Aluminum Cladding Panel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443102 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Aluminum Cladding Panel Market Size

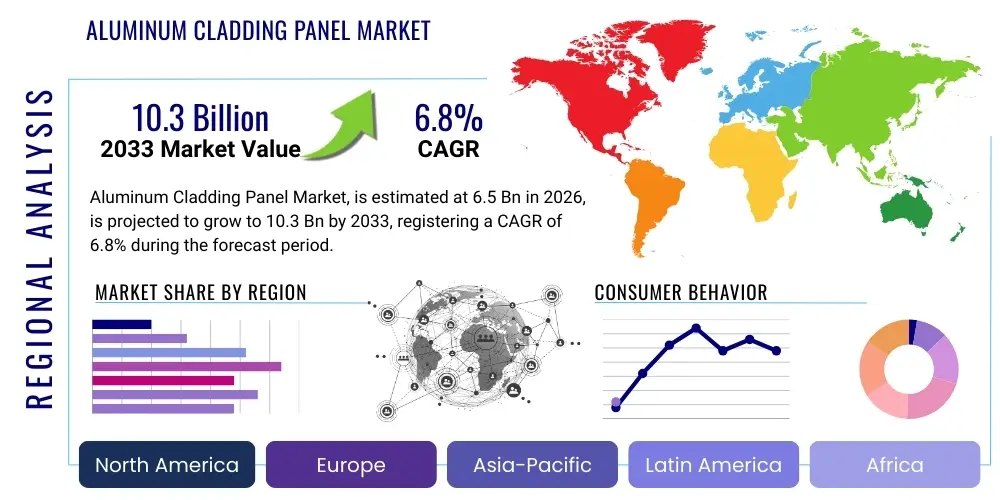

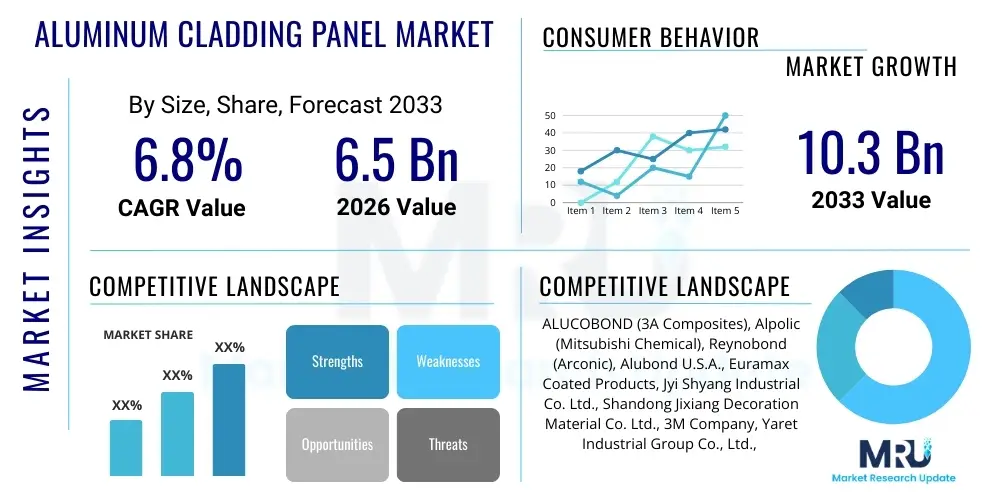

The Aluminum Cladding Panel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Aluminum Cladding Panel Market introduction

Aluminum Cladding Panels (ACPs) constitute essential components in modern architectural design, primarily used for exterior façades, interior walls, and signage. These engineered materials, often comprising two thin aluminum sheets bonded to a non-aluminum core (such as polyethylene or mineral-filled fire-retardant material), are highly valued for their exceptional balance of aesthetic flexibility, structural rigidity, and lightweight nature. The product's versatility allows for complex curves and designs, making it indispensable in high-end commercial and residential construction projects globally.

Major applications of aluminum cladding panels span across diverse sectors, including commercial buildings (office towers, retail centers), public infrastructure (airports, hospitals), and high-density residential complexes. The inherent durability and resistance to harsh weather conditions, corrosion, and UV radiation make ACPs a cost-effective long-term solution for building envelopes. Furthermore, their superior surface finish capabilities, facilitated by coatings like Polyvinylidene Fluoride (PVDF) and Polyester (PE), ensure color retention and minimal maintenance over decades, contributing significantly to a building’s lifecycle value.

The market is predominantly driven by accelerated urbanization, particularly in emerging economies, coupled with stringent building regulations promoting energy efficiency and sustainable construction practices. The need for materials that comply with contemporary architectural standards for both aesthetics and thermal performance fuels demand. Benefits such as ease of installation, recyclability, and broad customization options solidify the Aluminum Cladding Panel Market's crucial role within the global construction industry, despite ongoing regulatory pressures concerning core material flammability.

Aluminum Cladding Panel Market Executive Summary

The Aluminum Cladding Panel Market is characterized by robust growth, driven primarily by the escalating pace of commercial infrastructure development and the increasing adoption of lightweight, durable, and aesthetically appealing materials in the building sector. Key business trends indicate a significant shift towards panels incorporating fire-retardant (FR) mineral cores, necessitated by heightened global scrutiny following several high-profile building fires. Manufacturers are heavily investing in R&D to enhance product safety standards while maintaining the cost-effectiveness and design flexibility that aluminum composite materials offer.

Regionally, the Asia Pacific (APAC) stands as the dominant force in terms of market share and anticipated growth rate, attributed to massive governmental investments in smart city projects, rapid industrialization, and high-volume residential construction in countries like China, India, and Southeast Asia. North America and Europe, while mature, exhibit steady demand driven largely by renovation projects, retrofitting of older structures to improve energy efficiency, and compliance with updated green building codes. Regulatory harmonization across various global markets regarding material safety is a defining trend influencing global sourcing and trade dynamics.

Segment trends reveal that the Aluminum Composite Material (ACM) segment, owing to its versatility and comparatively lower cost, maintains the largest volume share. However, the use of solid aluminum panels is gaining traction in projects prioritizing absolute fire safety and premium, monolithic aesthetics. Application-wise, the commercial segment (including corporate headquarters and retail spaces) represents the highest consumption due to the inherent demand for brand-defining, visually striking façades. The market is increasingly competitive, prompting strategic mergers, acquisitions, and collaborations focused on expanding geographical reach and securing raw material supply chains.

AI Impact Analysis on Aluminum Cladding Panel Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Aluminum Cladding Panel market frequently center on three critical areas: optimized manufacturing, advanced quality assurance, and AI-assisted architectural design. Users are keen to understand how AI can minimize material waste, improve the precision of complex panel fabrication, and enhance quality control systems to detect minute defects in coatings or bonding layers. Furthermore, architects and developers express expectations for generative design tools powered by AI to rapidly prototype cladding patterns, test structural feasibility, and simulate thermal performance, thereby streamlining the design-to-production workflow significantly.

The primary themes emerging from these analyses emphasize efficiency and customization. AI integration is expected to revolutionize panel production by allowing for dynamic adjustments in cutting and bending processes, reducing cycle times, and optimizing sheet utilization—a critical factor given the high cost of aluminum. Concerns primarily revolve around the initial capital investment required for implementing AI-driven manufacturing execution systems (MES) and the need for a skilled workforce capable of managing and interpreting complex data generated by machine learning algorithms applied to production lines. The overarching expectation is that AI will drive down the effective cost of specialized, highly customized cladding solutions, democratizing complex architectural design.

Ultimately, AI promises to transform the entire product lifecycle, from predicting optimal raw material purchasing schedules based on global commodity fluctuations to leveraging drone-based inspection systems equipped with computer vision for post-installation quality checks and predictive maintenance. This shift toward intelligent manufacturing and deployment ensures higher quality standards, faster turnaround times for bespoke orders, and improved compliance tracking against ever-evolving international building safety standards, making AI a significant competitive differentiator.

- AI-driven optimization of manufacturing processes, including automated cutting path generation, reducing material scrap rates by 15-20%.

- Predictive maintenance analytics applied to production machinery, minimizing downtime and increasing overall equipment effectiveness (OEE).

- Computer vision systems utilizing AI for real-time defect detection in panel coatings, ensuring uniformity and adherence to aesthetic specifications.

- Generative design tools assisting architects in creating structurally sound and thermally efficient cladding systems based on project parameters and climate data.

- Supply chain risk management enabled by AI algorithms forecasting volatility in aluminum prices and suggesting optimal inventory levels.

DRO & Impact Forces Of Aluminum Cladding Panel Market

The Aluminum Cladding Panel Market is influenced by a dynamic interplay of growth drivers, structural restraints, and emerging opportunities, all impacting market trajectory and competitive intensity. Primary growth drivers stem from the global boom in infrastructure and commercial real estate development, particularly the demand for sustainable and aesthetically versatile external finishes. Architects increasingly favor aluminum due to its lightweight properties, high rigidity, and capacity for advanced coating systems that resist environmental degradation. The increasing focus on renovating and modernizing existing commercial buildings to meet modern energy efficiency standards further accelerates market penetration, especially in developed economies.

However, the market faces significant structural restraints, most notably the high volatility and upward pressure on the price of primary aluminum and core materials such as polyethylene (PE). Additionally, the regulatory landscape has become intensely scrutinized following catastrophic fire incidents associated with non-fire-retardant PE-core panels. This has led to strict bans or mandatory transitions to expensive mineral-filled (FR) cores in many jurisdictions, increasing manufacturing complexity and product cost, thereby challenging mass-market adoption. Concerns over product substitution by competing materials like high-pressure laminates (HPL) or fiber cement panels also exert restraint.

Opportunities for market expansion are centered around the rapid proliferation of green building certifications, which favor recyclable and low-maintenance materials like aluminum. Manufacturers focused on developing advanced non-combustible (A2 grade) core technology and integrating Building Integrated Photovoltaics (BIPV) into cladding systems stand to gain significant competitive advantage. The increasing adoption of prefabricated and modular construction techniques globally provides a fertile ground for standardized yet customizable aluminum panel solutions. The cumulative impact of these forces suggests a market leaning towards high-specification, safety-compliant, and value-added products, despite commodity price pressures.

Segmentation Analysis

The Aluminum Cladding Panel Market is meticulously segmented based on product type, core material, coating type, and application, reflecting the diverse requirements of the construction industry. Understanding these segmentations is crucial for manufacturers to tailor their product offerings and marketing strategies effectively. The segmentation by product type typically divides the market into Aluminum Composite Materials (ACM/ACP) and Solid Aluminum Panels (SAP). ACMs, being the more dominant category, are preferred for their cost-effectiveness and flexibility, while SAPs are chosen for superior fire performance and premium architectural projects where a monolithic appearance is required.

The crucial segmentation by core material reflects the regulatory environment, separating panels into Polyethylene (PE) Core, Fire-Retardant (FR) Core, and Non-Combustible (A2) Core. The increasing global adoption of A2 core panels, which offer the highest level of fire safety, is the fastest-growing sub-segment, directly influenced by stringent building codes across Europe and North America. Coating type segmentation focuses on durability and aesthetic retention, categorizing products mainly into PVDF (Polyvinylidene Fluoride) coated for long-term exterior use and PE (Polyester) coated for interior or less weather-exposed applications. PVDF coatings command a premium due to their excellent UV and chemical resistance.

Application segmentation illustrates the end-use demand, primarily categorized into Commercial (office buildings, retail, hospitality), Residential (multi-family units, high-rises), and Industrial/Infrastructure (factories, airports, public transport hubs). The commercial sector remains the largest consumer, driven by the need for visually impactful, durable façades. The increasing trend towards high-rise construction globally ensures sustained demand across all application segments, demanding specialized panel systems that can handle increased wind loads and height-specific safety regulations.

- By Product Type:

- Aluminum Composite Material (ACM/ACP)

- Solid Aluminum Panels (SAP)

- By Core Material:

- Polyethylene (PE) Core

- Fire-Retardant (FR) Core

- Non-Combustible (A2) Core

- By Coating Type:

- PVDF (Polyvinylidene Fluoride) Coating

- PE (Polyester) Coating

- Other Coatings (FEVE, Anodized)

- By Application:

- Commercial

- Residential

- Industrial/Infrastructure

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Aluminum Cladding Panel Market

The value chain for the Aluminum Cladding Panel Market begins with upstream activities focused on securing high-quality raw materials, primarily primary aluminum sheets (coils) and core materials (polyethylene, mineral fillers). Volatility in global aluminum futures directly impacts the manufacturing cost and pricing power of panel producers, making long-term supply agreements and hedging strategies critical. Key upstream suppliers include major aluminum rolling companies and specialty chemical manufacturers that provide the high-performance core compounds and coating resins (like PVDF and FEVE).

The middle segment involves the core manufacturing process, where companies utilize specialized bonding lines to laminate the aluminum skins to the core material, followed by precision coating application (often coil coating). Downstream activities focus on fabrication and installation. Panels are typically cut, routed, and formed into cassettes or panels based on architectural drawings, primarily performed by authorized fabricators using advanced CNC machinery. Effective distribution channels are essential to link the manufacturer to the project site efficiently, often requiring specialized logistics due to the size and fragility of the finished panels.

Distribution channels in this market are bifurcated into direct and indirect routes. Direct sales are common for large-scale commercial or high-profile projects, where manufacturers work closely with architects and general contractors to provide customized specifications and technical support. Indirect distribution utilizes a network of authorized distributors, wholesalers, and specialized construction material suppliers who hold inventory and serve smaller, regional projects or residential developers. Fabricators often play an intermediate role, purchasing raw panels and selling the finished, installation-ready system to the final construction firm. Success in the downstream market hinges on strong relationships with architectural firms and a reputation for fast, precise fabrication and compliance with local safety standards.

Aluminum Cladding Panel Market Potential Customers

The potential customer base for Aluminum Cladding Panels is broad and deeply embedded within the global construction ecosystem, ranging from large multinational property developers to individual contractors focusing on façade refurbishment. The primary end-users are commercial real estate developers who are constantly seeking aesthetically superior, low-maintenance materials that contribute positively to the building's overall valuation and LEED (Leadership in Energy and Environmental Design) ratings. These developers often require high volumes of customized panels for landmark skyscrapers, shopping malls, and corporate parks, demanding certified fire safety and long-term warranties.

Architectural firms and specialized façade consultants serve as crucial gatekeepers, heavily influencing material selection based on design specifications, performance requirements, and budget constraints. Manufacturers must focus efforts on achieving product specification status within these firms by demonstrating compliance with stringent quality and safety standards. Government agencies and public works departments represent another significant customer segment, especially those involved in infrastructure projects such as transportation terminals, government housing complexes, and educational facilities, where durability and regulatory adherence are paramount.

Furthermore, residential builders, particularly those specializing in high-density multi-family housing, are increasingly adopting ACPs due to their cost-efficiency compared to traditional materials and the speed of installation. Renovation and retrofitting contractors, focused on upgrading the energy efficiency and appearance of older buildings, also constitute a fast-growing customer segment. For manufacturers, developing strong partnerships with installation contractors, who manage the final phase of application, ensures smooth project execution and repeat business.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ALUCOBOND (3A Composites), Alpolic (Mitsubishi Chemical), Reynobond (Arconic), Alubond U.S.A., Euramax Coated Products, Jyi Shyang Industrial Co. Ltd., Shandong Jixiang Decoration Material Co. Ltd., 3M Company, Yaret Industrial Group Co., Ltd., Alucoil, Fairmate, Vista Architectural, Aluminum Composite Panel, Panel Tech, Goodsense, A.V.Cladding, Sino-Alu, Hongtai, Seven Group, Huabond |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Cladding Panel Market Key Technology Landscape

The technological landscape of the Aluminum Cladding Panel market is primarily driven by continuous advancements in material science, focusing on fire safety and coating durability, alongside significant improvements in fabrication machinery. The most critical technological shift involves the development and mass production of non-combustible core materials (A2 classification). This involves complex mineral filler formulations replacing standard polyethylene cores to ensure that the composite material does not contribute to fire spread, meeting the most stringent international standards. Innovations in core bonding technology are also vital to maintain structural integrity and prevent delamination under extreme thermal stress.

In terms of surface aesthetics and protection, coating technology remains a key competitive differentiator. While PVDF (Polyvinylidene Fluoride) has been the industry standard for high-performance exterior finishes, newer Fluoroethylene Vinyl Ether (FEVE) coatings are gaining traction. FEVE technology offers exceptional color gloss retention and resistance to weathering and environmental pollutants, often surpassing traditional PVDF performance in highly corrosive or polluted urban environments. Furthermore, self-cleaning coatings, which use photocatalytic properties (e.g., titanium dioxide) to break down organic dirt when exposed to sunlight, represent a high-value niche technology catering to maintenance-sensitive applications.

Manufacturing advancements, particularly in Computer Numerical Control (CNC) routing and fabrication systems, have significantly enhanced the market's capacity for complex, custom architectural elements. Advanced automated lines allow for rapid switching between different panel sizes and forms with minimal setup time, supporting the trend towards highly individualized façades. This technical capability, coupled with sophisticated digital modeling software (BIM integration), ensures precise fitment on site, reducing installation time and construction waste. Ongoing investment in coil coating lines that handle wider aluminum sheets also contributes to efficiency, minimizing joints and enhancing the visual continuity of large installations.

Regional Highlights

The Aluminum Cladding Panel Market exhibits highly differentiated regional dynamics influenced by local construction standards, economic growth rates, and regulatory frameworks, particularly regarding fire safety.

- Asia Pacific (APAC): APAC is the epicenter of market growth, characterized by rapid urbanization and massive infrastructure projects across China, India, and Southeast Asian nations. The region’s demand is driven by the sheer volume of new commercial and high-rise residential construction. While cost sensitivity remains high, leading to a strong presence of standard PE and FR core panels, the adoption of premium A2 grade panels is accelerating in major metropolitan areas due to increasing regulatory awareness and international influence.

- North America: North America presents a mature but highly lucrative market, driven primarily by strict regulatory environments and a focus on high-performance building envelopes. Demand here is heavily skewed towards high-quality PVDF-coated and A2/FR core panels. Significant activity is seen in the retrofitting sector, where cladding panels are used to upgrade existing commercial buildings for energy efficiency and modern aesthetics, especially in the US and Canada where energy codes are continually tightening.

- Europe: Europe maintains a sophisticated market structure, heavily defined by the Euroclass fire safety standards (A2 standard adoption is mandatory for most high-rise applications). The market growth is stable, powered by sustainable construction mandates and urban renewal projects. Nordic countries lead in embracing green aluminum and fully recyclable cladding systems, emphasizing lifecycle assessment (LCA) data. Germany, France, and the UK are key markets demanding specialized façade solutions that integrate seamlessly with insulation systems.

- Middle East and Africa (MEA): This region is characterized by monumental construction projects and extreme climatic conditions. The demand for highly durable, UV-resistant PVDF coatings is critical due to intense solar radiation and sand abrasion. Regulatory frameworks are rapidly evolving, particularly in the UAE and Saudi Arabia, moving towards mandatory A2 and non-combustible standards to ensure the safety of mega-projects, presenting significant opportunities for premium product manufacturers.

- Latin America (LATAM): The LATAM market, while generally smaller than APAC or North America, shows steady growth linked to economic development in countries like Brazil and Mexico. Demand is price-sensitive, often favoring standard ACM panels. However, growing safety awareness and international investment in commercial hubs are gradually driving interest toward certified fire-retardant options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Cladding Panel Market.- ALUCOBOND (3A Composites)

- Alpolic (Mitsubishi Chemical Corporation)

- Reynobond (Arconic)

- Alubond U.S.A.

- Euramax Coated Products

- Jyi Shyang Industrial Co. Ltd.

- Shandong Jixiang Decoration Material Co. Ltd.

- 3M Company (Specialty Coatings)

- Yaret Industrial Group Co., Ltd.

- Alucoil

- Fairmate

- Vista Architectural Products

- Panel Tech

- Goodsense

- A.V.Cladding

- Sino-Alu

- Hongtai

- Seven Group

- Huabond

- Zhengzhou Xinghe Aluminum & Plastic Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Aluminum Cladding Panel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between ACM and solid aluminum panels?

Aluminum Composite Material (ACM) panels consist of two aluminum sheets bonded to a core material (PE or FR mineral filler), offering high rigidity at a light weight and lower cost. Solid Aluminum Panels (SAP) are single, thicker sheets of aluminum, inherently non-combustible (A1/A2 classification), and preferred for absolute fire safety and premium, long-term architectural solutions.

How do fire safety regulations impact the demand for different core materials?

Stringent global fire safety regulations, particularly in developed markets and high-rise construction, have mandated a shift away from standard polyethylene (PE) core panels towards Fire-Retardant (FR) core panels, and increasingly, Non-Combustible (A2) mineral-filled core panels. This regulatory pressure significantly boosts demand for premium, high-safety products.

Which region is leading the growth in the Aluminum Cladding Panel Market?

The Asia Pacific (APAC) region is currently leading the growth in the Aluminum Cladding Panel Market. This dominance is driven by high levels of infrastructure investment, rapid urbanization, and a continuous boom in commercial and residential construction, especially in economies like China, India, and Southeast Asia.

What are the primary factors driving the adoption of PVDF coatings over PE coatings?

PVDF (Polyvinylidene Fluoride) coatings are predominantly adopted for exterior applications due to their superior resistance to UV radiation, fading, chalking, and corrosion, offering long-term aesthetic retention and durability. PE (Polyester) coatings are typically utilized for interior applications or projects with shorter lifespan requirements due to their lower cost and less robust weather resistance.

How is sustainability affecting material choices in aluminum cladding?

Sustainability significantly influences material choices by promoting the use of highly recyclable aluminum and panels manufactured using processes that minimize energy consumption. Architects favor providers who can supply certified green materials, often necessitating the use of post-consumer recycled aluminum content and providing detailed lifecycle assessment (LCA) documentation to meet green building standards (e.g., LEED).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager