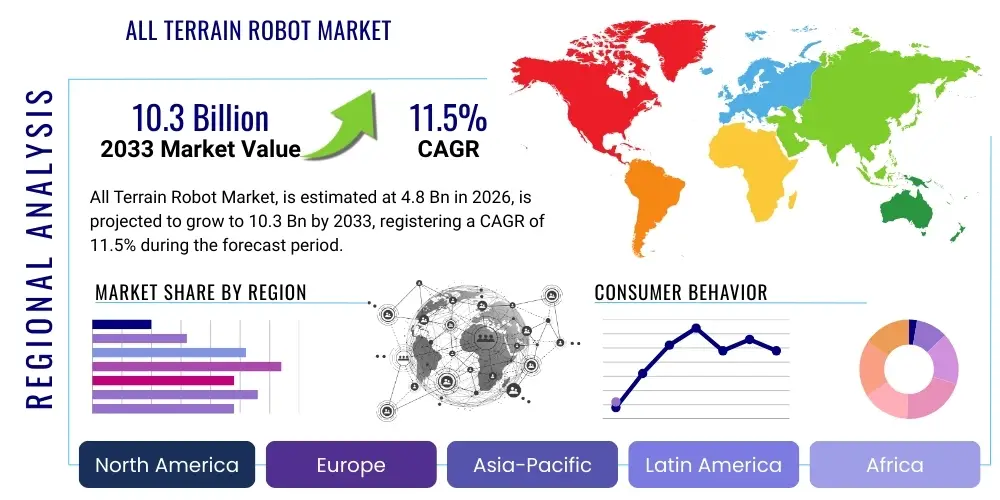

All Terrain Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441903 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

All Terrain Robot Market Size

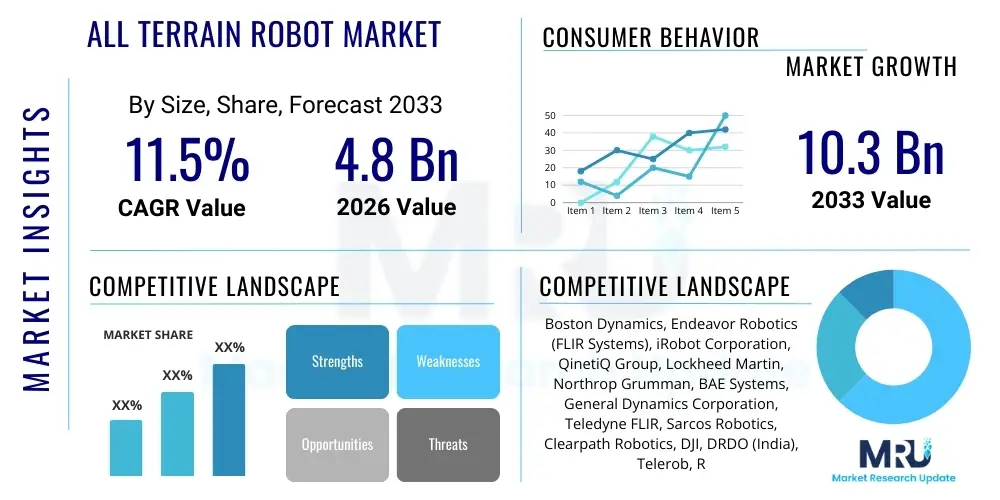

The All Terrain Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

All Terrain Robot Market introduction

The All Terrain Robot (ATR) Market encompasses specialized robotic systems designed to operate effectively across diverse and challenging environments, including rough topography, urban rubble, underwater, and aerial spaces. These robust systems utilize advanced locomotion mechanisms, such as articulated wheels, tracks, or complex legged structures, enabling superior mobility where conventional vehicles or robots fail. Key product descriptions include modular designs, high payload capacity, enhanced sensor suites, and extreme environmental durability, making them indispensable assets across various high-risk and inaccessible domains. The increasing global imperative for automating dangerous tasks, coupled with technological advancements in battery longevity and sensor fusion, is fundamentally driving the expansion of this market, positioning ATRs as critical tools for modern security, defense, and industrial operations.

Major applications of ATRs span defense and security, where they are utilized for reconnaissance, surveillance, explosive ordnance disposal (EOD), and border patrol, minimizing human risk in hostile zones. In the industrial sector, they are crucial for infrastructure inspection (pipelines, bridges, power grids), ensuring maintenance continuity and predictive failure analysis without requiring human access to hazardous areas. Furthermore, ATRs are foundational in disaster management and search and rescue operations, offering first responders invaluable situational awareness in scenarios like collapsed buildings or chemical spills. The inherent benefits include enhanced operational efficiency, significant reduction in human casualties, and the ability to gather highly accurate data in real-time under extreme conditions, providing a crucial competitive edge in critical situations.

Driving factors for sustained market growth are multifaceted, anchored by rising geopolitical instability necessitating sophisticated surveillance tools, increasing investment in smart city infrastructure requiring autonomous inspection capabilities, and rapid development in battery and computational technologies that enhance robot endurance and autonomy. Furthermore, the global trend towards automation in mining, agriculture, and construction—sectors characterized by demanding and variable terrain—is creating substantial demand for highly specialized ATR solutions. These factors coalesce to ensure the All Terrain Robot market remains dynamic, characterized by continuous innovation and diversification into new application areas previously considered too challenging for robotic deployment.

All Terrain Robot Market Executive Summary

The All Terrain Robot Market is experiencing robust acceleration, fueled primarily by escalating global defense modernization programs and the critical need for automation in hazardous industrial environments. Business trends indicate a strong pivot towards modular and versatile ATR systems capable of rapidly adapting to varying missions, driven by advancements in artificial intelligence for autonomous navigation and decision-making. Key investment areas include enhancing sensor payload capabilities—specifically integrating LIDAR, high-resolution thermal imaging, and advanced chemical detection—and developing energy efficient propulsion systems to maximize operational uptime. Strategic mergers, acquisitions, and partnerships between traditional defense contractors and niche robotics startups are reshaping the competitive landscape, focused on integrating advanced software and hardware platforms to deliver end-to-end autonomous solutions that meet stringent industry standards for reliability and security.

Regionally, North America maintains market dominance due to substantial R&D expenditure by government agencies, particularly the Department of Defense, and a mature ecosystem supporting technology commercialization. However, the Asia Pacific region is emerging as the fastest-growing market, driven by massive investments in infrastructure development, rising security concerns, and the widespread adoption of robotics in rapidly industrializing economies like China, India, and South Korea. Europe exhibits stable growth, mandated by environmental monitoring regulations and complex urban security requirements, focusing heavily on civilian applications such as agricultural precision farming and environmental cleanup efforts. This geographical shift highlights the market’s transition from a defense-centric industry to one with significant commercial viability across multiple continents.

Segment trends reveal that the wheeled and tracked ATR segments currently hold the largest market share due to their proven reliability and payload capacity, particularly in military and EOD applications. Nonetheless, the legged robot segment, though nascent, is projected to exhibit the highest CAGR, driven by advancements that allow them to mimic biological movement for unparalleled mobility over highly unstructured terrain, such as stairs, rubble, and vertical obstacles. Furthermore, the defense sector remains the largest end-user segment, but significant traction is noted in the energy and mining sectors, which are increasingly relying on ATRs for remote monitoring and maintenance in geographically isolated and high-risk extraction sites, confirming a diversification in demand beyond traditional military procurement cycles.

AI Impact Analysis on All Terrain Robot Market

Common user questions regarding the impact of AI on the All Terrain Robot Market frequently center on achieving true autonomy, enhancing situational awareness, and ensuring security against adversarial threats. Users are keenly interested in how deep learning and reinforcement learning can enable ATRs to navigate complex, previously unmapped environments without constant human intervention (Level 4/5 autonomy), including managing unexpected obstacles and dynamic terrain transitions. There is significant expectation regarding AI’s role in optimizing sensor fusion—combining data from visual, thermal, and geospatial sensors to generate highly accurate environmental models in real-time, crucial for complex tasks like search and rescue or EOD. Furthermore, concerns often arise about the trustworthiness and ethical programming of AI in defensive or security roles, alongside the necessary computational power requirements for edge processing directly on the robot, minimizing reliance on external communications infrastructure, which is often compromised in remote operations.

The integration of advanced Artificial Intelligence algorithms is fundamentally transformative for the All Terrain Robot Market, moving these systems beyond simple remote control toward intelligent, mission-adaptive platforms. AI enables complex decision-making capabilities, allowing ATRs to dynamically adjust locomotion patterns, optimize energy consumption, and prioritize mission objectives based on real-time environmental data and constraints. This enhancement in operational sophistication translates directly into higher mission success rates, especially in highly dynamic and dangerous environments where connectivity may be intermittent. The shift towards robust, AI-powered autonomy is critical for unlocking new applications in surveillance, deep-sea exploration, and planetary exploration, areas where human intervention is impossible or severely limited.

The immediate impact of AI is visible in enhanced perception stacks, where computer vision and machine learning models drastically improve object recognition, tracking, and classification, distinguishing between threats and harmless elements in complex visual noise. Predictive maintenance is another critical area, where AI analyzes operational telemetry to foresee mechanical failures, extending the operational lifespan of expensive ATR assets. This pervasive integration of intelligent systems not only reduces the necessary human operator-to-robot ratio but also standardizes operational protocols across various units, ensuring higher reliability and scalability for fleet deployment, positioning AI as the central engine of innovation and market growth in the coming decade.

- Enabling Level 4 and 5 Autonomy: Allowing robots to operate independently in highly unstructured and dynamic environments.

- Optimized Sensor Fusion: Real-time integration and interpretation of data from disparate sensors (LIDAR, radar, EO/IR).

- Dynamic Locomotion Control: AI algorithms automatically adjusting movement for optimal performance across varying terrains (e.g., transitioning from sand to rock).

- Predictive Maintenance and Diagnostics: Machine learning models analyzing telemetry data to forecast component failures and scheduling proactive repairs.

- Enhanced Threat Recognition: Deep learning improving the identification and classification of objects, targets, or explosive devices with higher accuracy than human operators.

- Improved Energy Management: AI optimizing power distribution to extend mission endurance in remote operations.

DRO & Impact Forces Of All Terrain Robot Market

The All Terrain Robot Market is significantly driven by escalating global defense spending, particularly for enhancing ground force capabilities through unmanned systems for reconnaissance and EOD missions, where minimizing human exposure to danger is paramount. A primary driver is the rapid technological convergence of sensor technology (e.g., miniaturized hyperspectral cameras) and computational hardware (high-performance embedded processors), which allows ATRs to perform sophisticated tasks like simultaneous localization and mapping (SLAM) and payload manipulation autonomously. Furthermore, the commercial sector’s increasing acceptance and deployment of robotics in hazardous industries, such as offshore oil and gas inspection, nuclear facility monitoring, and large-scale agricultural precision tasks, provide a diverse and growing demand base, ensuring sustained market momentum well beyond traditional military procurement cycles. These foundational drivers are supported by governments worldwide adopting national robotics strategies, incentivizing private sector R&D.

Restraints, however, pose critical challenges to widespread adoption. High initial capital investment remains a significant barrier, especially for small and medium enterprises, as advanced ATR platforms incorporating complex sensors and proprietary software require substantial financial outlay. Technical limitations surrounding battery life and power management are perpetual challenges; limited operational endurance restricts the utility of ATRs in long-duration missions far from recharging infrastructure. Moreover, regulatory complexity, particularly concerning spectrum allocation for communication and restrictions on autonomous weapon systems, creates legal and ethical hurdles that slow down commercial deployment, requiring developers to navigate a patchwork of international standards and regional regulations before achieving widespread market penetration.

Opportunities for explosive growth lie in the development of modular and open-source robotic platforms that decrease entry barriers and foster third-party innovation in application-specific software and payloads. The emerging space of infrastructure inspection and maintenance (e.g., wind turbine blades, high-voltage transmission lines) represents a massive, untapped commercial opportunity where ATRs offer clear safety and cost advantages over traditional manual methods. Furthermore, the development of swarming robotics—where multiple, small ATRs coordinate autonomously—promises to revolutionize large-area surveillance and complex search operations, dramatically increasing efficiency and robustness. The impact forces are generally high due to significant defense spending and relentless technological progression; however, the ongoing challenge of achieving true energy independence and navigating the intricate regulatory landscape exerts a moderating force on the overall market trajectory, necessitating focused R&D on power systems and coordinated global standardization efforts.

Segmentation Analysis

The segmentation of the All Terrain Robot market provides a detailed understanding of the diverse product offerings and their specialized applications, crucial for strategic market planning. Key segments are primarily categorized based on Mobility Type (Wheeled, Tracked, Legged, Hybrid), Application (Defense & Security, Industrial Inspection, Scientific Research, Search & Rescue), and Component (Hardware, Software, Services). This detailed breakdown highlights which technologies are experiencing the fastest uptake and which end-user industries are driving the highest demand. Tracked and Wheeled robots dominate current market share due to their maturity and reliability, but the nascent legged segment is attracting substantial investment due to its superior capability in highly unstructured and complex environments that are inaccessible to conventional designs.

From an application perspective, the Defense and Security segment maintains its leading position, primarily due to the high mission-critical nature of EOD and perimeter security, justifying premium pricing for specialized, ruggedized hardware. However, the fastest growth is observed within the Industrial Inspection and Scientific Research segments, particularly in areas requiring long-range monitoring and data collection in remote or hazardous locations, such as deep-sea mapping and volcano monitoring. The component segment analysis reveals a growing trend towards the recurring revenue model provided by the Services segment, including maintenance, cloud-based data processing, and software updates, indicating a shift from purely hardware sales to integrated service solutions, maximizing operational efficiency for end-users.

Understanding these segment dynamics is vital for market players focusing on innovation. For instance, companies specializing in advanced control software will target the legged and hybrid mobility platforms, anticipating future growth in urban and subterranean exploration. Conversely, providers of robust hardware platforms will continue to serve the defense sector, focusing on payload capacity and resistance to extreme environmental stressors. The evolving segmentation reflects the market's maturation from niche military hardware to a versatile commercial tool integral to global industrial and infrastructural integrity, requiring highly differentiated product strategies tailored to specific operational requirements across the globe.

- By Mobility Type:

- Wheeled (4-wheel, 6-wheel, 8-wheel)

- Tracked (Single Track, Double Track)

- Legged (Bi-pedal, Quadruped, Multi-legged)

- Hybrid (Combination of Tracks/Wheels and manipulation arms)

- By Component:

- Hardware (Sensors, Actuators, Chassis, Control Systems, Power Modules)

- Software (Navigation Software, Operating System, Data Analytics/AI Algorithms)

- Services (Maintenance, Integration, Training, Remote Monitoring)

- By Application:

- Defense and Security (EOD, Reconnaissance, Surveillance, Border Patrol)

- Industrial Inspection (Oil & Gas, Energy, Utilities, Construction)

- Scientific Research and Exploration (Space, Marine, Geology)

- Search and Rescue/Disaster Management

- Agriculture and Forestry

- By Payload Capacity:

- Low Payload (Under 10 kg)

- Medium Payload (10 kg to 50 kg)

- High Payload (Above 50 kg)

Value Chain Analysis For All Terrain Robot Market

The value chain for the All Terrain Robot market is complex and highly specialized, beginning with the upstream analysis involving core component manufacturing. This stage encompasses the specialized production of high-performance sensors (LIDAR, thermal cameras, advanced IMUs), ruggedized control systems, and custom-designed high-torque motors and actuators optimized for variable load conditions. Key suppliers are often specialized electronics manufacturers and defense component providers, operating under strict quality controls due to the mission-critical nature of the final product. Significant competitive advantage at this stage is derived from miniaturization, increasing computational efficiency, and securing supply chains for rare earth minerals used in advanced battery technology and specialized magnetics, forming the foundation of the robot's mobility and sensing capabilities.

Midstream activities involve the design, assembly, and integration of the ATR platform. This includes chassis fabrication, integration of proprietary software for navigation and AI-driven autonomy, and rigorous testing under simulated and real-world extreme environmental conditions. Manufacturers focus heavily on modular design, enabling quick swapping of payloads and simplified maintenance, thereby lowering the total cost of ownership for end-users. Direct distribution channels are prevalent, especially for high-value contracts with military and large industrial organizations, involving customized build-to-order solutions. This direct approach ensures technical compliance and allows for close collaboration between the manufacturer and the client during the design and deployment phases, which is crucial for maximizing performance in highly specialized applications.

The downstream analysis focuses on deployment, maintenance, and services provided to the end-users. For defense and government customers, distribution is often handled through established defense contractors or specialized system integrators who provide ongoing logistical and training support. Commercial applications often utilize indirect channels, partnering with regional distributors who specialize in specific vertical markets (e.g., energy inspection or agricultural robotics) and can offer local support and quick response times. The service segment, including software updates, data analysis support, and hardware repair, is growing rapidly, representing a key revenue stream and enhancing customer retention. This service-oriented downstream approach is critical for ensuring the long-term reliability and mission readiness of ATR fleets operating in geographically dispersed locations.

All Terrain Robot Market Potential Customers

The primary and most significant end-users of All Terrain Robots are national defense and homeland security agencies globally. These entities utilize ATRs extensively for critical tasks such as Explosive Ordnance Disposal (EOD), IED neutralization, border surveillance, tactical reconnaissance, and securing critical infrastructure. The inherent risks associated with these missions necessitate automated, highly resilient platforms capable of operating in chemically, radiologically, or structurally hazardous zones without risking human life. Procurement decisions in this sector are driven by operational reliability, cybersecurity features, adherence to military standards (MIL-STD), and the capacity for integrating specialized, heavy payloads like advanced communications relays and weaponized systems, making this segment the backbone of ATR market revenue.

Another major category of potential customers includes large industrial entities operating in sectors characterized by remote, hostile, or difficult-to-access environments, such as the Oil & Gas industry, Mining operations, and Utility providers (power generation and transmission). These customers deploy ATRs for preventive maintenance, remote inspection of pipelines, storage tanks, and structural elements of drilling platforms or wind farms, drastically reducing downtime and eliminating the need for costly and hazardous manual inspections. For these commercial customers, the purchasing criteria emphasize return on investment (ROI), system scalability, long-range autonomy, and the quality of data output generated by onboard analytical sensors, making efficiency and data precision paramount considerations for adoption.

Emerging but high-growth potential customers include Scientific Research institutions, specializing in fields like marine biology, polar exploration, and planetary science, which require robust mobility systems for data collection in environments too extreme or expensive for human presence. Furthermore, civil organizations focused on disaster relief, urban search and rescue (USAR), and environmental cleanup operations represent a rapidly expanding customer base. These groups prioritize speed of deployment, versatility, and the ability of the ATR to navigate complex, unstructured debris fields following natural disasters, driving demand for smaller, more agile, and easily deployable systems that offer instant situational awareness to emergency response teams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Dynamics, Endeavor Robotics (FLIR Systems), iRobot Corporation, QinetiQ Group, Lockheed Martin, Northrop Grumman, BAE Systems, General Dynamics Corporation, Teledyne FLIR, Sarcos Robotics, Clearpath Robotics, DJI, DRDO (India), Telerob, Remotec (Northrop Grumman), ECA Group, L3Harris Technologies, AeroVironment, Hi-Tech Robotic Systemz, Roboteam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

All Terrain Robot Market Key Technology Landscape

The technological landscape of the All Terrain Robot market is defined by the synergistic integration of advanced sensing, improved mechanical engineering, and sophisticated computational processing capabilities. Central to this evolution is the transition to highly efficient, ruggedized mobility platforms, which increasingly incorporate lightweight but durable composite materials to maximize speed and payload capacity without compromising resilience in harsh environments. Power management remains a core focus, with extensive research into solid-state batteries and alternative energy sources, such as hydrogen fuel cells, aimed at dramatically extending operational periods beyond the limitations of current Lithium-Ion technology. Furthermore, the development of modular interfaces, allowing for rapid attachment and calibration of diverse mission-specific payloads—ranging from multi-spectral cameras to ground-penetrating radar—is becoming a standard feature, enhancing the versatility and cost-effectiveness of these platforms.

In terms of intelligence, Simultaneous Localization and Mapping (SLAM) algorithms are crucial, providing ATRs with the ability to build accurate 3D maps of unknown environments while simultaneously tracking their own position, a non-negotiable requirement for autonomous navigation in subterranean or GPS-denied areas. The adoption of high-density LIDAR sensors, coupled with thermal and infrared cameras, ensures robust environmental perception across varying lighting and weather conditions. Crucially, the move toward edge computing—embedding powerful Graphics Processing Units (GPUs) directly onto the robot—enables real-time processing of massive sensor data streams for immediate decision-making, minimizing latency and maximizing operational responsiveness without continuous reliance on external communication links, a necessity in remote or hostile zones.

The evolution of control and communication systems is also pivotal. ATRs are increasingly utilizing mesh networking and specialized low-bandwidth communication protocols that ensure connectivity even when facing significant signal obstruction or interference, common in complex urban environments or mountainous regions. Advances in haptic feedback systems are enhancing operator control, allowing for more intuitive manipulation of robot arms and tools, particularly critical for delicate tasks like EOD or sample collection. Overall, the technology trajectory emphasizes increased autonomy, enhanced perception, and sustained endurance, driving the ATR from a simple teleoperated machine into a sophisticated, self-reliant robotic asset capable of performing complex multi-step missions without constant human guidance, thus redefining mission parameters across defense and industrial sectors.

Regional Highlights

- North America: Dominates the global market, driven by massive defense spending, particularly by the U.S. Department of Defense, focused on enhancing EOD and reconnaissance capabilities. The region benefits from a mature ecosystem of specialized robotics firms, strong R&D collaboration between academia and industry, and early adoption of AI-driven autonomous systems. Demand is also high from the vast energy sector for pipeline and infrastructure inspection.

- Europe: Exhibits significant growth driven by stringent safety regulations and high labor costs, promoting automation in industrial inspection, nuclear facility decommissioning, and advanced agricultural precision farming. Key markets include Germany, France, and the UK, focusing heavily on civilian and dual-use ATR technologies, particularly those addressing environmental monitoring and urban security challenges.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid industrialization, large-scale infrastructure projects (e.g., smart cities), and rising geopolitical tensions driving defense modernization in China, India, Japan, and South Korea. Demand is characterized by the need for cost-effective, scalable solutions for disaster relief and managing vast, complex geographies.

- Latin America: Characterized by nascent but growing demand, primarily driven by resource extraction industries (mining and oil & gas) in countries like Brazil and Mexico, seeking ATRs for safety enhancement, remote monitoring, and surveying in environmentally challenging terrains. Investment is often tied to foreign direct investment in these key economic sectors.

- Middle East and Africa (MEA): Growth is concentrated in defense and homeland security sectors due to regional conflicts and high surveillance needs. Significant opportunities exist in the oil and gas sector for infrastructure monitoring in remote desert environments, requiring highly specialized, heat-resistant ATRs. Capital investment is substantial, particularly in the GCC countries, reflecting a willingness to adopt cutting-edge security technologies.

North America’s market leadership is underpinned by unparalleled government investment in unmanned ground systems (UGS) research, ensuring continuous technological superiority. The established defense procurement cycle, combined with a highly developed sensor and software industry cluster in regions like California and Massachusetts, positions it as the primary innovation hub. The focus here is not merely on replacing human labor but on creating mission augmentation systems that significantly expand operational envelopes, particularly in areas concerning CBRN (Chemical, Biological, Radiological, and Nuclear) threats and complex urban warfare scenarios.

In contrast, the APAC region’s accelerated growth trajectory is less uniform, characterized by distinct national priorities. For instance, Japan and South Korea focus heavily on industrial and civil infrastructure maintenance using robotics due to aging populations, while China and India drive volume demand through large-scale deployment in public security and expansive border management. This region's large manufacturing base also facilitates rapid prototyping and scaling of ATR hardware, potentially leading to lower system costs, thereby broadening accessibility to non-traditional industrial users like construction and agriculture.

European market development is guided by strong ethical and regulatory frameworks, emphasizing safety and dual-use potential. Significant EU-funded research programs promote cross-border collaboration on robotics standards and interoperability. This focus results in highly specialized ATRs tailored for environmental monitoring, precision agriculture (e.g., vineyard robotics in France), and safe decommissioning of aging industrial facilities, requiring robust navigation and precision manipulation capabilities adapted for complex, confined indoor and outdoor spaces across varied climatic zones.

- North America: High defense spending, strong technological maturity, demand from oil & gas inspection.

- Asia Pacific: Fastest growth, driven by infrastructure development, manufacturing capabilities, and national security modernization.

- Europe: Focus on civil applications, environmental monitoring, precision agriculture, and stringent safety standards.

- MEA: Concentrated defense and high-value energy sector applications in arid and extreme temperature conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the All Terrain Robot Market.- Boston Dynamics

- Endeavor Robotics (A part of FLIR Systems/Teledyne FLIR)

- iRobot Corporation

- QinetiQ Group

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- General Dynamics Corporation

- Teledyne FLIR (formerly FLIR Systems)

- Sarcos Robotics

- Clearpath Robotics (A part of Rockwell Automation)

- DJI (Focus on Aerial/Hybrid Terrain Capabilities)

- DRDO (Defence Research and Development Organisation, India)

- Telerob Gesellschaft für Fernhantierungstechnik mbH

- Remotec (A subsidiary of Northrop Grumman)

- ECA Group

- L3Harris Technologies

- AeroVironment, Inc.

- Hi-Tech Robotic Systemz

- Roboteam Ltd.

- Cobham plc (Now part of Eaton)

- Kongsberg Gruppen ASA

Frequently Asked Questions

Analyze common user questions about the All Terrain Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand in the All Terrain Robot market?

The primary drivers are increased global defense expenditure focused on unmanned systems for high-risk missions (EOD, reconnaissance), the accelerating need for automated inspection in hazardous industrial environments (oil, gas, utilities), and continuous technological advancements in AI for enhancing operational autonomy and endurance across challenging terrains.

Which mobility type is expected to experience the highest growth rate?

While tracked and wheeled robots currently hold the largest market share due to their proven reliability, the legged robot segment is projected to exhibit the highest CAGR. This growth is driven by significant R&D breakthroughs enabling superior agility and navigation over highly unstructured obstacles like stairs and complex urban rubble, areas inaccessible to traditional wheeled or tracked systems.

How is Artificial Intelligence impacting the capabilities of All Terrain Robots?

AI is fundamentally transforming ATRs by enabling Level 4 and 5 autonomy, allowing them to make complex, real-time decisions regarding navigation, obstacle avoidance, and mission prioritization without continuous human input. AI also significantly improves data fusion from complex sensor arrays and optimizes energy consumption for extended missions in remote locations.

What are the main restraints hindering the broader adoption of ATRs?

Key restraints include the extremely high initial capital cost of purchasing and integrating advanced ATR platforms, the perpetual technological challenge of achieving long-duration battery endurance for extended missions, and the regulatory complexities surrounding the autonomous operation of unmanned ground systems in both civil and defense applications globally.

Which geographical region leads the All Terrain Robot market in terms of revenue?

North America currently leads the global All Terrain Robot market in terms of revenue. This dominance is attributed to substantial, sustained R&D investment by the U.S. defense sector, a mature technological ecosystem supporting innovation, and high adoption rates of robotics in critical infrastructure inspection and maintenance within the energy and utility sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager