Aluminum Matrix Composites Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441626 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Aluminum Matrix Composites Market Size

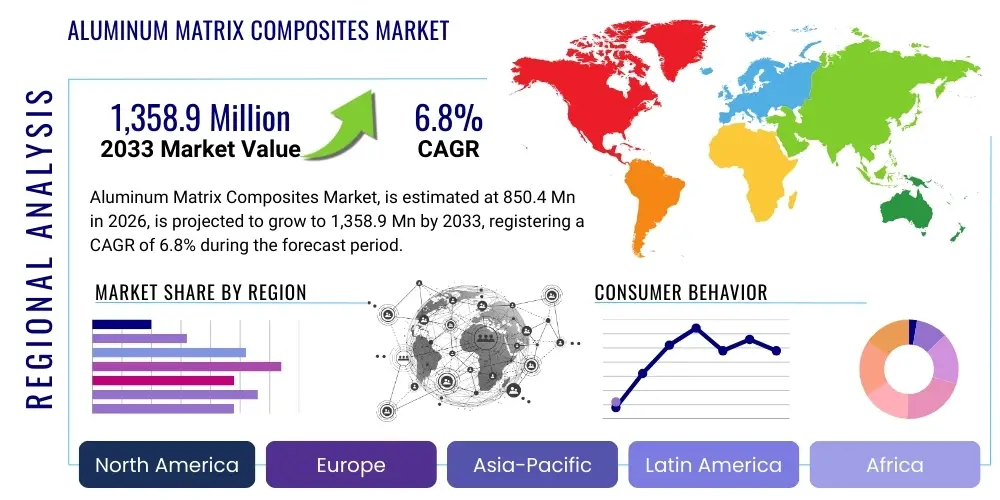

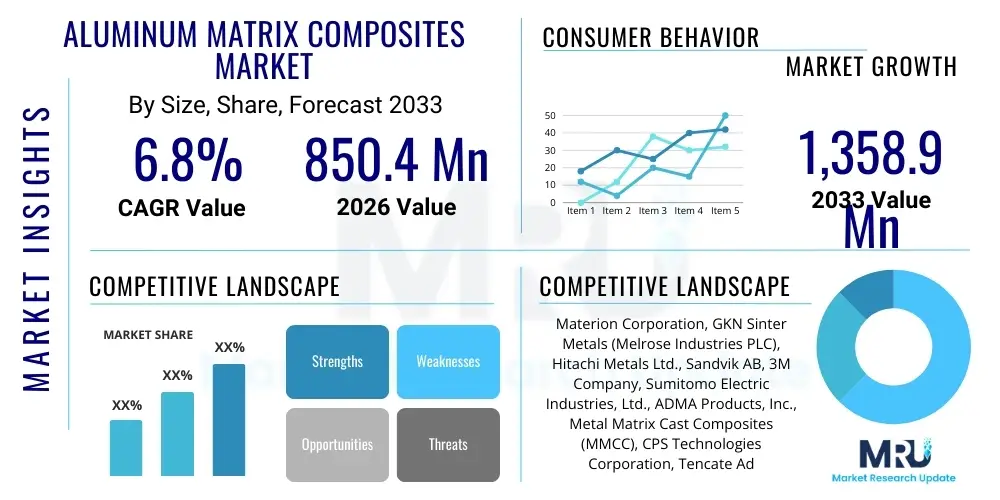

The Aluminum Matrix Composites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.4 million in 2026 and is projected to reach USD 1,358.9 million by the end of the forecast period in 2033.

Aluminum Matrix Composites Market introduction

Aluminum Matrix Composites (AMCs) represent a specialized class of advanced materials where aluminum or an aluminum alloy is reinforced with high-strength, high-stiffness materials such as ceramic particles (Silicon Carbide, Alumina), whiskers, or fibers (Carbon, Boron). These composites are engineered to leverage the low density of aluminum while significantly enhancing critical properties, including specific strength, stiffness, wear resistance, and thermal stability. The resultant materials offer superior performance compared to conventional aluminum alloys, making them indispensable in demanding industrial applications where weight reduction and durability are paramount.

The primary applications of AMCs span several high-value sectors, notably automotive, aerospace, defense, and electronics packaging. In the automotive industry, AMCs are increasingly used for brake rotors, engine components (pistons, cylinder liners), and driveshafts, driven by stringent fuel efficiency standards and the need for reduced unsprung mass in electric vehicles (EVs). The aerospace sector utilizes AMCs for structural components, engine parts, and thermal management systems due to their excellent strength-to-weight ratio at elevated temperatures, directly contributing to payload capacity and operational efficiency.

Key driving factors accelerating market adoption include the global push for lightweight materials to achieve sustainability goals, rapid advancements in manufacturing technologies (like powder metallurgy and stir casting), and increased investment in R&D aimed at developing cost-effective production methods. Furthermore, the burgeoning demand for high-performance thermal management solutions in modern electronics, especially high-power semiconductors and microprocessors, positions AMCs favorably due to their tunable coefficient of thermal expansion (CTE) and superior thermal conductivity.

Aluminum Matrix Composites Market Executive Summary

The Aluminum Matrix Composites (AMCs) market is poised for robust expansion, fundamentally driven by the escalating demand for high-performance, lightweight solutions across mobility and structural sectors. Business trends indicate a shift toward industrialized manufacturing processes, moving AMCs from niche specialized materials to components integrated into mass production, particularly within the luxury and electric vehicle segments. Strategic collaborations between material suppliers and OEMs are becoming standard practice to streamline the material qualification process and reduce production costs, ensuring market competitiveness against traditional metallic alloys.

Regionally, Asia Pacific (APAC) is projected to exhibit the fastest growth, fueled by rapid industrialization, expansion of domestic automotive manufacturing hubs (especially China and India), and substantial government investment in defense and aerospace capabilities. North America and Europe retain dominant market shares, primarily due to the established presence of major aerospace and defense contractors and the early adoption of advanced materials in performance automotive applications. The regulatory landscape emphasizing lower emissions and improved energy efficiency serves as a constant catalyst for demand in these mature markets.

Segment trends reveal that the type of reinforcing material, specifically Silicon Carbide (SiC) reinforced AMCs, holds the largest market share due to its proven efficacy in improving hardness and wear resistance, especially in brake systems and engine parts. By end-use industry, the automotive sector remains the most significant consumer, though aerospace is expected to show accelerated growth based on new aircraft programs and the need for materials capable of withstanding extreme operational conditions. The continuous innovation in processing technologies, such as Solid-State Synthesis and Additive Manufacturing techniques tailored for AMCs, is also defining segment trajectory, enabling complex geometries and enhanced material homogeneity.

AI Impact Analysis on Aluminum Matrix Composites Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Aluminum Matrix Composites market frequently revolve around questions of material discovery speed, optimization of complex manufacturing parameters (such as stir casting speed and temperature control), prediction of material performance under stress, and automation of quality control processes. Key themes emerging from these concerns include leveraging machine learning (ML) to simulate microstructural evolution, reducing the substantial R&D costs associated with new alloy and composite formulations, and ensuring reliable, high-throughput component production. Users expect AI to minimize defects, customize material properties precisely for specific applications, and accelerate the overall time-to-market for novel AMC formulations that meet stringent industry standards, especially in aerospace and medical device manufacturing.

AI is fundamentally transforming the AMC lifecycle, starting from the theoretical design stage. Machine learning algorithms are now being employed to rapidly screen millions of potential reinforcement-matrix combinations, predicting resulting composite properties (like strength, toughness, and thermal conductivity) far faster than traditional physical experimentation. This capability not only lowers research costs but also allows material scientists to fine-tune compositional ratios and processing conditions digitally, dramatically accelerating the path to optimized material specifications necessary for demanding applications.

Furthermore, within the production environment, AI is critical for process control and quality assurance. In techniques such as powder metallurgy and liquid infiltration, variations in temperature, pressure, and mixing homogeneity can drastically affect the final composite integrity. AI-powered sensors and closed-loop control systems monitor these parameters in real-time, adjusting process variables dynamically to maintain peak efficiency and minimize defects, such as porosity or interfacial reaction layers. This integration of predictive analytics ensures consistency in large-volume production runs, a crucial step for the widespread commercialization of high-integrity AMC parts.

- AI-Driven Material Discovery: Accelerating the identification of optimal reinforcement materials (e.g., novel nanotubes or nanoparticles) and matrix alloy compositions through ML simulations.

- Process Parameter Optimization: Using predictive models to optimize complex manufacturing parameters (stir casting, squeeze casting) to minimize defects and enhance material homogeneity.

- Predictive Performance Modeling: Simulating component behavior under extreme operational conditions (high temperature, fatigue) before physical prototyping, reducing testing cycles in aerospace.

- Automated Quality Control: Implementing computer vision and deep learning models for real-time defect detection during production, significantly improving yield rates and product reliability.

- Supply Chain Resilience: Utilizing AI tools for forecasting demand, managing raw material procurement (e.g., SiC whiskers), and optimizing inventory levels.

DRO & Impact Forces Of Aluminum Matrix Composites Market

The Aluminum Matrix Composites market is shaped by a strong combination of technological drivers and stringent regulatory constraints. The primary drivers revolve around the non-negotiable requirement for lightweighting in mobility sectors, propelled by regulatory mandates (e.g., CAFE standards, EU emission targets) and the inherent energy efficiency goals of Electric Vehicles (EVs). Simultaneously, the superior mechanical and thermal properties of AMCs, especially their high specific stiffness and excellent wear resistance, make them critical materials for increasing component lifespan and operational performance in harsh environments like aircraft engines and high-speed braking systems.

However, the market faces significant restraints, chiefly concerning the high manufacturing costs associated with advanced processing techniques (like Powder Metallurgy and specialized casting methods) and the difficulty in achieving large-scale, cost-effective production with consistent quality, especially when incorporating delicate or nano-scale reinforcements. Challenges related to secondary processing, such as machining and joining AMCs, which are typically harder and more abrasive than conventional alloys, also contribute to elevated production costs, often hindering their adoption in price-sensitive commercial applications.

The foremost opportunities lie in the rapidly expanding Electric Vehicle (EV) market, where AMCs can address critical challenges related to battery housing thermal management, motor components, and further reducing chassis weight to maximize range. Furthermore, the commercialization of sophisticated reinforcement materials, such as graphene and carbon nanotubes, promises to unlock new performance thresholds, allowing for the design of ultra-light, multi-functional composites. The impact forces are characterized by moderate technological disruption, high substitution threat from advanced polymers and carbon fiber composites, and medium bargaining power of sophisticated buyers (Tier 1 automotive suppliers and aerospace primes) who demand rigorous material qualification and cost effectiveness.

Segmentation Analysis

The Aluminum Matrix Composites market segmentation provides a critical view of the material types, manufacturing techniques, and end-use applications driving market dynamics. This detailed classification aids stakeholders in identifying high-growth pockets and understanding the differential demands placed on AMC suppliers. The segmentation is primarily categorized based on the nature of the reinforcing material—particulate, continuous fiber, or discontinuous fiber—which fundamentally dictates the composite’s mechanical properties and potential application domain. Further segregation by manufacturing method highlights the shift towards more scalable and cost-efficient processes like stir casting for high-volume automotive parts versus specialized techniques like squeeze casting or powder metallurgy reserved for complex, high-integrity aerospace components. This nuanced segmentation is vital for strategizing product development and market penetration efforts.

The largest segment by reinforcement material is generally particulate-reinforced AMCs, owing to their cost-effectiveness and ease of large-scale manufacturing via conventional routes like stir casting. Silicon Carbide (SiC) particles are overwhelmingly preferred due to their excellent compatibility with aluminum matrices and significant enhancement of wear resistance, making them a staple in brake rotors and high-wear machinery components. Conversely, continuous fiber reinforced AMCs, while providing superior specific strength and stiffness, are confined to niche, high-performance applications (such as space structures or specialized defense systems) due to their prohibitive cost and complexity of manufacture.

Geographically, market growth is bifurcated. Mature markets like North America and Europe focus on high-performance, complex AMC components for aerospace and premium automotive sectors, demanding rigorous quality control and certification. Emerging markets in APAC, while growing rapidly, focus more on volume production and cost-efficiency for mass-market automotive parts and industrial machinery. The strategic importance of lightweighting, particularly in the face of global supply chain volatility, ensures that all segments continue to prioritize R&D into lower-cost, high-reliability production methods.

- By Reinforcement Material:

- Particulate Reinforced (PR-AMCs)

- Discontinuous Fiber Reinforced (DFR-AMCs)

- Continuous Fiber Reinforced (CFR-AMCs)

- By Reinforcement Type:

- Silicon Carbide (SiC)

- Alumina (Al2O3)

- Boron Carbide (B4C)

- Graphite/Carbon (Fibers/Nanotubes/Graphene)

- Others (Boron, Titanium Diboride)

- By Manufacturing Process:

- Stir Casting

- Powder Metallurgy (PM)

- Squeeze Casting/Liquid Metal Infiltration (LMI)

- Spray Deposition

- In-Situ Methods

- By End-Use Industry:

- Automotive (Brake systems, Engine components, Driveshafts)

- Aerospace and Defense (Structural components, Thermal management, Engine parts)

- Electronics and Thermal Management (Heat sinks, Substrates, Housings)

- Industrial and Machinery (Pumps, Bearings, Tools)

- Sports and Leisure

Value Chain Analysis For Aluminum Matrix Composites Market

The value chain for the Aluminum Matrix Composites market is complex, beginning with the highly specialized procurement of raw materials and culminating in the assembly of advanced components by Original Equipment Manufacturers (OEMs). The upstream segment involves the production of high-purity aluminum alloys and, crucially, the manufacture of reinforcing materials such as fine-grained Silicon Carbide particles, high-strength carbon fibers, or Alumina whiskers. The quality and cost of these reinforcements—which often require advanced processing themselves—significantly dictate the final cost and performance of the AMC. Suppliers in this segment hold considerable leverage due to the technical barriers to entry and the need for specific material specifications compatible with casting or powder processes.

The midstream stage is dominated by the composite manufacturers who specialize in forming the AMC ingot or precursor material using techniques like stir casting, powder metallurgy, or infiltration. This stage involves intense R&D to control the interfacial reaction between the matrix and reinforcement, ensuring optimal load transfer and structural integrity. Key activities include precise mixing, controlled solidification, and specialized heat treatments. Distribution channels vary; for high-volume automotive parts, the channel is typically indirect, involving Tier 1 suppliers who machine and finish the AMC parts before delivery to the OEM. For bespoke aerospace components, the route is often more direct, involving close collaboration between the AMC manufacturer and the aerospace prime contractor for stringent qualification.

The downstream analysis focuses on the end-use applications, primarily in the automotive and aerospace sectors. Final product manufacturers (OEMs) demand high reliability, consistency, and traceability for every component. The shift towards electrification and sustainable manufacturing practices is influencing purchasing decisions, favoring suppliers who can demonstrate reduced energy consumption and waste in their processes. The inherent difficulty in machining and finishing AMCs also necessitates specialized machine shops, often creating a critical bottleneck in the value chain. This downstream requirement for specialized fabrication often strengthens the bargaining power of component finishing specialists.

Aluminum Matrix Composites Market Potential Customers

The primary consumers and end-users of Aluminum Matrix Composites are sophisticated, large-scale manufacturing entities that require materials offering a unique combination of lightweight characteristics and high performance, specifically in wear resistance, stiffness, and thermal stability. The automotive sector, particularly manufacturers of performance, luxury, and electric vehicles, represents the largest customer base. These buyers utilize AMCs for brake system components (rotors, calipers), engine blocks, cylinder liners, and driveshafts, driven by the need to reduce weight for improved fuel economy or electric range, and enhance durability.

The aerospace and defense industry forms another crucial customer segment. Major aerospace primes (such as Boeing, Airbus, Lockheed Martin) and their Tier 1 suppliers purchase AMCs for critical structural components, missile fins, satellite panels, and engine parts operating at elevated temperatures. These customers prioritize materials that offer exceptional strength-to-weight ratios and high specific stiffness, essential for minimizing operational mass and maximizing payload capacity, often requiring lengthy and rigorous material qualification procedures.

Furthermore, the electronics and thermal management sectors are emerging as high-potential customers. Manufacturers of advanced semiconductors, high-power LEDs, and specialized electronic devices require substrates and heat sinks with tailored coefficients of thermal expansion (CTE) that match silicon or ceramic components, alongside high thermal conductivity. AMCs, particularly SiC/Al composites, are ideal for dissipating heat efficiently while maintaining dimensional stability, thereby extending the life and performance of electronic assemblies. These customers prioritize suppliers capable of delivering highly precise, near-net-shape components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.4 Million |

| Market Forecast in 2033 | USD 1,358.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, GKN Sinter Metals (Melrose Industries PLC), Hitachi Metals Ltd., Sandvik AB, 3M Company, Sumitomo Electric Industries, Ltd., ADMA Products, Inc., Metal Matrix Cast Composites (MMCC), CPS Technologies Corporation, Tencate Advanced Composites, Nippon Light Metal Holdings Co., Ltd., SCM Metal Products Inc., Ametek Inc., VSMPO-AVISMA Corporation, DWA Aluminum Composites LLC, Metoxit AG, Advanced Ceramics Manufacturing, Ltd., Ceradyne, Inc. (3M), A&P Technology, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Matrix Composites Market Key Technology Landscape

The technology landscape governing the Aluminum Matrix Composites market is diverse, characterized by continuous innovation aimed at reducing production costs, enhancing material homogeneity, and enabling the integration of novel, high-performance reinforcements. The three dominant manufacturing methodologies are liquid state processing (primarily stir casting and squeeze casting), solid state processing (powder metallurgy), and in-situ techniques. Stir casting remains the most commercially viable and widely used method for producing particulate-reinforced AMCs, especially for high-volume automotive components, due to its relative simplicity and cost-effectiveness. Technological advancements here focus on optimizing impeller design and controlling particle wettability to prevent agglomeration and ensure uniform dispersion of reinforcements within the aluminum matrix, which is crucial for maximizing mechanical properties.

Powder Metallurgy (PM) is gaining importance, particularly for high-integrity components and those incorporating high-volume fractions of reinforcement or exotic materials like carbon nanotubes and graphene. PM offers superior control over microstructure, minimizing unwanted interfacial reactions that often plague liquid-state processes. Innovations in PM include Spark Plasma Sintering (SPS) and Hot Isostatic Pressing (HIP), which allow for the consolidation of powders at lower temperatures and shorter durations, thereby preserving the structural integrity of temperature-sensitive reinforcements. The PM route is essential for aerospace and electronic packaging materials requiring highly customized and stable thermal properties.

A burgeoning technological area is the utilization of Additive Manufacturing (AM) processes, such as Laser Powder Bed Fusion (L-PBF) and Binder Jetting, tailored for AMCs. While challenging due to the high melting point and reflectivity of reinforcements, AM promises unparalleled design freedom for complex geometries, minimizing material waste and eliminating expensive post-machining steps. Research in this field focuses on developing specialized feedstock powders (pre-mixed metal matrix and reinforcement powders) and optimizing laser parameters to prevent reinforcement settling or decomposition. This technological evolution signifies a major opportunity to transition AMCs into highly customized, near-net-shape components for high-value applications.

Regional Highlights

The global Aluminum Matrix Composites market demonstrates significant regional disparities in terms of technological maturity, adoption rate, and application focus, closely mirroring the distribution of major manufacturing and R&D centers globally.

North America is a dominant market, largely driven by the colossal aerospace and defense sectors, which demand extremely high-specification, low-volume AMC components. The region benefits from substantial government defense spending and the presence of globally leading aircraft and satellite manufacturers who rely on AMCs for weight-critical structures and thermal management systems. Furthermore, the specialized nature of high-performance automotive manufacturing and the stringent material requirements for advanced electronics packaging contribute significantly to the regional demand, focusing on advanced manufacturing techniques like powder metallurgy and continuous fiber infiltration. Material suppliers in this region emphasize material traceability and compliance with strict industry certifications (e.g., AS9100).

Europe represents another mature and technologically advanced market, characterized by strong regulatory drivers for vehicle lightweighting and energy efficiency, particularly in Germany, France, and the UK. The automotive sector, including premium and performance car manufacturers, is a primary consumer, leveraging AMCs for brake rotors, engine valve train components, and specialized transmission parts to meet stringent EU emissions standards. European research institutions are heavily invested in optimizing casting techniques, especially stir casting and high-pressure die casting, to improve the cost-effectiveness and scalability of particulate-reinforced AMCs for mass-market automotive applications. The region also maintains a strong focus on industrial machinery and high-speed train applications.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by rapid industrial expansion, massive investments in infrastructure, and the exponential growth of automotive production, particularly in China, Japan, and India. While historically focused on cost-effective, basic industrial applications, the region is rapidly shifting toward adopting AMCs in advanced applications. This growth is intensified by the rapid adoption of Electric Vehicles (EVs), where domestic manufacturers are integrating AMCs for battery thermal management and lightweight chassis components. Government initiatives supporting domestic aerospace and defense capabilities, especially in China and India, further bolster the demand for high-performance composites, though the market here is generally more price-sensitive compared to North America and Europe.

- North America: Dominance due to aerospace and defense sectors; focus on high-integrity components and thermal management for advanced electronics.

- Europe: Strong demand driven by stringent automotive lightweighting regulations and established premium vehicle manufacturing; high focus on scalable casting methods.

- Asia Pacific (APAC): Fastest growth trajectory fueled by mass-market automotive production (EVs), rapid industrialization, and increasing domestic defense spending; emphasis on cost-effective SiC particulate reinforcement.

- Latin America and Middle East & Africa (LAMEA): Emerging markets with growing demand linked to infrastructure projects, mining equipment maintenance (requiring wear-resistant components), and increasing, albeit smaller, domestic aerospace programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Matrix Composites Market.- Materion Corporation

- GKN Sinter Metals (Melrose Industries PLC)

- Hitachi Metals Ltd.

- Sandvik AB

- 3M Company

- Sumitomo Electric Industries, Ltd.

- ADMA Products, Inc.

- Metal Matrix Cast Composites (MMCC)

- CPS Technologies Corporation

- Tencate Advanced Composites (Toray Industries, Inc.)

- Nippon Light Metal Holdings Co., Ltd.

- SCM Metal Products Inc.

- Ametek Inc.

- VSMPO-AVISMA Corporation

- DWA Aluminum Composites LLC

- Metoxit AG

- Advanced Ceramics Manufacturing, Ltd.

- Ceradyne, Inc. (3M)

- A&P Technology, Inc.

- Kyocera Corporation

Frequently Asked Questions

Analyze common user questions about the Aluminum Matrix Composites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Aluminum Matrix Composites (AMCs) market?

The primary factor driving AMC market growth is the accelerating global requirement for lightweight materials, especially within the automotive and aerospace industries. AMCs offer superior specific strength and stiffness compared to conventional aluminum alloys, directly supporting enhanced fuel efficiency in traditional vehicles and increased driving range in electric vehicles, while also improving aircraft performance and payload capacity.

Which manufacturing process is currently most prevalent for large-scale production of AMCs?

Stir casting is the most prevalent and cost-effective manufacturing process utilized for the large-scale production of particulate-reinforced Aluminum Matrix Composites (PR-AMCs), particularly for automotive components like brake rotors and engine parts. This process allows for relatively high production volumes with better scalability compared to specialized techniques like powder metallurgy or liquid metal infiltration.

How do Aluminum Matrix Composites benefit the Electric Vehicle (EV) industry?

AMCs benefit the EV industry primarily by enabling significant weight reduction in structural and powertrain components, thereby maximizing battery range and energy efficiency. They are also crucial for advanced thermal management systems, such as heat sinks and cold plates, due to their tailored thermal conductivity and controlled coefficient of thermal expansion (CTE), ensuring stable operation of high-power electronics and battery packs.

What are the key restraints hindering the wider commercial adoption of AMCs?

The key restraints are the high manufacturing costs associated with specialized processes (e.g., controlling particle wettability and achieving uniform dispersion), and the difficulty and expense involved in post-processing operations, such as machining and joining, due to the high hardness and abrasive nature of ceramic reinforcements like Silicon Carbide.

Which reinforcement material dominates the AMC market segment?

Silicon Carbide (SiC) is the dominant reinforcement material, particularly in particulate form. SiC provides excellent hardness, wear resistance, and high stiffness, making SiC-reinforced AMCs highly suitable for high-wear applications, including automotive brake systems, bearings, and industrial pump components, leading to its substantial market share.

The global demand for Aluminum Matrix Composites is intricately linked to major macro-economic and technological shifts, specifically the transition to electrification in transport and the continuous pursuit of extreme performance materials in defense. The market is witnessing continuous innovation in reinforcement technology, moving beyond traditional ceramics to incorporate nanoscale materials, which promise revolutionary improvements in material strength and functionality. Furthermore, sustainability pressures are driving research into utilizing recycled aluminum matrices and minimizing energy consumption during composite fabrication, ensuring that AMCs remain a high-growth sector within the broader advanced materials industry. Future market leadership will depend heavily on vendors who successfully crack the code of high-volume, low-cost manufacturing while maintaining rigorous quality standards required by aerospace and defense buyers. The integration of Industry 4.0 principles, particularly AI-driven process optimization, is expected to be a critical differentiator among competitors in the latter half of the forecast period.

The specialized nature of the AMC market dictates that technological barriers to entry remain significant, favoring established players with deep expertise in both metallurgy and materials science. Companies are increasingly focusing on vertical integration or forming strategic partnerships to secure the supply of high-purity reinforcement materials and to gain access to specialized manufacturing equipment. This strategic positioning is vital for addressing the segmented demands of the end-user market, where automotive customers require volume and price efficiency, while aerospace clients prioritize unparalleled material performance and zero defects. The regulatory environment concerning material safety and recycling will also play an increasingly important role, demanding advanced material characterization and lifecycle management solutions from market participants.

In summary, the Aluminum Matrix Composites market is characterized by high growth potential, driven by fundamental material advantages over conventional metals, albeit tempered by high production complexities and costs. The future market trajectory is strongly dependent on two key developments: the reduction of manufacturing overheads through process innovation (like continuous casting or highly automated PM) and the successful integration of AMCs into mass-market applications, especially in the rapidly expanding EV battery and propulsion systems segment. Investment in developing novel, less-costly surface treatment techniques to improve wettability and bonding between matrix and reinforcement will be pivotal in unlocking the full commercial potential of AMCs globally.

The shift towards multifunctional AMCs, capable of performing structural duties while also managing thermal or electrical loads, represents a significant growth vector. For instance, designing composites that not only bear structural load but also serve as effective heat exchangers is a major area of R&D in both the defense and high-power electronics fields. This advanced functionality allows end-users to consolidate parts and reduce system complexity, offering substantial long-term cost savings despite the initial material premium. Consequently, manufacturers focusing on custom, multi-property material solutions will likely capture premium market share in specialized applications where performance outweighs cost sensitivity, such as in satellite communication equipment and advanced radar systems.

Furthermore, the material science community is actively exploring hybrid AMC systems—composites reinforced by two or more distinct types of materials (e.g., SiC particles combined with carbon fibers). This approach aims to synergistically combine the beneficial properties of different reinforcements, such as enhancing both toughness (via fibers) and hardness (via particles) within a single matrix. Such complex, engineered materials require sophisticated modeling and process control, further emphasizing the reliance on AI and computational materials science to streamline their development and qualification for commercial use. The widespread success of these next-generation hybrid AMCs will redefine performance benchmarks in high-stress industrial environments, including deep-sea drilling and high-temperature industrial turbines.

The stringent requirements from the aerospace industry, particularly concerning fatigue resistance and damage tolerance, necessitate continuous material testing and certification, forming a critical barrier to market entry for new suppliers. Establishing long-term supply agreements and securing necessary regulatory approvals (e.g., FAA or EASA certification) are essential milestones for any company targeting this high-value segment. Meanwhile, the automotive supply chain demands rapid prototyping and testing cycles, requiring AMC producers to be agile and responsive to evolving design specifications, particularly those related to crash safety and noise, vibration, and harshness (NVH) mitigation, demonstrating the dual competitive landscape based on performance rigor versus volume scalability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager