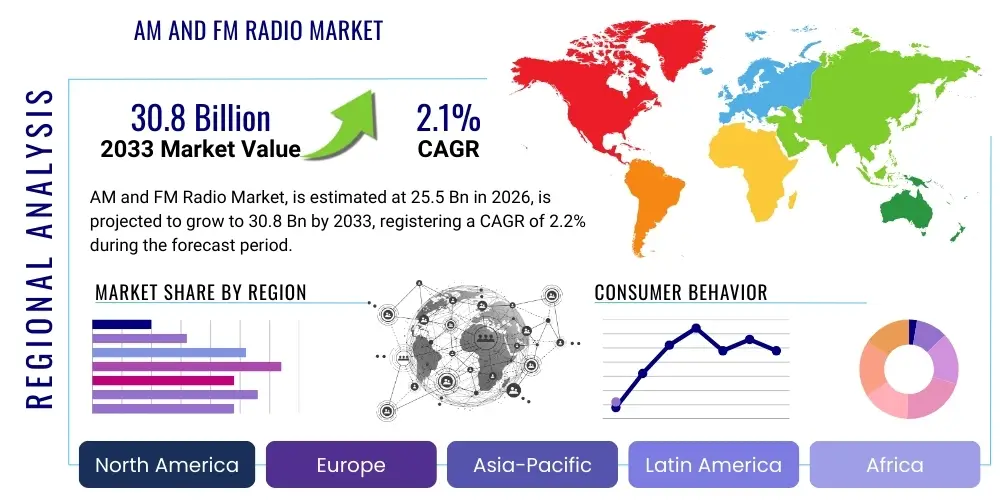

AM and FM Radio Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442140 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

AM and FM Radio Market Size

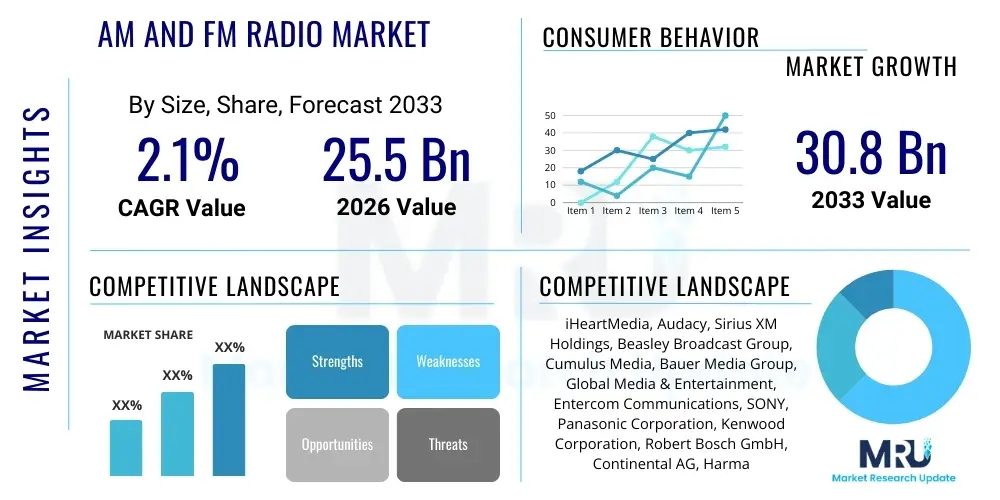

The AM and FM Radio Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.15% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2033. This consistent, albeit moderate, growth trajectory is underpinned by the enduring ubiquity of AM and FM infrastructure, particularly in emerging economies and automotive sectors where widespread accessibility and cost-effectiveness remain critical factors. Despite intense competition from digital audio streaming platforms and satellite radio services, traditional radio broadcasting maintains robust penetration rates globally, driven by local news delivery, emergency broadcasting mandates, and specific demographic appeal.

AM and FM Radio Market introduction

The AM and FM Radio Market encompasses the entire ecosystem surrounding analog and hybrid terrestrial radio broadcasting, including transmission equipment, receiving devices (portable, in-home, and automotive), content generation, and advertising revenue streams. The foundational technology involves Amplitude Modulation (AM) and Frequency Modulation (FM) for transmitting audio signals over radio waves, offering free, universally accessible content. Although often viewed as legacy technology, the market continues to evolve through digitization efforts, such as the adoption of HD Radio in North America and Digital Audio Broadcasting (DAB/DAB+) in Europe and APAC, which aim to improve audio fidelity and enhance supplementary data services, ensuring the continued relevance of terrestrial infrastructure amidst the digital transition. Key players across this value chain include broadcast equipment manufacturers, content creators, and regulatory bodies managing spectral allocation.

Major applications of AM and FM radio span critical communication, entertainment, and information dissemination. Social applications include real-time traffic updates, local news reporting, music programming tailored to regional tastes, and emergency alert systems, which demonstrate radio's unparalleled reliability during infrastructure failures or natural disasters. Commercially, radio remains a highly effective local advertising medium, providing businesses with a cost-efficient way to target geographically specific audiences. The inherent benefits, such as zero cost to the end-user, simplicity of operation, and extensive coverage footprint, especially in rural or underserved areas, contribute significantly to the market's stability and sustained operational output, making it an essential component of the global media landscape despite technological shifts.

Driving factors for the AM and FM Radio Market include mandatory integration into automotive dashboards globally, where radio receivers are considered standard safety and informational features. Furthermore, the persistent demand for hyper-local content that digital streaming services often fail to adequately address drives listener loyalty. Regulatory support, particularly government mandates ensuring spectrum availability for traditional broadcasting and promoting digital transition standards like DAB+, provides a stable operational framework. The low barrier to entry for listeners, requiring only a simple receiver without internet connectivity, solidifies its position as a primary mass communication medium, especially in regions with fluctuating internet access and high costs associated with cellular data consumption.

AM and FM Radio Market Executive Summary

The global AM and FM Radio Market is characterized by resilient revenue streams, primarily driven by localized advertising, coupled with necessary infrastructure upgrades focusing on hybrid digital broadcasting (e.g., HD Radio, DAB+). Business trends indicate a shift towards optimizing spectral efficiency and integrating terrestrial radio seamlessly with digital platforms, utilizing mechanisms like smart speaker compatibility and personalized content delivery through accompanying apps. Investment is heavily concentrated in sophisticated transmission equipment capable of handling both analog and digital signals simultaneously, maximizing existing infrastructure utility. The primary challenge lies in retaining younger demographics increasingly captivated by on-demand, personalized digital audio, prompting broadcasters to enhance content quality and interactivity.

Regional trends reveal significant diversity in market maturity and technological adoption. North America and Europe are focusing on transitioning listeners to digital platforms (DAB+ and HD Radio), capitalizing on high automotive penetration rates and regulatory push for spectrum efficiency. Conversely, the Asia Pacific (APAC) region and Latin America exhibit robust growth in pure analog infrastructure and basic receiver sales, driven by large, dispersed populations and the affordability of traditional radio as a primary source of entertainment and information. APAC, in particular, showcases high growth potential due to expanding middle classes and the continued necessity of basic communication infrastructure in diverse geographical settings, often bypassing immediate reliance on high-speed internet for mass media consumption.

Segmentation trends highlight the critical importance of the Automotive Receivers segment, which continues to dominate market value due to mandatory equipment standards and high consumer expectation for integrated, high-quality audio systems. Content-wise, News and Talk Radio segments demonstrate stability, leveraged by their essential public service role and relevance during crises, while Music remains the largest volume driver, adapting to modern content strategies by incorporating popular digital playlists. Revenue segmentation overwhelmingly favors Advertising, which benefits from radio’s ability to deliver high-frequency messages at a lower cost per thousand impressions (CPM) compared to video and premium digital advertising, maintaining its relevance for fast-moving consumer goods (FMCG) and local service providers.

AI Impact Analysis on AM and FM Radio Market

User queries regarding the impact of AI on the AM and FM Radio Market predominantly center on how Artificial Intelligence can modernize content scheduling, optimize advertising placement, and enhance spectral management to compete effectively with digital services. Key concerns revolve around the potential job displacement among content creators and traditional DJs, while expectations focus heavily on AI's ability to automate music rotations based on real-time listener data and demographic analysis, thereby increasing listener engagement and maximizing advertising yields. Users also frequently inquire about AI-driven solutions for managing complex hybrid environments (analog/digital) and improving audio quality restoration on aging AM signals. The overarching theme is the application of predictive analytics to transform radio from a passive broadcast medium into a highly responsive, data-driven audio experience that retains its local flavor.

- AI-driven personalized content scheduling and music rotation based on audience demographics and real-time feedback.

- Optimized programmatic advertising placement, allowing local advertisers to target specific time slots and geographic zones with enhanced precision.

- Predictive maintenance and spectral analysis, improving transmission reliability and identifying potential interference sources proactively.

- Automated news aggregation and voice synthesis for creating timely, localized weather, traffic, and news updates with reduced manual input.

- Enhanced audio processing and restoration algorithms, improving the clarity and fidelity of legacy AM signals and reducing noise interference.

- Operational efficiency gains through AI management of transmitter power levels and frequency usage, particularly critical in densely populated urban environments.

- Audience behavior modeling, enabling broadcasters to understand listener drop-off points and peak engagement times to refine programming strategies continuously.

DRO & Impact Forces Of AM and FM Radio Market

The AM and FM Radio Market is governed by a dynamic interplay of driving forces and structural restraints, alongside significant market opportunities that collectively define its impact forces. A primary driver is the pervasive, installed base of radio receivers across billions of devices globally, coupled with the unique regulatory requirement in many nations for radio to serve as the default emergency communication system, ensuring governmental and public reliance on this infrastructure. However, the market faces intense restraints from the proliferation of high-fidelity digital audio streaming platforms (Spotify, Apple Music) and podcasts, which offer personalization and on-demand access that traditional linear radio cannot natively replicate. Opportunities emerge through embracing hybrid solutions like HD Radio and DAB+, which leverage existing infrastructure while delivering digital quality and ancillary data services, opening new commercial avenues for data transmission and enhanced advertising products.

Impact forces are concentrated around the dual pressure of technological evolution and consumer migration. The push for digitalization (DAB+ and HD Radio adoption) is a major force compelling capital expenditure and technical innovation within broadcasting companies, aiming to future-proof the medium. Conversely, the high cost and complexity associated with replacing legacy analog transmission equipment with digital-capable systems act as a restraining force, particularly for smaller, independent stations with limited capital. The competitive threat posed by digital platforms forces traditional broadcasters to significantly enhance content quality, focus deeply on hyper-local relevance, and build interactive digital extensions to their core offerings, ensuring listener retention in an increasingly fragmented audio landscape. Furthermore, regulatory actions regarding spectrum reallocation and mandated receiver standards significantly influence investment cycles and long-term strategic planning.

Specific restraints also include the inherent limitations of analog bandwidth, which restricts the quality and quantity of content that can be transmitted, leading to a perceived technological lag compared to digital competitors. The reliance on terrestrial infrastructure makes the market susceptible to regulatory caps on advertising load and transmission power limits aimed at minimizing interference. Opportunities are robust in the developing world, where radio's independence from high-speed internet and high device cost makes it the most viable mass medium for public awareness and education. Strategic industry actions focus on establishing strong partnerships with automotive manufacturers and smart device providers to ensure seamless, modernized access to traditional radio content, thereby mitigating the risk of obsolescence and extending the reach of the traditional broadcast market into modern consumer technologies.

Segmentation Analysis

The AM and FM Radio Market is segmented based on critical parameters including technology (Analog vs. Hybrid/Digital), application (Automotive, Home/Portable), and revenue stream (Advertising, Subscription/Other Fees). This segmentation provides a granular view of market dynamics, revealing that while analog technology still holds the majority share in terms of geographic coverage and total installed base, the Hybrid/Digital segment is the primary growth driver in terms of revenue expansion and capital expenditure, especially in mature markets. The dominance of the automotive sector reflects the critical importance of integrated vehicle entertainment systems, whereas the advertising segment remains the foundational source of profitability, heavily influenced by macroeconomic trends and local business performance.

- By Technology:

- Analog AM/FM

- Hybrid/Digital Radio (HD Radio, DAB/DAB+, DRM)

- By Application:

- Automotive Receivers (Integrated systems)

- Portable Receivers (Handheld, Clock Radios)

- Home Receivers (Stereo systems, Tuners)

- By Frequency/Band:

- AM Band

- FM Band

- Combined Band

- By Content Type:

- Music

- News and Talk Radio

- Sports and Entertainment

- Religious and Cultural Programming

- By Revenue Source:

- Advertising Revenue (Local, National)

- Subscription Fees (Minority share, specific to satellite or premium content)

- Licensing and Syndication

Value Chain Analysis For AM and FM Radio Market

The value chain for the AM and FM Radio Market initiates with the upstream segment involving the manufacturing and supply of complex infrastructure components, including specialized antennae, high-power transmitters, modulation equipment, and sophisticated digital processing systems essential for analog-to-digital conversion (like HD Radio exciter technology). Upstream suppliers are characterized by high technical expertise and stringent regulatory compliance requirements, operating in a relatively consolidated market dominated by specialized telecommunications and broadcast technology providers. Investment decisions in the upstream segment are highly influenced by governmental mandates regarding spectrum efficiency and the pace of digital radio adoption within specific geographic jurisdictions, requiring long capital deployment cycles for innovation.

The midstream segment centers on the actual broadcasting operations, encompassing content creation, programming scheduling, studio production, and signal transmission and distribution. This segment includes local and national broadcasting organizations that hold valuable licenses and control content rights. Revenue generation here is primarily through the sale of advertising slots, managed either directly by internal sales teams or through specialized media buying agencies. Distribution channels are inherently dual: direct transmission over the airwaves to end-user receivers, which is the foundational direct channel, and increasingly, indirect distribution through digital platforms, such as companion mobile apps or aggregation services (e.g., TuneIn, radio streaming platforms), to extend reach beyond the immediate terrestrial footprint and cater to modern listening habits.

The downstream analysis focuses on the receiving apparatus market, including the manufacture and sale of automotive head units, portable devices, and home stereo equipment that integrate AM/FM functionality. This segment is characterized by consumer electronics manufacturers and automotive OEMs who dictate the final presentation and feature set of the radio product. Direct channels include OEM agreements ensuring radio inclusion in new vehicles, while indirect channels involve retail sales of portable and home receivers through electronics stores, online marketplaces, and general retailers. The efficiency of the downstream segment is tied closely to technological integration, requiring seamless user interfaces and adoption of hybrid standards (HD/DAB+) to remain competitive against feature-rich digital alternatives, ultimately determining the accessibility and perceived value of the broadcast signal to the final consumer.

AM and FM Radio Market Potential Customers

Potential customers for the AM and FM Radio Market are segmented primarily into two major categories: advertisers seeking mass communication reach and end-users who consume the broadcast content. The end-user base is highly diverse, spanning all socio-economic groups globally, with a significant concentration among automotive drivers, individuals in remote or rural areas lacking robust internet infrastructure, and demographics valuing free, real-time local information (e.g., commuters, elderly populations). Automotive manufacturers are critical B2B customers, as they integrate receivers into every new vehicle, treating the radio as an indispensable safety and entertainment feature, thus guaranteeing a consistent demand for receiver technology and integrated systems compliant with regional broadcast standards.

For the advertising segment, potential customers are businesses of all sizes, ranging from large national corporations running brand awareness campaigns to small, local businesses (restaurants, repair services, regional retailers) that rely on radio’s ability to target specific local markets effectively and affordably. Radio offers these advertisers a high-reach, high-frequency medium with a rapid deployment time for campaigns. Key buyer industries include consumer packaged goods (CPG), automotive dealerships, retail trade, and local service providers, all seeking cost-effective ways to connect with local communities. The appeal rests heavily on the credibility often associated with local radio personalities and the high level of trust listeners place in their favorite stations, leading to effective advertising recall and conversion rates that remain competitive against digital display advertising.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 30.8 Billion |

| Growth Rate | CAGR 2.15% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | iHeartMedia, Audacy, Sirius XM Holdings, Beasley Broadcast Group, Cumulus Media, Bauer Media Group, Global Media & Entertainment, Entercom Communications, SONY, Panasonic Corporation, Kenwood Corporation, Robert Bosch GmbH, Continental AG, Harman International, Xperi Corporation, TEAC Corporation, Grass Valley, Rohde & Schwarz, Elettronika S.R.L., GatesAir |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AM and FM Radio Market Key Technology Landscape

The core technology landscape of the AM and FM Radio Market is bifurcated, maintaining legacy analog transmission systems while rapidly integrating advanced digital standards. Analog systems rely on traditional transmitters, amplifiers, and antennae for Amplitude (AM) and Frequency (FM) modulation, characterized by their simplicity, long range, and low maintenance requirements, making them ideal for widespread coverage. However, the future relies heavily on hybrid technologies such as HD Radio (developed by Xperi Corporation, predominant in North America) and Digital Audio Broadcasting (DAB/DAB+, prevalent in Europe and parts of APAC). These digital overlays allow broadcasters to transmit high-quality audio and supplementary data services (like text, images, and emergency data) within the existing spectral allocation, effectively modernizing the service without abandoning the core transmission infrastructure.

Further technological advancements impacting the market include the deployment of Software-Defined Radios (SDR) in both transmission and receiving equipment, offering greater flexibility and easier upgrades via software patches rather than hardware replacement. This flexibility is crucial for adapting to evolving digital standards and optimizing spectral usage in real-time. Moreover, the integration of radio services into smart speaker ecosystems (using IP tunneling alongside traditional broadcast signals) and advanced car infotainment systems represents a significant technological convergence. Modern automotive receivers are expected to seamlessly switch between analog FM, digital HD/DAB+ signals, and IP streams (Hybrid Radio), prioritizing the best available audio source and incorporating rich metadata displays, positioning radio content competitively against digital alternatives and enhancing the user experience.

The operational technology focus is shifting toward maximizing spectral efficiency and minimizing energy consumption through intelligent transmitter management systems and single-frequency networks (SFN) used in DAB+ deployment. These technological shifts require significant investment in high-efficiency solid-state transmitters replacing older tube-based systems. Content management technology is also evolving, utilizing sophisticated automation software for playlist scheduling, ad insertion, and compliance logging, often incorporating AI algorithms to predict audience preferences. This dual focus on transmission hardware modernization and digital content delivery infrastructure is essential for the market to sustain profitability and compete effectively in the wider digital audio ecosystem, ensuring robust signal integrity and enhanced data capabilities for listeners.

Regional Highlights

- North America: This region is characterized by high adoption rates of HD Radio technology, particularly within the massive automotive market where integrated HD receivers are standard. The US market, dominated by large radio groups like iHeartMedia and Audacy, focuses heavily on revenue generation through programmatic advertising and leveraging strong local content to compete with satellite radio (Sirius XM) and streaming services. Regulations here mandate radio’s inclusion in emergency broadcasting infrastructure, ensuring its long-term relevance despite high digital penetration.

- Europe: Europe is the global leader in the transition to digital radio, primarily driven by the mandatory adoption of DAB/DAB+ in several key markets (e.g., Norway's successful FM switch-off, UK's high DAB penetration). Regulatory frameworks strongly support spectrum consolidation and digital migration, leading to significant investments in new transmission sites and digital content production. Automotive sales are heavily favoring DAB+ compatibility, creating a stable demand for digital receiver technology across the continent.

- Asia Pacific (APAC): APAC represents a high-growth region, driven by the sheer scale of its population and the necessity of cost-effective mass communication in diverse geographical settings. While major urban centers are exploring hybrid and digital solutions (DAB+ in South Korea, Australia), large parts of India, China, and Southeast Asia still rely heavily on conventional analog AM/FM for universal coverage. The market is primarily fueled by portable receiver sales and rapid expansion of community radio networks.

- Latin America: This region maintains a strong reliance on conventional FM broadcasting, which dominates the media landscape due to its ability to reach vast rural and geographically challenging areas. Market evolution is slower regarding digital transition compared to Europe, with primary focus remaining on maximizing coverage and improving analog signal quality. Localized content, particularly music and political talk shows, drives significant listenership and advertising expenditure.

- Middle East and Africa (MEA): The MEA region is characterized by fragmented but crucial growth, often influenced by geopolitical factors and government control over media. Radio serves as a vital tool for news dissemination and public service announcements. While some Gulf Cooperation Council (GCC) states invest in modern digital infrastructure, many African nations rely entirely on resilient, low-cost analog technology, where radio provides a fundamental source of information in areas with limited electricity and internet access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AM and FM Radio Market.- iHeartMedia

- Audacy

- Sirius XM Holdings (Integrated into receiving equipment manufacturing and content provision)

- Beasley Broadcast Group

- Cumulus Media

- Bauer Media Group

- Global Media & Entertainment

- Entercom Communications

- SONY Corporation

- Panasonic Corporation

- Kenwood Corporation

- Robert Bosch GmbH

- Continental AG

- Harman International (A Samsung Company)

- Xperi Corporation (Developer of HD Radio Technology)

- TEAC Corporation

- Grass Valley

- Rohde & Schwarz

- Elettronika S.R.L.

- GatesAir

Frequently Asked Questions

Analyze common user questions about the AM and FM Radio market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued growth of the AM and FM Radio Market despite digital competition?

The continued growth is driven primarily by mandatory inclusion in automotive systems, radio's function as a critical emergency communication infrastructure, and its unparalleled accessibility and cost-effectiveness in developing regions, ensuring mass reach without internet dependence. Furthermore, hyper-local content relevance sustains high listener loyalty.

How are hybrid technologies like HD Radio and DAB+ influencing market stability?

Hybrid technologies are crucial for market stability as they allow broadcasters to modernize existing infrastructure, offering CD-quality audio and data services (like traffic and weather) to listeners. This innovation helps traditional radio compete with digital streaming platforms by enhancing spectral efficiency and providing enriched user experiences without requiring complete transition.

Which revenue segment is most dominant in the AM and FM Radio Market?

Advertising revenue remains overwhelmingly dominant. Local and national businesses rely on radio for cost-efficient, high-frequency outreach to specific geographic demographics. The effectiveness of radio advertising, particularly for local campaigns, solidifies its position as the primary income stream for broadcasters globally.

What is the primary regional market trend regarding digitalization?

Europe is leading the digitalization trend through widespread and often mandated adoption of DAB/DAB+. North America follows with HD Radio integration, focusing heavily on automotive applications. Conversely, APAC and Latin America prioritize robust analog coverage due to infrastructure limitations and lower consumer cost tolerance, while steadily introducing hybrid systems in major urban centers.

How is Artificial Intelligence impacting content generation and programming in radio?

AI is primarily impacting programming by enabling automated, data-driven scheduling and music rotation based on real-time audience analytics and consumption patterns. AI also optimizes programmatic ad placement for higher yield and assists in generating localized updates (traffic/weather) through sophisticated voice synthesis, streamlining operational efficiencies.

The preceding analysis demonstrates that while the AM and FM Radio Market is evolving under significant pressure from digital alternatives, its fundamental utility, driven by widespread infrastructure, regulatory mandates, and hyper-local content delivery, ensures a stable, moderately growing trajectory through 2033. Strategic success relies on the effective integration of hybrid digital technologies and leveraging AI for competitive content optimization.

In conclusion, the global landscape of AM and FM radio broadcasting is characterized by strategic resilience, driven by its essential public service role and pervasive installed base. The market's moderate CAGR reflects a balancing act between the mature analog segment, which provides critical coverage, and the rapidly modernizing digital segment (HD Radio, DAB+), which attracts premium investment and facilitates richer data services. Key players are navigating this environment by focusing capital expenditure on transmitter modernization and developing robust content strategies that blend traditional broadcast loyalty with digital platform extensions. Regional variations in technology adoption underscore the market's diversity, with advanced digitalization concentrated in Western markets, while affordability and reach dictate strategies in emerging economies, ensuring the enduring global relevance of terrestrial radio infrastructure for information and entertainment.

Furthermore, the competitive dynamic is shifting from simple rivalry between broadcast and streaming to an integrated hybrid model where radio leverages its unique strengths—real-time immediacy and local connection—while adopting digital efficiencies for advertising and content personalization. The automotive sector remains the bedrock of receiver demand, guaranteeing a future market for integrated radio technology. Overcoming spectral congestion, managing regulatory compliance related to digital migration, and continually investing in local talent and content are paramount for sustaining market share against the overwhelming variety and personalization offered by on-demand audio. Success in this forecast period will hinge on the successful execution of digital transition policies and the continued ability of broadcasters to monetize their unique, trusted local presence effectively through data-optimized advertising platforms and enhanced ancillary services facilitated by hybrid technology adoption.

The long-term outlook for the AM and FM Radio Market is one of necessary adaptation and consolidation. Stations that successfully implement strategies to utilize their allocated spectrum for both analog and high-definition digital signals will capture both legacy listeners and those seeking better audio quality and features. The role of radio in disaster preparedness and public safety ensures governmental commitment to maintaining the core infrastructure, insulating the market against total obsolescence. Additionally, global growth in the sale of basic, affordable radio receivers, particularly in regions with unpredictable power and connectivity, demonstrates the market's intrinsic value as a social equity tool, providing accessible information across socioeconomic strata. Therefore, the trajectory is steady, supported by institutional dependence and geographic necessity, rather than aggressive consumer-driven expansion seen in pure digital sectors.

Technological advancement is not solely confined to transmission; studio automation and content delivery systems are undergoing a revolution. The increasing use of cloud-based solutions for managing production workflows, archiving content, and syndicating programming across different geographic locations contributes significantly to operational efficiency and reduces reliance on expensive proprietary hardware. This shift towards flexible, scalable cloud architectures enables smaller market stations to access professional-grade tools previously exclusive to large national networks, democratizing content quality. Moreover, the focus on metadata standards and seamless integration into smart devices highlights the industry's strategic move to ensure radio content is indexed, searchable, and discoverable across all modern consumer interfaces, mitigating the risk of being overshadowed by IP-native content formats. This integration effort, especially with smart speaker technology, ensures the AM and FM signal remains easily accessible to a generation accustomed to voice commands and on-demand interfaces.

Finally, sustainability and energy efficiency are becoming critical considerations in the development and deployment of new transmission infrastructure. Modern solid-state transmitters consume significantly less power than older vacuum tube counterparts, aligning with global corporate environmental responsibility (CER) goals and reducing operational costs. Investment in renewable energy sources to power remote transmission sites further reflects a commitment to sustainable broadcasting practices. These environmental and economic imperatives drive the replacement cycle for legacy equipment, providing a continuous stimulus for the market's equipment manufacturing segment. Regulatory bodies often encourage these transitions through incentives or mandates, reinforcing the link between technological modernization, fiscal responsibility, and environmental stewardship within the AM and FM Radio Market.

The segmentation by content type also illuminates market resilience; specifically, the News and Talk Radio segment exhibits significant anti-cyclical stability. During periods of social unrest, political change, or severe weather events, audience reliance on trusted local sources increases dramatically, showcasing the fundamental, non-substitutable function of radio. This segment's strong engagement provides highly valuable advertising inventory, particularly for institutions and governmental agencies seeking rapid, widespread communication. The music segment, while facing higher competition from personalized playlists, leverages local cultural relevance and personality-driven curation to maintain audience connection. Broadcasters are strategically using these distinct content strengths—immediacy, locality, and trusted voice—to differentiate themselves from generic global streaming catalogs, thereby reinforcing the overall market value proposition of terrestrial radio.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager