Aluminium Lithium Alloys Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441272 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Aluminium Lithium Alloys Market Size

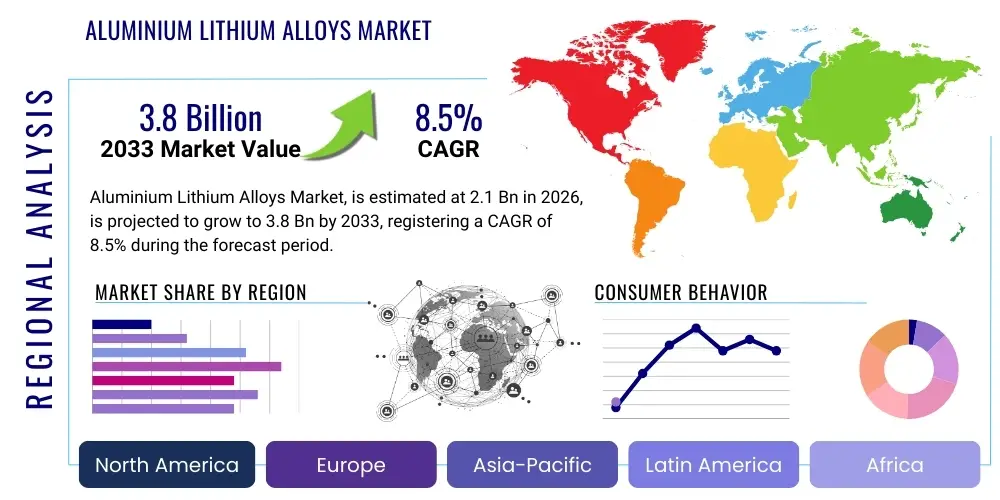

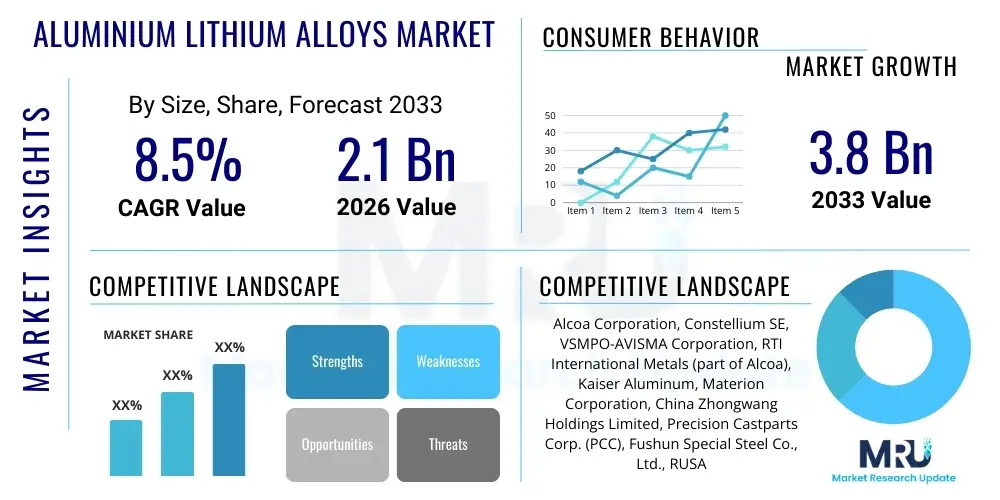

The Aluminium Lithium Alloys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Aluminium Lithium Alloys Market introduction

Aluminium-Lithium (Al-Li) alloys represent a critical class of structural materials highly valued across aerospace, defense, and high-performance automotive sectors due to their exceptional combination of low density, high stiffness, superior strength, and enhanced fatigue resistance. The primary product description encompasses alloys designed to incorporate 1% to 3% Lithium, resulting in materials that offer a 3% reduction in density and a 6% increase in elastic modulus for every weight percent of Lithium added. These alloys are specifically engineered to replace conventional aluminum alloys (like 7000 and 2000 series) in weight-critical applications, delivering significant operational efficiency gains, particularly through reduced fuel consumption in aviation. The metallurgical processes involved, such as controlled solidification and specialized heat treatments, are complex, ensuring the formation of stable precipitates that contribute to the material's superior properties.

Major applications of Aluminium Lithium alloys are predominantly centered within the aerospace industry, including structural components for commercial aircraft fuselages, wings, and empennage, as well as critical parts in space launch vehicles and military aircraft. Beyond aerospace, the alloys find use in high-speed trains, specialized sporting goods, and pressure vessels where weight savings without compromising structural integrity are paramount. The inherent benefits of utilizing Al-Li alloys include significant weight reduction, typically ranging from 10% to 15% compared to existing aluminum structures, improved corrosion resistance, and excellent damage tolerance. This material substitution directly translates into enhanced payload capacity and extended operational range for aircraft, offering a compelling return on investment for end-users facing stringent performance and emission targets.

The market is primarily driven by the escalating demand for fuel-efficient aircraft programs globally, necessitating materials with high strength-to-weight ratios. Furthermore, the increasing complexity of military platforms and the renewed focus on space exploration and satellite deployment fuel the adoption of these advanced materials. Technological advancements in alloy manufacturing, particularly in the fields of powder metallurgy and friction stir welding specifically adapted for Al-Li alloys, are making production more cost-effective and scalable. Government regulations emphasizing reduced carbon footprints in air travel also serve as a strong catalyst, pushing original equipment manufacturers (OEMs) towards lighter, more advanced material solutions like Al-Li alloys.

Aluminium Lithium Alloys Market Executive Summary

The Aluminium Lithium Alloys market is experiencing robust expansion fueled by critical business trends centered around material substitution and supply chain optimization within the aerospace and defense sectors. Key business trends include the move towards strategic, long-term sourcing contracts between major alloy producers and Tier 1 aerospace suppliers, mitigating supply volatility associated with specialized raw materials like lithium. Furthermore, the market sees significant investment in additive manufacturing technologies utilizing Al-Li powders, promising localized production capabilities and complex geometric component fabrication, bypassing traditional forging and rolling constraints. Sustained high order backlogs for commercial aircraft platforms, coupled with modernization initiatives in defense spending across North America and Asia Pacific, ensure consistent demand growth for lightweight, high-performance materials.

Regional trends indicate that North America and Europe currently dominate the market share, driven by the presence of major aircraft OEMs (Boeing, Airbus) and established defense contractors demanding stringent material specifications. However, the Asia Pacific region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is primarily attributed to rapid infrastructural development in the Chinese and Indian aerospace sectors, increased defense procurement budgets, and rising demand for domestically produced commercial aircraft components. Within these regions, there is an observable trend towards establishing local production facilities for Al-Li alloys to reduce reliance on Western suppliers and address logistics challenges associated with sensitive alloy transport.

Segment trends highlight the 3rd Generation Al-Li alloys (such as AA 2099 and AA 2195) maintaining dominance, particularly in fuselage and wing structures due to their superior combination of strength and fracture toughness. By application, the aerospace segment remains the undisputed leader, though niche growth is observed in the space and high-performance automotive segments, focusing on battery enclosures and chassis components for electric vehicles where mass reduction is critical for range extension. Processing method trends show increasing adoption of plate and sheet forms, although extrusion and forging segments are also growing steadily, adapting to meet specific component requirements for landing gear supports and bulkheads. The sustained emphasis on developing alloys with superior weldability continues to shape product development within the market.

AI Impact Analysis on Aluminium Lithium Alloys Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Aluminium Lithium Alloys market frequently revolve around how AI can optimize the extremely complex and sensitive manufacturing processes, predict material failures, and accelerate the discovery of novel alloy compositions. Users are concerned about the implementation costs versus the tangible benefits in quality control, specifically questioning if AI can consistently ensure the homogeneity and microstructural integrity required for aerospace certification, which traditional methods struggle with. Key themes include predictive maintenance for specialized rolling mills, algorithmic optimization of heat treatment cycles (which significantly dictates alloy performance), and the use of machine learning to analyze vast datasets generated during casting and fabrication to preemptively identify defects.

AI's primary influence will be in dramatically enhancing material development and production efficiency. Machine learning algorithms are already being utilized to screen thousands of potential alloy combinations in silico, significantly reducing the time and cost associated with traditional trial-and-error experimentation for new Al-Li alloy formulations that target specific property profiles (e.g., higher fatigue life or superior elevated temperature performance). Furthermore, in the manufacturing phase, AI-powered computer vision systems are deployed for real-time quality control during rolling and extrusion processes, detecting minute surface or subsurface anomalies that are critical in flight safety components, thereby reducing scrap rates and ensuring materials meet the demanding specifications required by certification bodies like the FAA and EASA.

The integration of AI also extends deeply into supply chain management and inventory optimization for the expensive raw materials (Lithium, Zirconium, Copper). Predictive modeling helps manufacturers forecast demand fluctuations and manage optimal buffer stocks, preventing material shortages or overstocking. Moreover, Generative Design powered by AI assists engineers in designing complex, lightweight structural components that maximize the performance benefits of Al-Li alloys while adhering to manufacturing constraints, pushing the boundaries of what is structurally achievable in aerospace design. This holistic application of AI, from inception to end-use, transforms the market landscape by improving material consistency and accelerating innovation cycles.

- AI optimizes complex heat treatment parameters, enhancing microstructural consistency and predictable mechanical properties.

- Machine learning accelerates the discovery of new, higher-performance Al-Li alloy compositions, reducing R&D cycles.

- Predictive maintenance algorithms minimize downtime for specialized manufacturing equipment, ensuring high utilization rates.

- AI-driven computer vision systems provide real-time, highly accurate defect detection during casting and fabrication processes.

- Generative design tools leverage Al-Li properties to create ultra-lightweight, topologically optimized structural components.

- Supply chain AI models improve inventory management and risk assessment for expensive and strategically vital raw materials.

DRO & Impact Forces Of Aluminium Lithium Alloys Market

The Aluminium Lithium Alloys market is fundamentally shaped by a dynamic interplay of potent drivers, restrictive cost hurdles, significant technological opportunities, and intense impact forces stemming primarily from regulatory demands and material competition. The primary driver remains the overwhelming global imperative for weight reduction in aerospace to meet stringent fuel efficiency targets and reduce carbon emissions. Conversely, the market faces a significant restraint in the exceptionally high cost associated with both the raw material (lithium, which is highly reactive and requires specialized handling) and the complex, capital-intensive manufacturing processes necessary to produce certified aerospace-grade material. Opportunities lie in expanding applications beyond traditional fixed-wing aircraft into emerging defense platforms, advanced automotive structures (EV battery protection), and the rapidly growing commercial space sector, demanding next-generation light alloys.

The impact forces exerted on the market are high, dominated by competition from advanced composites and other high-strength metals. While composites offer significant weight savings, Al-Li alloys retain an advantage in specific structural integrity, repairability, and operational environment performance, forcing continuous innovation in alloy development to maintain competitive superiority. Regulatory impact forces, particularly aerospace certification standards (e.g., AS9100, NADCAP), are exceptionally stringent, requiring extensive testing and traceability, which acts as a barrier to entry but ensures high material quality and reliability, impacting market structure. Furthermore, geopolitical stability affects the sourcing of lithium, an essential impact force that necessitates diversified supply strategies and technological advancements to utilize lower-grade lithium sources effectively.

Key drivers include substantial investment in R&D by major producers to enhance mechanical properties, such as ductility and weldability, and reduce production costs, making Al-Li alloys more competitive against alternatives like carbon fiber reinforced polymers (CFRPs). However, a persistent restraint is the susceptibility of some early-generation Al-Li alloys to anisotropic properties, where mechanical performance varies significantly depending on the direction of stress relative to the grain structure, requiring precise material placement in structural design. The major opportunity remains in developing fourth-generation alloys that integrate superior strength and damage tolerance with greater processing flexibility, potentially utilizing advanced techniques like rapid solidification to achieve novel microstructures. The collective impact forces push the industry toward greater vertical integration and strategic partnerships to control cost, quality, and supply chain reliability.

Segmentation Analysis

The Aluminium Lithium Alloys market segmentation provides a granular view of demand dynamics across various product forms, alloy generations, applications, and end-use industries. Product form segmentation is crucial as the application dictates the required format, with sheet and plate forms dominating for structural body applications, while forgings and extrusions are essential for high-stress components. This distinction is vital for manufacturers to tailor their production capabilities and focus on specific processing lines. The underlying principle governing market segmentation is the varying performance requirement of the end-user, wherein high-stress aerospace applications demand the sophisticated 3rd generation alloys, while less critical or earlier aerospace components might still utilize the established 2nd generation variants.

Segmentation by alloy generation reflects the continuous technological advancements in metallurgy. The evolution from 1st generation (which faced ductility challenges) to 3rd generation alloys (offering superior strength-to-weight ratio and improved fracture toughness) dictates pricing and suitability for modern programs. The key to capturing market share within these segments is the capability to reliably produce these advanced alloys in large volumes while maintaining aerospace certification standards. Furthermore, the segmentation by end-use application—Aerospace (Commercial, Military, Space), Defense, and Others (Automotive, Marine)—shows highly differentiated purchasing power and quality demands. Aerospace, being the largest consumer, sets the strictest standards and drives innovation in specific alloy properties.

Geographically, the segmentation allows companies to target investment in manufacturing and distribution based on regional aerospace manufacturing hubs and defense spending profiles. The growing prominence of the Asia Pacific segment, particularly China and India, represents a significant shift from the traditional dominance of North America and Europe. Understanding the application segmentation within these regions—for instance, China’s focus on commercial domestic aircraft production versus the U.S. focus on advanced military platforms—is critical for tailored market strategies. This detailed segmentation analysis enables stakeholders to identify high-growth segments and potential niche markets, such as the increasing use of Al-Li alloys in cryogenic fuel tanks for rockets.

- By Product Form

- Plate and Sheet

- Forgings

- Extrusions

- Others (Powders, Ingots)

- By Alloy Generation

- 1st Generation Alloys (e.g., 8090, 2090)

- 2nd Generation Alloys (e.g., 2091)

- 3rd Generation Alloys (e.g., 2099, 2195, 2198)

- 4th Generation Alloys (Under Development)

- By Application

- Fuselage Structures

- Wing Structures

- Empennage

- Fuel Tanks and Pressure Vessels

- Others (Landing Gear Components, Bulkheads)

- By End-Use Industry

- Aerospace (Commercial Aviation, Military Aircraft, Space Systems)

- Defense

- Automotive (High-Performance/Electric Vehicles)

- Marine

Value Chain Analysis For Aluminium Lithium Alloys Market

The Value Chain for the Aluminium Lithium Alloys market begins with the highly specialized Upstream Analysis, focusing on the sourcing and preparation of essential raw materials: high-purity Aluminum and Lithium. Lithium sourcing is critical and often geographically concentrated, requiring stringent supply chain management and geopolitical risk assessment. The upstream phase involves the complex process of master alloy production, where high-purity lithium is incorporated into the aluminum matrix under carefully controlled, inert atmospheres to prevent oxidation and ensure precise compositional control. This stage requires significant capital investment in specialized melting and casting equipment and is highly concentrated among a few major global specialty metal producers.

The midstream section encompasses the primary manufacturing processes, including ingot casting, homogenization, and subsequent conversion into various product forms like sheets, plates, forgings, and extrusions. This phase is dominated by advanced metallurgical firms possessing the required expertise in large-scale rolling and forging of Al-Li alloys, which are notoriously difficult to process due to their specific microstructural sensitivity. Distribution channels for these specialized materials are typically direct, involving long-term supply agreements with Tier 1 aerospace suppliers (e.g., Spirit AeroSystems, Premium Aerotec) or directly with major Original Equipment Manufacturers (OEMs) like Boeing and Airbus. Indirect distribution is minimal, typically only involving smaller batches sold through specialized metal distributors for niche, non-aerospace applications.

Downstream analysis centers on the fabrication and assembly of the final components by the end-users. Tier 1 and 2 suppliers machine, assemble, and join the Al-Li components (often utilizing specialized techniques like friction stir welding) before delivery to the OEMs for final aircraft or space vehicle assembly. The key value addition in this phase lies in advanced joining techniques and non-destructive testing (NDT) to ensure structural integrity. Since the material cost is substantial, the efficiency of fabrication and waste minimization is crucial. The direct customer relationship dominates, characterized by rigorous qualification protocols and years-long supplier approval processes, establishing high barriers to entry for new market participants and reinforcing the vertical integration tendencies observed in the industry.

Aluminium Lithium Alloys Market Potential Customers

Potential customers for Aluminium Lithium Alloys are primarily concentrated within the global aerospace and defense ecosystem, driven by the mandate to reduce structural weight for enhanced performance and fuel economy. The largest segment of customers includes major commercial aircraft Original Equipment Manufacturers (OEMs) such as Boeing, Airbus, COMAC, and Embraer, which utilize thousands of metric tons of these alloys for large structural applications like lower wing skins, fuselage structures, and floor beams in their latest generation programs (e.g., Boeing 777X, Airbus A350). These customers prioritize reliability, consistent quality, and supply continuity over short-term price fluctuations, often entering into decade-long sourcing contracts.

The second critical customer base comprises defense contractors and military aircraft manufacturers (e.g., Lockheed Martin, Northrop Grumman, BAE Systems). These customers utilize Al-Li alloys in high-performance fighter jets, cargo planes, and rotorcraft where performance characteristics like damage tolerance, ballistic resistance, and high-temperature stability are essential. For defense applications, the focus shifts slightly towards specialized, higher-strength alloys used in highly stressed areas. Additionally, government space agencies and commercial spaceflight companies (e.g., NASA, SpaceX, Blue Origin) are rapidly becoming high-value customers, requiring Al-Li alloys for cryogenic fuel tanks and lightweight structural elements in rockets and satellite structures, capitalizing on the alloy’s excellent performance at low temperatures.

Beyond the core aerospace and defense sectors, emerging potential customers include high-end automotive manufacturers, particularly those specializing in advanced Electric Vehicles (EVs) and high-performance racing vehicles. While the volume demand is lower than aerospace, these customers seek Al-Li alloys for battery structural components and lightweight chassis parts to maximize energy efficiency and range, tolerating the higher material cost due to the performance benefits. Specialized industrial equipment manufacturers requiring high-strength, lightweight components (e.g., robotics, high-speed machinery) also represent a growing, albeit smaller, segment of potential buyers seeking material properties that conventional aluminum cannot provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcoa Corporation, Constellium SE, VSMPO-AVISMA Corporation, RTI International Metals (part of Alcoa), Kaiser Aluminum, Materion Corporation, China Zhongwang Holdings Limited, Precision Castparts Corp. (PCC), Fushun Special Steel Co., Ltd., RUSAL, Nippon Steel Corporation, Allegheny Technologies Incorporated (ATI), ThyssenKrupp AG, Garmat Machining, LLC, Hydro Aluminium, Eramet Group, Sumitomo Metal Industries, Southwest Aluminum (Group) Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Lithium Alloys Market Key Technology Landscape

The technology landscape for Aluminium Lithium Alloys is defined by advancements aimed at overcoming the material’s inherent processing difficulties, primarily reactivity and anisotropy, while maximizing mechanical performance. A key technology is the development and optimization of specialized Melting and Casting Techniques. Since Lithium is highly reactive with air and moisture, the entire casting process must occur under controlled, inert atmospheres (e.g., argon gas shielding) and utilize vacuum induction melting (VIM) or vacuum arc remelting (VAR) to ensure the master alloy is homogenous and free of detrimental inclusions or oxides, which would severely compromise the fatigue life of the final product. Continuous R&D focuses on refining the rapid solidification technology to achieve finer grain structures, thereby improving strength and ductility simultaneously.

Advanced Forming and Heat Treatment technologies are crucial for dictating the final properties of Al-Li products. Specialized hot and cold rolling processes, often tailored to the specific alloy composition (e.g., AA 2198), are implemented to control grain structure and texture, mitigating anisotropy effects which were prominent in first-generation alloys. Furthermore, the precipitation hardening heat treatment (aging) is highly sensitive and complex. Modern technological approaches utilize sophisticated modeling and control systems, sometimes leveraging AI, to precisely manage temperature profiles and duration, ensuring optimal formation of the strengthening T1 (Al2CuLi) and delta prime (Al3Li) precipitates. This meticulous control is essential for achieving the required strength, toughness, and stress corrosion resistance demanded by aerospace standards.

The third major technological focus involves Advanced Joining Methods, necessitated by the poor weldability of conventional high-strength aluminum alloys. Friction Stir Welding (FSW) has emerged as the definitive joining technology for large Al-Li structures, particularly in fuselage panels and fuel tanks, as it operates below the melting point, preserving the alloy's critical heat-treated microstructure and minimizing weld defects. Research is also heavily invested in Additive Manufacturing (AM) using Al-Li alloy powders. Technologies such as Laser Powder Bed Fusion (LPBF) and Electron Beam Powder Bed Fusion (EBPBF) are being refined to produce complex, near-net-shape components, reducing material waste and enabling the fabrication of geometries previously impossible with traditional methods, significantly impacting prototyping and low-volume, high-value component production.

Regional Highlights

North America maintains its position as the dominant region in the Aluminium Lithium Alloys Market, driven by the presence of the world's largest aerospace and defense industrial base, including Boeing, Lockheed Martin, and numerous specialized component manufacturers. The region benefits from substantial, consistent defense procurement budgets and ongoing commercial aircraft programs (like the 777X and various military modernization efforts) that mandate the use of lightweight advanced materials to comply with fuel efficiency standards. Furthermore, extensive R&D collaboration between government entities (e.g., NASA, DoD), universities, and corporate research centers ensures technological leadership in 3rd and 4th generation alloy development, reinforcing high domestic consumption and export capabilities.

Europe is the second-largest market, primarily anchored by the substantial manufacturing footprint of Airbus and its extensive supply chain across France, Germany, and the UK. European demand is heavily focused on commercial aviation applications, where Al-Li alloys are crucial in the A350 and A380 programs, supporting the region's commitment to reducing aviation environmental impact. Regulatory frameworks like the EU's Clean Aviation Joint Undertaking further stimulate the adoption of high-performance materials. However, Europe also faces intense competition from composite materials; thus, regional alloy manufacturers focus heavily on materials that offer hybrid advantages, such as superior fire resistance and simpler repair protocols compared to CFRPs.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment. This accelerated growth is attributed to rapid expansion in commercial aircraft manufacturing in China (COMAC C919 program), growing domestic defense self-reliance, and significant capital investment in developing indigenous aerospace capabilities in countries like India and Japan. As these nations modernize their fleets and invest in domestic production, the demand for high-strength, lightweight materials like Al-Li alloys surges. While local production capability for high-grade Al-Li alloys is still maturing compared to Western counterparts, strategic international partnerships and joint ventures are accelerating technology transfer and local manufacturing capacity build-up to service the expanding regional market needs efficiently.

- North America: Market leader due to large defense spending, presence of key OEMs (Boeing, Lockheed), and mature R&D infrastructure driving 4th generation alloy innovation.

- Europe: Strong consumption driven by Airbus programs (A350), stringent environmental regulations, and established Tier 1 supplier network focusing on commercial aviation structures.

- Asia Pacific (APAC): Highest projected CAGR, fueled by China's indigenous C919 program, military modernization in India and Japan, and increasing regional self-sufficiency in aerospace manufacturing.

- Latin America: Emerging market with localized demand primarily driven by maintenance, repair, and overhaul (MRO) activities and smaller scale defense modernization programs.

- Middle East and Africa (MEA): Growth tied to strategic defense acquisitions and substantial commercial fleet expansion by major regional airlines, relying heavily on imports from Europe and North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Lithium Alloys Market.- Alcoa Corporation

- Constellium SE

- VSMPO-AVISMA Corporation

- RTI International Metals (part of Alcoa)

- Kaiser Aluminum

- Materion Corporation

- China Zhongwang Holdings Limited

- Precision Castparts Corp. (PCC)

- Fushun Special Steel Co., Ltd.

- RUSAL

- Nippon Steel Corporation

- Allegheny Technologies Incorporated (ATI)

- ThyssenKrupp AG

- Garmat Machining, LLC

- Hydro Aluminium

- Eramet Group

- Sumitomo Metal Industries

- Southwest Aluminum (Group) Co., Ltd.

- Universal Alloy Corporation (UAC)

- Midas Aluminum Inc.

Frequently Asked Questions

Analyze common user questions about the Aluminium Lithium Alloys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Aluminium Lithium Alloys market?

The primary driving factor is the global aerospace industry's intense demand for lightweight materials to achieve significant fuel efficiency improvements, reduce operational costs, and meet increasingly stringent environmental regulations concerning carbon emissions and noise reduction, particularly in new generation commercial aircraft programs.

How do Aluminium Lithium alloys compare against Carbon Fiber Reinforced Polymers (CFRPs) in aerospace applications?

Al-Li alloys generally offer superior repairability, better electrical conductivity (crucial for lightning strike protection), predictable damage tolerance, and lower material cost than CFRPs. While CFRPs often provide higher specific strength, Al-Li alloys are preferred in structures requiring high stiffness, excellent compression strength, and where metallic conductivity is essential.

Which generation of Aluminium Lithium alloys currently dominates the market?

The 3rd Generation alloys, such as AA 2099, 2195, and 2198, dominate the current market. These alloys successfully overcome the ductility and fracture toughness issues of earlier generations, offering the optimal balance of low density, high strength, and superior damage tolerance required for modern aerospace certifications.

What are the main technical challenges in manufacturing and processing Aluminium Lithium alloys?

Key technical challenges include the extremely high reactivity of lithium during melting and casting, requiring inert gas environments; the susceptibility of the material to microstructural anisotropy during rolling; and the difficulty in achieving reliable welds using conventional techniques, necessitating advanced methods like Friction Stir Welding (FSW).

Beyond aerospace, what emerging sectors are adopting Aluminium Lithium alloys?

The most promising emerging sector is the advanced automotive industry, specifically Electric Vehicles (EVs), where Al-Li alloys are being investigated for use in lightweight battery enclosures and structural elements to maximize vehicle range and energy efficiency. The space sector (cryogenic tanks, launch vehicle structures) is also a high-growth adopter.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager