uneven dye uptake, and improving the quality and processing efficiency of finished materials in these traditional industries.

- Dyes & Pigments: Essential for dispersing pigment particles in paints, coatings, inks, and masterbatches, ensuring vibrant and uniform color development without agglomeration, leading to high-quality visual appeal and performance.

- Oil & Gas: Utilized in drilling fluids, cementing operations, and enhanced oil recovery (EOR) to improve fluid properties, reduce friction, control fluid loss, and increase oil extraction efficiency, which are critical for maximizing resource recovery.

- Pulp & Paper: Applied as defoamers, dispersants for pulp, and pitch control agents to enhance paper quality, improve machine runnability, and ensure efficient manufacturing processes, reducing defects and waste.

- Mining & Metallurgy: Used in froth flotation processes for mineral separation, improving the recovery of valuable metals from ores by selectively separating desired minerals from gangue material, enhancing processing efficiency.

- Cleaning & Detergents: Incorporated into industrial and household cleaning formulations for their wetting and emulsifying capabilities, enhancing cleaning performance, dirt removal, and grease cutting in various applications.

- Other End-Use Industries (e.g., Adhesives, Paints & Coatings, Water Treatment): Broader applications where surface-active properties are beneficial for formulation stability, adhesion enhancement, anti-settling, and overall performance in specialized chemical products and processes.

Value Chain Analysis For Alkyl Naphthalene Sulfonates Market

The value chain for the Alkyl Naphthalene Sulfonates (ANS) market is a complex, interconnected network spanning from the foundational sourcing of raw materials to the ultimate delivery and application by diverse end-users, meticulously illustrating the flow of goods and services and highlighting critical value-adding activities at each stage. The

upstream analysis

stage is critical and commences with the procurement of primary feedstocks, most notably naphthalene, which is primarily derived from either petroleum or coal tar distillation, and various alkylating agents such as propene, butene, or dodecene, which are typically petrochemical derivatives. Sulfuric acid, an essential chemical, is also sourced for the sulfonation step. Key suppliers in this segment are often large-scale petrochemical companies and chemical producers that provide these fundamental building blocks. The stability of supply, purity of raw materials, and fluctuations in their commodity prices significantly influence the production costs and overall profitability of ANS manufacturers, making strong supplier relationships, strategic sourcing, and robust risk management paramount for operational resilience and competitive advantage.Moving further along the chain, the

downstream analysis

encompasses the transformation of raw materials into finished ANS products and their subsequent integration into various industrial formulations. After the synthesis of Alkyl Naphthalene Sulfonates by specialized chemical manufacturers, these products often undergo further processing, such as purification, blending, and formulation, to meet specific performance requirements of end-use applications. This involves combining ANS with other active ingredients, solvents, and additives to create customized solutions like sophisticated concrete superplasticizers, advanced pesticide dispersants, or high-performance textile auxiliaries. End-use industries, including agriculture, construction, textiles, and oil & gas, then incorporate these formulated ANS products into their final goods or processes. The efficiency and efficacy of these downstream formulation steps are crucial for delivering maximum value to the ultimate consumer, directly impacting product performance, regulatory compliance, and market acceptance, highlighting the importance of technical support and application expertise in this phase.The

distribution channel

for Alkyl Naphthalene Sulfonates is typically bifurcated into direct and indirect routes, each serving distinct market segments and strategic objectives.Direct distribution

involves ANS manufacturers supplying products directly to large industrial customers who purchase in significant bulk, such as major agrochemical corporations, large-scale construction chemical formulators, or multinational textile manufacturers. This approach allows for direct technical support, customized product development, and stronger, long-term contractual relationships, fostering deep client integration and understanding. Conversely,indirect distribution

relies on an expansive network of chemical distributors, wholesalers, and specialized agents who serve smaller businesses, regional markets, or customers with diverse, smaller-volume needs. These intermediaries provide critical logistical support, localized inventory management, market penetration in hard-to-reach areas, and often value-added services like repackaging and technical advisory. The choice between direct and indirect channels is often dictated by customer size, geographic reach, product complexity, and the level of personalized service required, ensuring efficient market coverage, timely product delivery, and optimized market access across the global landscape for ANS products.Alkyl Naphthalene Sulfonates Market Potential Customers

The Alkyl Naphthalene Sulfonates market caters to an exceptionally diverse and broad spectrum of

end-users and buyers

across numerous industrial sectors, a testament to the versatile and critical functionalities of ANS as superior wetting agents, robust dispersants, and effective emulsifiers. Prominent among these potential customers are manufacturers within theagrochemical industry

, which includes producers of pesticides, herbicides, fungicides, and fertilizers. These companies extensively utilize ANS to enhance the stability, spreading, and penetration of their active ingredients, thereby improving the overall efficacy and rain-fastness of crop protection and nutrient delivery solutions, directly contributing to increased agricultural productivity and global food security. The relentless drive for higher crop yields and more efficient farming practices, coupled with the need for sustainable agriculture, ensures a consistent and growing demand from this sector, making it a cornerstone for ANS consumption.Another significant customer segment is the

construction industry

, specifically manufacturers of concrete admixtures. Here, Alkyl Naphthalene Sulfonates are crucial components in superplasticizers and water-reducing agents, which significantly enhance the workability, strength, and durability of concrete. Their application facilitates easier pouring and compaction, reduces the water-cement ratio without compromising fluidity, and ultimately leads to stronger, more sustainable concrete structures for a wide array of infrastructure projects, commercial buildings, and residential developments worldwide. Similarly, thetextile and leather processing industries

represent substantial buyers, employing ANS as essential auxiliaries in dyeing processes to achieve uniform color penetration, as leveling agents to prevent uneven coloration, and as tanning aids to improve leather quality and processing efficiency. These applications underscore the critical role of ANS in achieving high-quality finished products in these traditional manufacturing sectors, where consistent performance and aesthetic appeal are paramount.Beyond these major sectors, the market extends to other vital industries. Manufacturers of

dyes and pigments

rely on ANS to effectively disperse color particles, preventing agglomeration and ensuring vibrant, consistent coloration in paints, coatings, inks, and masterbatches. Theoil and gas sector

incorporates ANS into drilling fluids, cementing operations, and enhanced oil recovery (EOR) processes, where their surfactant properties are crucial for improving fluid performance, reducing friction, and maximizing hydrocarbon extraction efficiency, especially in challenging environments. Thepulp and paper industry

utilizes ANS as defoaming and dispersing agents to improve paper quality and production line efficiency, while themining and metallurgy sector

employs them in froth flotation processes for efficient mineral separation, enhancing the recovery of valuable resources. Even thecleaning and detergents industry

integrates ANS into specialized industrial and household cleaning formulations for their powerful wetting and emulsifying capabilities, contributing to superior cleaning performance. This expansive customer base highlights the intrinsic value and broad utility of Alkyl Naphthalene Sulfonates across the global industrial landscape, ensuring a resilient and continuously expanding demand profile driven by diverse and evolving industrial needs.| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1170.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashland Global Holdings Inc., BASF SE, Stepan Company, Clariant AG, Kao Corporation, Croda International Plc, Dow Inc., Galaxy Surfactants Ltd., Huntsman Corporation, Solvay S.A., PCC Group, Chemiewerk Bad Kцstritz GmbH, Indofil Industries Limited, Himadri Speciality Chemical Ltd., Nanjing Surfactant Co., Ltd., Shandong Jiahua Chemical Co., Ltd., Dongying City Longxing Chemical Co., Ltd., Akzo Nobel N.V., Evonik Industries AG, Sasol Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alkyl Naphthalene Sulfonates Market Key Technology Landscape

The Alkyl Naphthalene Sulfonates market is continuously shaped and driven by a dynamic and evolving

technology landscape

, encompassing advancements in chemical synthesis, process optimization, and formulation science, all geared towards enhancing product performance, sustainability, and cost-efficiency. The core technologies for producing ANS typically involve a two-stage chemical transformation: the alkylation of naphthalene, followed by sulfonation. In the alkylation phase, modern processes frequently incorporate advanced catalytic systems, such as solid acid catalysts or ionic liquids, to improve reaction selectivity, increase overall efficiency, and minimize the formation of undesirable byproducts. These innovations are crucial for achieving higher purity ANS precursors and reducing the environmental footprint associated with manufacturing, reflecting a broader industry push towards greener chemical engineering principles. The selection and optimization of catalysts play a pivotal role in dictating the final product's molecular structure and performance characteristics, making R&D in this area particularly vital for competitive differentiation and market leadership.Regional Highlights

- North America: This region represents a mature yet continuously innovating market for Alkyl Naphthalene Sulfonates, driven by established industries such as construction, oil & gas, and a sophisticated agricultural sector. Demand is increasingly focused on high-performance, specialty ANS formulations that offer superior efficacy and meet stringent environmental regulations, particularly in the United States and Canada. Significant investments in R&D are observed here, aimed at developing more sustainable and advanced chemical solutions, including those with improved biodegradability profiles and lower environmental impact. The robust infrastructure, advanced manufacturing capabilities, and a strong emphasis on technological adoption further solidify North America's position as a key consumer of premium ANS products, with steady growth rates influenced by specific end-use sector expansions and continuous technological advancements in formulation and application techniques.

- Europe: Characterized by a strong regulatory environment and a pronounced emphasis on sustainability and eco-friendly products, Europe is a significant market for Alkyl Naphthalene Sulfonates. Countries like Germany, France, and the UK lead in adopting advanced ANS formulations, especially within the construction, textile, and specialty chemicals sectors. The region's mature industrial base and a high level of environmental consciousness drive demand for bio-based and low-VOC (Volatile Organic Compound) ANS, aligning with the European Union's ambitious green chemistry initiatives and circular economy goals. Innovation in process efficiency and product stewardship is paramount, with manufacturers focusing on reducing the environmental footprint of ANS production and application. Despite slower overall industrial growth compared to emerging markets, the demand for high-quality, compliant, and sustainable ANS remains strong, driven by regulatory push and consumer pull.

- Asia Pacific (APAC): The Asia Pacific region stands as the undisputed leader in the global Alkyl Naphthalene Sulfonates market, experiencing the most rapid and substantial growth. This dominance is primarily fueled by extensive industrialization, burgeoning agricultural activities, and unprecedented rates of urbanization and infrastructure development across key economies such as China, India, Japan, and Southeast Asian nations. The massive scale of construction projects, coupled with the critical need to enhance agricultural productivity to feed a growing population, drives immense demand for ANS in concrete admixtures and agrochemical formulations. The presence of a vast manufacturing base, comparatively lower production costs, and increasing domestic consumption further bolster the region's market share, making it a pivotal hub for both production and consumption of Alkyl Naphthalene Sulfonates, with continued high growth anticipated as economic development progresses.

- Latin America: This region is an emerging market for Alkyl Naphthalene Sulfonates, exhibiting promising growth prospects driven by expanding agricultural outputs, increasing industrialization, and significant investments in infrastructure development, particularly in Brazil, Mexico, and Argentina. The agricultural sector, crucial for many Latin American economies, consistently demands effective agrochemicals that utilize ANS as essential dispersants and wetting agents to improve crop yields and farm efficiency. Additionally, urbanization trends are stimulating construction activities, leading to increased adoption of ANS in concrete admixtures to support new building projects and infrastructure improvements. While starting from a relatively smaller market base compared to APAC, the region's economic development, coupled with growing foreign investments in various industrial sectors, positions Latin America for steady and sustained growth in ANS consumption over the forecast period, leveraging its natural resources and expanding industrial capabilities.

- Middle East and Africa (MEA): The MEA region represents a developing market for Alkyl Naphthalene Sulfonates, with growth primarily attributable to expanding oil & gas operations, significant infrastructure development projects (especially in the GCC countries), and ongoing efforts to modernize the agricultural sector. The demand for ANS in oilfield chemicals, for applications such as drilling fluids, cementing, and enhanced oil recovery, is a key driver due to the region's vast hydrocarbon reserves. Additionally, the development of new cities, industrial zones, and diversification initiatives are boosting the construction chemicals sector and other manufacturing industries. While the market size is currently smaller than other regions, increasing government initiatives to diversify economies and invest in non-oil sectors are expected to spur industrial growth, subsequently driving the demand for Alkyl Naphthalene Sulfonates across various applications in the medium to long term, supported by strategic investments in industrial capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alkyl Naphthalene Sulfonates Market.- Ashland Global Holdings Inc.

- BASF SE

- Stepan Company

- Clariant AG

- Kao Corporation

- Croda International Plc

- Dow Inc.

- Galaxy Surfactants Ltd.

- Huntsman Corporation

- Solvay S.A.

- PCC Group

- Chemiewerk Bad Kцstritz GmbH

- Indofil Industries Limited

- Himadri Speciality Chemical Ltd.

- Nanjing Surfactant Co., Ltd.

- Shandong Jiahua Chemical Co., Ltd.

- Dongying City Longxing Chemical Co., Ltd.

- Akzo Nobel N.V.

- Evonik Industries AG

- Sasol Limited

Frequently Asked Questions

What are Alkyl Naphthalene Sulfonates (ANS) and their primary industrial uses?

Alkyl Naphthalene Sulfonates (ANS) are a versatile class of anionic surfactants widely recognized for their superior wetting, dispersing, and emulsifying properties. Their primary industrial uses span diverse sectors, including agrochemicals where they enhance pesticide efficacy, construction for high-performance concrete admixtures, textiles for dyeing and processing, and oil & gas operations for improving fluid performance in drilling and enhanced oil recovery processes. These compounds are essential for stabilizing formulations, preventing particle agglomeration, and improving the spreading of liquids on surfaces, making them indispensable in numerous industrial applications requiring effective surface-active agents for optimized performance and stability.

Which end-use industries represent the largest market segments for Alkyl Naphthalene Sulfonates?

The largest market segments for Alkyl Naphthalene Sulfonates are predominantly the agrochemical industry, where ANS are crucial for the formulation of pesticides, herbicides, and fungicides to ensure efficient crop protection and enhanced nutrient delivery. The construction industry also represents a significant segment, with ANS being key components in concrete admixtures that improve workability and durability for infrastructure projects and building developments. Other major consumers include the textile and leather processing industries for dyeing and tanning, and the oil and gas sector for specialized drilling and extraction fluids, collectively driving substantial demand for these essential chemicals due to their critical functional roles.

What are the main factors driving the growth of the Alkyl Naphthalene Sulfonates market?

The growth of the Alkyl Naphthalene Sulfonates market is primarily driven by several key factors. These include the increasing global demand from the agricultural sector for enhanced crop protection and yield, the robust expansion of the construction industry fueled by rapid urbanization and extensive infrastructure development worldwide, and ongoing technological advancements leading to the development of high-performance and specialty ANS formulations with improved efficacy and sustainability profiles. Additionally, the versatility of ANS in diverse applications across various industrial sectors ensures a consistent and expanding market, complemented by a growing focus on product innovation and environmental stewardship initiatives.

What are the key challenges and restraints impacting the Alkyl Naphthalene Sulfonates market?

The Alkyl Naphthalene Sulfonates market faces several significant challenges and restraints. These include the volatility and unpredictable fluctuations in raw material prices, particularly for naphthalene and alkylating agents, which directly impact production costs and profit margins for manufacturers. Stringent and evolving environmental regulations globally also pose a considerable challenge, necessitating continuous investment in research and development for eco-friendlier alternatives and ensuring compliance. Furthermore, intense competition from a wide array of alternative surfactant chemistries, offering similar functionalities at varying price points and environmental profiles, contributes to market pressure and requires sustained innovation and differentiation from ANS manufacturers to maintain competitive advantage.

How is Artificial Intelligence (AI) expected to influence the Alkyl Naphthalene Sulfonates market?

Artificial Intelligence (AI) is expected to significantly influence the Alkyl Naphthalene Sulfonates market by optimizing various operational and strategic aspects. AI can enhance manufacturing efficiency through process optimization, leading to reduced energy consumption and higher yields in ANS synthesis. It can also improve supply chain management via predictive analytics for raw material sourcing, inventory control, and logistics optimization. Furthermore, AI is poised to accelerate research and development efforts for novel ANS formulations with superior performance and sustainability, facilitate advanced market demand forecasting, and enable more precise quality control, ultimately driving innovation, sustainability, and cost-effectiveness across the entire value chain of Alkyl Naphthalene Sulfonates products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager