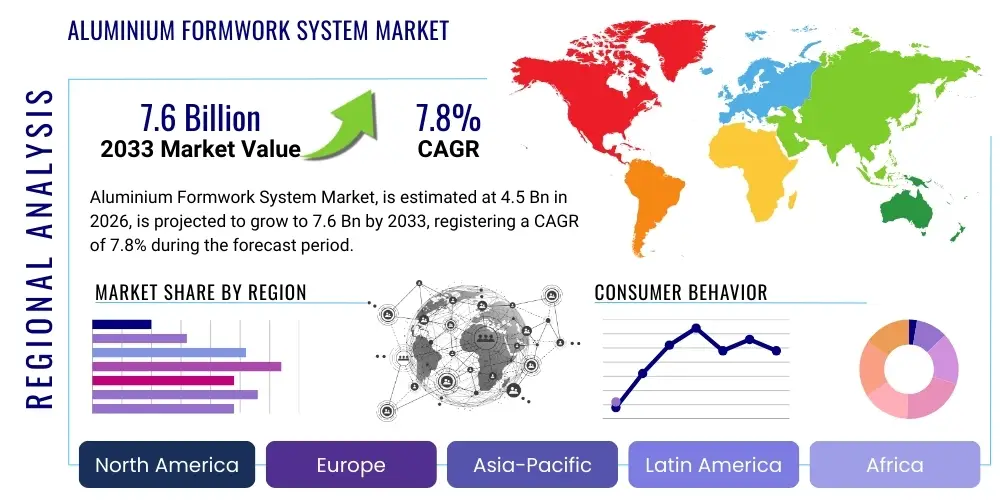

Aluminium Formwork System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442785 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Aluminium Formwork System Market Size

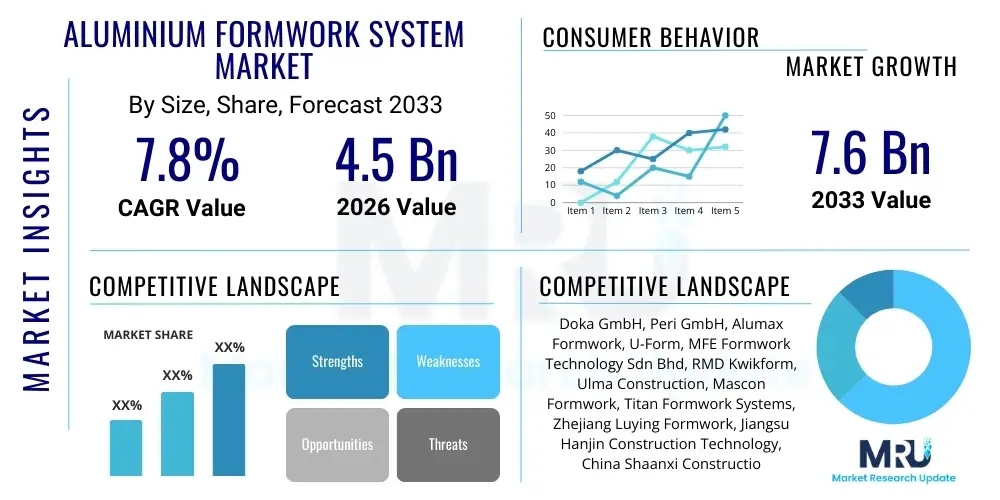

The Aluminium Formwork System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for rapid, high-quality, and standardized construction methodologies, particularly in high-density urban areas and large-scale affordable housing projects across emerging economies. The inherent advantages of aluminum formwork, such as reusability, lightweight nature, and superior surface finish, position it as a critical technology displacing traditional timber and conventional steel formwork systems in modern infrastructure development.

Aluminium Formwork System Market introduction

The Aluminium Formwork System Market encompasses the design, manufacture, and deployment of modular aluminum components utilized to create molds (formwork) for pouring concrete structures in construction projects. This sophisticated system, often referred to as 'MIVAN' or 'tunnel form,' facilitates the simultaneous casting of walls, slabs, and columns, significantly enhancing construction speed and structural integrity. Key applications span residential high-rise buildings, mass housing schemes, commercial complexes, and specialized infrastructure projects, where repetitive structural elements are utilized. The product's inherent lightweight properties allow for easier handling and faster cycle times compared to heavy conventional systems, directly reducing labor dependency and overall project timelines. Furthermore, the high precision and consistent dimensional accuracy provided by the aluminum molds result in minimal need for post-casting plastering or finishing, offering substantial cost savings in the long run.

Major applications driving market expansion are centered around rapid urbanization and the subsequent need for scalable construction solutions. Aluminium formwork excels in projects requiring uniformity and high speed, such as government-backed affordable housing initiatives and large-scale township developments in Asia Pacific and the Middle East. The system’s environmental benefits, stemming from its high reusability (often exceeding 250 uses) and reduced reliance on timber, align with global sustainable construction mandates. This focus on efficiency and sustainability positions the technology favorably against traditional construction methods, securing its place as a preferred system for developers seeking LEED certification or similar green building standards. The global shift toward mechanized construction processes further underpins the widespread adoption of these advanced formwork solutions.

Benefits of adopting aluminium formwork are multifaceted, encompassing enhanced quality control, significant reduction in construction waste, and improved safety profiles on construction sites due to standardized assembly procedures. Driving factors for market growth include favorable governmental policies promoting industrialized building systems (IBS), increasing foreign direct investment (FDI) in the real estate sectors of developing nations, and technological advancements leading to the development of stronger, yet lighter aluminum alloys for formwork panels. The ability of the system to deliver smooth, paint-ready concrete surfaces directly contributes to lower overall finishing costs, making the initial investment highly attractive over the lifespan of multi-unit residential projects.

Aluminium Formwork System Market Executive Summary

The Aluminium Formwork System Market exhibits strong growth dynamics, underpinned by fundamental shifts in global construction practices favoring industrialized, repeatable processes. Business trends indicate a movement toward modularization and standardization, with major construction firms increasingly integrating these formwork systems to overcome challenges related to skilled labor shortages and escalating material costs associated with traditional methods. Strategic collaborations between formwork manufacturers and large-scale developers are accelerating market penetration, particularly in high-growth construction hubs. Technology advancements are focusing on integrating smart features, such as RFID tagging for inventory management and real-time monitoring of formwork usage cycles, enhancing operational efficiency.

Regionally, the Asia Pacific (APAC) dominates the market, driven by massive infrastructure spending, rapid urbanization in China and India, and government mandates promoting high-density residential development utilizing fast-track construction technologies. The Middle East and Africa (MEA) region also shows significant promise, fueled by mega-projects in the UAE and Saudi Arabia demanding rapid, high-quality construction timelines. European and North American markets, while mature, are experiencing steady growth driven by the renovation sector and specialized, complex high-rise structures where the precision of aluminum formwork offers distinct advantages over conventional systems. Competitive intensity is high, characterized by continuous product innovation aimed at improving ease of use and longevity.

Segment trends highlight the dominance of the residential sector application, specifically high-rise apartments and affordable housing schemes, due to the inherent repetition in design that maximizes the cost-efficiency of aluminium formwork. By type, the wall and column formwork segment holds a substantial share, reflecting its foundational role in vertical construction. The trend toward customized and rental formwork solutions is also gaining traction, allowing smaller and medium-sized enterprises (SMEs) access to high-quality systems without significant capital expenditure. Overall, the market trajectory remains positive, supported by the compelling economic and operational advantages aluminum formwork offers across the entire construction lifecycle.

AI Impact Analysis on Aluminium Formwork System Market

Common user inquiries regarding AI's impact on the Aluminium Formwork System Market primarily revolve around how machine learning can optimize formwork design and inventory management, predict maintenance needs, and enhance on-site installation safety and efficiency. Users are keenly interested in predictive analytics for identifying optimal stripping times and maximizing the reuse cycle of formwork panels, thereby minimizing project delays and material costs. Key themes emerging from these questions include the integration of Computer Vision for quality control checks post-pour, the use of generative design algorithms to produce optimized formwork layouts with minimal material waste, and the application of AI-powered scheduling tools to manage the complex logistics of formwork transportation and sequencing across large construction sites. The underlying expectation is that AI will transform formwork from a passive tool into an active, data-generating asset, leading to unprecedented levels of operational precision and cost efficiency in the construction value chain.

- AI-driven optimization of formwork component design, minimizing material waste and maximizing structural integrity.

- Predictive maintenance analytics for formwork systems, extending operational lifespan and reducing unexpected failures.

- Enhanced logistics and sequencing planning using machine learning algorithms for just-in-time delivery and retrieval of panels.

- Integration of Computer Vision systems for automated quality control of concrete surface finish and dimensional accuracy.

- Optimization of concrete curing and striking times based on real-time environmental and material data.

- Autonomous robotic systems assisted by AI for precise assembly and dismantling of large formwork segments on site.

DRO & Impact Forces Of Aluminium Formwork System Market

The Aluminium Formwork Market is profoundly shaped by a combination of powerful drivers (D), persistent restraints (R), and significant opportunities (O), creating complex impact forces. Primary drivers include the global mandate for accelerated construction timelines, the growing preference for high-quality, monolithic concrete structures in seismic zones, and the sheer volume of governmental investment in affordable housing programs, particularly in Asia. These factors incentivize developers to adopt systems that guarantee speed and reliability. However, substantial restraints exist, notably the high initial capital investment required for procurement compared to conventional timber formwork, which presents a significant barrier to entry for smaller contractors. Furthermore, the successful implementation of aluminium formwork demands specialized training for labor, a scarcity in many developing markets, potentially offsetting some of the productivity gains. The system’s suitability is also constrained in non-repetitive or highly complex architectural designs, limiting its universal applicability.

Conversely, significant opportunities are emerging from the trend toward prefabrication and modular construction, where aluminium formwork serves as an essential tool for achieving factory-like precision on site. Technological advancements in lightweight, sustainable aluminum alloys and the development of integrated formwork solutions (combining heating/cooling or utility conduits) are opening new high-value application niches. The expansion of rental models and leasing services also addresses the constraint of high upfront cost, making the system more accessible to a broader contractor base. Moreover, the increasing regulatory focus on construction safety and waste reduction, particularly in developed economies, inherently favors the standardized, low-waste profile of aluminum systems, creating strong market pull. The push towards smart construction sites provides an avenue for differentiation through digital integration and data analysis.

The impact forces influencing the market are multifaceted: economic forces dictate the adoption rate based on construction project budgets and the availability of financing; technological forces drive innovation in material science and digital integration (e.g., BIM compatibility); while environmental forces push for sustainable construction, favoring reusable and recyclable materials like aluminum. Regulatory impact is critical, as mandates for industrialized building systems directly accelerate market growth. The competitive landscape is characterized by established global players and regional specialists, leading to continuous price pressure and product innovation, particularly focused on reducing the weight-to-strength ratio and enhancing the formwork's reusability cycle count. These dynamic forces collectively determine the pace and direction of market evolution.

Segmentation Analysis

The Aluminium Formwork System Market is meticulously segmented based on Type, Application, and Structure Type, reflecting the diverse requirements and use cases within the global construction industry. Segmentation by Type categorizes the market based on the specific structural elements being cast, such as beam formwork, slab formwork, and column formwork, with walls and slabs being the most dominant due to the high volume of repetitive elements in modern residential construction. Application segmentation clearly delineates the end-use sectors, with residential construction dominating due to the system's effectiveness in high-rise and mass housing projects where speed and standardization are paramount. The non-residential segment, including commercial and infrastructure projects, also contributes substantially, particularly where rapid delivery of standard structural cores is required.

The increasing sophistication of the construction industry has led to nuanced demand across these segments. For instance, in the Residential segment, the demand is shifting towards full formwork systems that can cast an entire floor plan simultaneously (monolithic pour), maximizing cycle speed. Conversely, the Infrastructure segment requires specialized aluminum formwork designed for tunnels, bridges, and other complex civil engineering structures, emphasizing high load-bearing capacity and bespoke design capabilities. Analyzing these segments provides strategic insights for manufacturers to tailor their product offerings, whether focusing on standardized, high-volume systems for the residential mass market or custom-engineered, high-precision solutions for complex non-residential projects.

- By Type: Wall Formwork, Column Formwork, Slab Formwork, Beam Formwork, Stair Formwork.

- By Application: Residential Construction (High-Rise Residential, Mass Housing), Non-Residential Construction (Commercial Buildings, Institutional Buildings, Infrastructure).

- By Structure Type: Load-Bearing Structures, Non-Load-Bearing Structures.

Value Chain Analysis For Aluminium Formwork System Market

The value chain for the Aluminium Formwork System Market begins with the upstream sourcing and processing of raw materials, primarily high-grade aluminum alloys, which necessitates high capital investment in smelting and fabrication facilities to ensure material purity and structural consistency. Key upstream activities involve specialized manufacturing processes, including extrusion, welding, and surface treatments like anodizing, critical for enhancing the durability, corrosion resistance, and reuse capability of the final formwork panels. Efficiency in this phase is determined by minimizing aluminum scrap rates and optimizing alloy composition for lightweight strength. Direct suppliers of aluminum billets and sheets hold significant leverage due to fluctuating global commodity prices, necessitating strong contractual relationships to stabilize input costs for formwork manufacturers. The integration of advanced manufacturing technologies, such as robotic welding and high-precision CNC machining, ensures the modularity and interchangeability of components, which are crucial selling points.

The middle segment of the chain is dominated by formwork system manufacturers and assemblers who design and engineer the customized or modular systems based on project specifications. This phase includes meticulous quality assurance processes, often involving testing the load-bearing capacity and dimensional accuracy of the components. Distribution channels are bifurcated into direct sales/leasing models, where large multinational companies manage their fleet and provide on-site technical supervision, and indirect channels relying on authorized distributors or dedicated rental agencies. For high-volume markets, the trend is shifting toward rental models, which lowers the financial barrier for smaller contractors and generates recurring revenue streams for manufacturers. Effective logistical planning for international shipping and managing the rotation of formwork fleets are vital components of this stage.

Downstream activities involve the crucial interaction with end-users, encompassing specialized construction contractors, real estate developers, and infrastructure bodies. This stage requires extensive technical support, installation training, and ongoing maintenance services to maximize the formwork's cycle life and operational safety. Post-project, the value chain incorporates the refurbishment, repair, and potential recycling of damaged or retired aluminum panels, leveraging the inherent recyclability of aluminum to minimize environmental impact and recover residual material value. The success of the downstream phase heavily relies on the quality of technical consulting provided by the formwork vendor, ensuring rapid learning curves for site labor and optimal scheduling for formwork stripping and reuse, thereby delivering the promised efficiency gains to the client.

Aluminium Formwork System Market Potential Customers

The primary potential customers for Aluminium Formwork Systems are large-scale real estate developers and government housing agencies focused on mass-market residential construction, particularly in rapidly urbanizing nations. These entities prioritize construction speed, consistency, and cost containment over the lifespan of multiple similar projects. Developers undertaking multi-tower residential complexes or affordable housing townships are ideal clients due to the high degree of repetition that maximizes the return on the initial investment in formwork system purchase or long-term lease. Furthermore, these large developers often have the necessary logistical and training infrastructure to efficiently manage and deploy sophisticated formwork technology, making them high-volume, repeat purchasers.

Another significant customer segment includes major infrastructure contractors specializing in civil engineering projects such as metro rail networks, large-span bridges, and utility tunnels. While requiring more bespoke solutions, these projects benefit immensely from the precision and speed of aluminum formwork for casting foundational and structural elements. Government construction departments and public works agencies, particularly those overseeing long-term public asset development, also constitute a key customer base. Their purchasing decisions are often influenced by mandates regarding building system efficiency, seismic resilience, and adherence to specific environmental standards, all areas where aluminium formwork holds a comparative advantage over traditional methods.

Lastly, specialist formwork rental and leasing companies represent a crucial indirect customer segment. These companies purchase large fleets of standardized aluminum formwork systems and subsequently rent them out to smaller and medium-sized contractors (SMEs) who cannot justify the high upfront capital expenditure of outright purchase. This model democratizes access to the technology, thereby expanding the overall market reach. For these rental companies, durability, standardization, and ease of refurbishment are the key purchasing criteria, ensuring a rapid and reliable turnover rate for their assets across various construction sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Doka GmbH, Peri GmbH, Alumax Formwork, U-Form, MFE Formwork Technology Sdn Bhd, RMD Kwikform, Ulma Construction, Mascon Formwork, Titan Formwork Systems, Zhejiang Luying Formwork, Jiangsu Hanjin Construction Technology, China Shaanxi Construction Engineering, Interserve Construction, Formwork Direct, Jiji Formwork, GCS Formwork, EFCO Corp, Acrow Corp, Paschal Formwork, E-Formwork. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Formwork System Market Key Technology Landscape

The technological landscape of the Aluminium Formwork System Market is characterized by continuous innovation focused on improving reusability, minimizing weight, and enhancing system integration with digital construction methodologies. Core technological advancements center on the metallurgical composition of aluminum alloys used. Manufacturers are increasingly utilizing higher strength-to-weight ratio alloys (e.g., specific grades of 6061 and 6082 aluminum) which allow for lighter panels capable of withstanding higher concrete pressures, thus increasing safety and reducing manual handling effort on site. Surface treatment technologies, such as advanced powder coating and specific anodization processes, are crucial for extending the lifespan of the panels by resisting abrasion and chemical erosion from concrete mixes, thereby maximizing the number of reuse cycles, often targeting 300 cycles or more for competitive advantage.

Digitalization represents another critical technological vector. Building Information Modeling (BIM) compatibility is now a prerequisite for leading formwork suppliers. BIM integration enables precise 3D modeling of the formwork layout, clash detection with reinforcement steel or mechanical, electrical, and plumbing (MEP) services, and automated generation of component lists and assembly sequences. This shift from 2D planning to 3D/4D digital simulation drastically reduces on-site errors and improves coordination between the formwork installation team and other trades. Furthermore, the incorporation of Internet of Things (IoT) sensors, sometimes embedded within the panels, is being explored to monitor real-time parameters such as temperature, pressure, and concrete setting status, feeding crucial data back to project managers for optimized scheduling of formwork stripping and turnaround.

A key disruptive technology trend involves the modularization and standardization of formwork components, moving away from fully bespoke systems to standardized panels that can be rapidly reconfigured across different projects. This modular approach significantly lowers the inventory requirements for developers and simplifies the training process for site workers. Innovations in locking mechanisms and tying systems are aimed at reducing assembly time—moving from traditional tie-rod systems to quicker, more intuitive clamping or pin-and-wedge solutions that can be operated by unskilled labor with minimal supervision. Furthermore, research is focused on developing formwork systems that can integrate seamlessly with climbing or self-climbing mechanisms for ultra-high-rise construction, ensuring worker safety and continuity of the construction process across multiple floors.

Regional Highlights

The global Aluminium Formwork System Market exhibits significant regional variations in adoption rates and market drivers, largely correlating with local construction standards, labor costs, and government housing policies. While North America and Europe prioritize the system for its precision and labor efficiency in complex, high-value projects and reconstruction, the most aggressive growth is concentrated in the high-density construction environments of Asia Pacific and the Middle East.

- Asia Pacific (APAC): Dominates the market share due to unparalleled growth in infrastructure and residential construction, particularly in China, India, and Southeast Asian countries. Government mandates promoting industrialized building systems (IBS) and affordable mass housing schemes heavily favor aluminum formwork for its speed and reusability.

- Middle East and Africa (MEA): Expected to experience substantial growth driven by mega-construction projects, especially in Saudi Arabia and the UAE (Vision 2030 initiatives). The harsh environmental conditions and tight delivery schedules necessitate high-durability, rapid-cycle systems like aluminum formwork.

- Europe: Characterized by stable, moderate growth, focusing on high-quality construction, labor cost optimization, and adherence to strict sustainability regulations. The market sees high adoption of rental models and specialized formwork for renovation and complex architectural forms.

- North America: Adoption is driven by the need for high-efficiency systems to counteract high skilled labor costs. Market penetration is strong in multi-family residential units and commercial high-rises, emphasizing safety features and rapid cycle times.

- Latin America: Growing steadily, supported by investment in basic infrastructure and residential development in economies like Brazil and Mexico. The market is highly price-sensitive, making the longevity and low lifetime cost of aluminum formwork increasingly attractive.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Formwork System Market.- Doka GmbH

- Peri GmbH

- Alumax Formwork

- U-Form

- MFE Formwork Technology Sdn Bhd

- RMD Kwikform

- Ulma Construction

- Mascon Formwork

- Titan Formwork Systems

- Zhejiang Luying Formwork

- Jiangsu Hanjin Construction Technology

- China Shaanxi Construction Engineering

- Interserve Construction

- Formwork Direct

- Jiji Formwork

- GCS Formwork

- EFCO Corp

- Acrow Corp

- Paschal Formwork

- E-Formwork

Frequently Asked Questions

Analyze common user questions about the Aluminium Formwork System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Aluminium Formwork System Market?

The primary factor driving market growth is the accelerated global demand for high-speed, high-quality, and standardized construction, especially for high-rise residential buildings and affordable mass housing schemes where the system's repeatability significantly reduces construction timelines and long-term costs.

How does the initial high cost of aluminum formwork compare to traditional timber systems?

While the initial capital investment for aluminium formwork is substantially higher than timber systems, its cost-effectiveness becomes apparent over the project lifecycle due to its high reusability (often over 250 cycles), minimal maintenance needs, reduced labor requirements, and elimination of post-pour finishing work (plastering).

Which application segment holds the largest share in the Aluminium Formwork Market?

The Residential Construction segment, particularly within high-rise and mass housing applications, holds the largest market share. This dominance is attributed to the inherent design repetition in residential structures, which maximizes the efficiency, speed, and standardization benefits offered by aluminum formwork systems.

What role does BIM play in the adoption of modern formwork systems?

Building Information Modeling (BIM) is crucial for the efficient deployment of modern formwork systems. BIM enables precise digital pre-planning, clash detection, accurate quantification of components, and optimized assembly sequencing, drastically reducing on-site errors and streamlining the entire construction process.

Are aluminium formwork systems suitable for all types of construction projects?

Aluminium formwork systems are highly suitable for projects requiring repetitive structures and standardized floor plans. They are less economically viable for projects involving unique, complex, or highly irregular architectural designs, where the high customization cost outweighs the benefits of speed and reuse.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager