Alkyl Succinic Anhydride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443511 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Alkyl Succinic Anhydride Market Size

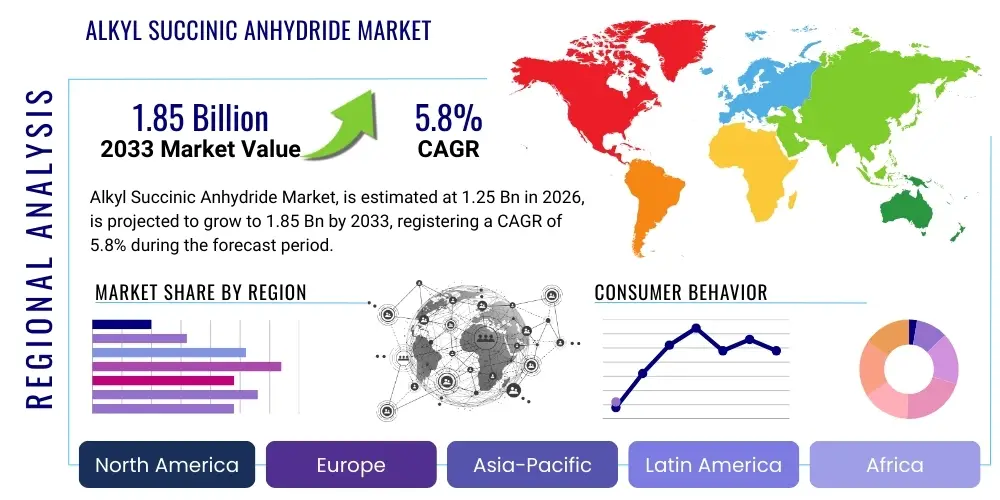

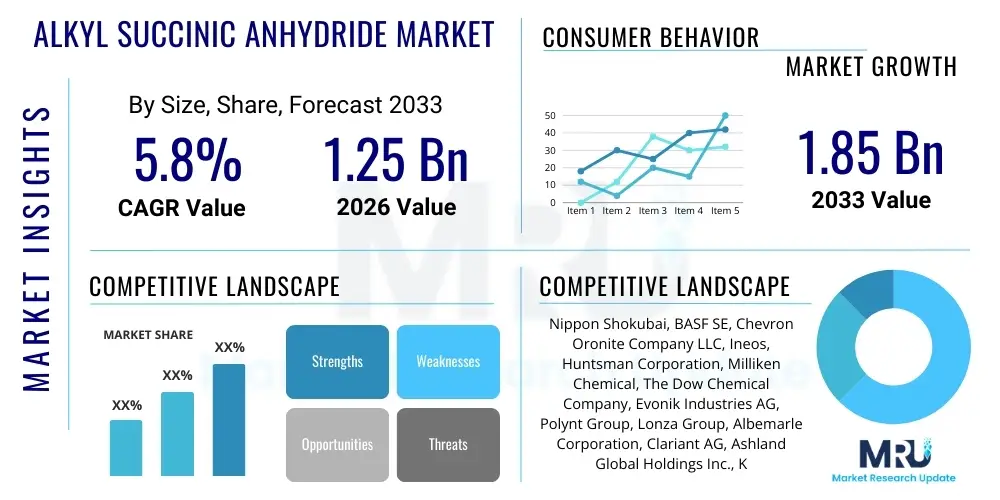

The Alkyl Succinic Anhydride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Alkyl Succinic Anhydride Market introduction

Alkyl Succinic Anhydride (ASA) is a critical chemical intermediate derived primarily from maleic anhydride and specific olefins, characterized by its reactive anhydride functional group and long alkyl chains. This unique structure allows ASA to impart hydrophobicity, dispersibility, and emulsifying properties, making it highly valuable across several industrial sectors. The primary and most historically significant application of ASA is as a key precursor in the synthesis of Alkyl Ketene Dimer (AKD), which is extensively utilized as a neutral internal sizing agent in the paper and pulp industry to improve water resistance and printing quality of paper products. The demand for high-quality packaging materials and printing papers, especially in emerging economies, remains a foundational driver for ASA consumption.

Beyond the paper sector, Alkyl Succinic Anhydride derivatives play a crucial role in enhancing the performance characteristics of various lubricant and fuel formulations. Due to their excellent thermal stability and detergency properties, ASAs are increasingly used as intermediates for synthesizing high-performance lubricant additives, such as ashless dispersants, which help prevent sludge and varnish formation in engines and machinery. This expansion into high-value additive markets, particularly within the automotive and industrial machinery sectors, is diversifying the revenue streams for ASA manufacturers and increasing the overall market resilience, moving it beyond its dependency on the cyclical nature of the global paper industry.

The inherent benefits of ASA, including its versatile reactivity and the ability to tailor alkyl chain lengths (C8 to C18+) to specific application requirements, underscore its importance in specialty chemical production. Market growth is further bolstered by the increasing industry shift toward more sustainable chemical processes and high-efficiency additives. For instance, the need for enhanced fuel economy and extended oil drain intervals in modern vehicles directly translates into higher demand for sophisticated, ASA-derived lubricant components. Furthermore, its application as a curing agent for specialized epoxy resins utilized in coatings and composites provides additional avenues for market expansion, particularly in the construction and protective coatings segments.

Alkyl Succinic Anhydride Market Executive Summary

The Alkyl Succinic Anhydride market is exhibiting robust growth, driven primarily by the sustained demand for neutral paper sizing agents (AKD) in the thriving global paper and packaging industry, particularly across the Asia Pacific region. Key business trends include continuous process optimization by manufacturers to reduce production costs and improve yield, alongside significant investments in R&D aimed at developing specialized ASA derivatives for high-performance applications in the automotive and oil & gas sectors. There is a noticeable trend toward backward integration among major players to secure raw material supply (maleic anhydride and olefins), mitigating volatility in input costs and ensuring competitive pricing for the final product. Furthermore, sustainability mandates are prompting the development of bio-based or partially bio-derived succinic anhydride precursors, aligning with global green chemistry initiatives.

Regionally, Asia Pacific maintains its dominance in both production and consumption, fueled by massive industrialization, urbanization, and the corresponding surge in demand for disposable packaging, office papers, and hygiene products. Countries like China and India are experiencing rapid expansion in their paper and pulp capacities, necessitating substantial supplies of ASA. North America and Europe, while slower in pulp production growth, represent mature markets characterized by stringent regulatory environments and a high demand for premium lubricant and fuel additives, pushing manufacturers to innovate toward low-volatility and high-thermal-stability products. The mature markets also focus heavily on maximizing operational efficiencies and adopting circular economy principles, impacting the supply chain dynamics for chemical intermediates.

Segment trends reveal that the application segment of Lubricant Additives is poised for the fastest growth, largely due to the increasing sophistication of internal combustion engines requiring advanced dispersants and corrosion inhibitors derived from ASA. By type, Linear Alkyl Succinic Anhydride (LASA) continues to hold the largest market share due to its established efficacy in AKD synthesis, yet Branched Alkyl Succinic Anhydride (BASA) is gaining traction, particularly in specialized niche applications like synthetic lubricants and complex resin systems, where its unique structural properties offer superior performance attributes. The market structure remains moderately consolidated, with a few global chemical giants controlling the bulk of the production capacity, utilizing their economies of scale and extensive global distribution networks to maintain market leadership.

AI Impact Analysis on Alkyl Succinic Anhydride Market

Common user questions regarding AI's influence on the Alkyl Succinic Anhydride market typically center on how artificial intelligence can optimize the complex synthesis processes, predict raw material price fluctuations (olefins and maleic anhydride), and accelerate the discovery of novel, high-performing ASA derivatives. Users are keen to understand if AI-driven predictive maintenance can reduce downtime in capital-intensive chemical plants and if machine learning models can improve the efficiency and quality control during the polymerization or functionalization stages inherent in ASA production. The overarching theme is the expectation that AI and advanced analytics will transition ASA manufacturing from traditional empirical methods to data-driven, precision chemical engineering, thereby enhancing sustainability and profitability simultaneously.

AI's primary influence is manifesting through sophisticated process modeling and control systems. Machine learning algorithms are being deployed to analyze real-time reactor data, including temperature profiles, pressure, and reactant concentrations, enabling dynamic adjustments that optimize reaction yield and purity of the ASA product. This level of optimization is critical for specialty chemicals where slight variations in quality can severely impact end-use performance, such as in high-specification lubricant additives. Furthermore, AI contributes significantly to supply chain resilience by providing predictive insights into logistics bottlenecks and potential disruptions in the procurement of key petrochemical feedstocks, allowing companies to implement proactive inventory management strategies.

Beyond operations, AI is revolutionizing R&D in the ASA domain. Computational chemistry and AI platforms are used to screen vast databases of potential alkyl chain structures and reaction parameters, accelerating the identification of novel ASA derivatives with superior performance characteristics for specific applications, such as enhanced thermal stability for synthetic oils or improved efficiency as a demulsifier. This capability significantly reduces the time and cost associated with traditional lab-based synthesis and testing cycles, fostering quicker market entry for advanced ASA-based solutions, thereby maintaining competitive advantage and driving innovation within the market landscape.

- AI-driven optimization of reaction parameters (temperature, pressure, catalyst load) leading to increased ASA synthesis yield.

- Predictive maintenance analytics deployed in chemical plants to minimize equipment failure and unplanned downtime.

- Machine learning models for forecasting fluctuating raw material costs (olefins, maleic anhydride).

- Accelerated discovery of novel ASA structures and derivatives for high-performance lubricant and fuel additive applications.

- Enhanced quality control systems utilizing computer vision and data analytics for immediate identification of off-spec batches.

- Optimization of energy consumption during distillation and purification processes through algorithmic control.

DRO & Impact Forces Of Alkyl Succinic Anhydride Market

The Alkyl Succinic Anhydride market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary Driver is the persistent growth of the global paper and packaging industry, particularly the demand for AKD-based neutral sizing agents, which offers superior performance over traditional rosin sizing in modern paper production facilities. Concurrently, the increasing need for high-performance automotive and industrial lubricants, driven by stricter emission standards and the requirement for extended equipment lifespan, provides a substantial demand uplift for ASA-derived dispersants and corrosion inhibitors. These synergistic demands across diverse end-use sectors ensure sustained market expansion, making ASA a critical component in both traditional and specialized chemical value chains.

Conversely, the market faces significant Restraints, most notably the high price volatility and supply chain instability of key petrochemical raw materials, including olefins (such as isobutylene or dodecene) and maleic anhydride, which directly impacts the production cost and pricing strategies of ASA manufacturers. Environmental regulations, particularly those concerning chemical intermediates and the disposal of industrial waste from their production, impose compliance costs and potential operational restrictions, especially in stringent regions like Europe. Furthermore, the market faces competition from alternative sizing agents in the paper industry, though AKD (derived from ASA) generally maintains a competitive edge in neutral sizing applications. However, continuous innovation in competing technologies necessitates ongoing investment in R&D to maintain ASA's relevance and cost-effectiveness.

The central Opportunity lies in the development and commercialization of bio-based or partially renewable Alkyl Succinic Anhydride precursors, aligning with the global trend toward sustainable chemistry and offering manufacturers a premium positioning in environmentally conscious markets. Significant opportunities also exist in targeting niche, high-margin specialty applications, such as sophisticated curing agents for advanced composite materials used in aerospace and wind energy sectors, and specialized demulsifiers for the challenging conditions within the oil and gas extraction processes. The combination of sustained demand in core markets (paper sizing) and penetration into high-growth, high-value specialty sectors (advanced lubricants, composites) defines the robust positive Impact Forces driving investment and innovation across the ASA supply chain, positioning the market for steady, moderate growth through the forecast period.

Segmentation Analysis

The Alkyl Succinic Anhydride market is systematically segmented based on Type, Application, and End-Use Industry, providing a nuanced view of market dynamics and consumer preferences across different chemical value chains. Segmentation by Type distinguishes between Linear Alkyl Succinic Anhydride (LASA) and Branched Alkyl Succinic Anhydride (BASA), where LASA dominates due to its established use in the high-volume production of AKD for paper sizing. However, BASA is critical for specific lubricant and specialty chemical applications where enhanced thermal stability and solubility are required. Analyzing these types helps market players align their production capacity with the specific performance demands of their target clientele.

Application segmentation highlights the diverse roles ASA derivatives play, ranging from the high-volume Paper Sizing segment to specialized segments like Lubricant Additives, Fuel Additives, and Resin Curing Agents. The Paper Sizing segment (via AKD) remains the largest consumer, anchoring the market volume. Conversely, the growth trajectory is steeper in the additive and curing agent segments, which command higher prices and are driven by stricter performance specifications in the automotive and construction industries. This application diversity mitigates risk and ensures that the market is not solely reliant on the health of any single end-use sector.

End-Use Industry analysis categorizes consumption into Paper & Pulp, Automotive, Oil & Gas, and Construction, among others. The Paper & Pulp industry is the foundational pillar of demand. Yet, the Automotive sector, with its continuous need for upgraded engine oils and transmission fluids, and the Oil & Gas sector, requiring efficient demulsifiers and corrosion inhibitors for extraction and processing, are the primary drivers of value-added, technical-grade ASA products. Understanding these segments is crucial for strategic positioning, product development, and tailoring marketing efforts toward industry-specific technical requirements and regulatory compliance standards.

- By Type:

- Linear Alkyl Succinic Anhydride (LASA)

- Branched Alkyl Succinic Anhydride (BASA)

- By Application:

- Paper Sizing (Alkyl Ketene Dimer - AKD Precursor)

- Lubricant Additives (Dispersants, Detergents)

- Fuel Additives

- Resin Curing Agents (Epoxy Resins, Polyester Resins)

- Emulsifiers & Detergents

- By End-Use Industry:

- Paper & Pulp Industry

- Automotive & Transportation

- Oil & Gas (Refining and Exploration)

- Construction (Coatings and Composites)

- Personal Care and Cosmetics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Alkyl Succinic Anhydride Market

The value chain of the Alkyl Succinic Anhydride market begins with the Upstream Analysis, focusing on the procurement and processing of foundational raw materials. The two primary precursors are olefins (such as specific linear or branched alpha olefins, like dodecene or tetradecene) and maleic anhydride (MA). Olefins are typically derived from crude oil refining or petrochemical processes, linking the ASA market directly to global energy prices and petrochemical supply stability. Maleic anhydride production involves the catalytic oxidation of n-butane or benzene. Suppliers of these raw materials often include large petrochemical complexes. Fluctuations in the cost and availability of these feedstocks represent the most significant cost driver for ASA manufacturers, leading many large chemical producers to integrate backwards to secure reliable supply and achieve cost efficiencies.

The Midstream phase involves the core manufacturing process of ASA, typically achieved via the thermal reaction (ene reaction) of maleic anhydride with the appropriate olefin, followed by purification processes such as distillation or crystallization. This stage requires significant capital investment in reaction vessels, specialized equipment for high-temperature and high-pressure processing, and stringent quality control protocols to ensure the purity and specified alkyl chain length distribution of the final ASA product. Manufacturers in this phase often differentiate themselves through proprietary catalyst systems, process optimization (often involving continuous rather than batch processes), and advanced analytical capabilities necessary for meeting the strict specifications of demanding applications like lubricant additives.

The Downstream Analysis involves the transformation of ASA into various commercial derivatives and its eventual distribution to end-users. The major downstream pathway involves reacting ASA with amines to form AKD (for paper sizing) or with polyamines to form ashless dispersants (for lubricants). Distribution channels are highly specialized: Direct sales are common for large-volume customers (e.g., major paper mills or lubricant blending houses) requiring technical support and customized formulations. Indirect distribution, leveraging chemical distributors and specialized traders, handles smaller volumes and services niche markets (e.g., specialized epoxy resin manufacturers or cosmetic formulators). The complexity of handling and transporting chemical intermediates necessitates robust supply chain logistics and adherence to global chemical safety regulations.

Alkyl Succinic Anhydride Market Potential Customers

The potential customer base for Alkyl Succinic Anhydride is fundamentally heterogeneous, spanning multiple large-scale industrial sectors, reflecting the versatility of ASA derivatives. The single largest consumer category comprises global Paper and Pulp manufacturers, specifically those operating modern paper machines requiring neutral sizing agents to produce high-quality printing, writing, and packaging papers. These customers purchase ASA as a precursor to synthesize Alkyl Ketene Dimer (AKD) internally or procure pre-formed AKD sizing emulsions from chemical suppliers. Their purchasing criteria focus heavily on product purity, consistency, and competitive pricing, given the volume-driven nature of paper production.

The second major segment consists of Lubricant and Additive Blending Companies, including major oil corporations and specialized chemical formulators. These customers utilize ASA as a key intermediate for synthesizing ashless dispersants, detergents, and corrosion inhibitors crucial for automotive engine oils, hydraulic fluids, and industrial gear oils. Their demand is highly specialized, requiring ASA derivatives tailored for extreme temperature performance, shear stability, and compatibility with other lubricant components, making purchasing decisions driven by performance efficacy and regulatory compliance (e.g., meeting API or ACEA standards).

Other significant buyers include Specialty Chemical Manufacturers and Resin Producers. The former uses ASA as an intermediate in producing sophisticated emulsifiers, demulsifiers (for oil and gas separation), and surfactants for personal care products. Resin Producers, particularly those in the construction and protective coatings industries, use ASA as a latent or non-latent curing agent for epoxy resins, benefiting from its ability to enhance the cured resin's thermal and chemical resistance. These diversified end-users underline the critical nature of ASA as a chemical building block for high-value specialty formulations across global manufacturing operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Shokubai, BASF SE, Chevron Oronite Company LLC, Ineos, Huntsman Corporation, Milliken Chemical, The Dow Chemical Company, Evonik Industries AG, Polynt Group, Lonza Group, Albemarle Corporation, Clariant AG, Ashland Global Holdings Inc., Kao Corporation, Italmatch Chemicals, Cargill, Inc., Ester Chemical, Shandong Taihe Chemical Co., Ltd., Wuxi Hongbo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alkyl Succinic Anhydride Market Key Technology Landscape

The technology landscape governing the Alkyl Succinic Anhydride market is characterized by mature, yet continuously optimized, synthetic processes focused on enhancing purity, controlling isomer distribution, and improving energy efficiency. The core production method relies on the thermal addition reaction, specifically the ene reaction, between maleic anhydride and various linear or branched olefins. Key technological advancements involve the use of proprietary catalyst systems to accelerate the reaction rate and minimize side product formation, ensuring the resulting ASA meets the strict specifications required for high-end applications like ashless dispersants where impurities can compromise additive performance and engine durability. Manufacturers are also heavily investing in continuous flow reactors rather than traditional batch processes to achieve greater throughput, better heat management, and consistent product quality, thereby lowering the overall cost of ownership.

A secondary, but increasingly vital, technological focus lies in downstream processing and functionalization technologies. Since ASA itself is an intermediate, the market's value is often determined by the efficiency of its conversion into derivatives like AKD or polyamine dispersants. Innovative emulsification and dispersion technologies are paramount, particularly for the paper industry, where highly stable, low-viscosity AKD emulsions are required for efficient sizing application. Furthermore, advances in separation and purification techniques, such as specialized fractional distillation and solvent extraction methods, are crucial for producing the high-purity, clear ASA required for synthetic lubricant and pharmaceutical intermediate uses, demanding precision control over the molecular weight distribution and removal of unreacted raw materials.

The future technology landscape is leaning heavily toward sustainability and digitalization. Research into utilizing bio-based succinic acid (derived from fermentation) and subsequent conversion to bio-based maleic anhydride provides a pathway for greener ASA production, necessitating new catalytic and process technologies compatible with bio-derived inputs. Simultaneously, the implementation of Industry 4.0 principles, including sensor technology, big data analytics, and Artificial Intelligence (AI) for real-time process monitoring and predictive modeling, is transforming plant operations. These digital technologies allow producers to dynamically manage reactor conditions, optimize energy usage, reduce waste, and ensure a more reliable and cost-effective supply of various chain-length Alkyl Succinic Anhydrides to global customers.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the dominant region in the Alkyl Succinic Anhydride market, driven by its massive industrial base and rapidly expanding economies, particularly China, India, and Southeast Asian nations. The region’s dominance is primarily attributed to the high volume of paper and pulp production, fueled by robust domestic consumption of packaging materials, tissue products, and printing papers associated with urbanization and the boom in e-commerce. China, in particular, is both the largest consumer and producer of ASA derivatives, benefiting from large-scale chemical manufacturing capacities and a continuous push for modernization in its paper mills, requiring high-efficiency sizing agents. Furthermore, the burgeoning automotive and manufacturing sectors across APAC are increasing the demand for advanced lubricants, significantly boosting the specialized additive segment of the ASA market. Investment in new chemical complexes and favorable government policies supporting manufacturing excellence continue to consolidate the region's leading market position.

- North America: North America represents a mature, high-value market for Alkyl Succinic Anhydride. While paper production volumes are stable or showing moderate decline in some areas, the demand for specialty ASA derivatives remains strong, primarily driven by the stringent regulatory landscape in the Automotive and Oil & Gas sectors. The shift toward low-viscosity, high-performance synthetic lubricants designed to meet strict fuel efficiency standards (e.g., CAFE standards) mandates the use of high-quality ashless dispersants and detergents derived from ASA. The region emphasizes technological innovation, focusing on bio-based alternatives and the optimization of existing chemical processes to enhance sustainability and purity. The presence of major global lubricant and additive formulators also contributes significantly to the sustained demand for premium-grade ASA intermediates.

- Europe: The European ASA market is characterized by high levels of environmental consciousness and stringent REACH regulations, which necessitate substantial investment in process safety and sustainable chemical practices. Europe remains a significant consumer, driven by its established packaging industry and a high-tech automotive sector. The regional focus is less on volume growth and more on value creation, with a strong preference for specialty ASA derivatives used in advanced coatings, high-performance composites, and environmentally benign lubricant formulations. The push toward circular economy models encourages research into renewable feedstocks, offering a strong market niche for bio-based succinic acid derivatives. Regulatory pressure acts as both a barrier (increasing compliance costs) and a driver (forcing innovation toward cleaner production methods).

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are emerging markets showing considerable growth potential for ASA. In LATAM, countries like Brazil and Mexico exhibit growing paper and pulp industries, leading to increased localized demand for AKD precursors. Economic recovery and rising industrial activities are also boosting lubricant consumption. The MEA region, heavily dominated by the Oil & Gas industry, demonstrates strong demand for high-performance ASA-derived demulsifiers, corrosion inhibitors, and specialty additives required for complex oil extraction and refining processes. Infrastructure investment and urbanization across both regions are expected to stimulate the construction and automotive sectors, creating diversified growth opportunities for ASA applications over the forecast period, albeit from a lower base compared to APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alkyl Succinic Anhydride Market.- Nippon Shokubai

- BASF SE

- Chevron Oronite Company LLC

- Ineos

- Huntsman Corporation

- Milliken Chemical

- The Dow Chemical Company

- Evonik Industries AG

- Polynt Group

- Lonza Group

- Albemarle Corporation

- Clariant AG

- Ashland Global Holdings Inc.

- Kao Corporation

- Italmatch Chemicals

- Cargill, Inc. (Focusing on bio-based precursors)

- Ester Chemical

- Shandong Taihe Chemical Co., Ltd.

- Wuxi Hongbo Chemical Co., Ltd.

- Lubrizol Corporation

Frequently Asked Questions

Analyze common user questions about the Alkyl Succinic Anhydride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Alkyl Succinic Anhydride (ASA) and its primary industrial application?

Alkyl Succinic Anhydride is a specialty chemical intermediate derived from maleic anhydride and olefins. Its primary application is as a crucial precursor in the synthesis of Alkyl Ketene Dimer (AKD), which functions as a highly effective neutral internal sizing agent for enhancing water resistance in the global paper and pulp industry.

How does the demand for electric vehicles (EVs) affect the ASA market?

While the transition to EVs reduces demand for ASA derivatives used in conventional engine oil additives, this transition is moderate. Furthermore, ASA is increasingly used in specialty lubricants for EV components (e.g., gear oils, thermal management fluids) and as a curing agent for composite materials used in lightweight battery housings, balancing overall market impact.

Which geographical region holds the largest market share for Alkyl Succinic Anhydride?

The Asia Pacific (APAC) region currently holds the largest market share for Alkyl Succinic Anhydride, driven by the massive scale of its paper and packaging manufacturing industries, rapid industrialization, and high consumption rates in countries like China and India.

What are the key drivers propelling the growth of the ASA market beyond the paper industry?

Key drivers include the stringent performance requirements for modern automotive and industrial lubricants, necessitating advanced ASA-derived ashless dispersants and detergents for improved thermal stability and extended drain intervals. Additionally, growth in the Oil & Gas sector demands specialized demulsifiers and corrosion inhibitors derived from ASA.

Are there sustainable or bio-based alternatives being developed for Alkyl Succinic Anhydride?

Yes, significant research and development efforts are focused on utilizing bio-based succinic acid, often derived from microbial fermentation of renewable feedstocks. Converting bio-succinic acid into bio-based maleic anhydride provides a sustainable pathway for producing partially or fully bio-derived Alkyl Succinic Anhydride, appealing to environmentally conscious industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager