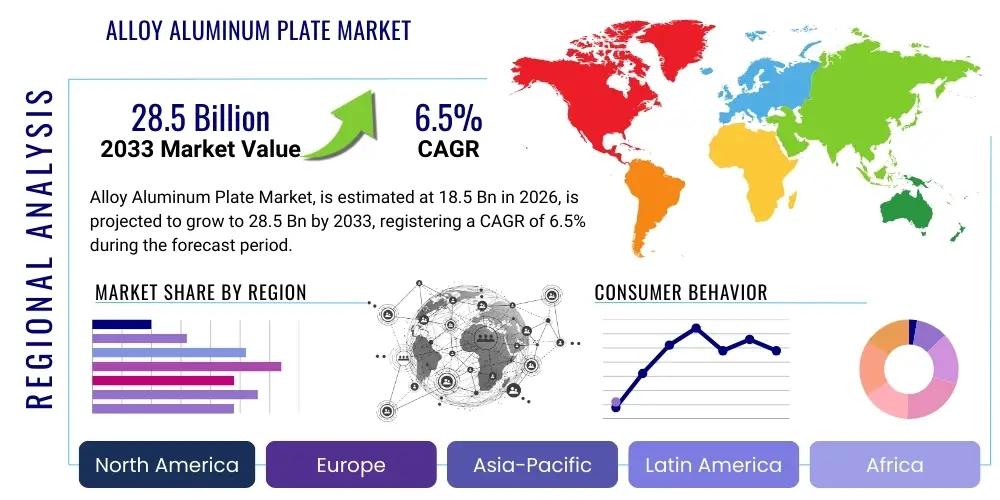

Alloy Aluminum Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442821 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Alloy Aluminum Plate Market Size

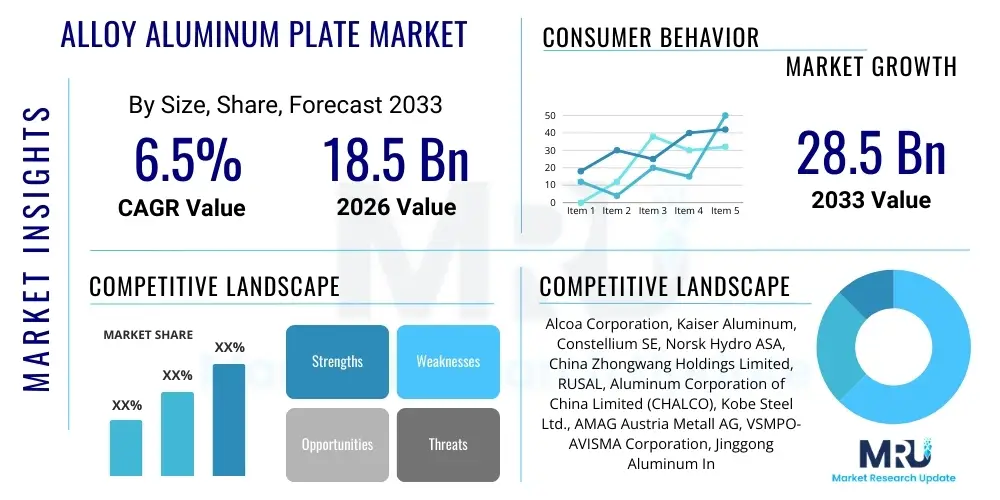

The Alloy Aluminum Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.5 Billion by the end of the forecast period in 2033.

Alloy Aluminum Plate Market introduction

The Alloy Aluminum Plate Market encompasses the global production, distribution, and consumption of semi-finished aluminum materials fabricated into flat sheets or plates, where aluminum is alloyed with elements such as copper, zinc, magnesium, manganese, or silicon to enhance specific performance characteristics like strength, corrosion resistance, and thermal conductivity. These plates are foundational materials in high-performance engineering sectors due to their inherent advantages over traditional materials, particularly their low density coupled with high strength-to-weight ratio. The market serves a wide array of demanding industries that prioritize material efficiency and structural integrity, setting the stage for consistent demand growth.

Alloy aluminum plates are classified primarily based on the alloy series (e.g., 2xxx, 5xxx, 6xxx, 7xxx), with each series designed for specialized applications. For instance, 7xxx series plates, rich in zinc, are crucial for aerospace structural components due to their superior tensile strength, while 5xxx series alloys, containing magnesium, are favored in marine applications and transportation dueables to their excellent resistance to saltwater corrosion. Major applications span structural components in aircraft fuselages and wings, body panels and chassis in automotive manufacturing, critical components in liquefied natural gas (LNG) tanks, and high-speed rail construction. The versatility and customization potential based on temper and alloy composition make these plates indispensable across modern manufacturing processes.

The primary benefit driving the market expansion is the continuous global trend toward lightweighting, especially in transportation sectors aiming to improve fuel efficiency and reduce carbon emissions. Furthermore, these plates offer enhanced durability, reduced maintenance costs, and superior recyclability compared to steel, aligning with stringent environmental and sustainability goals worldwide. Key driving factors include increasing military and commercial aircraft production, the accelerated adoption of electric vehicles (EVs) utilizing aluminum for battery casings and body structures, and infrastructural development projects requiring materials with extended service life and reliability.

Alloy Aluminum Plate Market Executive Summary

The Alloy Aluminum Plate Market is characterized by robust growth, primarily propelled by intense demand from the aerospace and automotive industries, which are undergoing significant technological shifts toward lightweight composite structures. Business trends indicate a focus on vertical integration among major players, aiming to control the supply chain from raw bauxite processing to advanced plate finishing, thereby ensuring quality consistency and optimizing production costs. Furthermore, there is a distinct competitive trend toward developing high-performance, ultra-strength aluminum-lithium (Al-Li) alloys and advanced 7xxx series variants, catering specifically to the stringent performance requirements of next-generation aircraft and electric vehicle architectures. Sustainability initiatives are compelling manufacturers to invest in recycling capabilities and energy-efficient smelting processes, transforming market operations.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by massive infrastructure projects, burgeoning automotive production (particularly China and India), and growing regional commercial aviation fleets. North America and Europe, while mature, remain dominant in terms of high-value, specialized alloy consumption, largely due to their established aerospace and defense manufacturing hubs. These regions are focused on adopting advanced manufacturing techniques, such as friction stir welding (FSW) and additive manufacturing integration, demanding tighter tolerances and superior quality in supplied plates. The geopolitical landscape, particularly trade policies concerning aluminum tariffs and quotas, significantly influences regional market dynamics and material sourcing decisions.

Segment trends reveal that the 7xxx series alloy segment, essential for aerospace and high-stress applications, commands the highest value share due to its complex processing requirements and premium pricing. However, the 6xxx series (Mg-Si alloys), popular in automotive and general structural applications, is projected to witness the fastest volume growth, driven by the mass market adoption of lightweight vehicle platforms. Application-wise, the transportation segment, combining aerospace and automotive, dominates the consumption landscape, followed by the industrial and packaging sectors. The thickness segmentation shows a strong preference for standard and thick plates used in structural engineering and pressure vessel construction, reflecting ongoing large-scale industrial investments globally.

AI Impact Analysis on Alloy Aluminum Plate Market

Common user questions regarding AI's impact on the Alloy Aluminum Plate Market frequently center on themes such as predictive maintenance of rolling mills, optimization of alloy composition design, automation in quality control (QC) testing, and enhanced supply chain efficiency. Users are keenly interested in how Artificial Intelligence can minimize material waste during plate cutting and finishing processes, improve the uniformity of heat treatment cycles for high-strength alloys like 7075, and ultimately reduce production costs while guaranteeing superior mechanical properties. The collective expectation is that AI will transition plate manufacturing from traditional batch processes to highly optimized, continuous, and data-driven systems, enhancing product reliability and customizability, which is crucial for safety-critical applications like aerospace.

AI is beginning to revolutionize the market by enabling highly precise control over complex manufacturing parameters, moving beyond simple automation to prescriptive analytics. Machine learning algorithms are being deployed to analyze real-time data from casting, rolling, and heat treatment stages, identifying subtle anomalies that precede equipment failure or material defects. This capability significantly improves operational uptime and dramatically reduces the rejection rate of high-value plates. Furthermore, generative AI tools are assisting materials scientists in rapidly screening and designing novel aluminum alloy compositions tailored for specific demands, such as extreme temperature resistance or enhanced fatigue life, cutting down the R&D cycle time substantially.

The successful integration of AI relies heavily on creating robust digital twins of manufacturing facilities, allowing for simulation and optimization before physical changes are implemented. This enhances predictive modeling for inventory management, ensuring just-in-time delivery of specialized plates to demanding sectors like defense and commercial aviation. Despite the high initial investment required for sensor installation and data infrastructure, the long-term benefits in terms of cost reduction, quality assurance, and accelerated product development are establishing AI as a core competitive differentiator in the Alloy Aluminum Plate Market.

- AI optimizes material consumption by predicting optimal cutting patterns, reducing scrap loss significantly.

- Machine learning algorithms enhance quality control by performing non-destructive testing analysis faster and more accurately than traditional methods.

- Predictive maintenance driven by AI minimizes costly downtime of rolling and annealing equipment.

- AI accelerates R&D by simulating performance characteristics of new alloy compositions (e.g., Al-Li variants).

- Enhanced supply chain management through predictive demand forecasting and dynamic inventory optimization.

- Real-time process control using sensor data ensures consistent microstructural integrity across plate batches.

DRO & Impact Forces Of Alloy Aluminum Plate Market

The dynamics of the Alloy Aluminum Plate Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape its trajectory. The fundamental market driver is the relentless pursuit of lightweighting across major end-use sectors, particularly global aerospace modernization and the automotive industry’s shift toward electric vehicles, where aluminum plates are essential for weight reduction and thermal management. This is supported by governmental policies promoting fuel efficiency standards and reduced emissions, which naturally favor aluminum over denser materials. The increasing military expenditure globally, requiring high-strength, durable plates for defense aircraft and naval vessels, further solidifies the demand base.

However, the market growth faces significant Restraints. High and volatile raw material costs, particularly alumina and alloying elements (like zinc and copper), create pricing pressures and instability for manufacturers. Furthermore, the energy-intensive nature of primary aluminum production poses environmental challenges and subjects operating costs to fluctuations in global energy prices. The stringent certification requirements and long qualification cycles, especially within the aerospace sector, present substantial barriers to entry for new market participants and slow down the adoption rate of novel alloy formulations. Additionally, the increasing competition from advanced composite materials in certain applications, such as large composite wing structures, acts as a potential ceiling for aluminum plate market expansion in specific high-end segments.

Opportunities for expansion lie in the rapid development of specialized alloys, such as those resistant to extreme corrosion or high temperatures, opening avenues in oil & gas and specialized industrial machinery. The burgeoning renewable energy sector, including solar and wind power installations, requires high-integrity aluminum plates for structural and thermal applications. Moreover, strategic market penetration into developing economies, coupled with investment in recycling infrastructure to manage material costs and improve sustainability credentials, offers compelling growth prospects. The dominant impact force on the market is the sustained technological push from end-user industries (aerospace and automotive) demanding higher performance specifications, forcing continuous innovation in alloy processing and quality assurance methodologies.

Segmentation Analysis

The Alloy Aluminum Plate Market is systematically segmented based on multiple criteria including alloy series, application, thickness, and end-use industry, providing a granular view of demand distribution and specialized requirements across the global landscape. This detailed segmentation is crucial for stakeholders to tailor their product offerings and strategic investments toward the fastest-growing and highest-value segments. The differentiation across alloy series reflects the functional requirements of end-users, with different series offering varying balances of strength, corrosion resistance, and weldability. For instance, high-strength alloys cater exclusively to structural applications, while general-purpose alloys serve fabrication and marine uses.

Segmentation by application clearly delineates the consumption pattern across key industrial verticals, highlighting the dominant influence of the transportation sector, which encompasses both commercial and defense aerospace, automotive, and rail transit. Thickness-based segmentation is critical for manufacturing processes, distinguishing between thin sheets used in cladding or non-structural components and thick plates required for structural bulkheads, armor, and tooling. Understanding these segments allows manufacturers to optimize mill scheduling, rolling parameters, and subsequent heat treatment processes to meet specific order requirements efficiently, thereby maximizing resource utilization and reducing lead times in highly competitive environments.

The segmentation data indicates a strategic shift toward specialized, lower-volume, higher-margin products (like 7xxx series plates for military and space applications) alongside sustained volume growth in the mid-range performance alloys (like 6xxx series) driven by mass-market automotive electrification. This bifurcated demand structure necessitates flexible manufacturing capabilities capable of handling both high throughput and highly customized, stringent specification products. The future market success hinges on accurately forecasting the growth rates of these specialized segments, particularly those driven by rapid technological advancements in electric mobility and aerospace material substitution programs.

- By Alloy Series:

- 2xxx Series (Al-Cu)

- 5xxx Series (Al-Mg)

- 6xxx Series (Al-Mg-Si)

- 7xxx Series (Al-Zn-Mg-Cu)

- 8xxx Series (Other Specialized Alloys)

- By Application:

- Aerospace Structures

- Automotive Body & Chassis

- Marine Applications

- Defense & Armor

- Tooling & Molds

- Pressure Vessels & Tanks (e.g., LNG Tanks)

- By Thickness:

- Standard Plates (e.g., up to 6mm)

- Medium Plates (e.g., 6mm to 25mm)

- Thick Plates (e.g., above 25mm)

- By End-Use Industry:

- Transportation (Aerospace, Automotive, Marine, Rail)

- Building & Construction

- Industrial & Machinery

- Packaging

- Electronics

Value Chain Analysis For Alloy Aluminum Plate Market

The value chain of the Alloy Aluminum Plate Market begins intensely in the upstream segment, dominated by the mining of bauxite ore, refining it into alumina (Bayer Process), and subsequently smelting alumina into primary aluminum (Hall-Héroult Process), which is highly energy-intensive. Key activities in the upstream segment include sourcing the necessary alloying elements (zinc, magnesium, copper) and managing the significant logistical costs associated with transporting raw materials and energy inputs. Success at this stage relies heavily on secure access to cheap, stable power supplies and efficient raw material procurement strategies, leading to strong vertical integration attempts by major market players to secure cost advantages and supply reliability.

Midstream processing involves the sophisticated manufacturing steps transforming primary and recycled aluminum ingots into finished plates. This includes casting large ingots, homogenization, hot rolling (breaking down the ingot structure), cold rolling (achieving precise thickness and surface finish), and crucial thermal treatments such as solution heat treating and artificial aging to achieve the desired mechanical properties and temper (e.g., T6, T7). This stage requires massive capital investment in advanced rolling mills, heat treatment furnaces, and specialized finishing equipment. Quality control and testing (ultrasonic, eddy current) are vital here, especially for safety-critical aerospace and defense plates, adding significant value and complexity to the process.

The downstream segment focuses on distribution and the final consumption of the plates. Distribution channels include direct sales from the manufacturer to large OEMs (Original Equipment Manufacturers) in aerospace and automotive sectors, often involving long-term supply contracts and specialized warehousing. Indirect distribution utilizes dedicated service centers and metal distributors who perform value-added services like cutting, contouring, and just-in-time inventory management for smaller fabricators and secondary manufacturers. The final value accretion occurs when the end-users integrate these plates into complex assemblies like aircraft structures or vehicle bodies, demanding tight supply chain coordination, especially for custom-sized and specified plates.

Alloy Aluminum Plate Market Potential Customers

Potential customers for alloy aluminum plates are concentrated within highly technical and capital-intensive industries that require materials offering an optimal balance of strength, weight reduction, and durability. The primary end-users are large Original Equipment Manufacturers (OEMs) in the transportation sector. Specifically, global aircraft manufacturers (Boeing, Airbus) and their Tier 1 suppliers are critical customers for high-strength 7xxx series plates used in wing structures, fuselages, and bulkheads. These buyers demand stringent quality certifications (e.g., NADCAP, AS9100) and long-term, stable supply relationships due to the generational lifecycle of their products.

The rapidly evolving automotive industry, particularly manufacturers of Electric Vehicles (EVs) and high-performance internal combustion engine (ICE) vehicles, represents a high-volume growth segment. These customers utilize 6xxx and 5xxx series plates for battery enclosures, structural frames, and body-in-white applications, driven by the mandate to improve vehicle range and efficiency. Naval shipbuilders and defense contractors also form a significant customer base, requiring specialized, often proprietary, armor-grade aluminum plates for marine vessels and military vehicles where impact resistance and reduced magnetic signature are paramount performance metrics.

Beyond transportation, potential customers include manufacturers of specialized industrial machinery, large-scale heat exchangers, cryogenic pressure vessels (essential for LNG transport and storage), and companies involved in the fabrication of large-scale tooling and molds. These customers value the material's thermal properties, corrosion resistance, and dimensional stability, purchasing plates based on specific alloy types and custom dimensions delivered by metal service centers. The purchasing decisions of these diverse customers are often influenced not just by price, but predominantly by technical specifications, lead time reliability, and the certified provenance of the material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcoa Corporation, Kaiser Aluminum, Constellium SE, Norsk Hydro ASA, China Zhongwang Holdings Limited, RUSAL, Aluminum Corporation of China Limited (CHALCO), Kobe Steel Ltd., AMAG Austria Metall AG, VSMPO-AVISMA Corporation, Jinggong Aluminum Industry Co., Ltd., Arconic Corporation, EGA (Emirates Global Aluminium), Speira GmbH, Aleris Corporation (now part of Novelis), Yawata Aluminum, Otto Fuchs KG, Henan Mingtai Aluminum Industrial Co., Ltd., Shandong Innovation Metal Technology Co., Ltd., Furukawa-Sky Aluminum Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alloy Aluminum Plate Market Key Technology Landscape

The technological landscape of the Alloy Aluminum Plate Market is defined by continuous innovation aimed at enhancing material performance, reducing production costs, and improving environmental sustainability. A cornerstone technology is the advanced Continuous Casting and Rolling (CCR) process, which offers higher yield rates and better dimensional control compared to traditional direct chill (DC) casting, especially for thinner gauge products. For thick aerospace and tooling plates, improvements in Direct Chill (DC) casting focus on electromagnetic stirring (EMS) and advanced cooling techniques to minimize segregation of alloying elements, ensuring superior internal quality and homogeneity, crucial for subsequent thermal treatments.

Significant technological advancements are concentrated in the heat treatment and finishing stages. Solution Heat Treatment (SHT) and subsequent controlled quenching are essential for achieving peak strength in 7xxx series alloys. Modern facilities utilize large, precisely controlled furnaces and rapid quenching systems (e.g., high-pressure air or water sprays) to lock in the required microstructure, minimizing distortion while maximizing mechanical properties. Furthermore, the industry is increasingly adopting specialized surface treatment techniques, such as high-precision milling and chemical etching, to achieve the extremely smooth finishes and tight flatness tolerances required for advanced components like those used in semiconductor manufacturing and high-speed train paneling.

Another crucial technological area involves non-destructive testing (NDT) and quality assurance. Automated Ultrasonic Testing (UT) systems are now standard, utilizing sophisticated phased array technology to detect minute internal flaws and porosity in thick plates, a mandatory requirement for aerospace certification. Moreover, Friction Stir Welding (FSW) is gaining traction as a joining technology, especially for large aluminum structures (e.g., naval vessels, fuel tanks), as it offers superior weld strength and fatigue resistance compared to fusion welding, further influencing the demand for plates with enhanced FSW compatibility. Finally, the incorporation of advanced recycling technologies, such as advanced sorting and purification of scrap, enables manufacturers to utilize secondary aluminum while maintaining the performance specifications required for highly specialized alloys.

Regional Highlights

The Asia Pacific (APAC) region is projected to maintain its position as the largest and fastest-growing market for Alloy Aluminum Plates throughout the forecast period. This growth is underpinned by massive governmental investments in infrastructure development, burgeoning domestic automotive production—particularly the aggressive push toward EV manufacturing in China and South Korea—and substantial expansion in the commercial and defense aviation sectors across economies like India and Japan. APAC manufacturers are increasingly competitive, benefiting from economies of scale and investments in state-of-the-art rolling facilities, positioning the region as a major global supplier for both commodity and specialized plates.

North America holds a significant value share, primarily driven by its mature and highly specialized aerospace and defense industries. The U.S. remains the global leader in demand for ultra-high-strength 7xxx and specialized aluminum-lithium (Al-Li) plates for military platforms and major commercial aircraft programs. The regional market is characterized by stringent quality controls, premium pricing, and a strong emphasis on domestic sourcing and supply chain security, influencing manufacturing strategies focused on high-precision output and advanced material certifications.

Europe represents a stable and high-value market, heavily influenced by robust automotive manufacturing, particularly in Germany and France, focusing on premium and luxury vehicles and the transition to electric mobility. Additionally, Europe has a strong presence in specialized industrial machinery and rail transport, requiring specific alloy types (6xxx and 5xxx series). The region is also at the forefront of sustainability initiatives, driving demand for alloys produced using low-carbon or recycled aluminum, forcing market players to adopt green energy sources and circular economy principles in their plate manufacturing operations.

- Asia Pacific (APAC): Dominant volume growth driven by China’s infrastructure expansion and EV manufacturing boom; India’s expanding aerospace and defense procurement.

- North America: High-value market segment focused on aerospace (7xxx and Al-Li alloys) and military applications; strong domestic demand security policies.

- Europe: Leading adoption of green aluminum plates; robust demand from premium automotive, rail, and specialized industrial machinery sectors.

- Latin America: Emerging market with increasing demand linked to local automotive assembly and limited construction/infrastructure projects, highly dependent on imports.

- Middle East and Africa (MEA): Growth driven by large-scale smelters (e.g., in the GCC countries) focusing on raw aluminum export, and local demand for 5xxx plates in marine and infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alloy Aluminum Plate Market.- Alcoa Corporation

- Kaiser Aluminum

- Constellium SE

- Norsk Hydro ASA

- China Zhongwang Holdings Limited

- RUSAL

- Aluminum Corporation of China Limited (CHALCO)

- Kobe Steel Ltd.

- AMAG Austria Metall AG

- VSMPO-AVISMA Corporation

- Jinggong Aluminum Industry Co., Ltd.

- Arconic Corporation

- EGA (Emirates Global Aluminium)

- Speira GmbH

- Novelis Inc. (Aleris Division)

- Otto Fuchs KG

- Henan Mingtai Aluminum Industrial Co., Ltd.

- Shandong Innovation Metal Technology Co., Ltd.

- Furukawa-Sky Aluminum Corp.

- Aoyama Aluminum Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Alloy Aluminum Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased demand for 7xxx series alloy aluminum plates?

The primary driver is the aerospace industry's need for materials with ultra-high strength and fatigue resistance for critical structural components in next-generation commercial and military aircraft. These plates are also gaining traction in performance automotive applications requiring superior strength-to-weight ratios.

How is the shift towards Electric Vehicles (EVs) impacting the alloy plate market?

The shift is creating substantial demand for 6xxx and 5xxx series plates for manufacturing lightweight battery enclosures, thermal management systems, and vehicle structural components, which are essential for maximizing EV range and performance while ensuring crash safety.

What are the primary restraints affecting the profitability of alloy aluminum plate manufacturers?

The profitability is constrained mainly by the volatility and high cost of raw materials (alumina, alloying elements) and the significant energy costs associated with the smelting and rolling processes. Additionally, lengthy aerospace certification cycles restrict rapid innovation adoption.

Which geographical region shows the strongest growth potential for alloy aluminum plates?

Asia Pacific (APAC), led by China and India, shows the strongest growth potential. This is due to massive infrastructure investments, rapid urbanization, and exponential growth in the region's domestic automotive and commercial aviation production capacities.

What key technological innovation is improving the quality of thick alloy aluminum plates?

Advanced Non-Destructive Testing (NDT) using automated Phased Array Ultrasonic Testing (PAUT) is the key technological innovation. This ensures highly reliable detection of internal flaws and homogeneity in thick plates, meeting the stringent quality standards required for critical aerospace and defense applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager