Almond Harvesters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441919 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Almond Harvesters Market Size

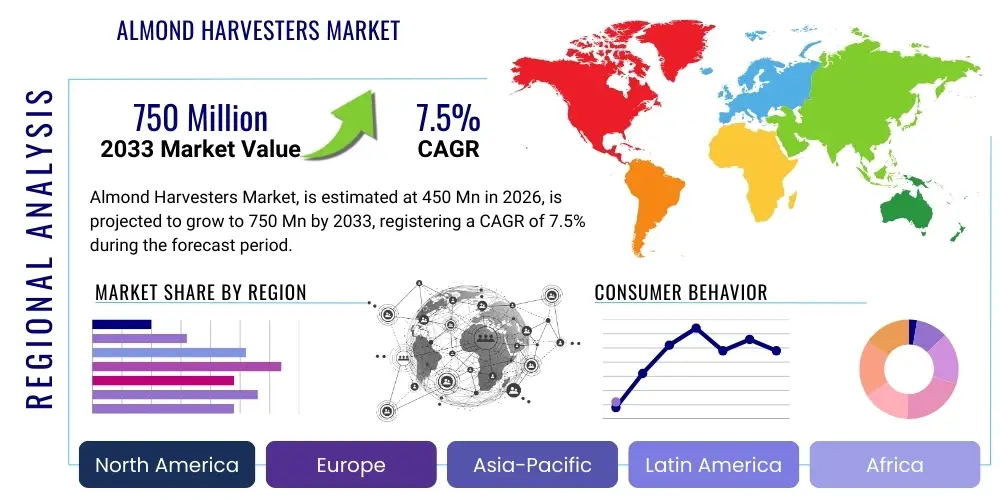

The Almond Harvesters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $450 million in 2026 and is projected to reach $750 million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for almonds, coupled with persistent challenges related to agricultural labor availability and the resultant necessity for high-efficiency mechanized harvesting solutions. The economic viability of large-scale almond production is increasingly dependent on reducing operational costs associated with manual labor, making the adoption of sophisticated harvesting equipment a critical investment for growers worldwide.

Almond Harvesters Market introduction

The Almond Harvesters Market encompasses the global trade and utilization of specialized machinery designed to efficiently and quickly detach, gather, and clean almonds from trees. These machines are essential components of modern, large-scale almond farming operations, providing mechanized alternatives to traditional, labor-intensive methods. Key products within this market include self-propelled shakers, tractor-mounted shakers, sweepers, and specialized pickup machines (harvesters) that operate in sequence to complete the harvesting process. The evolution of this machinery has focused significantly on minimizing kernel damage, reducing dust emissions, and optimizing fuel efficiency to meet strict environmental and quality standards required by global commodity markets.

Major applications of almond harvesters span across commercial almond orchards in key producing regions, including the United States (primarily California), Australia, Spain, and other developing agricultural regions transitioning to industrialized farming techniques. The primary benefit derived from these specialized machines is the massive increase in operational speed and scale, allowing producers to harvest vast acreage within optimal timeframes, which is crucial for maintaining nut quality and preventing crop loss due to weather variability. Furthermore, the inherent efficiency of mechanized harvesting directly addresses one of the most pressing issues in contemporary agriculture: the increasing scarcity and rising cost of skilled seasonal labor, thus securing the financial stability of farming enterprises.

Driving factors for market expansion are multifaceted, anchored by the consistent global rise in almond consumption attributed to health trends favoring nutrient-dense snacks and ingredients. Technological advancements, such as improved dust mitigation systems, GPS-guided operation for precision harvesting, and increased machine durability, further encourage replacement cycles and new fleet acquisitions. Regulatory pressure regarding environmental impact, particularly concerning airborne particulates generated during harvest, also drives demand for newer, compliant, and more technologically advanced harvesting models capable of meeting stringent air quality mandates.

Almond Harvesters Market Executive Summary

The global Almond Harvesters Market is positioned for robust expansion, primarily fueled by critical macro-level business trends centered on automation adoption and agricultural scale efficiency. A significant business trend involves the consolidation of smaller farming entities into larger commercial operations, which inherently possess the capital and operational necessity to invest in high-capacity, sophisticated harvesting fleets. This consolidation, coupled with the continued volatility and escalation of minimum wages across major agricultural economies, solidifies the economic justification for replacing manual labor with specialized machinery. Furthermore, Original Equipment Manufacturers (OEMs) are increasingly focusing their R&D efforts on integrating telematics, predictive maintenance features, and advanced sensor technology to enhance machine uptime and provide real-time operational feedback to growers, positioning precision agriculture as a core growth driver.

Regionally, North America, particularly the Central Valley of California, remains the uncontested center of demand and technological advancement, reflecting its overwhelming share of global almond production. However, substantial growth is being observed in the Asia Pacific (APAC) region, driven by Australia's expanding export market and modernizing agricultural practices, and in Europe, led by Spain's commitment to improving orchard efficiency. These regions are actively adapting harvesting technologies developed in the U.S. while simultaneously seeking models better suited to their unique orchard layouts, soil conditions, and regulatory environments. Latin America and the Middle East & Africa (MEA) present nascent but promising markets as local agricultural policies shift towards export-oriented commercial nut production, thereby necessitating mechanized harvesting solutions for international competitiveness.

Segment trends indicate a strong market preference for self-propelled shakers and sweepers due to their superior maneuverability, power, and high throughput capacity, especially on large, meticulously maintained orchards. While tractor-mounted equipment retains significance among medium-sized farms due to lower initial capital investment, the long-term trend favors fully integrated, purpose-built machines designed specifically for high-volume almond harvesting. There is also a notable movement toward specialized components focused on reducing environmental impact, such as high-efficiency filtration systems for dust control, representing a key area of differentiation and investment for market leaders.

AI Impact Analysis on Almond Harvesters Market

User inquiries regarding AI's influence in the almond harvesting sector frequently center on optimizing harvest timing, automating quality control, and improving machine efficiency. Growers are highly interested in how AI can move the industry beyond purely mechanical operation toward precision agriculture specific to nut production. Key themes include the implementation of machine vision systems to selectively identify and harvest only mature nuts, the use of predictive analytics based on weather and soil data to determine the optimal harvest window for maximizing yield and quality, and concerns over the computational infrastructure required to support these advanced systems. Furthermore, users question AI's role in predictive maintenance, ensuring high-capital equipment like harvesters remain operational during the critical, short harvest season, thus minimizing costly downtime.

The integration of Artificial Intelligence transforms traditional almond harvesters from simple mechanical tools into intelligent, adaptive farming systems. AI algorithms, powered by high-resolution imaging and sensor data, are being deployed to monitor tree health, assess yield variability within an orchard block, and guide the machinery's settings in real-time, optimizing shaker frequency and pickup height based on specific ground conditions and canopy density. This level of granular control minimizes tree stress, reduces soil disturbance, and significantly increases the recovery rate of premium-grade nuts. The long-term impact of AI will materialize in fully autonomous, self-navigating harvesting fleets that can operate 24/7 with minimal human intervention, dramatically lowering overall labor reliance and improving safety standards within the orchard environment.

Beyond the immediate operation, AI plays a crucial strategic role in logistics and fleet management. By analyzing operational data (fuel consumption, travel patterns, component wear), AI platforms can schedule necessary maintenance precisely before failures occur, a function known as predictive maintenance. This capability is invaluable in an operation where harvest windows are tight and equipment failure can result in massive crop losses. Moreover, AI models can be used to optimize the flow of nuts from the field to the hulling plant, scheduling transport and storage facilities efficiently, thereby enhancing the overall supply chain resilience and profitability of the almond growing enterprise.

- AI-driven Machine Vision Systems for real-time nut maturity assessment and selective harvesting.

- Predictive Maintenance Analytics utilizing operational data to forecast equipment failure and minimize critical downtime.

- Autonomous Navigation and Path Optimization, enabling 24/7 operation and reducing operator fatigue and error.

- Yield Mapping and Variable Rate Control (VRC) based on AI analysis of orchard imagery and environmental factors.

- Optimization of shaking frequency and intensity to maximize nut removal while minimizing tree damage.

DRO & Impact Forces Of Almond Harvesters Market

The dynamics of the Almond Harvesters Market are defined by a complex interplay of facilitating factors and limiting constraints, which collectively shape investment decisions and technological trajectories. Drivers (D) center predominantly on the overwhelming necessity to mechanize due to rising labor costs and shortages, ensuring efficiency across large commercial operations globally. Opportunities (O) are found in the expansion of high-density planting techniques, the integration of advanced robotics, and penetration into rapidly modernizing agricultural economies outside of established Western markets. Conversely, Restraints (R) include the high initial capital expenditure required for specialized machinery, the critical environmental concern of dust generation during harvest, and issues related to potential soil compaction caused by heavy equipment traffic.

The impact forces influencing the market are multifaceted, stemming from economic pressures, environmental regulations, and technological saturation points. Economically, the fluctuating global commodity prices for almonds directly affect grower profitability and, consequently, the willingness to invest in new capital equipment. Strong almond prices typically stimulate market demand for newer, high-efficiency harvesters. Environmentally, the market faces increasing scrutiny over particulate matter (PM10 and PM2.5) emissions, particularly in regions like California, leading to regulatory mandates that compel manufacturers to develop and market advanced dust suppression technology, thereby accelerating replacement cycles. Technologically, the rapid pace of innovation in autonomous capabilities and sensor integration acts as a powerful catalyst, ensuring that older fleets are continually rendered obsolete by superior, data-driven machinery.

The market's sensitivity to these forces necessitates strategic alignment between growers and machinery manufacturers. Manufacturers must continually innovate to address environmental restraints, primarily through dust reduction technology and lighter-weight designs to mitigate soil compaction. Simultaneously, they must capitalize on opportunities by developing highly automated, interconnected machines that seamlessly integrate into the broader farm management ecosystems. The persistent driver of labor shortage ensures a foundational, non-negotiable demand for mechanized solutions, making high-throughput and reliability the paramount competitive differentiators in the market.

Segmentation Analysis

The Almond Harvesters Market is systematically segmented based on equipment type, operational mechanism, power source, and end-use capacity, providing a granular view of grower preferences and technological adoption patterns across different agricultural scales and geographical regions. Understanding these segments is crucial for manufacturers to tailor their product offerings and for agricultural investors to assess optimal technology adoption strategies. The primary differentiation exists between self-propelled and towed/tractor-mounted systems, reflecting a clear split between high-volume commercial operations prioritizing speed and integration, and smaller or diversified farms focused on maximizing the utility of existing tractor fleets.

- By Type:

- Shakers (Self-Propelled, Tractor-Mounted)

- Sweepers

- Pick-up Harvesters (In-Row, Between-Row)

- Nut Carts/Handling Equipment

- By Operation:

- Fully Mechanical

- Semi-Autonomous

- Fully Autonomous (Emerging)

- By Capacity:

- Small to Medium (Up to 150 acres)

- Large Scale (150-500 acres)

- Very Large Scale (Above 500 acres)

- By Component:

- Engines and Power Trains

- Shaking Mechanisms (Canopy, Trunk)

- Conveyor and Cleaning Systems

- Electronic Control Units (ECUs)

Value Chain Analysis For Almond Harvesters Market

The value chain of the Almond Harvesters Market initiates with the upstream supply of specialized raw materials and components, including high-grade steel, complex hydraulic systems, precision engines, and advanced electronic components like sensors and GPS modules. Manufacturers engage in rigorous research and development to design and assemble these complex machines, focusing heavily on durability, efficiency, and compliance with increasingly strict environmental regulations (e.g., dust suppression and emission standards). Due to the capital-intensive nature of this machinery, R&D plays a crucial role in creating competitive advantage, particularly concerning autonomous features and precision agriculture integration.

The distribution channel represents the midstream segment, predominantly consisting of specialized agricultural equipment dealers and distributors who provide crucial services such as financing, spare parts inventory, and highly skilled technical maintenance. The nature of these high-cost, specialized tools mandates strong direct relationships between OEMs and their primary dealerships, ensuring rapid service response during the short, critical harvest season. Direct sales models are often employed for very large fleet purchases or specialized custom orders, but the localized dealer network remains vital for reaching the majority of commercial growers who require regional support and immediate access to maintenance services.

Downstream analysis focuses on the end-users—large-scale almond growers, agricultural cooperatives, and professional contract harvesting services. The machinery’s final value is realized in the orchard, where its performance dictates the quality and quantity of the final yield. The efficiency gained by mechanized harvesting, which translates directly into lower operational costs and better crop recovery, defines the value proposition. The flow concludes with the disposal or trade-in of older equipment, often entering secondary markets in regions with less stringent technological requirements, thus completing the cyclical nature of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 million |

| Market Forecast in 2033 | $750 million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jackrabbit, Flory Industries, Weiss McNair, Orchard-Rite, Ag-Right Harvesting, KMC, OMC, Nelson Manufacturing, CNH Industrial (New Holland), John Deere, Kubota, CAT, Fendt, Brandt Agricultural Products, Exact Corporation, Guss Automation, Monarch Tractor, AGCO Corporation, Case IH, Trellet Etablissements. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Almond Harvesters Market Potential Customers

The primary potential customers for almond harvesting equipment are large commercial almond growers operating high-density orchards, particularly those with acreage exceeding 150 acres, where the economic justification for high-capital machinery is clearly established through scale and operational needs. These entities require high-throughput, reliable equipment capable of operating continuously during the short harvest window to maximize yield and minimize exposure to adverse weather conditions. Their buying decisions are driven by factors such as machine reliability, advanced technological features (GPS, dust control), and the comprehensive aftermarket service support provided by the OEM or authorized dealer network. These large growers often seek self-propelled, integrated solutions that offer superior efficiency compared to towed counterparts.

A secondary, yet rapidly growing, customer segment includes contract harvesting service providers. These businesses specialize in offering comprehensive harvesting services to smaller or medium-sized farms that cannot justify the multi-million dollar investment in their own equipment fleet. Contract harvesters demand the most robust, versatile, and high-capacity machinery available, as their profitability is directly tied to the speed and quality of work they can deliver across multiple client properties. Their purchasing priorities lean heavily toward machines optimized for quick configuration changes and long-term durability under intense operational schedules.

Furthermore, agricultural cooperatives and consortiums represent another vital customer base. These groups collectively purchase machinery to be shared among their members, enabling smaller farms to access sophisticated technology without bearing the full capital cost individually. This segment often purchases reliable, easy-to-maintain models, frequently favoring tractor-mounted or semi-autonomous equipment that balances cost efficiency with sufficient operational throughput. Geographic customer concentration is heavily skewed toward regions with established export-grade almond industries, predominantly the US, Australia, and Mediterranean countries like Spain.

Almond Harvesters Market Key Technology Landscape

The technological landscape of the Almond Harvesters Market is characterized by continuous advancements aimed at increasing efficiency, enhancing precision, and mitigating environmental impact. A central pillar of current technology is the widespread integration of GPS and GNSS technology, allowing for precise machine guidance, optimized field passes (reducing fuel consumption and soil compaction), and real-time mapping of yield data. Modern harvesters utilize sophisticated electronic control units (ECUs) and telematics systems, enabling remote diagnostics, performance monitoring, and rapid software updates, essential capabilities for maximizing machine uptime during the critical harvest season. Furthermore, high-speed shaker technology has evolved to include variable frequency controls, allowing operators to adjust shaking intensity based on tree age and nut maturity, minimizing mechanical damage to the tree while maximizing nut removal.

Addressing environmental concerns, particularly dust control, has spurred significant technological investment. Manufacturers are now integrating advanced dust mitigation systems, including high-capacity vacuum filtration units, water injection systems, and improved air curtain technology on sweepers and pickup machines. These innovations are critical for compliance with strict air quality regulations, particularly in regions like California, and serve as a key differentiator in the market. The development of lighter, more powerful engines meeting Tier 4 Final emission standards further contributes to a reduced environmental footprint while maintaining the necessary hydraulic power for efficient operation.

The long-term trajectory focuses heavily on automation and robotics. The incorporation of Lidar and radar sensing, coupled with sophisticated AI algorithms, is paving the way for fully autonomous harvesting fleets. These systems are designed to navigate orchards without human input, identify and avoid obstacles, and optimize harvesting parameters automatically. While fully autonomous units are still emerging, semi-autonomous features, such as automatic row-following and precision speed control, are already standard on high-end models, ensuring operational consistency regardless of operator skill level and laying the foundation for future robotic integration within the orchard environment.

Regional Highlights

The global Almond Harvesters Market exhibits distinct regional dynamics driven by local production volumes, labor market conditions, and regulatory environments. North America, dominated by the California almond industry, is the most mature and technologically advanced market. California's high labor costs, coupled with its massive output, drive an intense demand for high-capacity, self-propelled, and technologically sophisticated harvesters featuring advanced dust suppression systems. This region not only accounts for the largest share of market revenue but also serves as the primary testing ground for new autonomous and precision agriculture technologies, setting global standards for efficiency and environmental compliance.

Europe represents a stable and growing market, led primarily by Spain and, to a lesser extent, Italy and Portugal. European demand is characterized by a high interest in versatile, often tractor-mounted equipment, suitable for smaller, more fragmented orchard landscapes compared to the expansive American operations. However, as Spanish growers transition toward higher-density, modern planting schemes, there is increasing demand for specialized, high-efficiency self-propelled units. Regulatory focus in Europe is on fuel efficiency and noise reduction, influencing manufacturer design choices and promoting the adoption of cleaner engine technologies.

The Asia Pacific (APAC) region is experiencing the fastest growth, largely attributable to the Australian almond industry, which is highly industrialized and export-focused. Australia mimics the large-scale, high-efficiency requirements of California, driving demand for similar self-propelled, high-capacity machinery. Furthermore, modernization efforts in emerging almond producing nations within APAC are stimulating new market opportunities for both new and used equipment. Latin America, specifically Chile, is also a focal point, investing in mechanized solutions to enhance its competitive position in the global nut export trade, prioritizing reliability and ease of maintenance in geographically challenging terrains.

- North America (USA - California): Dominant market share; high demand for autonomous readiness, advanced dust mitigation systems, and high-throughput self-propelled harvesters due to severe labor shortages.

- Europe (Spain): Significant growth driven by orchard modernization; increasing shift from tractor-mounted to specialized self-propelled units, focusing on precision technology for varied terrain.

- Asia Pacific (Australia): Fastest growth rate, characterized by large-scale, export-oriented farms; high adoption of fully mechanized systems mirroring U.S. operational scales.

- Latin America (Chile): Emerging market; focus on reliable, robust equipment to support expanding export production and increase global competitiveness.

- Middle East & Africa (MEA): Nascent demand, primarily driven by investments in modern irrigation and farming techniques in regions like South Africa, seeking reliable, durable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Almond Harvesters Market.- Jackrabbit

- Flory Industries

- Weiss McNair

- Orchard-Rite

- Ag-Right Harvesting

- KMC

- OMC (Oxbo International)

- Nelson Manufacturing

- CNH Industrial (New Holland)

- John Deere

- Kubota

- CAT (Caterpillar)

- Fendt (AGCO)

- Brandt Agricultural Products

- Exact Corporation

- Guss Automation

- Monarch Tractor

- Case IH

- Trellet Etablissements

- Schmeiser Manufacturing

Frequently Asked Questions

Analyze common user questions about the Almond Harvesters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Almond Harvesters Market through 2033?

The Almond Harvesters Market is projected to grow at a CAGR of 7.5% between 2026 and 2033, driven primarily by persistent agricultural labor shortages and the necessity for highly efficient mechanized harvesting solutions in key producing regions globally.

Which technological innovation is most critical for compliance in major almond producing regions like California?

The most critical technological innovation is advanced dust mitigation and suppression systems. These systems, including high-efficiency vacuum and water injection methods, are essential for compliance with strict air quality regulations regarding particulate matter emissions (PM10 and PM2.5) during harvest.

How is Artificial Intelligence (AI) being utilized to enhance modern almond harvesting equipment?

AI is integrated into modern harvesters primarily through machine vision systems for real-time nut maturity assessment and optimization of shaker settings. AI also drives predictive maintenance models, maximizing equipment uptime during the short, intensive harvest window.

What are the key differences between self-propelled and tractor-mounted almond harvesters?

Self-propelled harvesters offer superior speed, higher capacity, and integrated control systems, suitable for very large-scale operations. Tractor-mounted harvesters require a separate power source, feature lower initial capital costs, and are typically favored by medium-sized farms or those needing versatile machinery.

Which geographical region holds the largest market share for almond harvester sales and technology adoption?

North America, specifically the Central Valley of California, holds the largest market share. This dominance is due to the sheer volume of U.S. almond production, necessitating continuous investment in high-end, advanced, and autonomous-ready harvesting machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager