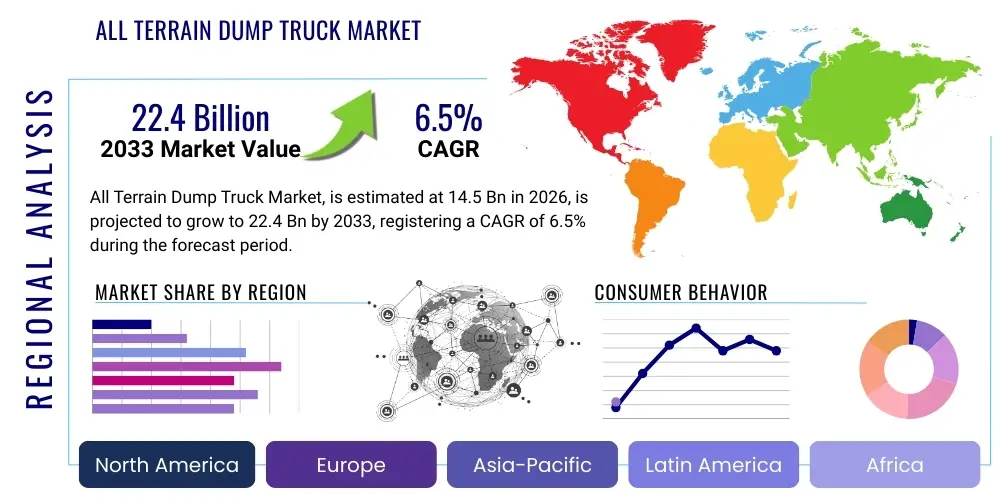

All Terrain Dump Truck Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443066 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

All Terrain Dump Truck Market Size

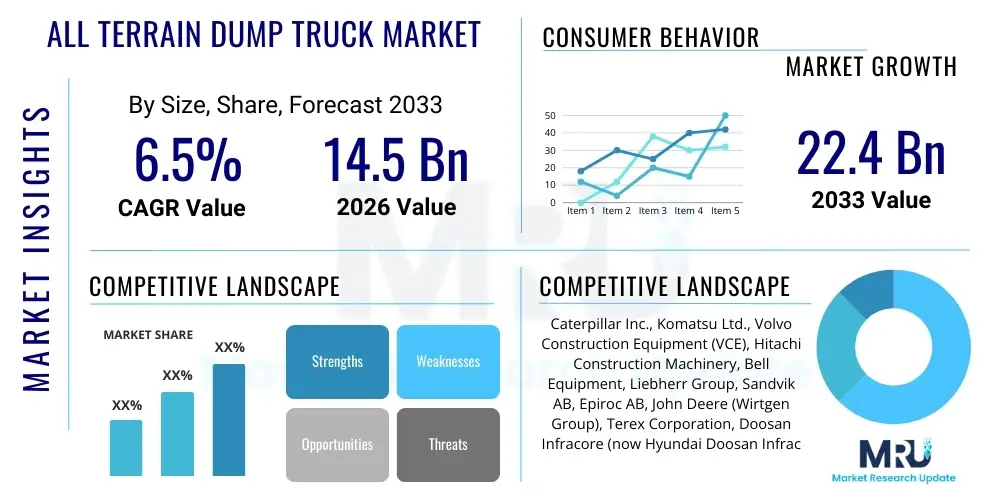

The All Terrain Dump Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 22.4 billion by the end of the forecast period in 2033.

All Terrain Dump Truck Market introduction

The All Terrain Dump Truck (ATDT) market encompasses heavy-duty specialized vehicles engineered for efficient material transport across challenging, unstructured, and often severe operational environments, including steep gradients, soft ground, and rugged landscapes typical of mining, large-scale construction, quarrying, and forestry operations. These trucks are distinct from standard on-highway or traditional rigid dump trucks due to their enhanced articulation, robust suspension systems, and superior traction capabilities, often utilizing high-flotation tires or multi-axle drive configurations. The primary product categories include Articulated Dump Trucks (ADTs) and specialized rigid haulers modified for extreme off-road use, both of which are critical assets in large infrastructure projects globally where reliability under adverse conditions is non-negotiable for project timeline adherence and operational safety.

The core application areas driving the demand for ATDTs are concentrated in global infrastructure development, particularly road construction, dam building, and urban expansion projects in emerging economies, alongside intensive raw material extraction activities such as coal, metal, and mineral mining. These specialized vehicles offer significant operational benefits, including reduced downtime, superior stability compared to conventional machinery, and enhanced fuel efficiency through optimized powertrain designs for variable terrain. Their ability to navigate tight turns and operate effectively in confined spaces—a necessity in underground mining or tight job sites—further solidifies their market importance and justifies the higher initial capital expenditure required for acquisition.

Key driving factors accelerating the adoption of ATDTs include unprecedented levels of public and private investment in infrastructure revitalization programs across North America and Europe, coupled with the ongoing expansion of large-scale mining operations in resource-rich regions of Africa and Asia Pacific. Furthermore, technological advancements, specifically related to engine efficiency (meeting stringent emission norms), operator safety enhancements (e.g., advanced telematics and collision avoidance systems), and the growing trend towards autonomous operation, are positioning ATDTs as essential components in modern, efficient, and sustainable material handling ecosystems. The replacement cycle for aging fleet infrastructure in established markets also contributes substantially to sustained market growth.

All Terrain Dump Truck Market Executive Summary

The All Terrain Dump Truck market is experiencing robust expansion, largely catalyzed by cyclical upturns in global commodity prices which stimulate heavy investment in mining and quarrying activities, alongside sustained governmental focus on infrastructure renewal, particularly in sectors such as transportation networks and renewable energy facilities. Current business trends indicate a strong shift towards optimizing total cost of ownership (TCO), prompting end-users to prioritize vehicles equipped with advanced telematics for predictive maintenance and real-time performance monitoring, thereby minimizing operational interruptions. Furthermore, the increasing integration of electric and hybrid powertrain technologies, driven by global sustainability mandates and lower long-term fuel costs, represents a major transformative trend influencing procurement decisions across all key vertical markets.

Regional market dynamics showcase the Asia Pacific (APAC) region as the primary driver of market volume and revenue growth, predominantly fueled by massive infrastructure projects in countries like India, China, and Indonesia, coupled with extensive resource extraction operations supporting rapid industrialization. North America and Europe, while slower in pure volume growth, lead in the adoption of advanced, high-specification trucks, especially those incorporating Tier 4 Final/Stage V emission-compliant engines and autonomous capabilities, reflecting their focus on operational efficiency, stringent environmental regulations, and worker safety. Latin America’s market growth remains closely tied to volatility in global copper and iron ore prices, yet it offers significant potential for fleet modernization and the introduction of rental models.

Segment trends reveal that the Articulated Dump Truck (ADT) segment is expected to maintain market dominance, attributed to its versatility, superior maneuverability, and efficacy across diverse construction and mining terrains compared to specialized rigid haulers. Within capacity segments, the mid-range capacity (25 to 45 tons) vehicles are experiencing the highest demand, striking an optimal balance between payload efficiency and operational footprint on smaller or constrained job sites. Application-wise, the mining sector continues to represent the largest consumer base for ATDTs, yet the construction and infrastructure segment is projected to exhibit the fastest CAGR due to widespread urbanization and government stimulus packages aimed at accelerating economic recovery through capital works.

AI Impact Analysis on All Terrain Dump Truck Market

User queries regarding the impact of Artificial Intelligence (AI) on the All Terrain Dump Truck market primarily center on the feasibility and immediate timeline for widespread autonomous operations, the effectiveness of AI-driven predictive maintenance systems, and the implications of automation on operational safety and skilled labor requirements. Users are concerned about the capital investment necessary for retrofitting existing fleets with AI-capable hardware and the complexity of integrating these smart systems into existing fleet management platforms. The consensus expectation is that AI will revolutionize efficiency by enabling optimal route planning, dynamic payload management, and comprehensive component health diagnostics, ultimately driving down TCO and enhancing machine longevity. Furthermore, safety improvements derived from advanced sensor fusion and immediate hazard detection algorithms are a major area of interest for end-users operating in high-risk environments.

AI’s influence is moving the ATDT industry beyond simple automation towards intelligent operational environments. For instance, sophisticated AI algorithms analyze continuous streams of data from integrated IoT sensors—covering everything from engine performance and tire pressure to hydraulic system stress—to predict potential mechanical failures with high accuracy, enabling maintenance scheduling that maximizes uptime. Moreover, AI is foundational to the development of fully autonomous hauling cycles. These systems use computer vision, LiDAR, and real-time mapping to navigate complex mine sites or construction zones without human intervention, ensuring consistent speeds, optimized load/dump cycles, and eliminating human error risks, thereby significantly boosting productivity, especially in round-the-clock operations.

Beyond vehicle-level operation, AI tools are transforming fleet management at a macro level. AI-powered software optimizes the entire logistical flow, coordinating multiple dump trucks, excavators, and loaders simultaneously to prevent bottlenecks and unnecessary idling, leading to substantial fuel savings and lower carbon emissions. The implementation of AI also facilitates comprehensive driver training analysis by simulating complex scenarios and evaluating operator responses, ultimately ensuring that human-operated fleets adhere to the highest safety and efficiency standards, bridging the gap between current operations and future full autonomy.

- AI enables predictive maintenance, dramatically reducing unplanned downtime and optimizing component lifecycles.

- Full autonomy and semi-autonomous features (e.g., automated steering, collision avoidance) enhance operational safety and consistency.

- Optimized dynamic route planning driven by machine learning minimizes travel distance and fuel consumption across job sites.

- AI-driven payload management ensures trucks operate within safe and optimal capacity limits, preventing mechanical stress and maximizing throughput.

- Enhanced sensor fusion and computer vision systems allow for accurate real-time environmental awareness and hazard detection, critical for safety.

DRO & Impact Forces Of All Terrain Dump Truck Market

The All Terrain Dump Truck market is shaped by a critical interplay of strong market drivers, significant operational restraints, and emerging opportunities that collectively determine its growth trajectory and competitive landscape. The primary driver is the global acceleration of infrastructure development spending, particularly in the post-pandemic recovery era, where governments globally are allocating substantial funds to essential capital projects. This driver is powerfully reinforced by the sustained demand for mineral and metal commodities necessitated by the energy transition (e.g., lithium, cobalt, copper for EVs and renewable technologies), ensuring continuous investment in exploration and extraction activities that rely heavily on ATDTs. However, these positive forces are constrained by high capital expenditure requirements, regulatory hurdles related to emission standards (driving up manufacturing costs), and, crucially, a persistent global shortage of skilled operators and maintenance technicians capable of managing increasingly complex, high-tech machinery.

The major opportunities in this market revolve around technological disruption and new business models. Electrification (the transition to battery-electric and hydrogen fuel cell ATDTs) represents a long-term growth opportunity, promising reduced emissions and lower operational costs in highly controlled environments like enclosed mines. Furthermore, the expansion of the rental and leasing market offers flexibility to smaller and mid-sized contractors who seek to minimize large upfront investments while benefiting from modern, well-maintained fleets. Impact forces such as commodity price volatility directly affect the profitability of mining end-users, subsequently influencing their capital equipment procurement cycles. Simultaneously, the accelerating rate of technological change—specifically the rapid adoption of IoT, telematics, and automation—acts as a powerful, sustained impact force, compelling manufacturers to continuously innovate and dictating which technologies become industry standard for efficiency and safety.

The combined impact of these forces dictates market momentum. While economic cycles and regulatory pressures introduce periodic headwinds (restraints), the fundamental need for infrastructure build-out and raw material extraction provides underlying stability (drivers). The market’s future dynamism will be defined by its ability to capitalize on opportunities—namely, automation and alternative powertrains—to mitigate the constraints of high operating costs and labor shortages. Successful market players are those who can effectively manage these impact forces by offering integrated, data-driven solutions that provide end-users with predictable operational expenditures and verifiable sustainability benefits, thereby securing long-term contracts and market share.

Segmentation Analysis

The All Terrain Dump Truck market is comprehensively segmented based on key functional, structural, and application characteristics to provide detailed insight into demand dynamics across diverse end-user industries. This segmentation is crucial for manufacturers to tailor product development and for buyers to identify the most suitable equipment for specific operational requirements, considering factors such as site terrain, hauling distance, and payload capacity. The fundamental breakdowns include classification by product type (articulated versus rigid), payload capacity (small, medium, large), and the final application area (mining, construction, quarrying, etc.), each exhibiting unique growth trajectories influenced by regional economic conditions and specific project mandates. The versatility and adaptability of Articulated Dump Trucks (ADTs) make them the preferred choice in general construction and small-to-medium mining operations, while specialized rigid trucks dominate ultra-large surface mining sites where massive hauling capacity and speed over controlled paths are prioritized.

Segmentation by capacity is particularly significant, as it directly correlates with the scale of the operation and the infrastructure investment required. Smaller capacity trucks (up to 25 metric tons) are typically favored for residential construction and utility projects, offering flexibility in congested urban areas. The medium-capacity range (25 to 45 metric tons) forms the core revenue generator, suitable for large infrastructure and medium-scale quarrying, providing an optimal blend of efficiency and maneuverability. Conversely, the heavy-duty segment (above 45 metric tons), primarily rigid haulers, serves the intense material movement demands of major global mining hubs. Understanding this demand distribution helps supply chain planning and inventory management for both OEMs and rental companies, ensuring availability matches project timelines and scale.

Application-based segmentation reveals that the mining industry, encompassing both underground and surface extraction, remains the single largest consumer of ATDTs globally, driven by continuous production requirements regardless of short-term economic fluctuations. However, the fastest-growing segment is infrastructure and general heavy construction, supported by global stimulus packages targeting road networks, bridges, and energy projects. This growth in construction often favors the more maneuverable ADTs. Analyzing these segments not only clarifies current market composition but also assists in forecasting future investments, especially regarding the adoption of hybrid or fully electric models, which are initially being deployed in specific application environments like underground mining due to stringent ventilation requirements.

- By Type:

- Articulated Dump Trucks (ADTs)

- Rigid Dump Trucks (Specialized All-Terrain Models)

- Tracked/Crawler Dumpers

- By Capacity:

- Below 25 Metric Tons

- 25 to 45 Metric Tons (Medium Capacity)

- Above 45 Metric Tons (Heavy Capacity)

- By Application:

- Mining (Surface Mining, Underground Mining)

- Construction and Infrastructure (Roads, Dams, Bridges)

- Quarrying and Aggregates

- Oil & Gas and Utilities

- Forestry and Agriculture

Value Chain Analysis For All Terrain Dump Truck Market

The value chain of the All Terrain Dump Truck market is complex, spanning from the procurement of raw materials and sophisticated component manufacturing to final deployment, operation, and maintenance. Upstream analysis highlights the critical reliance on suppliers of high-grade steel, advanced engine components (meeting emission standards like Tier 4/Stage V), complex hydraulic systems, and sophisticated electronics (telematics, sensor technology). Key players maintain strategic partnerships or vertical integration with component manufacturers to secure the supply of powertrain elements, tires, and axles, which are fundamental to the performance and all-terrain capability of the final product. Fluctuations in commodity prices, particularly steel and rare earth elements used in electronics, significantly impact manufacturing costs and upstream stability, requiring OEMs to employ robust procurement risk management strategies.

The midstream segment involves the core manufacturing, assembly, and integration processes. Leading OEMs focus heavily on automated assembly lines, quality control, and R&D investment to integrate advanced features such as optimized chassis design, robust suspension systems, and increasingly, autonomous driving technology and electric powertrains. Direct distribution typically involves a network of authorized regional dealerships, which play a crucial role in localized sales, financing, and immediate after-sales support. Indirect distribution channels, such as large global equipment rental companies, are also integral, offering ATDTs on short- or long-term leases, which is an increasingly preferred operational model for smaller contractors or specific, temporary projects requiring specialized equipment.

Downstream activities center on the end-users—primarily large mining corporations, international construction firms, and government infrastructure agencies. This phase includes the operational deployment, continuous monitoring via telematics, and crucial after-sales service, parts supply, and maintenance. Profitability throughout the value chain is significantly influenced by the lifecycle cost of the equipment; therefore, effective service support and guaranteed parts availability are major competitive differentiators. The growing importance of the used equipment market and remanufacturing programs (circular economy initiatives) also forms a substantial part of the downstream value chain, offering sustainable and cost-effective alternatives to new purchases, thereby extending the overall economic life of ATDT assets.

All Terrain Dump Truck Market Potential Customers

The primary consumers and end-users of All Terrain Dump Trucks are large-scale industrial operators whose core business involves material extraction or movement across challenging geographical locations. Major customers include multinational mining corporations (e.g., BHP, Rio Tinto, Vale), which utilize ATDTs extensively in both surface and underground operations for hauling overburden, ore, and coal. These entities prioritize high payload capacity, extreme durability, and increasingly, integration with autonomous fleet management systems to maximize operational throughput and safety across vast, remote sites. Their purchasing decisions are heavily influenced by the vehicle’s TCO, fuel efficiency, and the manufacturer’s capability to provide extensive global parts and service networks, crucial for minimizing costly downtime in critical operations.

Another significant customer segment comprises heavy construction and civil engineering firms involved in massive infrastructure projects such as the construction of highways, major dams, power generation facilities, and large commercial developments. Companies like Bechtel or VINCI require versatile, high-maneuverability ADTs to transport earth, aggregates, and construction debris over rough, temporary job site roads. For this segment, flexibility, articulation, and quick setup/teardown capabilities are highly valued. Furthermore, governmental public works departments, especially in developing regions, are substantial buyers, either directly or through contract partners, driven by national priorities to expand and modernize transportation infrastructure and utility networks.

In addition to these core segments, quarry and aggregate producers constitute a steady demand source, needing reliable trucks for moving crushed stone, sand, and gravel from extraction points to processing facilities. Moreover, specialized markets such as forestry (especially in regions with challenging topography like North America and Scandinavia) and large-scale industrial recycling facilities represent niche but growing customer bases. Furthermore, equipment rental and leasing companies are increasingly important as intermediaries, purchasing large fleets of ATDTs to offer flexible solutions to smaller contractors who cannot afford the high upfront capital cost of ownership, thereby democratizing access to high-performance specialized hauling equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 billion |

| Market Forecast in 2033 | USD 22.4 billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment (VCE), Hitachi Construction Machinery, Bell Equipment, Liebherr Group, Sandvik AB, Epiroc AB, John Deere (Wirtgen Group), Terex Corporation, Doosan Infracore (now Hyundai Doosan Infracore), SANY Group, XCMG, Kress Corporation, MAN Truck & Bus, JLG Industries, Astra S.p.A., Rokbak (formerly Terex Trucks), BEML Limited, Yanmar Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

All Terrain Dump Truck Market Key Technology Landscape

The technology landscape of the All Terrain Dump Truck market is rapidly evolving, driven by demands for increased operational efficiency, reduced environmental impact, and enhanced safety standards. A foundational technology driving current innovation is the integration of advanced telematics and the Internet of Things (IoT). These systems involve deploying numerous sensors across critical components—engine, transmission, tires, hydraulics—to collect real-time operational data. This data is transmitted via cellular or satellite networks to centralized fleet management platforms, allowing operators and managers to monitor machine performance, track location, measure payload, and analyze fuel consumption instantaneously. The utilization of IoT data is paramount for enabling precision maintenance scheduling and improving fleet utilization rates, thereby directly impacting the end-user’s bottom line by maximizing uptime and minimizing reactive repairs.

The most transformative technologies are centered on automation and autonomy. Many leading manufacturers are transitioning from providing simple driver-assist features to offering full Level 4 autonomy capabilities, particularly in controlled environments such as large open-pit mines. These systems rely on sophisticated sensor fusion—combining inputs from LiDAR, radar, GPS, and high-definition cameras—along with complex algorithms to navigate, detect obstacles, and manage the load/dump cycle without human input. This autonomy significantly boosts productivity by allowing 24/7 operation and mitigating risks associated with human fatigue. Furthermore, engine technology remains critical, with ongoing research focused on developing high-efficiency diesel engines that comply with increasingly stringent global emission standards (e.g., EU Stage V and US Tier 4 Final), incorporating advanced after-treatment systems like Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPFs).

Looking ahead, the shift towards sustainable powertrains—specifically hybrid-electric and pure battery-electric dump trucks—is gaining traction. Electric ATDTs offer zero tailpipe emissions, significantly lower noise pollution (critical for urban sites and underground mining), and reduced energy costs due to regenerative braking on downhill slopes. While battery density and charging infrastructure remain practical challenges, major players are heavily investing in these technologies. Complementary technologies include advanced cab design focusing on ergonomics and vibration reduction for operator comfort, and sophisticated transmission management systems that dynamically adjust torque and gear ratios based on real-time terrain analysis, ensuring optimal traction and fuel use in diverse operational conditions.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the ATDT market, characterized by the highest volume demand, driven by massive public infrastructure investment and rapid urbanization across China, India, and Southeast Asian nations. Extensive resource extraction activities in Australia, Indonesia, and China to support global manufacturing and energy demand further solidify its dominance. The region shows a growing appetite for ADTs and is increasingly adopting telematics, though initial purchasing decisions are often highly price-sensitive compared to North America or Europe.

- North America: This region is defined by maturity, a focus on technological integration, and high safety standards. Demand is steady, fueled by infrastructure revitalization initiatives (e.g., the U.S. Infrastructure Investment and Jobs Act) and consistent large-scale mining operations. North America leads the adoption of premium features, including advanced telematics, sophisticated emissions controls, and early implementation of fully autonomous hauling solutions in major mine sites, driving up the average selling price (ASP) of units sold.

- Europe: Driven by strict environmental regulations (Stage V emissions), the European market shows significant momentum toward electrification and hybrid powertrains. Demand is robust in countries like Germany and the Scandinavian nations, focusing on efficiency and sustainability in construction, quarrying, and specific forestry applications. The rental market is highly developed here, providing flexible fleet solutions and encouraging the rapid deployment of the newest, most efficient machinery models.

- Latin America: This market's trajectory is intimately linked to the global demand and pricing for minerals such as copper, iron ore, and gold, given its rich resource endowments. Brazil, Chile, and Peru are primary markets. While price sensitivity is present, the need for robust, high-capacity machinery capable of handling extreme altitudes and harsh climates ensures steady demand. Opportunities lie in fleet modernization and adopting high-durability rigid haulers for major mining complexes.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with the Middle East (especially Saudi Arabia and UAE) driving demand via gigaprojects (e.g., NEOM) requiring massive construction fleets. Africa’s demand is concentrated in sub-Saharan regions, centered on large-scale mining (gold, diamonds, coal) and emerging infrastructure development. The challenges here include logistical hurdles and a heightened need for rugged, easily maintainable machinery due to remote operating locations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the All Terrain Dump Truck Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (VCE)

- Hitachi Construction Machinery

- Bell Equipment

- Liebherr Group

- Sandvik AB

- Epiroc AB

- John Deere (Wirtgen Group)

- Terex Corporation

- Doosan Infracore (now Hyundai Doosan Infracore)

- SANY Group

- XCMG

- Kress Corporation

- MAN Truck & Bus

- JLG Industries

- Astra S.p.A.

- Rokbak (formerly Terex Trucks)

- BEML Limited

- Yanmar Holdings

Frequently Asked Questions

Analyze common user questions about the All Terrain Dump Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Articulated and Rigid All Terrain Dump Trucks?

Articulated Dump Trucks (ADTs) feature a hinged chassis allowing for superior maneuverability and operation on soft, slippery, or steep terrain. Rigid Dump Trucks (RDTs) are designed for higher payload capacity and faster speeds, primarily operating on well-maintained hauls roads typical of large surface mines or quarries.

How is electrification impacting the long-term outlook for ATDTs?

Electrification provides significant long-term market opportunity by reducing operational costs, minimizing emissions, and decreasing noise pollution. While currently niche, battery-electric and hydrogen-powered ATDTs are expected to gain traction, especially in underground mining and regulated urban construction zones, driven by sustainability mandates.

Which geographical region holds the largest market share for All Terrain Dump Trucks?

The Asia Pacific (APAC) region currently dominates the market share due to unparalleled levels of governmental investment in large-scale infrastructure projects, rapid urbanization, and extensive raw material extraction activities across countries such as China, India, and Australia.

What role does AI and automation play in modern ATDT fleet management?

AI is crucial for predictive maintenance, optimizing haul routes in real-time, and enabling full vehicle autonomy. Automation enhances safety, reduces operational downtime, ensures consistent performance, and minimizes fuel consumption, significantly lowering the total cost of ownership (TCO).

What are the key drivers sustaining the growth of the All Terrain Dump Truck market?

The primary growth drivers are sustained global investment in infrastructure renewal and expansion (especially in emerging economies), robust demand from the mining sector fueled by the energy transition (critical minerals), and continuous technological integration enhancing machine efficiency and safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager