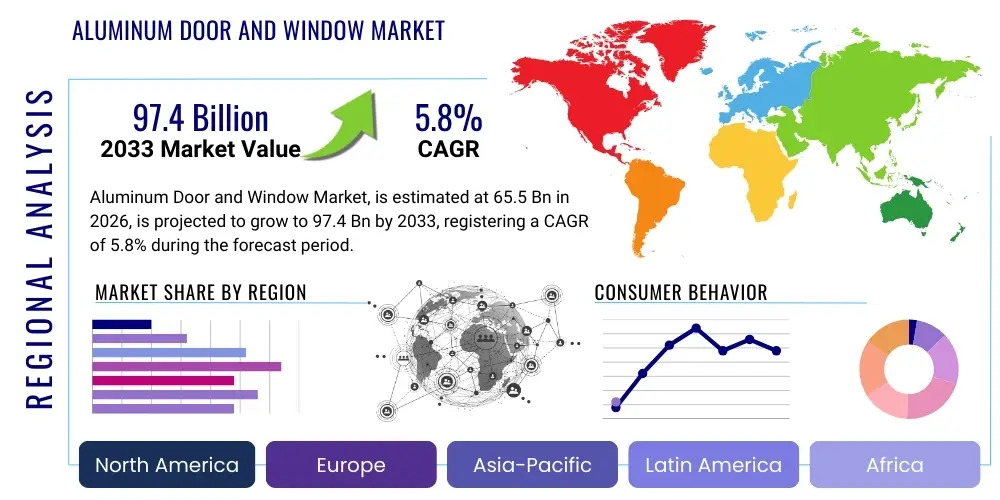

Aluminum Door and Window Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443438 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Aluminum Door and Window Market Size

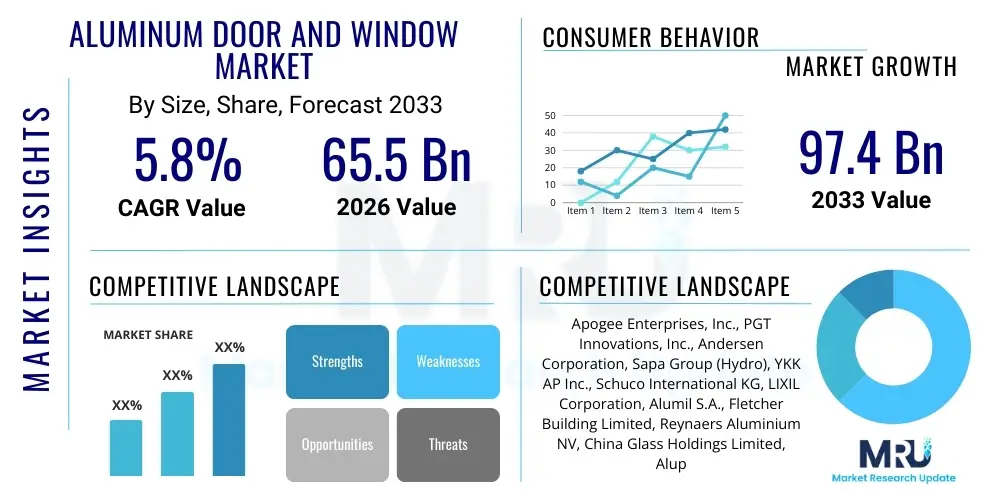

The Aluminum Door and Window Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 65.5 Billion in 2026 and is projected to reach USD 97.4 Billion by the end of the forecast period in 2033.

Aluminum Door and Window Market introduction

The Aluminum Door and Window Market encompasses the manufacturing, distribution, and installation of doors and windows constructed primarily using aluminum frames. These products are favored across the construction industry for their inherent strength, durability, resistance to corrosion, and aesthetic flexibility, allowing for sleek and minimalist designs often sought in modern architecture. Key applications span commercial buildings, institutional facilities, industrial complexes, and high-end residential projects, driven by their superior performance characteristics compared to traditional materials like wood or PVC in certain environments. The market includes standard sliding windows, casement windows, folding doors, security doors, and customized architectural glazing systems.

A primary benefit driving market adoption is aluminum's sustainability profile, as it is infinitely recyclable without loss of quality, appealing to environmentally conscious builders and consumers. Furthermore, ongoing innovation in thermal break technology has effectively mitigated aluminum's high thermal conductivity, significantly improving the energy efficiency of modern aluminum fenestration products. This capability is crucial for meeting increasingly strict global green building standards, especially in regions with extreme climate variability. The ease of maintenance and long operational lifespan of aluminum products contribute to lower lifecycle costs, positioning them as a premium, long-term investment for property developers.

Major applications of aluminum doors and windows are dominated by the burgeoning commercial sector, specifically office spaces, retail complexes, and hospitality venues, where large, unobstructed views and structural integrity are paramount. Simultaneously, the residential renovation and remodeling segment is exhibiting robust growth, fueled by homeowners seeking to upgrade existing structures with more aesthetically pleasing, secure, and energy-efficient solutions. Driving factors include rapid global urbanization, massive infrastructure spending in emerging economies, government incentives promoting energy-efficient buildings, and technological advancements that enhance product insulation and acoustic performance.

Aluminum Door and Window Market Executive Summary

The global Aluminum Door and Window Market is experiencing dynamic growth, propelled primarily by sustained growth in the construction sector globally, particularly in Asia Pacific and the Middle East, coupled with a strong emphasis on smart and green building initiatives. Business trends indicate a shift towards customized, high-performance products incorporating features like smart glass integration, automated operation mechanisms, and enhanced security hardware. Key manufacturers are focusing heavily on vertical integration and strategic partnerships to control supply chains, optimize raw material costs, and gain a competitive edge through specialized product offerings tailored for specific end-user segments, such as hurricane-resistant products for coastal regions.

Regionally, Asia Pacific maintains market dominance due to massive public infrastructure investments and rapid expansion of residential housing in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, show consistent growth driven by stringent energy efficiency mandates, extensive retrofitting of aging building stock, and high consumer spending power allocated to premium, thermally-broken aluminum systems. Emerging markets in Latin America and MEA are accelerating due to diversification of economies away from traditional sectors and development of smart cities, which prioritize modern, durable, and aesthetically superior building envelopes.

Segment trends reveal that the residential sector is increasingly adopting high-quality aluminum doors, particularly sliding and folding systems, enhancing indoor-outdoor living spaces. In terms of construction type, the new construction segment remains the largest volume driver, though the renovation and replacement segment is gaining traction due due to the longevity and performance advantages of replacing older wooden or steel frames with modern aluminum profiles. The rising cost of primary aluminum, coupled with geopolitical supply chain disruptions, remains a key challenge, pushing players towards greater operational efficiency and diversification of material sourcing strategies.

AI Impact Analysis on Aluminum Door and Window Market

User queries regarding the impact of Artificial Intelligence (AI) on the Aluminum Door and Window Market primarily center around manufacturing optimization, supply chain predictive modeling, and integration into 'smart' fenestration products. Users are keen to understand how AI can reduce manufacturing waste, improve the precision of complex cuts and assemblies, and optimize logistics, especially concerning the transportation of large, fragile elements. Furthermore, there is significant interest in AI's role in developing next-generation building management systems (BMS) where automated window and door operations, controlled by environmental inputs, enhance occupant comfort and energy conservation. Concerns often revolve around the high initial investment required for AI infrastructure and the need for specialized training to manage automated production lines and integrated smart home systems, driving demand for simplified, user-friendly AI solutions.

AI is set to revolutionize several aspects of the market, moving beyond simple automation to prescriptive analytics and cognitive processes. In the design phase, generative AI tools can rapidly iterate optimal frame designs based on structural load, thermal performance requirements, and aesthetic parameters, significantly shortening the product development cycle. For sales and marketing, AI-driven tools analyze customer behavior and design preferences to provide highly personalized product recommendations, improving conversion rates and inventory forecasting. This shift toward data-driven decision-making throughout the value chain minimizes human error and maximizes resource utilization, delivering higher quality products faster and at potentially lower operational costs.

The deepest impact will likely be felt in smart building integration. AI algorithms process data from sensors, weather forecasts, and internal occupancy patterns to dynamically adjust ventilation, sunlight ingress (via integrated shading or smart glass), and access control, ensuring peak energy efficiency and security. This intelligent integration transforms the door and window from passive components into active parts of a cohesive, sustainable building envelope. Companies that successfully leverage AI for both manufacturing efficiency and product intelligence will gain a substantial competitive advantage by offering solutions that seamlessly integrate into the expanding ecosystem of smart homes and commercial structures.

- AI-driven optimization of aluminum profile cutting and assembly, minimizing material waste.

- Predictive maintenance scheduling for manufacturing machinery, reducing unplanned downtime.

- Enhanced supply chain logistics and demand forecasting using machine learning algorithms.

- Development of smart windows and doors featuring AI-controlled climate response and security features.

- Generative design tools for rapid prototyping and simulation of structural and thermal performance.

- Personalized customer design recommendations and virtual visualization using AI platforms.

DRO & Impact Forces Of Aluminum Door and Window Market

The market dynamics are defined by several interwoven forces: robust drivers centered on global infrastructure development and sustainability mandates; significant restraints including raw material volatility and intense price competition; and compelling opportunities derived from technological innovation and emerging market penetration. Key drivers include accelerating urbanization, particularly in Asia, coupled with the global push for green construction and energy-efficient building codes, which favor thermally-broken aluminum systems. Restraints predominantly involve the fluctuating cost and availability of primary aluminum, energy-intensive manufacturing processes, and market saturation in highly developed economies, necessitating high investment in differentiation through specialized products.

Opportunities lie in developing advanced functionalities, such as integrating aluminum frames with IoT sensors for smart home ecosystems and specializing in high-performance segments like hurricane and blast-resistant windows and doors for specific safety-critical applications. The shift towards lightweight, high-strength aluminum alloys also presents a manufacturing opportunity to improve transportation efficiency and ease of installation. However, regulatory complexity regarding fire resistance and thermal performance across different regions poses a continuous challenge, requiring manufacturers to constantly adapt their product certifications and testing protocols to comply with evolving national and international standards, increasing operational overhead.

Impact forces illustrate how these DRO factors manifest in the competitive landscape. Supplier power is high due to consolidation in the primary aluminum industry, impacting manufacturer margins. Buyer power remains moderate, high in the mass market due to numerous substitutes (PVC, wood) but low in the high-end commercial segment where specialized performance is non-negotiable. The threat of substitutes is continuous, notably from advanced composite materials, but aluminum maintains a strong advantage in structural applications. New entrants face significant barriers related to high capital expenditure, complex certification requirements, and the necessity for established distribution networks, thus protecting existing major players.

Segmentation Analysis

The Aluminum Door and Window Market is analyzed across various segments, providing granular insights into specific product types, applications, and end-user demands. This detailed segmentation helps stakeholders identify high-growth areas and tailor their manufacturing and marketing strategies effectively. The core segmentation typically involves differentiating products based on operational mechanism (e.g., sliding vs. casement), material attributes (e.g., standard vs. thermally-broken profiles), and the intended application setting (residential versus commercial construction). Analyzing these segments reveals that the commercial sector, driven by large-scale projects, commands the highest market share in terms of volume and value, while the residential sector is demonstrating faster compound annual growth, particularly in renovation and custom-build projects focused on high-specification materials.

Further segmentation by construction type highlights the crucial distinction between new construction and renovation/replacement markets. While new construction historically accounts for the majority of installations, the renovation segment is becoming increasingly significant, especially in mature economies like Europe and North America where aging building stock requires energy-efficient upgrades. Demand in the renovation market is less susceptible to economic downturns in new project starts, offering a stable revenue stream for specialized suppliers. Geographical segmentation underscores the critical role of Asia Pacific as the manufacturing hub and largest consumer, owing to rapid population growth and massive ongoing infrastructure investment, while Western markets prioritize quality and sustainability over pure volume.

Understanding the interplay between these segments is vital for strategic planning. For instance, manufacturers targeting the high-end residential segment must focus on customization, advanced finishes (e.g., anodizing, powder coating), and integration with smart technologies, demanding higher Research and Development expenditure. Conversely, companies focusing on the mass-market commercial segment prioritize scalability, standardized profiles, and cost efficiency. The differentiation between standard aluminum frames and those utilizing advanced thermal break technology is a key performance metric that increasingly dictates market share, particularly under stringent energy conservation laws, making the material profile a critical segmentation criterion.

- By Product Type:

- Aluminum Doors (Sliding Doors, Bi-fold Doors, Hinged Doors, Lift-and-Slide Doors, Security Doors)

- Aluminum Windows (Sliding Windows, Casement Windows, Tilt-and-Turn Windows, Louvered Windows, Pivot Windows)

- By Application:

- Residential (Single-family homes, Multi-family residences)

- Commercial (Office buildings, Retail complexes, Hospitality, Healthcare, Educational institutions)

- By End-User:

- New Construction

- Renovation & Replacement

- By Frame Material Attribute:

- Standard Aluminum

- Thermally Broken Aluminum

- By Mechanism/Design:

- Fixed

- Operable

Value Chain Analysis For Aluminum Door and Window Market

The value chain for the Aluminum Door and Window Market begins with upstream activities dominated by primary aluminum production and extrusion, a highly capital-intensive and energy-intensive process. Key upstream players include major aluminum suppliers and specialized extrusion companies that process raw aluminum billets into custom profiles suitable for fenestration applications. The price fluctuations of raw aluminum (LME pricing) significantly influence the cost structure throughout the entire chain. Efficient sourcing, forward contracts, and maintaining relationships with reliable, high-volume extruders are critical success factors at this stage. Environmental scrutiny regarding the carbon footprint of primary aluminum production is driving interest in recycled and low-carbon aluminum alternatives.

The midstream involves the core manufacturing process, where profile cutting, precision machining, finishing (anodizing or powder coating), assembly, and glazing take place. This stage is characterized by high requirements for precision engineering and quality control to ensure products meet stringent structural, acoustic, and thermal performance standards. Manufacturers often invest heavily in advanced CNC machinery and automated assembly lines to maximize efficiency and maintain consistency. The complexity of manufacturing specialized products, such as those with integrated thermal breaks or large custom curtain wall sections, adds significant value at this stage, differentiating specialized fabricators from general assemblers.

Downstream activities involve distribution, installation, and after-sales service. Distribution channels are typically a mix of direct sales to large commercial contractors and developers, and indirect sales through specialized distributors, retailers, and dedicated installers serving the residential market. Direct channels ensure greater control over pricing and service quality for high-value projects, while indirect channels provide wider geographical reach. Successful companies invest heavily in training certified installers, as proper installation is paramount for product performance and longevity. Digital channels are increasingly used for marketing and pre-sales consultation, though the physical logistics of transporting large, finished goods remain a considerable operational challenge.

Aluminum Door and Window Market Potential Customers

Potential customers for the Aluminum Door and Window Market span a broad spectrum of the construction ecosystem, categorized primarily into institutional, commercial, industrial, and residential end-users, each with distinct requirements regarding scale, performance, and aesthetic criteria. The largest and most demanding customer group comprises large-scale commercial developers and general contractors responsible for constructing high-rise office towers, large retail centers, and hospitality projects. These buyers prioritize structural integrity, adherence to complex architectural specifications, superior weather performance, and reliable supply capacity to meet tight construction timelines, often purchasing customized curtain wall systems and high-security entrance doors.

The public and institutional sectors, including government agencies, healthcare facilities, and educational establishments, represent another critical customer base. These entities focus heavily on durability, low maintenance costs, energy efficiency (due to long-term operational budgets), and enhanced security features, frequently demanding thermally-broken systems and specialized acoustic glazing to manage noise pollution in sensitive environments. Procurement processes in this sector are often characterized by rigorous bidding procedures and mandatory compliance with public building standards and certifications, favoring manufacturers with established quality assurance credentials and long-term warranties.

In the residential sphere, potential customers include mass-market residential developers building apartment complexes and subdivisions, as well as individual homeowners undertaking custom builds or extensive renovations. Residential buyers are increasingly focused on aesthetic appeal, ease of operation (e.g., smooth sliding mechanisms), and integration into smart home systems. The renovation segment, specifically, seeks replacement products that offer significant performance upgrades over older frames, prioritizing improved insulation and acoustic properties to enhance home comfort and reduce energy bills, often driven by consumer lifestyle aspirations and local incentives for energy retrofits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Billion |

| Market Forecast in 2033 | USD 97.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apogee Enterprises, Inc., PGT Innovations, Inc., Andersen Corporation, Sapa Group (Hydro), YKK AP Inc., Schuco International KG, LIXIL Corporation, Alumil S.A., Fletcher Building Limited, Reynaers Aluminium NV, China Glass Holdings Limited, Aluprof S.A., Kawneer Company (Arconic), Jeld-Wen Holding, Inc., Fenesta Building Systems (DCM Shriram Ltd.), Veka AG, Continental Aluminium, Everest Industries Ltd., Geze GmbH, Marvin Windows and Doors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Door and Window Market Key Technology Landscape

The technological landscape of the Aluminum Door and Window Market is focused heavily on enhancing thermal performance, structural integrity, and aesthetic flexibility, moving beyond simple metal fabrication to complex engineered systems. The single most impactful technology is the implementation of thermal break profiles, which utilize a low-conductive material (like reinforced polyamide strips) inserted between the internal and external aluminum sections. This technology significantly reduces heat transfer, making aluminum systems viable in cold climates and essential for meeting passive house standards, driving demand for specialized machinery capable of precise thermal break insertion and crimping, and representing a major technological differentiator among manufacturers.

Beyond thermal performance, advancements in surface finishing techniques are crucial. Powder coating technologies have improved to offer enhanced durability, UV resistance, and a wider range of colors and textures, mimicking materials like wood or stone, thereby broadening architectural design possibilities without sacrificing the structural benefits of aluminum. Furthermore, the integration of smart technologies is rapidly emerging, including motorized opening and closing systems, embedded sensor arrays for monitoring environmental conditions and security status, and electrochromic or photovoltaic smart glass panels integrated directly into the aluminum frames, turning the fenestration into an active component of the building’s energy and security management system.

In the manufacturing sector, key technological shifts include the adoption of advanced Computer Numerical Control (CNC) machining centers specifically optimized for complex aluminum profile cuts and joinery, ensuring extremely tight tolerances and speed. Furthermore, digital modeling and Building Information Modeling (BIM) tools are standardizing the design process, allowing for seamless integration of complex door and window systems into overall architectural plans. The industry is also exploring novel joining techniques, such as friction stir welding, to create stronger, cleaner connections without the aesthetic and structural drawbacks associated with traditional mechanical fasteners or corner brackets, further improving product longevity and design sleekness.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, fueled by explosive growth in infrastructure development and urbanization across China, India, and Southeast Asia. The region is characterized by high volume manufacturing and massive demand from the new construction segment, though environmental regulations are increasingly driving adoption of thermally-broken systems, transitioning the focus from pure volume to balanced performance and cost efficiency.

- North America: A mature, value-driven market focusing on high-performance, energy-efficient, and hurricane-resistant products, particularly in coastal states (Florida, Texas). Growth is stable, driven equally by new high-end commercial projects and robust demand for residential renovations where consumers are willing to invest in premium aluminum systems featuring advanced coatings and smart technology integrations.

- Europe: Characterized by stringent energy efficiency mandates (e.g., Nearly Zero Energy Buildings—NZEB) and a strong emphasis on architectural aesthetics and sustainability. Western European countries lead in the adoption of high-specification, triple-glazed, and highly insulated aluminum windows and doors. The renovation market is exceptionally strong, supported by government initiatives to improve the thermal performance of existing building stock.

- Middle East & Africa (MEA): Experiencing rapid market expansion due to extensive construction projects associated with economic diversification and large-scale urban development initiatives (e.g., Saudi Vision 2030, UAE development). Demand is high for robust, corrosion-resistant, and high-security systems capable of withstanding extreme desert climate conditions, often favoring large, customized architectural glass facades framed by aluminum.

- Latin America (LATAM): Showing steady, though geographically diverse, growth. Construction activity in countries like Brazil and Mexico is driving demand, particularly in the commercial and multi-family residential sectors. The market is moderately price-sensitive but is progressively integrating better quality standards in line with international construction practices, slowly moving away from basic frames toward improved performance profiles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Door and Window Market.- Apogee Enterprises, Inc.

- PGT Innovations, Inc.

- Andersen Corporation

- Sapa Group (Hydro)

- YKK AP Inc.

- Schuco International KG

- LIXIL Corporation

- Alumil S.A.

- Fletcher Building Limited

- Reynaers Aluminium NV

- China Glass Holdings Limited

- Aluprof S.A.

- Kawneer Company (Arconic)

- Jeld-Wen Holding, Inc.

- Fenesta Building Systems (DCM Shriram Ltd.)

- Veka AG

- Continental Aluminium

- Everest Industries Ltd.

- Geze GmbH

- Marvin Windows and Doors

- Technal (Hydro Building Systems)

Frequently Asked Questions

Analyze common user questions about the Aluminum Door and Window market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Aluminum Door and Window Market?

The primary driver is the accelerating trend of global urbanization and significant investments in commercial and residential construction, coupled with increasingly stringent government regulations requiring energy-efficient and sustainable building materials globally.

How does thermal break technology affect aluminum window performance?

Thermal break technology utilizes non-conductive materials within the aluminum frame to interrupt the transfer of heat or cold, drastically improving the frame's insulation capabilities, reducing condensation, and ensuring compliance with modern energy efficiency standards.

Which region holds the largest market share for aluminum fenestration products?

The Asia Pacific region currently holds the largest market share due to rapid infrastructure development, high population density, and enormous new construction activity, particularly in China and India, where manufacturing capacity is also concentrated.

Are aluminum doors and windows considered sustainable?

Yes, aluminum is highly sustainable as it is 100% recyclable, retaining all structural properties during the recycling process. This feature significantly lowers the lifecycle carbon footprint compared to many other conventional building materials.

What is the major challenge facing manufacturers in this market?

The most significant challenge is the inherent volatility and high pricing of raw primary aluminum on global commodity markets, which directly impacts production costs and profit margins, forcing manufacturers to optimize operational efficiency and hedging strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager