Aloe Vera Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442693 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Aloe Vera Market Size

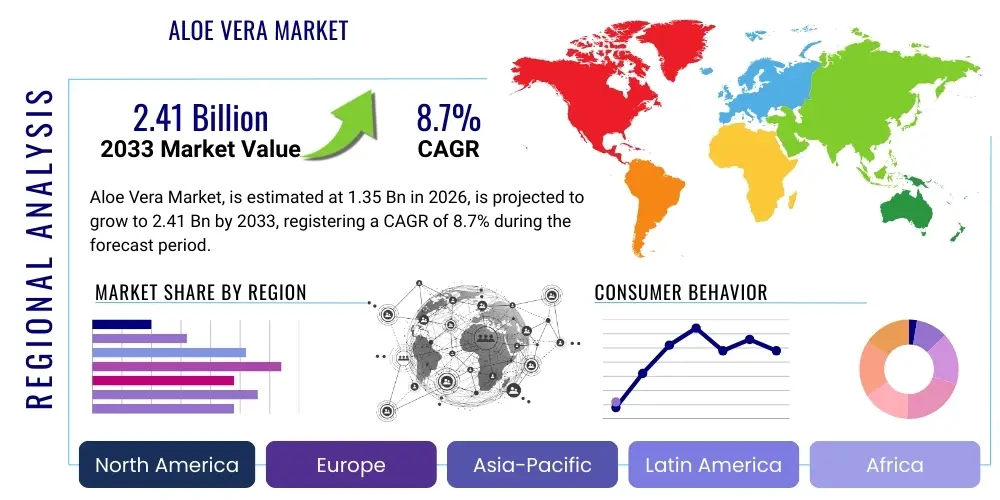

The Aloe Vera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.41 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global consumer inclination toward natural and organic ingredients, particularly within the fast-moving consumer goods (FMCG) sectors such as cosmetics, nutraceuticals, and functional foods. The perception of aloe vera as a safe, multi-functional ingredient with established therapeutic properties positions it favorably against synthetic alternatives, ensuring sustained market momentum.

Market valuation growth is also significantly influenced by advancements in processing and extraction technologies, which ensure higher purity and preservation of active compounds like polysaccharides and antioxidants. These technological improvements enable manufacturers to incorporate aloe vera into complex formulations without compromising efficacy, thus broadening its application scope from traditional topical creams to advanced internal health supplements. Furthermore, the robust regulatory support in key regions promoting botanical extracts in pharmaceuticals further cements the market's robust long-term growth trajectory.

Aloe Vera Market introduction

The Aloe Vera Market encompasses the cultivation, processing, and distribution of products derived from the Aloe barbadensis Miller plant, utilized predominantly for its medicinal, cosmetic, and nutritional properties. Products derived include concentrated extracts, gels, whole leaf juice, and powder forms, capitalizing on the plant’s rich composition of vitamins, enzymes, amino acids, and minerals. Major applications span the personal care industry, where it serves as a moisturizer, anti-inflammatory agent, and healing accelerator; the food and beverage sector, where it is incorporated into functional drinks and healthy snacks; and the pharmaceutical industry, recognized for its potential in treating digestive issues and boosting immunity. Key benefits driving market adoption include its soothing properties, efficacy in skin hydration, and digestive health support. The market is primarily driven by rising consumer awareness regarding natural wellness solutions, coupled with increasing disposable incomes globally allowing for greater expenditure on premium natural personal care and health products.

Aloe vera’s versatility is a core factor underpinning its market strength. Its use in dermal applications, ranging from treating minor burns and abrasions to anti-aging formulations, highlights its indispensable role in modern cosmetology. Simultaneously, the integration of aloe vera into functional beverages is expanding rapidly, appealing to health-conscious consumers seeking natural detoxification and gut health solutions. This dual functionality across major high-growth consumer segments ensures a broad and resilient market base. The ability of aloe vera derivatives to act as effective stabilizers and preservatives in certain formulations also offers synergistic benefits to manufacturers, further incentivizing its inclusion in new product lines.

The increasing institutional investment in research and development aimed at scientifically validating the traditional uses of aloe vera is bolstering consumer confidence and paving the way for advanced pharmaceutical applications. Studies focusing on the potential anti-diabetic, anti-cancer, and cardioprotective effects of aloe vera are crucial for unlocking high-value therapeutic markets. Government initiatives supporting organic farming and sustainable cultivation practices in major producing regions also contribute significantly to the consistent supply chain required to meet escalating global demand, solidifying the market's upward trajectory.

Aloe Vera Market Executive Summary

The Aloe Vera Market is experiencing dynamic growth, characterized by strong business trends centered on sustainability and premiumization. Key industry players are focusing heavily on vertical integration, controlling the supply chain from farm to finished product to ensure traceability and quality assurance, which resonates deeply with discerning consumers. Product innovation trends include microencapsulation techniques to enhance the bioavailability of active components and the development of certified organic, fair-trade aloe vera derivatives. Regional trends indicate that North America and Europe remain the largest revenue contributors due to high consumer spending power and established nutraceutical markets, while the Asia Pacific region, particularly India and China, demonstrates the highest growth rate, fueled by expanding middle classes and the convergence of traditional herbal medicine with modern personal care. Segment trends highlight the dominance of the cosmetics and personal care application segment, though the food and beverage sector is exhibiting the most rapid expansion, driven by the proliferation of aloe-based functional drinks and healthy food additives designed for digestive wellness.

Strategic imperatives across the market emphasize technological adoption, particularly in optimizing extraction yields and minimizing environmental impact during cultivation and processing. Furthermore, consolidation via mergers and acquisitions is becoming prevalent as larger corporations seek to acquire specialized organic farms or proprietary processing technologies to strengthen market positioning and secure consistent, high-quality raw material supply. Regulatory shifts, such as stricter labeling requirements for natural ingredients in Europe, are also shaping business strategies, prompting companies to invest more in third-party certifications and transparent supply chain documentation to maintain market access and consumer trust.

The overall market outlook remains exceptionally positive, predicated on the global shift away from synthetic chemicals towards plant-based ingredients across all major consumer segments. The versatility of aloe vera allows it to weather economic fluctuations better than specialized single-application ingredients, as demand remains stable across essential consumer goods like skin care and basic health supplements. Successful market participants are those who not only ensure product purity but also effectively communicate the ecological and health benefits of their sustainably sourced aloe vera products, positioning themselves strongly for future market leadership and value capture.

AI Impact Analysis on Aloe Vera Market

Common user questions regarding AI’s influence on the Aloe Vera Market typically revolve around how artificial intelligence can enhance agricultural yield predictability, ensure stringent quality control of raw materials, optimize complex processing parameters, and refine consumer personalization in product development. Users are specifically concerned with AI's role in diagnosing plant diseases early (precision agriculture), verifying the purity of aloe extracts against adulteration, and leveraging consumer data to forecast demand for specific aloe-based products, such as gels versus drinks. The key themes summarized from these inquiries center on efficiency improvement, enhanced transparency, and predictive analytics across the supply chain. Expectations are high regarding AI’s ability to reduce operational costs and substantially increase product consistency and safety, which are paramount in the natural health sector.

AI deployment is rapidly transforming the upstream segment of the Aloe Vera Market through precision farming techniques. Using drone imagery and satellite data combined with machine learning algorithms, cultivators can monitor soil moisture levels, nutrient deficiencies, and the onset of pests or diseases with exceptional accuracy. This capability allows for highly targeted intervention, reducing the use of water and pesticides, thereby lowering costs and enhancing the sustainability profile of aloe cultivation—a critical factor for environmentally conscious consumers. Furthermore, AI helps in optimizing harvesting schedules to maximize the concentration of beneficial active compounds in the leaves.

In the downstream processing and consumer segments, AI is pivotal for maintaining high product integrity. Machine vision systems coupled with AI algorithms are being integrated into manufacturing lines to perform real-time quality checks on aloe extracts, instantly identifying variations in color, viscosity, and chemical composition that might indicate contamination or degradation. On the consumer-facing side, advanced predictive modeling is allowing companies to tailor marketing efforts and develop highly personalized products, recommending specific aloe concentrations or formulations based on individual consumer health profiles and dermatological needs, ultimately enhancing customer satisfaction and brand loyalty.

- AI-driven Precision Agriculture: Optimizing irrigation, nutrient application, and pest detection for maximum yield and sustainability.

- Supply Chain Transparency: Blockchain technology integrated with AI for real-time tracking of aloe from farm to shelf, verifying origin and authenticity.

- Automated Quality Control: Machine learning systems analyzing spectral data to ensure purity, identify adulteration, and standardize polysaccharide content in extracts.

- Demand Forecasting and Inventory Management: AI algorithms predicting regional consumer demand shifts for various aloe-based product forms (e.g., gels vs. juices).

- Personalized Product Development: Utilizing AI to analyze consumer genomics and dermatological data for customized aloe vera concentrations in cosmetic formulations.

DRO & Impact Forces Of Aloe Vera Market

The Aloe Vera Market is primarily driven by the escalating global demand for natural, functional food ingredients and botanicals recognized for their therapeutic advantages, especially in skin health and digestive wellness. Restraints include the volatility of raw material pricing due to climatic variability, the complex regulatory landscape surrounding functional health claims in different jurisdictions, and the potential for product adulteration that erodes consumer trust. Significant opportunities arise from the application of aloe vera in novel pharmaceutical drug delivery systems and the surging market for sustainable, eco-friendly personal care products. The primary impact forces influencing the market are the immediate availability and competitiveness of natural substitutes like coconut oil, shea butter, and various herbal extracts, alongside stringent global quality and safety standards that demand high investment in processing technology to maintain compliance.

Drivers are strongly anchored in demographic shifts, particularly the aging global population seeking natural anti-aging and prophylactic health solutions, which significantly boosts demand for aloe vera in nutraceuticals and dietary supplements. Furthermore, robust marketing campaigns by industry leaders highlighting the clinically backed benefits of standardized aloe extracts are continuously educating consumers and expanding the user base beyond traditional topical applications. The ease of integration of aloe vera into existing product matrices across food, cosmetic, and pharmaceutical manufacturing processes also serves as a strong incentive for widespread corporate adoption.

However, the market faces structural challenges, notably the difficulty in standardizing the active compound concentration (e.g., aloin, polysaccharides) due to variations in cultivation practices, soil conditions, and subsequent processing methods. This lack of standardization can lead to inconsistent product efficacy, posing a restraint on clinical adoption and regulatory approvals. Opportunities are vast in emerging markets, where rapid urbanization and Westernization of consumer lifestyles are leading to increased expenditure on wellness products. Capitalizing on these regions requires strategic investments in local distribution networks and targeted product localization tailored to regional preferences and traditional usage patterns.

Segmentation Analysis

The Aloe Vera Market is intricately segmented based on product form, application, and distribution channel, reflecting the plant's diverse utility across consumer sectors. The segmentation provides critical insight into demand dynamics, highlighting which product formats are achieving high penetration and which end-use industries are showing the highest propensity for future growth. Understanding these segments is vital for strategic investment, allowing manufacturers to focus research and development efforts on high-yield and high-margin product lines, such as purified aloe extract powders for the nutraceutical sector, which commands a premium due to high concentration and ease of incorporation into supplements.

Analysis reveals that the extraction and processing techniques directly influence the end-user preference. For instance, decolorized whole leaf extract, which removes the laxative compound aloin, is favored in food and beverage applications for safety and taste compliance, while pure aloe gel remains dominant in the cosmetic and topical therapeutic markets due to its natural viscosity and soothing properties. Growth within the application segments is currently led by the food and beverage industry, which leverages aloe vera’s functional benefits for digestive health, transforming it from a niche ingredient into a mainstream component of healthy lifestyle products like water, teas, and yogurt.

Geographically, market segmentation underscores a distinct difference in product adoption: developed regions show a preference for highly processed, standardized extracts in supplement form, prioritizing efficacy and scientific validation, whereas developing regions often maintain a stronger inclination toward raw gel or minimally processed juice for traditional medicinal and domestic uses. This regional segmentation is crucial for logistics and marketing strategies, dictating the necessary level of processing infrastructure and the appropriate consumer messaging required for market success.

- By Product Form:

- Aloe Vera Gel

- Aloe Vera Extract (Liquid and Powder)

- Aloe Vera Whole Leaf Extract

- By Application:

- Cosmetics and Personal Care (Skin Care, Hair Care, Sun Care)

- Food and Beverages (Functional Drinks, Dairy, Confectionery)

- Pharmaceuticals and Healthcare (Topical Medications, Oral Supplements)

- Others (Textiles, Industrial Applications)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Supermarkets/Hypermarkets, Pharmacies, Specialty Stores)

Value Chain Analysis For Aloe Vera Market

The value chain of the Aloe Vera Market is complex, beginning with highly specialized upstream cultivation and culminating in globally distributed consumer products. The upstream segment involves the farming and harvesting of aloe leaves, which requires specific climatic conditions and careful handling to prevent degradation of active compounds immediately post-harvest. Efficiency at this stage is crucial, as the quality of the raw material directly dictates the efficacy and market value of the final product. Key activities include organic certification, meticulous leaf selection, and rapid transport to processing facilities to maintain freshness, which often necessitates proximity between farms and industrial processors.

The midstream phase focuses on processing, extraction, and stabilization, where raw aloe leaves are transformed into marketable components like aloe gel, purified extracts, and powdered concentrates. Advanced processing techniques, such as cold pressing and membrane filtration, are essential for removing undesirable compounds (like aloin) and preserving high concentrations of beneficial polysaccharides. Manufacturers often invest heavily in patented stabilization methods to extend shelf life without relying on harsh chemical preservatives. This phase adds substantial value, turning a perishable raw material into standardized, quality-assured industrial ingredients suitable for downstream integration.

The downstream distribution channel involves the incorporation of aloe vera ingredients into finished products by cosmetic, food, and pharmaceutical companies, followed by commercialization through direct and indirect routes. Direct distribution includes branded online sales and company-owned stores, offering higher margin control and direct consumer feedback. Indirect channels, such as global distribution through third-party wholesalers, retailers (supermarkets, specialty health stores), and e-commerce giants, ensure broad market penetration. The complexity of the global supply chain, involving cross-border logistics and adherence to diverse import regulations, requires sophisticated logistics management and strong partnerships between ingredient suppliers and consumer product manufacturers.

Aloe Vera Market Potential Customers

The primary end-users and buyers in the Aloe Vera Market are concentrated across three major sectors: the Cosmetics and Personal Care industry, the Functional Food and Beverage sector, and the Pharmaceutical and Healthcare sector. Within cosmetics, potential customers include multinational corporations and niche organic beauty brands requiring high-quality, standardized aloe gel for use in moisturizing creams, lotions, hair care products, and soothing dermatological preparations. These buyers prioritize purity, consistent viscosity, and certified organic sourcing to align with their brand ethos and meet consumer demand for natural ingredients.

The second major customer base lies within the functional food and beverage manufacturers, including producers of bottled waters, health drinks, energy shots, and dietary supplements. These companies seek decolorized aloe vera extracts and juices, focusing on guaranteed aloin-free status, stable pH, and ease of formulation into liquid products. Their purchasing decisions are heavily influenced by the ability of the supplier to provide clinically supported health claims relating to digestive health and immunity, thereby bolstering the marketability of their final consumer goods.

Finally, pharmaceutical and healthcare companies represent a high-value customer segment, utilizing aloe vera for topical burn treatments, wound healing ointments, and advanced nutraceutical capsules targeting gut health or immune support. These buyers require the most stringent quality controls, often demanding pharmaceutical-grade extracts with highly standardized polysaccharide content, backed by comprehensive scientific documentation and regulatory compliance data. They typically engage in long-term supply contracts to ensure uninterrupted access to specified, medical-grade raw materials for their proprietary formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.41 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AloeCorp, Inc., Terry Laboratories Inc., Aloe Farms, Inc., Foodchem International Corporation, Aloecorp, Inc., Lily of the Desert, Forever Living Products, Herbalife Nutrition, Real Aloe Solutions Inc., Natural Aloe International, Curaloe BV, Pharmachem Laboratories Inc., Patanjali Ayurved Limited, Hickman's Aloe Vera, Forever Young International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aloe Vera Market Key Technology Landscape

The technological evolution within the Aloe Vera Market is primarily focused on enhancing the purity, stability, and bioavailability of the active compounds, moving away from conventional heat-based processing that often degrades sensitive molecules. A pivotal technology is advanced cold processing and membrane filtration (ultrafiltration and nanofiltration), which allows for the efficient separation of active ingredients (like high-molecular-weight polysaccharides) from unwanted components (such as aloin and anthraquinones) without thermal damage. This results in pharmaceutical-grade, colorless, and odorless extracts required by premium food and medical applications, significantly increasing the market value per unit of raw material processed.

Furthermore, microencapsulation and liposomal delivery systems represent cutting-edge innovations utilized primarily in nutraceutical and cosmeceutical formulations. These techniques protect the sensitive aloe vera compounds from harsh environments (like stomach acid or oxidative stress) and ensure controlled release, dramatically improving the therapeutic efficacy when consumed or applied topically. For manufacturers, investing in proprietary microencapsulation technology offers a critical competitive advantage, allowing the development of high-potency, shelf-stable products that address specific health concerns more effectively than traditional formulations.

In the upstream cultivation sector, the adoption of sustainable farming technologies, including hydroponics and vertical farming, is gaining traction, particularly in regions facing water scarcity or limited arable land. While currently cost-intensive, these methods offer controlled environments that guarantee optimal growth conditions, minimize external contaminants, and ensure a highly consistent chemical profile in the harvested aloe leaves throughout the year. The future technology landscape points toward further integration of AI and sensor-based monitoring systems to perfect cultivation and extraction processes, ensuring unparalleled product standardization across global supply chains.

Regional Highlights

- North America: North America, particularly the United States, holds a significant market share, driven by high consumer awareness regarding natural health supplements and a robust, well-established nutraceutical industry. The region benefits from stringent quality standards that favor certified organic and high-purity aloe vera extracts, primarily consumed in dietary supplements for gut health and premium dermatological products. Strong growth is sustained by the proactive adoption of aloe-based functional beverages among young, health-conscious demographics.

- Europe: Europe is a major revenue contributor, characterized by sophisticated regulatory frameworks (e.g., EU Novel Food regulations) that necessitate high levels of scientific substantiation for health claims. The market is dominated by demand for aloe vera in high-end cosmetic and personal care products, where it is valued for its proven anti-inflammatory and moisturizing capabilities. Germany, France, and the UK are key markets, showing a sustained shift towards sustainably sourced and ethically produced botanical ingredients.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by massive populations in China and India, increasing disposable incomes, and the deep-rooted cultural acceptance of traditional herbal medicine, where aloe vera has been used for centuries. Market expansion is particularly evident in functional drinks and mass-market skin care products, driven by local manufacturers scaling up production to meet burgeoning domestic demand.

- Latin America (LATAM): LATAM is a crucial region for raw material sourcing, with countries like Mexico and the Caribbean being major cultivators due to favorable climates. While domestic consumption is rising, particularly in health and basic topical applications, the region's primary economic contribution is through the export of raw and semi-processed aloe vera derivatives to North America and Europe. Investment in local processing infrastructure is gradually increasing, shifting the value capture closer to the point of origin.

- Middle East and Africa (MEA): The MEA market shows promising growth potential, particularly in the Arabian Gulf countries, owing to rising imports of premium international cosmetic brands and increasing consumer spending on health and wellness products. In Africa, traditional uses are widespread, but the formal, standardized market is still emerging, focusing largely on localized production for affordable personal care items and basic pharmaceutical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aloe Vera Market.- AloeCorp, Inc.

- Terry Laboratories Inc.

- Aloe Farms, Inc.

- Foodchem International Corporation

- Aloecorp, Inc.

- Lily of the Desert

- Forever Living Products

- Herbalife Nutrition

- Real Aloe Solutions Inc.

- Natural Aloe International

- Curaloe BV

- Pharmachem Laboratories Inc.

- Patanjali Ayurved Limited

- Hickman's Aloe Vera

- Forever Young International

- Concentrated Aloe Corporation

- Natural Health Products, Inc.

- E. T. Browne Drug Co., Inc. (Palmer's)

- Goya Foods, Inc.

- Lakewood Organic Juice

Frequently Asked Questions

Analyze common user questions about the Aloe Vera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Aloe Vera Market?

The primary factor driving market growth is the significant and sustained global consumer shift toward natural, plant-based ingredients across cosmetics, nutraceuticals, and functional foods, coupled with increased scientific validation of aloe vera’s therapeutic benefits for skin and digestive health.

Which application segment holds the largest share in the Aloe Vera Market?

The Cosmetics and Personal Care application segment currently holds the largest market share, predominantly utilizing aloe vera gel and extracts for moisturizing, anti-inflammatory, and soothing properties in skin care, hair care, and sun protection products.

How do technological advancements influence the quality of aloe vera extracts?

Advanced technologies such as cold processing, membrane filtration, and microencapsulation significantly improve extract quality by preserving sensitive active compounds like polysaccharides, removing contaminants like aloin, and enhancing stability and bioavailability for premium product formulations.

What are the main regional markets contributing to the high growth rate?

While North America and Europe maintain large market values, the Asia Pacific (APAC) region, specifically emerging economies like China and India, is contributing the highest growth rate due to rapid urbanization, increasing middle-class income, and strong integration of herbal products into modern consumer health routines.

What are the key sustainability concerns addressed by aloe vera cultivators?

Key sustainability concerns include minimizing water usage during cultivation, preventing environmental impact from agricultural chemicals, and ensuring ethical labor practices. Many industry leaders are adopting organic farming, vertical farming techniques, and obtaining fair trade certifications to address these challenges.

How is the Aloe Vera Market segmented by product form?

The market is segmented into Aloe Vera Gel, which is minimally processed; Aloe Vera Extract, available in highly concentrated liquid or powdered forms for industrial use; and Aloe Vera Whole Leaf Extract, often used for specific internal applications after detoxification to remove aloin.

What role do dietary supplements play in the Aloe Vera Market expansion?

Dietary supplements play a critical role, leveraging aloe vera's benefits for internal health, particularly gut flora balance, digestive system soothing, and immune system support. This segment demands highly purified, standardized extracts with scientifically verifiable health claims, driving innovation in encapsulation and formulation.

What is the significance of aloin removal in aloe vera processing?

Aloin is a compound with laxative properties naturally present in the aloe rind. Its removal (decolorization) is crucial for extracts destined for internal consumption (food, beverage, and most supplements) to ensure product safety, regulatory compliance, and consumer palatability, making the resulting product safer for regular use.

Which distribution channel is showing the fastest growth for aloe vera products?

The Online Retail distribution channel is exhibiting the fastest growth due to the convenience of e-commerce platforms, the ability to reach global niche markets, and increased consumer reliance on digital platforms for researching and purchasing specialized health and wellness products, often driven by subscription models.

What impact does climate variability have on the raw material supply chain?

Climate variability, including extreme weather events such as droughts or heavy rainfall, significantly affects the yield and quality of aloe vera crops, leading to volatile raw material pricing and supply shortages. This necessitates strategic sourcing and increased investment in controlled agricultural environments by major processors.

Are there major restraints to market growth besides supply volatility?

Yes, significant restraints include the complex and varying regulatory scrutiny applied to 'natural' health claims across different countries, necessitating costly clinical trials and documentation, and the persistent risk of product adulteration by unscrupulous suppliers attempting to dilute extracts with cheaper alternatives.

What are the leading innovation areas in aloe vera processing?

Leading innovation areas focus on enhancing polysaccharide content preservation, utilizing specialized enzymes for targeted compound extraction, and implementing advanced spectroscopic methods combined with AI for real-time quality assurance during large-scale manufacturing processes.

Why is the pharmaceutical segment a high-value customer for aloe vera suppliers?

The pharmaceutical segment is high-value because it requires strict adherence to Good Manufacturing Practices (GMP), demands highly purified, standardized extracts for clinical use (often requiring specific polysaccharide molecular weights), and typically engages in long-term, high-volume contracts ensuring premium pricing for certified raw materials.

How does AI contribute to supply chain transparency in the aloe vera sector?

AI is integrated with blockchain technology to create tamper-proof digital ledgers, tracking aloe vera batches from the specific farm harvest date through every processing step. This enhances transparency, verifies organic status, and provides crucial data for quality compliance and regulatory audits.

What are the potential future opportunities for aloe vera in the industrial sector?

Future opportunities extend beyond traditional applications into industrial uses such as natural preservatives for food packaging, biocompatible materials for medical devices, and eco-friendly additives in the textile industry, leveraging its inherent antimicrobial and stabilizing properties.

What is the role of vertical integration among key players?

Vertical integration allows key players to control the entire production cycle, from cultivation (farming) to manufacturing and distribution. This strategy mitigates risks associated with raw material sourcing, ensures consistent quality, and maximizes profit margins by eliminating reliance on external suppliers.

How does the demand for organic certification affect the market?

Demand for organic certification significantly influences the market by driving up the cost of raw materials and processing, but also commands a premium price point at retail. Certification acts as a key market differentiator, particularly in North America and Europe, where consumer trust in organic labeling is high.

What types of functional food products are driving the beverage segment?

The beverage segment is driven by functional drinks, including detox waters, ready-to-drink teas, and smoothies infused with aloe vera, marketed for digestive comfort, hydration, and natural detoxification. These products often target wellness and lifestyle consumers seeking clean-label options.

Which countries in APAC are leading the consumption growth?

China and India are the leading countries in APAC driving consumption growth, attributed to their large, expanding consumer bases, cultural affinity for herbal remedies, and rapid adoption of Westernized beauty and wellness standards promoting natural ingredients.

How is the market influenced by competition from natural substitutes?

The market is constantly influenced by the availability of substitutes such as coconut oil, argan oil, and shea butter, which offer similar moisturizing and soothing properties. This competitive force mandates that aloe vera suppliers focus on scientific substantiation and highlight aloe's unique polysaccharide content to maintain market differentiation.

What defines the upstream segment of the aloe vera value chain?

The upstream segment is defined by primary production, encompassing the cultivation, harvesting, and initial handling of aloe leaves. Success in this phase relies on optimal agricultural practices, efficient logistics, and rapid cooling or stabilization of harvested leaves to minimize degradation of active biological compounds.

How are pharmaceutical companies utilizing aloe vera?

Pharmaceutical companies primarily utilize high-purity, standardized aloe extracts in proprietary drug formulations for topical wound healing, burn treatments, and gastrointestinal therapeutics, requiring the highest level of regulatory compliance and controlled active ingredient concentration.

Why is standardization of active compounds a challenge in this market?

Standardization is challenging because the concentration of key active compounds (like polysaccharides) varies significantly based on environmental factors (soil, climate), cultivation age, and differences in processing protocols. Achieving consistent chemical potency requires advanced technology and rigorous testing at every batch level.

What are the common end-user applications in the cosmetics segment?

Common end-user cosmetic applications include daily moisturizers, after-sun lotions, facial cleansers, anti-acne treatments, and hair conditioners, leveraging aloe vera's ability to soothe irritation, hydrate the skin, and act as a gentle, natural emollient.

What is the forecasted CAGR for the Aloe Vera Market between 2026 and 2033?

The Aloe Vera Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period from 2026 to 2033, driven by increasing health consciousness and demand for natural product versatility.

How do modern extraction techniques differ from traditional methods?

Modern extraction techniques, such as cold processing and supercritical fluid extraction, avoid high heat exposure used in traditional methods, thereby minimizing the thermal degradation of heat-sensitive vitamins and enzymes, resulting in a product with higher biological activity and purity.

What role does the demand for 'clean label' products play?

The demand for 'clean label' products—those free from artificial colors, preservatives, and synthetic chemicals—significantly boosts the use of aloe vera, as it is a recognized, natural ingredient that easily aligns with consumer preferences for minimal, recognizable components.

How do manufacturers ensure the stability and shelf life of aloe vera juice?

Manufacturers utilize various stabilization techniques, including flash pasteurization, high-pressure processing (HPP), and the careful addition of natural stabilizing agents (like citric acid or ascorbic acid), alongside advanced aseptic packaging to maintain purity and extend shelf life without compromising nutritional integrity.

What is the typical profile of a potential customer in the nutraceutical sector?

Potential customers in the nutraceutical sector are highly sophisticated manufacturers focused on developing premium health supplements. They require suppliers to provide aloe vera powders or extracts with guaranteed high concentration of active polysaccharides, comprehensive analytical testing results, and often proprietary certifications.

Why is Latin America primarily known for raw material export rather than finished product sales?

Latin America possesses ideal climatic conditions for efficient cultivation, making it a low-cost producer of raw aloe leaves. However, due to limited investment in advanced, high-tech processing infrastructure compared to North America or Europe, it focuses more on exporting bulk raw and semi-processed material rather than high-value finished consumer products.

What impact do macroeconomic factors, such as disposable income, have on the market?

Increasing disposable income, especially in emerging markets, directly correlates with higher consumer expenditure on premium, natural, and specialized wellness products, significantly boosting demand for higher-priced aloe vera supplements and organic cosmetics.

How do private label brands influence the Aloe Vera Market structure?

Private label brands, particularly those owned by major retailers, are increasing competition by offering affordable alternatives across all segments (cosmetics, supplements, juices). This forces national brands to innovate and focus on higher purity or unique formulations to justify their premium pricing.

What is the key challenge in managing the aloe vera downstream distribution channel?

The key challenge is navigating the complex and fragmented global retail landscape, managing product shelf stability across various climates, and ensuring compliance with the unique import regulations and labeling requirements specific to each region and distribution partner.

Which component of the aloe vera plant is most valuable for medicinal use?

The high-molecular-weight polysaccharides, particularly acemannan, found in the inner gel fillet are considered the most valuable medicinal component, recognized for their immunomodulatory, anti-inflammatory, and gut-healing properties, driving demand in the pharmaceutical and high-end nutraceutical sectors.

How is the industrial application segment expanding?

The industrial segment is expanding through the use of aloe vera derivatives as natural additives in water treatment, biodegradable plastics, and as an ingredient in certain textile finishing processes where antimicrobial and moisturizing properties are desired, moving beyond traditional consumer goods.

What is Generative Engine Optimization (GEO) and how is it relevant to this report?

Generative Engine Optimization (GEO) involves structuring content with high semantic density, clear categorization, and structured data elements (like lists and tables) to ensure AI models and search generative engines can accurately extract, synthesize, and present factual market insights directly to the end-user.

What market trend is driving innovation in sun care products utilizing aloe vera?

The trend towards multifunctional and natural sun care is driving innovation, where aloe vera is incorporated not just for post-sun soothing, but increasingly as a primary ingredient within the sunscreen formulation itself, offering natural hydration and reducing skin irritation caused by UV exposure or chemical filters.

What is the difference between Aloe Vera Gel and Aloe Vera Extract in terms of purity?

Aloe Vera Gel is typically the raw, minimally processed inner fillet, containing high moisture content. Extract is a concentrated form (often 200:1 concentrate powder) achieved after water removal and filtration, offering significantly higher potency and purity for industrial formulation, measured by polysaccharide content.

How are companies using research and development to gain a competitive edge?

Companies gain competitive edge by investing in R&D to scientifically validate specific health claims (leading to proprietary formulations), optimizing extraction protocols to yield higher purity products, and securing patents on unique delivery systems, such as advanced liposomal encapsulation for superior absorption.

What is the significance of the base year 2025 in the forecast timeline?

The base year 2025 serves as the current reference point for calculating market size and growth trajectory, representing the latest comprehensive data available for benchmarking and projecting future market movements against current economic and industry trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aloe Vera Gel Market Statistics 2025 Analysis By Application (Food, Cosmetics, Pharmaceutical), By Type (Aloe Vera Gel Extracts, Aloe Vera Whole Leaf Extracts), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aloe Vera Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Concentrates, Gels, Drinks, Powders, Capsules), By Application (Pharmaceutical Industry, Cosmetic Industry, Food Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Aloe Vera Juice Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Beverage, Capsule), By Application (Cosmetics, Pharmaceuticals, Health Foods and Drinks), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Isobarbaloin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Raw Material:Aloe Vera L, Raw Material:Aloe Ferox Mill, Others), By Application (Drugs, Cosmetics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager