Aluminum-Magnesium Alloys Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441123 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Aluminum-Magnesium Alloys Plate Market Size

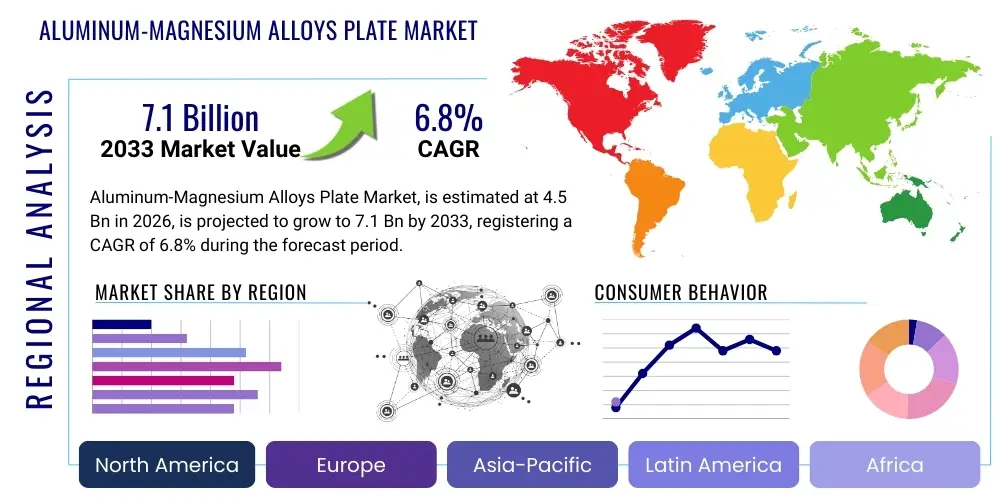

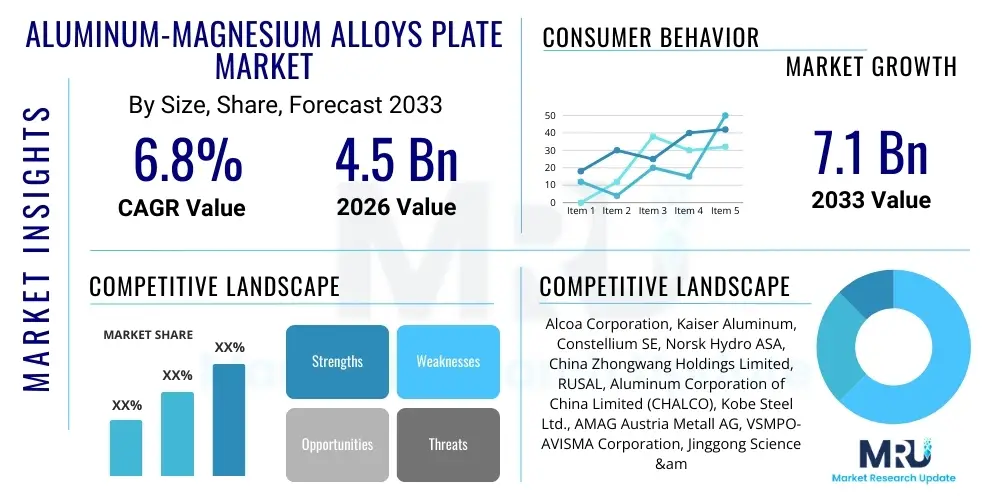

The Aluminum-Magnesium Alloys Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at 4.5 Billion USD in 2026 and is projected to reach 7.1 Billion USD by the end of the forecast period in 2033.

Aluminum-Magnesium Alloys Plate Market introduction

Aluminum-Magnesium alloys, often designated as the 5xxx series, are non-heat-treatable alloys characterized by exceptional resistance to corrosion, high strength-to-weight ratio, and excellent weldability. The plate market specifically addresses thick gauge products utilized primarily in demanding structural applications where durability and lightness are paramount. These plates leverage the synergistic properties of aluminum and magnesium, where magnesium acts as the primary alloying element, significantly enhancing tensile strength and improving resistance to saline and marine environments. This unique combination makes them indispensable across several heavy industries, notably shipbuilding, automotive manufacturing, and aerospace sectors.

The core product description centers around rolled aluminum plates containing 0.5% to 5.0% magnesium, depending on the specific alloy variant (e.g., 5083, 5052, 5754). These plates are processed through specialized hot and cold rolling mills to achieve precise thicknesses and surface finishes required for high-integrity structures. Major applications include large storage tanks for Liquefied Natural Gas (LNG), structural components for naval vessels and cruise ships, armor plating, and critical parts in high-speed trains. The inherent benefits, such as superior fatigue resistance and cryogenic performance, further solidify their dominance in these specialized market segments where safety and performance cannot be compromised. The manufacturing process demands stringent quality control, ensuring microstructural uniformity and freedom from defects, which contributes to the premium pricing of these materials compared to standard aluminum plates.

Driving factors for the substantial market growth include the global push for lightweighting in transportation to meet rigorous fuel efficiency and emission standards, particularly in the electric vehicle (EV) sector and commercial aviation. Furthermore, the sustained expansion of maritime trade and the necessary replacement or modernization of aging naval and commercial fleets globally necessitates high volumes of corrosion-resistant plates. Increased infrastructural spending on large-scale energy projects, such as offshore platforms and storage facilities, also serves as a significant consumption driver. Geopolitical factors, specifically rising defense budgets focused on naval modernization, provide consistent, high-volume contracts for specific high-strength aluminum-magnesium alloy plates used in military shipbuilding and ballistic protection.

Aluminum-Magnesium Alloys Plate Market Executive Summary

The Aluminum-Magnesium Alloys Plate Market is undergoing significant transformation driven by global sustainability mandates and rapid technological advancements in material processing. Key business trends include the consolidation of production capacity among major global aluminum manufacturers, focusing on vertically integrated operations to control raw material sourcing and specialized rolling capabilities. There is a marked shift towards producing ultra-thick plates and customized alloys tailored for extreme environments, such as deep-sea applications and cryogenic storage, demanding higher precision and lower defect rates. Regional trends indicate robust growth led by the Asia Pacific region, specifically China and South Korea, which dominate global shipbuilding and automotive production, requiring substantial input of 5xxx series plates. North America and Europe maintain strong demand, primarily fueled by the aerospace and defense sectors, where specifications are exceptionally stringent, prioritizing high-grade 5083 and 5754 alloys.

Segment trends reveal that the transportation segment, encompassing automotive body structures and marine construction, remains the largest consumer, although the defense and armor segment is experiencing the fastest growth rate due to escalating global security concerns and modernization programs. By alloy type, the high-magnesium 5083 plate is projected to hold the dominant market share owing to its unparalleled corrosion resistance and strength essential for naval architectures and LNG transport applications. The industry is also witnessing innovation in plate surface treatments and joining technologies, which improve structural integrity and reduce overall manufacturing time for end-users. Economic indicators suggest that fluctuations in global aluminum and magnesium commodity prices, coupled with energy costs associated with the rolling process, will continue to influence market profitability and competitive pricing strategies among primary producers.

The market outlook remains strongly positive, anchored by structural demand drivers that are less susceptible to short-term economic downturns, such as long-term infrastructure projects and mandatory defense spending. Technological innovation is heavily focused on developing lighter variants that still meet structural integrity requirements, which is critical for future mobility solutions. Successful penetration into emerging markets and diversification into new application areas, such as renewable energy installations (e.g., solar racking structures requiring high corrosion resistance), are critical strategic imperatives for leading market participants. Overall, the market structure is characterized by high barriers to entry due to the capital-intensive nature of plate production and the necessity for specialized certifications required by demanding sectors like aerospace and marine engineering, ensuring established players maintain significant competitive advantages.

AI Impact Analysis on Aluminum-Magnesium Alloys Plate Market

User queries regarding AI’s influence on the Aluminum-Magnesium Alloys Plate Market commonly revolve around themes of operational efficiency, quality control, predictive maintenance, and materials science innovation. Users are keen to understand how AI algorithms can optimize complex rolling mill parameters—such as temperature, speed, and thickness reduction—to minimize energy consumption and reduce material scrap rate, which directly impacts profitability given the high cost of raw materials. Key concerns often center on the reliability of AI models in predicting microstructural defects or optimizing alloy compositions for novel applications while ensuring compliance with stringent industry safety standards (e.g., naval and aerospace certifications). Expectations are high for AI to revolutionize non-destructive testing (NDT) processes, replacing traditional manual inspections with faster, more accurate, machine vision-based defect detection systems, thereby accelerating throughput and enhancing overall plate quality assurance.

AI’s influence spans the entire value chain, starting from predictive modeling of raw material mixing to optimizing the intricate processes of homogenization and hot rolling. Machine learning models are increasingly being employed to analyze vast datasets generated by sensors within the rolling equipment, allowing for real-time adjustments that maintain tighter tolerance specifications, crucial for aerospace-grade plates. Furthermore, generative design AI is being explored to simulate and test novel aluminum-magnesium alloy compositions with superior mechanical properties, potentially accelerating the R&D cycle necessary to introduce new products that meet increasingly challenging environmental and performance criteria, such as enhanced ballistic resistance or improved cryogenic stability required for specialized military and energy infrastructure.

The adoption of Industrial Internet of Things (IIoT) sensors coupled with AI analytics platforms provides manufacturers with unprecedented insight into equipment performance, leading to highly effective predictive maintenance schedules. This shift from reactive to proactive maintenance minimizes costly unplanned downtime in capital-intensive rolling facilities, ensuring consistent supply and stable pricing for end-users. While the initial investment in AI infrastructure and the requisite specialized data scientists presents a barrier, the long-term benefits of optimized energy use, reduced material waste, and superior quality consistency are driving mandatory adoption among leading global plate producers seeking sustainable competitive differentiation in a highly regulated manufacturing environment. This technological integration promises a smarter, more efficient future for high-performance metal plate manufacturing globally.

- AI-driven optimization of rolling mill parameters (speed, temperature, pressure) leading to 10-15% reduction in energy consumption and waste.

- Predictive maintenance analytics minimizing unplanned equipment downtime by up to 25% in heavy rolling machinery.

- Enhanced quality control through AI-powered machine vision systems for real-time defect detection and surface inspection, ensuring compliance with strict marine and aerospace standards.

- Accelerated alloy development using generative AI to simulate mechanical performance and corrosion resistance of new aluminum-magnesium compositions.

- Supply chain optimization via ML algorithms for accurate demand forecasting and strategic raw material procurement (aluminum ingots and magnesium), mitigating price volatility risks.

- Improved welding process control using robotic systems guided by AI for enhanced structural integrity in critical end-use applications like LNG tanks and naval hulls.

DRO & Impact Forces Of Aluminum-Magnesium Alloys Plate Market

The Aluminum-Magnesium Alloys Plate Market is driven primarily by the global imperative for lightweight structural materials in transportation, coupled with strong defense and infrastructure spending worldwide, particularly in maritime and energy sectors. However, the market faces significant restraints stemming from volatility in commodity prices (aluminum and magnesium), high energy consumption associated with the manufacturing process, and stringent regulatory requirements that necessitate lengthy certification and approval processes for new materials. Opportunities abound in the burgeoning electric vehicle battery housing market and the rapid expansion of cryogenic storage and transport infrastructure (LNG, liquid hydrogen), which demand the specific low-temperature performance characteristics of 5xxx series alloys. The interaction of these factors creates dynamic impact forces, where the strong, non-cyclical demand from defense and high-value infrastructure often buffers the market against the cyclical economic downturns that affect other segments like commercial building construction, resulting in moderate yet consistent growth momentum driven by technological substitution.

The primary drivers include escalating environmental regulations requiring reduced carbon emissions, forcing industries like automotive and marine to adopt lighter materials to improve fuel efficiency and extend electric range. The inherent corrosion resistance of aluminum-magnesium alloys (especially 5083) makes them the preferred choice over steel in saltwater environments, sustaining robust demand from the naval and commercial shipbuilding industry. Conversely, restraints such such as the capital intensity of specialized rolling mills and the reliance on imported bauxite and magnesium resources create potential supply chain bottlenecks and cost pressures. Furthermore, competition from advanced composites and other high-strength aluminum alloys (like 6xxx series) poses a moderate threat in specific non-marine structural applications. This creates a delicate balance where superior technical performance must justify the higher production cost and complex supply chain management associated with these specialized plates.

Significant opportunities lie in geographical expansion, targeting industrialization in emerging economies where shipbuilding and infrastructure development are accelerating, provided manufacturers can navigate local regulatory landscapes and establish efficient distribution networks. Technological opportunities include developing plates with enhanced joining capabilities, such as friction stir welding compatibility, reducing the complexity and cost of final assembly for end-users. Impact forces are further amplified by global trade policies and tariffs affecting aluminum imports and exports, which can rapidly alter the competitive dynamics and regional pricing structures. The long-term durability and recyclability of aluminum-magnesium alloys also align perfectly with circular economy mandates, serving as a powerful, underlying force that favors their sustained adoption over less environmentally friendly alternatives, particularly as corporate sustainability goals become mandatory requirements for major industrial purchasers globally.

Segmentation Analysis

The Aluminum-Magnesium Alloys Plate Market is segmented based on critical parameters including Alloy Type, Thickness, Manufacturing Process, and End-Use Application, allowing for precise market sizing and strategic targeting across diverse industrial sectors. Understanding these segments is vital as performance requirements vary dramatically—a thin plate used in commercial automotive parts has vastly different specifications than an ultra-thick, stress-relieved plate destined for a nuclear storage canister or submarine hull. The segmentation highlights the technical complexity of the market, where different alloys are optimized for distinct physical and chemical properties, such as cryogenic temperature resilience (5083) versus formability (5052). This structured analysis provides manufacturers with the necessary framework to prioritize investment in specific rolling capacity and specialized treatment processes, aligning production capabilities with high-growth, high-margin application areas like defense and LNG transport infrastructure globally.

The differentiation by End-Use application reveals the core demand drivers: Marine, Aerospace, Automotive, and Industrial/Building & Construction. The Marine segment, fueled by commercial shipping and naval modernization, typically requires the largest volumes of highly corrosion-resistant plates. The Thickness segmentation is crucial, differentiating between thin plates (under 10mm), medium plates (10mm to 50mm), and heavy/ultra-thick plates (over 50mm). Heavy plates command a significant price premium due to the demanding rolling and heat treatment processes required, serving specialized applications such as ship hull sections, specialized pressure vessels, and ballistic protection systems. The manufacturing process segmentation distinguishes between hot-rolled and cold-rolled plates, reflecting differences in mechanical properties, dimensional stability, and final surface quality, impacting their suitability for different fabrication techniques utilized by end-users.

Furthermore, geographic segmentation is indispensable, revealing where manufacturing centers are concentrated and where end-user demand originates. Asia Pacific is dominant in volume due to high maritime activity, while North America and Europe lead in value due to highly specialized, high-grade material requirements for aerospace and defense programs. The alloy type remains the most fundamental segmentation, detailing the specific chemical composition that dictates performance characteristics—5083 is optimized for strength and corrosion resistance in marine environments, 5052 offers superior formability for sheet metal work, and 5454 is often used in chemical processing and road transportation tanks due to its resistance to slightly elevated temperatures. This hierarchical segmentation structure allows for detailed forecasting and competitive analysis, identifying niche markets requiring customized product specifications and long-term supply agreements.

- By Alloy Type:

- 5083 (High Strength, Excellent Corrosion Resistance, Marine & Cryogenic Applications)

- 5052 (Good Formability, General Industrial Applications)

- 5754 (Moderate Strength, Automotive & Rail)

- 5A06/5454 (Specialized Chemical & High-Temperature Service)

- By Thickness:

- Thin Plates (Under 10 mm)

- Medium Plates (10 mm to 50 mm)

- Heavy/Ultra-Thick Plates (Above 50 mm)

- By End-Use Application:

- Marine & Shipbuilding (Naval, Commercial Hulls, Superstructures, LNG Carriers)

- Aerospace & Defense (Aircraft Components, Armor Plating, Ballistic Protection)

- Automotive & Transportation (Truck Bodies, Railcars, EV Battery Enclosures)

- Industrial & Construction (Pressure Vessels, Tanks, Infrastructure)

Value Chain Analysis For Aluminum-Magnesium Alloys Plate Market

The value chain for the Aluminum-Magnesium Alloys Plate Market begins with highly capital-intensive upstream activities involving the sourcing and refinement of primary aluminum (from bauxite) and magnesium ore. This stage is dominated by a few large global integrated producers who control the initial smelting and casting processes necessary to create high-purity aluminum ingots and alloy feedstock. Critical upstream elements include specialized recycling facilities focused on high-quality scrap aluminum, as the purity of the input material directly impacts the final plate performance and metallurgical integrity required for demanding applications. Upstream profitability is heavily influenced by global energy prices, particularly electricity, which is a significant cost component in the aluminum smelting process, and the logistics associated with international bauxite transportation. Strategic control over the upstream supply ensures cost predictability and material quality consistency, which are competitive advantages for major integrated plate producers globally.

The midstream phase focuses on conversion, encompassing rolling, heat treatment, and finishing processes. This stage, where ingots are transformed into specialized plates, is characterized by high technological barriers to entry due to the necessity of owning and operating massive, precision hot- and cold-rolling mills capable of handling large-format plates and achieving tight thickness tolerances, especially for military and aerospace specifications. Manufacturing processes include homogenization, hot rolling, solution heat treatment (when applicable, though less common for 5xxx series), and often elaborate stress-relieving procedures to ensure dimensional stability during subsequent fabrication by the end-user. Distribution channels for these materials are typically structured into direct sales to large end-users (e.g., major shipyards or defense contractors) via long-term supply agreements, and indirect sales through specialized global metal service centers and high-performance material distributors who provide inventory management and localized cutting services for smaller-volume customers across regional markets.

Downstream activities involve the final fabrication and integration of the aluminum-magnesium plates into finished products across key industries such as naval vessel construction, LNG tank assembly, and aircraft structure manufacture. The high cost and specialized handling requirements of these plates necessitate highly skilled labor and advanced joining techniques, such as laser welding or friction stir welding, especially in marine and cryogenic applications where failure tolerance is zero. Direct distribution through dedicated sales teams is preferred for major contracts in defense and aerospace due to the need for strict quality control, material traceability, and adherence to specific regulatory standards like MIL-SPEC or specific aerospace standards. Indirect channels, primarily specialized material dealers, service the industrial and general construction markets, offering quick turnaround times and smaller, customized orders, though they often handle lower-grade, more standard 5052 plates rather than the specialized 5083/5454 variants. The efficacy of the value chain is determined by the seamless coordination between primary producers and specialized service centers to deliver precision-cut materials promptly to demanding fabrication schedules globally.

Aluminum-Magnesium Alloys Plate Market Potential Customers

Potential customers for Aluminum-Magnesium Alloys Plate are primarily large-scale industrial consumers requiring high structural integrity, exceptional corrosion resistance, and lightweight characteristics in hostile or critical operating environments. The principal end-users are concentrated within the Marine, Defense, and Specialized Transportation sectors globally. Shipbuilders, encompassing both commercial mega-shipyards producing LNG carriers, cruise ships, and large ferries, and governmental defense contractors building naval vessels (frigates, destroyers, submarines), represent the single largest customer base, relying heavily on the 5083 alloy for hull and superstructure construction due to its resistance to seawater corrosion. These customers typically place large volume, multi-year contracts demanding full material traceability and adherence to specific marine classification society rules (e.g., DNV, ABS, Lloyd’s Register).

Another major segment consists of manufacturers in the Aerospace and Defense industries. Aerospace companies utilize these plates for aircraft structural components, while defense contractors are major consumers for ballistic protection systems, armored vehicles, and specialized military structures where a high strength-to-weight ratio is crucial for mobility and performance. Furthermore, the specialized energy sector constitutes a rapidly growing customer base, including engineering procurement and construction (EPC) firms involved in building large cryogenic storage tanks for liquefied gases such as LNG and emerging liquid hydrogen storage facilities. The excellent low-temperature performance of 5xxx series alloys makes them mandatory for these specialized, high-pressure applications where materials must maintain ductility and strength at temperatures down to -165°C.

Beyond the core heavy industries, key buyers include major original equipment manufacturers (OEMs) in the high-speed rail and commercial vehicle sectors. These customers are driven by regulatory requirements for mass reduction to enhance energy efficiency. For example, trailer and truck body manufacturers use 5754 and 5052 plates for lightweighting vehicles to maximize payload capacity. Finally, specialized industrial customers, such as manufacturers of large pressure vessels, chemical processing equipment, and municipal infrastructure demanding long lifespan and minimal maintenance in challenging environments, round out the market. The purchasing decisions of all these customers are characterized by stringent quality assurance requirements, long procurement cycles, and a preference for established suppliers with robust global production and technical support capabilities, reinforcing the market dominance of top-tier integrated aluminum producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 4.5 Billion USD |

| Market Forecast in 2033 | 7.1 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcoa Corporation, Kaiser Aluminum, Constellium SE, Norsk Hydro ASA, China Zhongwang Holdings Limited, RUSAL, Aluminum Corporation of China Limited (CHALCO), Kobe Steel Ltd., AMAG Austria Metall AG, VSMPO-AVISMA Corporation, Jinggong Science & Technology Co., Ltd., Arconic Corporation, Novelis Inc., Hulamin Limited, JW Aluminum, Mingtai Aluminum, Gwangyang Aluminum, Universal Alloy Corporation, Henan Mingtai Industrial Co., Ltd., Saudi Arabian Mining Company (MA'ADEN) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum-Magnesium Alloys Plate Market Key Technology Landscape

The technological landscape in the Aluminum-Magnesium Alloys Plate Market is characterized by continuous refinement of rolling processes, advancements in specialized heat treatments, and the adoption of cutting-edge joining technologies. The primary focus is on achieving tighter dimensional tolerances, improved internal quality (reduction of porosity and inclusions), and enhanced mechanical properties for critical applications. Technologies like continuous casting and rolling (CC&R) are being utilized to potentially reduce energy consumption and improve material yield, although traditional DC (direct chill) casting followed by dedicated hot and cold rolling sequences remains the benchmark for high-performance plates like the 5083 series. Furthermore, specialized homogenization furnaces and precise quenching systems are essential to control the microstructural evolution, ensuring optimal grain structure and maximizing the corrosion resistance and strength required for marine environments, necessitating substantial investment in automated process control systems.

A pivotal technological trend is the development of ultra-thick plate manufacturing capabilities, driven by demand from the defense industry for enhanced armor protection and the energy sector for larger LNG storage tanks. Producing plates exceeding 100mm in thickness while maintaining microstructural homogeneity and minimizing residual stress is a significant challenge requiring extremely powerful rolling mills and advanced stress-relieving techniques, such as plate stretching. Simultaneously, non-destructive testing (NDT) technologies are rapidly evolving, with automated ultrasonic inspection (UT) systems replacing manual methods. These advanced systems, often integrated with AI, provide 100% volumetric inspection and mapping of internal defects, ensuring the highest level of material integrity demanded by regulatory bodies like the American Bureau of Shipping (ABS) and other global marine classification societies, thereby facilitating rapid certification and delivery.

Furthermore, technology focused on the usability and integration of these plates by end-users is crucial. Friction Stir Welding (FSW) technology, a solid-state joining process, is increasingly becoming the preferred method over traditional fusion welding for critical aluminum-magnesium alloy structures, particularly in aerospace and marine applications. FSW offers superior mechanical properties, significantly reduced distortion, and eliminates the common weld defects associated with high-magnesium content alloys, addressing a major fabrication bottleneck. Investment in FSW capability among large shipyards and defense fabricators is accelerating, compelling plate manufacturers to ensure their products are optimized for this specific joining technique, including controlling surface oxidation and internal stress profiles. The adoption of digital twin technology is also emerging, allowing manufacturers to simulate the entire rolling process, predict final properties, and optimize production schedules to meet highly specific client requirements and demanding delivery timelines in the global supply chain.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of production volume and consumption, primarily driven by massive shipbuilding activities in China, South Korea, and Japan, which are the world leaders in commercial vessel construction, including LNG carriers. Robust automotive production, especially the rapid shift towards electric vehicles requiring lightweight structural frames and battery enclosures, further fuels demand for 5052 and 5754 alloys. Rapid urbanization and infrastructure investments across Southeast Asia also sustain high consumption levels in industrial applications, establishing APAC as the epicenter of global market growth, although competition and pricing pressures are intense due to the sheer volume of regional supply capacity.

- North America: Characterized by high-value, highly specialized demand concentrated in the Aerospace and Defense sectors. The U.S. remains the largest consumer of high-specification 5xxx series plate for naval construction (including destroyers and submarines) and advanced ballistic armor plating, adhering to stringent government and military procurement standards. Growth is stable and driven by long-term defense budgets and the cyclical nature of commercial aircraft production, prioritizing quality and domestic sourcing due to strategic security considerations, resulting in premium pricing structures compared to global averages.

- Europe: Exhibits robust demand fueled by the luxury cruise ship and ferry building industry, particularly in countries like Italy, Germany, and Finland, requiring high volumes of corrosion-resistant plates for superstructures. Furthermore, the European automotive industry, focused heavily on meeting strict CO2 emission reduction targets, drives significant uptake of lightweight aluminum-magnesium alloys for vehicle bodies and rail components. Regulatory clarity regarding material sustainability and circular economy principles is particularly strong here, promoting the use of highly recyclable aluminum plates.

- Middle East and Africa (MEA): Emerging market for aluminum-magnesium plates, driven primarily by investments in the oil and gas sector, specifically the expansion of petrochemical infrastructure, storage tanks, and offshore platforms that require materials resistant to aggressive coastal environments. Significant naval modernization programs in Gulf Cooperation Council (GCC) countries also provide steady demand for high-strength, anti-corrosive marine-grade plates, signaling potential long-term growth as regional industrial diversification efforts intensify.

- Latin America: Represents a smaller but growing market, influenced by localized shipbuilding efforts (particularly Brazil) and infrastructure projects. Demand is more volatile, heavily reliant on commodity prices and government spending cycles, with material sourcing often dependent on imports from North America and Asia, limiting large-scale domestic production but offering opportunities for specialized distributors serving the mining and industrial repair sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum-Magnesium Alloys Plate Market.- Alcoa Corporation

- Kaiser Aluminum

- Constellium SE

- Norsk Hydro ASA

- China Zhongwang Holdings Limited

- RUSAL

- Aluminum Corporation of China Limited (CHALCO)

- Kobe Steel Ltd.

- AMAG Austria Metall AG

- VSMPO-AVISMA Corporation

- Jinggong Science & Technology Co., Ltd.

- Arconic Corporation

- Novelis Inc.

- Hulamin Limited

- JW Aluminum

- Mingtai Aluminum

- Gwangyang Aluminum

- Universal Alloy Corporation

- Henan Mingtai Industrial Co., Ltd.

- Saudi Arabian Mining Company (MA'ADEN)

Frequently Asked Questions

Analyze common user questions about the Aluminum-Magnesium Alloys Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Aluminum-Magnesium alloys (5xxx series) over conventional steel in shipbuilding?

The primary advantages are superior corrosion resistance, particularly against saltwater environments, and a significantly higher strength-to-weight ratio. This reduction in weight enhances vessel fuel efficiency, increases payload capacity, and lowers maintenance costs over the operational life of naval and commercial vessels.

Which specific aluminum-magnesium alloy dominates the cryogenic storage and LNG transport sector?

The 5083-O temper aluminum-magnesium alloy is the dominant material in the cryogenic storage and LNG transport sector. Its excellent ductility and strength retention at extremely low temperatures (down to -165°C) make it mandatory for high-integrity storage tanks and carriers.

How is market growth in the Aluminum-Magnesium Plate segment influenced by the rise of electric vehicles (EVs)?

The EV sector significantly boosts demand, as manufacturers increasingly use aluminum-magnesium plates (like 5754 and 5052) for lightweight battery enclosures and structural components. This use case is critical for maximizing EV range and meeting safety standards through mass reduction.

What is the main geographic region driving demand for ultra-thick aluminum-magnesium plates?

North America and Europe currently drive the highest demand for ultra-thick (over 50mm) aluminum-magnesium plates. This is largely attributed to specialized defense contracts requiring high-specification armor plating and strategic naval vessel hull sections.

What technological advancements are impacting the fabrication of aluminum-magnesium plate structures?

Friction Stir Welding (FSW) is the most impactful fabrication technology, offering superior joint strength, reduced residual stress, and minimal distortion compared to traditional fusion welding, thus improving the structural integrity and lifespan of final assemblies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager